“Apple’s Outlook Dims: China’s Challenges Cast a Shadow on Investor Confidence”

Introduction

Apple’s recent financial forecast and its ongoing challenges in China have left investors unimpressed, casting a shadow over the tech giant’s market performance. Despite its reputation for innovation and strong brand loyalty, Apple faces significant hurdles in one of its most crucial markets. The company’s cautious revenue projections, coupled with geopolitical tensions and regulatory pressures in China, have raised concerns about its growth prospects. As Apple navigates these complexities, investors remain wary, questioning the company’s ability to sustain its momentum in an increasingly competitive and uncertain global landscape.

Apple’s Revenue Forecast: What It Means for Investors

Apple Inc., a titan in the technology industry, recently released its revenue forecast, which has left investors with mixed feelings. The company’s projections, while still robust, have not met the high expectations that many stakeholders had anticipated. This tempered outlook is largely attributed to a confluence of factors, including economic uncertainties and geopolitical tensions, particularly with China, a key market for Apple. As investors digest this information, it is crucial to understand the implications of Apple’s forecast and the challenges it faces in China.

To begin with, Apple’s revenue forecast reflects a cautious optimism. The company has consistently demonstrated resilience and innovation, maintaining its position as a leader in the tech sector. However, the forecast suggests a slower growth trajectory than previously expected. This is partly due to the global economic slowdown, which has affected consumer spending patterns. Inflationary pressures and rising interest rates have also contributed to a more conservative consumer outlook, impacting sales of high-end products like the iPhone and MacBook.

Moreover, Apple’s challenges in China cannot be overlooked. China represents a significant portion of Apple’s revenue, and any disruption in this market can have substantial repercussions. The ongoing trade tensions between the United States and China have created an environment of uncertainty, affecting supply chains and consumer sentiment. Additionally, China’s own economic challenges, including a slowing economy and regulatory pressures on tech companies, have further complicated Apple’s operations in the region.

In light of these challenges, Apple has been striving to diversify its revenue streams. The company has been investing heavily in its services segment, which includes the App Store, Apple Music, and iCloud. This strategic shift aims to reduce reliance on hardware sales and capitalize on the growing demand for digital services. While this transition is promising, it is not without its hurdles. The services market is highly competitive, and Apple must continuously innovate to maintain its edge.

Furthermore, Apple’s commitment to sustainability and ethical practices is becoming increasingly important to investors. The company has made significant strides in reducing its carbon footprint and ensuring responsible sourcing of materials. These efforts not only enhance Apple’s brand image but also align with the growing emphasis on environmental, social, and governance (ESG) criteria among investors. However, balancing these initiatives with profitability remains a delicate task.

As investors assess Apple’s revenue forecast, it is essential to consider the broader context. The tech industry is inherently volatile, and companies must navigate a complex landscape of technological advancements, regulatory changes, and shifting consumer preferences. Apple’s ability to adapt to these changes will be a critical determinant of its future success.

In conclusion, while Apple’s revenue forecast may not have met the lofty expectations of some investors, it is important to recognize the company’s enduring strengths and strategic initiatives. The challenges in China and the global economic environment present significant hurdles, but Apple’s track record of innovation and adaptability provides a solid foundation for future growth. Investors would do well to keep a long-term perspective, considering both the risks and opportunities that lie ahead for this iconic company. As Apple continues to evolve, its ability to address these challenges will be pivotal in shaping its trajectory in the years to come.

The Impact of China’s Economic Slowdown on Apple

Apple Inc., a global leader in technology, has long been a bellwether for the tech industry, with its financial performance often seen as an indicator of broader market trends. However, recent developments have left investors less than impressed, as Apple’s forecast and its challenges in China have raised concerns about the company’s future growth prospects. The economic slowdown in China, a critical market for Apple, has emerged as a significant factor influencing the company’s outlook.

China, the world’s second-largest economy, has been experiencing a deceleration in its economic growth, which has had ripple effects across various industries, including technology. For Apple, China represents not only a substantial market for its products but also a crucial component of its supply chain. The slowdown in consumer spending in China has led to a decrease in demand for high-end electronics, including Apple’s flagship iPhones. This decline in demand has been exacerbated by increasing competition from local smartphone manufacturers, who offer feature-rich devices at more competitive prices.

Moreover, the geopolitical tensions between the United States and China have further complicated Apple’s position in the Chinese market. Trade restrictions and tariffs have increased the cost of doing business, while regulatory scrutiny has added layers of complexity to Apple’s operations in the region. These challenges have prompted Apple to reassess its strategies, including diversifying its supply chain to reduce dependency on China. However, such strategic shifts are not without their own set of challenges and require significant time and investment to implement effectively.

In addition to these external factors, Apple’s own forecasts have contributed to investor apprehension. The company has projected slower revenue growth, citing not only the challenges in China but also a broader global economic uncertainty. This cautious outlook has led to a reevaluation of Apple’s stock by investors, who are now more wary of the potential risks associated with the company’s heavy reliance on the Chinese market.

Despite these challenges, Apple remains a formidable player in the tech industry, with a strong brand and a loyal customer base. The company’s continued investment in innovation and its expansion into new product categories, such as wearables and services, offer potential avenues for growth. However, the success of these initiatives is contingent upon Apple’s ability to navigate the complex landscape of global trade and economic fluctuations.

Furthermore, Apple’s efforts to strengthen its presence in other emerging markets could serve as a buffer against the slowdown in China. By tapping into the growing middle class in countries like India and Brazil, Apple could offset some of the losses incurred in the Chinese market. Nevertheless, these markets present their own unique challenges, including different consumer preferences and regulatory environments.

In conclusion, while Apple’s forecast and the challenges it faces in China have left investors unimpressed, the company’s resilience and adaptability should not be underestimated. The economic slowdown in China is undoubtedly a significant hurdle, but it also presents an opportunity for Apple to innovate and diversify its market presence. As the company navigates these turbulent times, its ability to balance short-term challenges with long-term strategic goals will be crucial in maintaining its position as a leader in the global tech industry.

Apple’s Supply Chain Challenges in China

Apple Inc., a titan in the technology industry, has long been a bellwether for innovation and market success. However, recent developments have cast a shadow over its otherwise stellar reputation, particularly concerning its supply chain operations in China. As the company released its latest financial forecast, investors were left unimpressed, largely due to the challenges Apple faces in its Chinese supply chain. These challenges are multifaceted, involving geopolitical tensions, regulatory hurdles, and the ongoing impact of the COVID-19 pandemic.

To begin with, Apple’s reliance on China as a manufacturing hub is both a strength and a vulnerability. The country offers a vast network of suppliers and a skilled workforce, which have been instrumental in Apple’s ability to produce high-quality products at scale. However, this dependency also exposes Apple to risks associated with geopolitical tensions between the United States and China. Trade disputes and tariffs have already impacted the cost structure of Apple’s supply chain, and any further escalation could exacerbate these issues. Consequently, investors are wary of the potential financial implications that such geopolitical dynamics could have on Apple’s bottom line.

Moreover, regulatory challenges in China present another layer of complexity for Apple. The Chinese government has been tightening its grip on technology companies, both domestic and foreign, through increased scrutiny and regulatory measures. For Apple, this means navigating a landscape where compliance with local laws is becoming increasingly demanding. The company must ensure that its operations align with China’s stringent data privacy regulations and cybersecurity laws, which can be a daunting task given the scale of its operations. Failure to comply could result in significant fines or even restrictions on its ability to operate in the region, further unsettling investors.

In addition to geopolitical and regulatory challenges, the COVID-19 pandemic continues to disrupt Apple’s supply chain in China. Although the initial shock of the pandemic has subsided, its lingering effects are still felt across the global supply chain. Factory shutdowns, labor shortages, and logistical bottlenecks have led to delays in production and shipment of Apple’s products. These disruptions have not only affected Apple’s ability to meet consumer demand but have also increased operational costs, thereby squeezing profit margins. As a result, investors are concerned about the company’s ability to maintain its growth trajectory in the face of such persistent supply chain challenges.

Furthermore, Apple’s efforts to diversify its supply chain away from China have been met with mixed results. While the company has made strides in expanding its manufacturing footprint to other countries such as India and Vietnam, these markets do not yet offer the same level of infrastructure and expertise as China. This transition is a complex and time-consuming process, and any missteps could further strain Apple’s supply chain capabilities. Investors are closely monitoring these developments, as successful diversification could mitigate some of the risks associated with China’s challenges, while failure could exacerbate them.

In conclusion, Apple’s supply chain challenges in China are a significant concern for investors, as they have the potential to impact the company’s financial performance and strategic direction. The interplay of geopolitical tensions, regulatory hurdles, and pandemic-related disruptions creates a complex environment that Apple must navigate carefully. While the company has demonstrated resilience and adaptability in the past, the current landscape presents unique challenges that require innovative solutions. As Apple continues to address these issues, investors will be keenly observing how the company manages its supply chain operations in China and beyond.

Investor Reactions to Apple’s Latest Earnings Report

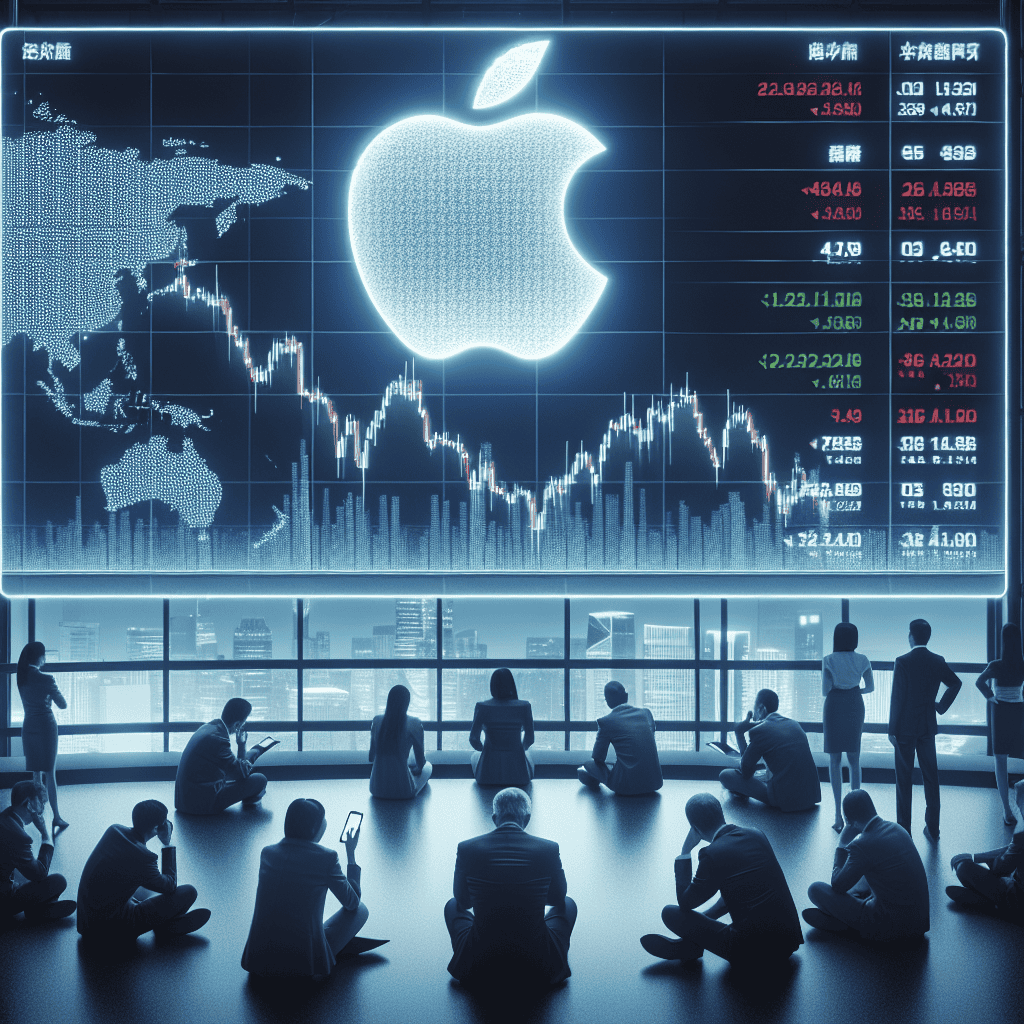

Apple’s latest earnings report has left investors with mixed feelings, as the tech giant’s forecast and challenges in China have raised concerns about its future growth prospects. Despite reporting strong quarterly earnings, the company’s cautious outlook and geopolitical tensions have cast a shadow over its performance, leaving investors unimpressed. As Apple continues to navigate a complex global landscape, its ability to maintain its market dominance is being closely scrutinized.

In its recent earnings announcement, Apple reported revenue and profit figures that exceeded Wall Street expectations. The company’s robust sales of iPhones, wearables, and services contributed to its strong financial performance. However, despite these positive results, Apple’s forecast for the upcoming quarter was more conservative than anticipated. This cautious outlook has raised questions among investors about the company’s ability to sustain its growth trajectory in the face of mounting challenges.

One of the primary concerns for Apple is its relationship with China, a critical market for the company. China not only serves as a significant consumer base but also plays a crucial role in Apple’s supply chain. However, ongoing geopolitical tensions between the United States and China have created an uncertain environment for businesses operating in the region. Apple’s reliance on China for both manufacturing and sales has made it particularly vulnerable to these tensions, and any escalation could have a substantial impact on its operations.

Moreover, China’s economic slowdown has added another layer of complexity to Apple’s challenges in the region. As the Chinese economy grapples with various headwinds, consumer spending has shown signs of weakening. This slowdown poses a risk to Apple’s sales in the country, as Chinese consumers may become more cautious with their discretionary spending. Consequently, Apple’s ability to navigate these economic challenges will be crucial in determining its future success in the Chinese market.

In addition to geopolitical and economic challenges, Apple is also facing increased competition from local Chinese smartphone manufacturers. Companies like Huawei, Xiaomi, and Oppo have been gaining market share by offering high-quality devices at competitive prices. This intensifying competition has put pressure on Apple to differentiate its products and maintain its premium brand image. As a result, the company must continue to innovate and deliver compelling features to attract and retain customers in this highly competitive market.

Despite these challenges, Apple remains a formidable player in the global technology landscape. The company’s strong brand loyalty, extensive ecosystem, and commitment to innovation provide it with a solid foundation to weather these storms. However, investors are keenly aware that Apple’s ability to address its challenges in China will be a critical factor in determining its long-term growth prospects.

In conclusion, while Apple’s latest earnings report showcased its financial strength, the company’s cautious forecast and challenges in China have left investors with lingering concerns. As Apple navigates this complex environment, its ability to adapt to geopolitical tensions, economic headwinds, and increased competition will be closely watched by investors. Ultimately, Apple’s success in addressing these challenges will play a pivotal role in shaping its future trajectory and maintaining its position as a leader in the technology industry.

How Geopolitical Tensions Affect Apple’s Market Performance

Apple Inc., a titan in the technology industry, has long been a bellwether for market trends and investor sentiment. However, recent developments have cast a shadow over its otherwise stellar performance. The company’s latest forecast, coupled with mounting challenges in China, has left investors unimpressed and raised questions about its future market performance. Understanding the intricate relationship between geopolitical tensions and Apple’s market dynamics is crucial for comprehending the broader implications for the tech giant.

To begin with, Apple’s forecast has been a focal point for investors who closely monitor the company’s guidance to gauge its future prospects. The recent forecast, however, has not met the high expectations set by its past performance. While Apple continues to innovate and expand its product line, the forecast suggests a more cautious outlook, reflecting uncertainties in global markets. This tempered guidance has, in part, been influenced by the geopolitical tensions that have increasingly become a significant factor in Apple’s strategic considerations.

China, a critical market for Apple, presents both opportunities and challenges. On one hand, it is a vast consumer base with a growing appetite for premium products. On the other hand, the geopolitical landscape between the United States and China has become increasingly fraught, impacting Apple’s operations and market performance. Trade tensions, regulatory scrutiny, and supply chain disruptions are some of the challenges that Apple faces in this region. These issues have been exacerbated by the broader geopolitical climate, which has seen a shift towards protectionism and economic nationalism.

Moreover, the Chinese government’s emphasis on promoting domestic technology companies has intensified competition for Apple. Local brands, often supported by government policies, have gained significant market share, challenging Apple’s dominance. This competitive pressure is compounded by the regulatory environment in China, which can be unpredictable and stringent. For instance, data privacy laws and cybersecurity regulations have posed compliance challenges for Apple, affecting its ability to operate seamlessly in the region.

In addition to these challenges, the ongoing trade war between the United States and China has further complicated Apple’s market dynamics. Tariffs and trade barriers have increased costs for Apple, affecting its pricing strategy and profit margins. The uncertainty surrounding trade negotiations has also led to volatility in Apple’s stock performance, as investors remain wary of potential disruptions to its supply chain and market access.

Despite these challenges, Apple has taken steps to mitigate the impact of geopolitical tensions on its operations. The company has diversified its supply chain, reducing its reliance on China by expanding manufacturing capabilities in other countries. Additionally, Apple has invested in strengthening its relationships with Chinese consumers and stakeholders, emphasizing its commitment to the market. These strategic moves are aimed at ensuring resilience in the face of geopolitical uncertainties.

In conclusion, the interplay between geopolitical tensions and Apple’s market performance is a complex and evolving narrative. While the company’s recent forecast and challenges in China have left investors unimpressed, it is important to recognize the broader context in which these developments occur. As Apple navigates this intricate landscape, its ability to adapt and innovate will be crucial in maintaining its position as a leader in the technology industry. Investors and analysts alike will continue to closely monitor how Apple addresses these geopolitical challenges, as they hold significant implications for its future growth and market performance.

Strategies Apple Might Use to Overcome China-Related Hurdles

Apple Inc., a titan in the technology industry, has long been a beacon of innovation and financial success. However, recent forecasts and challenges in China have left investors less than impressed. As Apple navigates these turbulent waters, it is crucial to explore the strategies the company might employ to overcome the hurdles it faces in the Chinese market. Understanding these strategies requires a comprehensive look at the multifaceted issues at play and the potential pathways Apple could take to maintain its stronghold in this vital region.

To begin with, China’s significance to Apple cannot be overstated. The country not only serves as a major manufacturing hub but also represents a substantial portion of Apple’s consumer base. Consequently, any disruptions in this market can have far-reaching implications for the company’s global operations. Recently, geopolitical tensions and regulatory challenges have posed significant obstacles for Apple in China. These issues have been compounded by a slowing Chinese economy, which has dampened consumer spending and, in turn, affected Apple’s sales figures. In light of these challenges, Apple must adopt a multifaceted approach to safeguard its interests in China.

One potential strategy is for Apple to diversify its supply chain. By reducing its reliance on Chinese manufacturing, Apple can mitigate the risks associated with geopolitical tensions and regulatory changes. This could involve expanding production capabilities in other countries, such as India or Vietnam, which have been increasingly attractive to tech companies seeking alternative manufacturing bases. Diversification would not only provide Apple with greater flexibility but also enhance its resilience against potential disruptions in China.

In addition to supply chain diversification, Apple could focus on strengthening its relationships with Chinese regulators and government officials. Building and maintaining positive relationships with key stakeholders in China could help Apple navigate the complex regulatory landscape more effectively. This might involve increased engagement with local authorities and a commitment to compliance with Chinese laws and regulations. By fostering goodwill and demonstrating a willingness to cooperate, Apple could potentially ease some of the regulatory pressures it faces in the region.

Moreover, Apple could enhance its localization efforts to better cater to Chinese consumers. This strategy would involve tailoring products and services to meet the specific needs and preferences of the Chinese market. For instance, Apple could introduce features that resonate with local consumers or collaborate with popular Chinese apps and services to integrate them more seamlessly into its ecosystem. By offering a more personalized experience, Apple could strengthen its brand loyalty among Chinese consumers and boost its market share.

Furthermore, Apple might consider investing in local talent and innovation. By establishing research and development centers in China, Apple could tap into the country’s vast pool of skilled professionals and foster innovation that aligns with local market trends. This approach would not only enhance Apple’s product offerings but also demonstrate its commitment to contributing to China’s technological advancement.

In conclusion, while Apple’s forecast and challenges in China have left investors unimpressed, the company has several strategic options at its disposal to address these hurdles. By diversifying its supply chain, strengthening regulatory relationships, enhancing localization efforts, and investing in local talent, Apple can navigate the complexities of the Chinese market and continue to thrive. As the company implements these strategies, it will be crucial for investors to monitor Apple’s progress and assess the effectiveness of its efforts in overcoming the challenges it faces in China.

The Future of Apple’s Growth Amidst Global Economic Uncertainty

Apple Inc., a titan in the technology industry, has long been a bellwether for global economic trends, with its performance often seen as a reflection of broader market conditions. Recently, however, the company has faced a confluence of challenges that have left investors less than impressed. Central to these concerns is Apple’s forecast, which has been tempered by a series of headwinds, most notably the economic uncertainties emanating from China. As the world’s second-largest economy, China’s economic health is crucial not only to its domestic market but also to global supply chains and consumer demand, both of which are vital to Apple’s growth trajectory.

In recent quarters, Apple’s revenue forecasts have been scrutinized by investors who are increasingly wary of the company’s reliance on the Chinese market. This apprehension is not unfounded, as China represents a significant portion of Apple’s revenue, both in terms of sales and manufacturing. The ongoing economic slowdown in China, exacerbated by geopolitical tensions and domestic policy shifts, has raised questions about the sustainability of Apple’s growth in the region. Moreover, the Chinese government’s regulatory environment has become more unpredictable, adding another layer of complexity to Apple’s operations.

Transitioning from these macroeconomic concerns, it is essential to consider how Apple is navigating these challenges. The company has been proactive in diversifying its supply chain, seeking to mitigate risks associated with over-reliance on any single market. This strategy includes expanding manufacturing capabilities in other countries, such as India and Vietnam, which could serve as alternative hubs for production. However, these efforts are not without their own set of challenges, as establishing new supply chains requires significant investment and time.

Furthermore, Apple’s innovation pipeline remains a critical factor in maintaining its competitive edge. The company continues to invest heavily in research and development, aiming to introduce new products and services that can capture consumer interest and drive growth. The recent launch of the iPhone 15, along with advancements in wearable technology and services like Apple TV+ and Apple Music, exemplifies Apple’s commitment to innovation. Nevertheless, the question remains whether these initiatives can offset the potential slowdown in its traditional markets.

In addition to product innovation, Apple’s focus on sustainability and environmental responsibility is becoming increasingly important. As consumers and investors alike prioritize companies with strong environmental, social, and governance (ESG) credentials, Apple’s efforts to reduce its carbon footprint and promote sustainable practices could enhance its brand value and appeal. This strategic emphasis on sustainability may not only help Apple differentiate itself from competitors but also align with the growing global demand for responsible corporate behavior.

Despite these strategic initiatives, the overarching uncertainty in the global economy continues to cast a shadow over Apple’s growth prospects. Inflationary pressures, fluctuating currency exchange rates, and potential recessions in key markets are all factors that could impact consumer spending and, consequently, Apple’s bottom line. As such, investors remain cautious, seeking reassurance that Apple can navigate these turbulent times while maintaining its position as a leader in the technology sector.

In conclusion, while Apple’s forecast and the challenges it faces in China have left investors unimpressed, the company’s strategic responses and commitment to innovation and sustainability offer a glimmer of hope. As Apple continues to adapt to an ever-changing global landscape, its ability to balance these challenges with opportunities will be crucial in determining its future growth trajectory.

Q&A

1. **Question:** What recent financial forecast did Apple provide that left investors unimpressed?

– **Answer:** Apple provided a forecast indicating that its revenue would decline for the fourth consecutive quarter, which left investors unimpressed.

2. **Question:** How has Apple’s performance in China been a challenge for the company?

– **Answer:** Apple’s performance in China has been challenged by increased competition from local smartphone manufacturers and regulatory hurdles, impacting its sales and market share.

3. **Question:** What specific product category has seen a decline in sales contributing to Apple’s forecasted revenue drop?

– **Answer:** The iPhone category has seen a decline in sales, contributing significantly to Apple’s forecasted revenue drop.

4. **Question:** How have geopolitical tensions affected Apple’s business operations in China?

– **Answer:** Geopolitical tensions have led to increased scrutiny and regulatory challenges for Apple in China, affecting its supply chain and market access.

5. **Question:** What strategy is Apple employing to mitigate the impact of declining sales in China?

– **Answer:** Apple is focusing on diversifying its supply chain and increasing its investment in other markets to mitigate the impact of declining sales in China.

6. **Question:** How have investors reacted to Apple’s recent financial forecast and challenges in China?

– **Answer:** Investors have reacted with concern, leading to a decline in Apple’s stock price as they worry about the company’s growth prospects.

7. **Question:** What long-term impact could the challenges in China have on Apple’s overall business strategy?

– **Answer:** The challenges in China could lead Apple to accelerate its efforts in diversifying its market presence and investing in new technologies to reduce dependency on the Chinese market.

Conclusion

Apple’s recent forecast and its challenges in China have left investors unimpressed due to several factors. The company’s cautious outlook, particularly in light of economic uncertainties and competitive pressures in the Chinese market, has raised concerns about its growth prospects. Despite Apple’s strong brand and product ecosystem, the slowing demand in China, coupled with regulatory hurdles and geopolitical tensions, poses significant risks. Investors are wary of these headwinds potentially impacting Apple’s revenue and market share in one of its key regions. Consequently, the lack of a more optimistic forecast has led to a tepid response from the investment community, reflecting broader apprehensions about Apple’s ability to navigate these challenges effectively.