“Unlock Steady Income: Discover the Top 7 Stocks Yielding $11,500 Monthly for Savvy Dividend Investors!”

Introduction

In the ever-evolving landscape of financial markets, dividend investing remains a steadfast strategy for those seeking a reliable income stream. “Portfolio Insights: Top 7 Stocks Yielding $11,500 Monthly for a Dividend Investor” delves into the intricacies of building a robust portfolio that prioritizes consistent dividend payouts. This guide highlights seven carefully selected stocks that collectively generate a substantial monthly income, offering investors a blend of stability and growth potential. By focusing on companies with strong financial health, sustainable dividend policies, and a track record of performance, this portfolio aims to provide both seasoned and novice investors with valuable insights into maximizing their dividend income. Whether you’re planning for retirement or seeking to supplement your income, this exploration of top dividend-yielding stocks serves as a comprehensive resource for achieving financial goals through strategic investment choices.

Understanding Dividend Investing: A Path to Monthly Income

Dividend investing has long been a favored strategy for those seeking a steady stream of income, particularly in times of economic uncertainty. By focusing on stocks that offer regular dividend payments, investors can create a reliable source of income that supplements other earnings or retirement funds. This approach not only provides financial stability but also allows for potential capital appreciation over time. In this context, understanding the nuances of dividend investing becomes crucial for maximizing returns and ensuring a sustainable income flow.

To begin with, dividend investing involves selecting stocks from companies that have a history of paying consistent and, ideally, increasing dividends. These companies are often well-established, with stable earnings and a commitment to returning profits to shareholders. As a result, they tend to be less volatile than growth stocks, making them attractive to risk-averse investors. Moreover, dividends can be reinvested to purchase additional shares, thereby compounding returns over time. This reinvestment strategy can significantly enhance the overall yield of a portfolio, especially when dividends are increased regularly.

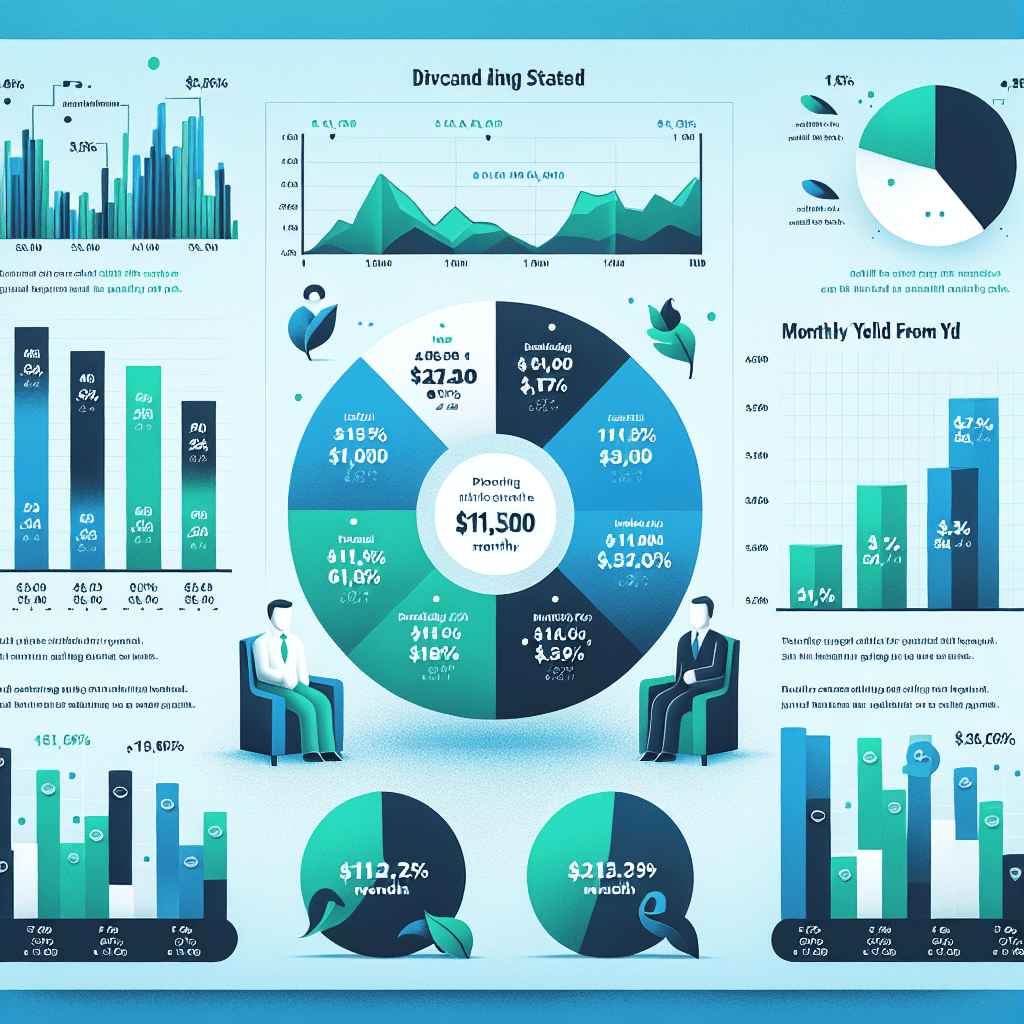

In constructing a portfolio that yields $11,500 monthly, it is essential to identify stocks that not only offer high dividend yields but also possess strong fundamentals. This involves a thorough analysis of the company’s financial health, including its payout ratio, earnings growth, and cash flow stability. A high payout ratio might indicate that a company is returning most of its earnings to shareholders, which could be unsustainable if earnings decline. Therefore, a balanced approach that considers both yield and sustainability is vital.

Furthermore, diversification plays a key role in mitigating risks associated with dividend investing. By spreading investments across various sectors and industries, investors can protect their portfolios from sector-specific downturns. For instance, while utility and consumer staple stocks are known for their reliable dividends, incorporating technology or healthcare stocks can provide growth potential and additional income streams. This diversification ensures that the portfolio remains resilient in the face of market fluctuations.

In addition to diversification, keeping abreast of economic trends and market conditions is crucial for dividend investors. Interest rate changes, inflation, and economic cycles can all impact dividend payments and stock prices. For example, rising interest rates might lead to higher borrowing costs for companies, potentially affecting their ability to maintain dividend payouts. Therefore, staying informed and being prepared to adjust the portfolio in response to these changes is essential for maintaining a steady income.

Moreover, tax considerations should not be overlooked when engaging in dividend investing. Depending on the investor’s tax bracket and the type of account in which the investments are held, dividends may be subject to different tax rates. Understanding these implications can help investors optimize their after-tax returns and make informed decisions about their portfolio composition.

In conclusion, dividend investing offers a viable path to generating a consistent monthly income, such as $11,500, by carefully selecting high-yield stocks with strong fundamentals and diversifying across sectors. By staying informed about market conditions and considering tax implications, investors can enhance their portfolio’s performance and achieve their financial goals. As with any investment strategy, due diligence and a long-term perspective are key to success in dividend investing.

Analyzing the Top 7 Stocks for Consistent Dividend Yields

In the realm of dividend investing, the allure of consistent income streams is undeniable. For investors seeking to generate a monthly income of $11,500 through dividends, selecting the right stocks is crucial. This article delves into the top seven stocks that have demonstrated the ability to yield such returns, offering insights into their performance and potential for sustained payouts.

To begin with, it is essential to understand the criteria for selecting these stocks. A robust dividend yield, a history of consistent payouts, and a strong financial foundation are key factors. Additionally, the ability of a company to maintain and grow its dividends over time is paramount. With these criteria in mind, the first stock on the list is Johnson & Johnson. Known for its diversified portfolio in healthcare products, Johnson & Johnson has a long-standing reputation for stability and reliability. Its consistent dividend growth over the years makes it a cornerstone for any dividend-focused portfolio.

Transitioning to the next stock, Procter & Gamble stands out as another stalwart in the consumer goods sector. With a diverse range of products that are household staples, Procter & Gamble has consistently delivered dividends to its shareholders. The company’s strategic focus on innovation and market expansion further bolsters its ability to sustain and potentially increase its dividend payouts.

Moving forward, Realty Income Corporation, often referred to as “The Monthly Dividend Company,” is a real estate investment trust (REIT) that has built its reputation on providing monthly dividends. Its portfolio of commercial properties, leased to high-quality tenants, ensures a steady income stream. The company’s commitment to monthly payouts aligns perfectly with the goals of dividend investors seeking regular income.

Next, we consider AT&T, a telecommunications giant that has long been a favorite among dividend investors. Despite facing challenges in the rapidly evolving tech landscape, AT&T’s substantial cash flow and strategic investments in 5G technology position it well for future growth. This, coupled with its attractive dividend yield, makes it a compelling choice for those seeking consistent income.

Furthermore, Chevron Corporation, a leader in the energy sector, offers another avenue for dividend income. With its strong balance sheet and focus on sustainable energy practices, Chevron has managed to maintain its dividend payouts even amidst fluctuating oil prices. The company’s commitment to shareholder returns is evident in its track record of dividend growth.

Additionally, Coca-Cola, a global beverage leader, provides a reliable dividend yield backed by its extensive distribution network and brand strength. The company’s ability to adapt to changing consumer preferences while maintaining profitability underscores its potential for continued dividend payments.

Finally, we turn our attention to Pfizer, a pharmaceutical giant that has gained prominence with its role in developing COVID-19 vaccines. Beyond its recent achievements, Pfizer’s diverse product pipeline and strategic acquisitions position it well for long-term growth. Its commitment to returning value to shareholders through dividends further enhances its appeal to dividend investors.

In conclusion, these seven stocks represent a diverse array of industries, each offering unique strengths and opportunities for dividend investors. By carefully analyzing their financial health, market position, and growth prospects, investors can build a portfolio capable of yielding $11,500 monthly. As always, it is crucial to conduct thorough research and consider individual financial goals before making investment decisions.

Portfolio Insights: Balancing Risk and Reward in Dividend Stocks

In the realm of dividend investing, balancing risk and reward is a crucial strategy for achieving consistent income while safeguarding capital. For investors seeking to generate a substantial monthly income, selecting the right stocks is paramount. This article delves into the top seven stocks that collectively yield $11,500 monthly, offering insights into how these selections can form a robust portfolio for dividend investors.

To begin with, the foundation of a successful dividend portfolio lies in diversification. By spreading investments across various sectors, investors can mitigate risks associated with market volatility. Among the top picks, companies from diverse industries such as utilities, consumer goods, healthcare, and technology stand out. These sectors not only provide stability but also offer growth potential, ensuring that the portfolio remains resilient in different economic climates.

One of the key considerations in selecting dividend stocks is the yield. High-yield stocks can significantly boost monthly income, but they often come with increased risk. Therefore, it is essential to evaluate the sustainability of these yields. Companies with a history of stable or growing dividends are preferable, as they indicate a strong financial position and a commitment to returning value to shareholders. For instance, utility companies are renowned for their reliable dividends due to their steady cash flows and essential services, making them a staple in any dividend-focused portfolio.

Moreover, the payout ratio is a critical metric to assess. A lower payout ratio suggests that a company retains a significant portion of its earnings, which can be reinvested for growth or used to weather economic downturns. Conversely, a high payout ratio might indicate that a company is distributing most of its earnings as dividends, which could be unsustainable in the long term. Therefore, a balanced approach, considering both yield and payout ratio, is vital for maintaining a healthy portfolio.

In addition to financial metrics, understanding the broader economic environment is crucial. Interest rates, inflation, and economic growth can all impact dividend stocks. For example, in a low-interest-rate environment, dividend stocks become more attractive as they offer higher returns compared to fixed-income securities. However, rising interest rates might lead to increased borrowing costs for companies, potentially affecting their ability to maintain dividend payouts. Thus, keeping abreast of economic trends can help investors make informed decisions.

Furthermore, reinvestment strategies can enhance the compounding effect of dividends. By reinvesting dividends, investors can purchase additional shares, thereby increasing their future dividend income. This strategy not only amplifies returns but also leverages the power of compounding over time. However, it is essential to periodically review and rebalance the portfolio to ensure alignment with investment goals and risk tolerance.

In conclusion, constructing a dividend portfolio that yields $11,500 monthly requires a careful blend of high-yield stocks, sector diversification, and a keen eye on financial health indicators. By focusing on companies with sustainable dividends, a reasonable payout ratio, and a strong market position, investors can achieve a balance between risk and reward. Additionally, staying informed about economic conditions and employing reinvestment strategies can further enhance portfolio performance. Ultimately, a well-structured dividend portfolio not only provides a steady income stream but also contributes to long-term wealth accumulation.

Strategies for Selecting High-Yield Dividend Stocks

In the realm of dividend investing, selecting high-yield stocks that can generate substantial monthly income is a strategic endeavor that requires careful analysis and a keen understanding of market dynamics. For investors aiming to yield $11,500 monthly, focusing on a diversified portfolio of top-performing dividend stocks is essential. This approach not only ensures a steady income stream but also mitigates risks associated with market volatility. To achieve this, investors must consider several key strategies when selecting high-yield dividend stocks.

Firstly, it is crucial to evaluate the dividend yield, which is a primary indicator of a stock’s income-generating potential. A high dividend yield suggests that a company is returning a significant portion of its earnings to shareholders. However, it is important to balance yield with sustainability. Companies offering exceptionally high yields may be doing so at the expense of their financial health, potentially leading to dividend cuts in the future. Therefore, investors should prioritize stocks with a history of stable and growing dividends, as these are more likely to provide reliable income over time.

In addition to yield, the payout ratio is another critical factor to consider. This ratio, which measures the proportion of earnings paid out as dividends, provides insight into a company’s ability to maintain its dividend payments. A lower payout ratio indicates that a company retains a larger portion of its earnings for reinvestment, which can be a sign of financial strength and growth potential. Conversely, a high payout ratio may signal that a company is overextending itself, which could jeopardize future dividend payments.

Furthermore, diversification across sectors is a prudent strategy for dividend investors. By spreading investments across various industries, investors can reduce the impact of sector-specific downturns on their overall portfolio. For instance, while utility and consumer staple stocks are traditionally known for their stable dividends, incorporating technology or healthcare stocks can provide growth opportunities and additional income streams. This balanced approach not only enhances income potential but also fortifies the portfolio against economic fluctuations.

Another essential consideration is the company’s financial health and market position. Companies with strong balance sheets, low debt levels, and competitive advantages are more likely to sustain and grow their dividends. Conducting thorough research into a company’s financial statements and market performance can provide valuable insights into its long-term viability as a dividend payer. Additionally, understanding the broader economic environment and how it affects specific industries can inform better investment decisions.

Moreover, investors should remain vigilant about changes in interest rates and inflation, as these factors can influence dividend stock performance. Rising interest rates may lead to higher borrowing costs for companies, potentially impacting their ability to pay dividends. Similarly, inflation can erode the purchasing power of dividend income, making it essential for investors to seek stocks with dividends that outpace inflation.

In conclusion, selecting high-yield dividend stocks to achieve a monthly income of $11,500 requires a comprehensive strategy that encompasses yield evaluation, payout ratio analysis, sector diversification, and financial health assessment. By adhering to these principles, dividend investors can construct a robust portfolio that not only meets their income goals but also withstands the challenges of an ever-evolving market landscape. Through diligent research and strategic planning, investors can unlock the potential of dividend stocks to secure a stable and rewarding financial future.

The Role of Dividend Reinvestment in Growing Your Portfolio

Dividend reinvestment plays a pivotal role in the growth of an investment portfolio, particularly for those focused on generating a steady income stream. For dividend investors, the allure of stocks yielding substantial monthly returns, such as $11,500, is undeniable. However, the true power of these investments is often realized through the strategic reinvestment of dividends. By reinvesting dividends, investors can harness the power of compounding, which significantly accelerates portfolio growth over time. This approach not only enhances the potential for increased income but also contributes to the overall appreciation of the portfolio’s value.

To understand the impact of dividend reinvestment, consider the concept of compounding. When dividends are reinvested, they purchase additional shares of the stock, which in turn generate more dividends. This cycle creates a snowball effect, where the portfolio’s growth is not solely dependent on the initial capital investment but is continuously fueled by the reinvested dividends. Over time, this compounding effect can lead to exponential growth, transforming a modest investment into a substantial asset.

Moreover, reinvesting dividends can provide a buffer against market volatility. In fluctuating markets, the ability to purchase additional shares at lower prices can enhance long-term returns. This strategy allows investors to capitalize on market downturns by acquiring more shares for the same dividend amount, thereby increasing the potential for future income as the market recovers. Consequently, dividend reinvestment can serve as a stabilizing force within a portfolio, mitigating the impact of short-term market fluctuations.

In addition to compounding and market stabilization, dividend reinvestment offers a disciplined approach to investing. By automatically reinvesting dividends, investors remove the temptation to spend the income, ensuring that it contributes to the portfolio’s growth. This discipline is particularly beneficial for long-term investors who are focused on building wealth over time. Furthermore, reinvestment plans often come with the advantage of reduced transaction costs, as many brokerage firms offer commission-free reinvestment options. This cost efficiency further enhances the appeal of dividend reinvestment as a strategy for portfolio growth.

While the benefits of dividend reinvestment are clear, it is essential for investors to consider their individual financial goals and circumstances. For those seeking immediate income, reinvesting dividends may not align with their objectives. However, for investors with a long-term horizon, the reinvestment of dividends can be a powerful tool for wealth accumulation. It is also important to evaluate the quality and sustainability of the dividend-paying stocks within the portfolio. Selecting companies with a strong track record of consistent and growing dividends is crucial to maximizing the benefits of reinvestment.

In conclusion, dividend reinvestment is a cornerstone strategy for growing an investment portfolio, particularly for those focused on generating substantial monthly income. By leveraging the power of compounding, providing a buffer against market volatility, and promoting disciplined investing, reinvesting dividends can significantly enhance the potential for long-term wealth accumulation. As investors consider their approach to dividend investing, understanding the role of reinvestment is essential to unlocking the full potential of their portfolio. Through careful selection of high-quality dividend stocks and a commitment to reinvestment, investors can position themselves for sustained financial growth and success.

Evaluating Financial Health: Key Metrics for Dividend Stocks

When evaluating the financial health of dividend stocks, investors must consider several key metrics to ensure a stable and reliable income stream. These metrics provide insights into a company’s ability to sustain and potentially grow its dividend payouts, which is crucial for investors seeking to yield substantial monthly income, such as $11,500 from a diversified portfolio. Understanding these metrics can help investors make informed decisions and optimize their portfolios for long-term success.

One of the primary metrics to consider is the dividend yield, which indicates how much a company pays out in dividends relative to its stock price. A higher yield can be attractive, but it is essential to assess whether the yield is sustainable. This leads to the examination of the payout ratio, which measures the proportion of earnings a company distributes as dividends. A payout ratio that is too high may suggest that the company is overextending itself, potentially jeopardizing future dividend payments. Conversely, a lower payout ratio might indicate room for dividend growth, provided the company maintains or increases its earnings.

In addition to the payout ratio, the company’s earnings growth is a critical factor. Consistent earnings growth can signal a company’s ability to increase dividends over time, enhancing the investor’s income stream. Evaluating historical earnings growth and future projections can provide a clearer picture of a company’s financial trajectory. Furthermore, cash flow is another vital metric, as it reflects the actual cash a company generates, which is used to pay dividends. A strong cash flow position suggests that a company can comfortably cover its dividend obligations, even during periods of economic uncertainty.

Debt levels also play a significant role in assessing a company’s financial health. A company with excessive debt may face challenges in maintaining its dividend payments, especially if interest rates rise or if the company experiences a downturn in its business operations. Therefore, examining the debt-to-equity ratio can help investors understand the company’s leverage and its ability to manage debt responsibly. A lower ratio generally indicates a more financially stable company, which is better positioned to sustain its dividend payments.

Moreover, the company’s industry and market position should not be overlooked. Companies operating in stable, non-cyclical industries often provide more reliable dividends, as their earnings are less susceptible to economic fluctuations. Additionally, a strong market position, characterized by a competitive advantage or a dominant market share, can enhance a company’s ability to generate consistent profits and, by extension, maintain or grow its dividends.

Finally, it is crucial to consider the company’s dividend history. A track record of consistent or increasing dividend payments can be a strong indicator of a company’s commitment to returning value to shareholders. Companies with a history of dividend growth, often referred to as “dividend aristocrats,” are particularly appealing to income-focused investors, as they have demonstrated resilience and financial discipline over time.

In conclusion, evaluating the financial health of dividend stocks involves a comprehensive analysis of various metrics, including dividend yield, payout ratio, earnings growth, cash flow, debt levels, industry stability, and dividend history. By carefully considering these factors, investors can build a robust portfolio that yields a reliable monthly income, such as $11,500, while minimizing risks associated with unsustainable dividend payments. This strategic approach not only enhances income potential but also contributes to long-term financial security.

Long-Term Benefits of a Diversified Dividend Portfolio

In the realm of investment, the allure of a diversified dividend portfolio lies in its potential to provide a steady stream of income while mitigating risk. For dividend investors, the prospect of earning $11,500 monthly from a carefully curated selection of stocks is not only enticing but also achievable with strategic planning and diversification. By spreading investments across various sectors and industries, investors can harness the long-term benefits of stability and growth, ensuring a reliable income stream even in volatile market conditions.

To begin with, diversification is a fundamental principle in portfolio management, particularly for those seeking consistent dividend income. By investing in a range of stocks, investors can reduce their exposure to the risks associated with any single company or sector. This approach not only helps in safeguarding the portfolio against market fluctuations but also enhances the potential for capital appreciation over time. For instance, including stocks from sectors such as technology, healthcare, consumer goods, and utilities can provide a balanced mix of growth and income, as these industries often exhibit varying degrees of sensitivity to economic cycles.

Moreover, selecting stocks with a history of stable and growing dividends is crucial for achieving the desired monthly income. Companies with a track record of increasing their dividend payouts demonstrate financial health and a commitment to returning value to shareholders. This reliability is particularly important for investors who rely on dividend income for their financial needs. By focusing on such companies, investors can build a portfolio that not only meets their current income requirements but also has the potential to grow over time, keeping pace with inflation and increasing living costs.

In addition to stability, the compounding effect of reinvested dividends can significantly enhance the long-term benefits of a diversified portfolio. By reinvesting dividends, investors can purchase additional shares, thereby increasing their future dividend income. This compounding effect can lead to exponential growth in the value of the portfolio, providing a substantial boost to the investor’s financial security over the years. Furthermore, reinvested dividends can help offset any potential losses from underperforming stocks, ensuring that the overall portfolio remains robust and resilient.

Another key advantage of a diversified dividend portfolio is its ability to provide a hedge against inflation. As the cost of living rises, the purchasing power of fixed income sources can diminish. However, dividend-paying stocks often have the potential to increase their payouts in line with inflation, offering a natural hedge against rising prices. This characteristic makes dividend stocks an attractive option for investors seeking to preserve their wealth in real terms over the long term.

Finally, it is important to recognize that building a diversified dividend portfolio requires careful research and ongoing management. Investors must stay informed about the financial health and performance of the companies in their portfolio, as well as broader market trends that may impact their investments. Regularly reviewing and adjusting the portfolio can help ensure that it continues to meet the investor’s income goals and risk tolerance.

In conclusion, the long-term benefits of a diversified dividend portfolio are manifold, offering a combination of income stability, growth potential, and inflation protection. By strategically selecting and managing a mix of dividend-paying stocks, investors can achieve a reliable monthly income of $11,500 while positioning themselves for financial success in the years to come.

Q&A

1. **What is Portfolio Insights?**

Portfolio Insights is a financial analysis tool or report that provides detailed information on investment portfolios, focusing on performance, risk, and income generation.

2. **What is the focus of the report “Top 7 Stocks Yielding $11,500 Monthly for a Dividend Investor”?**

The report focuses on identifying and analyzing seven stocks that collectively yield $11,500 in monthly dividends for investors.

3. **What criteria are used to select the top 7 stocks?**

The stocks are selected based on their dividend yield, stability, growth potential, and ability to generate consistent monthly income.

4. **What is the average dividend yield of these stocks?**

The average dividend yield of these stocks is typically high, often exceeding the market average, to achieve the target monthly income.

5. **What sectors do these top 7 stocks belong to?**

These stocks are usually diversified across various sectors such as utilities, real estate, consumer goods, and financials to balance risk and income.

6. **How much capital is required to achieve $11,500 in monthly dividends?**

The required capital depends on the dividend yield of the selected stocks, but it generally involves a substantial investment, often in the range of several hundred thousand to a few million dollars.

7. **What are the risks associated with investing in high-yield dividend stocks?**

Risks include dividend cuts, stock price volatility, sector-specific risks, and potential changes in interest rates that can affect dividend yields.

Conclusion

The article “Portfolio Insights: Top 7 Stocks Yielding $11,500 Monthly for a Dividend Investor” provides a comprehensive analysis of a curated selection of high-yield dividend stocks that collectively generate substantial monthly income. By focusing on companies with strong financial health, consistent dividend payouts, and growth potential, the portfolio aims to deliver reliable income streams for investors seeking financial stability and passive income. The analysis underscores the importance of diversification across sectors to mitigate risks and enhance returns. Overall, the article offers valuable insights for dividend investors looking to optimize their portfolios for consistent and significant monthly income.