“Coinbase Challenges the System: Battling Unseen Forces in the Crypto Arena”

Introduction

In a recent development, Coinbase, one of the leading cryptocurrency exchanges, has publicly accused the U.S. Securities and Exchange Commission (SEC) and the Federal Deposit Insurance Corporation (FDIC) of engaging in unfair market interference. The allegations center around what Coinbase perceives as regulatory overreach and inconsistent enforcement actions that hinder innovation and competition within the burgeoning digital asset industry. Coinbase argues that the SEC’s lack of clear guidelines and the FDIC’s stringent requirements are stifling the growth of cryptocurrency platforms, creating an uneven playing field that favors traditional financial institutions. This confrontation highlights the ongoing tension between regulatory bodies and the rapidly evolving crypto sector, raising critical questions about the future of digital currency regulation in the United States.

Overview Of Coinbase’s Allegations Against The SEC And FDIC

In recent developments, Coinbase, one of the leading cryptocurrency exchanges in the United States, has raised significant concerns regarding the actions of the Securities and Exchange Commission (SEC) and the Federal Deposit Insurance Corporation (FDIC). The company has accused these regulatory bodies of engaging in unfair market interference, which it claims is stifling innovation and growth within the burgeoning cryptocurrency sector. This accusation comes at a time when the regulatory landscape for digital assets is under intense scrutiny, with various stakeholders debating the appropriate level of oversight required to ensure market stability while fostering innovation.

Coinbase’s allegations primarily focus on what it perceives as inconsistent and unclear regulatory guidelines from the SEC. The company argues that the SEC’s approach to cryptocurrency regulation has been marked by ambiguity, leading to a challenging environment for businesses operating in the space. This lack of clarity, Coinbase contends, has resulted in a chilling effect on innovation, as companies are hesitant to develop new products or services without a clear understanding of the regulatory framework. Furthermore, Coinbase asserts that the SEC’s enforcement actions have been selective and unpredictable, creating an uneven playing field that disadvantages certain market participants.

In addition to its concerns about the SEC, Coinbase has also taken issue with the FDIC’s role in the cryptocurrency market. The company claims that the FDIC has been slow to adapt its policies to accommodate the unique characteristics of digital assets, thereby hindering the ability of cryptocurrency firms to offer services that are comparable to those provided by traditional financial institutions. Coinbase argues that this reluctance to evolve has placed unnecessary constraints on the industry, limiting its potential to provide consumers with innovative financial solutions.

To support its claims, Coinbase points to several instances where it believes the SEC and FDIC have overstepped their regulatory mandates. For example, the company highlights recent enforcement actions taken by the SEC against other cryptocurrency firms, which it argues were based on outdated interpretations of securities laws that do not adequately account for the nuances of digital assets. Similarly, Coinbase criticizes the FDIC for its cautious approach to insuring cryptocurrency-related deposits, which it believes has deterred banks from engaging with the sector.

In response to these perceived injustices, Coinbase has called for a more collaborative approach to regulation, one that involves open dialogue between regulators and industry participants. The company advocates for the establishment of clear, consistent guidelines that provide a roadmap for compliance while allowing for the flexibility needed to accommodate the rapid pace of technological advancement. By fostering a regulatory environment that encourages innovation, Coinbase believes that the United States can maintain its position as a global leader in the cryptocurrency space.

While the allegations made by Coinbase have sparked a heated debate, they also underscore the broader challenges facing the cryptocurrency industry as it seeks to navigate an evolving regulatory landscape. As digital assets continue to gain mainstream acceptance, the need for a balanced approach to regulation becomes increasingly apparent. It remains to be seen how the SEC and FDIC will respond to Coinbase’s accusations, but the outcome of this dispute could have far-reaching implications for the future of cryptocurrency regulation in the United States. Ultimately, finding a middle ground that protects consumers while promoting innovation will be crucial in shaping the trajectory of this dynamic and rapidly evolving industry.

The Impact Of Regulatory Actions On Cryptocurrency Markets

In recent years, the cryptocurrency market has experienced significant growth, attracting both individual and institutional investors. However, this burgeoning sector has also faced increasing scrutiny from regulatory bodies, leading to a complex interplay between innovation and regulation. A notable development in this ongoing saga is Coinbase’s recent accusation against the U.S. Securities and Exchange Commission (SEC) and the Federal Deposit Insurance Corporation (FDIC) of unfair market interference. This accusation highlights the broader impact of regulatory actions on cryptocurrency markets, raising questions about the balance between protecting investors and fostering innovation.

Coinbase, one of the largest cryptocurrency exchanges in the United States, has been at the forefront of advocating for clearer regulatory frameworks. The company’s recent allegations against the SEC and FDIC stem from what it perceives as inconsistent and opaque regulatory practices. Coinbase argues that these practices not only hinder its operations but also stifle the growth of the entire cryptocurrency ecosystem. By accusing these regulatory bodies of unfair market interference, Coinbase seeks to draw attention to the challenges faced by crypto businesses in navigating the current regulatory landscape.

The SEC, tasked with protecting investors and maintaining fair markets, has taken a cautious approach to cryptocurrency regulation. Its actions, such as classifying certain digital assets as securities, have significant implications for how these assets are traded and managed. While the SEC’s intent is to safeguard investors from potential fraud and market manipulation, its regulatory measures have often been criticized for lacking clarity. This ambiguity can create an environment of uncertainty, deterring innovation and investment in the cryptocurrency space.

Similarly, the FDIC’s role in ensuring the stability of the financial system has led it to scrutinize the involvement of traditional banks with cryptocurrency businesses. The FDIC’s cautious stance is driven by concerns over the volatility and perceived risks associated with digital assets. However, this approach can inadvertently limit the ability of banks to engage with the cryptocurrency market, potentially stifling the development of new financial products and services that could benefit consumers.

The impact of these regulatory actions extends beyond individual companies like Coinbase. The broader cryptocurrency market is affected by the uncertainty and potential restrictions imposed by regulatory bodies. Investors, both retail and institutional, may be hesitant to enter the market due to fears of sudden regulatory changes that could affect the value and legality of their investments. This hesitancy can lead to reduced liquidity and slower market growth, ultimately impacting the overall adoption of cryptocurrencies.

Moreover, the global nature of the cryptocurrency market means that regulatory actions in one jurisdiction can have ripple effects worldwide. As countries develop their own regulatory frameworks, inconsistencies between jurisdictions can create challenges for companies operating across borders. This patchwork of regulations can lead to increased compliance costs and operational complexities, further complicating the landscape for cryptocurrency businesses.

In conclusion, the accusations made by Coinbase against the SEC and FDIC underscore the significant impact that regulatory actions can have on the cryptocurrency market. While the intent of these regulatory bodies is to protect investors and ensure market stability, their actions can also create challenges for innovation and growth. As the cryptocurrency market continues to evolve, finding a balance between regulation and innovation will be crucial. Clear and consistent regulatory frameworks are essential to fostering a healthy and dynamic cryptocurrency ecosystem that can thrive while safeguarding the interests of all stakeholders involved.

Analyzing The Legal Grounds Of Coinbase’s Accusations

In recent developments, Coinbase, one of the leading cryptocurrency exchanges, has leveled serious accusations against the United States Securities and Exchange Commission (SEC) and the Federal Deposit Insurance Corporation (FDIC), alleging unfair market interference. This situation has sparked significant debate within the financial and legal communities, as it raises critical questions about the regulatory landscape governing digital assets. To understand the legal grounds of Coinbase’s accusations, it is essential to delve into the intricate relationship between cryptocurrency platforms and regulatory bodies, as well as the specific grievances Coinbase has articulated.

At the heart of Coinbase’s allegations is the assertion that the SEC and FDIC have overstepped their regulatory boundaries, thereby stifling innovation and competition within the burgeoning cryptocurrency market. Coinbase argues that the SEC’s approach to regulating digital assets has been inconsistent and lacks clarity, creating an environment of uncertainty that hampers the growth of legitimate businesses. This claim is rooted in the broader debate over whether cryptocurrencies should be classified as securities, a determination that significantly impacts how they are regulated. The SEC has historically taken a cautious stance, often opting to evaluate digital assets on a case-by-case basis, which Coinbase contends leads to arbitrary enforcement actions that disadvantage certain market participants.

Moreover, Coinbase’s accusations extend to the FDIC, which it claims has engaged in practices that unfairly limit the ability of cryptocurrency exchanges to operate on a level playing field with traditional financial institutions. The FDIC’s role in insuring deposits at banks and savings institutions is well-established, but its involvement in the cryptocurrency sector is less clear-cut. Coinbase argues that the FDIC’s reluctance to extend similar protections to digital asset platforms creates a competitive imbalance, as consumers may perceive traditional banks as safer options due to the presence of federal insurance. This perception, Coinbase suggests, undermines consumer confidence in cryptocurrency exchanges and stifles their potential to innovate and expand.

Transitioning to the legal framework, Coinbase’s accusations are grounded in the principles of administrative law, which governs the actions of federal agencies. Central to this legal discourse is the Administrative Procedure Act (APA), which requires agencies to follow certain procedures when creating regulations and to provide clear guidance to the entities they regulate. Coinbase contends that both the SEC and FDIC have failed to adhere to these principles, resulting in a regulatory environment that is both unpredictable and detrimental to the cryptocurrency industry. By invoking the APA, Coinbase seeks to challenge the legitimacy of the regulatory actions taken by these agencies, arguing that they have not provided adequate notice or opportunity for public comment on their policies regarding digital assets.

Furthermore, Coinbase’s legal strategy may involve questioning the statutory authority of the SEC and FDIC to regulate cryptocurrencies in the manner they have. This line of argument hinges on the interpretation of existing financial laws, such as the Securities Act of 1933 and the Federal Deposit Insurance Act, and whether these statutes were intended to encompass digital assets. Coinbase’s position is that without explicit congressional authorization, the SEC and FDIC are overreaching in their attempts to regulate the cryptocurrency market.

In conclusion, Coinbase’s accusations against the SEC and FDIC highlight the ongoing tension between innovation and regulation in the cryptocurrency space. As this legal battle unfolds, it will likely have far-reaching implications for the future of digital asset regulation, potentially prompting legislative action to clarify the roles and responsibilities of federal agencies in this rapidly evolving sector.

How Market Interference Affects Crypto Innovation

Coinbase, one of the leading cryptocurrency exchanges, has recently raised concerns about what it perceives as unfair market interference by the U.S. Securities and Exchange Commission (SEC) and the Federal Deposit Insurance Corporation (FDIC). This accusation highlights a growing tension between regulatory bodies and the burgeoning cryptocurrency industry, which is striving to innovate and expand within a framework that is often seen as restrictive and outdated. The implications of such interference are profound, as they not only affect the operations of individual companies like Coinbase but also have broader ramifications for the entire crypto ecosystem.

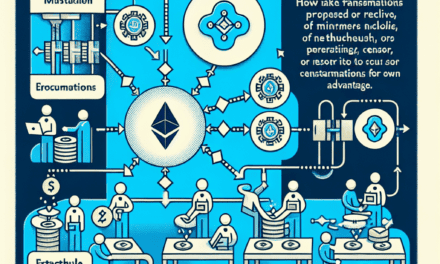

To understand the impact of regulatory interference on crypto innovation, it is essential to first consider the nature of the cryptocurrency market. Unlike traditional financial systems, cryptocurrencies operate on decentralized networks, which are designed to be transparent, secure, and free from centralized control. This decentralization is a core tenet of the crypto ethos, promoting innovation by allowing developers to experiment with new technologies and financial models. However, the regulatory landscape has struggled to keep pace with these rapid advancements, often applying traditional financial regulations to a fundamentally different system.

Coinbase’s allegations against the SEC and FDIC center around the notion that these agencies are imposing regulations that stifle innovation rather than fostering a conducive environment for growth. For instance, the SEC’s approach to classifying certain cryptocurrencies as securities has led to significant legal ambiguity. This uncertainty can deter investment and innovation, as companies may be hesitant to develop new products or services that could later be deemed non-compliant. Furthermore, the FDIC’s stance on insuring crypto-related assets has also been a point of contention, as it limits the ability of crypto companies to offer services that are comparable to those provided by traditional financial institutions.

The impact of such regulatory actions extends beyond individual companies, affecting the entire crypto industry. When regulatory bodies impose stringent requirements, they inadvertently create barriers to entry for smaller startups that lack the resources to navigate complex legal landscapes. This can lead to a concentration of power among a few large players, stifling competition and reducing the diversity of ideas and solutions in the market. Moreover, excessive regulation can drive innovation offshore, as companies seek jurisdictions with more favorable regulatory environments. This not only hampers domestic growth but also risks the U.S. losing its competitive edge in the global crypto market.

In response to these challenges, there is a growing call within the industry for a more nuanced regulatory approach that recognizes the unique characteristics of cryptocurrencies. Proponents argue for a framework that balances the need for consumer protection and market integrity with the flexibility to accommodate innovation. Such an approach would involve open dialogue between regulators and industry stakeholders, fostering a collaborative environment where regulations are informed by a deep understanding of the technology and its potential.

In conclusion, the accusations by Coinbase against the SEC and FDIC underscore a critical issue facing the cryptocurrency industry: the need for regulatory frameworks that support rather than hinder innovation. As the crypto market continues to evolve, it is imperative that regulatory bodies adapt to these changes, ensuring that their actions do not inadvertently stifle the very innovation that has the potential to transform the financial landscape. By fostering a regulatory environment that encourages growth and experimentation, the U.S. can position itself as a leader in the global crypto economy, reaping the benefits of this transformative technology.

The Role Of The SEC And FDIC In Cryptocurrency Regulation

In recent years, the rapid growth of the cryptocurrency market has prompted increased scrutiny from regulatory bodies, particularly in the United States. Among these, the Securities and Exchange Commission (SEC) and the Federal Deposit Insurance Corporation (FDIC) have emerged as key players in shaping the regulatory landscape for digital assets. However, this involvement has not been without controversy. Coinbase, one of the largest cryptocurrency exchanges in the world, has recently accused these agencies of unfair market interference, raising questions about the role and approach of the SEC and FDIC in cryptocurrency regulation.

To understand the crux of Coinbase’s allegations, it is essential to first examine the responsibilities of the SEC and FDIC. The SEC is primarily tasked with protecting investors, maintaining fair and efficient markets, and facilitating capital formation. In the context of cryptocurrencies, the SEC has focused on determining whether certain digital assets qualify as securities, thereby subjecting them to federal securities laws. Meanwhile, the FDIC’s role is to maintain stability and public confidence in the nation’s financial system, which includes overseeing the safety and soundness of financial institutions. As cryptocurrencies increasingly intersect with traditional banking, the FDIC’s involvement has grown, particularly concerning the protection of consumer deposits linked to digital assets.

Coinbase’s accusations center on what it perceives as inconsistent and overreaching actions by these agencies. The company argues that the SEC has adopted an overly broad interpretation of securities laws, applying them to a wide range of digital assets without clear guidelines. This, Coinbase contends, creates an uncertain regulatory environment that stifles innovation and deters investment in the cryptocurrency sector. Furthermore, Coinbase claims that the SEC’s enforcement actions often lack transparency, leaving market participants in the dark about compliance expectations.

In addition to its grievances with the SEC, Coinbase has also expressed concerns about the FDIC’s approach to cryptocurrency regulation. The exchange argues that the FDIC’s cautionary stance on digital assets, particularly regarding the insurance of deposits linked to cryptocurrencies, has led to confusion among consumers and financial institutions alike. Coinbase asserts that this has resulted in a fragmented regulatory framework that hinders the integration of cryptocurrencies into the broader financial system.

Despite these criticisms, it is important to recognize the challenges faced by the SEC and FDIC in regulating a rapidly evolving and complex market. Cryptocurrencies, by their very nature, defy traditional categorizations, making it difficult for regulators to apply existing legal frameworks. Moreover, the decentralized and global nature of digital assets presents unique risks, including fraud, market manipulation, and cybersecurity threats, which necessitate vigilant oversight.

Nevertheless, the concerns raised by Coinbase highlight the need for a more coherent and collaborative regulatory approach. As the cryptocurrency market continues to mature, it is crucial for regulatory bodies to engage with industry stakeholders to develop clear and consistent guidelines that balance innovation with investor protection. This could involve the establishment of dedicated regulatory frameworks for digital assets, as well as increased dialogue between regulators and market participants to address emerging challenges.

In conclusion, while the SEC and FDIC play vital roles in safeguarding the financial system, their approach to cryptocurrency regulation has sparked significant debate. Coinbase’s accusations of unfair market interference underscore the complexities and tensions inherent in regulating a nascent industry. Moving forward, a more nuanced and cooperative regulatory strategy will be essential to fostering a thriving and secure cryptocurrency ecosystem.

Potential Outcomes Of Coinbase’s Dispute With Regulators

Coinbase’s recent allegations against the U.S. Securities and Exchange Commission (SEC) and the Federal Deposit Insurance Corporation (FDIC) have sparked significant debate within the financial and regulatory communities. The cryptocurrency exchange accuses these regulatory bodies of unfair market interference, a claim that could have far-reaching implications for the future of digital asset regulation in the United States. As the dispute unfolds, it is crucial to consider the potential outcomes and their impact on the broader cryptocurrency market.

To begin with, one possible outcome of Coinbase’s dispute with the SEC and FDIC is a legal battle that could set a precedent for how cryptocurrencies are regulated in the future. If Coinbase decides to pursue litigation, the courts may be tasked with interpreting existing securities laws in the context of digital assets. This could lead to a landmark decision that clarifies the regulatory framework for cryptocurrencies, providing much-needed guidance for other market participants. Such a decision could either affirm the SEC’s current approach to regulating digital assets or compel the agency to revise its policies to better accommodate the unique characteristics of cryptocurrencies.

Moreover, the dispute could prompt legislative action aimed at addressing the regulatory ambiguity surrounding digital assets. Lawmakers may see this conflict as an opportunity to introduce new legislation that clearly defines the roles and responsibilities of regulatory agencies in overseeing the cryptocurrency market. This could result in a more cohesive regulatory environment that balances the need for investor protection with the desire to foster innovation in the rapidly evolving digital asset space. However, the legislative process can be slow and contentious, and there is no guarantee that any proposed bills would gain the necessary support to become law.

In addition to potential legal and legislative outcomes, the dispute may also influence the behavior of other cryptocurrency exchanges and market participants. If Coinbase’s allegations gain traction, other exchanges may become more vocal in their criticism of regulatory practices, potentially leading to a broader industry push for reform. This collective pressure could encourage regulators to engage in more open dialogue with the industry, fostering a collaborative approach to developing a regulatory framework that supports both innovation and consumer protection.

On the other hand, if Coinbase’s claims are dismissed or fail to gain significant support, the SEC and FDIC may feel emboldened to continue their current regulatory strategies. This could result in increased enforcement actions against other cryptocurrency exchanges and market participants, potentially stifling innovation and driving some companies to relocate to more crypto-friendly jurisdictions. Such an outcome could have a chilling effect on the U.S. cryptocurrency market, hindering its growth and competitiveness on the global stage.

Furthermore, the outcome of this dispute could have implications for investor confidence in the cryptocurrency market. A resolution that favors Coinbase may reassure investors that the regulatory environment is becoming more accommodating to digital assets, potentially attracting more capital to the market. Conversely, a resolution that upholds the current regulatory approach could deter some investors, particularly those who are wary of the perceived risks associated with regulatory uncertainty.

In conclusion, the potential outcomes of Coinbase’s dispute with the SEC and FDIC are varied and complex, with each scenario carrying its own set of implications for the cryptocurrency market. As this situation continues to develop, stakeholders across the industry will be closely monitoring the proceedings, eager to understand how the resolution of this conflict will shape the future of digital asset regulation in the United States.

Public And Industry Reactions To Coinbase’s Claims Against The SEC And FDIC

In recent developments, Coinbase, one of the leading cryptocurrency exchanges, has publicly accused the U.S. Securities and Exchange Commission (SEC) and the Federal Deposit Insurance Corporation (FDIC) of engaging in unfair market interference. This bold assertion has sparked a wide array of reactions from both the public and industry stakeholders, highlighting the complex dynamics at play in the rapidly evolving cryptocurrency landscape. As Coinbase’s claims reverberate through the financial world, they have ignited a debate over regulatory practices and the future of digital currencies.

To begin with, the public’s response to Coinbase’s allegations has been mixed. On one hand, cryptocurrency enthusiasts and advocates have rallied behind Coinbase, viewing the company’s stance as a necessary pushback against what they perceive as overreach by regulatory bodies. These supporters argue that the SEC and FDIC’s actions stifle innovation and hinder the growth of a burgeoning industry that promises to revolutionize financial systems. They contend that regulatory clarity is essential, but it should not come at the expense of innovation and market freedom.

Conversely, skeptics of the cryptocurrency market have expressed support for the regulatory agencies, emphasizing the need for oversight to protect investors and maintain market stability. They argue that the volatile nature of cryptocurrencies necessitates a robust regulatory framework to prevent fraud, money laundering, and other illicit activities. For these individuals, Coinbase’s accusations are seen as an attempt to circumvent necessary regulations that ensure the integrity of financial markets.

Within the industry, reactions have been equally varied. Some companies and industry leaders have echoed Coinbase’s concerns, calling for a more balanced approach to regulation that fosters innovation while safeguarding investors. They argue that the current regulatory environment is ambiguous and inconsistent, creating uncertainty that hampers the industry’s growth. These stakeholders advocate for a collaborative dialogue between regulators and industry participants to establish clear guidelines that promote both innovation and consumer protection.

On the other hand, certain industry players have distanced themselves from Coinbase’s claims, emphasizing the importance of compliance with existing regulations. These companies argue that adherence to regulatory standards is crucial for gaining legitimacy and trust in the eyes of both investors and the general public. They caution against framing regulatory efforts as interference, suggesting instead that constructive engagement with regulators is the path forward for the cryptocurrency industry.

As the debate unfolds, it is evident that Coinbase’s accusations have brought to the forefront the ongoing tension between innovation and regulation in the cryptocurrency space. The discourse surrounding these claims underscores the need for a nuanced approach to regulation that balances the interests of various stakeholders. While the path forward remains uncertain, it is clear that the resolution of this issue will have significant implications for the future of cryptocurrencies and their integration into the broader financial system.

In conclusion, Coinbase’s allegations against the SEC and FDIC have sparked a diverse range of reactions from the public and industry alike. As the conversation continues, it is crucial for all parties involved to engage in open dialogue and work towards a regulatory framework that supports innovation while ensuring market integrity. The outcome of this debate will undoubtedly shape the trajectory of the cryptocurrency industry and its role in the global economy.

Q&A

1. **What is the main accusation Coinbase has made against the SEC and FDIC?**

Coinbase has accused the SEC and FDIC of unfair market interference, claiming that these agencies are hindering its business operations and stifling innovation in the cryptocurrency sector.

2. **Why does Coinbase believe the SEC’s actions are unfair?**

Coinbase argues that the SEC’s regulatory approach lacks clarity and consistency, creating an uncertain environment that makes it difficult for crypto companies to operate and comply with regulations.

3. **What specific actions by the SEC are being criticized by Coinbase?**

Coinbase criticizes the SEC for its enforcement actions and for not providing clear guidelines on how existing securities laws apply to cryptocurrencies, which Coinbase believes leads to arbitrary and unpredictable enforcement.

4. **How has the FDIC been involved in Coinbase’s accusations?**

Coinbase has accused the FDIC of contributing to market interference by not providing clear guidance on how crypto assets should be treated under existing banking regulations, which affects partnerships with traditional financial institutions.

5. **What impact does Coinbase claim these actions have on the crypto market?**

Coinbase claims that the actions of the SEC and FDIC create a chilling effect on innovation, deter investment, and limit the growth potential of the cryptocurrency market in the United States.

6. **Has Coinbase taken any legal action against the SEC or FDIC?**

As of the latest reports, Coinbase has not initiated legal action but has been vocal in its criticism and has engaged in lobbying efforts to push for clearer regulatory frameworks.

7. **What solutions or changes is Coinbase advocating for?**

Coinbase is advocating for clearer and more consistent regulatory guidelines, a collaborative approach between regulators and the crypto industry, and the establishment of a regulatory framework that supports innovation while ensuring consumer protection.

Conclusion

Coinbase’s accusation against the SEC and FDIC of unfair market interference highlights ongoing tensions between cryptocurrency platforms and regulatory bodies. The company argues that these agencies are overstepping their bounds, potentially stifling innovation and growth within the crypto industry. This conflict underscores the broader debate over how digital assets should be regulated, balancing consumer protection with fostering technological advancement. The outcome of this dispute could significantly impact the regulatory landscape for cryptocurrencies in the United States, setting precedents for how digital financial services are governed.