“UPS Delivers: Breaking Revenue Records, Stock Soars!”

Introduction

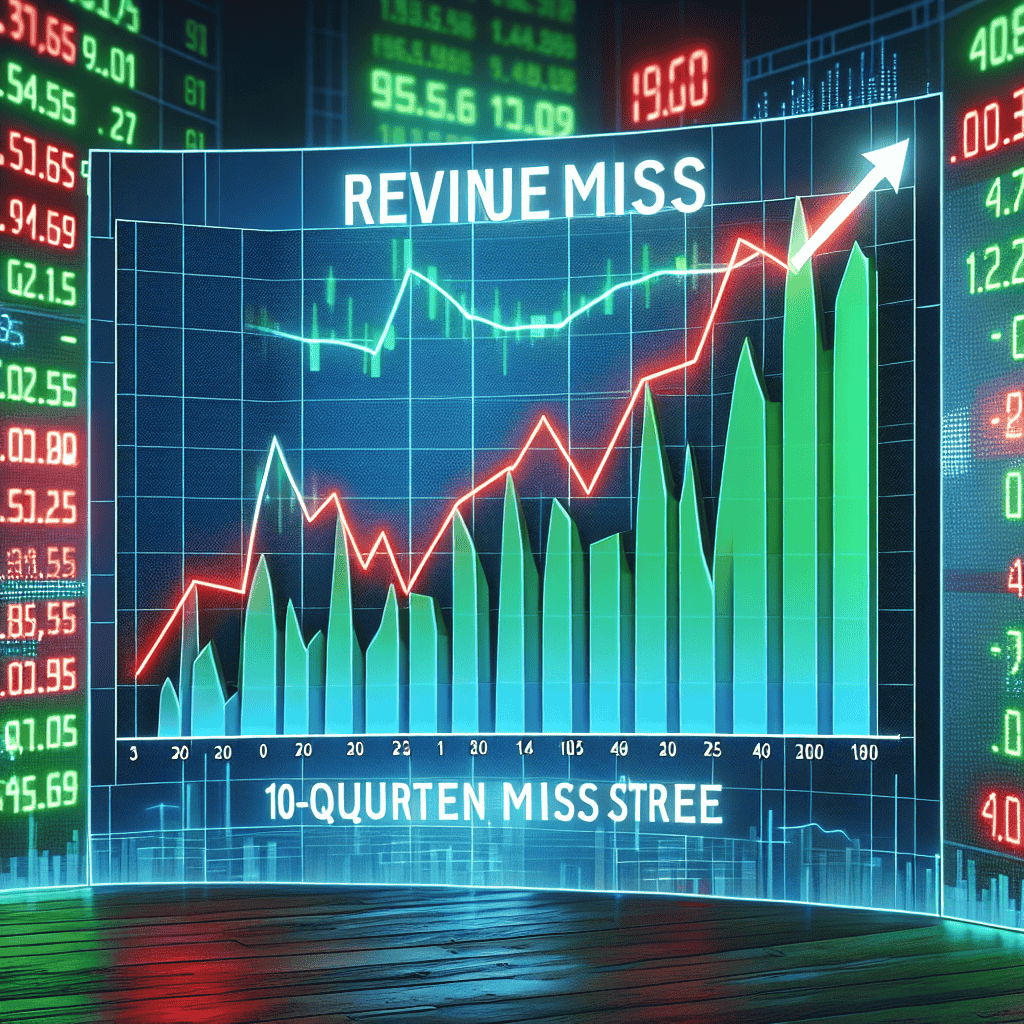

United Parcel Service (UPS) recently broke its 10-quarter streak of revenue misses, marking a significant turnaround for the logistics giant. This achievement has been met with enthusiasm from investors, leading to a notable surge in the company’s stock price. The end of this prolonged period of underperformance in revenue highlights UPS’s strategic adjustments and operational improvements, which have successfully aligned with market expectations. This development not only boosts investor confidence but also positions UPS favorably in the competitive logistics and delivery industry.

UPS Breaks Revenue Miss Streak: Key Factors Behind the Success

United Parcel Service (UPS) has recently made headlines by ending its 10-quarter revenue miss streak, a development that has sent its stock surging and captured the attention of investors and analysts alike. This remarkable turnaround can be attributed to several key factors that have collectively contributed to the company’s improved financial performance. Understanding these elements provides valuable insights into UPS’s strategic maneuvers and the broader logistics industry landscape.

To begin with, one of the primary drivers behind UPS’s recent success is its strategic focus on enhancing operational efficiency. Over the past few quarters, the company has invested significantly in technology and infrastructure to streamline its operations. By leveraging advanced data analytics and automation, UPS has been able to optimize its delivery routes, reduce transit times, and improve package handling processes. These improvements have not only reduced operational costs but also enhanced customer satisfaction, leading to increased demand for UPS’s services.

In addition to operational enhancements, UPS has also benefited from a robust e-commerce market. The surge in online shopping, accelerated by the global pandemic, has created a sustained demand for reliable and efficient delivery services. UPS has capitalized on this trend by expanding its e-commerce capabilities and forging strategic partnerships with major online retailers. This has allowed the company to capture a larger share of the growing e-commerce logistics market, thereby boosting its revenue streams.

Moreover, UPS’s commitment to sustainability has played a crucial role in its recent success. As environmental concerns continue to shape consumer preferences and regulatory landscapes, UPS has proactively adopted sustainable practices to reduce its carbon footprint. The company’s investments in electric vehicles, alternative fuels, and energy-efficient facilities have not only enhanced its environmental credentials but also attracted environmentally conscious customers. This alignment with sustainability trends has positioned UPS as a preferred logistics partner for businesses seeking to meet their own sustainability goals.

Furthermore, UPS’s international expansion strategy has contributed significantly to its revenue growth. By strengthening its presence in key global markets, particularly in Asia and Europe, UPS has tapped into new customer bases and diversified its revenue sources. The company’s ability to navigate complex international trade dynamics and adapt to regional market demands has been instrumental in driving its global growth. This international diversification has not only mitigated risks associated with domestic market fluctuations but also opened up new avenues for revenue generation.

Additionally, UPS’s focus on customer-centric innovations has set it apart from competitors. The company has introduced a range of customer-focused solutions, such as flexible delivery options, real-time tracking, and personalized services, to enhance the overall customer experience. By prioritizing customer needs and preferences, UPS has fostered strong customer loyalty and retention, which has translated into sustained revenue growth.

In conclusion, UPS’s successful end to its 10-quarter revenue miss streak can be attributed to a combination of strategic initiatives and market dynamics. The company’s emphasis on operational efficiency, e-commerce expansion, sustainability, international growth, and customer-centric innovations has collectively driven its improved financial performance. As UPS continues to adapt to evolving market trends and customer expectations, it is well-positioned to maintain its upward trajectory and further solidify its position as a leader in the logistics industry. This achievement not only marks a significant milestone for UPS but also underscores the importance of strategic agility and innovation in today’s competitive business environment.

Stock Market Reaction: How UPS’s Revenue Achievement Boosted Shares

United Parcel Service (UPS) recently made headlines by breaking its 10-quarter streak of revenue misses, a development that has significantly impacted its stock performance. This achievement has not only bolstered investor confidence but also provided a much-needed boost to the company’s market standing. The stock market’s reaction to UPS’s latest financial results underscores the importance of meeting or exceeding revenue expectations, particularly in a competitive industry where market perception can heavily influence stock prices.

The end of UPS’s prolonged revenue miss streak was met with enthusiasm from investors, leading to a notable surge in the company’s stock price. This positive market reaction can be attributed to several factors, including the company’s strategic initiatives aimed at enhancing operational efficiency and expanding its service offerings. By focusing on these areas, UPS has managed to improve its financial performance, thereby reassuring investors of its growth potential. Moreover, the company’s ability to adapt to changing market conditions and consumer demands has played a crucial role in its recent success.

In addition to strategic improvements, UPS’s revenue achievement can also be linked to broader economic trends. The global logistics and transportation industry has experienced a resurgence in demand, driven by the continued growth of e-commerce and the need for efficient supply chain solutions. As a key player in this sector, UPS has benefited from these trends, which have contributed to its improved financial results. Furthermore, the company’s investments in technology and infrastructure have enabled it to capitalize on these opportunities, positioning it well for future growth.

The stock market’s response to UPS’s revenue achievement highlights the critical role that financial performance plays in shaping investor sentiment. When a company consistently misses revenue expectations, it can lead to a loss of confidence among investors, resulting in downward pressure on its stock price. Conversely, meeting or exceeding these expectations can restore investor trust and drive stock price appreciation. In the case of UPS, the end of its revenue miss streak has served as a catalyst for renewed investor interest, as evidenced by the surge in its stock price.

Moreover, the positive market reaction to UPS’s financial results reflects broader investor optimism about the company’s long-term prospects. By demonstrating its ability to overcome past challenges and deliver strong financial performance, UPS has reinforced its position as a leader in the logistics and transportation industry. This, in turn, has encouraged investors to view the company as a viable long-term investment, further contributing to the upward momentum in its stock price.

In conclusion, UPS’s recent revenue achievement has had a significant impact on its stock performance, underscoring the importance of meeting financial expectations in the eyes of investors. The company’s strategic initiatives, coupled with favorable economic trends, have played a pivotal role in driving its improved financial results. As a result, UPS has managed to restore investor confidence and enhance its market standing, as reflected in the surge in its stock price. This development serves as a reminder of the critical role that financial performance plays in shaping market perceptions and influencing stock prices, particularly in a competitive industry such as logistics and transportation.

Analyzing UPS’s Strategic Changes Leading to Revenue Growth

United Parcel Service (UPS) has recently made headlines by ending its 10-quarter revenue miss streak, a development that has sent its stock surging. This remarkable turnaround can be attributed to a series of strategic changes implemented by the company, which have collectively contributed to its renewed financial success. To understand the factors behind this achievement, it is essential to examine the strategic initiatives that UPS has undertaken in recent years.

One of the most significant changes UPS has made is its investment in technology and automation. Recognizing the growing demand for efficient and timely delivery services, UPS has prioritized the modernization of its logistics network. By integrating advanced technologies such as artificial intelligence and machine learning, the company has optimized its delivery routes and improved package tracking capabilities. This technological overhaul has not only enhanced operational efficiency but also reduced costs, allowing UPS to offer competitive pricing and attract more customers.

In addition to technological advancements, UPS has also focused on expanding its global footprint. The company has strategically increased its presence in emerging markets, where e-commerce is experiencing rapid growth. By establishing new distribution centers and forming partnerships with local businesses, UPS has been able to tap into these burgeoning markets and capture a larger share of the global logistics industry. This expansion has been instrumental in driving revenue growth, as it has opened up new revenue streams and diversified the company’s customer base.

Moreover, UPS has made a concerted effort to enhance its customer service offerings. Understanding that customer satisfaction is paramount in the logistics industry, the company has implemented several initiatives aimed at improving the overall customer experience. For instance, UPS has introduced flexible delivery options, allowing customers to choose specific delivery windows that suit their schedules. Additionally, the company has invested in customer support infrastructure, ensuring that any issues or inquiries are promptly addressed. These customer-centric strategies have not only bolstered UPS’s reputation but also fostered customer loyalty, contributing to sustained revenue growth.

Furthermore, UPS has embraced sustainability as a core component of its business strategy. In response to increasing environmental concerns, the company has committed to reducing its carbon footprint and promoting eco-friendly practices. UPS has invested in alternative fuel vehicles and energy-efficient technologies, which have not only minimized its environmental impact but also resulted in cost savings. By aligning its operations with sustainable practices, UPS has appealed to environmentally conscious consumers and businesses, further enhancing its competitive edge in the market.

The culmination of these strategic changes has been reflected in UPS’s financial performance, as evidenced by its recent revenue growth. The company’s ability to adapt to changing market dynamics and address customer needs has been pivotal in ending its 10-quarter revenue miss streak. As a result, investor confidence in UPS has been restored, leading to a surge in its stock price.

In conclusion, UPS’s impressive turnaround can be attributed to its strategic focus on technology, global expansion, customer service, and sustainability. By implementing these initiatives, the company has not only improved its operational efficiency but also strengthened its market position. As UPS continues to innovate and adapt to evolving industry trends, it is well-positioned to sustain its revenue growth and maintain its status as a leader in the logistics sector.

The Role of E-commerce in UPS’s Recent Financial Performance

United Parcel Service (UPS) has recently made headlines by ending its 10-quarter revenue miss streak, a development that has significantly boosted its stock performance. This remarkable turnaround can be largely attributed to the pivotal role of e-commerce in shaping the company’s recent financial success. As the global economy continues to evolve, e-commerce has emerged as a dominant force, reshaping traditional business models and creating new opportunities for logistics companies like UPS. The surge in online shopping, accelerated by the COVID-19 pandemic, has fundamentally altered consumer behavior, leading to an increased demand for efficient and reliable delivery services.

In recent years, e-commerce has experienced exponential growth, driven by technological advancements and changing consumer preferences. This shift has presented both challenges and opportunities for logistics providers. For UPS, the rise of e-commerce has necessitated significant investments in infrastructure, technology, and workforce to meet the growing demand for parcel deliveries. By strategically aligning its operations with the needs of e-commerce businesses, UPS has been able to capitalize on this trend and enhance its financial performance.

One of the key factors contributing to UPS’s recent success is its ability to adapt to the evolving e-commerce landscape. The company has implemented innovative solutions to streamline its operations and improve delivery efficiency. For instance, UPS has invested in advanced technologies such as artificial intelligence and machine learning to optimize its supply chain and enhance route planning. These technological advancements have enabled UPS to reduce delivery times and improve customer satisfaction, thereby strengthening its position in the competitive logistics market.

Moreover, UPS has expanded its service offerings to cater to the diverse needs of e-commerce businesses. The company has introduced flexible delivery options, such as same-day and next-day delivery, to meet the expectations of online shoppers. Additionally, UPS has developed specialized solutions for handling returns, a critical aspect of the e-commerce experience. By providing comprehensive logistics solutions, UPS has positioned itself as a preferred partner for e-commerce companies, further driving its revenue growth.

Furthermore, UPS’s strategic partnerships with major e-commerce platforms have played a crucial role in its financial turnaround. Collaborations with industry giants such as Amazon and Alibaba have allowed UPS to tap into a vast network of online retailers and consumers. These partnerships have not only increased UPS’s delivery volumes but have also provided valuable insights into consumer trends and preferences. By leveraging these insights, UPS has been able to tailor its services to better meet the demands of the e-commerce market.

In addition to its operational improvements, UPS’s commitment to sustainability has also contributed to its recent financial success. As consumers become increasingly conscious of environmental issues, there is a growing demand for eco-friendly delivery options. UPS has responded to this trend by investing in alternative fuel vehicles and implementing sustainable practices across its operations. By aligning its business practices with the values of environmentally conscious consumers, UPS has enhanced its brand reputation and attracted a loyal customer base.

In conclusion, the end of UPS’s 10-quarter revenue miss streak can be largely attributed to the transformative impact of e-commerce on its business model. By embracing technological advancements, expanding its service offerings, and forming strategic partnerships, UPS has successfully navigated the challenges and opportunities presented by the e-commerce boom. As the e-commerce sector continues to grow, UPS is well-positioned to maintain its upward trajectory and capitalize on the evolving needs of online consumers.

UPS’s Competitive Edge: Innovations Driving Revenue Increases

United Parcel Service (UPS) has recently made headlines by ending its 10-quarter revenue miss streak, a development that has sent its stock surging. This remarkable turnaround can be attributed to a series of strategic innovations and operational enhancements that have fortified UPS’s competitive edge in the logistics and delivery industry. As the company navigates an increasingly complex market landscape, these innovations have not only driven revenue increases but also positioned UPS as a leader in adapting to the evolving demands of global commerce.

One of the key innovations that have contributed to UPS’s recent success is its investment in advanced technology. By leveraging cutting-edge data analytics and artificial intelligence, UPS has optimized its delivery routes and improved package tracking capabilities. This technological advancement has enabled the company to enhance its operational efficiency, reduce delivery times, and provide customers with real-time updates on their shipments. Consequently, these improvements have led to increased customer satisfaction and loyalty, which are crucial factors in driving revenue growth.

In addition to technological advancements, UPS has also focused on expanding its service offerings to meet the diverse needs of its clientele. The company has introduced new services such as same-day delivery and expanded its network of access points, allowing customers greater flexibility in sending and receiving packages. By catering to the growing demand for convenience and speed, UPS has successfully captured a larger share of the market, thereby boosting its revenue streams.

Moreover, UPS’s commitment to sustainability has played a significant role in enhancing its competitive edge. The company has made substantial investments in green technologies, such as electric delivery vehicles and alternative fuel sources, to reduce its carbon footprint. This commitment to environmental responsibility not only aligns with the values of an increasingly eco-conscious consumer base but also positions UPS as a forward-thinking leader in the logistics industry. As a result, the company’s sustainable practices have attracted environmentally-minded customers and partners, further contributing to its revenue growth.

Furthermore, UPS has strategically expanded its global footprint to tap into emerging markets and capitalize on international trade opportunities. By establishing a robust presence in key regions such as Asia and Latin America, UPS has been able to diversify its revenue streams and mitigate risks associated with economic fluctuations in any single market. This global expansion strategy has allowed the company to benefit from the rapid growth of e-commerce and cross-border trade, which have become significant drivers of revenue in recent years.

In conclusion, UPS’s ability to end its 10-quarter revenue miss streak and achieve a surge in stock value can be attributed to a combination of technological innovation, service expansion, sustainability initiatives, and global market penetration. These strategic moves have not only strengthened UPS’s competitive edge but also positioned the company for sustained growth in an ever-evolving industry. As UPS continues to adapt to the changing needs of its customers and the global market, its commitment to innovation and excellence will likely remain a driving force behind its ongoing success.

Investor Insights: What UPS’s Revenue Milestone Means for Shareholders

United Parcel Service (UPS) has recently achieved a significant milestone by ending its 10-quarter streak of revenue misses, a development that has sent its stock surging and captured the attention of investors. This achievement marks a pivotal moment for the logistics giant, signaling a potential turnaround in its financial performance and offering a renewed sense of optimism for shareholders. The implications of this revenue milestone are multifaceted, providing insights into the company’s strategic direction and its potential impact on shareholder value.

To begin with, the end of the revenue miss streak underscores UPS’s ability to adapt to the evolving demands of the global logistics market. Over the past few years, the company has faced numerous challenges, including fluctuating fuel prices, labor disputes, and increased competition from both traditional rivals and emerging e-commerce platforms. By successfully addressing these issues, UPS has demonstrated resilience and a capacity for strategic innovation. This adaptability is crucial for maintaining a competitive edge in an industry characterized by rapid technological advancements and shifting consumer expectations.

Moreover, the recent revenue success can be attributed to UPS’s strategic investments in technology and infrastructure. The company has been proactive in enhancing its operational efficiency through the integration of advanced technologies such as automation, artificial intelligence, and data analytics. These investments have not only streamlined operations but also improved delivery times and customer satisfaction. As a result, UPS has been able to capture a larger share of the growing e-commerce market, which has been a key driver of its recent revenue growth.

In addition to technological advancements, UPS’s focus on expanding its global footprint has played a significant role in its financial turnaround. The company has strategically entered new markets and strengthened its presence in existing ones, capitalizing on the increasing demand for cross-border logistics services. This expansion has allowed UPS to diversify its revenue streams and reduce its reliance on any single market, thereby enhancing its financial stability and growth prospects.

For shareholders, the end of the revenue miss streak is a promising sign of UPS’s potential for sustained growth and profitability. The recent surge in stock price reflects investor confidence in the company’s strategic direction and its ability to deliver value over the long term. Furthermore, the improved financial performance may lead to increased dividends and share buybacks, providing additional returns to shareholders.

However, it is important for investors to remain vigilant and consider potential risks that could impact UPS’s future performance. The logistics industry is inherently volatile, with factors such as geopolitical tensions, regulatory changes, and economic fluctuations posing potential challenges. Additionally, the competitive landscape continues to evolve, with new entrants and technological disruptions constantly reshaping the market dynamics.

In conclusion, UPS’s achievement in ending its 10-quarter revenue miss streak is a significant milestone that holds positive implications for shareholders. The company’s strategic investments in technology, infrastructure, and global expansion have positioned it well for future growth. While the recent stock surge reflects investor optimism, it is essential for shareholders to stay informed about industry trends and potential risks. By doing so, they can make informed decisions and capitalize on the opportunities presented by UPS’s evolving business landscape.

Future Outlook: Can UPS Sustain Its Revenue Growth Momentum?

United Parcel Service (UPS) recently broke its 10-quarter streak of revenue misses, a development that has sent its stock surging and captured the attention of investors and analysts alike. This achievement marks a significant turning point for the logistics giant, which has been grappling with various challenges over the past few years. As UPS celebrates this milestone, the focus now shifts to whether the company can sustain its revenue growth momentum in the future.

To understand the potential for continued growth, it is essential to examine the factors that contributed to UPS’s recent success. The company has been implementing strategic initiatives aimed at enhancing operational efficiency and expanding its service offerings. These efforts have included investments in technology to streamline logistics processes, as well as the expansion of its e-commerce capabilities to meet the growing demand for online shopping. By leveraging these advancements, UPS has been able to improve delivery times and customer satisfaction, which have been critical in driving revenue growth.

Moreover, UPS has been proactive in addressing the challenges posed by the global supply chain disruptions. By diversifying its supply chain and forging strategic partnerships, the company has managed to mitigate some of the risks associated with these disruptions. This adaptability has not only helped UPS maintain its service levels but has also positioned it as a reliable partner for businesses navigating the complexities of the current economic landscape.

However, sustaining this momentum will require UPS to navigate several potential headwinds. The logistics industry is highly competitive, with rivals constantly innovating to capture market share. To stay ahead, UPS must continue to invest in cutting-edge technologies and explore new markets. Additionally, the company will need to remain vigilant in managing costs, particularly in light of rising fuel prices and labor expenses, which could impact profitability.

Another critical factor in UPS’s future growth will be its ability to capitalize on emerging trends in the logistics sector. The rise of sustainable logistics, for instance, presents both challenges and opportunities. As consumers and businesses increasingly prioritize environmental responsibility, UPS will need to enhance its sustainability initiatives to meet these expectations. This could involve investing in electric vehicles, optimizing delivery routes to reduce emissions, and exploring alternative packaging solutions.

Furthermore, the ongoing digital transformation across industries presents a unique opportunity for UPS to expand its service offerings. By harnessing data analytics and artificial intelligence, the company can enhance its predictive capabilities, optimize supply chain operations, and offer more personalized services to its customers. This technological edge could prove invaluable in maintaining a competitive advantage and driving future revenue growth.

In conclusion, while UPS’s recent revenue success is a promising sign, the company must remain agile and forward-thinking to sustain its growth momentum. By continuing to innovate, manage costs effectively, and adapt to evolving market trends, UPS can position itself for long-term success. The path forward will undoubtedly present challenges, but with a strategic focus on leveraging technology and sustainability, UPS has the potential to not only maintain its current trajectory but also set new benchmarks in the logistics industry. As investors and stakeholders watch closely, the coming quarters will be crucial in determining whether UPS can build on its recent achievements and continue to deliver strong financial performance.

Q&A

1. **What was the recent financial performance of UPS?**

UPS ended its 10-quarter revenue miss streak, indicating a positive financial performance.

2. **How did the stock market react to UPS’s financial results?**

The stock surged following the announcement of the financial results.

3. **What does a “revenue miss streak” mean?**

A revenue miss streak refers to a period during which a company consistently reports revenue figures below analysts’ expectations.

4. **How many quarters did UPS miss revenue expectations before this change?**

UPS missed revenue expectations for 10 consecutive quarters before this change.

5. **What might have contributed to UPS ending its revenue miss streak?**

Potential factors could include improved operational efficiency, increased demand for services, or successful strategic initiatives.

6. **What impact does ending a revenue miss streak have on investor confidence?**

Ending a revenue miss streak can boost investor confidence, as it suggests the company is back on track with its financial goals.

7. **What are the implications of a stock surge for UPS?**

A stock surge can increase the company’s market valuation, attract more investors, and provide a positive outlook for future growth.

Conclusion

UPS recently ended its 10-quarter streak of revenue misses, leading to a significant surge in its stock price. This turnaround indicates a positive shift in the company’s financial performance, likely driven by strategic adjustments and improved operational efficiencies. The market’s favorable response reflects renewed investor confidence in UPS’s ability to meet or exceed revenue expectations, potentially signaling sustained growth and stability in the company’s future financial outlook.