“Unraveling Turbulence: The Missteps Behind Boeing’s Descent”

Introduction

The Downfall of Boeing: Analyzing the Missteps

Boeing, once a paragon of innovation and reliability in the aerospace industry, has faced a series of challenges that have significantly tarnished its reputation and financial standing. The company’s decline can be attributed to a combination of strategic missteps, management failures, and a series of high-profile safety incidents that have shaken public confidence. Central to this downfall was the 737 MAX crisis, which exposed critical flaws in Boeing’s engineering practices and regulatory oversight. Additionally, internal cultural issues and a relentless focus on cost-cutting over quality further exacerbated the situation. This analysis delves into the multifaceted reasons behind Boeing’s struggles, examining how a confluence of poor decision-making and systemic issues led to one of the most significant downturns in the history of aviation.

Leadership Failures: The Impact of Management Decisions on Boeing’s Decline

The downfall of Boeing, once a titan of the aerospace industry, can be attributed to a series of leadership failures that have significantly impacted the company’s trajectory. At the heart of these missteps lies a pattern of management decisions that prioritized short-term gains over long-term stability and safety. This approach not only eroded trust among stakeholders but also compromised the company’s reputation, leading to a decline that has been difficult to arrest.

To begin with, the leadership at Boeing made a critical error in its handling of the 737 Max crisis. The decision to rush the development and certification of the 737 Max aircraft, in an effort to compete with Airbus’s A320neo, exemplifies a short-sighted strategy that prioritized market competition over safety. This haste resulted in the implementation of the Maneuvering Characteristics Augmentation System (MCAS) without adequate pilot training or comprehensive safety assessments. Consequently, the tragic crashes of Lion Air Flight 610 and Ethiopian Airlines Flight 302 exposed the severe repercussions of these management decisions, leading to a global grounding of the 737 Max fleet and a loss of confidence in Boeing’s commitment to safety.

Moreover, the leadership’s focus on cost-cutting measures further exacerbated the company’s decline. In an attempt to maximize profits, Boeing’s management implemented aggressive cost-reduction strategies that compromised quality control and engineering excellence. This was evident in the outsourcing of critical components and the reduction of experienced engineering staff, which led to production delays and quality issues across various aircraft models. The emphasis on financial performance over technical integrity not only affected product reliability but also strained relationships with suppliers and customers, further tarnishing Boeing’s reputation.

In addition to these operational missteps, Boeing’s leadership struggled with transparency and accountability. The company’s initial response to the 737 Max crisis was marked by a lack of openness and a reluctance to acknowledge the severity of the issues at hand. This approach not only delayed corrective actions but also fueled public and regulatory skepticism. The leadership’s failure to communicate effectively and take responsibility for its actions eroded trust among regulators, airlines, and the flying public, making it challenging for Boeing to regain its standing in the industry.

Furthermore, the leadership’s inability to adapt to changing market dynamics played a role in Boeing’s decline. As the aerospace industry evolved, with increasing emphasis on sustainability and innovation, Boeing’s management was slow to pivot its strategy. The company’s delayed entry into the market for more fuel-efficient and environmentally friendly aircraft allowed competitors to gain a foothold, further diminishing Boeing’s market share. This lack of strategic foresight underscored a broader issue within the leadership ranks: an inability to anticipate and respond to industry trends effectively.

In conclusion, the downfall of Boeing can be traced back to a series of leadership failures that have had far-reaching consequences. The prioritization of short-term financial gains over safety, quality, and innovation, coupled with a lack of transparency and accountability, has significantly impacted the company’s reputation and market position. As Boeing seeks to recover from these setbacks, it is imperative for its leadership to learn from past mistakes and adopt a more balanced approach that values long-term stability and stakeholder trust. Only then can Boeing hope to reclaim its status as a leader in the aerospace industry.

Safety Compromises: How Boeing’s Prioritization of Profits Over Safety Led to Disaster

The downfall of Boeing, once a paragon of aviation excellence, serves as a cautionary tale of how prioritizing profits over safety can lead to catastrophic consequences. The company’s recent history is marred by a series of missteps that have not only tarnished its reputation but also raised serious concerns about its commitment to passenger safety. At the heart of this crisis is the Boeing 737 MAX, an aircraft that was involved in two tragic crashes within five months, claiming the lives of 346 people. These incidents have been attributed to a flawed design process, where safety was compromised in favor of cost-cutting measures and expedited production timelines.

To understand how Boeing arrived at this juncture, it is essential to examine the competitive pressures that influenced its decision-making. In the early 2010s, Boeing faced intense competition from Airbus, its European rival, which had launched the A320neo, a fuel-efficient aircraft that quickly gained market traction. In response, Boeing sought to develop a comparable model, leading to the creation of the 737 MAX. However, rather than designing a new aircraft from scratch, Boeing opted to modify the existing 737 design. This decision was driven by the desire to minimize costs and reduce the time required for regulatory approval.

As Boeing rushed to bring the 737 MAX to market, it made several critical compromises. One of the most significant was the implementation of the Maneuvering Characteristics Augmentation System (MCAS), a software designed to prevent stalls by automatically adjusting the aircraft’s nose downward. While the system was intended to enhance safety, it was not adequately disclosed to pilots, nor was it accompanied by sufficient training. This lack of transparency and preparation proved disastrous when the system malfunctioned, leading to the crashes of Lion Air Flight 610 and Ethiopian Airlines Flight 302.

The fallout from these tragedies exposed systemic issues within Boeing’s corporate culture. Internal communications revealed that some employees were aware of the potential risks associated with the MCAS but felt pressured to remain silent due to the company’s aggressive production targets. This culture of silence and the prioritization of financial performance over safety considerations were further exacerbated by Boeing’s close relationship with the Federal Aviation Administration (FAA). The regulatory body, tasked with ensuring aviation safety, delegated significant portions of the certification process to Boeing itself, creating a conflict of interest that undermined the integrity of safety assessments.

In the wake of these revelations, Boeing has faced intense scrutiny from regulators, lawmakers, and the public. The company has been forced to ground the 737 MAX, overhaul its leadership, and implement comprehensive changes to its safety protocols. However, rebuilding trust with airlines, passengers, and regulators will be a long and arduous process. Boeing’s experience serves as a stark reminder of the perils of allowing financial imperatives to overshadow safety considerations. It underscores the need for robust regulatory oversight and a corporate culture that prioritizes transparency and accountability.

Ultimately, the downfall of Boeing highlights the critical importance of maintaining a steadfast commitment to safety in the aviation industry. As the company strives to recover from this crisis, it must learn from its past mistakes and ensure that safety remains at the forefront of its operations. Only then can Boeing hope to restore its reputation and regain its position as a leader in the global aerospace market.

The 737 MAX Crisis: A Case Study in Engineering and Ethical Oversight

The downfall of Boeing, particularly highlighted by the 737 MAX crisis, serves as a poignant case study in both engineering and ethical oversight. This crisis, which unfolded over several years, underscores the complex interplay between technological innovation, corporate governance, and regulatory compliance. To understand the full scope of this debacle, it is essential to examine the series of missteps that led to one of the most significant challenges in Boeing’s history.

Initially, the 737 MAX was introduced as a response to growing competition from Airbus, which had launched its A320neo with advanced fuel efficiency. In an effort to maintain its market dominance, Boeing sought to develop an aircraft that could match or exceed these capabilities. However, rather than designing a new plane from scratch, Boeing opted to modify its existing 737 model. This decision, while cost-effective, introduced a host of engineering challenges. The most notable of these was the need to accommodate larger engines, which altered the aircraft’s aerodynamics and necessitated the development of the Maneuvering Characteristics Augmentation System (MCAS).

The MCAS was designed to automatically adjust the plane’s angle of attack to prevent stalling. However, the system’s reliance on a single sensor made it vulnerable to failure. This vulnerability was tragically realized in two fatal crashes: Lion Air Flight 610 in October 2018 and Ethiopian Airlines Flight 302 in March 2019. These incidents, which claimed the lives of 346 people, were directly linked to the malfunctioning of the MCAS. As investigations unfolded, it became apparent that Boeing had not only failed to adequately test the system but had also downplayed its significance in pilot training materials.

Moreover, the crisis was exacerbated by a series of ethical oversights. Internal communications revealed that some Boeing employees had expressed concerns about the safety of the 737 MAX, yet these warnings were largely ignored or dismissed by management. This culture of complacency was further compounded by Boeing’s close relationship with the Federal Aviation Administration (FAA), which led to a lack of rigorous oversight. The FAA’s delegation of certain certification processes to Boeing itself created a conflict of interest, ultimately compromising the integrity of the safety assessments.

In the aftermath of the crashes, Boeing faced intense scrutiny from regulators, lawmakers, and the public. The grounding of the 737 MAX fleet worldwide resulted in significant financial losses and a tarnished reputation. Boeing’s response, which included a public apology and a commitment to improving safety protocols, was seen by many as too little, too late. The company also faced legal challenges, including lawsuits from victims’ families and penalties from regulatory bodies.

The 737 MAX crisis serves as a stark reminder of the consequences of prioritizing profit over safety. It highlights the importance of transparency, accountability, and ethical responsibility in engineering and corporate governance. As Boeing works to rebuild trust and restore its standing in the aviation industry, it must learn from these missteps and implement robust measures to prevent similar incidents in the future. This case study not only provides valuable lessons for Boeing but also for the broader aerospace sector, emphasizing the need for a balanced approach that values both innovation and safety.

Regulatory Challenges: Boeing’s Relationship with the FAA and Its Consequences

The downfall of Boeing, once a titan of the aerospace industry, can be attributed to a series of missteps, particularly in its regulatory challenges and its relationship with the Federal Aviation Administration (FAA). This relationship, which was once seen as a model of cooperation between industry and regulator, has become emblematic of the broader issues that have plagued Boeing in recent years. To understand the consequences of this relationship, it is essential to examine the regulatory challenges that have arisen and how they have impacted Boeing’s operations and reputation.

Initially, Boeing’s close ties with the FAA were perceived as beneficial, allowing for efficient communication and streamlined processes. However, this relationship gradually evolved into one where oversight was compromised. The FAA’s delegation of certain certification responsibilities to Boeing, intended to expedite the approval process, inadvertently led to a lack of rigorous scrutiny. This delegation was a double-edged sword; while it allowed Boeing to bring products to market more swiftly, it also meant that critical safety assessments were sometimes conducted with insufficient independence.

The consequences of this regulatory approach became starkly apparent with the introduction of the Boeing 737 MAX. The aircraft, which was intended to be a cornerstone of Boeing’s commercial fleet, was grounded worldwide following two tragic crashes. Investigations revealed that the FAA had relied heavily on Boeing’s own assessments during the certification process, particularly concerning the Maneuvering Characteristics Augmentation System (MCAS). This reliance highlighted a significant flaw in the regulatory framework: the potential for conflicts of interest when manufacturers are too involved in their own oversight.

In the aftermath of the 737 MAX incidents, the FAA faced intense scrutiny for its role in the certification process. Critics argued that the agency had become too reliant on Boeing, compromising its ability to act as an independent regulator. This criticism was not unfounded, as internal communications from Boeing suggested that some employees were aware of issues with the MCAS system but felt pressured to downplay them to meet regulatory and commercial deadlines. Consequently, the FAA’s credibility was called into question, prompting a reevaluation of its certification processes and its relationship with manufacturers.

The regulatory challenges faced by Boeing have had far-reaching consequences. Financially, the grounding of the 737 MAX resulted in billions of dollars in losses, not only from halted sales but also from compensation claims by airlines and victims’ families. Moreover, Boeing’s reputation suffered a severe blow, with trust in the company’s commitment to safety eroded among consumers and industry stakeholders alike. This erosion of trust has had a lasting impact, influencing airline purchasing decisions and prompting a shift in the competitive landscape of the aerospace industry.

In response to these challenges, both Boeing and the FAA have taken steps to address the shortcomings in their relationship. Boeing has committed to enhancing its internal safety culture and improving transparency with regulators. Meanwhile, the FAA has implemented reforms to strengthen its oversight capabilities and reduce its reliance on manufacturers for safety assessments. These measures, while necessary, underscore the importance of maintaining a balance between industry collaboration and regulatory independence.

In conclusion, the regulatory challenges faced by Boeing, particularly in its relationship with the FAA, have been a significant factor in the company’s recent struggles. The consequences of these challenges have been profound, affecting not only Boeing’s financial standing but also its reputation and the broader aerospace industry. As both Boeing and the FAA work to rebuild trust and improve safety standards, the lessons learned from this experience will undoubtedly shape the future of aviation regulation.

Corporate Culture: The Role of Internal Dynamics in Boeing’s Downfall

The downfall of Boeing, once a paragon of aerospace innovation and reliability, can be attributed to a complex interplay of factors, with corporate culture playing a pivotal role. The internal dynamics within Boeing, particularly in the years leading up to the 737 Max crisis, reveal a company grappling with conflicting priorities and a culture that increasingly prioritized financial performance over engineering excellence. This shift in focus, while not uncommon in large corporations, had profound implications for Boeing’s operational integrity and reputation.

To understand the role of corporate culture in Boeing’s decline, it is essential to examine the company’s historical context. Boeing, for decades, was synonymous with engineering prowess and safety. However, as competition intensified, particularly from Airbus, Boeing’s leadership began to emphasize cost-cutting and shareholder value. This strategic pivot was not inherently flawed, but the manner in which it was executed led to unintended consequences. The pressure to deliver financial results fostered an environment where engineering concerns were often overshadowed by business imperatives.

One of the most telling manifestations of this cultural shift was the development process of the 737 Max. Engineers and technical staff reportedly raised concerns about the aircraft’s design and the integration of the Maneuvering Characteristics Augmentation System (MCAS). However, these warnings were not given the attention they deserved. The internal dynamics at Boeing had evolved to a point where dissenting voices were either marginalized or ignored, creating a culture of silence that proved detrimental. The prioritization of meeting production deadlines and cost targets over addressing safety issues was a critical misstep that underscored the company’s cultural malaise.

Moreover, the communication breakdown within Boeing was exacerbated by a hierarchical structure that discouraged open dialogue. Employees felt disempowered to speak up, fearing repercussions or being sidelined. This lack of transparency and open communication stifled innovation and problem-solving, as critical feedback from those on the ground was not adequately considered by decision-makers. The internal dynamics thus became a barrier to addressing the very issues that would later culminate in the 737 Max tragedies.

In addition to these internal challenges, Boeing’s corporate culture was also influenced by external pressures. The relentless pursuit of market dominance and the need to satisfy Wall Street’s expectations created a high-stakes environment where short-term gains were often prioritized over long-term sustainability. This external pressure further compounded the internal dynamics, leading to a culture that was reactive rather than proactive.

In conclusion, the downfall of Boeing cannot be attributed to a single factor, but the role of corporate culture is undeniably significant. The internal dynamics within Boeing, characterized by a shift in priorities, communication breakdowns, and external pressures, created an environment where safety and engineering excellence were compromised. As Boeing seeks to rebuild its reputation and regain trust, it must address these cultural issues head-on. By fostering a culture that values transparency, encourages open dialogue, and balances financial performance with engineering integrity, Boeing can hope to navigate its way out of this crisis and restore its standing as a leader in the aerospace industry.

Market Competition: How Rivals Capitalized on Boeing’s Missteps

The downfall of Boeing, once a titan in the aerospace industry, has been a subject of intense scrutiny and analysis. As the company grappled with a series of missteps, its rivals seized the opportunity to capitalize on its vulnerabilities, reshaping the competitive landscape of the aviation market. Understanding how competitors leveraged Boeing’s challenges provides insight into the dynamics of market competition and the strategic maneuvers that can alter industry standings.

Boeing’s troubles began to surface prominently with the 737 Max crisis, which not only tarnished its reputation but also exposed significant flaws in its operational and safety protocols. The grounding of the 737 Max fleet following two tragic crashes was a pivotal moment that sent shockwaves through the industry. This crisis was exacerbated by Boeing’s initial response, which was widely criticized for its lack of transparency and accountability. As Boeing struggled to manage the fallout, its competitors, particularly Airbus, were quick to respond.

Airbus, Boeing’s primary rival, adeptly capitalized on the situation by promoting its A320neo family as a safer and more reliable alternative. The timing was fortuitous for Airbus, as airlines seeking to expand or renew their fleets were suddenly wary of Boeing’s offerings. Airbus’s strategic advantage was further bolstered by its ability to ramp up production to meet the increased demand, thereby securing a significant number of orders that might have otherwise gone to Boeing. This shift in market dynamics was not merely a result of Boeing’s missteps but also a testament to Airbus’s agility and foresight in exploiting the opportunity.

Moreover, other players in the aerospace sector, such as Embraer and Bombardier, also found avenues to strengthen their positions. These companies, while not direct competitors in the same aircraft categories, benefited from the broader industry uncertainty. Airlines, diversifying their fleets to mitigate risk, began to consider smaller aircraft for regional routes, which played to the strengths of these manufacturers. The strategic partnerships and mergers, such as Airbus’s acquisition of Bombardier’s C Series program, further illustrate how competitors leveraged Boeing’s challenges to enhance their market presence.

In addition to the immediate impact on aircraft sales, Boeing’s missteps had longer-term implications for its market position. The erosion of trust among customers and regulators necessitated a comprehensive overhaul of its safety and compliance practices. This process, while essential, diverted resources and attention away from innovation and development, areas where competitors continued to advance. As Boeing focused on rectifying past errors, rivals pushed forward with new technologies and models, thereby widening the competitive gap.

Furthermore, the financial repercussions of the 737 Max crisis, compounded by the COVID-19 pandemic, strained Boeing’s resources. The company faced significant financial losses, leading to cost-cutting measures that included workforce reductions and delays in new projects. In contrast, competitors with healthier balance sheets were better positioned to weather the storm and invest in future growth.

In conclusion, the downfall of Boeing serves as a cautionary tale of how missteps can alter the competitive dynamics of an industry. Rivals like Airbus, Embraer, and Bombardier capitalized on Boeing’s challenges by strategically positioning themselves to capture market share and enhance their offerings. This shift underscores the importance of agility, transparency, and innovation in maintaining a competitive edge in the ever-evolving aerospace market. As Boeing works to rebuild its reputation and market position, the lessons learned from this period will undoubtedly shape its future strategies and those of its competitors.

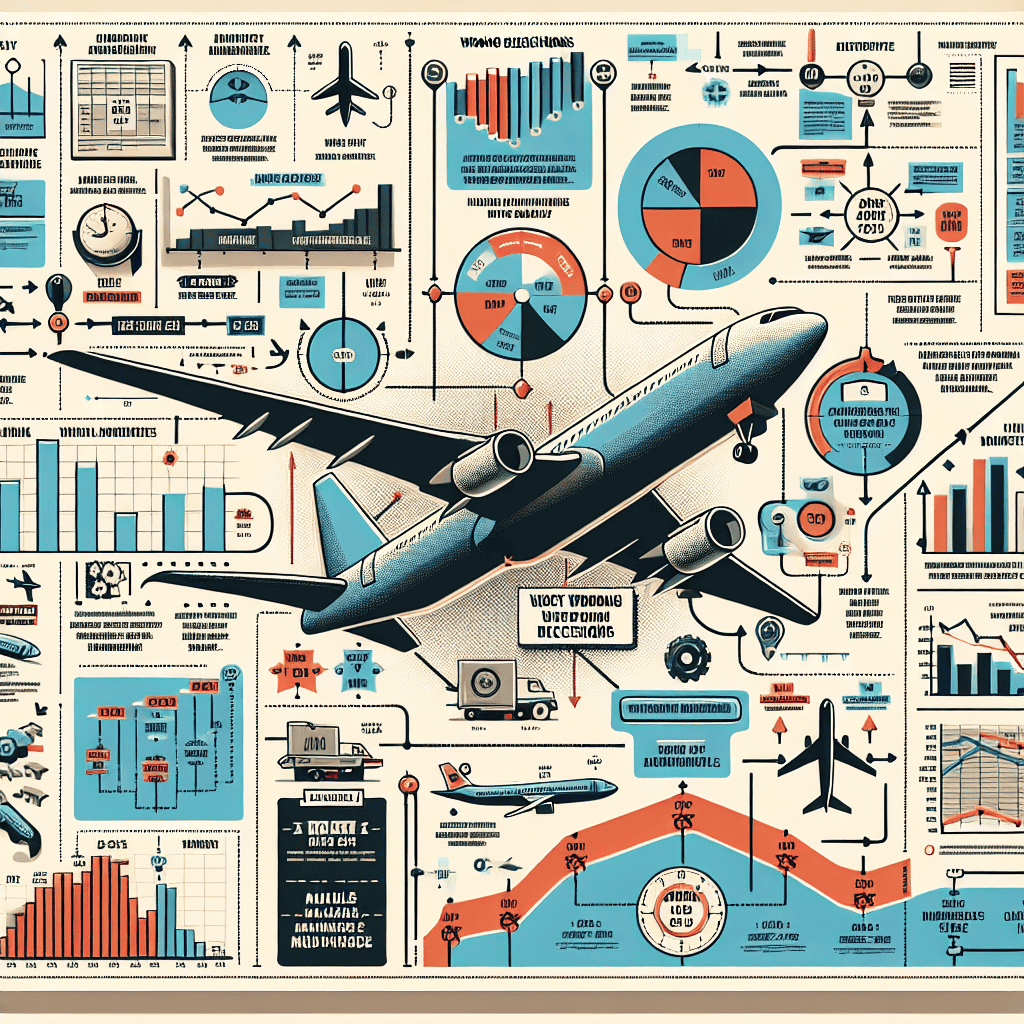

Recovery Strategies: Lessons Learned and the Path Forward for Boeing

The downfall of Boeing, once a titan of the aerospace industry, serves as a cautionary tale of how missteps in management, safety, and strategy can lead to significant challenges. As the company seeks to recover, it is crucial to analyze the lessons learned and explore the strategies that could pave the way for a successful resurgence. Understanding the root causes of Boeing’s decline is essential for crafting effective recovery strategies. The company’s troubles began with the 737 Max crisis, which exposed significant flaws in its safety protocols and decision-making processes. The grounding of the 737 Max fleet following two tragic crashes not only tarnished Boeing’s reputation but also highlighted the consequences of prioritizing speed and cost-cutting over safety and quality. This crisis underscored the importance of transparency and accountability in corporate governance, lessons that Boeing must internalize as it moves forward.

In addition to addressing safety concerns, Boeing must also focus on rebuilding trust with its stakeholders. This includes not only customers and regulators but also employees and suppliers. A comprehensive approach to stakeholder engagement is necessary to restore confidence in the company’s ability to deliver safe and reliable products. By fostering open communication and collaboration, Boeing can demonstrate its commitment to learning from past mistakes and implementing meaningful changes. Furthermore, Boeing’s recovery strategy should emphasize innovation and adaptability. The aerospace industry is rapidly evolving, with advancements in technology and shifts in market demand presenting both challenges and opportunities. To remain competitive, Boeing must invest in research and development to create cutting-edge products that meet the needs of a changing world. This includes exploring sustainable aviation solutions, such as electric and hybrid aircraft, which align with the growing emphasis on environmental responsibility.

Moreover, Boeing must reassess its organizational structure and culture to ensure that it supports long-term success. This involves fostering a culture of safety and quality, where employees are empowered to voice concerns and contribute to continuous improvement. By prioritizing employee engagement and development, Boeing can cultivate a workforce that is resilient and capable of driving innovation. In addition to internal changes, Boeing must also navigate external challenges, such as geopolitical tensions and supply chain disruptions. Developing a robust risk management strategy is essential to mitigate these risks and ensure business continuity. This includes diversifying supply chains, strengthening partnerships, and enhancing flexibility to adapt to unforeseen circumstances.

As Boeing charts its path forward, it is imperative to learn from the experiences of other companies that have faced similar challenges. By studying successful recovery strategies, Boeing can identify best practices and avoid common pitfalls. This includes understanding the importance of strategic vision, effective leadership, and a commitment to ethical business practices. In conclusion, the path to recovery for Boeing is complex and multifaceted, requiring a holistic approach that addresses both internal and external factors. By learning from past missteps and embracing a forward-thinking mindset, Boeing can rebuild its reputation and regain its position as a leader in the aerospace industry. The lessons learned from this experience will not only benefit Boeing but also serve as a valuable guide for other companies navigating the challenges of a rapidly changing world.

Q&A

1. **What were the primary factors leading to Boeing’s downfall?**

The primary factors included management prioritizing cost-cutting over engineering, the rushed development and flawed design of the 737 MAX, and inadequate response to safety concerns.

2. **How did the 737 MAX crashes impact Boeing’s reputation?**

The crashes severely damaged Boeing’s reputation, leading to a loss of public trust, increased scrutiny from regulators, and significant financial losses.

3. **What role did corporate culture play in Boeing’s missteps?**

A corporate culture that emphasized financial performance over safety and engineering integrity contributed to poor decision-making and risk management.

4. **How did regulatory oversight affect the situation?**

Lax regulatory oversight and Boeing’s influence over the FAA allowed critical safety issues to go unaddressed, exacerbating the crisis.

5. **What were the financial consequences for Boeing?**

Boeing faced billions in losses due to halted production, compensation to airlines, legal settlements, and a decline in stock value.

6. **How did Boeing attempt to recover from the crisis?**

Boeing implemented leadership changes, increased focus on safety and transparency, and worked on recertifying the 737 MAX with enhanced safety measures.

7. **What lessons can be learned from Boeing’s downfall?**

The importance of prioritizing safety and engineering integrity, maintaining robust regulatory oversight, and fostering a corporate culture that values ethical decision-making.

Conclusion

The downfall of Boeing can be attributed to a series of critical missteps that undermined its reputation and financial stability. Key factors include a relentless pursuit of profit over safety, which led to the rushed development and flawed design of the 737 MAX aircraft. The company’s failure to address safety concerns and adequately train pilots resulted in two tragic crashes, eroding public trust. Additionally, Boeing’s corporate culture, characterized by poor communication and a lack of transparency, exacerbated the crisis. The company’s inability to effectively manage regulatory relationships and its overreliance on outsourcing further compounded its challenges. Ultimately, Boeing’s downfall serves as a cautionary tale about the consequences of prioritizing short-term gains over long-term integrity and safety in the aerospace industry.