“US Banks on Edge: Silver Surge Sparks Short Seller Turmoil”

Introduction

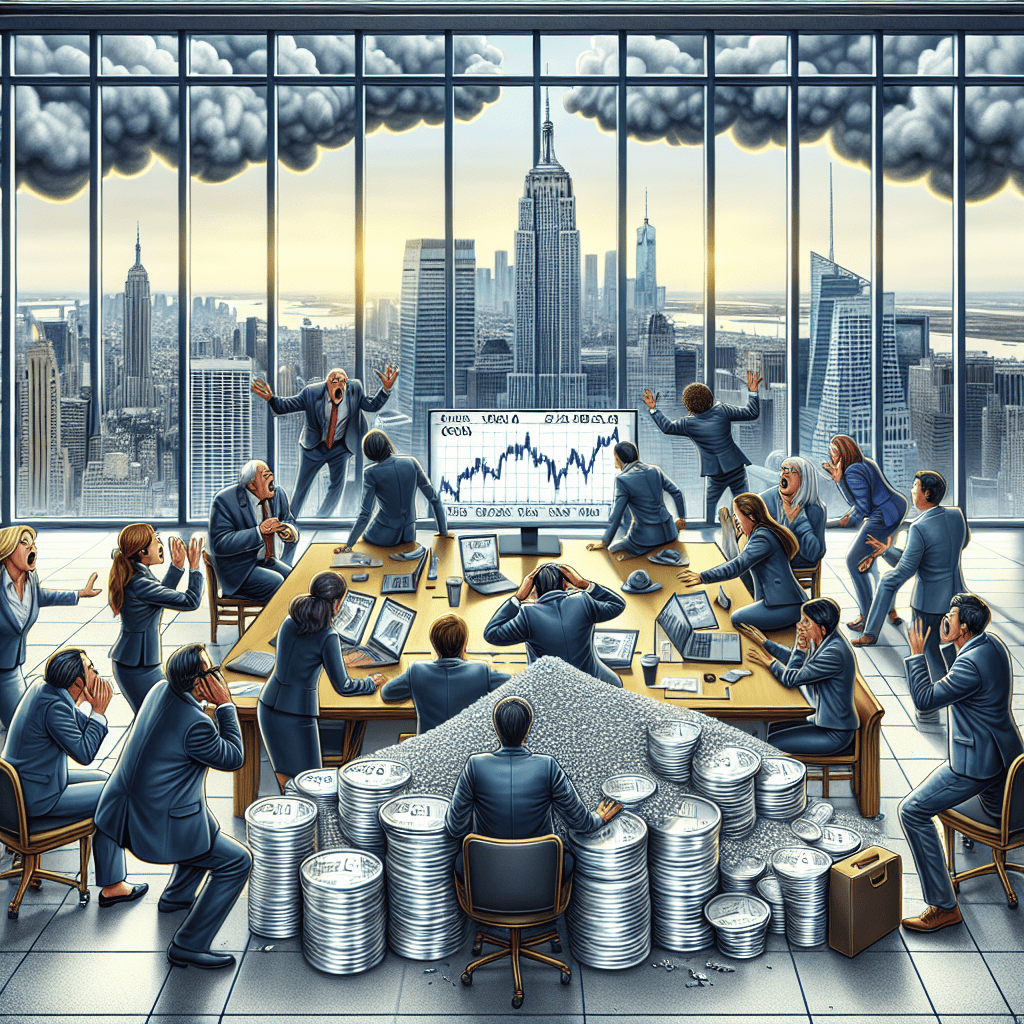

U.S. banks are reportedly preparing for significant financial losses as a surge in silver prices creates a challenging environment for short sellers. The unexpected rise in silver’s value has caught many financial institutions off guard, particularly those with substantial short positions in the precious metal. This development has prompted banks to reassess their risk management strategies and brace for potential repercussions in the financial markets. The situation underscores the volatility and unpredictability inherent in commodity markets, as well as the broader implications for financial institutions engaged in speculative trading activities. As the silver market continues to fluctuate, banks are closely monitoring the situation to mitigate potential losses and stabilize their financial standing.

Impact Of Silver Price Surge On US Banks’ Financial Stability

The recent surge in silver prices has sent ripples through the financial sector, particularly impacting US banks with significant exposure to short positions in the precious metal. As silver prices climb, these financial institutions are bracing for substantial losses, raising concerns about their overall financial stability. This development underscores the intricate relationship between commodity markets and the banking sector, highlighting the potential vulnerabilities that can arise from unexpected market shifts.

The surge in silver prices can be attributed to a confluence of factors, including increased industrial demand, geopolitical tensions, and a growing interest in precious metals as a hedge against inflation. As investors flock to silver, its price has experienced a notable upswing, catching many short sellers off guard. Short selling, a strategy where investors bet on the decline of an asset’s price, can lead to significant losses when the market moves contrary to expectations. In this case, the unexpected rise in silver prices has placed short sellers, including several US banks, in a precarious position.

US banks, which often engage in short selling as part of their trading strategies, now face the challenge of managing these positions amid rising silver prices. The potential losses from these short positions could have far-reaching implications for their financial health. As banks grapple with these challenges, they must also consider the broader impact on their balance sheets and capital reserves. The need to cover these losses may lead to a reallocation of resources, potentially affecting other areas of their operations.

Moreover, the situation is further complicated by the interconnectedness of global financial markets. As US banks navigate the repercussions of the silver price surge, they must also contend with potential ripple effects across international markets. This interconnectedness means that the financial stability of US banks is not only a domestic concern but also a global one. The potential for contagion, where financial distress spreads from one institution to others, underscores the importance of robust risk management practices.

In response to these challenges, US banks are likely to reassess their risk management strategies, particularly concerning their exposure to volatile commodity markets. This reassessment may involve a more cautious approach to short selling and a greater emphasis on diversification to mitigate potential losses. Additionally, regulatory bodies may increase scrutiny of banks’ trading activities, ensuring that they maintain adequate capital buffers to withstand market fluctuations.

While the immediate focus is on managing the impact of the silver price surge, this situation also serves as a reminder of the broader risks associated with financial markets. The volatility inherent in commodity markets can have significant implications for financial institutions, particularly those with substantial exposure to these assets. As such, banks must remain vigilant and proactive in their risk management efforts, ensuring that they are well-prepared to navigate future market disruptions.

In conclusion, the recent surge in silver prices has highlighted the potential vulnerabilities within the US banking sector, particularly concerning short selling strategies. As banks brace for potential losses, they must also consider the broader implications for their financial stability and the interconnectedness of global markets. By reassessing their risk management practices and maintaining robust capital reserves, US banks can better position themselves to weather the challenges posed by volatile commodity markets. This situation underscores the importance of vigilance and adaptability in an ever-evolving financial landscape.

Strategies For US Banks To Mitigate Losses From Silver Market Volatility

As the silver market experiences unprecedented volatility, US banks are strategizing to mitigate potential losses, particularly those stemming from short-selling activities. The recent surge in silver prices has caught many financial institutions off guard, prompting a reevaluation of risk management strategies. This unexpected price movement has been largely driven by a combination of increased industrial demand, inflationary pressures, and speculative trading, which have collectively contributed to a challenging environment for banks with significant short positions in silver.

To navigate this volatile landscape, banks are employing a variety of strategies aimed at minimizing their exposure to potential losses. One of the primary approaches involves diversifying their investment portfolios. By spreading investments across a broader range of assets, banks can reduce their reliance on any single commodity, thereby mitigating the impact of adverse price movements in the silver market. This diversification strategy not only helps in managing risk but also provides opportunities for banks to capitalize on gains in other sectors.

In addition to diversification, banks are increasingly turning to hedging techniques to protect themselves against unfavorable price fluctuations. Hedging allows banks to offset potential losses in their short positions by taking opposite positions in related markets. For instance, banks might use futures contracts or options to lock in prices and limit their downside risk. This approach provides a safety net, ensuring that even if silver prices continue to rise, the financial impact on the banks’ overall portfolios remains contained.

Moreover, banks are enhancing their risk assessment frameworks to better anticipate and respond to market changes. By leveraging advanced analytics and real-time data, financial institutions can gain deeper insights into market trends and potential triggers for volatility. This proactive approach enables banks to adjust their strategies swiftly, ensuring they remain agile in the face of rapidly changing market conditions. Enhanced risk assessment also involves stress testing, where banks simulate various scenarios to evaluate their resilience against extreme market events.

Furthermore, collaboration with regulatory bodies and adherence to compliance standards play a crucial role in mitigating risks associated with silver market volatility. By maintaining open lines of communication with regulators, banks can ensure they are operating within the legal framework and are prepared for any regulatory changes that may arise. Compliance with established guidelines not only safeguards banks from legal repercussions but also enhances their reputation and credibility in the financial markets.

In parallel, banks are focusing on strengthening their capital reserves to cushion against potential losses. By maintaining robust capital buffers, financial institutions can absorb shocks from adverse market movements without compromising their operational stability. This strategy is particularly important in the current environment, where uncertainty and volatility are prevalent.

Lastly, banks are investing in technology and innovation to improve their trading and risk management capabilities. Advanced trading platforms and algorithms enable banks to execute trades more efficiently and with greater precision, reducing the likelihood of significant losses. Additionally, technology-driven solutions facilitate better monitoring and management of market positions, allowing banks to respond promptly to emerging risks.

In conclusion, as US banks brace for potential losses amid the silver price surge, a multifaceted approach is essential to navigate the complexities of the current market environment. Through diversification, hedging, enhanced risk assessment, regulatory compliance, capital strengthening, and technological advancements, banks can effectively mitigate the risks associated with silver market volatility. These strategies not only safeguard financial institutions against immediate threats but also position them for long-term resilience and success in an ever-evolving financial landscape.

The Role Of Short Sellers In The Silver Price Surge And Its Effect On Banks

The recent surge in silver prices has sent ripples through the financial markets, particularly affecting short sellers and the banks that support them. Short selling, a strategy where investors borrow and sell assets they believe will decrease in value, has long been a contentious practice. In the case of silver, short sellers have been betting against the metal, anticipating a decline in its price. However, the unexpected surge in silver prices has caught many off guard, leading to significant financial repercussions.

Short sellers play a crucial role in the financial ecosystem by providing liquidity and contributing to price discovery. They often identify overvalued assets, betting on their decline to profit from the difference. However, when the market moves against them, as it has with silver, the consequences can be severe. The recent rally in silver prices has been driven by a combination of factors, including increased demand for physical silver, geopolitical tensions, and a weakening US dollar. These elements have created a perfect storm, pushing prices higher and squeezing short sellers who are now scrambling to cover their positions.

The impact of this silver price surge extends beyond individual investors to the banks that facilitate short selling. Banks provide the necessary infrastructure for short selling, including lending the silver that short sellers borrow. When prices rise unexpectedly, banks face increased risk as they are exposed to potential defaults by short sellers unable to cover their losses. This situation has led to heightened scrutiny of banks’ risk management practices and their ability to withstand such market volatility.

Moreover, the financial strain on banks is compounded by the broader economic environment. With interest rates remaining low and economic recovery still uncertain, banks are already navigating a challenging landscape. The added pressure from the silver market only exacerbates these difficulties, potentially leading to massive losses. As banks brace for these potential losses, they may be forced to reassess their exposure to commodities and adjust their lending practices accordingly.

In response to the silver price surge, some banks have already begun tightening their lending criteria for short sellers. This move aims to mitigate risk by ensuring that only those with sufficient collateral and financial stability can engage in short selling. However, this tightening of credit could have broader implications for the market, potentially reducing liquidity and increasing volatility as fewer participants are able to engage in short selling activities.

Furthermore, the situation has sparked a debate about the role of short selling in the market and whether additional regulations are necessary to prevent similar occurrences in the future. Proponents of short selling argue that it is a vital component of a healthy market, providing checks and balances against overvaluation. Critics, however, contend that the practice can lead to excessive speculation and market manipulation, as seen in the recent silver price surge.

In conclusion, the surge in silver prices has highlighted the intricate relationship between short sellers and banks, underscoring the potential risks involved in this financial strategy. As banks brace for potential losses, the situation serves as a reminder of the importance of robust risk management practices and the need for ongoing evaluation of market dynamics. The outcome of this scenario may well influence future regulatory discussions and shape the landscape of short selling in the years to come.

Historical Analysis: How Precious Metal Price Fluctuations Affect Banking Sector

The relationship between precious metal price fluctuations and the banking sector has long been a subject of interest for economists and financial analysts. Historically, the prices of metals like gold and silver have been influenced by a myriad of factors, including economic instability, inflation, and changes in industrial demand. These fluctuations, in turn, have had significant implications for the banking sector, particularly for institutions involved in trading and short selling these commodities. The recent surge in silver prices has once again brought this dynamic into sharp focus, as US banks brace for potential massive losses, particularly impacting those engaged in short selling activities.

To understand the current situation, it is essential to examine the historical context of precious metal trading and its impact on financial institutions. Traditionally, banks have engaged in the trading of precious metals as part of their broader investment strategies. This involvement often includes short selling, a practice where banks sell borrowed metal with the expectation that prices will fall, allowing them to buy it back at a lower price and pocket the difference. However, when prices rise unexpectedly, as is currently the case with silver, banks can face substantial losses.

The recent surge in silver prices can be attributed to several factors, including increased industrial demand, geopolitical tensions, and a growing interest in silver as a hedge against inflation. As these factors converge, they create a perfect storm that drives prices upward, catching short sellers off guard. This scenario is reminiscent of past instances where unexpected price hikes in precious metals have led to significant financial repercussions for banks. For example, during the 1980s, the Hunt brothers’ attempt to corner the silver market led to a dramatic spike in prices, resulting in substantial losses for banks that had bet against the metal.

In the current context, the impact on US banks is multifaceted. On one hand, those with significant short positions in silver are facing mounting losses as they scramble to cover their positions. This situation is exacerbated by the fact that silver, unlike some other commodities, has a relatively small market size, making it more susceptible to price volatility. On the other hand, banks that have diversified their portfolios and maintained a balanced approach to precious metal trading may find themselves in a more favorable position, able to capitalize on the rising prices.

Moreover, the implications of silver price fluctuations extend beyond immediate financial losses. They also highlight the broader risks associated with commodity trading and the need for robust risk management strategies within the banking sector. As banks navigate these turbulent waters, they must reassess their exposure to volatile markets and consider the potential long-term impacts on their financial health.

In conclusion, the recent surge in silver prices serves as a stark reminder of the intricate relationship between precious metal markets and the banking sector. As US banks brace for potential losses, the situation underscores the importance of historical analysis in understanding and mitigating the risks associated with commodity trading. By learning from past experiences and adapting to current market conditions, banks can better position themselves to weather the challenges posed by fluctuating precious metal prices. This ongoing interplay between market forces and financial institutions continues to shape the landscape of global finance, offering valuable lessons for the future.

Regulatory Implications For US Banks Amid Silver Price Surge

The recent surge in silver prices has sent ripples through the financial markets, particularly affecting US banks with significant exposure to short positions in the precious metal. As silver prices climb, these institutions face the daunting prospect of substantial losses, prompting regulatory bodies to scrutinize the potential systemic risks involved. This situation underscores the intricate relationship between commodity markets and financial institutions, highlighting the need for robust regulatory frameworks to mitigate potential fallout.

The surge in silver prices can be attributed to a confluence of factors, including increased industrial demand, geopolitical tensions, and a growing interest in precious metals as a hedge against inflation. As prices rise, banks with short positions in silver find themselves in a precarious position, as they are obligated to cover these positions at higher costs. This scenario has led to heightened concerns about the financial stability of these institutions, as well as the broader implications for the financial system.

In response to these developments, regulatory bodies are closely monitoring the situation, emphasizing the importance of transparency and risk management. The Commodity Futures Trading Commission (CFTC) and other regulatory agencies are particularly focused on ensuring that banks maintain adequate capital reserves to absorb potential losses. This scrutiny is crucial, as the interconnectedness of financial markets means that significant losses in one area can quickly cascade into broader financial instability.

Moreover, the current situation highlights the need for banks to reassess their risk management strategies, particularly in relation to commodity markets. The volatility inherent in these markets necessitates a proactive approach to risk assessment and mitigation. Banks must ensure that they have robust systems in place to monitor market conditions and adjust their positions accordingly. This includes not only maintaining adequate capital reserves but also diversifying their portfolios to reduce exposure to any single asset class.

In addition to internal risk management measures, regulatory bodies are also considering broader policy implications. The potential for significant losses in the banking sector raises questions about the adequacy of existing regulatory frameworks in addressing the unique challenges posed by commodity markets. As such, there is a growing call for regulatory reforms that enhance oversight and ensure that banks are better equipped to manage the risks associated with volatile commodity prices.

Furthermore, the situation underscores the importance of international cooperation in addressing systemic risks. Given the global nature of financial markets, coordinated efforts among regulatory bodies across different jurisdictions are essential to effectively manage potential threats to financial stability. This includes sharing information and best practices, as well as developing harmonized regulatory standards that address the complexities of modern financial markets.

In conclusion, the surge in silver prices and its impact on US banks with short positions in the metal serve as a stark reminder of the intricate interplay between commodity markets and financial institutions. As regulatory bodies scrutinize the potential risks, there is a clear need for enhanced risk management strategies and regulatory reforms to safeguard financial stability. By fostering transparency, promoting robust risk management practices, and encouraging international cooperation, regulators can help ensure that the financial system remains resilient in the face of such challenges.

Silver Price Surge: A Catalyst For Change In US Banking Risk Management

The recent surge in silver prices has sent ripples through the financial markets, particularly impacting US banks that have significant exposure to short positions in the precious metal. As silver prices climb, these financial institutions are bracing for substantial losses, prompting a reevaluation of risk management strategies. This development underscores the intricate relationship between commodity markets and banking operations, highlighting the need for robust risk assessment frameworks.

Historically, silver has been a volatile commodity, with prices influenced by a myriad of factors including industrial demand, geopolitical tensions, and currency fluctuations. However, the current surge is attributed to a combination of increased investor interest and supply chain disruptions. As investors seek safe-haven assets amid economic uncertainties, silver has emerged as a preferred choice, driving up its price. Consequently, banks with short positions in silver are facing mounting pressure as they are forced to cover these positions at higher prices, leading to potential financial losses.

The impact of this price surge is not confined to the banks alone. It extends to the broader financial system, as these institutions play a pivotal role in the economy. The potential losses from silver short positions could affect their balance sheets, thereby influencing their lending capabilities and overall financial stability. In response, banks are revisiting their risk management practices, emphasizing the importance of diversification and hedging strategies to mitigate exposure to volatile commodities.

Moreover, this situation has sparked a broader conversation about the role of short selling in financial markets. While short selling is a legitimate strategy used to profit from declining asset prices, it carries inherent risks, particularly in volatile markets. The silver price surge serves as a stark reminder of these risks, prompting banks to reassess their short-selling strategies and consider alternative approaches to managing market exposure.

In addition to internal risk management adjustments, regulatory scrutiny is likely to intensify. Regulators may seek to understand the extent of banks’ exposure to commodity markets and evaluate the adequacy of their risk management frameworks. This could lead to stricter regulations and oversight, aimed at ensuring that financial institutions are better equipped to handle such market fluctuations in the future.

Furthermore, the silver price surge highlights the interconnectedness of global financial markets. As US banks grapple with the implications of rising silver prices, the effects are felt across international markets, influencing investor sentiment and market dynamics worldwide. This interconnectedness underscores the need for a coordinated approach to risk management, where banks not only focus on domestic factors but also consider global market trends and their potential impact.

In conclusion, the surge in silver prices has emerged as a catalyst for change in US banking risk management practices. As banks brace for potential losses, they are compelled to reevaluate their strategies, emphasizing the importance of diversification, hedging, and robust risk assessment frameworks. This development also raises important questions about the role of short selling and the need for regulatory oversight. Ultimately, the silver price surge serves as a reminder of the complexities of financial markets and the critical importance of effective risk management in safeguarding financial stability.

Future Outlook: US Banks’ Adaptation To Precious Metal Market Dynamics

As the financial landscape continues to evolve, US banks are increasingly finding themselves at the crossroads of market dynamics, particularly in the realm of precious metals. Recent reports have highlighted a significant surge in silver prices, a development that has sent ripples through the banking sector, especially impacting those institutions with substantial short positions in the metal. This unexpected rise in silver prices has not only caught short sellers off guard but has also prompted banks to reassess their strategies and risk management practices in the face of potential massive losses.

The surge in silver prices can be attributed to a confluence of factors, including increased industrial demand, geopolitical uncertainties, and a growing interest in precious metals as a hedge against inflation. As investors flock to silver, viewing it as a safe haven in turbulent times, the price of the metal has experienced a notable upswing. This trend has placed significant pressure on banks that had bet against silver, expecting its price to decline. Consequently, these institutions are now grappling with the financial repercussions of their short positions, which have become increasingly costly to maintain.

In response to this challenging environment, US banks are exploring various strategies to mitigate potential losses and adapt to the shifting market dynamics. One approach involves diversifying their investment portfolios to reduce reliance on short positions in volatile commodities like silver. By broadening their exposure to a wider range of assets, banks aim to cushion themselves against the adverse effects of sudden price fluctuations in any single market segment. Additionally, banks are enhancing their risk management frameworks, incorporating more sophisticated models and analytics to better anticipate and respond to market changes.

Moreover, the current situation has underscored the importance of agility and adaptability in the banking sector. Institutions are recognizing the need to stay abreast of market trends and adjust their strategies accordingly. This includes not only reacting to immediate challenges but also proactively positioning themselves to capitalize on emerging opportunities. For instance, some banks are exploring the potential of leveraging technological advancements, such as artificial intelligence and machine learning, to gain deeper insights into market behavior and enhance their decision-making processes.

Furthermore, the silver price surge has prompted a broader discussion within the financial industry about the role of precious metals in investment portfolios. As traditional asset classes face increasing volatility, precious metals are gaining renewed attention as a means of diversification and risk mitigation. This shift in perspective is encouraging banks to reevaluate their approach to precious metals, considering them not merely as speculative assets but as integral components of a balanced investment strategy.

In conclusion, the recent surge in silver prices has presented US banks with both challenges and opportunities. While the immediate focus is on managing potential losses from short positions, the situation also serves as a catalyst for broader strategic adjustments. By diversifying portfolios, enhancing risk management practices, and embracing technological innovations, banks are positioning themselves to navigate the complexities of the precious metal market more effectively. As they adapt to these dynamics, US banks are not only safeguarding their financial stability but also paving the way for a more resilient and forward-looking approach to investment in an ever-changing economic landscape.

Q&A

1. **What is causing US banks to brace for massive losses?**

The surge in silver prices is impacting short sellers, leading to potential massive losses for US banks.

2. **How are silver prices affecting short sellers?**

The increase in silver prices is causing significant financial strain on short sellers who bet against the metal, leading to potential losses.

3. **Which financial institutions are most at risk?**

US banks with significant exposure to silver short positions or those providing services to short sellers are most at risk.

4. **What is the potential impact on the banking sector?**

The banking sector could face substantial financial losses, increased volatility, and potential liquidity issues due to the silver price surge.

5. **Are there any regulatory concerns related to this situation?**

Regulatory concerns may arise regarding market stability, risk management practices, and the potential need for intervention to prevent systemic risks.

6. **What measures are banks taking to mitigate these risks?**

Banks may be increasing their collateral requirements, adjusting their risk management strategies, and closely monitoring market developments.

7. **How might this situation affect the broader economy?**

If banks incur significant losses, it could lead to tighter credit conditions, reduced lending, and potential negative impacts on economic growth.

Conclusion

The report highlights the potential financial strain on US banks due to a significant surge in silver prices, which is adversely affecting short sellers. As silver prices rise, short sellers face substantial losses, leading to increased financial exposure for banks that have extended credit or hold derivative positions linked to these short-selling activities. This situation underscores the vulnerability of financial institutions to market volatility and the importance of risk management strategies to mitigate potential losses. The banks must navigate this challenging environment carefully to maintain financial stability and protect their balance sheets from further adverse impacts.