“Navigating the Unpredictable: Presidential Terms and Stock Market Surprises Since 1933”

Introduction

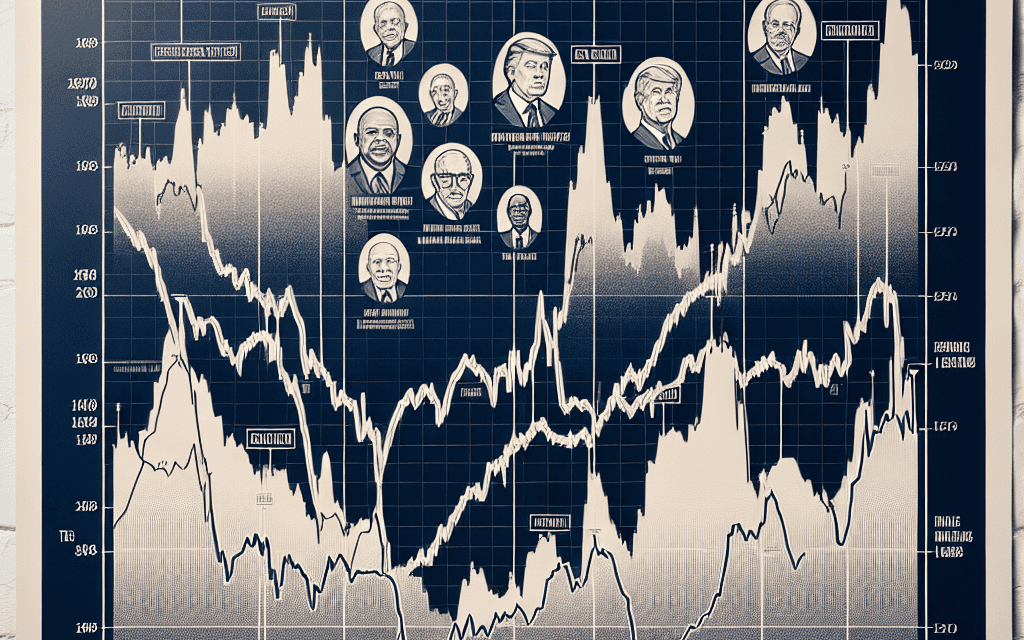

Since 1933, the relationship between U.S. presidential terms and stock market trends has been a subject of considerable interest and analysis. Historically, the stock market has often been influenced by the economic policies and political climate associated with different administrations. While some patterns have emerged, such as the tendency for markets to perform differently under Democratic and Republican leadership, there have been notable exceptions that defy conventional expectations. These exceptions highlight the complexity of market dynamics and the multitude of factors that can influence stock performance, including global events, technological advancements, and unforeseen economic challenges. Understanding these anomalies provides valuable insights into the intricate interplay between political leadership and financial markets, offering a nuanced perspective on how presidential terms can impact economic trajectories.

Impact Of The Great Depression On Presidential Terms And Stock Market Trends

The Great Depression, a severe worldwide economic downturn that began in 1929 and lasted through the late 1930s, had profound effects on the United States, influencing both presidential terms and stock market trends. As the nation grappled with unprecedented economic challenges, the interplay between political leadership and market performance became increasingly significant. Since 1933, the year Franklin D. Roosevelt assumed the presidency, there have been notable exceptions to the typical patterns observed in the relationship between presidential terms and stock market trends.

Franklin D. Roosevelt’s presidency marked a pivotal shift in the U.S. economic landscape. Taking office during the depths of the Great Depression, Roosevelt implemented the New Deal, a series of programs and reforms aimed at revitalizing the economy. This period saw a remarkable recovery in the stock market, with the Dow Jones Industrial Average experiencing substantial gains. However, the recovery was not linear, as the market faced volatility and setbacks, such as the recession of 1937-1938. Despite these fluctuations, Roosevelt’s leadership is often credited with stabilizing the economy and restoring public confidence, illustrating how presidential policies can significantly impact market trends.

Transitioning to the post-World War II era, the U.S. economy entered a period of robust growth, often referred to as the “Golden Age of Capitalism.” During this time, the stock market generally thrived, reflecting the nation’s economic expansion. However, there were exceptions, such as the bear market of 1966-1982, which spanned the presidencies of Lyndon B. Johnson, Richard Nixon, Gerald Ford, and Jimmy Carter. This prolonged period of market stagnation and high inflation, known as “stagflation,” challenged the conventional wisdom that economic growth would consistently accompany presidential terms. The complex interplay of domestic policies, global events, and market forces during this time underscores the multifaceted nature of the relationship between political leadership and stock market performance.

In more recent history, the presidencies of George W. Bush and Barack Obama provide further examples of notable exceptions. The early 2000s were marked by the bursting of the dot-com bubble and the September 11 attacks, leading to a recession and a turbulent stock market during Bush’s first term. The subsequent recovery was interrupted by the 2008 financial crisis, one of the most severe economic downturns since the Great Depression. This crisis, which began in the final year of Bush’s presidency and continued into Obama’s first term, resulted in significant market declines and required substantial government intervention to stabilize the financial system. The eventual recovery, aided by policies such as the Troubled Asset Relief Program (TARP) and the American Recovery and Reinvestment Act, demonstrated the critical role of presidential leadership in navigating economic crises and influencing market trends.

Throughout these periods, it becomes evident that while presidential terms often coincide with certain stock market trends, there are notable exceptions driven by a myriad of factors. Economic policies, global events, and unforeseen crises can all disrupt expected patterns, highlighting the complexity of predicting market behavior based solely on political leadership. As history has shown, the relationship between U.S. presidential terms and stock market trends is not always straightforward, with each era presenting unique challenges and opportunities that shape the economic landscape. Understanding these exceptions provides valuable insights into the dynamic interplay between politics and economics, offering lessons for future leaders and investors alike.

Franklin D. Roosevelt’s New Deal And Its Influence On The Stock Market

Franklin D. Roosevelt’s presidency, beginning in 1933, marked a pivotal era in American history, not only politically but also economically. The New Deal, a series of programs and policies implemented by Roosevelt, aimed to provide relief, recovery, and reform in the wake of the Great Depression. This ambitious agenda had profound implications for the U.S. stock market, which had been devastated by the 1929 crash and the subsequent economic downturn. Understanding the influence of the New Deal on the stock market requires an examination of the specific measures introduced and their broader economic impact.

When Roosevelt assumed office, the U.S. economy was in dire straits, with unemployment rates soaring and industrial production plummeting. The stock market, a barometer of economic health, had lost nearly 90% of its value from its 1929 peak. In response, the New Deal sought to restore confidence and stimulate economic activity through a combination of financial reforms, public works projects, and social welfare programs. One of the first significant steps was the Emergency Banking Act, which aimed to stabilize the banking system by closing insolvent banks and reorganizing those that could be saved. This measure helped restore public confidence, leading to a gradual recovery in stock prices as investors regained trust in the financial system.

Moreover, the Securities Act of 1933 and the Securities Exchange Act of 1934 were instrumental in regulating the stock market. These acts established the Securities and Exchange Commission (SEC), which was tasked with enforcing federal securities laws and ensuring transparency and fairness in the market. By curbing fraudulent practices and mandating disclosure of financial information, these regulations helped create a more stable and trustworthy environment for investors. Consequently, the stock market began to recover, reflecting the increased confidence in the regulatory framework.

In addition to financial reforms, the New Deal’s emphasis on public works projects played a crucial role in revitalizing the economy. Programs such as the Civilian Conservation Corps (CCC) and the Public Works Administration (PWA) provided employment to millions, thereby increasing consumer spending and stimulating demand for goods and services. This boost in economic activity had a positive effect on corporate earnings, which in turn supported higher stock prices. The increased government spending also contributed to a more favorable investment climate, as businesses anticipated improved economic conditions.

However, it is important to note that the recovery was not without its challenges. The stock market experienced volatility during Roosevelt’s first two terms, partly due to policy shifts and external factors. For instance, the decision to scale back government spending in 1937 led to a recession, causing a temporary setback in the market’s recovery. Nevertheless, the overall trajectory during Roosevelt’s presidency was one of gradual improvement, with the stock market regaining much of its lost ground by the end of his second term.

In conclusion, Franklin D. Roosevelt’s New Deal had a significant and lasting impact on the U.S. stock market. Through a combination of financial reforms, regulatory measures, and economic stimulus programs, the New Deal helped restore confidence and set the stage for a sustained recovery. While challenges remained, the policies implemented during this period laid the groundwork for a more resilient financial system and demonstrated the potential for government intervention to stabilize and invigorate the economy. As such, Roosevelt’s presidency serves as a notable exception in the historical relationship between U.S. presidential terms and stock market trends, illustrating the complex interplay between policy and market dynamics.

The Post-War Economic Boom Under Harry Truman And Dwight Eisenhower

The post-war economic boom in the United States, spanning the presidencies of Harry Truman and Dwight Eisenhower, represents a significant period in American history, marked by substantial economic growth and notable stock market trends. This era, beginning in the mid-1940s and extending into the late 1950s, was characterized by a unique set of circumstances that contributed to a robust economic expansion, setting the stage for future prosperity.

Following the conclusion of World War II, the United States emerged as a global economic powerhouse. The war had stimulated industrial production and technological advancements, which, in turn, laid the groundwork for post-war economic growth. Under President Harry Truman, who assumed office in 1945, the nation faced the challenge of transitioning from a wartime to a peacetime economy. Despite initial concerns about potential economic downturns, the U.S. economy experienced a remarkable period of expansion. This growth was fueled by several factors, including increased consumer demand, a burgeoning middle class, and significant government investment in infrastructure and housing.

During Truman’s presidency, the stock market reflected this economic optimism. The Dow Jones Industrial Average, a key indicator of market performance, saw substantial gains. The post-war period was marked by a surge in consumer spending, driven by pent-up demand and the availability of new consumer goods. This consumer-driven growth was further supported by the G.I. Bill, which provided returning veterans with access to education and affordable housing, thereby stimulating economic activity.

As Truman’s presidency gave way to that of Dwight Eisenhower in 1953, the economic boom continued unabated. Eisenhower’s administration prioritized fiscal responsibility and infrastructure development, most notably through the Federal-Aid Highway Act of 1956, which led to the creation of the Interstate Highway System. This massive infrastructure project not only created jobs but also facilitated commerce and mobility, further bolstering economic growth.

Under Eisenhower, the stock market continued its upward trajectory, reflecting the sustained economic prosperity of the era. The 1950s were characterized by low inflation, rising incomes, and increased consumer confidence. The stock market benefited from these favorable conditions, with investors showing a strong appetite for equities. The period also saw the rise of institutional investors, such as pension funds, which contributed to the stock market’s growth.

However, it is important to note that this era was not without its challenges. The economy faced periodic recessions, and there were concerns about income inequality and the sustainability of growth. Despite these challenges, the overall economic environment remained positive, and the stock market continued to perform well.

In conclusion, the post-war economic boom under Presidents Harry Truman and Dwight Eisenhower was a period of significant economic growth and stock market expansion. This era was characterized by a confluence of factors, including increased consumer demand, government investment, and technological advancements, which collectively contributed to a robust economic environment. While there were challenges along the way, the overall trajectory of the economy and the stock market during this period was one of growth and prosperity, setting a precedent for future economic developments in the United States.

The Stock Market During The Turbulent 1970s: Nixon, Ford, And Carter

The 1970s were a tumultuous decade for the United States, marked by significant political, economic, and social upheavals. This period also witnessed notable fluctuations in the stock market, influenced by the presidencies of Richard Nixon, Gerald Ford, and Jimmy Carter. Understanding the stock market trends during these years requires an examination of the broader economic context and the specific policies implemented by these administrations.

Richard Nixon’s presidency, beginning in 1969, was initially characterized by a continuation of the economic prosperity of the 1960s. However, the early 1970s soon brought challenges that would significantly impact the stock market. The United States faced rising inflation, partly due to increased government spending on the Vietnam War and social programs. In response, Nixon implemented a series of economic measures, including wage and price controls in 1971, which temporarily stabilized the economy but ultimately led to distortions in the market. The stock market, initially buoyed by these controls, soon faced volatility as the measures proved unsustainable.

The situation worsened with the onset of the 1973 oil crisis, triggered by an embargo by the Organization of Arab Petroleum Exporting Countries (OAPEC). This event led to skyrocketing oil prices, exacerbating inflation and contributing to a period of economic stagnation known as “stagflation.” The stock market reacted negatively, with the Dow Jones Industrial Average experiencing significant declines. Nixon’s resignation in 1974 amid the Watergate scandal further eroded investor confidence, leading to a bear market that persisted into the early years of Gerald Ford’s presidency.

Gerald Ford, who assumed the presidency in August 1974, inherited an economy in distress. His administration focused on combating inflation, which remained a pressing issue. Ford introduced the “Whip Inflation Now” (WIN) campaign, encouraging voluntary measures to curb inflation, but it had limited success. The stock market continued to struggle, reflecting the broader economic challenges. However, Ford’s tenure also saw some recovery, as his administration implemented tax cuts and deregulation efforts aimed at stimulating growth. By the end of Ford’s presidency in 1977, the stock market had begun to stabilize, although it remained below its pre-crisis levels.

Jimmy Carter’s presidency, beginning in 1977, faced similar economic challenges. Inflation persisted, driven by high energy prices and rising costs of goods. Carter’s administration attempted to address these issues through a combination of monetary restraint and energy policy reforms. However, these measures had mixed results, and the stock market remained volatile. The late 1970s saw another oil crisis in 1979, further complicating economic recovery efforts. Despite these challenges, Carter’s presidency also laid the groundwork for future economic reforms, including deregulation in industries such as transportation and finance.

Throughout the 1970s, the stock market’s performance was closely tied to the broader economic conditions and the policies of the Nixon, Ford, and Carter administrations. While each president faced unique challenges, common themes of inflation, energy crises, and political uncertainty influenced market trends. The decade serves as a reminder of the complex interplay between political leadership and economic forces, highlighting the importance of adaptive policy responses in navigating turbulent times. As investors and policymakers reflect on this period, the lessons learned continue to inform strategies for managing economic volatility in the present day.

Ronald Reagan’s Economic Policies And The 1980s Bull Market

Ronald Reagan’s presidency, spanning from 1981 to 1989, is often associated with a significant bull market that characterized much of the 1980s. This period of economic expansion and stock market growth is frequently attributed to Reagan’s economic policies, which were collectively known as “Reaganomics.” These policies were grounded in supply-side economics, emphasizing tax cuts, deregulation, and a reduction in government spending. As a result, they played a pivotal role in shaping the economic landscape of the United States during the decade.

To understand the impact of Reagan’s policies on the stock market, it is essential to consider the economic context of the early 1980s. When Reagan assumed office in January 1981, the U.S. economy was grappling with stagflation—a combination of high inflation and stagnant economic growth. The Federal Reserve, under Chairman Paul Volcker, had already begun implementing tight monetary policies to combat inflation, which had reached double-digit levels. These measures, while necessary, initially led to a recession in the early 1980s, causing unemployment to rise and economic output to contract.

In response to these challenges, Reagan implemented a series of tax cuts, most notably the Economic Recovery Tax Act of 1981, which aimed to stimulate economic growth by reducing the marginal tax rates for individuals and businesses. The rationale behind these tax cuts was to increase disposable income for consumers and incentivize investment by businesses, thereby fostering economic expansion. Additionally, Reagan’s administration pursued a policy of deregulation, particularly in industries such as telecommunications, transportation, and finance, which further encouraged competition and innovation.

As the decade progressed, the combination of these fiscal policies and the Federal Reserve’s successful efforts to control inflation began to bear fruit. By the mid-1980s, the U.S. economy was experiencing robust growth, with GDP expanding at an impressive rate. This economic resurgence was mirrored in the stock market, which entered a prolonged bull phase. The Dow Jones Industrial Average, a key indicator of stock market performance, more than tripled during Reagan’s presidency, reflecting investor confidence in the economic policies of the time.

However, it is important to note that while Reagan’s policies contributed to the bull market, they were not the sole factors at play. The technological advancements of the era, particularly in computing and telecommunications, also played a significant role in driving economic growth and stock market gains. Moreover, the global economic environment, characterized by increased trade and investment flows, provided additional impetus for the U.S. economy.

Despite the overall success of Reagan’s economic policies, they were not without criticism. Critics argued that the tax cuts disproportionately benefited the wealthy and contributed to a growing income inequality. Additionally, the increase in military spending during Reagan’s tenure led to a significant rise in the federal budget deficit, raising concerns about fiscal sustainability.

In conclusion, Ronald Reagan’s presidency and the economic policies he championed were instrumental in shaping the stock market trends of the 1980s. While his approach to economic management was not without controversy, the period of sustained economic growth and stock market expansion that occurred during his time in office remains a notable exception in the historical relationship between U.S. presidential terms and stock market performance. As such, the 1980s bull market serves as a compelling case study in understanding the complex interplay between government policy and financial markets.

The Dot-Com Bubble And Bill Clinton’s Presidency

The relationship between U.S. presidential terms and stock market trends has long been a subject of interest for economists, investors, and historians alike. While many factors influence market performance, the policies and economic conditions during a president’s tenure can have significant impacts. One notable period that exemplifies this dynamic is the presidency of Bill Clinton, which coincided with the rise and fall of the dot-com bubble. This era provides a compelling case study of how technological innovation, investor behavior, and economic policy can intersect to create both unprecedented growth and dramatic downturns in the stock market.

Bill Clinton’s presidency, spanning from 1993 to 2001, was marked by a period of substantial economic expansion. During this time, the United States experienced one of the longest peacetime economic booms in its history. A key driver of this growth was the rapid advancement of technology, particularly the internet, which gave rise to the dot-com bubble. The proliferation of internet-based companies led to a surge in stock prices, as investors were eager to capitalize on the potential of this new digital frontier. The Nasdaq Composite Index, heavily weighted with technology stocks, saw an extraordinary increase, more than quadrupling in value from 1995 to 2000.

However, the exuberance surrounding internet stocks was not solely due to technological innovation. Clinton’s economic policies also played a role in shaping the market environment. His administration focused on fiscal discipline, resulting in budget surpluses by the end of his second term. Additionally, the Federal Reserve, under Chairman Alan Greenspan, maintained relatively low interest rates, which encouraged borrowing and investment. These factors contributed to a favorable economic climate that further fueled investor optimism and risk-taking.

Despite the initial success, the dot-com bubble eventually burst, leading to a significant market correction. By the early 2000s, it became apparent that many internet companies were overvalued, with business models that were unsustainable in the long term. As a result, stock prices plummeted, and the Nasdaq Composite lost nearly 80% of its value from its peak in March 2000 to October 2002. This downturn had widespread implications, affecting not only investors but also the broader economy, as it led to a slowdown in growth and a rise in unemployment.

The collapse of the dot-com bubble serves as a reminder of the inherent volatility in stock markets and the risks associated with speculative investment. It also highlights the complex interplay between government policy, technological advancement, and market dynamics. While Clinton’s presidency is often remembered for its economic prosperity, the subsequent market correction underscores the challenges of sustaining growth in an environment driven by rapid innovation and investor speculation.

In conclusion, the dot-com bubble during Bill Clinton’s presidency illustrates a notable exception in the historical relationship between U.S. presidential terms and stock market trends. It demonstrates how periods of economic expansion can be accompanied by significant market volatility, particularly when fueled by technological change and speculative investment. As we reflect on this era, it is essential to consider the lessons learned and the importance of balancing innovation with prudent economic policy to ensure sustainable growth in the future.

The 2008 Financial Crisis: George W. Bush And Barack Obama’s Responses

The 2008 financial crisis stands as one of the most significant economic downturns in recent history, profoundly impacting global markets and economies. As the crisis unfolded, the responses of U.S. Presidents George W. Bush and Barack Obama were pivotal in shaping the trajectory of the recovery. Understanding their approaches provides insight into how presidential actions can influence stock market trends, even amidst severe economic turmoil.

In the final months of George W. Bush’s presidency, the financial crisis reached its peak. The collapse of major financial institutions, such as Lehman Brothers, sent shockwaves through the global economy, leading to a severe liquidity crunch. In response, the Bush administration took decisive action to stabilize the financial system. One of the most significant measures was the Emergency Economic Stabilization Act of 2008, which established the Troubled Asset Relief Program (TARP). This program authorized the U.S. Treasury to purchase distressed assets and inject capital into banks, aiming to restore confidence in the financial system. Although controversial, TARP was instrumental in preventing a complete collapse of the banking sector.

As the crisis continued to unfold, the transition to Barack Obama’s presidency marked a shift in focus from immediate stabilization to long-term recovery. Upon taking office in January 2009, President Obama faced the daunting task of reviving an economy in recession. His administration swiftly enacted the American Recovery and Reinvestment Act (ARRA), a $787 billion stimulus package designed to spur economic growth. The ARRA included tax cuts, infrastructure spending, and aid to state and local governments, all intended to boost demand and create jobs. This comprehensive approach aimed to address both the symptoms and root causes of the economic downturn.

The stock market, which had plummeted during the height of the crisis, began to show signs of recovery as these measures took effect. The coordinated efforts of both administrations, along with actions by the Federal Reserve, helped to stabilize financial markets and restore investor confidence. By March 2009, the stock market had reached its lowest point, but it soon embarked on a sustained upward trajectory. This recovery was not solely attributable to government intervention; however, the policies implemented by Bush and Obama played a crucial role in setting the stage for economic revival.

While the responses of both presidents were instrumental in addressing the crisis, it is important to recognize the broader context in which these actions took place. The global nature of the financial crisis meant that international cooperation was essential. Central banks around the world coordinated efforts to provide liquidity and support financial institutions, further bolstering market confidence. Additionally, the crisis prompted significant regulatory reforms, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act, aimed at preventing future financial instability.

In conclusion, the 2008 financial crisis and the subsequent responses by Presidents George W. Bush and Barack Obama highlight the complex interplay between presidential actions and stock market trends. While their approaches differed in focus and scope, both administrations contributed to stabilizing the financial system and fostering economic recovery. This period serves as a notable exception in the historical relationship between U.S. presidential terms and stock market performance, demonstrating the profound impact of policy decisions during times of economic crisis.

Q&A

1. **Question:** Which U.S. President served during the Great Depression and saw significant stock market recovery?

**Answer:** Franklin D. Roosevelt served during the Great Depression, and the stock market saw significant recovery during his terms starting in 1933.

2. **Question:** Which President’s term is associated with the stock market crash of 1987?

**Answer:** Ronald Reagan was the U.S. President during the stock market crash of 1987.

3. **Question:** During which President’s term did the dot-com bubble burst, affecting the stock market?

**Answer:** The dot-com bubble burst during Bill Clinton’s second term and continued into George W. Bush’s presidency.

4. **Question:** Which President’s term saw the stock market crash of 2008?

**Answer:** The stock market crash of 2008 occurred during George W. Bush’s presidency.

5. **Question:** Under which President did the stock market experience a significant bull run starting in 2009?

**Answer:** The significant bull run starting in 2009 occurred under Barack Obama’s presidency.

6. **Question:** Which President’s term included the COVID-19 pandemic’s initial impact on the stock market in 2020?

**Answer:** The initial impact of the COVID-19 pandemic on the stock market in 2020 occurred during Donald Trump’s presidency.

7. **Question:** Which President’s term saw the end of the Bretton Woods system, affecting global markets?

**Answer:** Richard Nixon’s presidency saw the end of the Bretton Woods system in 1971, affecting global markets.

Conclusion

Since 1933, the relationship between U.S. presidential terms and stock market trends has generally followed a pattern where markets tend to perform better during certain phases of the presidential cycle, often influenced by economic policies, geopolitical events, and broader economic conditions. However, notable exceptions have occurred, such as during the Great Depression, World War II, the stagflation of the 1970s, the dot-com bubble burst in the early 2000s, and the financial crisis of 2008. These exceptions highlight that while political leadership can influence market sentiment and policy direction, external economic factors and global events often play a more significant role in shaping market outcomes. Thus, while there is some correlation between presidential terms and market performance, it is not a definitive predictor, and investors should consider a wide range of factors when assessing market trends.