“Stabilizing Markets, Empowering Growth: PBOC’s Strategic Liquidity Boost”

Introduction

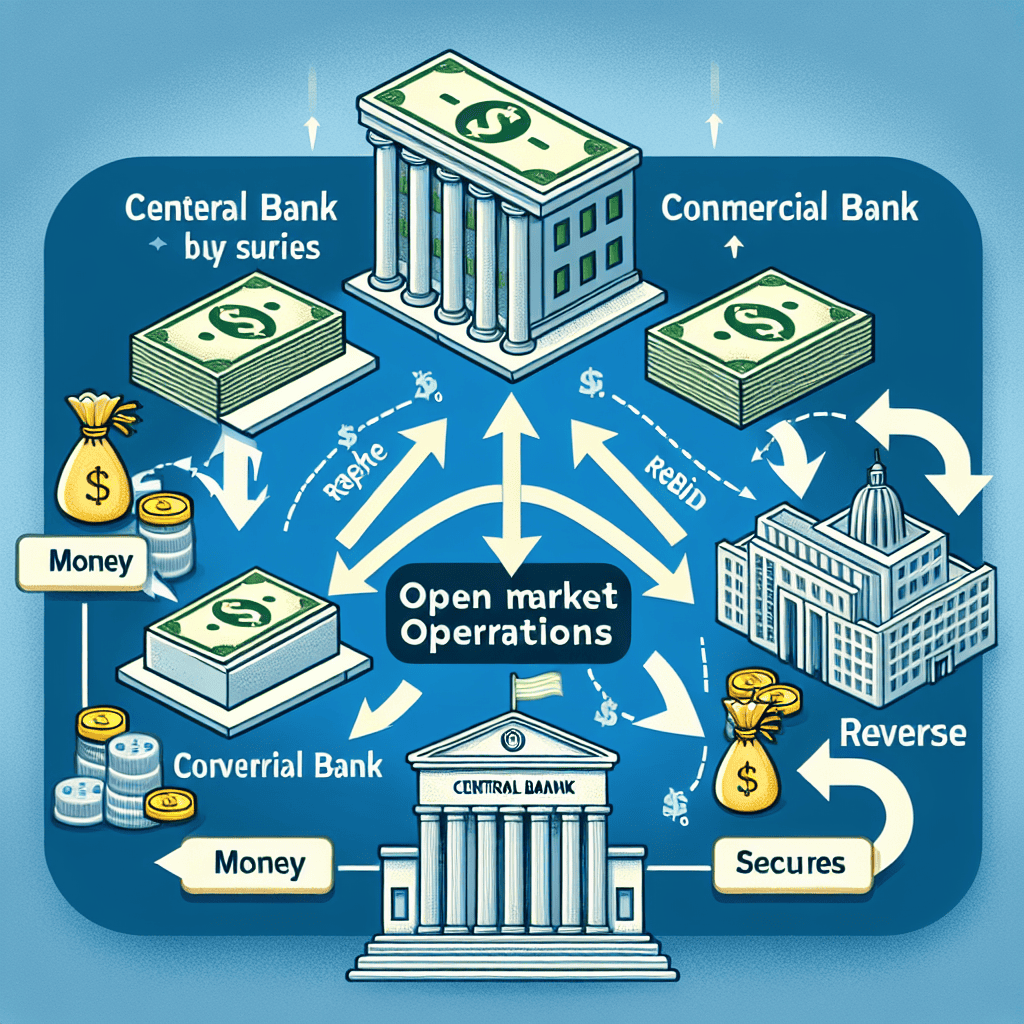

The People’s Bank of China (PBOC) has initiated an open market reverse repurchase agreement (reverse repo) operations facility, a strategic move aimed at managing liquidity in the banking system and stabilizing short-term interest rates. This facility allows the central bank to inject liquidity into the financial system by purchasing securities from commercial banks with an agreement to sell them back in the future. By conducting reverse repo operations, the PBOC can effectively address temporary liquidity shortages, ensuring that banks have sufficient funds to meet their short-term obligations. This mechanism is part of the PBOC’s broader monetary policy toolkit, designed to maintain financial stability and support economic growth by influencing money supply and credit conditions in the market.

Understanding the PBOC’s Reverse Repo Operations: A Comprehensive Guide

The People’s Bank of China (PBOC) has recently initiated an open market reverse repurchase agreement (reverse repo) operations facility, a strategic move that underscores its commitment to maintaining liquidity and stability in the financial system. This development is particularly significant as it reflects the central bank’s proactive approach in managing short-term interest rates and ensuring that the banking system has adequate liquidity to support economic activities. To fully comprehend the implications of this facility, it is essential to delve into the mechanics of reverse repo operations and their role in monetary policy.

Reverse repo operations are a tool used by central banks to manage liquidity in the financial system. In a reverse repo transaction, the central bank sells securities to commercial banks with an agreement to repurchase them at a later date. This process temporarily absorbs liquidity from the banking system, allowing the central bank to influence short-term interest rates. By adjusting the volume and frequency of these operations, the PBOC can effectively manage the supply of money, thereby stabilizing interest rates and ensuring that they remain within the desired range.

The initiation of the open market reverse repo operations facility by the PBOC is a clear indication of its intent to fine-tune monetary policy in response to evolving economic conditions. This facility provides the central bank with greater flexibility to inject or withdraw liquidity as needed, thereby enhancing its ability to respond to short-term fluctuations in the financial markets. Moreover, it serves as a signal to market participants about the central bank’s policy stance, helping to anchor expectations and reduce uncertainty.

In addition to managing liquidity, reverse repo operations also play a crucial role in the transmission of monetary policy. By influencing short-term interest rates, the PBOC can affect borrowing costs for businesses and consumers, thereby impacting economic activity. For instance, lower interest rates can stimulate investment and consumption by making borrowing more affordable, while higher rates can help cool down an overheating economy by discouraging excessive borrowing. Thus, reverse repo operations are an essential tool for the PBOC in achieving its dual mandate of promoting economic growth and maintaining price stability.

Furthermore, the open market reverse repo operations facility can also enhance financial stability by providing a reliable source of liquidity to the banking system. In times of market stress, when liquidity may become scarce, the facility can serve as a backstop, ensuring that banks have access to the funds they need to meet their obligations. This can help prevent disruptions in the financial system and mitigate the risk of a broader economic downturn.

In conclusion, the PBOC’s initiation of an open market reverse repo operations facility represents a significant step in its ongoing efforts to manage liquidity and stabilize the financial system. By providing the central bank with greater flexibility to adjust liquidity conditions, this facility enhances its ability to respond to changing economic circumstances and maintain control over short-term interest rates. As such, it is a vital component of the PBOC’s monetary policy toolkit, playing a key role in promoting economic growth and ensuring financial stability. As the global economic landscape continues to evolve, the importance of such tools in central banking is likely to grow, underscoring the need for a nuanced understanding of their functions and implications.

The Impact of PBOC’s Open Market Operations on China’s Economy

The People’s Bank of China (PBOC) has recently initiated an open market reverse repo operations facility, a strategic move that holds significant implications for China’s economy. This decision is part of the central bank’s broader monetary policy framework aimed at maintaining liquidity in the financial system and ensuring economic stability. By engaging in reverse repurchase agreements, the PBOC effectively injects liquidity into the banking system, thereby influencing interest rates and overall economic activity.

To understand the impact of this facility, it is essential to consider the mechanics of reverse repo operations. In a reverse repo transaction, the central bank purchases securities from commercial banks with an agreement to sell them back at a later date. This process temporarily increases the money supply, providing banks with the necessary liquidity to meet their short-term funding needs. Consequently, this can lead to a reduction in short-term interest rates, encouraging borrowing and investment across various sectors of the economy.

The timing of the PBOC’s decision is particularly noteworthy, as it comes amid a period of global economic uncertainty. With the lingering effects of the COVID-19 pandemic and geopolitical tensions affecting international trade, China’s economy faces several challenges. By implementing reverse repo operations, the PBOC aims to mitigate these challenges by ensuring that financial institutions have adequate liquidity to support economic growth. This move is also indicative of the central bank’s proactive approach to managing monetary policy in response to evolving economic conditions.

Moreover, the PBOC’s open market operations are closely watched by market participants, as they provide insights into the central bank’s policy stance. A decision to increase the frequency or scale of reverse repo operations could signal a more accommodative monetary policy, aimed at stimulating economic activity. Conversely, a reduction in such operations might suggest a tightening of monetary policy, reflecting concerns over inflationary pressures or financial stability risks. Therefore, the PBOC’s actions in the open market serve as a barometer for the broader economic outlook.

In addition to influencing domestic economic conditions, the PBOC’s open market operations have implications for global financial markets. As one of the world’s largest economies, China’s monetary policy decisions can affect capital flows and investor sentiment internationally. For instance, increased liquidity in China’s financial system may lead to greater demand for foreign assets, impacting exchange rates and global asset prices. Thus, the PBOC’s reverse repo operations are not only a tool for domestic economic management but also a factor in the interconnected global financial landscape.

Furthermore, the effectiveness of the PBOC’s open market operations depends on several factors, including the responsiveness of commercial banks and the broader economic environment. While the injection of liquidity can lower borrowing costs, the extent to which this translates into increased lending and investment depends on the confidence of businesses and consumers. In times of economic uncertainty, even ample liquidity may not be sufficient to spur economic activity if there is a lack of demand for credit.

In conclusion, the PBOC’s initiation of an open market reverse repo operations facility is a critical component of its monetary policy toolkit, aimed at ensuring liquidity and stability in China’s economy. By influencing interest rates and financial conditions, these operations play a vital role in supporting economic growth amid global uncertainties. As such, the PBOC’s actions are closely monitored by both domestic and international stakeholders, reflecting their significance in shaping economic outcomes.

How Reverse Repo Operations Influence Liquidity in Financial Markets

The People’s Bank of China (PBOC) has recently initiated an open market reverse repurchase agreement (reverse repo) operations facility, a strategic move aimed at influencing liquidity within the financial markets. This decision underscores the central bank’s commitment to maintaining stability and ensuring adequate liquidity in the financial system. Reverse repo operations are a critical tool used by central banks worldwide to manage short-term interest rates and control the money supply. By engaging in these operations, the PBOC can effectively inject liquidity into the banking system, thereby influencing the overall economic environment.

To understand the impact of reverse repo operations on liquidity, it is essential to first grasp the mechanics of these transactions. In a reverse repo operation, the central bank purchases securities from commercial banks with an agreement to sell them back at a later date. This transaction temporarily increases the reserves of the commercial banks, thereby enhancing their ability to lend. Consequently, the increased availability of funds in the banking system can lead to lower interest rates, as banks have more capital to offer loans at competitive rates. This, in turn, can stimulate economic activity by encouraging borrowing and investment.

Moreover, reverse repo operations serve as a signaling mechanism for the central bank’s monetary policy stance. By adjusting the frequency and volume of these operations, the PBOC can convey its intentions regarding future monetary policy. For instance, an increase in reverse repo operations may signal an accommodative policy stance, indicating the central bank’s willingness to support economic growth by ensuring ample liquidity. Conversely, a reduction in these operations might suggest a tightening of monetary policy, aimed at curbing inflationary pressures.

The influence of reverse repo operations on liquidity is not limited to domestic markets; it also extends to global financial markets. As China plays a significant role in the global economy, changes in its monetary policy can have far-reaching implications. For example, an increase in liquidity within China’s financial system can lead to greater demand for foreign assets, impacting exchange rates and capital flows. Additionally, global investors closely monitor the PBOC’s actions, as they provide insights into the health of the Chinese economy and potential shifts in global economic dynamics.

Furthermore, the effectiveness of reverse repo operations in influencing liquidity is contingent upon various factors, including the prevailing economic conditions and the responsiveness of financial institutions. In times of economic uncertainty or financial stress, banks may be more cautious in their lending practices, potentially dampening the impact of increased liquidity. Therefore, the PBOC must carefully calibrate its operations to ensure that they achieve the desired outcomes without unintended consequences.

In conclusion, the PBOC’s initiation of an open market reverse repo operations facility is a pivotal step in managing liquidity within the financial markets. By employing this tool, the central bank can influence short-term interest rates, signal its monetary policy intentions, and impact both domestic and global economic conditions. As the financial landscape continues to evolve, the PBOC’s strategic use of reverse repo operations will remain a crucial component of its monetary policy toolkit, ensuring stability and fostering sustainable economic growth.

Comparing PBOC’s Reverse Repo Strategy with Other Central Banks

The People’s Bank of China (PBOC) has recently initiated an open market reverse repurchase agreement (repo) operations facility, a strategic move that aligns with its broader monetary policy objectives. This development invites a comparison with the reverse repo strategies employed by other central banks around the world, highlighting both similarities and differences in approach and execution.

To begin with, reverse repo operations are a common tool used by central banks to manage liquidity in the financial system. By selling securities with an agreement to repurchase them at a later date, central banks can effectively control the money supply and influence short-term interest rates. The PBOC’s decision to utilize this mechanism reflects its intent to maintain stability in the Chinese financial markets, particularly in the face of fluctuating economic conditions.

In comparison, the Federal Reserve in the United States has long employed reverse repo operations as part of its monetary policy toolkit. The Fed’s approach is characterized by its focus on maintaining the federal funds rate within a target range, thereby influencing broader economic activity. The Fed’s reverse repo operations are typically conducted on a large scale, involving a wide range of counterparties, which helps to ensure that liquidity is distributed efficiently across the financial system. This strategy has been particularly evident in recent years, as the Fed has sought to navigate the challenges posed by the COVID-19 pandemic and its aftermath.

Similarly, the European Central Bank (ECB) utilizes reverse repo operations as a means of managing liquidity and steering short-term interest rates. However, the ECB’s approach is often more nuanced, reflecting the diverse economic conditions across the Eurozone. The ECB’s operations are designed to address specific liquidity needs within member states, ensuring that monetary policy is effectively transmitted throughout the region. This tailored approach underscores the complexity of managing a multi-national currency union, where economic conditions can vary significantly from one country to another.

In contrast, the Bank of Japan (BOJ) employs reverse repo operations as part of its broader strategy of quantitative and qualitative monetary easing. The BOJ’s approach is characterized by its aggressive stance, aimed at combating deflationary pressures and stimulating economic growth. By maintaining a low-interest-rate environment and providing ample liquidity to the financial system, the BOJ seeks to encourage lending and investment, thereby supporting economic activity.

While the PBOC’s reverse repo strategy shares common elements with those of other central banks, it is also shaped by China’s unique economic context. The PBOC must balance the need for economic growth with the imperative of financial stability, particularly in light of China’s rapidly evolving financial markets. As such, the PBOC’s operations are often more targeted, focusing on specific sectors or institutions that may require liquidity support.

In conclusion, the PBOC’s initiation of an open market reverse repo operations facility is a significant development in its monetary policy strategy. By comparing this approach with those of other central banks, it becomes clear that while there are commonalities in the use of reverse repo operations, each central bank tailors its strategy to its specific economic context and policy objectives. As global economic conditions continue to evolve, the role of reverse repo operations in central bank policy is likely to remain a critical tool for managing liquidity and ensuring financial stability.

The Role of Reverse Repo Operations in Stabilizing the Yuan

The People’s Bank of China (PBOC) has recently initiated an open market reverse repo operations facility, a strategic move aimed at stabilizing the yuan amidst fluctuating global economic conditions. This decision underscores the central bank’s commitment to maintaining monetary stability and ensuring adequate liquidity in the financial system. Reverse repo operations, a tool frequently employed by central banks worldwide, involve the purchase of securities with an agreement to sell them back at a later date. This mechanism serves as a means to inject liquidity into the banking system, thereby influencing short-term interest rates and stabilizing the national currency.

In the context of the yuan, reverse repo operations play a crucial role in mitigating volatility and maintaining investor confidence. By providing liquidity, the PBOC can effectively manage the supply of money in the economy, which in turn helps to stabilize the exchange rate of the yuan. This is particularly important in times of economic uncertainty or when external pressures, such as trade tensions or geopolitical events, threaten to destabilize the currency. Through these operations, the PBOC can signal its monetary policy intentions to the market, thereby guiding expectations and reducing speculative pressures on the yuan.

Moreover, the implementation of reverse repo operations is indicative of the PBOC’s proactive approach to monetary policy. By adjusting the scale and frequency of these operations, the central bank can respond swiftly to changing economic conditions. For instance, during periods of economic slowdown, the PBOC might increase the volume of reverse repos to ensure that banks have sufficient liquidity to support lending and investment activities. Conversely, in times of economic overheating, the central bank might scale back these operations to prevent excessive money supply growth and curb inflationary pressures.

The effectiveness of reverse repo operations in stabilizing the yuan is further enhanced by their integration with other monetary policy tools. The PBOC often employs a combination of interest rate adjustments, reserve requirement changes, and open market operations to achieve its policy objectives. This multifaceted approach allows the central bank to fine-tune its interventions and address specific challenges facing the economy. For example, by coordinating reverse repo operations with interest rate cuts, the PBOC can provide a more comprehensive stimulus to the economy, thereby supporting growth while maintaining currency stability.

In addition to their domestic implications, reverse repo operations also have significant international ramifications. As China continues to integrate into the global financial system, the stability of the yuan becomes increasingly important for international trade and investment. A stable yuan not only facilitates cross-border transactions but also enhances China’s attractiveness as a destination for foreign investment. By maintaining a stable currency, the PBOC can help to foster a favorable economic environment that supports sustainable growth and development.

In conclusion, the PBOC’s initiation of open market reverse repo operations is a testament to its commitment to stabilizing the yuan and ensuring monetary stability. Through these operations, the central bank can effectively manage liquidity, influence interest rates, and guide market expectations. As China navigates an increasingly complex global economic landscape, the role of reverse repo operations in stabilizing the yuan will remain a critical component of the PBOC’s monetary policy toolkit. By leveraging this tool alongside other policy measures, the PBOC can continue to support economic growth while safeguarding the stability of its national currency.

Analyzing the Short-Term and Long-Term Effects of PBOC’s Monetary Policy

The People’s Bank of China (PBOC) has recently initiated an open market reverse repo operations facility, a move that has garnered significant attention from economists and financial analysts worldwide. This strategic decision is aimed at injecting liquidity into the banking system, thereby stabilizing short-term interest rates and supporting economic growth. To fully comprehend the implications of this policy, it is essential to analyze both its short-term and long-term effects on China’s economy and the global financial landscape.

In the short term, the PBOC’s reverse repo operations are designed to address immediate liquidity needs within the banking sector. By purchasing securities from commercial banks with an agreement to sell them back in the future, the central bank effectively provides these institutions with the necessary cash to meet their short-term obligations. This influx of liquidity is crucial, particularly during periods of economic uncertainty or when banks face unexpected cash flow challenges. Consequently, the immediate effect of this policy is a reduction in short-term interest rates, which can stimulate borrowing and investment by making credit more accessible and affordable for businesses and consumers alike.

Moreover, the PBOC’s actions can help stabilize financial markets by alleviating liquidity pressures that might otherwise lead to volatility. In times of market stress, the assurance of central bank support can bolster investor confidence, thereby preventing panic selling and maintaining orderly market conditions. This stability is vital for sustaining economic activity, as it encourages continued investment and consumption, which are key drivers of growth.

Transitioning to the long-term effects, the PBOC’s reverse repo operations can have more profound implications for China’s monetary policy framework and economic trajectory. By consistently utilizing this tool, the central bank signals its commitment to maintaining a flexible and responsive monetary policy. This adaptability is crucial in a rapidly changing global economic environment, where unforeseen challenges can arise at any moment. Furthermore, the PBOC’s actions may influence the expectations of market participants, shaping their perceptions of future monetary policy and economic conditions.

In the broader context, the PBOC’s reverse repo operations can also impact global financial markets. As China is a major player in the world economy, its monetary policy decisions can have ripple effects across international markets. For instance, increased liquidity in China can lead to capital flows into other emerging markets, as investors seek higher returns. Additionally, changes in China’s interest rates can influence global borrowing costs, affecting everything from corporate financing to government debt issuance.

However, it is important to consider potential risks associated with the PBOC’s policy. Prolonged periods of low interest rates and abundant liquidity can lead to asset bubbles, as investors may take on excessive risk in search of higher yields. Moreover, if not carefully managed, the central bank’s interventions could lead to distortions in the financial system, undermining the efficient allocation of resources.

In conclusion, the PBOC’s initiation of open market reverse repo operations represents a significant step in its monetary policy strategy. While the short-term effects are largely positive, providing much-needed liquidity and stability, the long-term implications require careful consideration. As China continues to navigate its economic challenges, the PBOC’s actions will undoubtedly play a crucial role in shaping the country’s financial landscape and its interactions with the global economy. Through prudent management and strategic foresight, the central bank can harness the benefits of this policy while mitigating potential risks, ensuring sustainable growth and stability for the future.

The Future of PBOC’s Open Market Operations in a Global Context

The People’s Bank of China (PBOC) has recently taken a significant step in its monetary policy strategy by initiating an open market reverse repo operations facility. This move is poised to have far-reaching implications not only for China’s domestic economy but also for the global financial landscape. As the world’s second-largest economy, China’s monetary policy decisions are closely watched by international markets, and the introduction of this facility marks a pivotal moment in the PBOC’s approach to managing liquidity and interest rates.

Reverse repurchase agreements, or reverse repos, are a tool used by central banks to inject liquidity into the banking system. By purchasing securities from commercial banks with an agreement to sell them back at a later date, the PBOC can effectively manage short-term interest rates and ensure that there is sufficient liquidity in the financial system. This mechanism is particularly crucial in times of economic uncertainty, as it provides banks with the necessary funds to continue lending to businesses and consumers, thereby supporting economic growth.

In the context of China’s economic landscape, the introduction of the reverse repo operations facility is a strategic move to address several challenges. Firstly, it aims to stabilize the financial system amid ongoing concerns about the country’s real estate sector and potential defaults by major property developers. By ensuring that banks have access to liquidity, the PBOC can mitigate the risk of a credit crunch that could exacerbate these issues. Furthermore, this facility is part of a broader effort to transition China’s economy from one driven by investment and exports to a more sustainable model centered on domestic consumption and innovation.

On a global scale, the PBOC’s decision to implement this facility reflects a growing trend among central banks to adopt more flexible and responsive monetary policy tools. As the global economy becomes increasingly interconnected, central banks must navigate a complex web of economic indicators and geopolitical factors. The PBOC’s move aligns with similar strategies employed by other major central banks, such as the Federal Reserve and the European Central Bank, which have also utilized open market operations to manage liquidity and stabilize their respective economies.

Moreover, the introduction of the reverse repo operations facility underscores China’s commitment to maintaining financial stability while pursuing its long-term economic goals. As the country continues to open its financial markets to foreign investors, the PBOC’s ability to effectively manage liquidity and interest rates will be crucial in building confidence among international stakeholders. This facility not only enhances the PBOC’s toolkit for addressing domestic economic challenges but also positions China as a key player in the global financial system.

In conclusion, the PBOC’s initiation of an open market reverse repo operations facility represents a significant development in its monetary policy framework. By providing a mechanism to manage liquidity and interest rates, the PBOC is better equipped to address both domestic and global economic challenges. As China continues to play an increasingly prominent role in the global economy, the effectiveness of its monetary policy tools will be closely scrutinized by international markets. The introduction of this facility is a testament to the PBOC’s proactive approach to ensuring financial stability and supporting sustainable economic growth in an ever-evolving global context.

Q&A

1. **What is the PBOC?**

The People’s Bank of China (PBOC) is the central bank of China, responsible for implementing monetary policy and maintaining financial stability.

2. **What are open market operations?**

Open market operations involve the buying and selling of government securities in the open market to regulate the money supply and influence interest rates.

3. **What is a reverse repo operation?**

A reverse repo operation is a process where the central bank purchases securities from commercial banks with an agreement to sell them back at a later date, effectively injecting liquidity into the banking system.

4. **Why does the PBOC use reverse repo operations?**

The PBOC uses reverse repo operations to manage short-term liquidity in the banking system, ensuring adequate cash flow and stabilizing interest rates.

5. **How do reverse repo operations affect the economy?**

By injecting liquidity, reverse repo operations can lower short-term interest rates, encourage lending, and stimulate economic activity.

6. **What is the typical duration of a reverse repo operation by the PBOC?**

The duration can vary, but common tenors include 7, 14, or 28 days, depending on the liquidity needs of the banking system.

7. **How does the PBOC decide the amount for reverse repo operations?**

The PBOC assesses factors such as current liquidity conditions, economic indicators, and monetary policy objectives to determine the appropriate amount for reverse repo operations.

Conclusion

The People’s Bank of China (PBOC) initiating open market reverse repo operations is a strategic move aimed at managing liquidity in the banking system. By conducting these operations, the PBOC injects short-term funds into the financial system, which helps to stabilize interest rates and ensure adequate liquidity for banks. This action is often taken to address seasonal fluctuations in liquidity demand, respond to economic conditions, or guide monetary policy. The reverse repo operations can also signal the central bank’s stance on monetary policy, whether it is easing or tightening. Overall, the PBOC’s use of reverse repo operations is a critical tool for maintaining financial stability and supporting economic growth.