“Newmont’s Profit Dips: Rising Costs and Nevada’s Decline Take a Toll”

Introduction

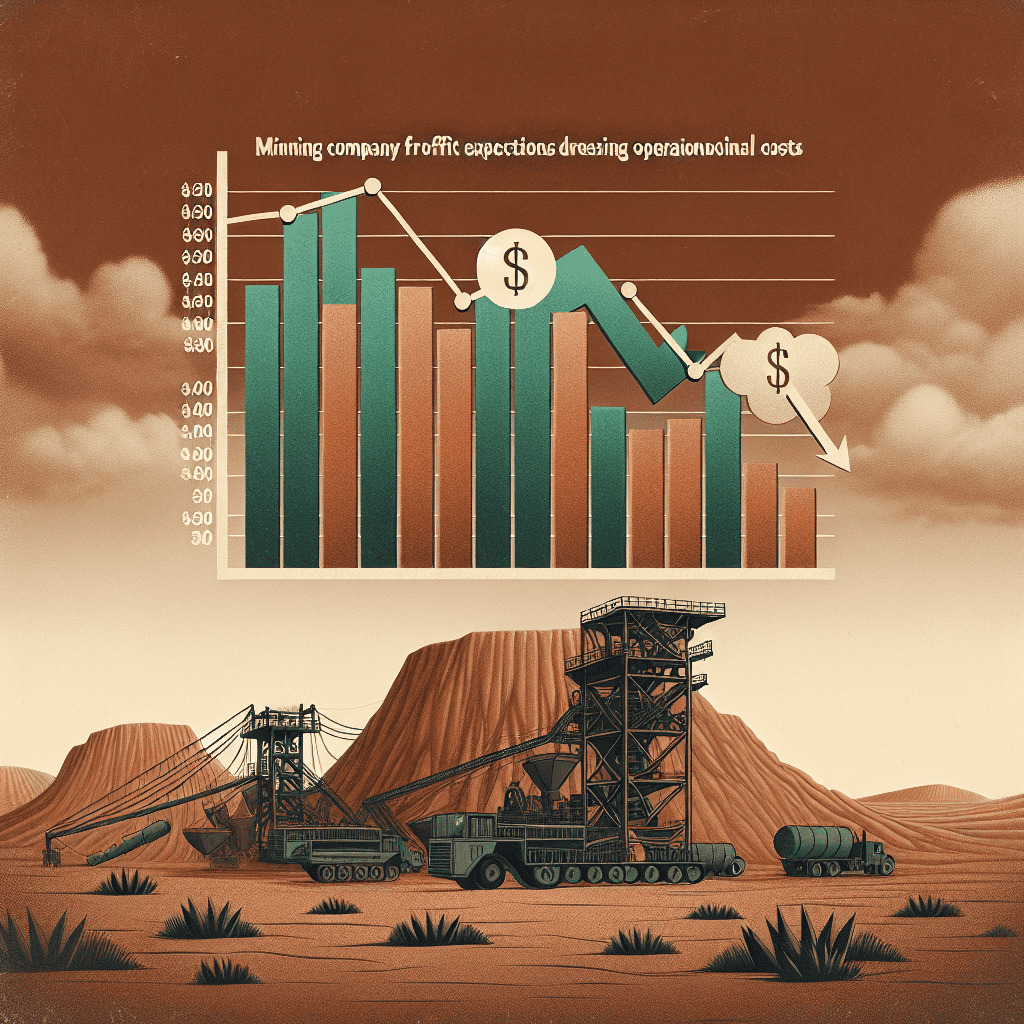

Newmont Corporation, a leading global gold producer, recently reported financial results that fell short of profit expectations, primarily due to escalating operational costs and a notable decline in production at its Nevada mining operations. The company, which has been navigating a challenging economic landscape marked by inflationary pressures and supply chain disruptions, faced increased expenses that eroded its profit margins. Additionally, a decrease in output from its Nevada mines, a significant contributor to Newmont’s overall production portfolio, further compounded the financial shortfall. This combination of rising costs and reduced production underscores the complex challenges facing the mining industry, as companies strive to balance operational efficiency with market demands.

Impact Of Rising Costs On Newmont’s Profit Margins

Newmont Corporation, one of the world’s leading gold producers, recently reported financial results that fell short of profit expectations, primarily due to rising operational costs and a decline in production at its Nevada operations. This development has raised concerns among investors and industry analysts, as the company grapples with the dual challenges of managing escalating expenses and optimizing production efficiency.

The impact of rising costs on Newmont’s profit margins cannot be overstated. In recent quarters, the mining industry has faced a surge in input costs, driven by a combination of factors including increased energy prices, higher labor expenses, and supply chain disruptions. For Newmont, these cost pressures have been particularly pronounced, as the company operates in diverse geographical locations, each with its own set of logistical and regulatory challenges. Consequently, the company’s ability to maintain its profit margins has been significantly hampered, as the cost of extracting and processing gold has risen more rapidly than anticipated.

Moreover, the decline in production at Newmont’s Nevada operations has further exacerbated the situation. Nevada, a key region for Newmont, has historically been a major contributor to the company’s overall output. However, recent operational challenges, including lower ore grades and technical difficulties, have led to a reduction in production volumes. This decline has not only affected Newmont’s revenue generation but has also increased the per-unit cost of production, as fixed costs are spread over a smaller output base. As a result, the company’s profitability has been squeezed from both ends, with rising costs and declining production creating a challenging financial environment.

In response to these challenges, Newmont has initiated several strategic measures aimed at mitigating the impact of rising costs and stabilizing production levels. The company is actively exploring opportunities to enhance operational efficiency through technological innovations and process improvements. By leveraging advanced mining technologies and optimizing resource allocation, Newmont aims to reduce its cost structure and improve productivity. Additionally, the company is focusing on strengthening its supply chain resilience to better manage external cost pressures and ensure a steady flow of essential inputs.

Furthermore, Newmont is committed to maintaining a disciplined approach to capital allocation, prioritizing investments that offer the highest potential returns. This includes a focus on high-quality assets and projects that align with the company’s long-term strategic objectives. By carefully managing its investment portfolio, Newmont seeks to enhance its competitive position and deliver sustainable value to its shareholders.

While the current challenges are significant, Newmont remains optimistic about its future prospects. The company continues to benefit from a robust balance sheet and a diversified asset base, which provide a solid foundation for navigating the complexities of the mining industry. Moreover, with gold prices remaining relatively strong, Newmont is well-positioned to capitalize on favorable market conditions once operational efficiencies are restored.

In conclusion, the impact of rising costs and declining Nevada production on Newmont’s profit margins underscores the importance of strategic adaptability in the mining sector. As the company works to address these challenges, its focus on operational efficiency, disciplined capital allocation, and technological innovation will be critical in ensuring long-term success. Investors and industry stakeholders will be closely monitoring Newmont’s progress as it strives to overcome these hurdles and achieve its financial and operational objectives.

Analyzing The Decline In Nevada Production At Newmont

Newmont Corporation, one of the world’s leading gold producers, recently reported earnings that fell short of market expectations, primarily due to rising operational costs and a notable decline in production from its Nevada operations. This development has raised concerns among investors and industry analysts, prompting a closer examination of the factors contributing to the decline in Nevada production and its broader implications for the company.

To begin with, Nevada has long been a cornerstone of Newmont’s mining operations, contributing significantly to its overall gold output. However, recent reports indicate a downturn in production levels, which can be attributed to several interrelated factors. One of the primary reasons for this decline is the depletion of high-grade ore reserves in some of Newmont’s key Nevada mines. As these reserves dwindle, the company is compelled to process lower-grade ore, which inherently yields less gold and requires more extensive processing efforts. Consequently, this shift not only reduces the volume of gold produced but also increases the cost per ounce, thereby impacting profitability.

In addition to ore grade challenges, Newmont has faced operational disruptions in Nevada due to regulatory and environmental considerations. The mining industry is subject to stringent regulations aimed at minimizing environmental impact, and compliance with these regulations can sometimes lead to delays or modifications in mining activities. For Newmont, navigating these regulatory landscapes has occasionally resulted in production slowdowns, further exacerbating the decline in output from its Nevada operations.

Moreover, the rising costs of labor and materials have compounded the challenges faced by Newmont in maintaining its production levels. The mining sector, like many others, has been affected by global supply chain disruptions and inflationary pressures, leading to increased expenses for essential inputs such as fuel, equipment, and skilled labor. These cost escalations have placed additional strain on Newmont’s operations, making it more difficult to achieve the desired profit margins.

Despite these challenges, Newmont is actively pursuing strategies to mitigate the impact of declining Nevada production on its overall performance. The company is investing in advanced technologies and innovative mining techniques to enhance efficiency and reduce costs. For instance, Newmont is exploring the use of automation and digitalization to optimize its mining processes, which could potentially offset some of the increased costs associated with lower-grade ore processing. Additionally, the company is focusing on expanding its exploration efforts to identify new high-grade ore deposits that could revitalize its Nevada operations.

Furthermore, Newmont is diversifying its portfolio by investing in mining projects outside of Nevada, thereby reducing its reliance on a single geographic region. This strategic shift not only helps in spreading risk but also positions the company to capitalize on opportunities in emerging mining regions with untapped potential.

In conclusion, while Newmont’s recent earnings report highlights the challenges posed by rising costs and declining Nevada production, the company is taking proactive measures to address these issues. By leveraging technology, exploring new opportunities, and diversifying its operations, Newmont aims to navigate the current landscape and sustain its position as a leading player in the global gold mining industry. As the company continues to adapt to evolving market conditions, its ability to effectively manage these challenges will be crucial in determining its future success.

Strategies For Newmont To Mitigate Rising Operational Costs

Newmont Corporation, a leading name in the gold mining industry, recently reported earnings that fell short of market expectations. This shortfall was primarily attributed to rising operational costs and a decline in production at its Nevada operations. As the company navigates these challenges, it becomes imperative to explore strategies that could help mitigate these rising costs and stabilize production levels. By implementing a combination of technological advancements, strategic partnerships, and sustainable practices, Newmont can potentially offset the financial pressures it currently faces.

To begin with, embracing technological innovation is a crucial step for Newmont. The mining industry is increasingly turning to automation and digitalization to enhance efficiency and reduce costs. By investing in advanced technologies such as autonomous vehicles, drones for site inspections, and real-time data analytics, Newmont can streamline its operations. These technologies not only improve safety and precision but also significantly cut down on labor and operational expenses. Moreover, the integration of artificial intelligence and machine learning can optimize resource allocation and predictive maintenance, thereby minimizing downtime and enhancing productivity.

In addition to technological advancements, forming strategic partnerships can provide Newmont with the necessary leverage to manage costs effectively. Collaborating with other mining companies or technology firms can lead to shared resources and expertise, resulting in cost savings. Joint ventures can also facilitate access to new markets and innovative technologies, which might otherwise be financially prohibitive. Furthermore, partnerships with local governments and communities can ensure smoother operations and reduce the risk of disruptions, which often lead to increased costs.

Another vital strategy is the adoption of sustainable practices. As environmental regulations become more stringent, mining companies are under pressure to reduce their carbon footprint and environmental impact. By investing in renewable energy sources such as solar or wind power, Newmont can decrease its reliance on fossil fuels, thereby reducing energy costs in the long run. Additionally, implementing water recycling and waste management systems can not only lower operational costs but also enhance the company’s reputation as a responsible corporate entity. This, in turn, can lead to increased investor confidence and potentially open up new funding opportunities.

Furthermore, optimizing supply chain management is another area where Newmont can achieve cost reductions. By analyzing and restructuring its supply chain, the company can identify inefficiencies and areas for improvement. This might involve renegotiating contracts with suppliers, consolidating shipments, or adopting just-in-time inventory practices. Such measures can lead to significant cost savings and improve the overall agility of the company’s operations.

Lastly, workforce management plays a critical role in controlling operational costs. By investing in employee training and development, Newmont can enhance workforce productivity and reduce turnover rates. A skilled and motivated workforce is more likely to contribute to efficient operations and innovative problem-solving. Additionally, fostering a culture of continuous improvement and open communication can lead to the identification of cost-saving opportunities from within the organization.

In conclusion, while Newmont faces challenges due to rising operational costs and declining production in Nevada, there are several strategies that can be employed to mitigate these issues. By leveraging technology, forming strategic partnerships, adopting sustainable practices, optimizing supply chain management, and focusing on workforce development, Newmont can position itself to overcome current obstacles and achieve long-term profitability. As the company implements these strategies, it will be better equipped to navigate the complexities of the modern mining landscape and continue its legacy as a leader in the industry.

The Role Of Commodity Prices In Newmont’s Financial Performance

Newmont Corporation, a leading name in the global mining industry, recently reported financial results that fell short of profit expectations, primarily due to rising operational costs and declining production in its Nevada operations. This development has brought to the forefront the significant role that commodity prices play in shaping the financial performance of mining companies like Newmont. As a company heavily reliant on the extraction and sale of precious metals, Newmont’s profitability is intricately linked to the fluctuating prices of commodities such as gold and copper. These prices are influenced by a myriad of factors, including global economic conditions, geopolitical tensions, and changes in supply and demand dynamics.

In recent months, the global economic landscape has been marked by uncertainty, with inflationary pressures and interest rate hikes affecting consumer spending and investment patterns. Such economic conditions have a direct impact on commodity prices, as investors often turn to gold as a safe-haven asset during times of financial instability. However, while gold prices have seen some upward movement, the increase has not been sufficient to offset the rising costs that Newmont has been grappling with. The company has faced higher expenses related to labor, energy, and raw materials, all of which have eroded profit margins.

Moreover, Newmont’s operations in Nevada, a key region for its gold production, have experienced a decline in output. This reduction in production can be attributed to several factors, including the depletion of high-grade ore reserves and operational challenges that have hindered efficiency. As a result, the company has been unable to capitalize fully on the potential benefits of any favorable shifts in commodity prices. The interplay between production levels and commodity prices is crucial; even when prices are favorable, reduced production can limit revenue generation and, consequently, profitability.

Furthermore, the volatility of commodity prices adds another layer of complexity to Newmont’s financial performance. Prices can fluctuate significantly over short periods, influenced by speculative trading and macroeconomic indicators. This volatility necessitates strategic planning and risk management to mitigate potential adverse effects on financial outcomes. Newmont, like many of its peers, employs hedging strategies to manage price risks, but these measures can only provide partial insulation against market fluctuations.

In addition to external economic factors, Newmont’s financial performance is also shaped by its internal strategies and operational efficiencies. The company has been investing in technological advancements and sustainable practices to enhance productivity and reduce costs. However, the benefits of these initiatives may take time to materialize fully, and in the interim, the company must navigate the challenges posed by current market conditions.

In conclusion, the recent shortfall in Newmont’s profit expectations underscores the critical role that commodity prices play in the financial performance of mining companies. While rising costs and declining production have been significant contributors to the company’s recent challenges, the broader context of commodity price fluctuations cannot be overlooked. As Newmont continues to adapt to the evolving economic environment, its ability to manage costs, optimize production, and strategically respond to commodity price trends will be pivotal in determining its future financial success. The intricate balance between these factors will remain a focal point for stakeholders as they assess the company’s prospects in an ever-changing market landscape.

Future Outlook For Newmont Amidst Current Challenges

Newmont Corporation, one of the world’s leading gold producers, recently reported earnings that fell short of market expectations, primarily due to rising operational costs and a decline in production at its Nevada operations. This development has prompted analysts and investors to reassess the company’s future outlook amidst these current challenges. As the mining industry grapples with fluctuating commodity prices and increasing environmental regulations, Newmont’s ability to navigate these hurdles will be crucial in determining its long-term success.

The company’s recent financial performance has been impacted by several factors, with rising costs being a significant concern. Inflationary pressures have led to increased expenses in labor, energy, and raw materials, which have collectively eroded profit margins. Additionally, supply chain disruptions have further exacerbated cost challenges, making it difficult for Newmont to maintain its previous levels of profitability. These issues are not unique to Newmont, as the entire mining sector is experiencing similar headwinds. However, Newmont’s strategic response to these challenges will be pivotal in shaping its future trajectory.

Compounding these cost-related issues is the decline in production at Newmont’s Nevada operations, which has traditionally been a cornerstone of the company’s output. The reduction in production can be attributed to a combination of factors, including lower ore grades and operational inefficiencies. As a result, Newmont has been unable to capitalize fully on the recent uptick in gold prices, which would have otherwise provided a buffer against rising costs. To address this, the company is exploring various strategies to enhance operational efficiency and optimize its asset portfolio. This includes investing in technology and innovation to improve mining processes and reduce waste.

Looking ahead, Newmont’s future outlook will largely depend on its ability to adapt to these evolving challenges. The company has already initiated several measures aimed at cost control and operational improvement. For instance, Newmont is focusing on streamlining its operations and implementing cost-saving initiatives across its global portfolio. By leveraging technology and data analytics, the company aims to enhance decision-making processes and improve overall efficiency. Furthermore, Newmont is committed to sustainable mining practices, which not only align with regulatory requirements but also resonate with the growing demand for environmentally responsible operations.

In addition to internal measures, Newmont’s future prospects will also be influenced by external factors such as global economic conditions and commodity market dynamics. The ongoing geopolitical tensions and economic uncertainties could impact gold prices, thereby affecting Newmont’s revenue streams. However, gold’s status as a safe-haven asset may provide some stability amidst market volatility. Moreover, Newmont’s diversified asset base and strategic partnerships position it well to capitalize on potential growth opportunities in emerging markets.

In conclusion, while Newmont faces significant challenges due to rising costs and declining production in Nevada, the company’s proactive approach to addressing these issues offers a glimpse of optimism for the future. By focusing on operational efficiency, cost management, and sustainable practices, Newmont is well-positioned to navigate the current landscape and emerge stronger. As the mining industry continues to evolve, Newmont’s ability to adapt and innovate will be key to maintaining its leadership position and delivering value to its stakeholders.

Comparing Newmont’s Performance With Industry Peers

In the ever-evolving landscape of the mining industry, Newmont Corporation, one of the world’s leading gold producers, recently reported financial results that fell short of market expectations. This underperformance can be attributed to a combination of rising operational costs and a notable decline in production from its Nevada operations. As investors and analysts scrutinize these results, it becomes essential to compare Newmont’s performance with that of its industry peers to gain a comprehensive understanding of the company’s current standing.

To begin with, Newmont’s recent financial disclosures highlighted a significant increase in production costs, which have been a growing concern across the mining sector. The company faced escalating expenses related to labor, energy, and raw materials, all of which have been exacerbated by global inflationary pressures. These rising costs have not only impacted Newmont but have also been a common theme among its competitors. For instance, Barrick Gold, another major player in the industry, has similarly reported increased operational expenses, although it has managed to mitigate some of these impacts through strategic cost management initiatives.

Moreover, Newmont’s production decline in Nevada, a key region for the company, has further compounded its challenges. The Nevada operations, which have historically been a cornerstone of Newmont’s production portfolio, experienced lower output due to a combination of technical difficulties and regulatory hurdles. This decline stands in contrast to some of Newmont’s peers, such as Agnico Eagle Mines, which have successfully ramped up production in other regions to offset similar challenges. Agnico Eagle’s ability to diversify its production base has allowed it to maintain a more stable output, thereby providing a buffer against localized production issues.

In addition to these operational challenges, Newmont’s financial performance has also been influenced by fluctuating gold prices. While gold prices have generally remained robust, providing a favorable backdrop for mining companies, the volatility in the market has necessitated agile financial strategies. Companies like Kinross Gold have demonstrated resilience by employing hedging strategies to protect against price swings, thereby stabilizing their revenue streams. In contrast, Newmont’s approach has been more conservative, which, while reducing risk, has also limited its ability to capitalize on price surges.

Furthermore, when comparing Newmont’s recent performance with its peers, it is important to consider the strategic initiatives undertaken by these companies to navigate the current economic environment. For example, companies such as AngloGold Ashanti have invested heavily in technological advancements and sustainability initiatives, which have not only improved operational efficiency but also enhanced their market reputation. Newmont, while also committed to sustainability, has faced criticism for not advancing these initiatives as aggressively as some of its competitors.

In conclusion, Newmont’s recent financial results underscore the challenges faced by the mining industry as a whole, characterized by rising costs and production hurdles. However, when compared to its peers, Newmont’s performance reveals both areas of concern and opportunities for improvement. By examining the strategies employed by its competitors, Newmont can glean valuable insights into cost management, production diversification, and strategic planning. As the company navigates these turbulent times, its ability to adapt and innovate will be crucial in maintaining its position as a leader in the global mining industry.

Investor Reactions To Newmont’s Profit Shortfall

In the wake of Newmont Corporation’s recent announcement regarding its profit shortfall, investor reactions have been notably mixed, reflecting a complex interplay of factors influencing the mining giant’s financial performance. The company’s latest earnings report revealed that rising operational costs and declining production in Nevada have significantly impacted its bottom line, leading to profits that fell short of market expectations. This development has prompted a range of responses from investors, who are now reassessing their positions and strategies concerning Newmont’s stock.

To begin with, the increase in operational costs has been a primary concern for investors. The mining industry, by its very nature, is heavily reliant on a variety of resources, including labor, energy, and equipment. In recent months, these costs have surged due to a combination of global supply chain disruptions and inflationary pressures. For Newmont, this has translated into higher expenses that have eroded profit margins. Investors, particularly those with a keen eye on cost management, have expressed apprehension about the company’s ability to control these rising expenses in the near term. Consequently, some have opted to reduce their holdings, fearing that continued cost pressures could further impact profitability.

Moreover, the decline in production from Newmont’s Nevada operations has added another layer of complexity to the situation. Nevada, known for its rich mineral deposits, has historically been a cornerstone of Newmont’s production portfolio. However, recent operational challenges, including regulatory hurdles and technical difficulties, have led to a decrease in output. This decline has not only affected revenue streams but has also raised questions about the company’s long-term production strategy. Investors are particularly concerned about whether Newmont can effectively address these issues and restore production levels to their previous highs. As a result, some investors are adopting a wait-and-see approach, closely monitoring the company’s efforts to resolve these challenges.

Despite these concerns, it is important to note that not all investor reactions have been negative. Some investors remain optimistic about Newmont’s future prospects, citing the company’s strong asset base and strategic initiatives aimed at enhancing operational efficiency. They argue that while the current challenges are significant, Newmont possesses the resources and expertise necessary to navigate these difficulties successfully. Furthermore, the company’s commitment to sustainable mining practices and its focus on innovation are seen as positive indicators of its long-term growth potential. These investors are choosing to maintain or even increase their positions, viewing the current dip in profits as a temporary setback rather than a fundamental flaw in the company’s business model.

In addition, the broader context of the global mining industry cannot be overlooked. Commodity prices, particularly for gold, have experienced volatility, influenced by macroeconomic factors such as interest rates and geopolitical tensions. For investors with a diversified portfolio, Newmont’s performance is often evaluated in relation to these broader market trends. Some investors are taking a holistic view, considering Newmont’s challenges as part of the cyclical nature of the mining industry, and are therefore less inclined to make hasty decisions based solely on short-term profit fluctuations.

In conclusion, investor reactions to Newmont’s profit shortfall have been varied, reflecting a spectrum of perspectives on the company’s current challenges and future potential. While rising costs and declining Nevada production have undoubtedly raised concerns, there remains a contingent of investors who are confident in Newmont’s ability to overcome these obstacles. As the company works to address these issues, investor sentiment will likely continue to evolve, shaped by both internal developments and external market conditions.

Q&A

1. **What company is the article about?**

Newmont Corporation.

2. **What financial metric did Newmont fall short on?**

Profit expectations.

3. **What were the main reasons for Newmont’s profit shortfall?**

Rising costs and declining production in Nevada.

4. **Which geographic location is specifically mentioned as having declining production?**

Nevada.

5. **What industry does Newmont operate in?**

Mining, specifically gold mining.

6. **How might rising costs impact a mining company’s profitability?**

Increased operational expenses can reduce profit margins.

7. **What could be a potential consequence of declining production for Newmont?**

Reduced revenue and potential challenges in meeting market demand.

Conclusion

Newmont’s recent financial performance has been adversely impacted by rising operational costs and a decline in production at its Nevada operations, leading to profits falling short of expectations. The increased costs, likely driven by inflationary pressures and supply chain challenges, have eroded profit margins. Simultaneously, the reduced output from Nevada, a significant contributor to Newmont’s overall production, has further compounded the company’s financial challenges. This combination of higher expenses and lower production underscores the need for strategic adjustments to manage costs effectively and optimize production processes to enhance profitability in future quarters.