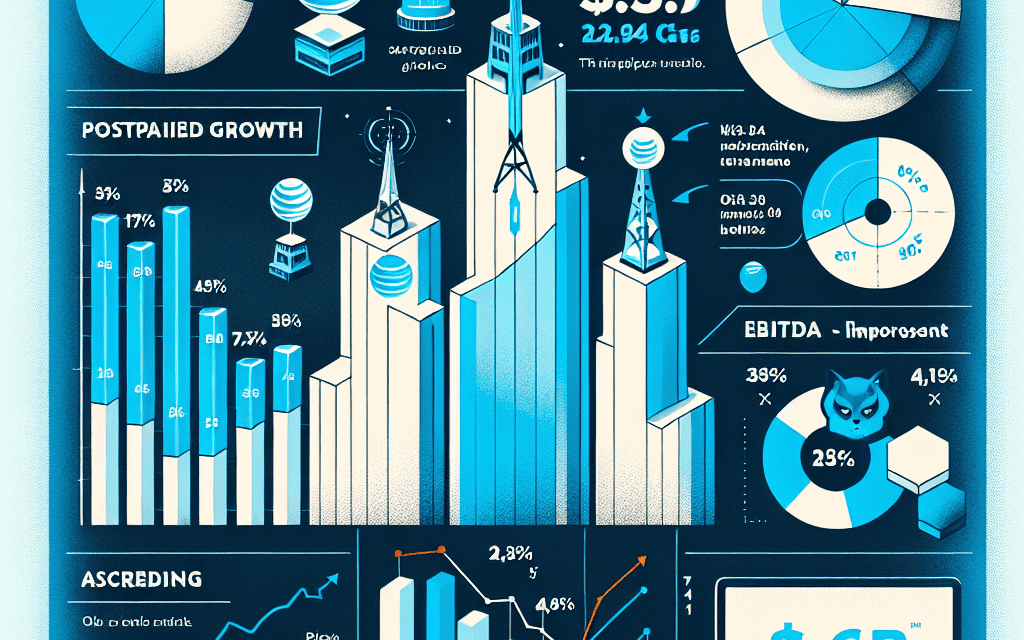

“AT&T Q3: Strong Postpaid Surge, EBITDA Growth, and a $4.4B Impairment Hurdle”

Introduction

AT&T’s third-quarter earnings report highlights a period of significant financial activity, marked by robust postpaid subscriber growth, an increase in EBITDA, and a substantial $4.4 billion impairment charge. The telecommunications giant demonstrated strong operational performance with a notable rise in postpaid customer additions, underscoring its competitive position in the market. This growth in subscribers contributed to an increase in EBITDA, reflecting improved profitability and operational efficiency. However, the quarter was also impacted by a $4.4 billion impairment charge, which affected the overall financial results. This charge, primarily related to asset write-downs, underscores the challenges and strategic adjustments the company is navigating in a rapidly evolving industry landscape. Despite this, AT&T’s core business operations continue to show resilience and adaptability, positioning the company for future growth and stability.

Analyzing AT&T’s Q3 Earnings: Key Takeaways from Robust Postpaid Growth

AT&T’s third-quarter earnings report for 2023 presents a complex yet promising picture of the telecommunications giant’s current financial health and strategic direction. The company has demonstrated robust growth in its postpaid segment, a critical area for telecom operators, as it often indicates customer loyalty and stable revenue streams. This growth is a testament to AT&T’s strategic initiatives aimed at enhancing customer experience and expanding its network capabilities. The company reported an impressive increase in postpaid phone net additions, which underscores its competitive positioning in the market. This achievement is particularly noteworthy given the intense competition in the telecommunications sector, where customer acquisition and retention are paramount.

In addition to the strong performance in the postpaid segment, AT&T’s earnings before interest, taxes, depreciation, and amortization (EBITDA) also saw a significant rise. This increase in EBITDA reflects the company’s operational efficiency and its ability to manage costs effectively while driving revenue growth. The improvement in EBITDA is a positive indicator of AT&T’s financial health, suggesting that the company is on a solid footing to invest in future growth opportunities and navigate the challenges of a rapidly evolving industry landscape.

However, the quarter was not without its challenges. AT&T reported a substantial $4.4 billion impairment charge, which has raised questions among investors and analysts. This impairment charge is primarily related to the company’s legacy copper network assets, which are becoming increasingly obsolete as the industry shifts towards more advanced fiber and 5G technologies. While this charge has impacted AT&T’s net income for the quarter, it also highlights the company’s commitment to transitioning away from outdated infrastructure and investing in next-generation technologies. This strategic pivot is essential for AT&T to maintain its competitive edge and meet the growing demand for high-speed, reliable connectivity.

Despite the impairment charge, AT&T’s overall financial performance in the third quarter remains strong. The company’s focus on expanding its fiber footprint and enhancing its 5G capabilities is yielding positive results, as evidenced by the growth in its customer base and improved service offerings. Moreover, AT&T’s strategic partnerships and investments in digital transformation initiatives are positioning the company to capitalize on emerging opportunities in the telecommunications sector.

Looking ahead, AT&T’s management has expressed confidence in the company’s ability to sustain its growth momentum. The continued expansion of its fiber and 5G networks is expected to drive further improvements in customer satisfaction and operational efficiency. Additionally, AT&T’s efforts to streamline its business operations and focus on core areas of growth are likely to enhance its competitive positioning in the market.

In conclusion, AT&T’s third-quarter earnings report paints a picture of a company that is navigating the challenges of a dynamic industry while capitalizing on growth opportunities. The robust postpaid growth and rise in EBITDA are clear indicators of AT&T’s operational strength and strategic focus. Although the $4.4 billion impairment charge presents a short-term financial hurdle, it also underscores the company’s commitment to future-proofing its business. As AT&T continues to invest in cutting-edge technologies and expand its network capabilities, it is well-positioned to deliver long-term value to its shareholders and meet the evolving needs of its customers.

Understanding the Impact of EBITDA Rise on AT&T’s Financial Health

AT&T’s third-quarter earnings report has drawn significant attention, particularly due to its robust postpaid growth, a notable rise in EBITDA, and a substantial $4.4 billion impairment charge. Understanding the impact of the EBITDA rise on AT&T’s financial health requires a closer examination of these elements and their interplay within the company’s broader financial landscape. EBITDA, or earnings before interest, taxes, depreciation, and amortization, serves as a key indicator of a company’s operational performance. It provides insight into the company’s ability to generate earnings from its core business activities, excluding the effects of capital structure, tax rates, and non-cash accounting items. In AT&T’s case, the rise in EBITDA suggests an improvement in operational efficiency and profitability, which is crucial for maintaining investor confidence and supporting future growth initiatives.

The robust postpaid growth reported by AT&T is a significant contributor to the rise in EBITDA. Postpaid customers, who typically pay for services after usage, represent a stable and recurring revenue stream for telecommunications companies. AT&T’s ability to attract and retain these customers indicates strong market positioning and effective customer engagement strategies. This growth not only boosts revenue but also enhances the company’s ability to leverage economies of scale, thereby improving operational margins and contributing to the rise in EBITDA. Furthermore, the increase in EBITDA reflects AT&T’s strategic focus on optimizing its cost structure and enhancing operational efficiencies. By streamlining operations and reducing unnecessary expenditures, the company can improve its bottom line, even in a competitive market environment. This focus on efficiency is particularly important as AT&T navigates the challenges of a rapidly evolving telecommunications landscape, characterized by technological advancements and shifting consumer preferences.

However, the $4.4 billion impairment charge presents a contrasting element in AT&T’s financial narrative. Impairment charges occur when the carrying value of an asset exceeds its recoverable amount, necessitating a write-down to reflect the asset’s diminished value. In AT&T’s case, this charge likely relates to its media assets, which have faced challenges amid changing industry dynamics and competitive pressures. While such charges can negatively impact net income, they are non-cash in nature and do not directly affect the company’s cash flow or operational performance. Therefore, despite the impairment charge, the rise in EBITDA underscores AT&T’s underlying financial health and operational resilience.

Moreover, the increase in EBITDA provides AT&T with greater financial flexibility to invest in strategic initiatives and pursue growth opportunities. This flexibility is essential for the company as it seeks to expand its 5G network, enhance its service offerings, and explore new revenue streams. By reinvesting in its core business and exploring innovative solutions, AT&T can strengthen its competitive position and drive long-term value creation for shareholders. In conclusion, the rise in EBITDA is a positive indicator of AT&T’s financial health, reflecting improved operational performance and strategic focus. While the $4.4 billion impairment charge poses a challenge, it does not overshadow the company’s ability to generate earnings from its core operations. As AT&T continues to navigate the complexities of the telecommunications industry, its robust postpaid growth and increased EBITDA provide a solid foundation for future success. This financial resilience, coupled with strategic investments and a commitment to operational excellence, positions AT&T to capitalize on emerging opportunities and deliver sustained value to its stakeholders.

The Significance of AT&T’s $4.4B Impairment Charge in Q3 Earnings

In the third quarter of 2023, AT&T’s financial performance was marked by a blend of robust growth and significant financial adjustments, capturing the attention of investors and analysts alike. The telecommunications giant reported a notable increase in postpaid growth and a rise in EBITDA, underscoring its operational strength and strategic focus. However, the quarter was also characterized by a substantial $4.4 billion impairment charge, which warrants a closer examination to understand its implications on the company’s financial health and future outlook.

The $4.4 billion impairment charge primarily reflects a reassessment of the value of certain assets on AT&T’s balance sheet. Impairment charges are typically recognized when the carrying amount of an asset exceeds its recoverable amount, indicating that the asset’s value has diminished. In AT&T’s case, this charge is largely attributed to its legacy copper network infrastructure, which has been increasingly overshadowed by the company’s strategic pivot towards more advanced fiber and 5G technologies. As the telecommunications landscape evolves, AT&T has been investing heavily in modernizing its network to meet the growing demand for high-speed connectivity and to remain competitive in an industry that is rapidly embracing digital transformation.

While the impairment charge may initially appear as a setback, it is essential to view it within the broader context of AT&T’s strategic objectives. By recognizing this charge, AT&T is aligning its financial statements with the current market realities and its long-term vision. This move not only provides a more accurate representation of the company’s asset values but also signals a commitment to shedding legacy operations in favor of future-ready technologies. Consequently, this financial adjustment can be seen as a proactive measure that positions AT&T to capitalize on emerging opportunities in the telecommunications sector.

Moreover, the impairment charge did not overshadow AT&T’s operational achievements during the quarter. The company reported robust postpaid growth, a key performance indicator in the telecommunications industry. Postpaid subscribers are typically more valuable to telecom companies due to their higher average revenue per user and lower churn rates compared to prepaid customers. AT&T’s success in this area reflects its ability to attract and retain high-value customers, driven by its competitive offerings and enhanced network capabilities.

In addition to postpaid growth, AT&T experienced a rise in EBITDA, which serves as a testament to its operational efficiency and cost management efforts. EBITDA, or earnings before interest, taxes, depreciation, and amortization, is a widely used metric to assess a company’s core profitability. The increase in EBITDA indicates that AT&T is effectively managing its expenses while generating substantial revenue from its core operations. This financial resilience is crucial as the company navigates the challenges and opportunities presented by the rapidly changing telecommunications landscape.

In conclusion, AT&T’s third-quarter earnings report presents a nuanced picture of the company’s financial performance. The $4.4 billion impairment charge, while significant, should be viewed as a strategic realignment rather than a mere financial burden. By addressing legacy asset values and focusing on future-ready technologies, AT&T is positioning itself for sustained growth and competitiveness. Simultaneously, the company’s robust postpaid growth and rising EBITDA underscore its operational strength and strategic acumen. As AT&T continues to execute its vision, these elements collectively highlight the company’s commitment to driving long-term value for its shareholders and stakeholders.

How AT&T’s Postpaid Growth is Shaping the Telecom Industry

AT&T’s third-quarter earnings report has drawn significant attention, particularly due to its robust postpaid growth, a rise in EBITDA, and a notable $4.4 billion impairment charge. These elements collectively paint a complex picture of the company’s current standing and its influence on the broader telecom industry. The postpaid segment, a critical component of AT&T’s business model, has shown remarkable growth, underscoring the company’s strategic focus on enhancing customer retention and acquisition. This growth is not only pivotal for AT&T’s financial health but also indicative of broader trends within the telecom sector.

The postpaid market, characterized by customers who pay their bills at the end of each billing cycle, is a lucrative segment for telecom companies due to its potential for stable and recurring revenue. AT&T’s success in this area can be attributed to its aggressive marketing strategies, competitive pricing, and investment in network infrastructure. By prioritizing customer satisfaction and network reliability, AT&T has managed to attract a significant number of new subscribers while retaining existing ones. This growth in postpaid subscribers is a testament to the company’s ability to adapt to changing consumer preferences and technological advancements.

Moreover, the rise in AT&T’s EBITDA, or earnings before interest, taxes, depreciation, and amortization, further highlights the company’s operational efficiency and profitability. This increase is a positive indicator for investors, as it reflects the company’s ability to generate cash flow and sustain its business operations. The improvement in EBITDA can be linked to cost-cutting measures, strategic investments, and a focus on high-margin services. As a result, AT&T is better positioned to navigate the competitive landscape of the telecom industry and capitalize on emerging opportunities.

However, the $4.4 billion impairment charge presents a contrasting narrative, revealing some of the challenges AT&T faces. This charge, primarily related to its legacy copper network, indicates the financial burden of maintaining outdated infrastructure in an era of rapid technological advancement. The impairment underscores the necessity for telecom companies to transition towards more modern and efficient technologies, such as fiber optics and 5G networks. While this charge may impact short-term financial results, it also highlights AT&T’s commitment to investing in future-ready infrastructure, which is essential for long-term growth and competitiveness.

In the broader context of the telecom industry, AT&T’s performance in the third quarter serves as a microcosm of the sector’s ongoing transformation. The emphasis on postpaid growth reflects a shift towards more sustainable revenue models, while the rise in EBITDA demonstrates the importance of operational efficiency. At the same time, the impairment charge underscores the challenges of legacy systems and the need for continuous innovation. As telecom companies strive to meet the increasing demand for high-speed connectivity and digital services, those that successfully balance these elements are likely to emerge as industry leaders.

In conclusion, AT&T’s third-quarter earnings report provides valuable insights into the company’s strategic direction and its impact on the telecom industry. The robust postpaid growth, rise in EBITDA, and significant impairment charge collectively illustrate the dynamic nature of the sector and the challenges and opportunities that lie ahead. As AT&T continues to navigate this evolving landscape, its ability to adapt and innovate will be crucial in shaping its future and influencing the broader industry.

Exploring the Factors Behind AT&T’s EBITDA Increase in Q3

In the third quarter of 2023, AT&T reported a notable increase in its earnings before interest, taxes, depreciation, and amortization (EBITDA), driven by robust postpaid growth and strategic financial management. This development comes amidst a challenging economic landscape, where telecommunications companies are navigating fluctuating consumer demands and technological advancements. AT&T’s performance in this quarter underscores its resilience and adaptability, as well as its ability to capitalize on emerging market trends.

One of the primary factors contributing to AT&T’s EBITDA growth is the significant increase in postpaid subscribers. Postpaid plans, which typically offer more stable and predictable revenue streams compared to prepaid options, have seen a surge in demand. This growth can be attributed to AT&T’s strategic focus on enhancing customer experience and expanding its network capabilities. By investing in 5G infrastructure and offering competitive pricing plans, AT&T has successfully attracted a larger customer base, thereby boosting its postpaid subscriber numbers. This increase not only enhances revenue but also strengthens customer loyalty, providing a solid foundation for future growth.

Moreover, AT&T’s strategic cost management initiatives have played a crucial role in improving its EBITDA. The company has been actively streamlining its operations, optimizing its supply chain, and reducing unnecessary expenditures. These efforts have resulted in significant cost savings, which have positively impacted the company’s bottom line. By focusing on operational efficiency, AT&T has been able to allocate resources more effectively, ensuring that investments are directed towards areas with the highest potential for growth and profitability.

In addition to these operational strategies, AT&T’s financial performance in the third quarter was also influenced by a $4.4 billion impairment charge. This charge, while substantial, reflects the company’s proactive approach to managing its asset portfolio. By reassessing the value of certain assets and making necessary adjustments, AT&T is positioning itself for long-term sustainability. Although impairment charges can have a short-term impact on financial statements, they are often indicative of a company’s commitment to maintaining a healthy balance sheet and ensuring that its assets are aligned with current market conditions.

Furthermore, AT&T’s focus on innovation and technological advancement has been instrumental in driving its EBITDA growth. The company’s investment in next-generation technologies, such as 5G and fiber-optic networks, has not only enhanced its service offerings but also opened up new revenue streams. By staying at the forefront of technological developments, AT&T is able to meet the evolving needs of its customers and maintain a competitive edge in the telecommunications industry.

In conclusion, AT&T’s impressive EBITDA growth in the third quarter of 2023 can be attributed to a combination of factors, including robust postpaid subscriber growth, strategic cost management, and a proactive approach to asset management. While the $4.4 billion impairment charge may have raised some concerns, it ultimately reflects the company’s commitment to long-term financial health and sustainability. As AT&T continues to invest in innovation and expand its network capabilities, it is well-positioned to navigate the challenges of the telecommunications landscape and capitalize on emerging opportunities. This quarter’s performance not only highlights AT&T’s resilience but also sets the stage for continued success in the future.

The Financial Implications of AT&T’s Impairment Charge on Future Strategies

AT&T’s third-quarter earnings report has drawn significant attention, particularly due to its robust postpaid growth, a rise in EBITDA, and a substantial $4.4 billion impairment charge. These financial elements not only reflect the company’s current performance but also have profound implications for its future strategies. As we delve into the financial implications of AT&T’s impairment charge, it is essential to understand how these factors interplay to shape the company’s strategic direction.

To begin with, AT&T’s impressive postpaid growth is a testament to its strong market position and customer retention strategies. The increase in postpaid subscribers indicates a healthy demand for AT&T’s services, which is crucial for sustaining revenue streams. This growth is further complemented by a rise in EBITDA, showcasing the company’s operational efficiency and ability to generate earnings before interest, taxes, depreciation, and amortization. Such financial health provides AT&T with a solid foundation to invest in future initiatives and expand its market presence.

However, the $4.4 billion impairment charge presents a more complex picture. Impairment charges typically arise when the carrying amount of an asset exceeds its recoverable amount, indicating that the asset’s value has diminished. For AT&T, this significant charge suggests a reassessment of certain assets, possibly due to changes in market conditions or strategic priorities. While impairment charges can negatively impact short-term financial results, they also offer an opportunity for companies to realign their asset portfolios and focus on more promising ventures.

In light of this impairment charge, AT&T may need to reevaluate its investment strategies and asset management practices. The charge could prompt the company to divest underperforming assets or redirect resources towards more lucrative opportunities. This strategic shift could enhance AT&T’s long-term profitability and competitiveness, as it allows the company to concentrate on areas with higher growth potential. Moreover, by addressing impaired assets, AT&T can improve its balance sheet and financial transparency, which are critical for maintaining investor confidence.

Furthermore, the impairment charge may influence AT&T’s approach to innovation and technology adoption. As the telecommunications industry rapidly evolves, companies must continuously adapt to new technologies and consumer preferences. The financial flexibility gained from addressing impaired assets could enable AT&T to invest in cutting-edge technologies, such as 5G networks and digital services, thereby strengthening its market position. Additionally, this strategic focus on innovation could enhance customer experiences and drive further postpaid growth, creating a virtuous cycle of revenue generation and reinvestment.

It is also important to consider the broader economic context in which AT&T operates. The telecommunications sector is characterized by intense competition and regulatory challenges, which can impact profitability and strategic decision-making. In this environment, AT&T’s ability to manage impairment charges effectively and leverage its financial strengths becomes even more critical. By aligning its strategies with market trends and consumer demands, AT&T can navigate these challenges and capitalize on emerging opportunities.

In conclusion, AT&T’s third-quarter earnings report highlights both the company’s strengths and the challenges it faces. The robust postpaid growth and rise in EBITDA underscore AT&T’s operational success, while the $4.4 billion impairment charge necessitates a strategic reassessment. By addressing this charge and focusing on innovation and asset optimization, AT&T can enhance its competitive edge and ensure sustainable growth in the dynamic telecommunications landscape. As the company moves forward, its ability to balance short-term financial impacts with long-term strategic goals will be key to its continued success.

Comparing AT&T’s Q3 Performance with Industry Peers: A Focus on Growth and Challenges

In the third quarter of 2023, AT&T reported a mixed financial performance characterized by robust postpaid growth and a notable rise in EBITDA, juxtaposed with a significant $4.4 billion impairment charge. This performance invites a closer examination of how AT&T’s results compare with its industry peers, particularly in terms of growth trajectories and the challenges faced by major telecommunications companies.

AT&T’s postpaid growth stands out as a key highlight of its Q3 earnings. The company added a substantial number of postpaid phone subscribers, a critical metric in the telecommunications industry, as it often indicates customer loyalty and potential for long-term revenue. This growth can be attributed to AT&T’s strategic focus on enhancing customer experience and offering competitive pricing plans, which have resonated well with consumers. In comparison, Verizon and T-Mobile, AT&T’s primary competitors, have also reported strong postpaid growth, although AT&T’s figures suggest a slightly more aggressive expansion in this segment. This trend underscores the intense competition within the industry, as companies vie for market share in a saturated market.

Moreover, AT&T’s EBITDA rise reflects improved operational efficiency and cost management. The company has been actively streamlining its operations, focusing on core business areas, and divesting non-essential assets. This strategic realignment has not only bolstered its financial health but also positioned it favorably against its peers. Verizon, for instance, has similarly focused on operational efficiency, yet AT&T’s EBITDA growth indicates a more pronounced impact from its cost-cutting measures. T-Mobile, on the other hand, continues to leverage its merger with Sprint to drive synergies and enhance profitability, presenting a different growth narrative within the industry.

However, the $4.4 billion impairment charge casts a shadow over AT&T’s otherwise positive performance. This charge primarily relates to the company’s legacy assets, which have been devalued due to shifting market dynamics and technological advancements. The impairment highlights the ongoing challenge for telecommunications companies to adapt to rapid technological changes and consumer preferences. While AT&T is not alone in facing such challenges, the magnitude of the charge is noteworthy. Verizon and T-Mobile have also encountered similar issues, albeit on a smaller scale, as they navigate the transition from traditional services to more advanced, digital offerings.

In comparing AT&T’s Q3 performance with its industry peers, it becomes evident that while the company has made significant strides in postpaid growth and operational efficiency, it must continue to address the challenges posed by legacy assets and evolving market conditions. The telecommunications industry is at a pivotal juncture, with companies needing to balance growth initiatives with the imperative to innovate and modernize their service offerings. As AT&T moves forward, its ability to sustain postpaid growth, enhance operational efficiency, and mitigate the impact of impairment charges will be crucial in maintaining its competitive edge.

In conclusion, AT&T’s Q3 earnings report paints a complex picture of growth and challenges, reflective of broader industry trends. The company’s robust postpaid growth and EBITDA rise are commendable achievements, yet the significant impairment charge underscores the ongoing challenges faced by telecommunications companies. As the industry continues to evolve, AT&T and its peers must navigate these dynamics with strategic foresight and adaptability to ensure sustained success in an increasingly competitive landscape.

Q&A

1. **What was the key highlight of AT&T’s Q3 earnings?**

AT&T reported robust postpaid growth, indicating strong customer acquisition and retention.

2. **How did AT&T’s EBITDA perform in Q3?**

AT&T saw a rise in EBITDA, reflecting improved operational efficiency and profitability.

3. **What significant financial charge did AT&T report in Q3?**

AT&T reported a $4.4 billion impairment charge, impacting its financial statements.

4. **What does the postpaid growth indicate for AT&T?**

The robust postpaid growth suggests a healthy demand for AT&T’s services and successful competitive positioning.

5. **How might the $4.4 billion impairment charge affect AT&T’s financial outlook?**

The impairment charge could affect AT&T’s net income and overall financial health, potentially influencing investor sentiment.

6. **What sectors contributed to the EBITDA rise for AT&T?**

The rise in EBITDA was likely driven by efficiencies and growth in AT&T’s core telecommunications and media operations.

7. **What are the implications of AT&T’s Q3 performance for its future strategy?**

The strong postpaid growth and EBITDA rise may encourage AT&T to continue investing in customer acquisition and operational improvements, while addressing the impact of the impairment charge.

Conclusion

AT&T’s Q3 earnings report highlights a strong performance in its postpaid segment, contributing to overall growth. The company experienced an increase in EBITDA, indicating improved operational efficiency and profitability. However, these positive outcomes were partially offset by a significant $4.4 billion impairment charge, which impacted net income. Despite this charge, AT&T’s robust postpaid growth and EBITDA rise suggest a solid underlying business performance, positioning the company well for future financial stability and growth.