“Apple’s Core Shaken: iPhone 16 Order Cuts Send Shares Tumbling”

Introduction

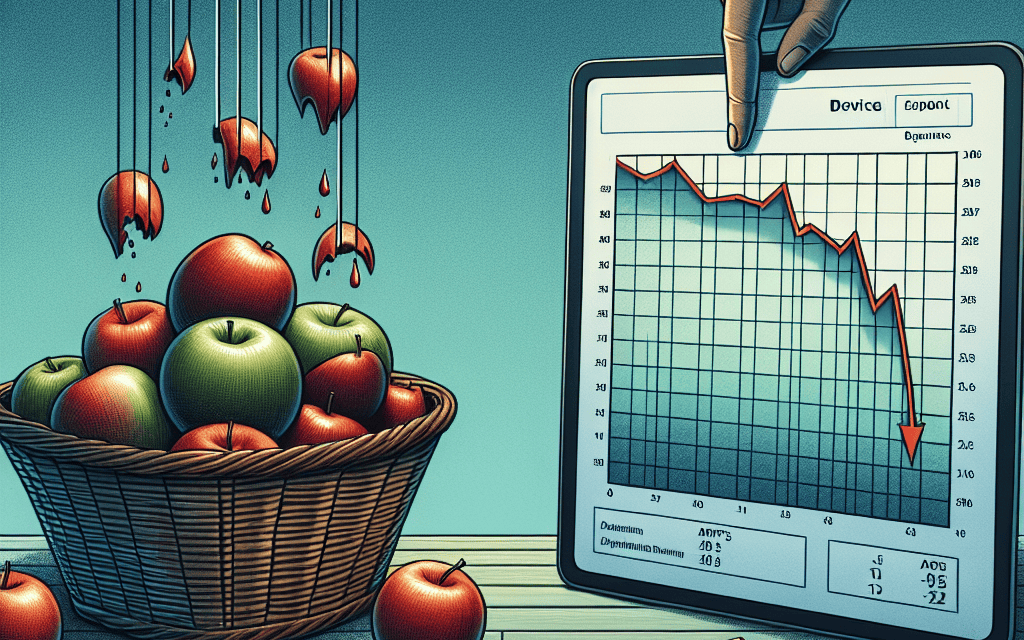

Apple shares experienced a notable decline following a recent analyst report indicating a reduction in orders for the upcoming iPhone 16. The report, which has sparked concern among investors, suggests that Apple may be anticipating lower demand for its next-generation smartphone, prompting a reassessment of production targets. This development has raised questions about the tech giant’s growth prospects and market strategy, as the iPhone remains a critical component of Apple’s revenue stream. The news has led to increased scrutiny of Apple’s supply chain dynamics and competitive positioning in the ever-evolving smartphone market.

Impact Of Analyst Reports On Apple Stock Prices

Apple Inc., a titan in the technology industry, has long been a focal point for investors and analysts alike. The company’s stock prices are often subject to fluctuations based on a myriad of factors, including product launches, market trends, and, notably, analyst reports. Recently, Apple shares experienced a decline following a report from a prominent analyst suggesting a reduction in orders for the upcoming iPhone 16. This development underscores the significant impact that analyst reports can have on stock prices, particularly for a company as closely watched as Apple.

Analyst reports are influential tools in the financial world, providing investors with insights and predictions that can shape market perceptions. When an analyst with a strong reputation issues a report, it can sway investor sentiment, leading to immediate reactions in the stock market. In the case of Apple, the report indicating reduced orders for the iPhone 16 raised concerns about potential challenges in demand or production, prompting a sell-off among investors. This reaction highlights the sensitivity of Apple’s stock to perceived changes in its product pipeline, which is a critical driver of the company’s revenue and growth.

The iPhone, being one of Apple’s flagship products, plays a pivotal role in the company’s financial performance. Any indication of a shift in its production or sales forecasts can have a ripple effect on investor confidence. The report suggesting reduced orders for the iPhone 16 may have sparked fears of a slowdown in consumer demand or possible supply chain issues, both of which could impact Apple’s earnings. Consequently, investors may have opted to adjust their portfolios in anticipation of potential headwinds, leading to the observed decline in Apple’s stock price.

Moreover, the influence of analyst reports is not limited to immediate stock price movements. These reports can also affect long-term investor strategies and market perceptions. For instance, if the report’s predictions materialize, it could lead to a reassessment of Apple’s growth prospects and valuation. On the other hand, if the concerns raised in the report are proven unfounded, it could result in a rebound of investor confidence and stock prices. Thus, the impact of such reports extends beyond short-term market reactions, potentially shaping the broader narrative around a company’s future.

In addition to affecting stock prices, analyst reports can also influence corporate strategies. Companies like Apple may respond to such reports by addressing the concerns raised, whether through strategic adjustments, public statements, or changes in their operational plans. This dynamic interaction between analyst reports and corporate actions further illustrates the significant role these reports play in the financial ecosystem.

In conclusion, the recent decline in Apple shares following an analyst’s report on reduced iPhone 16 orders exemplifies the profound impact that such reports can have on stock prices. As a key player in the technology sector, Apple’s financial performance is closely scrutinized, and any perceived changes in its product strategy can lead to swift market reactions. The influence of analyst reports extends beyond immediate price movements, affecting investor sentiment, corporate strategies, and long-term market perceptions. As such, these reports remain a critical component of the financial landscape, shaping the narratives and decisions of investors and companies alike.

Understanding The Market Reaction To iPhone 16 Order Reductions

Apple Inc., a titan in the technology industry, recently experienced a notable decline in its share value following an analyst’s report suggesting a reduction in orders for the upcoming iPhone 16. This development has sparked considerable interest and concern among investors and market analysts alike, prompting a closer examination of the factors contributing to this market reaction. Understanding the dynamics at play requires an exploration of both the immediate implications of the report and the broader context of Apple’s market position.

To begin with, the analyst’s report indicated that Apple has allegedly reduced its component orders for the iPhone 16, a move that has been interpreted as a signal of potentially weaker-than-expected demand for the new model. This speculation has led to a ripple effect in the stock market, with investors reacting swiftly to the possibility of diminished sales performance. The immediate consequence was a drop in Apple’s share price, reflecting the market’s sensitivity to any news that could impact the company’s future revenue streams.

Moreover, the report has raised questions about consumer demand trends in the smartphone market. In recent years, the global smartphone market has shown signs of saturation, with incremental technological advancements and longer replacement cycles influencing consumer purchasing behavior. Consequently, any indication of reduced demand for a flagship product like the iPhone 16 can exacerbate concerns about Apple’s ability to sustain its growth trajectory. This is particularly significant given that the iPhone line has historically been a major revenue driver for the company.

In addition to these demand-side considerations, supply chain dynamics also play a crucial role in shaping market perceptions. Apple’s decision to adjust its component orders could be influenced by various factors, including supply chain constraints, cost management strategies, or a strategic shift in product focus. However, without clear communication from Apple, investors are left to speculate, which can contribute to heightened volatility in the stock market.

Furthermore, it is essential to consider the competitive landscape in which Apple operates. The smartphone market is fiercely competitive, with numerous players vying for consumer attention and market share. Companies like Samsung, Google, and emerging Chinese manufacturers continue to innovate and release compelling alternatives to the iPhone. As a result, any perceived weakness in Apple’s product lineup can lead to increased scrutiny from investors who are keenly aware of the competitive pressures facing the company.

Despite these challenges, it is important to recognize that Apple has a history of resilience and adaptability. The company has successfully navigated market fluctuations in the past, leveraging its strong brand loyalty, ecosystem integration, and innovation capabilities. While the current situation may present short-term challenges, Apple’s long-term prospects remain robust, supported by its diverse product portfolio and strategic investments in emerging technologies.

In conclusion, the recent decline in Apple shares following the analyst’s report on reduced iPhone 16 orders underscores the complex interplay of factors influencing market reactions. From demand trends and supply chain considerations to competitive pressures and investor sentiment, a multitude of elements contribute to shaping the market’s response. As Apple continues to navigate these challenges, its ability to communicate effectively with stakeholders and adapt to evolving market conditions will be crucial in maintaining investor confidence and sustaining its position as a leader in the technology industry.

How Supply Chain Issues Affect Apple’s Financial Performance

Apple Inc., a titan in the technology industry, has recently experienced a decline in its share value, a development that has captured the attention of investors and analysts alike. This downturn follows a report from a prominent analyst suggesting a reduction in orders for the upcoming iPhone 16. The report has sparked concerns about potential supply chain issues, which have historically played a significant role in affecting Apple’s financial performance. Understanding the intricate relationship between supply chain dynamics and Apple’s market standing is crucial for comprehending the broader implications of this development.

Supply chain issues have long been a critical factor in the technology sector, where the timely availability of components can make or break product launches. For Apple, a company renowned for its meticulous attention to detail and high-quality products, any disruption in the supply chain can have cascading effects. The iPhone, being one of Apple’s flagship products, is particularly sensitive to such disruptions. A reduction in orders for the iPhone 16, as suggested by the analyst, could indicate potential bottlenecks in the supply chain, possibly due to shortages of key components or logistical challenges.

Moreover, the global supply chain has been under unprecedented strain in recent years, exacerbated by geopolitical tensions, trade restrictions, and the lingering effects of the COVID-19 pandemic. These factors have led to increased lead times and higher costs for raw materials and components, which in turn can impact production schedules and profit margins. For Apple, which relies on a complex network of suppliers and manufacturers across the globe, navigating these challenges is crucial to maintaining its competitive edge and financial health.

In addition to external pressures, Apple’s supply chain strategy itself plays a pivotal role in its financial performance. The company has traditionally employed a just-in-time inventory system, which minimizes holding costs but also leaves little room for error in the event of supply disruptions. While this approach has allowed Apple to operate efficiently under normal circumstances, it can become a liability when unexpected disruptions occur. Consequently, any indication of reduced iPhone orders can lead to investor apprehension, as it may signal potential revenue shortfalls or increased operational costs.

Furthermore, the impact of supply chain issues on Apple’s financial performance extends beyond immediate revenue implications. Investor sentiment, which is often influenced by perceptions of a company’s ability to manage risks and maintain growth, can be significantly affected by reports of supply chain challenges. A decline in share value, as seen following the analyst’s report, reflects broader concerns about Apple’s capacity to navigate these complexities and sustain its market leadership.

In response to these challenges, Apple has been actively working to diversify its supply chain and reduce dependency on single sources. Initiatives such as investing in new manufacturing facilities and exploring alternative suppliers are part of Apple’s strategy to enhance resilience and mitigate risks. However, these efforts require time and resources, and their effectiveness in addressing current supply chain issues remains to be seen.

In conclusion, the recent decline in Apple shares underscores the profound impact that supply chain issues can have on the company’s financial performance. As Apple continues to grapple with these challenges, its ability to adapt and innovate will be crucial in maintaining investor confidence and ensuring long-term success. The situation serves as a reminder of the intricate interplay between supply chain dynamics and financial outcomes in the technology sector, highlighting the importance of strategic foresight and operational agility.

Investor Sentiment And Its Influence On Apple Shares

Apple Inc., a titan in the technology industry, has long been a favorite among investors, consistently demonstrating robust financial performance and innovation. However, recent developments have caused a stir in the market, leading to a noticeable decline in Apple shares. This downturn was triggered by an analyst’s report suggesting a reduction in orders for the upcoming iPhone 16, a development that has sparked concerns among investors about the company’s future growth prospects.

The analyst’s report, which emerged from a reputable financial institution, indicated that Apple has scaled back its production orders for the iPhone 16. This decision is reportedly due to anticipated lower demand, a factor that has raised eyebrows among investors who have come to expect strong sales figures from Apple’s flagship product line. The iPhone, being a significant revenue driver for the company, plays a crucial role in shaping investor sentiment. Consequently, any indication of reduced demand can have a profound impact on the company’s stock performance.

Investor sentiment is a powerful force in the stock market, often driving share prices up or down based on perceptions of a company’s future performance. In the case of Apple, the report of reduced iPhone 16 orders has led to a wave of concern, prompting some investors to reassess their positions. This reaction is not uncommon, as investors tend to be highly sensitive to any news that might suggest a deviation from expected growth trajectories. The immediate response in the market was a decline in Apple’s share price, reflecting the apprehension surrounding the potential implications of the report.

Moreover, the influence of investor sentiment on Apple shares is further compounded by the broader context of the technology sector. The industry is characterized by rapid innovation and intense competition, with companies constantly vying for consumer attention and market share. In such an environment, any perceived weakness or slowdown in a leading company’s product line can lead to heightened scrutiny and volatility in its stock performance. For Apple, a company that has consistently set high standards for innovation and market leadership, the pressure to maintain its competitive edge is immense.

In addition to the immediate impact on share prices, the report has also sparked discussions about Apple’s strategic direction and its ability to adapt to changing market dynamics. Investors are keenly aware that the technology landscape is evolving, with emerging trends such as artificial intelligence, augmented reality, and 5G connectivity reshaping consumer preferences. As such, Apple’s ability to innovate and align its product offerings with these trends is crucial for sustaining its growth momentum and investor confidence.

While the report on reduced iPhone 16 orders has undoubtedly influenced investor sentiment, it is important to consider the broader context of Apple’s business strategy. The company has a history of navigating challenges and emerging stronger, often leveraging its vast resources and talent to drive innovation. Furthermore, Apple’s diverse product portfolio and expanding services segment provide additional avenues for growth, potentially offsetting any short-term fluctuations in iPhone sales.

In conclusion, the recent decline in Apple shares following the analyst’s report underscores the significant role that investor sentiment plays in shaping stock performance. As the company continues to navigate the complexities of the technology sector, its ability to address market concerns and demonstrate resilience will be key to maintaining investor confidence. Ultimately, while the report has raised questions about the immediate future, Apple’s track record suggests that it remains well-positioned to adapt and thrive in an ever-evolving industry landscape.

The Role Of Product Demand In Apple’s Stock Volatility

Apple Inc., a titan in the technology industry, has long been a bellwether for market trends, with its stock performance closely watched by investors and analysts alike. Recently, Apple shares experienced a notable decline following a report from a prominent analyst suggesting a reduction in orders for the upcoming iPhone 16. This development underscores the critical role that product demand plays in the volatility of Apple’s stock, reflecting broader market sentiments and investor expectations.

The report, which highlighted a potential decrease in production orders for the iPhone 16, sent ripples through the financial markets. Investors, who often rely on such analyses to gauge future performance, reacted swiftly, leading to a dip in Apple’s stock price. This reaction is emblematic of the sensitivity of Apple’s stock to fluctuations in product demand, particularly for its flagship iPhone series, which remains a significant revenue driver for the company. The iPhone’s success is not only pivotal to Apple’s financial health but also serves as a barometer for consumer confidence and technological innovation.

Transitioning to the broader implications, the volatility in Apple’s stock due to changes in product demand is not an isolated phenomenon. It reflects a broader trend in the technology sector, where companies are often judged by their ability to anticipate and meet consumer needs. In Apple’s case, the anticipation surrounding each new iPhone release is immense, with consumers and investors alike eager to see how the company will innovate and differentiate its products in a highly competitive market. Consequently, any indication of reduced demand or production can lead to significant market reactions, as stakeholders reassess their expectations for the company’s future performance.

Moreover, the impact of product demand on stock volatility is further compounded by the global nature of Apple’s supply chain. The company relies on a complex network of suppliers and manufacturers, and any disruptions or changes in this network can have cascading effects on production capabilities and timelines. In the case of the iPhone 16, speculation about reduced orders may also be influenced by external factors such as supply chain constraints, geopolitical tensions, or shifts in consumer preferences. These factors add layers of complexity to the already intricate relationship between product demand and stock performance.

In addition to these external factors, Apple’s strategic decisions also play a crucial role in shaping product demand and, by extension, stock volatility. The company’s approach to innovation, marketing, and pricing can significantly influence consumer interest and purchasing behavior. For instance, the introduction of new features or technologies in the iPhone 16 could either bolster demand or, conversely, fail to resonate with consumers, thereby affecting sales projections and investor confidence.

In conclusion, the recent decline in Apple shares following the analyst’s report on reduced iPhone 16 orders highlights the intricate interplay between product demand and stock volatility. As a leading player in the technology sector, Apple’s ability to navigate these challenges and maintain consumer interest is paramount to its continued success. Investors and analysts will undoubtedly continue to scrutinize the company’s performance, particularly in relation to its flagship products, as they seek to understand and anticipate the factors driving Apple’s stock movements. This dynamic underscores the importance of product demand as a key determinant of stock volatility, not only for Apple but for the technology industry as a whole.

Analyzing The Long-term Implications Of Reduced iPhone Orders

Apple Inc., a titan in the technology industry, recently experienced a notable decline in its share value following an analyst’s report suggesting a reduction in orders for the upcoming iPhone 16. This development has sparked widespread discussion among investors and industry experts, as it raises questions about the potential long-term implications for the company. While fluctuations in stock prices are not uncommon, the underlying reasons for this particular dip warrant a closer examination, especially considering Apple’s significant influence on the global market.

To begin with, the report indicating reduced iPhone 16 orders suggests a potential shift in consumer demand or market strategy. Historically, Apple’s iPhone releases have been met with high anticipation and robust sales, often setting benchmarks for the industry. However, a decrease in orders could imply that Apple is adjusting its expectations based on market research or feedback. This adjustment might be a strategic move to prevent overproduction and manage inventory more efficiently, thereby avoiding the pitfalls of excess supply. Alternatively, it could reflect a broader trend of market saturation or changing consumer preferences, which might be gravitating towards alternative brands or different technological innovations.

Moreover, the implications of reduced iPhone orders extend beyond immediate financial metrics. Apple’s supply chain, which is a complex network of global suppliers and manufacturers, could face disruptions or adjustments as a result of these changes. Suppliers who rely heavily on Apple’s orders might experience financial strain, leading to a ripple effect throughout the industry. This situation underscores the interconnected nature of modern supply chains and highlights the importance of adaptability and resilience in the face of shifting demands.

In addition to supply chain considerations, Apple’s brand perception could also be impacted. The company has long been associated with innovation and premium quality, attributes that have cultivated a loyal customer base. However, if the reduction in orders is perceived as a sign of waning innovation or competitiveness, it could challenge Apple’s reputation. Maintaining consumer trust and interest is crucial, especially in an era where technological advancements occur at a rapid pace and competition is fierce.

Furthermore, the potential long-term implications of reduced iPhone orders may influence Apple’s strategic direction. The company might need to explore new avenues for growth, such as expanding its services sector or investing in emerging technologies like augmented reality or artificial intelligence. Diversification could mitigate the risks associated with reliance on a single product line and open up new revenue streams. This strategic pivot would not only address immediate concerns but also position Apple for sustained success in the future.

In conclusion, while the recent decline in Apple shares following the analyst’s report on reduced iPhone 16 orders has raised concerns, it also presents an opportunity for the company to reassess and adapt its strategies. The long-term implications of this development are multifaceted, affecting supply chains, brand perception, and strategic direction. As Apple navigates these challenges, its ability to innovate and respond to market dynamics will be crucial in maintaining its leadership position in the technology sector. Investors and industry observers alike will be keenly watching how Apple addresses these issues, as the outcomes will likely have significant ramifications for the broader market.

Strategies For Investors During Apple Stock Fluctuations

Apple Inc., a titan in the technology industry, has long been a staple in the portfolios of many investors. However, recent developments have caused a stir in the market, prompting investors to reassess their strategies. The company’s shares experienced a notable decline following an analyst’s report suggesting a reduction in orders for the upcoming iPhone 16. This news has raised concerns about potential impacts on Apple’s revenue and market position, leading to fluctuations in its stock price. In light of these events, it is crucial for investors to adopt informed strategies to navigate the volatility associated with Apple shares.

To begin with, understanding the underlying reasons for the reported reduction in iPhone 16 orders is essential. Analysts have speculated that a combination of factors, including supply chain disruptions and shifting consumer preferences, may have influenced Apple’s decision. While these factors are significant, it is important to recognize that Apple’s ecosystem extends beyond the iPhone. The company’s diverse product lineup, including services and wearables, continues to contribute to its overall revenue stream. Therefore, investors should consider the broader context of Apple’s business operations when evaluating the impact of the iPhone 16 order reduction.

Moreover, diversification remains a key strategy for investors during periods of stock fluctuation. By spreading investments across various sectors and asset classes, investors can mitigate the risks associated with a single company’s performance. In the case of Apple, this approach can help cushion the impact of any potential downturns in its stock price. Additionally, diversification allows investors to capitalize on growth opportunities in other areas of the market, thereby enhancing their overall portfolio performance.

Furthermore, maintaining a long-term perspective is crucial when dealing with stock market volatility. Apple’s history of innovation and resilience suggests that short-term fluctuations may not necessarily reflect the company’s long-term potential. Investors who focus on the bigger picture and remain patient are often better positioned to weather temporary setbacks. By keeping an eye on Apple’s strategic initiatives and future product developments, investors can make more informed decisions about their holdings.

In addition to these strategies, staying informed about market trends and analyst reports is vital. Regularly reviewing financial news and analysis can provide valuable insights into the factors influencing Apple’s stock performance. This information can help investors anticipate potential changes in the market and adjust their strategies accordingly. However, it is important to approach such reports with a critical mindset, recognizing that analyst opinions can vary and may not always accurately predict future outcomes.

Finally, consulting with financial advisors can offer personalized guidance tailored to individual investment goals and risk tolerance. Advisors can provide expert insights into market dynamics and help investors develop strategies that align with their financial objectives. By leveraging professional advice, investors can navigate the complexities of stock market fluctuations with greater confidence.

In conclusion, while the recent decline in Apple shares following the analyst’s report on reduced iPhone 16 orders may cause concern, it also presents an opportunity for investors to reassess their strategies. By understanding the broader context of Apple’s business, diversifying their portfolios, maintaining a long-term perspective, staying informed, and seeking professional advice, investors can effectively manage the challenges and opportunities associated with Apple stock fluctuations. Through these strategies, investors can position themselves to achieve their financial goals while navigating the ever-evolving landscape of the stock market.

Q&A

1. **What caused Apple shares to fall?**

Apple shares fell following an analyst’s report suggesting reduced orders for the upcoming iPhone 16.

2. **Which product’s orders were reportedly reduced?**

The orders reportedly reduced were for the iPhone 16.

3. **Who released the report that impacted Apple shares?**

An analyst released the report that impacted Apple shares.

4. **What was the market’s reaction to the report?**

The market reacted negatively, leading to a decline in Apple shares.

5. **How significant was the share price drop?**

The significance of the share price drop would depend on the percentage or dollar amount, which is not specified here.

6. **What might be the reason for the reduced iPhone 16 orders?**

Possible reasons could include anticipated lower demand, supply chain issues, or strategic adjustments, though specifics are not provided.

7. **How could this report affect Apple’s future performance?**

The report could lead to investor concerns about future sales and revenue, potentially affecting Apple’s stock performance and market perception.

Conclusion

Apple shares experienced a decline following an analyst’s report indicating reduced orders for the upcoming iPhone 16. This development suggests potential concerns about future demand and market performance for Apple’s flagship product. The report may have influenced investor sentiment, leading to a sell-off in Apple stock as stakeholders reassess the company’s growth prospects and revenue expectations. The situation underscores the sensitivity of Apple’s market valuation to product demand forecasts and highlights the importance of maintaining strong consumer interest in its product lineup.