“Union Pacific: Delivering More, Yet Falling Short of Wall Street’s Track”

Introduction

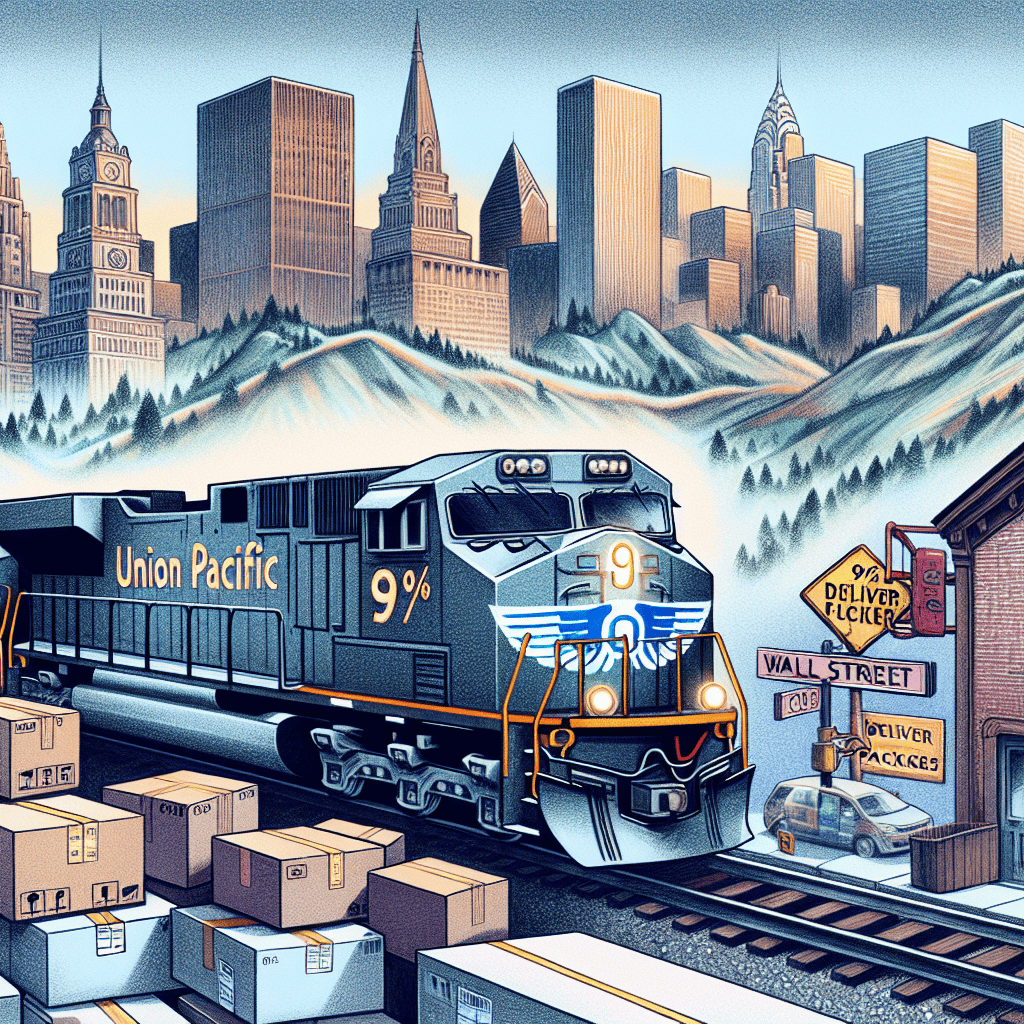

Union Pacific Corporation, one of the leading railroad operators in the United States, reported a 9% increase in profits for the recent quarter, driven by a surge in freight deliveries across its expansive rail network. Despite this growth, the company’s earnings fell short of Wall Street analysts’ expectations, highlighting the challenges faced in balancing operational efficiency with market demands. The rise in profit underscores Union Pacific’s ability to capitalize on heightened shipping activity, yet the shortfall against projections suggests potential areas for strategic improvement and market adaptation.

Union Pacific’s Profit Growth: Analyzing the 9% Increase

Union Pacific, one of the largest railroad networks in the United States, recently reported a 9% increase in its quarterly profit, a development that underscores the company’s operational resilience and strategic initiatives aimed at enhancing delivery efficiency. This growth, however, fell short of Wall Street’s expectations, highlighting the complex dynamics at play in the transportation and logistics sector. The company’s financial performance was buoyed by an uptick in deliveries, driven by a robust demand for freight services across various industries. This demand surge can be attributed to the gradual recovery of the economy, as businesses ramp up production and distribution activities in response to increasing consumer demand.

Despite the positive growth in profit, Union Pacific’s earnings did not meet analysts’ projections, which had anticipated a more substantial increase. This discrepancy between actual performance and market expectations can be attributed to several factors. Firstly, the company faced higher operational costs, including increased fuel prices and labor expenses, which exerted pressure on profit margins. Additionally, supply chain disruptions, a lingering challenge from the global pandemic, continued to affect the efficiency of freight operations, leading to delays and increased costs.

Moreover, Union Pacific’s strategic investments in infrastructure and technology, while essential for long-term growth, also contributed to the shortfall in meeting Wall Street’s expectations. The company has been focusing on modernizing its rail network and implementing advanced technologies to enhance operational efficiency and service reliability. These initiatives, although promising for future profitability, require significant capital expenditure, which impacts short-term financial results.

In light of these challenges, Union Pacific’s management remains optimistic about the company’s growth prospects. They emphasize the importance of strategic investments in positioning the company for sustained success in an increasingly competitive market. The focus on enhancing delivery capabilities and improving service quality is expected to yield positive results as the company navigates the evolving landscape of the transportation industry.

Furthermore, Union Pacific’s commitment to sustainability and environmental responsibility is another critical aspect of its growth strategy. The company has been actively working to reduce its carbon footprint by investing in fuel-efficient locomotives and exploring alternative energy sources. These efforts not only align with global sustainability goals but also enhance the company’s reputation and competitiveness in the market.

Looking ahead, Union Pacific is poised to capitalize on emerging opportunities in the freight transportation sector. The ongoing recovery of the global economy, coupled with increasing demand for efficient and reliable logistics solutions, presents a favorable environment for growth. However, the company must continue to address operational challenges and adapt to changing market conditions to fully realize its potential.

In conclusion, while Union Pacific’s 9% profit increase reflects its ability to navigate a complex and dynamic market, the shortfall in meeting Wall Street expectations underscores the need for continued focus on cost management and operational efficiency. By leveraging strategic investments and embracing innovation, Union Pacific is well-positioned to drive future growth and deliver value to its stakeholders. As the company continues to adapt to the evolving demands of the transportation industry, its commitment to sustainability and service excellence will remain key pillars of its long-term success.

Factors Behind Union Pacific’s Increased Deliveries

Union Pacific’s recent financial performance has been a topic of considerable interest, particularly as the company reported a 9% rise in profits due to increased deliveries. However, despite this growth, the results fell short of Wall Street’s expectations, prompting a closer examination of the factors contributing to the company’s increased deliveries. Understanding these elements provides insight into the dynamics of the freight transportation industry and Union Pacific’s strategic maneuvers within it.

One of the primary factors behind Union Pacific’s increased deliveries is the robust demand for freight transportation services. As the economy continues to recover and expand, there has been a notable uptick in the movement of goods across various sectors. This surge in demand has been driven by several key industries, including manufacturing, agriculture, and retail, all of which rely heavily on efficient and reliable rail services to transport their products. Union Pacific, with its extensive rail network spanning the western two-thirds of the United States, is well-positioned to capitalize on this demand, thereby boosting its delivery volumes.

Moreover, Union Pacific has made significant investments in its infrastructure and technology, which have played a crucial role in enhancing its operational efficiency. By upgrading its rail lines, locomotives, and freight cars, the company has improved its capacity to handle increased volumes of goods. Additionally, the implementation of advanced technologies, such as precision scheduled railroading, has optimized train scheduling and routing, reducing transit times and increasing the reliability of deliveries. These improvements have not only enabled Union Pacific to accommodate higher delivery volumes but have also strengthened its competitive position in the freight transportation market.

In addition to infrastructure and technological advancements, Union Pacific’s strategic partnerships have been instrumental in driving increased deliveries. The company has forged alliances with key players in various industries, facilitating seamless integration of its rail services with other modes of transportation, such as trucking and shipping. These partnerships have expanded Union Pacific’s reach and allowed it to offer comprehensive logistics solutions to its customers, thereby attracting more business and contributing to the rise in delivery volumes.

Furthermore, Union Pacific’s focus on sustainability has resonated with environmentally conscious customers, leading to increased demand for its services. The company has implemented numerous initiatives aimed at reducing its carbon footprint, such as investing in fuel-efficient locomotives and promoting the use of rail over less environmentally friendly transportation modes. By positioning itself as a leader in sustainable freight transportation, Union Pacific has not only enhanced its brand image but also tapped into a growing market segment that prioritizes eco-friendly logistics solutions.

Despite these positive developments, Union Pacific’s financial results did not meet Wall Street’s expectations, highlighting the challenges that the company faces. Rising operational costs, including labor and fuel expenses, have exerted pressure on profit margins, offsetting some of the gains from increased deliveries. Additionally, supply chain disruptions and logistical bottlenecks have posed challenges to maintaining consistent service levels, impacting overall performance.

In conclusion, Union Pacific’s increased deliveries can be attributed to a combination of factors, including strong demand for freight services, infrastructure and technological enhancements, strategic partnerships, and a commitment to sustainability. While these elements have driven growth in delivery volumes, the company must navigate ongoing challenges to align its financial performance with market expectations. As Union Pacific continues to adapt to the evolving landscape of the freight transportation industry, its ability to address these challenges will be crucial in sustaining its growth trajectory.

Wall Street Expectations: Why Union Pacific Fell Short

Union Pacific, one of the largest railroad networks in the United States, recently reported a 9% increase in profits, driven by a surge in deliveries. Despite this positive development, the company fell short of Wall Street’s expectations, prompting a closer examination of the factors contributing to this discrepancy. The railroad industry, a critical component of the nation’s infrastructure, has been experiencing a dynamic shift in recent years, influenced by fluctuating demand, regulatory changes, and evolving market conditions. Union Pacific’s recent performance offers a lens through which to understand these broader trends and the challenges they present.

The increase in Union Pacific’s profits can be attributed to a rise in freight volumes, particularly in the agricultural and energy sectors. As the global economy continues to recover from the disruptions caused by the COVID-19 pandemic, demand for raw materials and finished goods has surged. This has led to an uptick in rail shipments, as companies seek efficient and cost-effective ways to transport their products across the country. Union Pacific, with its extensive network and strategic positioning, has been well-placed to capitalize on this increased demand.

However, despite the growth in deliveries and subsequent profit rise, Union Pacific’s financial performance did not meet the expectations set by Wall Street analysts. Several factors contributed to this shortfall. Firstly, operational challenges, including labor shortages and supply chain disruptions, have impacted the company’s ability to fully leverage the increased demand. The railroad industry, like many others, has been grappling with a shortage of skilled workers, which has led to delays and inefficiencies in operations. Additionally, supply chain bottlenecks, exacerbated by the pandemic, have further constrained the company’s capacity to meet delivery schedules.

Moreover, rising costs have also played a significant role in Union Pacific’s inability to meet Wall Street’s projections. The company has faced increased expenses related to fuel, maintenance, and labor, which have eroded profit margins. While Union Pacific has implemented measures to mitigate these costs, such as investing in fuel-efficient technologies and optimizing its network operations, these efforts have not been sufficient to offset the financial pressures entirely.

Another contributing factor to the missed expectations is the competitive landscape of the railroad industry. Union Pacific operates in a highly competitive environment, with other major players vying for market share. This competition has intensified as companies seek to capitalize on the growing demand for freight transportation. As a result, Union Pacific has had to balance the need to maintain competitive pricing with the imperative to sustain profitability, a challenge that has proven difficult in the current economic climate.

In conclusion, while Union Pacific’s 9% profit increase is a testament to its resilience and adaptability in a challenging market, the company’s failure to meet Wall Street expectations underscores the complexities of the railroad industry. The interplay of operational challenges, rising costs, and competitive pressures has created a difficult environment for Union Pacific and its peers. As the company navigates these challenges, it will need to continue innovating and optimizing its operations to meet the evolving demands of the market and align more closely with investor expectations. This case serves as a reminder of the intricate dynamics at play in the transportation sector and the need for strategic agility in the face of uncertainty.

The Impact of Freight Demand on Union Pacific’s Performance

Union Pacific’s recent financial performance has been a topic of considerable interest, particularly in light of the company’s reported 9% increase in profit. This growth, driven by heightened freight demand, underscores the dynamic nature of the transportation and logistics sector. However, despite this positive development, Union Pacific’s earnings fell short of Wall Street’s expectations, highlighting the complexities and challenges that the company faces in an ever-evolving market landscape.

The surge in profit can be attributed to a notable increase in freight deliveries, which has been a significant factor in Union Pacific’s recent financial trajectory. As industries across the United States ramp up production and distribution activities, the demand for efficient and reliable freight transportation has intensified. Union Pacific, with its extensive rail network, has been well-positioned to capitalize on this demand, facilitating the movement of goods across vast distances. This uptick in freight activity has not only bolstered the company’s revenue but also reinforced its role as a critical player in the national supply chain.

Nevertheless, the company’s performance did not fully align with the optimistic projections set by Wall Street analysts. This discrepancy can be attributed to several factors that have impacted Union Pacific’s operations and financial outcomes. For instance, while the increase in freight demand has been beneficial, it has also placed additional pressure on the company’s infrastructure and resources. The need to accommodate higher volumes of goods has necessitated investments in equipment, technology, and workforce, which in turn have influenced the company’s cost structure.

Moreover, external economic conditions have played a role in shaping Union Pacific’s financial results. Fluctuations in fuel prices, regulatory changes, and global trade dynamics are just a few of the variables that can affect the company’s bottom line. These factors, often beyond the control of Union Pacific, can introduce volatility into its financial performance, making it challenging to consistently meet or exceed market expectations.

In addition to these operational and economic considerations, Union Pacific must also navigate the competitive landscape of the freight transportation industry. The company faces competition from other rail operators, as well as alternative modes of transportation such as trucking and shipping. Each of these competitors offers distinct advantages and challenges, compelling Union Pacific to continuously innovate and optimize its services to maintain its competitive edge.

Despite these challenges, Union Pacific’s ability to achieve a 9% increase in profit is a testament to its resilience and adaptability. The company has demonstrated a capacity to respond to market demands and leverage its strengths to drive growth. However, to align more closely with Wall Street’s expectations, Union Pacific may need to further refine its strategies, focusing on enhancing operational efficiency and cost management.

In conclusion, while Union Pacific’s recent financial performance reflects the positive impact of increased freight demand, it also highlights the multifaceted challenges that the company must address to meet market expectations. By continuing to adapt to changing conditions and investing in its infrastructure and capabilities, Union Pacific can position itself for sustained success in the competitive freight transportation industry. As the company navigates these complexities, its ability to balance growth with operational efficiency will be crucial in shaping its future trajectory.

Union Pacific’s Strategic Moves to Boost Profitability

Union Pacific’s recent financial performance has been a topic of considerable interest, particularly as the company reported a 9% increase in profit amid a surge in deliveries. This growth, however, fell short of Wall Street’s expectations, prompting a closer examination of the strategic maneuvers the company has employed to enhance its profitability. As one of the leading railroad operators in the United States, Union Pacific’s ability to navigate the complexities of the transportation industry is crucial to its financial health and long-term success.

To begin with, Union Pacific has been focusing on optimizing its operational efficiency. This involves streamlining its logistics and supply chain processes to ensure timely and cost-effective deliveries. By investing in advanced technologies and infrastructure improvements, the company aims to reduce bottlenecks and enhance the overall reliability of its services. These efforts are designed to not only improve customer satisfaction but also to lower operational costs, thereby boosting profit margins.

Moreover, Union Pacific has been actively pursuing strategic partnerships and collaborations. By aligning with key players in various industries, the company seeks to expand its market reach and tap into new revenue streams. These partnerships often involve joint ventures or long-term contracts that provide a steady flow of business, contributing to a more stable financial outlook. Additionally, such collaborations can lead to shared resources and expertise, further enhancing Union Pacific’s competitive edge.

In addition to these strategies, Union Pacific has been focusing on diversifying its service offerings. Recognizing the evolving needs of its clientele, the company has been expanding its portfolio to include more specialized and value-added services. This diversification not only caters to a broader customer base but also mitigates risks associated with market fluctuations in any single sector. By offering a wider range of services, Union Pacific can better withstand economic uncertainties and maintain a steady growth trajectory.

Despite these strategic initiatives, Union Pacific’s recent profit increase did not meet Wall Street’s expectations, highlighting the challenges that remain. One significant factor is the competitive landscape of the transportation industry, which is characterized by intense rivalry and price pressures. To address this, Union Pacific must continue to innovate and differentiate itself from competitors. This could involve further investments in technology, such as automation and data analytics, to enhance operational efficiency and customer service.

Furthermore, external factors such as regulatory changes and economic conditions also play a crucial role in shaping Union Pacific’s financial performance. The company must remain agile and adaptable to navigate these challenges effectively. This may involve proactive engagement with policymakers and stakeholders to advocate for favorable regulations and policies that support the growth of the railroad industry.

In conclusion, while Union Pacific’s recent profit increase is a positive indicator of its strategic efforts, the shortfall in meeting Wall Street’s expectations underscores the need for continued focus on innovation and adaptability. By optimizing operations, forging strategic partnerships, and diversifying services, Union Pacific is well-positioned to enhance its profitability in the long run. However, the company must remain vigilant in addressing competitive pressures and external challenges to sustain its growth momentum. As Union Pacific continues to refine its strategies, its ability to balance these various factors will be key to achieving its financial objectives and maintaining its leadership position in the industry.

Comparing Union Pacific’s Results with Industry Peers

Union Pacific’s recent financial performance has drawn significant attention, particularly as the company reported a 9% increase in profit, driven by a surge in deliveries. However, despite this positive growth, the results fell short of Wall Street’s expectations, prompting a closer examination of how Union Pacific’s performance compares with its industry peers. In the broader context of the railroad industry, Union Pacific’s results offer a mixed picture of success and challenges.

To begin with, Union Pacific’s profit growth can be attributed to a combination of factors, including increased demand for freight transportation and strategic operational improvements. The company has effectively capitalized on the economic recovery, which has spurred higher volumes of goods being transported across the country. This uptick in deliveries has been a common trend among major railroad companies, as businesses seek to replenish inventories and meet consumer demand. However, while Union Pacific has managed to increase its profit, the company’s performance did not meet the more optimistic projections set by analysts, highlighting a gap between expectations and actual outcomes.

In comparison to its industry peers, Union Pacific’s results reflect both strengths and areas for improvement. For instance, other major players in the railroad sector, such as CSX Corporation and Norfolk Southern, have also reported increased profits, benefiting from similar market conditions. These companies have implemented cost-cutting measures and efficiency improvements, which have contributed to their financial success. However, unlike Union Pacific, some of these peers have managed to exceed Wall Street expectations, suggesting that they may have been more effective in navigating the current economic landscape.

Moreover, the competitive dynamics within the railroad industry play a crucial role in shaping the performance of individual companies. Union Pacific, with its extensive network and strategic positioning, has certain advantages that enable it to capture a significant share of the market. Nevertheless, the company faces stiff competition from other railroads that are equally focused on expanding their market presence and enhancing service offerings. This competitive pressure necessitates continuous innovation and investment in infrastructure to maintain a leading position.

Furthermore, the challenges faced by Union Pacific are not unique to the company but are indicative of broader industry trends. The railroad sector is grappling with issues such as labor shortages, supply chain disruptions, and regulatory changes, all of which can impact operational efficiency and profitability. Companies that can effectively address these challenges are likely to outperform their peers and achieve sustainable growth.

In conclusion, while Union Pacific’s 9% profit increase is a testament to its ability to leverage favorable market conditions, the shortfall in meeting Wall Street expectations underscores the complexities of the current economic environment. When compared to its industry peers, Union Pacific’s performance highlights both competitive strengths and areas where further improvements are needed. As the railroad industry continues to evolve, companies must remain agile and responsive to changing market dynamics to ensure long-term success. By focusing on operational excellence and strategic investments, Union Pacific and its peers can navigate the challenges ahead and capitalize on emerging opportunities.

Future Outlook: Can Union Pacific Meet Investor Expectations?

Union Pacific’s recent financial performance has been a topic of considerable interest, particularly as the company reported a 9% increase in profit due to heightened delivery volumes. Despite this positive development, the results fell short of Wall Street’s expectations, prompting questions about the company’s future trajectory and its ability to meet investor demands. As the transportation sector continues to evolve, Union Pacific faces both opportunities and challenges that will shape its future outlook.

The increase in profit can largely be attributed to a surge in freight volumes, driven by a recovering economy and increased demand for goods. This uptick in deliveries has allowed Union Pacific to capitalize on its extensive rail network, which spans across the western two-thirds of the United States. However, while the company has benefited from these favorable market conditions, it has also encountered several hurdles that have tempered investor enthusiasm.

One of the primary challenges facing Union Pacific is the ongoing pressure to improve operational efficiency. As the transportation industry becomes increasingly competitive, companies are under constant scrutiny to optimize their operations and reduce costs. Union Pacific has made strides in this area, implementing precision scheduled railroading (PSR) to streamline its processes and enhance service reliability. Nevertheless, the full benefits of these initiatives have yet to be realized, and investors remain cautious about the company’s ability to sustain long-term growth.

Moreover, Union Pacific must navigate the complexities of an evolving regulatory landscape. Environmental concerns and sustainability initiatives are at the forefront of industry discussions, with increasing emphasis on reducing carbon emissions and adopting greener practices. Union Pacific has committed to these goals, investing in technology and infrastructure to minimize its environmental impact. However, the transition to more sustainable operations requires significant capital investment, which could affect short-term profitability and investor sentiment.

In addition to these operational and regulatory challenges, Union Pacific must also contend with broader economic uncertainties. Fluctuations in global trade, supply chain disruptions, and geopolitical tensions can all influence freight demand and impact the company’s financial performance. While Union Pacific has demonstrated resilience in navigating these complexities, the unpredictable nature of these factors adds an element of risk to its future outlook.

Despite these challenges, Union Pacific has several opportunities to enhance its value proposition and meet investor expectations. The company is well-positioned to benefit from the ongoing shift towards rail transportation, which is often more cost-effective and environmentally friendly compared to other modes of transport. By leveraging its extensive network and investing in technology, Union Pacific can improve service offerings and capture a larger share of the freight market.

Furthermore, Union Pacific’s commitment to innovation and digital transformation presents additional avenues for growth. By harnessing data analytics and automation, the company can enhance operational efficiency, improve customer service, and drive revenue growth. These initiatives, coupled with strategic partnerships and collaborations, can help Union Pacific strengthen its competitive position and deliver value to shareholders.

In conclusion, while Union Pacific’s recent profit increase is a positive indicator of its operational capabilities, the company must address several challenges to meet investor expectations. By focusing on operational efficiency, sustainability, and innovation, Union Pacific can navigate the complexities of the transportation industry and position itself for long-term success. As the company continues to adapt to changing market dynamics, its ability to execute on these strategic priorities will be crucial in shaping its future outlook and satisfying investor demands.

Q&A

1. **What was the percentage increase in Union Pacific’s profit?**

Union Pacific’s profit increased by 9%.

2. **What was the main factor contributing to the profit increase?**

The profit increase was mainly due to increased deliveries.

3. **Did Union Pacific meet Wall Street expectations with their profit rise?**

No, Union Pacific’s profit rise missed Wall Street expectations.

4. **What sector does Union Pacific operate in?**

Union Pacific operates in the railroad and transportation sector.

5. **How did the increased deliveries impact Union Pacific’s financial performance?**

Increased deliveries contributed positively to Union Pacific’s financial performance, leading to a 9% profit rise.

6. **What was the market’s reaction to Union Pacific’s financial results?**

The market reaction was likely negative or disappointed since the profit rise missed Wall Street expectations.

7. **What might Union Pacific focus on to meet future expectations?**

Union Pacific might focus on improving operational efficiency, cost management, and aligning delivery growth with market expectations to meet future expectations.

Conclusion

Union Pacific reported a 9% increase in profits due to higher delivery volumes, indicating operational growth and efficiency improvements. However, despite this positive performance, the company’s earnings fell short of Wall Street’s expectations, suggesting that analysts anticipated even stronger results or that other financial metrics did not meet projected targets. This discrepancy highlights potential challenges or market conditions that may have impacted Union Pacific’s ability to fully capitalize on increased deliveries, warranting further analysis of their operational strategies and market environment.