“Unlocking the Power: Understanding Hashrate’s Role in Securing the Bitcoin Network”

Introduction

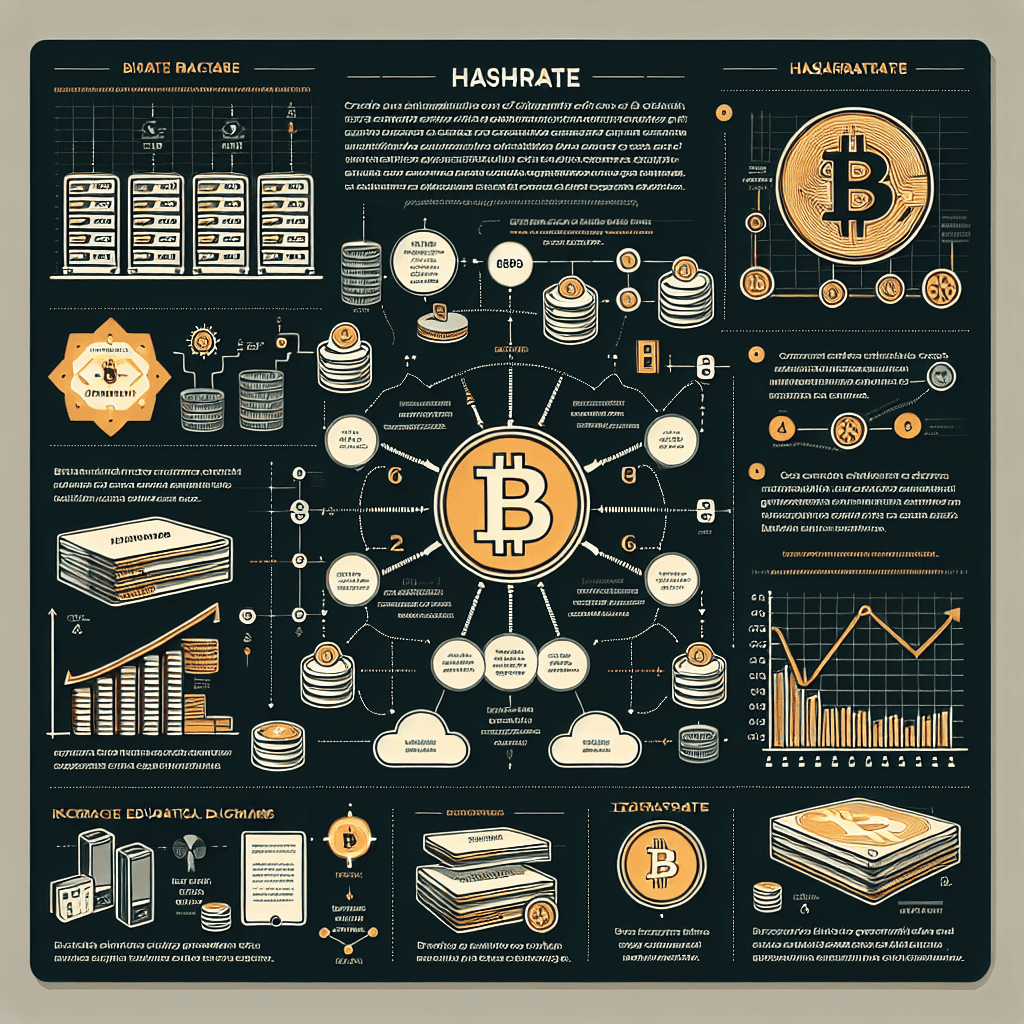

Hashrate, a fundamental concept within the realm of cryptocurrency, plays a pivotal role in the functioning and security of the Bitcoin network. It refers to the computational power used to mine and process transactions on the blockchain. Essentially, hashrate measures the number of hash operations performed by miners per second as they compete to solve complex mathematical puzzles. This process is crucial for validating and adding new blocks to the blockchain, ensuring the integrity and immutability of the network. A higher hashrate signifies a more secure and efficient network, as it becomes increasingly difficult for malicious actors to manipulate the blockchain. Moreover, hashrate is a key indicator of the network’s health and miner participation, influencing factors such as mining difficulty and block generation time. Understanding hashrate is essential for grasping the dynamics of Bitcoin mining and its impact on the broader cryptocurrency ecosystem.

Understanding Hashrate: The Backbone of Bitcoin Mining

In the realm of cryptocurrency, particularly within the Bitcoin network, the term “hashrate” frequently emerges as a pivotal concept. Understanding hashrate is essential for comprehending the intricate processes that underpin Bitcoin mining, as it serves as the backbone of this decentralized digital currency system. At its core, hashrate refers to the computational power used to mine and process transactions on the Bitcoin network. It is measured in hashes per second (H/s), indicating how many calculations a miner can perform in one second. The higher the hashrate, the more calculations can be completed, enhancing the likelihood of successfully mining a block and receiving the associated rewards.

To appreciate the significance of hashrate, one must first grasp the fundamentals of Bitcoin mining. Mining is the process by which new bitcoins are introduced into circulation and transactions are verified and added to the public ledger, known as the blockchain. Miners use powerful computers to solve complex mathematical problems, and the first to solve the problem gets to add a new block to the blockchain, receiving a reward in bitcoins. This process is not only competitive but also energy-intensive, requiring substantial computational power, which is where hashrate becomes crucial.

The importance of hashrate extends beyond individual miners to the overall security and efficiency of the Bitcoin network. A higher hashrate indicates a more secure network, as it would require a significant amount of computational power to alter any part of the blockchain. This security is vital in maintaining the integrity of the decentralized system, preventing malicious actors from gaining control over the network. Moreover, a robust hashrate ensures that transactions are processed swiftly, maintaining the network’s efficiency and reliability.

Furthermore, the hashrate is a dynamic metric, influenced by various factors such as technological advancements, energy costs, and market conditions. As technology evolves, more efficient mining hardware is developed, increasing the hashrate. However, this also means that miners must continuously upgrade their equipment to remain competitive. Additionally, fluctuations in energy prices can impact the profitability of mining operations, thereby affecting the overall hashrate. Market conditions, including the price of Bitcoin, also play a role; when Bitcoin’s value rises, more miners are incentivized to join the network, boosting the hashrate.

It is also worth noting that the hashrate is closely linked to Bitcoin’s difficulty adjustment mechanism. The network adjusts the difficulty of mining approximately every two weeks to ensure that blocks are mined at a consistent rate, roughly every ten minutes. If the hashrate increases, the difficulty level rises, making it harder to mine new blocks. Conversely, if the hashrate decreases, the difficulty level drops, facilitating easier mining. This self-regulating mechanism is crucial for maintaining the stability and predictability of the Bitcoin network.

In conclusion, the hashrate is a fundamental component of the Bitcoin network, serving as a measure of computational power and a key determinant of security and efficiency. Its dynamic nature reflects the ever-evolving landscape of Bitcoin mining, influenced by technological, economic, and market factors. Understanding hashrate provides valuable insights into the operational dynamics of Bitcoin, highlighting its role as the backbone of this revolutionary digital currency system. As the cryptocurrency ecosystem continues to evolve, the significance of hashrate will undoubtedly remain a central focus for miners, investors, and enthusiasts alike.

How Hashrate Influences Bitcoin Network Security

In the realm of cryptocurrency, particularly within the Bitcoin network, the concept of hashrate plays a pivotal role in maintaining the system’s integrity and security. To understand how hashrate influences Bitcoin network security, it is essential to first grasp what hashrate actually represents. Hashrate refers to the computational power used to mine and process transactions on the Bitcoin blockchain. It is measured in hashes per second (H/s) and indicates how many calculations a miner can perform in a given time frame. The higher the hashrate, the more attempts a miner can make to solve the cryptographic puzzles that validate transactions and add new blocks to the blockchain.

The significance of hashrate in the Bitcoin network cannot be overstated, as it directly correlates with the network’s security. A higher hashrate means that more computational power is being dedicated to processing transactions and securing the network. This increased power makes it more difficult for any single entity to gain control over the network, thereby reducing the risk of a 51% attack. In such an attack, a malicious actor would need to control more than half of the network’s total hashrate to manipulate transactions or double-spend coins. Therefore, a robust hashrate acts as a deterrent against potential attacks, ensuring that the network remains decentralized and secure.

Moreover, the hashrate is also indicative of the network’s health and miner confidence. When the hashrate is high, it suggests that miners are investing in more powerful hardware and are confident in the network’s future. This confidence is crucial because it encourages further investment and participation in the network, which in turn enhances its security. Conversely, a declining hashrate might signal a lack of confidence or profitability, potentially leading to reduced security as fewer miners participate in the network.

In addition to its role in security, hashrate also influences the difficulty adjustment mechanism of the Bitcoin network. Approximately every two weeks, the network adjusts the difficulty of mining new blocks to ensure that blocks are added at a consistent rate, roughly every ten minutes. If the hashrate increases, the difficulty level rises to maintain this block time, and if the hashrate decreases, the difficulty level lowers. This self-regulating mechanism ensures that the network remains stable and secure, regardless of fluctuations in mining power.

Furthermore, the hashrate has economic implications for miners. A higher hashrate generally means increased competition among miners, which can lead to higher operational costs as they invest in more advanced hardware to remain competitive. However, it also means that the network is more secure, which can enhance the value of Bitcoin and potentially lead to higher rewards for successful miners. Thus, miners must balance their investments in hardware with the potential returns from mining activities.

In conclusion, the hashrate is a fundamental component of the Bitcoin network, intricately linked to its security, stability, and economic dynamics. By understanding the role of hashrate, stakeholders can better appreciate the complexities of maintaining a secure and efficient blockchain. As the Bitcoin network continues to evolve, monitoring and analyzing hashrate trends will remain crucial for ensuring its long-term viability and security.

The Relationship Between Hashrate and Bitcoin’s Difficulty Adjustment

In the realm of cryptocurrency, particularly within the Bitcoin network, the concept of hashrate plays a pivotal role in maintaining the system’s integrity and efficiency. To comprehend the relationship between hashrate and Bitcoin’s difficulty adjustment, it is essential to first understand what these terms signify. Hashrate refers to the computational power used to mine and process transactions on the Bitcoin blockchain. It is measured in hashes per second, indicating how many calculations a miner can perform in a given time frame. A higher hashrate suggests a more secure and efficient network, as it becomes increasingly difficult for malicious actors to manipulate the blockchain.

The Bitcoin network operates on a decentralized ledger, where miners compete to solve complex mathematical puzzles to validate transactions and add new blocks to the blockchain. This process, known as mining, is integral to the network’s security and functionality. The difficulty of these puzzles is not static; it adjusts approximately every two weeks, or every 2,016 blocks, to ensure that blocks are mined at a consistent rate of one every ten minutes. This is where the relationship between hashrate and difficulty adjustment becomes evident.

As more miners join the network and the collective hashrate increases, the probability of solving these puzzles more quickly also rises. To counterbalance this, the Bitcoin protocol automatically increases the difficulty level of the puzzles. Conversely, if the hashrate decreases, the difficulty is lowered to maintain the ten-minute block interval. This self-regulating mechanism is crucial for the stability of the Bitcoin network, as it prevents the rapid creation of new bitcoins, which could lead to inflation and undermine the currency’s value.

The interplay between hashrate and difficulty adjustment also has significant implications for miners. When the difficulty increases, miners require more computational power and energy to solve puzzles and earn rewards. This can lead to higher operational costs, prompting less efficient miners to exit the network. On the other hand, a decrease in difficulty can make mining more accessible and profitable, encouraging new participants to join. Thus, the balance between hashrate and difficulty is vital for maintaining a competitive and decentralized mining ecosystem.

Moreover, the hashrate serves as an indicator of the network’s health and security. A high hashrate signifies a robust network with numerous miners contributing to its security, making it more resistant to attacks such as double-spending or the infamous 51% attack. In such an attack, a single entity gains control of more than half of the network’s hashrate, allowing them to manipulate transactions. Therefore, a higher hashrate is generally perceived as a positive attribute, reflecting confidence in the network’s security and stability.

In conclusion, the relationship between hashrate and Bitcoin’s difficulty adjustment is a fundamental aspect of the cryptocurrency’s architecture. This dynamic ensures that the network remains secure, efficient, and resistant to inflationary pressures. By understanding this relationship, stakeholders can better appreciate the intricacies of Bitcoin mining and the factors that influence its operation. As the Bitcoin network continues to evolve, the balance between hashrate and difficulty will remain a critical component in sustaining its decentralized and secure nature.

Hashrate and Its Impact on Bitcoin Transaction Speed

In the realm of cryptocurrency, particularly within the Bitcoin network, the concept of hashrate plays a pivotal role in determining the efficiency and security of transactions. To comprehend its significance, one must first understand what hashrate entails. Essentially, hashrate refers to the total computational power used by miners to process transactions and secure the Bitcoin network. It is measured in hashes per second, indicating how many calculations are performed every second to solve complex mathematical puzzles. These puzzles are integral to the process of adding new blocks to the blockchain, a process known as mining.

The importance of hashrate in the Bitcoin network cannot be overstated, as it directly influences the speed and security of transactions. A higher hashrate signifies a more robust network, as it implies that more computational power is being dedicated to processing transactions and securing the blockchain. This increased power makes it more difficult for malicious actors to execute attacks, such as the infamous 51% attack, where a single entity gains control over the majority of the network’s mining power. Consequently, a higher hashrate enhances the overall security of the Bitcoin network, instilling greater confidence among users and investors.

Moreover, the hashrate has a direct impact on the speed at which Bitcoin transactions are confirmed. In the Bitcoin network, transactions are grouped into blocks, which are then added to the blockchain. The process of confirming these transactions and adding them to a block is contingent upon miners solving the aforementioned mathematical puzzles. A higher hashrate means that these puzzles are solved more quickly, leading to faster block creation and, subsequently, quicker transaction confirmations. This is particularly crucial in times of high network congestion, where a surge in transaction volume can lead to delays and increased transaction fees.

However, it is important to note that while a higher hashrate generally leads to faster transaction speeds, it is not the sole determinant. Other factors, such as network congestion and the size of the transaction backlog, also play significant roles. Nevertheless, a robust hashrate provides a strong foundation for maintaining efficient transaction processing, even during periods of high demand.

In addition to its impact on transaction speed and security, the hashrate also influences the economic dynamics of the Bitcoin network. Miners, who are rewarded with newly minted bitcoins and transaction fees for their efforts, are incentivized to contribute their computational power to the network. As the hashrate increases, so does the competition among miners, leading to advancements in mining technology and efficiency. This competitive environment fosters innovation and drives the development of more energy-efficient mining solutions, which is crucial given the environmental concerns associated with Bitcoin mining.

In conclusion, the hashrate is a fundamental component of the Bitcoin network, playing a critical role in ensuring the security and efficiency of transactions. By providing a measure of the network’s computational power, it serves as an indicator of the network’s health and resilience against potential threats. As the Bitcoin network continues to evolve, understanding the intricacies of hashrate and its impact on transaction speed will remain essential for stakeholders, from miners to investors, who are navigating the ever-changing landscape of cryptocurrency.

Global Hashrate Distribution: Key Players in the Bitcoin Network

The global distribution of hashrate is a critical aspect of the Bitcoin network, as it directly influences the network’s security, efficiency, and decentralization. Hashrate, which refers to the computational power used to mine and process transactions on the Bitcoin blockchain, is a fundamental metric that determines how quickly and effectively new blocks are added to the chain. Understanding the key players in the global hashrate distribution provides insight into the dynamics of the Bitcoin network and its resilience against potential threats.

To begin with, the hashrate is distributed among various mining pools and individual miners worldwide. These entities contribute their computational resources to solve complex mathematical problems, thereby validating transactions and securing the network. The distribution of hashrate is not uniform, as certain regions and organizations have emerged as dominant players due to factors such as access to cheap electricity, favorable regulatory environments, and technological advancements. For instance, China historically held a significant share of the global hashrate due to its abundant and inexpensive energy resources. However, recent regulatory crackdowns have led to a shift in the landscape, with other countries like the United States and Kazakhstan gaining prominence.

The United States has become a key player in the global hashrate distribution, largely due to its stable regulatory framework and access to renewable energy sources. American mining operations have increasingly adopted sustainable practices, utilizing hydroelectric, wind, and solar power to reduce their carbon footprint. This shift not only enhances the environmental sustainability of Bitcoin mining but also attracts investment from environmentally conscious stakeholders. Furthermore, the presence of established financial markets and technological infrastructure in the United States provides a conducive environment for the growth of mining operations.

Meanwhile, Kazakhstan has emerged as another significant contributor to the global hashrate. The country’s vast coal reserves and relatively low energy costs have attracted numerous mining operations. However, this reliance on fossil fuels raises concerns about the environmental impact of Bitcoin mining in the region. Despite these concerns, Kazakhstan’s strategic location and energy resources make it an attractive destination for miners seeking cost-effective solutions.

In addition to these countries, other regions such as Russia, Canada, and certain European nations also play vital roles in the global hashrate distribution. Russia’s abundant natural resources and cold climate provide favorable conditions for mining operations, while Canada’s emphasis on renewable energy aligns with the growing demand for sustainable mining practices. European countries, on the other hand, benefit from advanced technological infrastructure and supportive regulatory frameworks, which facilitate the growth of mining activities.

The concentration of hashrate in specific regions and among certain players has implications for the decentralization and security of the Bitcoin network. A highly concentrated hashrate could potentially lead to centralization, making the network vulnerable to attacks or manipulation by a few dominant entities. Therefore, a more distributed hashrate is desirable to ensure the robustness and resilience of the network.

In conclusion, the global distribution of hashrate is a dynamic and evolving aspect of the Bitcoin network. Key players such as the United States, Kazakhstan, and other regions contribute significantly to the network’s security and efficiency. As the landscape continues to change, driven by regulatory developments and technological advancements, the distribution of hashrate will remain a critical factor in shaping the future of Bitcoin. Understanding these dynamics is essential for stakeholders seeking to navigate the complexities of the Bitcoin ecosystem and ensure its long-term sustainability.

The Role of Hashrate in Bitcoin’s Energy Consumption Debate

In the ongoing discourse surrounding Bitcoin’s energy consumption, the concept of hashrate plays a pivotal role. Understanding hashrate is essential to grasp the broader implications of Bitcoin mining and its environmental impact. Hashrate, in essence, refers to the computational power used to mine and process transactions on the Bitcoin network. It is measured in hashes per second, indicating how many calculations a miner can perform in a given timeframe. As the hashrate increases, so does the network’s security and efficiency, but this also leads to heightened energy consumption, which has become a focal point of criticism.

To comprehend the significance of hashrate in the energy consumption debate, one must first consider its function within the Bitcoin network. The primary purpose of mining is to secure the network by validating transactions and adding them to the blockchain. This process involves solving complex mathematical puzzles, known as proof-of-work, which requires substantial computational power. The higher the hashrate, the more secure the network becomes, as it becomes increasingly difficult for malicious actors to alter transaction data. Consequently, a robust hashrate is crucial for maintaining the integrity and trustworthiness of the Bitcoin network.

However, the relationship between hashrate and energy consumption is a double-edged sword. As miners compete to solve these puzzles and earn Bitcoin rewards, they invest in more powerful hardware, which in turn demands more electricity. This has led to concerns about the environmental impact of Bitcoin mining, particularly as the network’s hashrate has grown exponentially over the years. Critics argue that the energy-intensive nature of mining contributes significantly to carbon emissions, especially in regions where electricity is generated from fossil fuels.

Despite these concerns, it is important to recognize that not all energy consumption is inherently detrimental. Proponents of Bitcoin mining often highlight that a substantial portion of mining operations utilize renewable energy sources. In fact, some estimates suggest that a significant percentage of Bitcoin’s energy consumption comes from sustainable sources, such as hydroelectric, wind, and solar power. This shift towards greener energy solutions is partly driven by economic incentives, as miners seek to reduce operational costs by tapping into cheaper, renewable energy.

Moreover, the debate over Bitcoin’s energy consumption should also consider the broader context of global energy use. While Bitcoin mining does consume a notable amount of electricity, it is relatively small compared to other industries, such as traditional banking or gold mining. Additionally, innovations in mining technology and energy efficiency continue to evolve, potentially mitigating some of the environmental concerns associated with high hashrates.

In conclusion, the role of hashrate in Bitcoin’s energy consumption debate is multifaceted. While it is undeniable that a higher hashrate contributes to increased energy use, it is also a critical component of the network’s security and functionality. As the Bitcoin ecosystem continues to mature, ongoing efforts to integrate renewable energy sources and improve mining efficiency may help address environmental concerns. Ultimately, a nuanced understanding of hashrate and its implications is essential for informed discussions about the future of Bitcoin and its place in the global energy landscape.

Future Trends in Hashrate: What to Expect in the Bitcoin Network

As the Bitcoin network continues to evolve, understanding the concept of hashrate and its future trends becomes increasingly important for both enthusiasts and investors. The hashrate, which measures the computational power used to mine and process transactions on the Bitcoin network, is a critical component in maintaining the network’s security and efficiency. As we look to the future, several factors are poised to influence the trajectory of Bitcoin’s hashrate, each with significant implications for the network’s stability and growth.

To begin with, technological advancements in mining hardware are expected to play a pivotal role in shaping future hashrate trends. The development of more efficient and powerful mining equipment, such as application-specific integrated circuits (ASICs), has historically driven increases in hashrate. As manufacturers continue to innovate, we can anticipate further enhancements in mining technology, leading to a more robust and capable network. These advancements not only improve the energy efficiency of mining operations but also enable miners to solve complex cryptographic puzzles more quickly, thereby increasing the overall hashrate.

In addition to technological progress, the geographical distribution of mining operations is likely to impact future hashrate trends. Historically, a significant portion of Bitcoin mining has been concentrated in regions with access to cheap electricity, such as China. However, recent regulatory changes and a growing emphasis on sustainable energy sources have prompted a shift in mining activities to other parts of the world. This decentralization of mining power is expected to contribute to a more resilient network, as it reduces the risk of hashrate concentration and potential vulnerabilities associated with it.

Moreover, the economic incentives for miners will continue to influence hashrate dynamics. The Bitcoin network operates on a reward system, where miners receive newly minted bitcoins and transaction fees for their efforts. As the block reward halves approximately every four years, miners must rely more heavily on transaction fees to sustain their operations. This shift in revenue structure could lead to fluctuations in hashrate, as miners adjust their strategies to remain profitable. Consequently, the interplay between Bitcoin’s market price, transaction volume, and mining costs will be crucial in determining future hashrate levels.

Furthermore, regulatory developments across the globe are likely to shape the future landscape of Bitcoin mining and its associated hashrate. Governments and regulatory bodies are increasingly scrutinizing the environmental impact of cryptocurrency mining, prompting calls for more sustainable practices. As a result, miners may be compelled to adopt greener energy sources or face potential restrictions. This transition towards sustainable mining practices could influence the distribution and growth of hashrate, as regions with abundant renewable energy resources become more attractive for mining operations.

Lastly, the broader adoption of Bitcoin and its integration into mainstream financial systems could have a profound impact on hashrate trends. As more individuals and institutions embrace Bitcoin, the demand for secure and efficient transaction processing will likely increase. This heightened demand could incentivize further investment in mining infrastructure, thereby boosting the network’s hashrate. Additionally, the development of layer-two solutions, such as the Lightning Network, may alleviate some of the pressure on the main blockchain, allowing for a more balanced and sustainable growth in hashrate.

In conclusion, the future trends in Bitcoin’s hashrate are shaped by a complex interplay of technological, economic, regulatory, and adoption factors. As these elements continue to evolve, they will collectively determine the trajectory of the Bitcoin network’s hashrate, influencing its security, efficiency, and overall resilience. Understanding these dynamics is essential for stakeholders seeking to navigate the ever-changing landscape of the Bitcoin ecosystem.

Q&A

1. **What is Hashrate?**

Hashrate is the measure of computational power used per second in the Bitcoin network to perform cryptographic hashing functions, primarily for mining and validating transactions.

2. **Why is Hashrate Important in Bitcoin Mining?**

Hashrate is crucial because it determines the speed and efficiency at which miners can solve complex mathematical puzzles, secure the network, and earn rewards.

3. **How Does Hashrate Affect Network Security?**

A higher hashrate enhances network security by making it more difficult for malicious actors to execute a 51% attack, where they could potentially control and manipulate the blockchain.

4. **What Factors Influence Hashrate?**

Factors influencing hashrate include the efficiency and number of mining hardware, electricity costs, mining difficulty, and the overall profitability of mining.

5. **How is Hashrate Measured?**

Hashrate is measured in hashes per second (H/s), with common units being kilohashes (KH/s), megahashes (MH/s), gigahashes (GH/s), terahashes (TH/s), and petahashes (PH/s).

6. **What is the Relationship Between Hashrate and Mining Difficulty?**

Mining difficulty adjusts approximately every two weeks to ensure block times remain around 10 minutes, and it typically increases with a rising hashrate to maintain network stability.

7. **How Does Hashrate Impact Bitcoin’s Price?**

While not directly correlated, a rising hashrate can indicate increased miner confidence and investment, potentially influencing market sentiment and Bitcoin’s price positively.

Conclusion

The hashrate is a critical metric in the Bitcoin network, representing the total computational power used to mine and process transactions. A higher hashrate indicates a more secure and robust network, as it becomes increasingly difficult for malicious actors to execute attacks. It also reflects the level of competition and investment in Bitcoin mining, influencing the network’s decentralization and efficiency. Understanding hashrate is essential for assessing the health and security of the Bitcoin network, as well as for making informed decisions related to mining operations and investments.