“Uncertain Skies: Boeing Workers’ Pension Hopes Face Turbulence”

Introduction

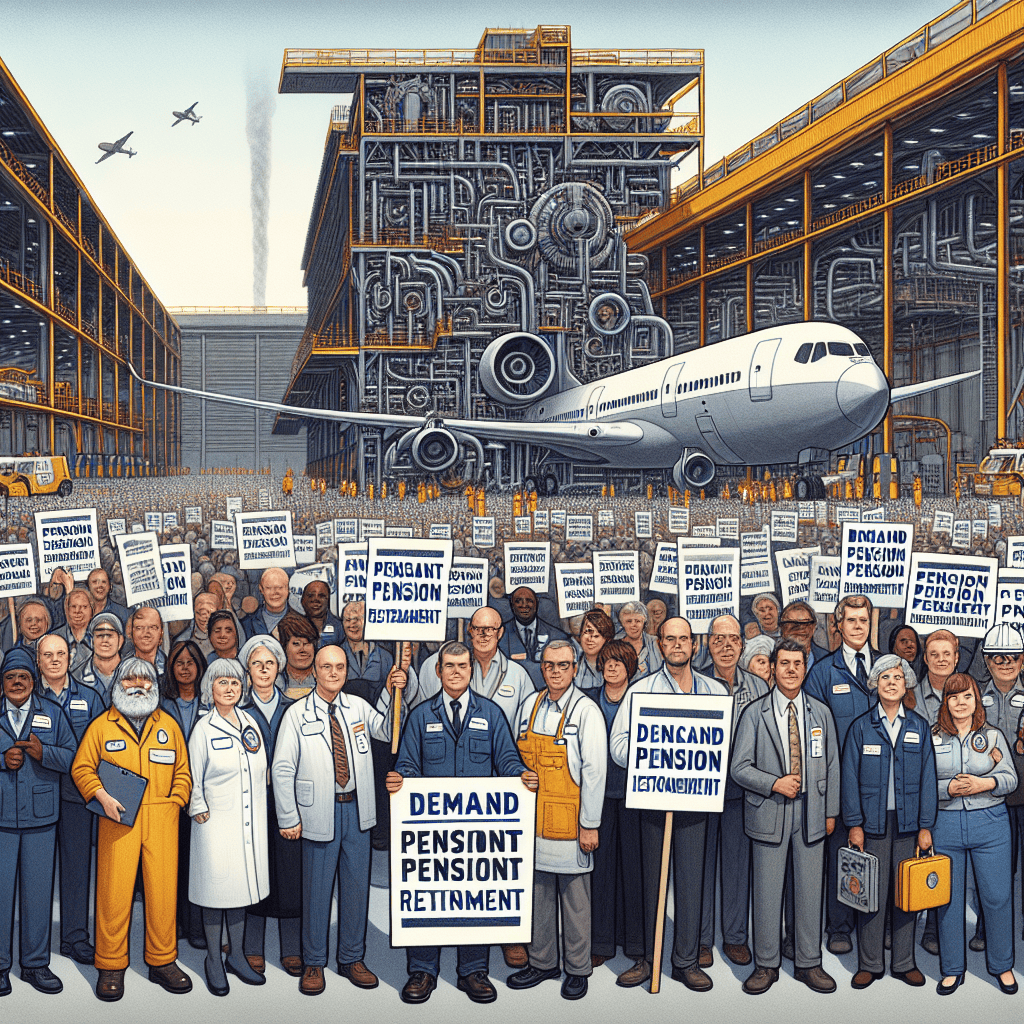

In recent developments, a contentious debate has emerged surrounding the demands of Boeing workers for the reinstatement of their pension plans, a move that has been met with skepticism by industry experts. The issue traces back to significant changes in Boeing’s employee benefits structure, where traditional pension plans were replaced with 401(k) retirement savings plans, a shift that has sparked discontent among the workforce. As employees rally for the restoration of their pensions, experts in labor relations and financial management express doubts about the feasibility and sustainability of such demands. They cite the broader industry trend of moving away from defined benefit plans due to financial pressures and the evolving economic landscape. This skepticism is compounded by Boeing’s recent financial challenges, including production setbacks and market fluctuations, which further complicate the potential for reversing pension policies. The situation underscores a critical tension between employee welfare and corporate financial strategy, raising questions about the future of retirement benefits in the aerospace sector.

Analysis Of Boeing’s Pension Reinstatement Controversy

In recent years, the issue of pension reinstatement for Boeing workers has emerged as a contentious topic, drawing attention from industry experts, labor unions, and financial analysts alike. The controversy centers around the demands of Boeing employees for the reinstatement of traditional pension plans, which were phased out in favor of 401(k) plans. This shift, part of a broader trend across various industries, reflects a significant change in how retirement benefits are structured. However, the call for reinstatement has sparked debate over the feasibility and implications of such a move.

To understand the roots of this controversy, it is essential to consider the historical context. Traditionally, defined benefit pension plans provided employees with a guaranteed income upon retirement, calculated based on factors such as salary history and years of service. However, due to rising costs and financial risks associated with maintaining these plans, many companies, including Boeing, transitioned to defined contribution plans like 401(k)s. These plans shift the investment risk to employees, offering them more control over their retirement savings but also exposing them to market volatility.

The demand for pension reinstatement by Boeing workers is driven by concerns over financial security in retirement. Many employees argue that the shift to 401(k) plans has left them vulnerable to market fluctuations and has not provided the same level of security as traditional pensions. This sentiment is echoed by labor unions, which have been vocal in their support for reinstating defined benefit plans, citing the need for stable and predictable retirement income.

Despite these demands, experts express skepticism about the likelihood of pension reinstatement at Boeing. One primary reason is the financial burden it would impose on the company. Reinstating traditional pension plans would require significant financial resources, potentially impacting Boeing’s profitability and competitiveness. Moreover, the company would need to navigate complex regulatory and actuarial challenges to reintroduce these plans, further complicating the process.

Additionally, the broader economic environment poses challenges to pension reinstatement. With increasing life expectancies and fluctuating interest rates, maintaining defined benefit plans has become more costly and unpredictable. Companies are wary of the long-term liabilities associated with these plans, which can strain financial resources and hinder growth. Consequently, many firms have opted for defined contribution plans as a more sustainable alternative.

Furthermore, the shift in retirement benefits reflects a broader trend in the labor market, where employees are increasingly expected to take responsibility for their financial futures. This shift aligns with the growing emphasis on individual financial literacy and planning, as workers are encouraged to actively manage their retirement savings. While this approach offers greater flexibility, it also requires employees to be more proactive in their financial decision-making.

In conclusion, while the demand for pension reinstatement by Boeing workers highlights valid concerns about retirement security, experts remain doubtful about the feasibility of such a move. The financial and regulatory challenges, coupled with broader economic trends, make it unlikely that Boeing will revert to traditional pension plans. As the debate continues, it underscores the need for a balanced approach to retirement benefits that addresses both the financial realities faced by companies and the security concerns of employees. Ultimately, finding a sustainable solution will require collaboration between employers, employees, and policymakers to ensure a secure and equitable retirement for all.

The Impact Of Pension Disputes On Boeing’s Workforce

In recent years, the aerospace giant Boeing has faced numerous challenges, ranging from technical setbacks to financial hurdles. Among these, a significant issue that has emerged is the ongoing dispute over pension reinstatement demands by Boeing’s workforce. This matter has not only stirred internal discord but has also attracted the attention of industry experts who express skepticism about the feasibility of meeting these demands. The pension dispute underscores a broader concern about the impact of such conflicts on employee morale and the company’s operational stability.

The roots of the pension dispute can be traced back to changes in Boeing’s retirement benefits structure. In an effort to cut costs and remain competitive, Boeing shifted from traditional pension plans to 401(k)-style retirement savings plans for new employees. This transition, while financially prudent from a corporate perspective, has been met with resistance from the workforce, particularly among long-serving employees who feel that their retirement security has been compromised. The demand for pension reinstatement is thus driven by a desire to restore what many workers perceive as a lost promise of financial stability in their post-employment years.

However, experts in labor relations and corporate finance express doubt about the likelihood of Boeing acquiescing to these demands. They argue that reinstating traditional pension plans would impose a significant financial burden on the company, potentially affecting its ability to invest in innovation and maintain its competitive edge in the aerospace industry. Moreover, the broader trend in corporate America has been a move away from defined-benefit pension plans, making Boeing’s potential reversal an outlier rather than a norm. This context makes it challenging for employees to leverage their demands effectively.

The skepticism of experts is further compounded by the complex dynamics of labor negotiations. While unions representing Boeing’s workforce have been vocal in advocating for pension reinstatement, the negotiation process is fraught with challenges. The company must balance the demands of its employees with the expectations of shareholders and the need to remain financially viable. This delicate balancing act often results in protracted negotiations, with neither side willing to concede easily. Consequently, the uncertainty surrounding the outcome of these negotiations can lead to decreased morale among employees, who may feel undervalued and insecure about their future.

The impact of the pension dispute extends beyond individual employees, affecting the overall productivity and efficiency of Boeing’s operations. When workers are preoccupied with concerns about their financial future, it can lead to decreased focus and engagement in their day-to-day tasks. This, in turn, can have a ripple effect on the company’s ability to meet production targets and maintain high standards of quality and safety. In an industry where precision and reliability are paramount, any dip in workforce performance can have serious implications.

In conclusion, while the demands for pension reinstatement by Boeing’s workforce are rooted in legitimate concerns about retirement security, the path to achieving these demands is fraught with challenges. Experts remain doubtful about the feasibility of such a move, given the financial and strategic considerations at play. As Boeing navigates this complex issue, the company must carefully consider the impact of the dispute on its workforce and overall operational health. Balancing employee satisfaction with corporate sustainability will be crucial in resolving this contentious issue and ensuring the long-term success of the company.

Historical Context Of Pension Reinstatement In The Aviation Industry

In the complex landscape of the aviation industry, the issue of pension reinstatement has long been a contentious topic, particularly among workers who have seen their benefits eroded over time. The recent demands by Boeing workers for the reinstatement of their pensions have reignited discussions about the historical context of such demands and the feasibility of their fulfillment. To understand the current situation, it is essential to delve into the historical precedents and the broader economic and industry-specific factors that have shaped pension policies over the years.

Historically, the aviation industry, like many others, offered defined benefit pension plans as a cornerstone of employee compensation. These plans promised a fixed, pre-determined benefit upon retirement, providing workers with a sense of financial security. However, the economic downturns of the late 20th and early 21st centuries, coupled with increased competition and rising operational costs, led many companies to reconsider their pension commitments. In the case of Boeing, the shift from defined benefit plans to defined contribution plans, such as 401(k)s, was part of a broader trend aimed at reducing financial liabilities and aligning with industry standards.

The transition from traditional pension plans to more flexible, albeit riskier, retirement savings options was not unique to Boeing. Across the aviation sector, companies faced mounting pressure to cut costs and improve profitability. This often meant renegotiating labor contracts and, in many cases, freezing or terminating pension plans. While these measures helped stabilize companies financially, they left many workers feeling uncertain about their retirement prospects. Consequently, the demand for pension reinstatement has become a rallying cry for labor unions and employee advocacy groups.

Despite the fervor surrounding these demands, experts remain skeptical about the likelihood of pension reinstatement at Boeing or within the broader aviation industry. One of the primary reasons for this skepticism is the financial burden that reinstating pensions would impose on companies. The aviation industry is notoriously cyclical, with profitability heavily influenced by factors such as fuel prices, geopolitical tensions, and global economic conditions. In such an environment, reinstating pensions could strain financial resources and hinder a company’s ability to invest in innovation and growth.

Moreover, the regulatory landscape has evolved significantly, with stricter accounting standards and funding requirements for pension plans. These regulations, designed to protect employees’ retirement benefits, also increase the complexity and cost of maintaining defined benefit plans. As a result, companies are often reluctant to revert to a system that could expose them to financial volatility and regulatory scrutiny.

In addition to financial and regulatory challenges, there is also a generational shift in workforce expectations. Younger employees tend to prioritize flexibility and portability in their retirement savings, favoring defined contribution plans that allow them to manage their investments. This shift in preferences further complicates the push for pension reinstatement, as companies must balance the needs and expectations of a diverse workforce.

In conclusion, while the demand for pension reinstatement by Boeing workers is rooted in a historical context of secure retirement benefits, the feasibility of such demands is fraught with challenges. Financial constraints, regulatory complexities, and changing workforce dynamics all contribute to the skepticism expressed by experts. As the aviation industry continues to navigate these complexities, the future of pension policies remains uncertain, highlighting the need for innovative solutions that address both employee security and corporate sustainability.

Legal Challenges In Reinstating Pensions For Boeing Workers

In recent years, the issue of pension reinstatement for Boeing workers has emerged as a contentious topic, drawing attention from legal experts, labor unions, and the workers themselves. The demand for reinstating pensions, which were previously altered or terminated, has been met with skepticism from various quarters, particularly from legal experts who question the feasibility and legality of such demands. As the debate unfolds, it is essential to understand the complexities involved in reinstating pensions and the legal challenges that accompany these efforts.

To begin with, the historical context of pension plans at Boeing provides a backdrop to the current demands. Traditionally, defined benefit pension plans were a cornerstone of employee compensation, offering workers a guaranteed income upon retirement. However, over the past few decades, there has been a significant shift in the corporate landscape, with many companies, including Boeing, transitioning to defined contribution plans such as 401(k)s. This shift was largely driven by the need to reduce financial liabilities and adapt to changing economic conditions. Consequently, the move away from defined benefit plans has left many workers feeling insecure about their financial futures.

In light of these changes, Boeing workers have been vocal in their demands for pension reinstatement, arguing that the company has a moral obligation to honor its original commitments. However, legal experts caution that the path to reinstating pensions is fraught with challenges. One of the primary obstacles is the legal framework governing pension plans, which is complex and often favors the employer’s discretion in altering or terminating plans. The Employee Retirement Income Security Act (ERISA) of 1974, which sets minimum standards for most voluntarily established pension and health plans, provides some protection for workers. Yet, it also allows for certain modifications under specific circumstances, making it difficult for employees to successfully challenge changes in court.

Moreover, the financial implications of reinstating pensions cannot be overlooked. For a company like Boeing, which operates in a highly competitive and capital-intensive industry, the cost of reinstating defined benefit plans could be substantial. This financial burden could potentially impact the company’s profitability and its ability to invest in future growth. Legal experts argue that any attempt to reinstate pensions would require a careful balancing act between meeting employee demands and maintaining the company’s financial health.

Furthermore, the role of labor unions in this debate is significant. Unions have historically been strong advocates for workers’ rights, including the preservation of pension benefits. However, even with union support, the legal battle for pension reinstatement is likely to be protracted and complex. Unions must navigate the intricacies of labor law, collective bargaining agreements, and the broader economic context to effectively advocate for their members.

In conclusion, while the demand for pension reinstatement by Boeing workers is understandable, given the financial security it promises, the legal challenges involved are formidable. The interplay between legal frameworks, financial considerations, and union advocacy creates a multifaceted issue that requires careful deliberation. As the situation continues to evolve, it remains to be seen whether Boeing workers will achieve their goal of pension reinstatement or if alternative solutions will emerge to address their concerns. Ultimately, this issue underscores the broader challenges faced by workers in securing their financial futures in an ever-changing economic landscape.

Economic Implications Of Pension Reinstatement For Boeing

In recent discussions surrounding the economic implications of pension reinstatement for Boeing workers, experts have expressed skepticism about the feasibility and potential impact of such demands. The call for pension reinstatement has gained traction among Boeing employees, who argue that restoring traditional pension plans would provide greater financial security in retirement. However, industry analysts and economic experts caution that the broader economic consequences of reinstating these pensions could be significant, both for Boeing as a corporation and for the aerospace industry as a whole.

To begin with, the financial burden of reinstating traditional pension plans could be substantial for Boeing. The company, like many others in the industry, shifted away from defined benefit pension plans to defined contribution plans in recent years. This transition was largely driven by the need to manage long-term financial liabilities and reduce the unpredictability associated with pension obligations. Reinstating traditional pensions would likely require Boeing to allocate significant financial resources to cover past and future liabilities, potentially impacting its profitability and ability to invest in innovation and growth.

Moreover, the competitive landscape of the aerospace industry adds another layer of complexity to the issue. Boeing operates in a highly competitive global market where cost efficiency and financial stability are paramount. Reinstating pensions could place Boeing at a disadvantage compared to its competitors, who may not face similar financial obligations. This could, in turn, affect Boeing’s pricing strategies, market share, and overall competitiveness, potentially leading to broader economic repercussions within the industry.

In addition to the direct financial implications for Boeing, there are also potential ripple effects on the labor market and employee relations. While pension reinstatement might be seen as a victory for workers, it could also lead to unintended consequences. For instance, the increased financial burden on the company might necessitate cost-cutting measures in other areas, such as workforce reductions or limitations on wage growth. This could create tension between management and employees, potentially affecting morale and productivity.

Furthermore, the broader economic environment must be considered when evaluating the feasibility of pension reinstatement. The aerospace industry is subject to cyclical fluctuations, influenced by factors such as global economic conditions, geopolitical tensions, and technological advancements. In such a volatile environment, committing to long-term pension obligations could expose Boeing to heightened financial risks, particularly during economic downturns. This could, in turn, impact the company’s ability to weather economic challenges and maintain its position as a leading player in the industry.

While the demand for pension reinstatement is rooted in legitimate concerns about retirement security, experts argue that alternative solutions may be more viable. For instance, enhancing existing defined contribution plans or offering supplemental retirement benefits could provide employees with greater financial security without imposing the same level of financial strain on the company. Additionally, fostering open dialogue between management and employees could lead to innovative solutions that balance the needs of both parties.

In conclusion, while the demand for pension reinstatement among Boeing workers is understandable, experts remain doubtful about its economic feasibility and potential impact. The financial burden on Boeing, coupled with the competitive dynamics of the aerospace industry and broader economic considerations, suggests that alternative approaches may be more prudent. As the conversation continues, it is crucial for all stakeholders to carefully weigh the economic implications and explore solutions that ensure both the financial stability of the company and the retirement security of its employees.

Expert Opinions On The Feasibility Of Pension Reinstatement

In recent discussions surrounding the demands for pension reinstatement by Boeing workers, experts have expressed skepticism regarding the feasibility of such a move. The issue of pension reinstatement is complex, involving not only financial considerations but also legal and organizational challenges. As Boeing workers continue to advocate for the restoration of their pensions, experts in labor relations, finance, and corporate governance have weighed in on the potential implications and obstacles associated with these demands.

To begin with, the financial aspect of pension reinstatement poses a significant challenge. Pension plans require substantial funding to ensure long-term sustainability, and reinstating them could impose a considerable financial burden on Boeing. Experts point out that the company would need to allocate significant resources to cover past liabilities and future obligations. This could potentially divert funds from other critical areas such as research and development, innovation, and operational improvements. Consequently, the financial feasibility of reinstating pensions is a major concern for both the company and its stakeholders.

Moreover, the legal landscape surrounding pension reinstatement is fraught with complexities. Labor laws and regulations vary across jurisdictions, and navigating these legal frameworks can be daunting. Experts emphasize that any attempt to reinstate pensions would require careful consideration of existing contracts, collective bargaining agreements, and regulatory requirements. Additionally, there may be legal challenges from other stakeholders, such as shareholders, who might argue that reinstating pensions could negatively impact the company’s financial performance and shareholder value. Thus, the legal feasibility of pension reinstatement is another critical factor that cannot be overlooked.

In addition to financial and legal challenges, organizational dynamics within Boeing also play a crucial role in the feasibility of pension reinstatement. Experts highlight that the company’s management and board of directors would need to be aligned in their support for such a move. This alignment is essential to ensure that the decision to reinstate pensions is strategically sound and aligns with the company’s long-term goals. However, achieving consensus among various stakeholders, including employees, management, and shareholders, can be a complex and time-consuming process. Therefore, the organizational feasibility of pension reinstatement is contingent upon effective communication and negotiation among all parties involved.

Furthermore, experts caution that the broader economic environment could influence the feasibility of pension reinstatement. Economic uncertainties, such as fluctuations in interest rates, inflation, and market volatility, can impact the financial stability of pension plans. In times of economic instability, companies may be more hesitant to commit to long-term financial obligations like pension plans. As such, the economic feasibility of reinstating pensions is closely tied to the prevailing economic conditions and the company’s ability to weather potential financial challenges.

In conclusion, while the demands for pension reinstatement by Boeing workers are understandable, experts remain doubtful about the feasibility of such a move. The financial, legal, organizational, and economic challenges associated with pension reinstatement present significant hurdles that must be carefully navigated. As discussions continue, it is crucial for all stakeholders to engage in open dialogue and explore alternative solutions that balance the interests of employees, the company, and its shareholders. Ultimately, the path forward will require a comprehensive understanding of the complexities involved and a commitment to finding a sustainable resolution that addresses the concerns of all parties involved.

Comparing Boeing’s Pension Dispute With Other Corporate Cases

In recent years, the issue of pension reinstatement has become a focal point of labor disputes across various industries, with Boeing workers being the latest to demand the restoration of their traditional pension plans. This demand arises amidst broader concerns about retirement security and the shifting landscape of employee benefits. However, experts remain skeptical about the likelihood of Boeing workers successfully reinstating their pensions, drawing comparisons to similar corporate cases that have unfolded over the past decade.

To understand the complexities of Boeing’s pension dispute, it is essential to consider the broader context of corporate pension plans in the United States. Traditionally, defined benefit pension plans were a staple of employee compensation packages, providing workers with a guaranteed income upon retirement. However, over the past few decades, there has been a marked shift towards defined contribution plans, such as 401(k)s, which transfer the investment risk from employers to employees. This transition has been driven by various factors, including the desire of companies to reduce long-term financial liabilities and the increasing volatility of global markets.

Boeing’s decision to freeze its defined benefit pension plan in favor of a defined contribution plan is not an isolated case. Many corporations have made similar moves, citing the need to remain competitive and financially sustainable. For instance, major companies like General Motors and IBM have also transitioned away from traditional pension plans, often facing significant pushback from employees and unions. Despite these challenges, these corporations have largely succeeded in implementing the changes, suggesting that Boeing’s workers may face an uphill battle in their quest for pension reinstatement.

Moreover, the legal landscape surrounding pension disputes further complicates the situation for Boeing employees. The Employee Retirement Income Security Act (ERISA) governs private sector pension plans, providing certain protections for employees. However, ERISA does not mandate the continuation of specific types of pension plans, allowing companies considerable leeway in altering or freezing their pension offerings. This legal framework has often favored employers in disputes over pension changes, as seen in previous cases where courts have upheld companies’ rights to modify or terminate pension plans.

In addition to legal challenges, economic considerations play a significant role in the feasibility of pension reinstatement. The financial implications of reinstating a defined benefit plan can be substantial, potentially impacting a company’s bottom line and its ability to invest in future growth. For Boeing, which operates in a highly competitive and capital-intensive industry, the financial burden of reinstating traditional pensions could be particularly onerous. This economic reality further diminishes the likelihood of a successful outcome for Boeing workers.

While the demand for pension reinstatement reflects broader concerns about retirement security, it is crucial to recognize the evolving nature of employee benefits in today’s corporate environment. As companies continue to navigate the complexities of global markets and financial sustainability, the traditional pension model may become increasingly rare. Consequently, employees and unions may need to explore alternative strategies to secure retirement benefits, such as negotiating enhanced contributions to defined contribution plans or advocating for policy changes at the federal level.

In conclusion, while the demands of Boeing workers for pension reinstatement highlight important issues surrounding retirement security, experts remain doubtful about the prospects of success. By examining similar corporate cases and considering the legal and economic factors at play, it becomes evident that the path to pension reinstatement is fraught with challenges. As the landscape of employee benefits continues to evolve, stakeholders must adapt to new realities and seek innovative solutions to ensure the financial well-being of workers in their retirement years.

Q&A

1. **What is the main issue concerning Boeing workers?**

Boeing workers are demanding the reinstatement of their pension plans, which were previously altered or replaced with different retirement benefits.

2. **Why are experts doubtful about the pension reinstatement?**

Experts doubt the feasibility of reinstating the pension plans due to financial, legal, and logistical challenges that Boeing would face in reversing the changes.

3. **What changes were made to Boeing workers’ pensions?**

Boeing shifted from traditional defined-benefit pension plans to defined-contribution plans, such as 401(k)s, which are generally less costly for the company.

4. **What are the financial implications for Boeing if pensions are reinstated?**

Reinstating pensions could significantly increase Boeing’s financial liabilities and impact its long-term financial stability.

5. **How have Boeing workers responded to the pension changes?**

Many Boeing workers have expressed dissatisfaction and concern over their retirement security, leading to demands for the reinstatement of the original pension plans.

6. **What legal challenges could arise from reinstating pensions?**

Legal challenges could include navigating existing contracts, regulatory compliance, and potential disputes with stakeholders or unions.

7. **Are there any precedents for companies reinstating pensions?**

While there are instances of companies modifying retirement benefits, full reinstatement of traditional pension plans is rare and often complicated by financial and legal constraints.

Conclusion

The conclusion regarding the demands for pension reinstatement by Boeing workers, which experts doubt, is that while the workers’ demands highlight significant concerns about retirement security and fair compensation, the feasibility of reinstating pensions is challenged by economic, financial, and strategic considerations. Experts suggest that Boeing may prioritize financial stability and shareholder interests over pension reinstatement, potentially leading to alternative solutions such as enhanced 401(k) contributions or other retirement benefits. The skepticism from experts underscores the complexity of balancing employee demands with corporate financial health in a competitive industry.