“United in Anger: Boeing Workers Stand Firm for Their Future”

Introduction

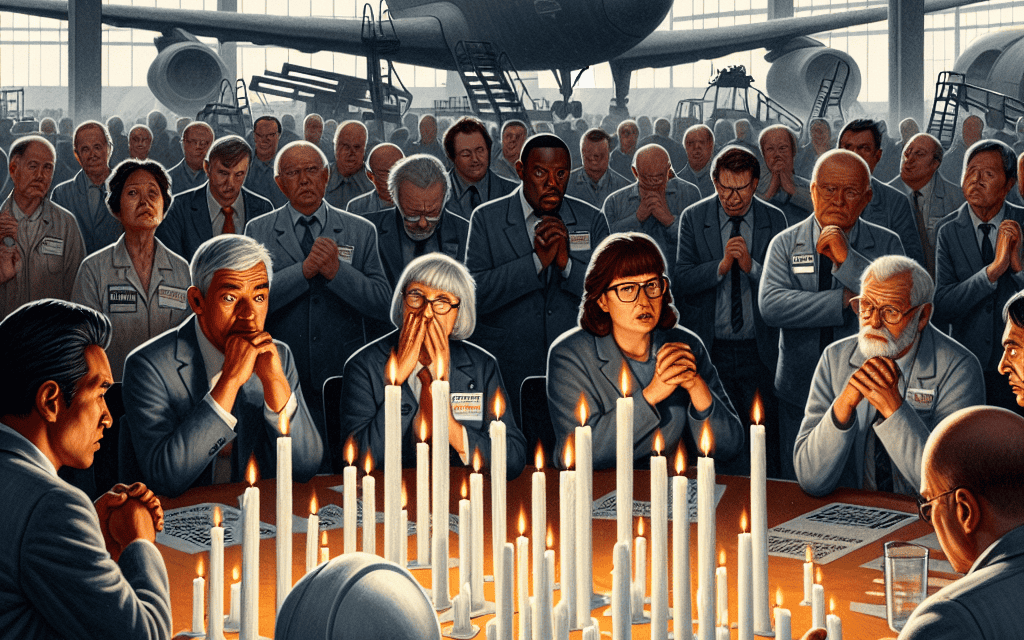

Boeing workers are expressing growing frustration and anger over the loss of their pensions, a key issue fueling the momentum behind a vote to continue their strike. The dispute has intensified as employees demand the restoration of their retirement benefits, which they argue were unfairly diminished. This unrest highlights broader tensions within the company, as workers rally for financial security and fair compensation. The ongoing strike reflects a deep-seated dissatisfaction with corporate policies perceived as prioritizing profits over employee welfare, underscoring the critical role of pensions in labor negotiations and worker morale.

Impact Of Pension Loss On Boeing Workers’ Morale

The recent decision by Boeing to alter its pension scheme has ignited a wave of discontent among its workforce, leading to a significant strike that has captured national attention. The impact of pension loss on Boeing workers’ morale cannot be overstated, as it has become a central issue fueling the continuation of the strike. For many employees, the pension plan represented not just a financial safety net for retirement but also a symbol of the company’s commitment to its workforce. The abrupt changes have left many feeling betrayed, sparking a sense of fury that has only intensified as negotiations have stalled.

To understand the depth of this discontent, it is essential to consider the role that pensions have historically played in the lives of Boeing workers. For decades, these benefits have been a cornerstone of employment at the company, offering a sense of security and stability. The promise of a reliable pension allowed workers to plan for their futures with confidence, knowing that their years of service would be rewarded with financial support in retirement. However, the recent shift away from traditional pension plans to 401(k)-style retirement savings accounts has disrupted this long-standing expectation, leaving many employees anxious about their financial futures.

The decision to alter the pension scheme comes at a time when economic uncertainties are already weighing heavily on workers’ minds. Rising living costs, coupled with concerns about the adequacy of social security, have made the prospect of a secure retirement increasingly elusive for many. In this context, the loss of a guaranteed pension is not merely a financial blow but a profound psychological one as well. It undermines the trust that employees have placed in their employer and raises questions about the company’s commitment to its workforce.

Moreover, the impact of this decision extends beyond individual financial concerns. It has also affected the overall morale within the company, as workers grapple with feelings of insecurity and disillusionment. The sense of community and shared purpose that once characterized the Boeing workforce has been eroded, replaced by a pervasive sense of uncertainty and frustration. This shift in morale has been a driving force behind the decision to continue the strike, as workers seek to make their voices heard and demand a return to the benefits they were promised.

In addition to the immediate financial implications, the loss of pensions has also raised broader questions about the future of labor relations at Boeing. The strike has highlighted the growing tension between management and employees, as well as the challenges of balancing corporate profitability with employee welfare. As negotiations continue, both sides are acutely aware of the need to find a resolution that addresses workers’ concerns while ensuring the company’s long-term viability.

In conclusion, the fury over lost pensions has had a profound impact on Boeing workers’ morale, driving the continuation of the strike and highlighting the broader challenges facing the company. As employees grapple with the loss of a key benefit, their sense of betrayal and insecurity has fueled a determination to fight for their rights. The outcome of this dispute will not only shape the future of labor relations at Boeing but also serve as a bellwether for other companies grappling with similar issues. As such, it is a situation that demands careful attention and thoughtful resolution.

Historical Context Of Boeing Workers’ Strikes

The history of labor strikes at Boeing is a testament to the enduring struggle between workers and management over fair compensation and benefits. This ongoing conflict has been marked by a series of strikes, each driven by the workers’ demand for better working conditions and equitable treatment. The recent uproar over lost pensions has reignited this historical tension, leading to a continuation vote on the strike. To understand the current situation, it is essential to delve into the historical context of Boeing workers’ strikes and the pivotal role pensions have played in these labor disputes.

Boeing, a titan in the aerospace industry, has long been a focal point for labor activism. The company’s workers, represented by unions such as the International Association of Machinists and Aerospace Workers (IAM), have historically been at the forefront of advocating for improved labor conditions. Over the decades, these workers have engaged in numerous strikes, each with its own set of demands and outcomes. However, a common thread running through these labor actions has been the issue of pensions, which have often served as a flashpoint for discontent.

In the late 20th century, Boeing workers embarked on several significant strikes, with pensions frequently at the heart of their grievances. During the 1995 strike, for instance, workers walked off the job for 69 days, demanding better pension benefits among other improvements. This strike underscored the workers’ determination to secure a stable financial future, highlighting the importance of pensions as a critical component of their overall compensation package. The resolution of this strike saw some concessions from Boeing, but the underlying tension over pensions persisted.

As the 21st century unfolded, the issue of pensions continued to be a contentious topic. The 2005 strike, which lasted 28 days, once again brought pensions to the forefront. Workers were increasingly concerned about the company’s shift towards defined contribution plans, which placed more financial risk on employees compared to traditional defined benefit plans. This change was perceived as a threat to the workers’ long-term financial security, fueling their resolve to strike until a more favorable agreement was reached.

Fast forward to the present day, and the fury over lost pensions has once again ignited the flames of labor unrest at Boeing. The company’s decision to freeze pension plans for certain workers has been met with widespread anger and frustration. This move is seen as a betrayal by many employees who have dedicated years of service to the company, only to find their retirement security jeopardized. The continuation vote on the strike reflects the workers’ deep-seated dissatisfaction and their determination to fight for what they believe is rightfully theirs.

In conclusion, the historical context of Boeing workers’ strikes reveals a persistent struggle over pensions and other benefits. The current situation is not an isolated incident but rather part of a long-standing pattern of labor disputes at the company. As Boeing workers cast their votes on whether to continue the strike, they are not only expressing their discontent with the present circumstances but also drawing on a rich history of labor activism. This ongoing battle underscores the critical importance of pensions in the broader conversation about workers’ rights and fair compensation, serving as a reminder of the enduring power of collective action in the face of corporate challenges.

Financial Implications Of Pension Cuts For Boeing Employees

The ongoing strike by Boeing workers has brought to light the significant financial implications of pension cuts, a matter that has fueled considerable unrest among the workforce. As the strike continues, the decision to vote on its continuation underscores the deep-seated frustration and anger among employees who feel betrayed by the loss of their promised financial security. The pension cuts, which have been a contentious issue for some time, are seen by many workers as a breach of trust, leading to a broader discussion about the financial stability and future planning of those affected.

Pensions have long been a cornerstone of financial security for employees, providing a reliable source of income during retirement. For Boeing workers, the promise of a stable pension was not just a benefit but a fundamental part of their employment package. The recent cuts have therefore not only disrupted their financial planning but have also raised concerns about the company’s commitment to its workforce. This sense of betrayal is palpable among the workers, many of whom have dedicated decades of service to the company with the expectation that their loyalty would be reciprocated with financial stability in their later years.

The financial implications of these pension cuts are profound. For many employees, the reduction in expected retirement income means a significant reevaluation of their financial futures. This could involve delaying retirement, seeking additional employment, or making substantial lifestyle changes to accommodate the reduced income. The uncertainty surrounding their financial future has understandably led to heightened anxiety and stress among the workforce, further exacerbating the tensions between the employees and the company.

Moreover, the pension cuts have broader implications beyond the immediate financial impact on individual workers. They also raise questions about the company’s long-term strategy and its ability to attract and retain talent. In an industry where skilled labor is crucial, the perception of instability or unreliability in employee benefits can deter potential recruits and encourage current employees to seek opportunities elsewhere. This could have a ripple effect on the company’s operations and its competitive standing in the market.

The decision to vote on the continuation of the strike reflects the workers’ determination to fight for their rights and secure a more stable financial future. It is a testament to their collective resolve and their unwillingness to accept what they perceive as an unjust decision. The outcome of this vote will not only determine the immediate course of action but will also signal to the company the depth of the workers’ dissatisfaction and their readiness to stand firm in their demands.

In conclusion, the financial implications of pension cuts for Boeing employees are significant and multifaceted. They affect not only the immediate financial well-being of the workers but also their long-term planning and the company’s ability to maintain a stable and motivated workforce. As the strike continues and the vote looms, it is clear that the resolution of this issue will require careful negotiation and a willingness on both sides to address the underlying concerns. The outcome will likely have lasting implications for the company and its employees, shaping the future of labor relations within Boeing and potentially setting a precedent for the industry as a whole.

Union Strategies In Response To Pension Disputes At Boeing

The ongoing dispute between Boeing and its workers has reached a critical juncture, as the fury over lost pensions continues to fuel the determination of union members to extend their strike. This situation underscores the broader challenges faced by labor unions in negotiating fair compensation and benefits in an era where corporate cost-cutting measures often target employee pensions. The Boeing workers’ strike, which has garnered significant attention, highlights the growing discontent among employees who feel that their financial security in retirement is being undermined. As the strike vote looms, union leaders are strategizing to address these pension disputes effectively, ensuring that their members’ voices are heard and their demands are met.

The crux of the issue lies in Boeing’s decision to freeze pension plans, a move that has been met with widespread disapproval among its workforce. This decision is part of a broader trend in the corporate world, where companies are increasingly shifting from defined-benefit pension plans to defined-contribution plans, such as 401(k)s. While this shift may reduce financial liabilities for companies, it places a greater burden on employees, who must now bear the risks associated with market fluctuations and investment decisions. Consequently, Boeing workers are not only concerned about their immediate financial well-being but also about their long-term security, which has been a significant factor in their decision to continue striking.

In response to these pension disputes, union leaders are employing a range of strategies to advocate for their members. One key approach is to engage in direct negotiations with Boeing management, seeking to reach a compromise that addresses the workers’ concerns while also considering the company’s financial constraints. These negotiations are often complex and require a delicate balance between assertiveness and diplomacy. Union representatives must present a united front, articulating the collective grievances of their members and emphasizing the importance of fair pension provisions as a fundamental component of employee compensation.

Moreover, unions are leveraging public support to bolster their position in these negotiations. By raising awareness about the impact of pension freezes on workers’ lives, unions aim to garner sympathy from the public and pressure Boeing to reconsider its stance. This strategy involves organizing rallies, engaging with media outlets, and utilizing social media platforms to amplify their message. Public opinion can be a powerful tool in labor disputes, as companies are often sensitive to their reputation and the potential backlash from consumers.

Additionally, unions are exploring legal avenues to challenge pension freezes, arguing that such actions may violate existing labor agreements or employment laws. By pursuing legal action, unions seek to hold companies accountable and ensure that workers’ rights are protected. This approach, however, can be time-consuming and costly, requiring careful consideration of the potential outcomes and implications.

As the strike vote approaches, the determination of Boeing workers to continue their fight for fair pensions remains steadfast. The outcome of this vote will not only impact the immediate future of Boeing employees but also set a precedent for other labor disputes across the industry. Union leaders are acutely aware of the significance of this moment and are committed to employing all available strategies to secure a favorable resolution for their members. Ultimately, the resolution of these pension disputes will require a collaborative effort, with both Boeing and its workers working towards a solution that ensures financial security and stability for all parties involved.

The Role Of Pensions In Employee Retention At Boeing

The role of pensions in employee retention at Boeing has become a focal point of discussion, particularly in light of the recent strike continuation vote fueled by workers’ dissatisfaction over lost pensions. Pensions have long been a cornerstone of employee benefits, serving as a critical tool for companies to attract and retain skilled workers. At Boeing, a company renowned for its engineering prowess and innovation, the significance of pensions cannot be overstated. They represent not only a financial safety net for employees but also a symbol of the company’s commitment to its workforce.

In recent years, however, changes in pension plans have sparked considerable unrest among Boeing employees. The shift from traditional defined-benefit plans to defined-contribution plans has left many workers feeling uncertain about their financial futures. This transition reflects a broader trend in the corporate world, where companies are increasingly moving away from guaranteed pension benefits in favor of plans that place more risk on employees. For Boeing workers, this change has been particularly jarring, given the historical stability and reliability of their pension plans.

The dissatisfaction over pension changes has been a significant factor in the decision by Boeing workers to vote for the continuation of their strike. This move underscores the deep-seated frustration and sense of betrayal felt by many employees. They argue that the loss of guaranteed pension benefits undermines their long-term financial security and diminishes the overall attractiveness of working for Boeing. Moreover, the issue of pensions is not merely a financial concern; it is also a matter of trust and loyalty between the company and its employees.

As the strike continues, it is essential to consider the broader implications of pension changes on employee retention at Boeing. Pensions have traditionally been a powerful incentive for employees to remain with a company for the long term. They provide a sense of stability and assurance that is difficult to replicate with other forms of compensation. When employees perceive that their retirement benefits are being eroded, it can lead to decreased morale and increased turnover, both of which are detrimental to a company’s productivity and success.

Furthermore, the ongoing strike highlights the need for Boeing to reassess its approach to employee benefits and retention strategies. In an industry where skilled labor is crucial, maintaining a satisfied and committed workforce is paramount. Companies that fail to address employee concerns about pensions risk losing valuable talent to competitors who offer more attractive retirement benefits. Therefore, it is in Boeing’s best interest to engage in meaningful dialogue with its employees and explore potential solutions that address their pension-related grievances.

In conclusion, the fury over lost pensions among Boeing workers serves as a stark reminder of the critical role that retirement benefits play in employee retention. As the strike continues, it is imperative for Boeing to recognize the importance of pensions in fostering a loyal and motivated workforce. By addressing the concerns of its employees and finding a balanced approach to retirement benefits, Boeing can not only resolve the current unrest but also strengthen its position as an employer of choice in the aerospace industry. Ultimately, the resolution of this issue will require a collaborative effort between the company and its workforce, with a focus on rebuilding trust and ensuring long-term financial security for all employees.

Legal Aspects Of Pension Negotiations In The Aerospace Industry

In recent years, the aerospace industry has witnessed significant labor unrest, with pension negotiations emerging as a central issue. The ongoing strike by Boeing workers, fueled by anger over lost pensions, underscores the complex legal landscape surrounding pension negotiations in this sector. As employees continue to vote on whether to extend their strike, it is crucial to understand the legal aspects that govern these negotiations and the implications for both workers and employers.

Pensions have long been a cornerstone of employee compensation, providing financial security for workers in their retirement years. However, the shift from defined benefit plans to defined contribution plans has sparked considerable debate and dissatisfaction among employees. Defined benefit plans, which promise a specific payout upon retirement, have become increasingly rare as companies seek to reduce long-term financial liabilities. In contrast, defined contribution plans, such as 401(k)s, place the investment risk on employees, leading to uncertainty about future retirement income.

The legal framework governing pension negotiations is complex, involving federal laws such as the Employee Retirement Income Security Act (ERISA) and the National Labor Relations Act (NLRA). ERISA sets minimum standards for pension plans in private industry, ensuring that plan funds are protected and that participants receive the benefits promised by their employers. Meanwhile, the NLRA guarantees workers the right to collectively bargain over wages, hours, and other terms and conditions of employment, including pensions.

In the case of Boeing, workers’ dissatisfaction stems from the company’s decision to freeze their defined benefit pension plans, transitioning employees to a defined contribution system. This move, while legally permissible, has been perceived by many workers as a breach of trust, exacerbating tensions between the workforce and management. The legal permissibility of such changes often hinges on the language of the collective bargaining agreement (CBA) in place. If the CBA allows for modifications to pension plans, employers may have the legal right to implement such changes, albeit with potential repercussions in labor relations.

The ongoing strike at Boeing highlights the critical role of collective bargaining in addressing pension disputes. Workers, through their unions, have the opportunity to negotiate terms that can mitigate the impact of pension changes. However, these negotiations are often fraught with challenges, as employers balance financial constraints with the need to maintain a satisfied and motivated workforce. The legal obligation to bargain in good faith requires both parties to engage in meaningful discussions, yet it does not compel either side to agree to specific terms.

As Boeing workers continue to vote on whether to extend their strike, the outcome will likely hinge on the perceived fairness of the company’s pension proposals. The legal landscape provides a framework for negotiations, but it is ultimately the willingness of both parties to find common ground that will determine the resolution of this dispute. The situation at Boeing serves as a poignant reminder of the broader challenges facing the aerospace industry, where the need to remain competitive in a global market must be balanced with the imperative to honor commitments to employees.

In conclusion, the legal aspects of pension negotiations in the aerospace industry are multifaceted, involving a delicate interplay between federal regulations, collective bargaining agreements, and the evolving economic landscape. As Boeing workers grapple with the implications of lost pensions, their actions underscore the importance of understanding and navigating these legal complexities to achieve equitable outcomes for all stakeholders involved.

Comparative Analysis Of Pension Policies In Major Corporations

The recent decision by Boeing workers to continue their strike over lost pensions has brought to light the broader issue of pension policies across major corporations. This situation at Boeing is not an isolated incident but rather a reflection of a growing trend in corporate America where traditional pension plans are being replaced or significantly altered. As companies seek to cut costs and increase profitability, employees often find themselves bearing the brunt of these financial strategies. The Boeing strike serves as a poignant example of the tensions that can arise when workers feel their financial security is being compromised.

In the past, defined benefit pension plans were a standard offering among large corporations, providing employees with a guaranteed income upon retirement. However, over the last few decades, there has been a marked shift towards defined contribution plans, such as 401(k)s, which place the investment risk on employees rather than employers. This transition has been driven by several factors, including the volatility of financial markets, increased life expectancy, and the desire of companies to reduce long-term liabilities. While these changes may benefit corporate balance sheets, they often leave employees feeling uncertain about their financial futures.

Boeing’s situation is emblematic of this broader trend. The company’s decision to alter its pension plan has sparked outrage among its workforce, who argue that they have been denied the retirement security they were promised. This sentiment is not unique to Boeing employees; workers across various industries have expressed similar concerns as they witness the erosion of traditional pension benefits. The frustration among Boeing workers is further compounded by the perception that the company is prioritizing shareholder returns over employee welfare, a common criticism leveled at many large corporations today.

Comparatively, other major corporations have adopted different approaches to managing pension obligations. For instance, some companies have opted to maintain traditional pension plans but have closed them to new employees, offering alternative retirement savings options instead. This strategy allows companies to honor commitments to existing employees while gradually shifting towards more sustainable financial models. In contrast, other corporations have chosen to buy out pension plans altogether, transferring the responsibility to insurance companies. This approach can provide immediate financial relief to companies but may not always be in the best interest of employees, who might face reduced benefits or increased uncertainty.

The ongoing strike at Boeing highlights the need for a balanced approach to pension management that considers both corporate sustainability and employee welfare. As the workforce becomes increasingly aware of the implications of pension policy changes, companies must navigate these challenges with transparency and fairness. Open communication and negotiation with employees can help mitigate tensions and foster a more cooperative relationship between management and labor.

In conclusion, the Boeing workers’ strike over lost pensions underscores a significant issue facing many major corporations today. As companies continue to reevaluate their pension policies, it is crucial to strike a balance that ensures financial stability for both the organization and its employees. By examining the various strategies employed by different corporations, it becomes evident that there is no one-size-fits-all solution. However, prioritizing transparency, fairness, and open dialogue can help bridge the gap between corporate objectives and employee expectations, ultimately leading to more sustainable and equitable pension policies.

Q&A

1. **What is the main reason for the Boeing workers’ strike?**

The main reason for the Boeing workers’ strike is their anger over the loss of pensions.

2. **How has the loss of pensions affected Boeing workers?**

The loss of pensions has significantly impacted Boeing workers’ financial security and retirement plans, leading to widespread dissatisfaction.

3. **What action are Boeing workers taking in response to their lost pensions?**

Boeing workers are voting to continue their strike as a response to the loss of pensions.

4. **What is the workers’ primary demand in the strike?**

The workers’ primary demand is the restoration or improvement of their pension benefits.

5. **How has Boeing management responded to the strike?**

Boeing management has likely engaged in negotiations, but specific responses can vary, including offering alternative benefits or refusing to reinstate pensions.

6. **What role do unions play in the Boeing workers’ strike?**

Unions play a crucial role in organizing the strike, representing the workers’ interests, and negotiating with Boeing management.

7. **What are the potential consequences of the strike for Boeing?**

Potential consequences for Boeing include production delays, financial losses, and reputational damage, as well as pressure to address workers’ demands.

Conclusion

The continuation of the strike by Boeing workers, driven by their anger over lost pensions, underscores the deep-seated frustration and dissatisfaction among the workforce. This situation highlights the critical importance of secure retirement benefits in labor negotiations and the potential for prolonged industrial action when such benefits are perceived to be under threat. The workers’ determination to vote for the continuation of the strike reflects their commitment to safeguarding their financial futures and sends a strong message to the company about the value they place on their pensions. This ongoing conflict serves as a reminder of the broader tensions between labor and management in industries where pension security is a key concern.