“Charting a New Course: Finding Support for Retirement at 70 Without Savings”

Introduction

Navigating retirement at 70 without savings can be a daunting prospect, but it’s a reality faced by many individuals. As traditional safety nets like pensions become less common and the cost of living continues to rise, finding oneself at the threshold of retirement without a financial cushion is increasingly prevalent. However, there are resources and strategies available to help manage this challenging situation. From government assistance programs and community resources to part-time work opportunities and financial counseling, there are avenues to explore that can provide support and guidance. Understanding where to seek help and how to leverage available resources is crucial for creating a sustainable and fulfilling retirement, even when starting from a position of financial insecurity.

Understanding Government Assistance Programs for Seniors

Navigating retirement at 70 without savings can be a daunting prospect, yet understanding the available government assistance programs for seniors can provide a lifeline. As individuals approach this stage of life, it is crucial to explore the various resources designed to support those who may not have had the opportunity to accumulate substantial savings. By familiarizing oneself with these programs, seniors can better manage their financial needs and maintain a reasonable quality of life.

To begin with, Social Security remains one of the most significant sources of income for retirees in the United States. For those who have worked and paid into the system, Social Security benefits can provide a steady stream of income. It is essential to understand how benefits are calculated and the optimal time to start claiming them. While benefits can be claimed as early as age 62, waiting until full retirement age or even later can result in higher monthly payments. This decision should be made based on individual circumstances, including health, life expectancy, and financial needs.

In addition to Social Security, Medicare is another critical program for seniors, offering health insurance coverage to those aged 65 and older. Medicare is divided into several parts, each covering different aspects of healthcare, such as hospital stays, outpatient services, and prescription drugs. Understanding the nuances of Medicare, including enrollment periods and potential out-of-pocket costs, is vital for managing healthcare expenses effectively. For those with limited income, programs like Medicaid and the Medicare Savings Program can provide additional assistance by covering premiums, deductibles, and other costs.

Furthermore, the Supplemental Security Income (SSI) program offers financial assistance to seniors with limited income and resources. Administered by the Social Security Administration, SSI provides monthly payments to help cover basic needs such as food, clothing, and shelter. Eligibility for SSI is determined by income and asset limits, and it is important for seniors to be aware of these criteria when applying for assistance.

Beyond these federal programs, many states offer additional resources tailored to the needs of their senior residents. State-specific programs may include property tax relief, utility assistance, and transportation services, all of which can alleviate some of the financial burdens faced by retirees. It is advisable for seniors to contact their local Area Agency on Aging to learn more about the programs available in their region.

Moreover, nonprofit organizations and community groups often provide valuable support to seniors in need. These organizations may offer services such as meal delivery, home care, and financial counseling, which can significantly enhance the quality of life for those navigating retirement without savings. Engaging with these groups can also foster a sense of community and connection, which is particularly important for emotional well-being during retirement.

In conclusion, while retiring at 70 without savings presents challenges, understanding and accessing government assistance programs can provide essential support. By leveraging resources such as Social Security, Medicare, SSI, and state-specific programs, seniors can better manage their financial and healthcare needs. Additionally, seeking help from nonprofit organizations and community groups can further enhance their quality of life. Through informed decision-making and proactive engagement with available resources, seniors can navigate retirement with greater confidence and security.

Exploring Community Resources and Support Networks

Navigating retirement at 70 without savings can be a daunting prospect, yet it is a reality faced by many individuals. As traditional safety nets like pensions become less common, and with the rising cost of living, more seniors find themselves entering retirement without the financial cushion they had anticipated. However, there are numerous community resources and support networks available to help ease this transition. Understanding and accessing these resources can make a significant difference in maintaining a quality standard of living during retirement.

Firstly, local government programs can provide essential support. Many municipalities offer services specifically designed for seniors, such as subsidized housing, transportation assistance, and meal programs. These services aim to alleviate some of the financial burdens associated with daily living expenses. For instance, subsidized housing can significantly reduce the cost of rent, allowing retirees to allocate their limited funds to other necessities. Additionally, transportation assistance programs can help seniors maintain their independence by providing affordable or free access to public transit, ensuring they can attend medical appointments and engage in social activities.

Moreover, non-profit organizations play a crucial role in supporting seniors without savings. Organizations such as the National Council on Aging and local senior centers offer a variety of programs and workshops that focus on financial literacy, health and wellness, and social engagement. These programs are designed to empower seniors by providing them with the knowledge and skills needed to manage their finances effectively and maintain a healthy lifestyle. Furthermore, many non-profits offer volunteer opportunities, which not only provide a sense of purpose but can also lead to new friendships and community connections.

In addition to government and non-profit resources, faith-based organizations often extend a helping hand to seniors in need. Many churches, synagogues, and mosques have outreach programs that offer financial assistance, food pantries, and companionship services. These organizations can be a source of comfort and support, providing both material aid and a sense of belonging. Engaging with a faith-based community can also offer spiritual support, which can be invaluable during challenging times.

Furthermore, exploring intergenerational living arrangements can be a practical solution for seniors without savings. By sharing a home with family members or other seniors, individuals can reduce living expenses and benefit from shared responsibilities. This arrangement can also foster a supportive environment where seniors can receive assistance with daily tasks and enjoy companionship. Intergenerational living not only addresses financial concerns but also combats the isolation that many seniors experience.

Additionally, technology can be a powerful tool for seniors seeking support. Online platforms and social media groups dedicated to senior issues provide a space for individuals to share experiences, advice, and resources. These digital communities can offer emotional support and practical tips for navigating retirement without savings. Moreover, many websites and apps are designed to help seniors manage their finances, find discounts, and access community resources.

In conclusion, while retiring at 70 without savings presents significant challenges, there are numerous community resources and support networks available to assist seniors in this situation. By leveraging government programs, non-profit organizations, faith-based initiatives, intergenerational living arrangements, and technology, retirees can find the support they need to maintain a fulfilling and dignified life. It is essential for seniors to proactively seek out these resources and engage with their communities to ensure they receive the assistance they require.

Leveraging Healthcare Options and Benefits

Navigating retirement at 70 without savings can be a daunting prospect, particularly when considering the healthcare needs that often accompany advancing age. However, there are several avenues through which individuals can leverage healthcare options and benefits to ease the financial burden. Understanding these options is crucial for ensuring access to necessary medical care while maintaining financial stability.

To begin with, Medicare serves as a cornerstone for healthcare coverage for individuals aged 65 and older in the United States. It is essential for retirees to familiarize themselves with the different parts of Medicare, which include Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug coverage). While Part A is typically premium-free for those who have paid Medicare taxes for a sufficient period, Parts B, C, and D may involve additional costs. Therefore, it is advisable to carefully evaluate one’s healthcare needs and financial situation to select the most appropriate plan. Additionally, for those with limited income and resources, programs such as Medicaid and the Medicare Savings Program can provide further assistance by covering premiums, deductibles, and other out-of-pocket expenses.

Moreover, retirees should explore the benefits offered by the Affordable Care Act (ACA), which has expanded access to healthcare for many Americans. The ACA provides subsidies to help lower the cost of health insurance premiums for those who qualify, based on income and household size. This can be particularly beneficial for individuals who may not yet qualify for Medicare or who require supplemental coverage. Furthermore, the ACA ensures that insurance plans cover essential health benefits, including preventive services, which can help retirees maintain their health and potentially avoid more costly medical interventions in the future.

In addition to government programs, retirees should consider the role of community resources in supporting their healthcare needs. Many communities offer free or low-cost clinics that provide basic medical services, dental care, and prescription assistance. These clinics are often staffed by volunteer healthcare professionals and can be a valuable resource for those without substantial savings. Additionally, non-profit organizations and charitable foundations may offer grants or financial assistance for specific medical conditions or treatments, providing another layer of support for retirees facing healthcare challenges.

Furthermore, it is important for retirees to engage in proactive health management to minimize healthcare costs. This includes maintaining a healthy lifestyle through regular exercise, a balanced diet, and routine health screenings. Preventive care can significantly reduce the risk of chronic diseases and the associated medical expenses. Retirees should also consider utilizing telemedicine services, which have become increasingly popular and accessible. Telemedicine can offer a convenient and cost-effective way to consult with healthcare providers, particularly for routine check-ups or minor health concerns.

In conclusion, while retiring at 70 without savings presents significant challenges, there are numerous healthcare options and benefits available to help manage medical expenses. By understanding and leveraging programs such as Medicare, Medicaid, and the Affordable Care Act, as well as utilizing community resources and engaging in preventive health measures, retirees can navigate their healthcare needs more effectively. It is crucial to remain informed and proactive in seeking out these resources to ensure a secure and healthy retirement.

Finding Affordable Housing Solutions for Retirees

Navigating retirement at 70 without savings can be a daunting prospect, particularly when it comes to securing affordable housing. As the cost of living continues to rise, many retirees find themselves in a precarious financial situation, necessitating the exploration of various housing solutions. Fortunately, there are several avenues available to those seeking affordable housing options, each offering unique benefits and considerations.

One of the primary resources for retirees in need of affordable housing is government-assisted programs. The U.S. Department of Housing and Urban Development (HUD) offers several programs designed to assist low-income seniors. The Section 202 Supportive Housing for the Elderly Program, for instance, provides affordable apartment communities specifically for seniors with limited income. These communities often include services such as housekeeping, transportation, and counseling, which can significantly enhance the quality of life for retirees. Additionally, the Housing Choice Voucher Program, commonly known as Section 8, allows eligible seniors to rent privately-owned residences at a reduced cost, with the government subsidizing a portion of the rent.

Transitioning from government programs, another viable option is to explore nonprofit organizations dedicated to providing affordable housing for seniors. Organizations such as Habitat for Humanity and Volunteers of America offer housing solutions tailored to the needs of older adults. These nonprofits often collaborate with local communities to build or renovate homes, ensuring they are accessible and affordable for retirees. By engaging with these organizations, seniors can access housing that not only meets their financial constraints but also fosters a sense of community and support.

In addition to government and nonprofit options, retirees may consider co-housing arrangements as a means of reducing housing costs. Co-housing involves sharing a living space with other seniors, thereby splitting expenses such as rent, utilities, and groceries. This arrangement not only alleviates financial burdens but also combats the social isolation that many retirees face. By living with peers, seniors can enjoy companionship and mutual support, enhancing their overall well-being. Co-housing communities often emphasize shared responsibilities and decision-making, creating an environment where retirees can actively participate in shaping their living conditions.

Moreover, retirees should not overlook the potential of downsizing as a strategy to secure affordable housing. By moving to a smaller home or apartment, seniors can significantly reduce their living expenses, freeing up resources for other essential needs. Downsizing can also simplify daily life, as smaller spaces typically require less maintenance and upkeep. This transition, while challenging, can ultimately lead to a more manageable and financially sustainable lifestyle.

Finally, it is crucial for retirees to seek guidance from financial advisors or housing counselors who specialize in senior housing issues. These professionals can provide valuable insights into the various options available and help retirees navigate the complexities of securing affordable housing. By leveraging their expertise, seniors can make informed decisions that align with their financial situation and personal preferences.

In conclusion, while retiring at 70 without savings presents significant challenges, there are numerous resources and strategies available to help seniors find affordable housing solutions. By exploring government programs, engaging with nonprofit organizations, considering co-housing arrangements, downsizing, and seeking professional advice, retirees can secure housing that meets their needs and ensures a stable and fulfilling retirement.

Utilizing Food Assistance and Nutrition Programs

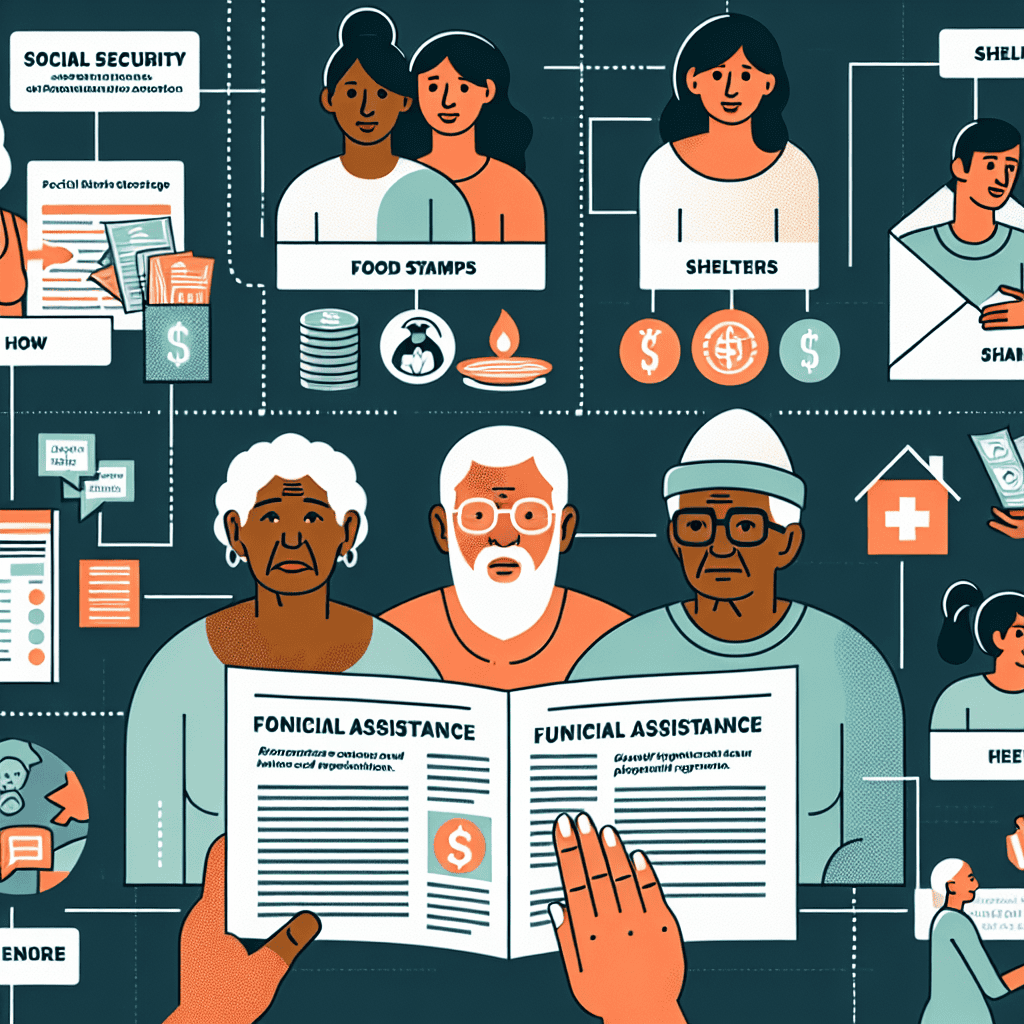

Navigating retirement at 70 without savings can be a daunting prospect, especially when considering the basic necessity of food. However, there are numerous food assistance and nutrition programs available that can provide substantial support. Understanding and utilizing these resources can significantly alleviate the financial burden and ensure access to nutritious meals.

One of the primary resources available is the Supplemental Nutrition Assistance Program (SNAP), formerly known as food stamps. SNAP is a federal program designed to help low-income individuals and families purchase food. Eligibility for SNAP is determined by income and household size, and the benefits are provided through an Electronic Benefits Transfer (EBT) card, which functions like a debit card. For retirees, especially those without savings, SNAP can be a vital source of assistance. Applying for SNAP can be done online or through local social services offices, and it is advisable to gather all necessary documentation, such as proof of income and identification, to streamline the process.

In addition to SNAP, the Commodity Supplemental Food Program (CSFP) specifically targets low-income individuals aged 60 and above. This program provides a monthly package of nutritious food items, including fruits, vegetables, and grains, to supplement the diets of seniors. The CSFP is administered at the state level, and interested individuals can contact their local food bank or state agency to apply. This program not only helps in meeting nutritional needs but also reduces the financial strain of purchasing groceries.

Furthermore, the Senior Farmers’ Market Nutrition Program (SFMNP) offers another avenue for accessing fresh produce. This program provides low-income seniors with coupons that can be exchanged for fruits, vegetables, honey, and herbs at farmers’ markets and roadside stands. The SFMNP not only supports nutritional health but also encourages engagement with local agricultural communities. To participate, seniors can inquire at local senior centers or state agencies that administer the program.

Moreover, Meals on Wheels is a well-known program that delivers nutritious meals directly to the homes of seniors who are unable to prepare their own meals. This service is particularly beneficial for those with mobility issues or health concerns that make grocery shopping and cooking challenging. Meals on Wheels operates through local organizations, and eligibility criteria may vary. Contacting the local Meals on Wheels provider can provide information on how to apply and what services are available in the area.

In addition to these programs, many community-based organizations and food banks offer food assistance to seniors. These organizations often provide free or low-cost groceries and meals, and they may also offer additional services such as nutrition education and cooking classes. Engaging with these community resources can provide not only food assistance but also a sense of community and support.

In conclusion, while retiring at 70 without savings presents significant challenges, there are numerous food assistance and nutrition programs available to help seniors maintain a healthy diet. By exploring and utilizing programs such as SNAP, CSFP, SFMNP, and Meals on Wheels, retirees can access essential food resources. Additionally, community organizations and food banks offer valuable support. Taking advantage of these programs can significantly ease the financial burden and ensure that nutritional needs are met, allowing retirees to focus on enjoying their golden years with peace of mind.

Engaging in Part-Time Work or Volunteer Opportunities

Navigating retirement at 70 without savings can be a daunting prospect, yet it is a reality faced by many individuals. In such circumstances, engaging in part-time work or volunteer opportunities can provide not only financial relief but also a sense of purpose and community involvement. As individuals approach this stage of life, it is crucial to explore various avenues that can offer both economic support and personal fulfillment.

One of the primary benefits of part-time work is the ability to supplement income without the demands of a full-time job. Many industries offer flexible positions that cater to retirees, such as retail, hospitality, or administrative roles. These jobs often provide the opportunity to work limited hours, allowing retirees to maintain a balance between earning an income and enjoying their retirement. Moreover, part-time work can help individuals stay active and engaged, which is essential for both physical and mental well-being.

In addition to traditional part-time roles, the gig economy presents a modern alternative for retirees seeking flexible work. Platforms like Uber, Lyft, or TaskRabbit allow individuals to work on their own terms, choosing when and how much they want to work. This flexibility can be particularly appealing to those who wish to remain in control of their schedules. Furthermore, these platforms often require minimal training, making them accessible to those who may not have specific skills or experience in a particular field.

On the other hand, volunteering offers a different kind of reward. While it may not provide direct financial benefits, volunteering can enrich one’s life in numerous ways. Engaging in volunteer work allows retirees to contribute to their communities, fostering a sense of belonging and purpose. Many organizations, such as local charities, hospitals, or schools, are in constant need of volunteers and offer a variety of roles that can match an individual’s interests and skills. By dedicating time to meaningful causes, retirees can build new social connections and enhance their quality of life.

Moreover, volunteering can sometimes lead to unexpected opportunities. For instance, it can serve as a stepping stone to paid positions within an organization or help individuals develop new skills that can be leveraged in the job market. Additionally, the experience gained through volunteering can be a valuable addition to a resume, demonstrating a commitment to community service and personal growth.

For those considering part-time work or volunteering, it is important to assess personal interests and capabilities. Identifying what one enjoys and is capable of doing will ensure that the chosen path is both fulfilling and sustainable. Furthermore, retirees should explore resources available in their communities, such as local job centers or volunteer organizations, which can provide guidance and support in finding suitable opportunities.

In conclusion, while retiring at 70 without savings presents challenges, engaging in part-time work or volunteer opportunities can offer viable solutions. These avenues not only provide financial support but also contribute to a fulfilling and active retirement. By exploring these options, individuals can navigate this stage of life with confidence and purpose, ensuring that their retirement years are both productive and enjoyable.

Accessing Financial Counseling and Planning Services

Navigating retirement at 70 without savings can be a daunting prospect, yet it is a reality faced by many individuals. As the traditional safety nets of pensions and social security become increasingly strained, the importance of accessing financial counseling and planning services cannot be overstated. These services offer invaluable guidance, helping retirees make informed decisions about their financial futures. Understanding where to seek help is the first step in creating a sustainable plan for retirement.

To begin with, local government agencies often provide resources tailored to seniors in need of financial advice. Many municipalities have departments dedicated to aging services, which can connect retirees with financial counselors who specialize in retirement planning. These professionals can assist in evaluating current financial situations, identifying potential sources of income, and developing a budget that aligns with one’s lifestyle and needs. Additionally, they can offer advice on managing debt, which is crucial for those entering retirement without savings.

Moreover, nonprofit organizations play a significant role in offering financial counseling to seniors. Organizations such as the National Council on Aging and AARP provide a wealth of resources, including workshops, online tools, and one-on-one counseling sessions. These services are often free or offered at a reduced cost, making them accessible to those on a limited budget. By leveraging the expertise of these organizations, retirees can gain a clearer understanding of their financial options and develop strategies to maximize their income.

In addition to nonprofit organizations, financial institutions also offer retirement planning services. Banks and credit unions frequently have financial advisors on staff who can provide personalized advice. While some of these services may come with fees, many institutions offer complimentary consultations to their customers. These advisors can help retirees explore various financial products, such as annuities or reverse mortgages, which may provide additional income streams during retirement.

Furthermore, online resources have become increasingly valuable for those seeking financial guidance. Numerous websites offer free tools and calculators that can help retirees assess their financial health and plan for the future. For instance, the Social Security Administration’s website provides calculators to estimate benefits, while other platforms offer budgeting tools and investment advice. These resources can be particularly beneficial for individuals who prefer to conduct their research independently before consulting with a professional.

It is also important to consider the role of community support networks in navigating retirement without savings. Local senior centers and community groups often host financial literacy workshops and seminars, providing opportunities for retirees to learn from experts and peers alike. These events not only offer practical advice but also foster a sense of community and support, which can be invaluable during the transition into retirement.

In conclusion, while retiring at 70 without savings presents significant challenges, there are numerous avenues for seeking financial counseling and planning services. By utilizing resources offered by government agencies, nonprofit organizations, financial institutions, and online platforms, retirees can develop a comprehensive plan to manage their finances effectively. Additionally, engaging with community support networks can provide both practical advice and emotional support. Ultimately, taking proactive steps to access these services can empower retirees to navigate their financial futures with confidence and security.

Q&A

1. **Question:** What government programs can assist retirees without savings?

**Answer:** Social Security benefits and Supplemental Security Income (SSI) can provide financial support for retirees without savings.

2. **Question:** Are there any healthcare options available for retirees without savings?

**Answer:** Medicare provides healthcare coverage for individuals 65 and older, and Medicaid can offer additional assistance for those with limited income.

3. **Question:** How can retirees without savings find affordable housing?

**Answer:** Retirees can explore options like Section 8 housing vouchers, senior housing communities, and low-income housing tax credit properties.

4. **Question:** What community resources are available for retirees in need?

**Answer:** Local Area Agencies on Aging, community centers, and nonprofit organizations often provide resources such as meal programs, transportation, and social services.

5. **Question:** Can retirees without savings find employment opportunities?

**Answer:** Programs like the Senior Community Service Employment Program (SCSEP) offer part-time job training and employment opportunities for low-income seniors.

6. **Question:** How can retirees manage debt without savings?

**Answer:** Retirees can seek assistance from credit counseling agencies to negotiate with creditors and create manageable repayment plans.

7. **Question:** What financial planning resources are available for retirees without savings?

**Answer:** Free or low-cost financial counseling services are available through nonprofit organizations, community centers, and some financial institutions to help retirees budget and plan effectively.

Conclusion

Navigating retirement at 70 without savings can be challenging, but there are several avenues to seek help. First, consider applying for government assistance programs such as Social Security benefits, Supplemental Security Income (SSI), or Medicaid, which can provide financial support and healthcare coverage. Additionally, explore community resources like local senior centers, nonprofit organizations, and charities that offer services and support for seniors in need. Part-time work or freelance opportunities can also supplement income, while downsizing or sharing living expenses with family or roommates can reduce financial burdens. Consulting with a financial advisor or a social worker can provide personalized guidance and help identify available resources. By leveraging these options, individuals can create a more secure and manageable retirement plan despite the absence of savings.