“Carvana’s Comeback: From Near Collapse to Skyrocketing Success!”

Introduction

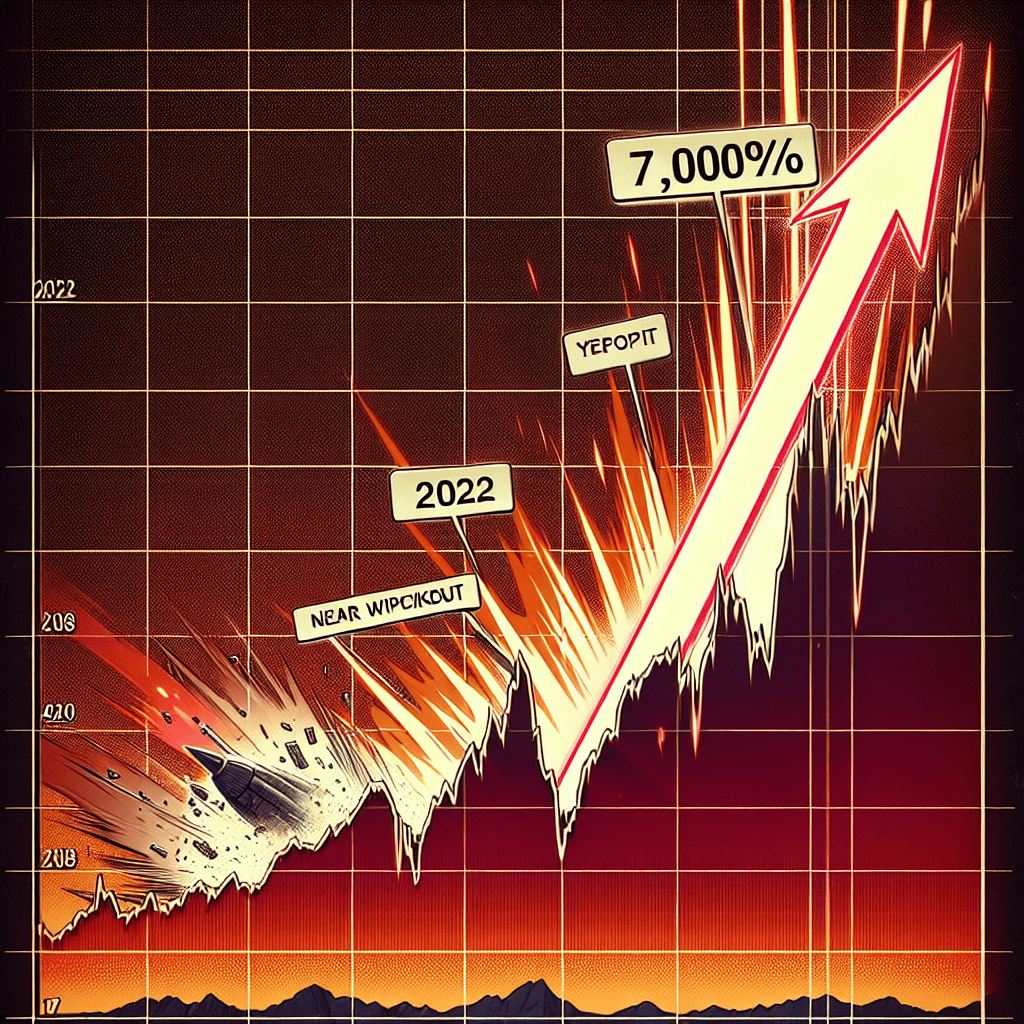

Carvana, the online used car retailer, has experienced a remarkable resurgence in its stock value, surging over 7,000% following a near wipeout in 2022. This dramatic turnaround has captured the attention of investors and market analysts alike, as the company navigated through a challenging period marked by financial instability and operational hurdles. The resurgence can be attributed to strategic restructuring efforts, improved market conditions, and a renewed focus on customer experience and operational efficiency. As Carvana regains its footing, the company’s remarkable recovery underscores its resilience and adaptability in the competitive automotive retail sector.

Carvana’s Remarkable Comeback: Analyzing the Factors Behind the 7,000% Stock Surge

Carvana’s remarkable resurgence in the stock market has captured the attention of investors and analysts alike, as the company’s shares have surged over 7,000% following a near wipeout in 2022. This dramatic turnaround is a testament to the company’s resilience and strategic maneuvers, which have played a pivotal role in restoring investor confidence and driving the stock’s meteoric rise. To understand the factors behind this extraordinary recovery, it is essential to examine the key elements that have contributed to Carvana’s resurgence.

Firstly, Carvana’s ability to adapt to changing market conditions has been instrumental in its comeback. The company, known for its innovative online platform for buying and selling used cars, faced significant challenges in 2022 due to supply chain disruptions and a volatile economic environment. However, Carvana swiftly implemented measures to mitigate these issues, such as optimizing its inventory management and enhancing its logistics network. By doing so, the company was able to improve its operational efficiency and better meet consumer demand, which in turn bolstered its financial performance.

In addition to operational improvements, Carvana’s strategic partnerships have also played a crucial role in its stock surge. The company has forged alliances with key industry players, enabling it to expand its market reach and enhance its service offerings. These partnerships have not only provided Carvana with access to a broader customer base but have also facilitated the integration of advanced technologies into its platform. As a result, Carvana has been able to offer a more seamless and user-friendly experience to its customers, further strengthening its competitive position in the market.

Moreover, Carvana’s focus on customer satisfaction has been a driving force behind its resurgence. The company has consistently prioritized delivering a superior customer experience, which has helped it build a loyal customer base and attract new buyers. By investing in customer service initiatives and leveraging data analytics to personalize the buying process, Carvana has been able to differentiate itself from traditional car dealerships. This customer-centric approach has not only enhanced Carvana’s brand reputation but has also contributed to increased sales and revenue growth.

Furthermore, the broader economic landscape has also played a role in Carvana’s stock surge. As the economy began to recover from the disruptions caused by the pandemic, consumer confidence improved, leading to a resurgence in demand for used cars. Carvana, with its robust online platform and extensive inventory, was well-positioned to capitalize on this trend. The company’s ability to offer a convenient and hassle-free car buying experience resonated with consumers, driving increased traffic to its platform and boosting sales.

Finally, investor sentiment has been a significant factor in Carvana’s stock performance. The company’s ability to navigate challenges and deliver strong financial results has instilled confidence among investors, leading to increased demand for its shares. Additionally, Carvana’s commitment to innovation and growth has been viewed favorably by the market, further fueling the stock’s upward trajectory.

In conclusion, Carvana’s remarkable stock surge can be attributed to a combination of strategic initiatives, operational improvements, and favorable market conditions. The company’s ability to adapt to changing circumstances, forge strategic partnerships, and prioritize customer satisfaction has been instrumental in its recovery. As Carvana continues to build on its strengths and capitalize on emerging opportunities, it remains well-positioned to sustain its growth momentum and deliver value to its shareholders.

Lessons from Carvana’s 2022 Wipeout and Subsequent Recovery

Carvana’s remarkable stock surge of over 7,000% following its near wipeout in 2022 offers a compelling case study in resilience and strategic adaptation within the volatile landscape of the automotive retail industry. The company’s journey from the brink of collapse to a triumphant recovery underscores several critical lessons for businesses navigating turbulent times. Understanding these lessons can provide valuable insights into the dynamics of market recovery and the importance of strategic pivots.

Initially, Carvana’s near wipeout in 2022 was precipitated by a confluence of factors, including supply chain disruptions, escalating operational costs, and a sharp decline in consumer demand. These challenges were exacerbated by the broader economic uncertainties that plagued many industries during that period. As a result, Carvana’s stock plummeted, leaving investors and analysts questioning the company’s future viability. However, rather than succumbing to these pressures, Carvana embarked on a comprehensive restructuring plan aimed at stabilizing its operations and restoring investor confidence.

One of the pivotal lessons from Carvana’s experience is the importance of agility and adaptability in business strategy. Faced with mounting challenges, Carvana swiftly implemented cost-cutting measures, streamlined its operations, and refocused its business model to align with the evolving market conditions. This strategic pivot not only helped the company weather the immediate storm but also positioned it for long-term growth. By embracing a flexible approach and being willing to make difficult decisions, Carvana demonstrated the critical role of adaptability in overcoming adversity.

Moreover, Carvana’s recovery highlights the significance of innovation and technological integration in driving business success. Throughout its turnaround, the company leveraged its robust online platform to enhance customer experience and expand its reach. By investing in technology and digital solutions, Carvana was able to differentiate itself from traditional automotive retailers and capitalize on the growing trend of online car shopping. This emphasis on innovation not only bolstered its competitive edge but also contributed to the remarkable surge in its stock value.

In addition to strategic agility and innovation, effective communication with stakeholders emerged as a crucial factor in Carvana’s recovery. The company maintained transparent and consistent communication with investors, customers, and employees, fostering trust and confidence during a period of uncertainty. By articulating its vision and outlining clear steps for recovery, Carvana was able to rally support and maintain stakeholder engagement, which proved instrumental in its resurgence.

Furthermore, Carvana’s experience underscores the importance of resilience and perseverance in the face of adversity. Despite the daunting challenges it faced, the company remained committed to its core mission and values, demonstrating unwavering determination to overcome obstacles. This resilience not only inspired confidence among stakeholders but also served as a driving force behind its successful recovery.

In conclusion, Carvana’s extraordinary stock surge following its near wipeout in 2022 offers valuable lessons for businesses navigating challenging environments. The company’s journey underscores the importance of strategic agility, innovation, effective communication, and resilience in overcoming adversity and achieving long-term success. As businesses continue to face an ever-changing landscape, these lessons from Carvana’s experience serve as a testament to the power of adaptability and perseverance in driving recovery and growth.

The Role of Market Sentiment in Carvana’s Stock Rebound

Carvana’s remarkable stock resurgence, surging over 7,000% after a near wipeout in 2022, underscores the profound impact of market sentiment on stock performance. This dramatic turnaround highlights how investor perception and broader market dynamics can significantly influence a company’s valuation, often beyond its fundamental financial metrics. Understanding the role of market sentiment in Carvana’s stock rebound requires an exploration of the factors that contributed to both its initial decline and subsequent recovery.

In 2022, Carvana faced a confluence of challenges that severely impacted its stock price. The company, known for its innovative online car sales platform, struggled with supply chain disruptions, rising interest rates, and a cooling used car market. These factors, coupled with broader economic uncertainties, led to a sharp decline in investor confidence. As a result, Carvana’s stock plummeted, reflecting widespread skepticism about its ability to navigate these turbulent conditions. However, the narrative began to shift as the company implemented strategic measures to address its operational challenges.

Carvana’s management took decisive steps to stabilize the business, including cost-cutting initiatives and efforts to streamline operations. These actions, while crucial, were not the sole drivers of the stock’s recovery. Instead, the rebound was largely fueled by a shift in market sentiment. Investors began to reassess Carvana’s long-term potential, buoyed by signs of stabilization in the used car market and a broader recovery in consumer demand. This renewed optimism was further amplified by positive analyst reports and strategic partnerships that signaled confidence in Carvana’s business model.

Moreover, the broader stock market environment played a pivotal role in Carvana’s resurgence. As inflationary pressures eased and interest rates stabilized, investor appetite for growth stocks increased. This shift in market dynamics created a more favorable backdrop for Carvana, allowing its stock to benefit from a broader rally in the technology and consumer discretionary sectors. The interplay between these macroeconomic factors and company-specific developments illustrates the complex nature of market sentiment and its influence on stock performance.

Additionally, the role of retail investors cannot be overlooked in Carvana’s stock rebound. The rise of social media platforms and online trading communities has democratized access to financial markets, enabling individual investors to collectively influence stock prices. In Carvana’s case, the stock became a focal point for retail investors who were drawn to its potential for outsized returns. This surge in retail interest contributed to increased trading volumes and heightened volatility, further propelling the stock’s upward trajectory.

In conclusion, Carvana’s extraordinary stock recovery serves as a testament to the power of market sentiment in shaping investor behavior and stock valuations. While fundamental factors such as operational improvements and strategic initiatives are essential, they are often intertwined with broader market dynamics and investor perceptions. Carvana’s experience underscores the importance of understanding these complex interactions, as they can lead to significant shifts in stock performance, sometimes defying conventional expectations. As the company continues to navigate its path forward, the lessons from its stock rebound offer valuable insights into the intricate relationship between market sentiment and corporate success.

Carvana’s Strategic Moves: Key Decisions That Fueled the Stock Surge

Carvana’s remarkable resurgence in the stock market, with a staggering surge of over 7,000% following a near wipeout in 2022, has captured the attention of investors and analysts alike. This dramatic turnaround can be attributed to a series of strategic decisions and operational adjustments that have revitalized the company’s fortunes. Understanding these key moves provides valuable insights into how Carvana navigated its way back to prominence in the highly competitive online car retailing industry.

To begin with, Carvana’s leadership recognized the urgent need to address the financial instability that had plagued the company. In response, they implemented a comprehensive restructuring plan aimed at reducing costs and improving operational efficiency. This involved streamlining their logistics network, optimizing inventory management, and renegotiating supplier contracts. By focusing on these core areas, Carvana was able to significantly cut expenses, thereby stabilizing its financial position and restoring investor confidence.

In addition to cost-cutting measures, Carvana made a concerted effort to enhance its customer experience, which is a critical component of its business model. The company invested heavily in technology to improve its online platform, making it more user-friendly and efficient. This included the introduction of advanced search algorithms, virtual car tours, and a seamless checkout process. By leveraging technology to create a more engaging and convenient shopping experience, Carvana was able to attract a larger customer base and increase sales volume.

Moreover, Carvana’s strategic expansion into new markets played a pivotal role in its stock resurgence. The company identified key regions with high demand for online car purchases and strategically established its presence in these areas. This expansion was supported by the development of additional vehicle inspection and reconditioning centers, which enabled Carvana to offer a wider selection of vehicles and faster delivery times. By tapping into these new markets, Carvana not only increased its revenue streams but also strengthened its competitive position in the industry.

Another crucial factor contributing to Carvana’s stock surge was its ability to adapt to changing consumer preferences. The company recognized the growing demand for electric vehicles (EVs) and took proactive steps to expand its EV inventory. By partnering with leading EV manufacturers and offering attractive financing options, Carvana positioned itself as a go-to destination for environmentally conscious consumers. This strategic alignment with market trends not only boosted sales but also enhanced Carvana’s brand image as an innovative and forward-thinking company.

Furthermore, Carvana’s commitment to transparency and customer trust proved instrumental in its recovery. The company introduced a comprehensive vehicle history report and a seven-day return policy, which reassured customers about the quality and reliability of their purchases. This emphasis on transparency helped build a loyal customer base and generated positive word-of-mouth, further driving sales growth.

In conclusion, Carvana’s extraordinary stock surge following its near wipeout in 2022 can be attributed to a combination of strategic cost-cutting, technological enhancements, market expansion, adaptation to consumer trends, and a commitment to transparency. These key decisions not only revitalized the company’s financial health but also positioned it for sustained growth in the future. As Carvana continues to innovate and adapt to the evolving automotive landscape, its remarkable turnaround serves as a testament to the power of strategic foresight and operational excellence in the business world.

Investor Reactions to Carvana’s Unprecedented Stock Performance

Carvana’s stock performance has captured the attention of investors and market analysts alike, as it has experienced a remarkable surge of over 7,000% following a near wipeout in 2022. This unprecedented rebound has prompted a variety of reactions from investors, ranging from cautious optimism to enthusiastic endorsement. To understand the dynamics behind this dramatic turnaround, it is essential to examine the factors contributing to Carvana’s resurgence and the broader implications for the investment community.

Initially, Carvana faced significant challenges in 2022, as the company grappled with operational inefficiencies, supply chain disruptions, and a volatile economic environment. These issues culminated in a steep decline in stock value, leading many investors to question the company’s long-term viability. However, Carvana’s management team responded with a series of strategic initiatives aimed at stabilizing the business and restoring investor confidence. By streamlining operations, enhancing customer experience, and leveraging technology to optimize inventory management, Carvana laid the groundwork for a potential recovery.

As these efforts began to bear fruit, investor sentiment gradually shifted. The company’s ability to adapt to changing market conditions and its commitment to innovation played a crucial role in restoring credibility. Furthermore, Carvana’s focus on expanding its market presence and improving financial performance resonated with investors seeking growth opportunities in the automotive sector. Consequently, as Carvana’s stock price began to climb, it attracted renewed interest from both institutional and retail investors.

The dramatic surge in Carvana’s stock has also been fueled by broader market trends, including a resurgence in consumer demand for used vehicles and a growing preference for online car buying platforms. As the automotive industry continues to evolve, Carvana’s digital-first approach positions it well to capitalize on these shifts. This alignment with market trends has further bolstered investor confidence, contributing to the stock’s meteoric rise.

However, the extraordinary performance of Carvana’s stock has not been without its skeptics. Some investors remain cautious, citing concerns about the sustainability of such rapid growth and the potential for market volatility. The memory of the company’s struggles in 2022 serves as a reminder of the inherent risks associated with investing in high-growth stocks. As a result, some market participants advocate for a more measured approach, emphasizing the importance of diversification and risk management in investment portfolios.

Despite these reservations, the overwhelming response to Carvana’s stock surge has been one of optimism and excitement. The company’s ability to rebound from adversity and deliver substantial returns has captured the imagination of investors, reinforcing the notion that resilience and innovation can drive success in even the most challenging circumstances. This sentiment is reflected in the increased trading volumes and heightened media attention surrounding Carvana’s stock.

In conclusion, Carvana’s remarkable stock performance has elicited a wide range of reactions from the investment community. While some investors remain cautious, the overall sentiment is one of optimism and confidence in the company’s future prospects. As Carvana continues to navigate the complexities of the automotive market, its ability to sustain this momentum will be closely watched by investors and analysts alike. Ultimately, Carvana’s story serves as a testament to the power of strategic adaptation and innovation in driving business success and creating value for shareholders.

Comparing Carvana’s Recovery to Other Historic Stock Market Comebacks

Carvana’s remarkable resurgence in the stock market, with its shares surging over 7,000% after a near wipeout in 2022, has captured the attention of investors and analysts alike. This dramatic recovery invites comparisons to other historic stock market comebacks, offering valuable insights into the dynamics of market resilience and investor sentiment. To understand the significance of Carvana’s rebound, it is essential to examine the factors that contributed to its initial decline and subsequent recovery, as well as to compare it with other notable recoveries in stock market history.

In 2022, Carvana faced a series of challenges that nearly led to its downfall. The company, known for its innovative approach to selling used cars online, was hit hard by supply chain disruptions, rising interest rates, and a slowdown in consumer spending. These factors, coupled with mounting debt and operational inefficiencies, caused investor confidence to wane, leading to a precipitous drop in its stock price. However, Carvana’s management took decisive action to address these issues, implementing cost-cutting measures, streamlining operations, and securing additional financing. These efforts, along with a gradual improvement in market conditions, set the stage for a remarkable turnaround.

Carvana’s recovery can be compared to other historic stock market comebacks, such as Apple’s resurgence in the late 1990s and Tesla’s meteoric rise in the 2010s. Apple’s comeback was driven by a renewed focus on innovation and product development, exemplified by the launch of the iMac and later the iPod. Similarly, Tesla’s ascent was fueled by its ability to capture the imagination of investors with its vision for electric vehicles and sustainable energy. In both cases, the companies were able to overcome significant challenges by leveraging their unique strengths and adapting to changing market conditions.

Carvana’s recovery shares some similarities with these examples, particularly in its ability to adapt and innovate in response to adversity. The company’s focus on enhancing its digital platform and improving the customer experience has resonated with consumers, driving increased sales and revenue growth. Moreover, Carvana’s ability to secure additional financing has provided the necessary capital to support its expansion efforts and strengthen its balance sheet. These strategic moves have not only restored investor confidence but also positioned the company for long-term success.

While Carvana’s comeback is impressive, it is important to recognize that not all companies are able to achieve such dramatic recoveries. The stock market is littered with examples of companies that failed to adapt to changing conditions or were unable to overcome significant challenges. This underscores the importance of strong leadership, strategic vision, and the ability to execute effectively in the face of adversity. Carvana’s experience serves as a reminder that while the stock market can be volatile and unpredictable, companies that are able to navigate these challenges successfully can emerge stronger and more resilient.

In conclusion, Carvana’s extraordinary stock market recovery is a testament to the company’s ability to adapt and innovate in response to significant challenges. By comparing Carvana’s resurgence to other historic comebacks, we gain a deeper understanding of the factors that contribute to successful turnarounds and the importance of strategic leadership in navigating the complexities of the stock market. As Carvana continues to build on its recent success, it will be interesting to see how the company leverages its strengths to sustain its growth and maintain its competitive edge in the evolving automotive industry.

Future Prospects for Carvana: Sustainability of the Stock Surge

Carvana’s remarkable stock surge, exceeding 7,000% after a near wipeout in 2022, has captured the attention of investors and market analysts alike. This dramatic turnaround raises questions about the sustainability of such a meteoric rise and the future prospects for the company. To understand the potential longevity of this surge, it is essential to examine the factors contributing to Carvana’s recent success and the challenges it may face moving forward.

Initially, Carvana’s recovery can be attributed to a combination of strategic initiatives and favorable market conditions. The company, known for its innovative online platform for buying and selling used cars, capitalized on the growing consumer preference for digital transactions, a trend accelerated by the COVID-19 pandemic. As more consumers sought the convenience and safety of online car purchases, Carvana’s business model gained significant traction. Furthermore, the company implemented cost-cutting measures and operational efficiencies, which improved its financial health and investor confidence.

In addition to these internal factors, external market dynamics played a crucial role in Carvana’s resurgence. The used car market experienced a surge in demand due to supply chain disruptions affecting new car production. This imbalance between supply and demand led to higher prices for used vehicles, benefiting Carvana’s bottom line. Moreover, the broader economic recovery and increased consumer spending power contributed to the company’s improved performance.

Despite these positive developments, the sustainability of Carvana’s stock surge remains uncertain. One of the primary concerns is the potential normalization of the used car market. As supply chain issues gradually resolve and new car production stabilizes, the demand for used cars may decrease, potentially impacting Carvana’s revenue growth. Additionally, the company faces intense competition from both traditional dealerships and other online platforms, which could pressure its market share and profitability.

Another factor to consider is Carvana’s financial position. While the company has made strides in improving its operational efficiency, it still carries a significant debt burden. The ability to manage and reduce this debt will be crucial for maintaining investor confidence and supporting long-term growth. Furthermore, Carvana’s expansion plans, including the development of new markets and enhancement of its logistics network, will require substantial capital investment. Balancing these investments with the need for financial stability will be a delicate task.

Moreover, regulatory challenges could pose a threat to Carvana’s continued success. As the company expands its operations, it must navigate a complex web of state and federal regulations governing the sale of vehicles. Compliance with these regulations is essential to avoid legal issues that could disrupt operations and damage the company’s reputation.

In conclusion, while Carvana’s stock surge is undoubtedly impressive, its sustainability hinges on several factors. The company must continue to adapt to changing market conditions, manage its financial obligations, and navigate regulatory challenges. Additionally, maintaining a competitive edge in the increasingly crowded online car sales market will be vital for sustaining growth. Investors and stakeholders will be closely monitoring Carvana’s ability to address these challenges and capitalize on opportunities in the evolving automotive landscape. As such, the future prospects for Carvana remain promising yet fraught with uncertainties that require careful consideration and strategic planning.

Q&A

1. **What caused Carvana’s stock to surge over 7,000%?**

The surge was driven by a combination of improved financial performance, strategic restructuring, and positive market sentiment.

2. **How did Carvana perform financially in 2022?**

Carvana faced significant financial challenges in 2022, including high debt levels and operational inefficiencies, leading to a near wipeout of its stock value.

3. **What strategic changes did Carvana implement to recover?**

Carvana focused on cost-cutting measures, restructuring debt, and enhancing its online car sales platform to improve profitability and operational efficiency.

4. **How did the market react to Carvana’s recovery efforts?**

Investors responded positively to Carvana’s recovery efforts, leading to a dramatic increase in stock value as confidence in the company’s future prospects improved.

5. **What role did the automotive market play in Carvana’s stock surge?**

A recovering automotive market, with increased demand for used cars, contributed to Carvana’s improved sales and stock performance.

6. **Did Carvana face any regulatory challenges during its recovery?**

Carvana navigated various regulatory challenges related to its business model and operations but managed to address these issues as part of its restructuring efforts.

7. **What are analysts’ expectations for Carvana’s future performance?**

Analysts have mixed views, with some optimistic about continued growth due to strategic improvements, while others remain cautious due to potential market volatility and competition.

Conclusion

Carvana’s stock experiencing a surge of over 7,000% following a near wipeout in 2022 highlights the company’s remarkable recovery and resilience in the face of significant financial challenges. This dramatic rebound may be attributed to strategic operational improvements, market conditions favoring online car sales, or investor optimism about the company’s future prospects. However, such a volatile stock performance also underscores the inherent risks and uncertainties in the market, suggesting that investors should remain cautious and consider both the potential for high returns and the possibility of future fluctuations.