“Faith Meets Finance: Church’s $2.3M Loan Request Faces Dave Ramsey’s Caution”

Introduction

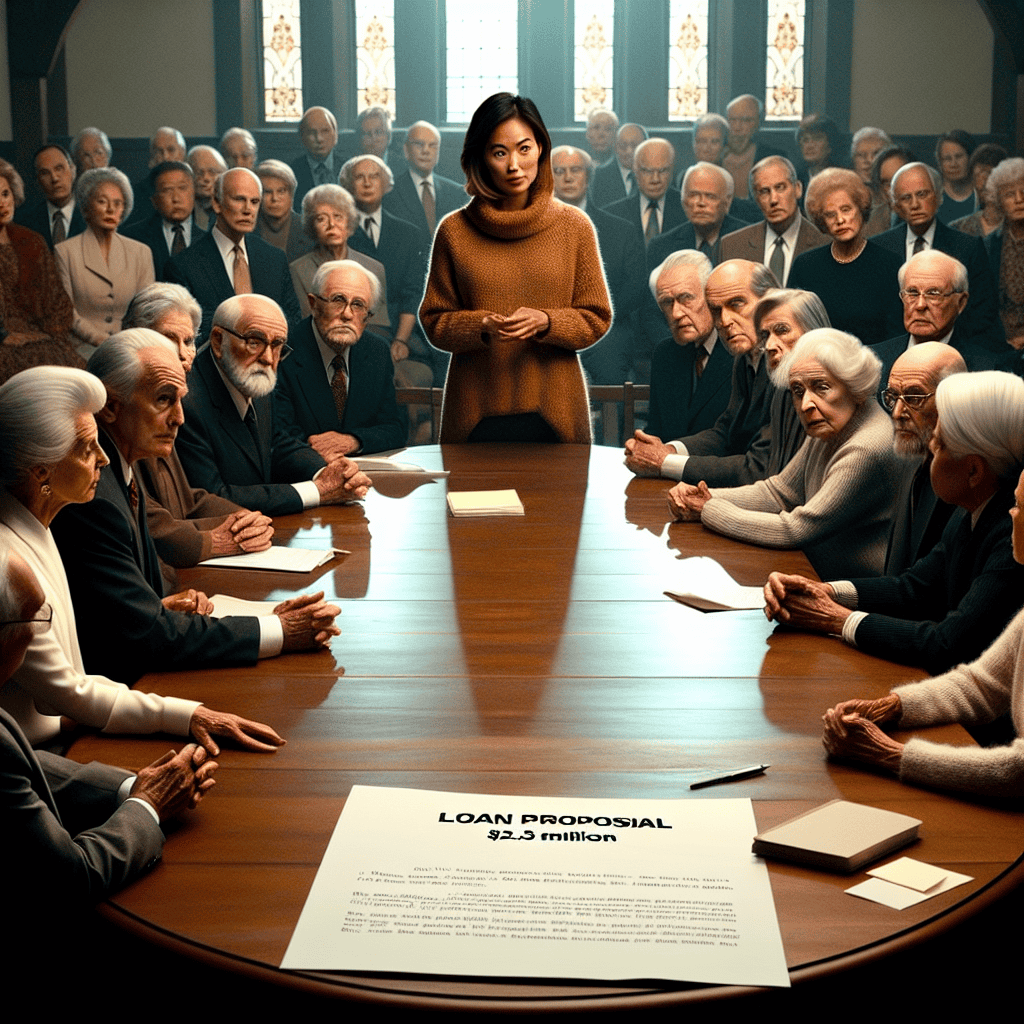

In a recent development, a local church has reached out to its senior members, requesting them to cosign a substantial $2.3 million loan intended for the expansion of its facilities. This move has sparked a debate within the community, particularly after financial expert Dave Ramsey publicly advised against such a decision. Ramsey, known for his conservative financial guidance and emphasis on debt-free living, cautions against the potential risks and financial burdens that cosigning a loan of this magnitude could impose on the individuals involved. As the church navigates its financial strategy for growth, the contrasting perspectives highlight the complexities and responsibilities associated with financial commitments in religious and community settings.

Church Financial Decisions: Balancing Faith and Fiscal Responsibility

In recent developments within the realm of church financial management, a significant decision has emerged that has sparked considerable debate among congregants and financial advisors alike. A church has requested its senior members to cosign a substantial $2.3 million loan, a move that has raised eyebrows and prompted financial expert Dave Ramsey to weigh in with cautionary advice. This situation underscores the delicate balance between faith-based initiatives and prudent fiscal responsibility, a balance that many religious organizations strive to maintain.

The church in question, seeking to expand its facilities and enhance its community outreach programs, has turned to its senior members for financial backing. The rationale behind this request is rooted in the church’s desire to leverage the trust and commitment of its long-standing members to secure favorable loan terms. However, this approach has not been without controversy. The decision to involve senior members as cosigners introduces a layer of personal financial risk that many may not fully comprehend. It is within this context that Dave Ramsey, a well-respected financial advisor known for his conservative approach to debt management, has voiced his concerns.

Ramsey’s advice against cosigning the loan is grounded in the potential financial pitfalls that could ensnare well-meaning individuals. He emphasizes that cosigning a loan is not merely a gesture of support but a legally binding commitment that could have serious repercussions on one’s personal finances. Should the church encounter difficulties in repaying the loan, the financial burden would fall on the cosigners, potentially jeopardizing their financial stability. Ramsey’s perspective serves as a reminder of the importance of understanding the full scope of financial commitments before agreeing to them, particularly in a religious context where trust and faith often play significant roles in decision-making.

Moreover, this situation highlights the broader issue of how churches manage their finances and the ethical considerations involved. Churches, as nonprofit entities, rely heavily on donations and tithes from their congregants to fund their operations and initiatives. While expansion and outreach are noble goals, they must be pursued with a clear understanding of the financial implications and potential risks involved. The decision to involve senior members as cosigners raises questions about the transparency and accountability of church financial practices, as well as the ethical responsibility of church leaders to protect their congregants from undue financial risk.

In navigating these complex issues, churches must strive to balance their faith-driven missions with sound financial management practices. This involves not only seeking expert financial advice but also fostering open communication with their congregants about the financial health and goals of the organization. By doing so, churches can ensure that their financial decisions align with their values and serve the best interests of their community.

In conclusion, the request for senior members to cosign a $2.3 million loan presents a challenging scenario that requires careful consideration and discernment. While the desire to support church growth and outreach is commendable, it is imperative that such efforts are undertaken with a clear understanding of the financial risks involved. Dave Ramsey’s advice serves as a valuable reminder of the importance of fiscal responsibility, urging both church leaders and congregants to weigh their decisions carefully and prioritize financial stability alongside their faith-based objectives.

The Role of Senior Members in Church Financial Matters

In recent developments within the financial landscape of religious institutions, a church has made headlines by requesting its senior members to cosign a substantial $2.3 million loan. This move has sparked a significant debate regarding the role of senior members in church financial matters, raising questions about the ethical and financial implications of such requests. As churches often rely on the support and generosity of their congregations, the involvement of senior members in financial decisions is not uncommon. However, the magnitude of this particular request has prompted financial experts, including renowned personal finance advisor Dave Ramsey, to weigh in on the matter.

Churches, as community-centered organizations, frequently engage their members in various aspects of their operations, including financial planning and decision-making. Senior members, often seen as pillars of the community, are typically more involved due to their long-standing commitment and experience within the church. Their involvement can range from participating in fundraising activities to serving on financial committees. However, the request for senior members to cosign a multi-million dollar loan introduces a new level of responsibility and risk that warrants careful consideration.

The decision to involve senior members in cosigning a loan of this magnitude raises several concerns. Primarily, it places a significant financial burden on individuals who may not be fully aware of the potential risks involved. Cosigning a loan means that these members would be legally obligated to repay the debt if the church defaults, potentially jeopardizing their personal financial stability. This situation underscores the importance of transparency and informed consent when involving congregation members in financial matters of such scale.

Dave Ramsey, a prominent figure in personal finance education, has publicly advised against the practice of cosigning loans, particularly in situations involving large sums of money. Ramsey’s advice is rooted in the principle that cosigning a loan can lead to unforeseen financial consequences for the cosigner, including damage to their credit score and financial liability. He emphasizes that individuals should prioritize their financial security and avoid entangling themselves in financial commitments that could have long-term repercussions.

Moreover, Ramsey’s perspective highlights the need for churches to explore alternative methods of financing that do not place undue pressure on their members. Churches might consider options such as capital campaigns, where funds are raised through donations and pledges, or seeking financial assistance from denominational bodies or religious organizations that offer grants or low-interest loans. These alternatives can provide the necessary financial support without compromising the financial well-being of individual members.

In conclusion, the request for senior members to cosign a $2.3 million loan brings to light the complex dynamics of church financial management and the ethical considerations involved. While senior members play a crucial role in supporting their church’s mission and operations, it is imperative that their involvement in financial matters is approached with caution and transparency. By heeding the advice of financial experts like Dave Ramsey and exploring alternative financing options, churches can ensure that their financial strategies align with the best interests of their congregation, safeguarding both the institution’s future and the financial security of its members.

Dave Ramsey’s Financial Principles: Why He Advises Against Cosigning Loans

In the realm of personal finance, few voices resonate as strongly as that of Dave Ramsey, a well-known financial advisor and author. His principles, often rooted in common sense and fiscal responsibility, have guided countless individuals toward financial stability. Recently, a situation arose that underscores the importance of his advice: a church requested its senior members to cosign a $2.3 million loan. This scenario has sparked considerable debate, with Ramsey firmly advising against such a move. To understand his stance, it is crucial to delve into the principles that underpin his financial philosophy.

At the heart of Dave Ramsey’s teachings is the belief that financial decisions should be made with caution and foresight. Cosigning a loan, in his view, is fraught with potential pitfalls. When an individual cosigns a loan, they are essentially agreeing to take on the financial responsibility if the primary borrower defaults. This means that the cosigner’s credit score and financial stability are at risk, a reality that many may not fully appreciate at the outset. Ramsey argues that this risk is often underestimated, leading to unforeseen financial burdens that can have long-lasting repercussions.

Moreover, Ramsey emphasizes the importance of maintaining healthy financial boundaries. By cosigning a loan, individuals may inadvertently blur these boundaries, intertwining their financial future with that of another entity—in this case, a church. While the intention behind such a gesture may be noble, the potential consequences can be severe. If the church were to encounter financial difficulties and default on the loan, the cosigners would be left to shoulder the debt. This scenario could lead to strained relationships and financial strain, outcomes that Ramsey advises against.

Furthermore, Ramsey’s financial principles advocate for living within one’s means and avoiding debt whenever possible. Cosigning a loan, particularly one as substantial as $2.3 million, runs counter to this philosophy. It places individuals in a position where they are effectively taking on debt, even if indirectly. This can hinder their ability to achieve personal financial goals, such as saving for retirement or building an emergency fund. Ramsey’s advice is to prioritize one’s financial well-being and avoid entanglements that could jeopardize it.

In addition to these considerations, Ramsey also highlights the importance of transparency and communication in financial matters. Before making any significant financial decision, individuals should engage in open discussions with all parties involved. In the case of the church’s request, it is essential for senior members to fully understand the terms of the loan, the church’s financial health, and the potential risks involved. Ramsey encourages individuals to seek professional financial advice and to weigh the pros and cons carefully before proceeding.

In conclusion, Dave Ramsey’s advice against cosigning loans is grounded in a commitment to financial prudence and personal responsibility. While the request from the church may come from a place of trust and community, the potential risks cannot be ignored. By adhering to Ramsey’s principles, individuals can protect their financial future and make informed decisions that align with their long-term goals. Ultimately, the decision to cosign a loan should not be taken lightly, and Ramsey’s guidance serves as a valuable reminder of the importance of careful financial planning.

Understanding the Risks of Cosigning a Loan for Religious Institutions

In recent developments, a church has made headlines by requesting its senior members to cosign a substantial $2.3 million loan. This move has sparked a significant debate within the community, raising questions about the financial responsibilities and potential risks associated with such a commitment. Financial expert Dave Ramsey, known for his conservative approach to personal finance, has weighed in on the matter, advising against cosigning the loan. To understand the implications of this situation, it is essential to explore the risks and responsibilities that come with cosigning a loan, particularly for religious institutions.

Cosigning a loan is a serious financial commitment that involves a third party agreeing to take on the responsibility of repaying the loan if the primary borrower defaults. In this case, the church is seeking senior members to act as guarantors, which could place these individuals in a precarious financial position. While the intention behind the church’s request may be rooted in a desire to secure funding for expansion or other projects, the potential consequences for the cosigners cannot be overlooked.

One of the primary risks associated with cosigning a loan is the impact on the cosigner’s credit score. If the church fails to make timely payments, the cosigner’s credit history could suffer, leading to difficulties in obtaining future loans or credit. Moreover, cosigners are legally obligated to repay the loan if the primary borrower defaults, which could result in significant financial strain. This is particularly concerning for senior members who may be on fixed incomes or have limited financial flexibility.

Furthermore, the emotional and relational dynamics within the church community could be affected by this financial arrangement. Members who feel pressured to cosign may experience stress or resentment, potentially leading to discord within the congregation. It is crucial for religious institutions to consider the broader implications of their financial strategies on their community’s well-being and cohesion.

Dave Ramsey’s advice against cosigning the loan is grounded in his broader financial philosophy, which emphasizes living debt-free and avoiding financial entanglements that could jeopardize one’s financial stability. Ramsey often highlights the importance of maintaining control over one’s financial future and avoiding situations where one’s financial health is contingent on another party’s actions. His perspective serves as a cautionary reminder of the potential pitfalls of cosigning, particularly when the borrower is an organization rather than an individual.

In light of these considerations, it is imperative for church members to thoroughly evaluate the risks before agreeing to cosign the loan. This includes assessing their own financial situation, understanding the church’s financial health and repayment plan, and considering alternative ways to support the church’s goals without assuming personal financial liability. Open and transparent communication between church leadership and members is essential to ensure that all parties are fully informed and comfortable with the proposed arrangement.

Ultimately, while the church’s request may be driven by a genuine need for financial support, it is crucial for senior members to approach the decision with caution and due diligence. By carefully weighing the potential risks and benefits, individuals can make informed choices that align with their financial goals and personal values. As this situation unfolds, it serves as a valuable case study in understanding the complexities and responsibilities associated with cosigning loans for religious institutions.

Ethical Considerations in Church Financial Requests

In recent developments within the realm of church finance, a significant ethical dilemma has emerged as a church has requested its senior members to cosign a substantial $2.3 million loan. This request has sparked a debate about the ethical considerations involved in such financial solicitations, particularly when they are directed towards older congregants who may be more vulnerable to financial risk. The situation has garnered attention from financial experts, including renowned personal finance advisor Dave Ramsey, who has publicly advised against such practices.

The church’s request raises several ethical questions, primarily concerning the potential exploitation of trust and the financial security of its senior members. Churches often hold a position of authority and trust within their communities, and their members may feel a strong sense of loyalty and obligation to support their church’s endeavors. However, asking individuals to cosign a loan of this magnitude places them in a precarious financial position, as cosigning involves a legal commitment to repay the loan if the primary borrower defaults. This could lead to severe financial consequences for the cosigners, particularly if they are on fixed incomes or have limited financial resources.

Dave Ramsey, a well-respected figure in personal finance, has weighed in on the matter, advising against cosigning loans in general. Ramsey’s financial philosophy emphasizes living debt-free and avoiding financial entanglements that could jeopardize one’s financial stability. He argues that cosigning a loan, especially one as large as $2.3 million, is fraught with risk and could lead to financial ruin for those who are unable to fulfill the obligation if the church defaults. His advice is rooted in the principle of financial prudence and the protection of one’s financial future.

Moreover, the ethical implications extend beyond the immediate financial risks. There is a broader concern about the power dynamics at play when a religious institution makes such requests. The potential for undue influence is significant, as congregants may feel pressured to comply out of fear of social or spiritual repercussions. This raises questions about the responsibility of religious organizations to protect their members from financial harm and to ensure that their requests are made transparently and ethically.

In addition to the ethical concerns, there are practical considerations that churches must take into account when seeking financial support from their members. Transparency about the purpose of the loan, the church’s financial health, and the potential risks involved is crucial. Churches should also explore alternative funding methods that do not place undue financial burdens on their members, such as fundraising campaigns or seeking grants and donations from external sources.

Ultimately, the situation underscores the need for churches to carefully consider the ethical implications of their financial requests and to prioritize the well-being of their members. While the desire to support the church’s mission is commendable, it should not come at the expense of the financial security of its congregants. As this issue continues to unfold, it serves as a reminder of the importance of ethical decision-making in church finance and the need for clear guidelines to protect both the institution and its members from potential harm.

How Churches Can Explore Alternative Funding Options

In recent times, a church’s request for its senior members to cosign a substantial $2.3 million loan has sparked significant discussion within the community. This situation has drawn attention not only from the congregation but also from financial experts, including renowned personal finance advisor Dave Ramsey, who has advised against such a move. The church’s decision to seek cosigners for a loan of this magnitude raises important questions about the financial strategies employed by religious institutions and highlights the need for exploring alternative funding options.

Churches, like many other organizations, often face financial challenges that necessitate securing additional funds for expansion, renovation, or community projects. However, relying on senior members to cosign loans can place undue financial pressure on individuals who may not be in a position to bear such risks. Dave Ramsey, known for his conservative financial advice, has consistently emphasized the potential dangers of cosigning loans, pointing out that it can lead to financial strain and damaged relationships if the primary borrower defaults.

In light of these concerns, it is crucial for churches to consider alternative funding options that do not jeopardize the financial well-being of their members. One viable approach is to engage in comprehensive fundraising campaigns. By organizing events, reaching out to the broader community, and leveraging social media platforms, churches can raise significant funds without resorting to high-risk financial strategies. These campaigns not only generate necessary capital but also foster a sense of community involvement and shared purpose.

Additionally, churches can explore partnerships with local businesses and philanthropic organizations. By collaborating with entities that share similar values and missions, churches can secure grants or donations that align with their goals. Such partnerships can provide a sustainable source of funding while also strengthening community ties and enhancing the church’s visibility and impact.

Moreover, churches might consider implementing stewardship programs that encourage regular giving from their congregations. By educating members about the importance of consistent financial support and demonstrating transparency in how funds are utilized, churches can cultivate a culture of generosity. This approach not only ensures a steady flow of resources but also empowers members to contribute meaningfully to the church’s mission.

Another innovative funding option is the establishment of endowment funds. By creating a financial reserve that generates income over time, churches can ensure long-term financial stability. Endowments can be funded through bequests, major gifts, or planned giving, providing a reliable source of income that supports the church’s ongoing activities and future projects.

Furthermore, churches can explore the potential of leveraging their existing assets. For instance, renting out church facilities for events or community gatherings can generate additional revenue. This not only maximizes the use of church properties but also fosters community engagement and outreach.

In conclusion, while the request for senior members to cosign a $2.3 million loan may seem like a quick solution to financial challenges, it is fraught with risks that could have long-lasting implications. By considering alternative funding options such as comprehensive fundraising campaigns, partnerships, stewardship programs, endowment funds, and asset utilization, churches can secure the necessary resources without compromising the financial security of their members. These strategies not only provide sustainable financial solutions but also strengthen the church’s role as a vital and responsible community institution.

The Impact of Financial Decisions on Church Community Dynamics

In recent developments, a church’s request for its senior members to cosign a substantial $2.3 million loan has sparked significant discussion within the community. This situation underscores the profound impact financial decisions can have on church community dynamics. As churches often serve as pillars of support and guidance, the financial strategies they employ can influence not only their operations but also the trust and cohesion among their congregants. The request for cosigning a loan of this magnitude raises questions about the financial health of the institution and the potential risks involved for those who choose to participate.

Financial expert Dave Ramsey, known for his conservative approach to personal finance, has weighed in on the matter, advising against such a move. Ramsey’s perspective is rooted in the principle that cosigning a loan can expose individuals to significant financial risk without any direct benefit. He emphasizes that cosigning essentially means taking on the responsibility of the debt, should the primary borrower default. This could lead to strained relationships within the church community, as members may feel pressured to support the institution at the expense of their financial security.

The implications of this request extend beyond individual financial risk. It also touches on the broader issue of transparency and trust within the church. Congregants may begin to question the financial management practices of their leaders, especially if the need for such a large loan is not clearly communicated or justified. This can lead to a breakdown in trust, which is essential for maintaining a strong and united community. Moreover, the decision to involve senior members, who may be on fixed incomes or nearing retirement, adds another layer of complexity. These individuals might be more vulnerable to financial instability, making the request particularly contentious.

Furthermore, the dynamics within the church community could shift as a result of this financial decision. Members who choose to cosign may feel a sense of obligation or entitlement, potentially leading to divisions between those who are financially involved and those who are not. This could create an environment where financial contributions become a measure of one’s commitment to the church, overshadowing other forms of participation and service. Such a shift could alienate members who are unable or unwilling to take on financial risk, thereby weakening the sense of inclusivity and shared purpose that is vital to any community.

In light of these considerations, it is crucial for church leaders to approach financial decisions with transparency and sensitivity. Open communication about the reasons for the loan, the intended use of the funds, and the potential risks involved can help mitigate concerns and foster a sense of collective responsibility. Additionally, exploring alternative funding options that do not place undue burden on individual members could demonstrate a commitment to the well-being of the entire congregation.

Ultimately, the request for senior members to cosign a $2.3 million loan serves as a poignant reminder of the intricate relationship between financial decisions and community dynamics within a church. By prioritizing transparency, inclusivity, and prudent financial management, church leaders can navigate these challenges while maintaining the trust and unity of their congregants. As this situation unfolds, it will be essential for all parties involved to consider the long-term implications of their financial choices on the health and vitality of their community.

Q&A

1. **What is the main issue discussed?**

A church is requesting senior members to cosign a $2.3 million loan.

2. **Who is advising against the action?**

Financial expert Dave Ramsey is advising against cosigning the loan.

3. **Why is cosigning a loan considered risky?**

Cosigning a loan is risky because it makes the cosigner responsible for the debt if the primary borrower defaults.

4. **What are potential consequences for cosigners?**

Cosigners could face financial liability, damage to their credit score, and strained personal relationships if the loan is not repaid.

5. **What is Dave Ramsey’s general advice on cosigning loans?**

Dave Ramsey generally advises against cosigning loans due to the financial risks involved.

6. **What alternatives might be suggested instead of cosigning?**

Alternatives could include fundraising, seeking donations, or finding other financing options that do not require cosigners.

7. **What is the potential impact on the church community?**

The request could create tension or division within the church community, especially if members feel pressured to cosign.

Conclusion

In the situation where a church requests senior members to cosign a $2.3 million loan, financial expert Dave Ramsey advises against it. Ramsey’s guidance likely stems from his general financial principles, which emphasize avoiding debt and the risks associated with cosigning loans. Cosigning can place individuals in a precarious financial position, as they become legally responsible for the debt if the primary borrower defaults. This can lead to potential financial strain and damage to personal credit. Ramsey’s advice underscores the importance of financial prudence and protecting one’s financial stability, especially for senior members who may be on fixed incomes or nearing retirement.