“Stablecoins: Anchoring Trust in the Volatile World of Crypto.”

Introduction

Stablecoins have emerged as a pivotal component in the rapidly evolving landscape of cryptocurrency markets, offering a bridge between the volatile world of digital assets and the stability of traditional fiat currencies. As the name suggests, stablecoins are designed to maintain a stable value, typically pegged to a reserve of assets such as the US dollar, euro, or commodities like gold. This stability is achieved through various mechanisms, including collateralization, algorithmic adjustments, or a combination of both. By providing a reliable medium of exchange and a store of value, stablecoins facilitate seamless transactions, enhance liquidity, and mitigate the risks associated with price fluctuations in the crypto ecosystem. As such, they have become an indispensable tool for traders, investors, and businesses seeking to harness the benefits of blockchain technology while minimizing exposure to market volatility. Understanding the intricacies of stablecoins is crucial for anyone looking to navigate the complexities of the crypto markets and leverage the opportunities they present.

Introduction To Stablecoins: What They Are And Why They Matter

Stablecoins have emerged as a pivotal component in the rapidly evolving landscape of cryptocurrency markets, offering a bridge between the volatile world of digital assets and the stability of traditional fiat currencies. As the name suggests, stablecoins are designed to maintain a stable value, typically pegged to a reserve of assets such as the US dollar, euro, or even commodities like gold. This stability is achieved through various mechanisms, including collateralization, algorithmic adjustments, or a combination of both. By providing a reliable store of value, stablecoins have become an essential tool for traders, investors, and businesses seeking to navigate the often unpredictable terrain of cryptocurrencies.

The primary allure of stablecoins lies in their ability to mitigate the extreme price fluctuations that are characteristic of cryptocurrencies like Bitcoin and Ethereum. These fluctuations can pose significant risks for users who require a dependable medium of exchange or a stable unit of account. In contrast, stablecoins offer a semblance of predictability, making them an attractive option for those looking to engage in everyday transactions or preserve their wealth without the fear of sudden devaluation. Moreover, stablecoins facilitate seamless entry and exit points for investors in the crypto market, allowing them to hedge against volatility while maintaining exposure to the digital asset ecosystem.

In addition to their role as a stabilizing force, stablecoins have also played a crucial part in enhancing the liquidity and efficiency of cryptocurrency exchanges. By providing a consistent value benchmark, stablecoins enable smoother trading operations and reduce the friction associated with converting between fiat currencies and cryptocurrencies. This has led to increased adoption of stablecoins on major exchanges, where they often serve as a base trading pair against other digital assets. Consequently, stablecoins have become instrumental in fostering a more robust and interconnected crypto market infrastructure.

Furthermore, stablecoins have opened new avenues for financial innovation and inclusion, particularly in regions with limited access to traditional banking services. By leveraging blockchain technology, stablecoins offer a decentralized and borderless means of transferring value, enabling individuals and businesses to participate in the global economy without the constraints of conventional financial systems. This has significant implications for remittances, cross-border trade, and peer-to-peer transactions, where stablecoins can provide a faster, cheaper, and more transparent alternative to traditional methods.

Despite their advantages, stablecoins are not without challenges and risks. Regulatory scrutiny has intensified as governments and financial institutions grapple with the implications of widespread stablecoin adoption. Concerns over consumer protection, financial stability, and the potential for illicit activities have prompted calls for clearer regulatory frameworks and oversight. Additionally, the mechanisms underpinning stablecoins, such as collateral reserves and algorithmic controls, must be robust and transparent to maintain trust and prevent systemic failures.

In conclusion, stablecoins represent a critical innovation in the cryptocurrency space, offering a stable and reliable alternative to volatile digital assets. Their ability to bridge the gap between traditional finance and the burgeoning world of cryptocurrencies has made them indispensable to traders, investors, and businesses alike. As the crypto market continues to mature, the role of stablecoins is likely to expand, driving further integration and adoption across various sectors. However, it is imperative that stakeholders address the associated risks and challenges to ensure the sustainable growth and development of this transformative financial instrument.

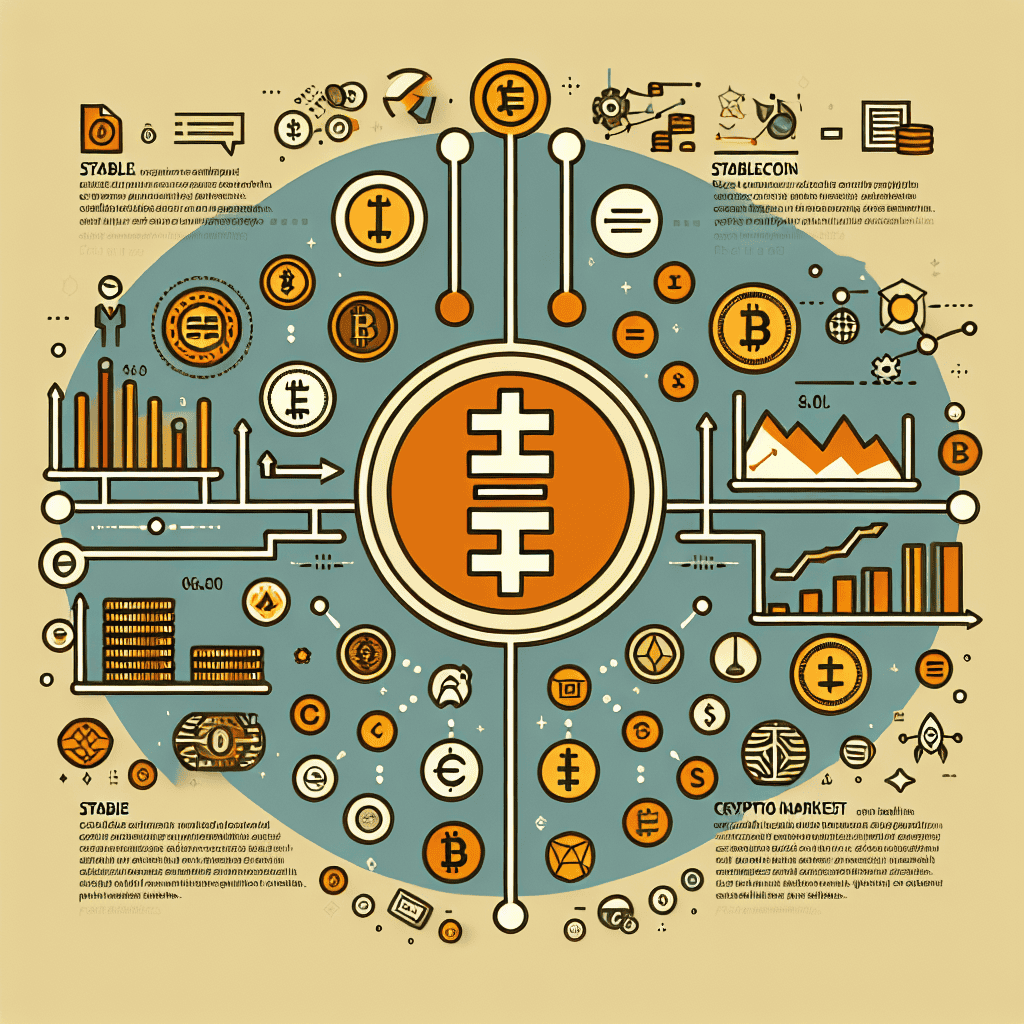

The Different Types Of Stablecoins: Fiat-Backed, Crypto-Backed, And Algorithmic

Stablecoins have emerged as a pivotal component in the cryptocurrency ecosystem, offering a bridge between the volatile world of digital currencies and the stability of traditional financial systems. As the name suggests, stablecoins are designed to maintain a stable value, typically pegged to a reserve of assets such as fiat currencies, other cryptocurrencies, or even commodities. This stability is crucial for users who seek the benefits of blockchain technology without the price fluctuations associated with cryptocurrencies like Bitcoin or Ethereum. To achieve this stability, different types of stablecoins have been developed, each with its unique mechanism: fiat-backed, crypto-backed, and algorithmic stablecoins.

Fiat-backed stablecoins are perhaps the most straightforward and widely used type. These stablecoins are pegged to a fiat currency, such as the US dollar, and are backed by reserves held in a bank or a financial institution. For every unit of fiat-backed stablecoin issued, an equivalent amount of fiat currency is held in reserve, ensuring that the stablecoin can be redeemed at a 1:1 ratio. This model provides a high level of trust and stability, as the value of the stablecoin is directly linked to a stable fiat currency. Tether (USDT) and USD Coin (USDC) are prominent examples of fiat-backed stablecoins, and they have gained significant traction in the market due to their simplicity and reliability. However, the reliance on centralized entities to hold the reserves introduces counterparty risk, as users must trust that the reserves are adequately maintained and audited.

In contrast, crypto-backed stablecoins utilize cryptocurrencies as collateral to maintain their value. These stablecoins are typically over-collateralized, meaning that the value of the collateral exceeds the value of the stablecoins issued. This over-collateralization acts as a buffer against the inherent volatility of cryptocurrencies. For instance, MakerDAO’s DAI is a well-known crypto-backed stablecoin that uses Ethereum as collateral. Users lock their Ethereum in a smart contract to mint DAI, which can then be used as a stable medium of exchange. The decentralized nature of crypto-backed stablecoins offers increased transparency and reduces reliance on centralized entities. However, the complexity of the system and the need for over-collateralization can be seen as drawbacks, as they require users to lock up more value than they wish to transact.

Algorithmic stablecoins represent a more innovative approach, relying on algorithms and smart contracts to maintain their peg. Instead of being backed by reserves, these stablecoins use algorithms to control the supply of the stablecoin in response to changes in demand. When the price of the stablecoin rises above its peg, the algorithm increases the supply to bring the price down. Conversely, when the price falls below the peg, the supply is reduced. This dynamic adjustment aims to stabilize the price without the need for collateral. However, algorithmic stablecoins face significant challenges, as maintaining stability solely through supply and demand mechanisms can be difficult, especially during periods of extreme market volatility. The collapse of some algorithmic stablecoins in the past has highlighted the risks associated with this model.

In conclusion, stablecoins play a crucial role in the cryptocurrency market by providing stability and facilitating transactions. Each type of stablecoin—fiat-backed, crypto-backed, and algorithmic—offers distinct advantages and challenges. While fiat-backed stablecoins provide simplicity and reliability, they rely on centralized entities. Crypto-backed stablecoins offer decentralization and transparency but require over-collateralization. Algorithmic stablecoins present an innovative approach but face challenges in maintaining stability. As the cryptocurrency market continues to evolve, stablecoins will likely remain a fundamental component, adapting to meet the needs of users seeking stability in an otherwise volatile landscape.

How Stablecoins Maintain Their Value: Mechanisms And Challenges

Stablecoins have emerged as a pivotal component in the cryptocurrency ecosystem, offering a semblance of stability in an otherwise volatile market. These digital assets are designed to maintain a stable value, typically pegged to a fiat currency like the US dollar, thereby providing a reliable medium of exchange and a store of value. Understanding the mechanisms by which stablecoins maintain their value, as well as the challenges they face, is crucial for comprehending their role in the broader crypto markets.

To begin with, stablecoins employ various mechanisms to achieve and maintain their stability. The most common type is fiat-collateralized stablecoins, which are backed by reserves of fiat currency held in a bank account. For every stablecoin issued, an equivalent amount of fiat currency is held in reserve, ensuring that the stablecoin can be redeemed at a 1:1 ratio. This model relies heavily on trust and transparency, as users must have confidence that the issuer indeed holds the necessary reserves. Regular audits and transparent reporting are essential to maintaining this trust.

Another mechanism is crypto-collateralized stablecoins, which are backed by other cryptocurrencies rather than fiat currency. These stablecoins are typically over-collateralized to account for the inherent volatility of cryptocurrencies. For instance, a stablecoin might require $150 worth of cryptocurrency to back $100 worth of stablecoins. This over-collateralization provides a buffer against price fluctuations, but it also introduces complexity in terms of managing collateral and ensuring liquidity.

Algorithmic stablecoins represent a more innovative approach, relying on smart contracts and algorithms to maintain their peg. These stablecoins adjust their supply based on market demand, using mechanisms such as minting new coins or burning existing ones to stabilize the price. While this model offers a decentralized alternative to collateralized stablecoins, it also poses significant challenges. The reliance on algorithms means that any flaws or unforeseen market conditions can lead to instability, as seen in past instances where algorithmic stablecoins have failed to maintain their peg.

Despite these mechanisms, stablecoins face several challenges that can impact their ability to maintain value. Regulatory scrutiny is a significant concern, as governments around the world grapple with how to classify and regulate these digital assets. The lack of a unified regulatory framework can lead to uncertainty and hinder the growth and adoption of stablecoins. Additionally, the risk of reserve mismanagement or fraud in fiat-collateralized models poses a threat to stability, underscoring the need for robust oversight and transparency.

Moreover, the inherent volatility of the cryptocurrency market can affect crypto-collateralized stablecoins, as sharp declines in collateral value may necessitate rapid liquidation to maintain the peg. This can create a feedback loop, exacerbating market volatility. Algorithmic stablecoins, while innovative, must contend with the challenge of maintaining stability in the face of unpredictable market dynamics and potential attacks on their underlying mechanisms.

In conclusion, stablecoins play a crucial role in the cryptocurrency markets by providing stability and facilitating transactions. However, the mechanisms they employ to maintain their value are not without challenges. As the crypto landscape continues to evolve, addressing these challenges through regulatory clarity, technological innovation, and enhanced transparency will be essential to ensuring the continued stability and growth of stablecoins. Understanding these dynamics is vital for stakeholders seeking to navigate the complex and rapidly changing world of digital finance.

The Role Of Stablecoins In Cryptocurrency Trading And DeFi

Stablecoins have emerged as a pivotal component in the rapidly evolving landscape of cryptocurrency trading and decentralized finance (DeFi). As the name suggests, stablecoins are designed to maintain a stable value, typically pegged to a fiat currency like the US dollar, or other assets such as gold. This stability is achieved through various mechanisms, including collateralization and algorithmic adjustments, which distinguish them from the highly volatile nature of traditional cryptocurrencies like Bitcoin and Ethereum. Consequently, stablecoins have become an essential tool for traders and investors seeking to mitigate risk and navigate the crypto markets with greater confidence.

In the realm of cryptocurrency trading, stablecoins serve as a reliable medium of exchange and a store of value. They provide a safe haven for traders during periods of market volatility, allowing them to exit positions in more volatile cryptocurrencies without converting their holdings back into fiat currency. This ability to quickly and efficiently move funds into stablecoins helps traders preserve capital and maintain liquidity, which is crucial for executing timely trades and taking advantage of market opportunities. Moreover, stablecoins facilitate seamless transactions across different cryptocurrency exchanges, as they are widely accepted and can be easily transferred between platforms.

Beyond their utility in trading, stablecoins play a significant role in the burgeoning DeFi ecosystem. DeFi platforms leverage blockchain technology to offer financial services such as lending, borrowing, and yield farming without the need for traditional intermediaries like banks. Stablecoins are integral to these platforms, providing a stable unit of account that underpins various DeFi protocols. For instance, in lending and borrowing platforms, stablecoins are often used as collateral or loaned assets, ensuring that the value of transactions remains consistent and predictable. This stability is crucial for maintaining trust and reliability in DeFi applications, which are often subject to the same market fluctuations that affect the broader cryptocurrency space.

Furthermore, stablecoins enable users to earn interest on their holdings through yield farming and liquidity provision. By supplying stablecoins to liquidity pools, users can earn returns in the form of interest or additional tokens, often at rates that surpass those offered by traditional financial institutions. This has attracted a growing number of participants to the DeFi space, seeking to capitalize on the lucrative opportunities presented by these innovative financial instruments. The use of stablecoins in these contexts underscores their versatility and importance in supporting the infrastructure of decentralized finance.

Despite their advantages, stablecoins are not without challenges and risks. Regulatory scrutiny has intensified as governments and financial authorities seek to understand and manage the implications of these digital assets on the global financial system. Concerns about transparency, security, and the potential for systemic risk have prompted calls for clearer regulatory frameworks and oversight. Additionally, the mechanisms used to maintain the stability of stablecoins, such as collateralization and algorithmic controls, must be robust and resilient to ensure their continued reliability.

In conclusion, stablecoins have become the backbone of cryptocurrency markets, offering stability and utility in both trading and DeFi applications. Their ability to provide a stable store of value and facilitate seamless transactions has made them indispensable to traders and investors alike. As the cryptocurrency landscape continues to evolve, the role of stablecoins is likely to expand, driven by ongoing innovation and the increasing integration of digital assets into the global financial system. However, addressing the challenges associated with their use will be crucial to ensuring their long-term success and sustainability.

Regulatory Perspectives On Stablecoins: Current Landscape And Future Outlook

Stablecoins have emerged as a pivotal component in the cryptocurrency ecosystem, offering a bridge between the volatile world of digital currencies and the stability of traditional fiat currencies. As their popularity and usage have grown, so too has the attention of regulators worldwide. Understanding the regulatory perspectives on stablecoins is crucial for grasping their current landscape and future outlook.

Initially, stablecoins were developed to address the inherent volatility of cryptocurrencies like Bitcoin and Ethereum. By pegging their value to stable assets such as the US dollar, stablecoins provide a reliable medium of exchange and store of value within the crypto markets. This stability has made them attractive not only to individual users but also to businesses and financial institutions seeking to leverage blockchain technology without exposure to extreme price fluctuations.

However, the rapid proliferation of stablecoins has raised significant regulatory concerns. One primary issue is the potential impact on financial stability. Regulators worry that widespread adoption of stablecoins could undermine traditional banking systems, especially if these digital currencies are not adequately backed by reserves. This concern is compounded by the fact that stablecoins can facilitate cross-border transactions, potentially bypassing existing financial regulations and controls.

In response to these concerns, regulatory bodies across the globe have begun to scrutinize stablecoin issuers more closely. In the United States, for instance, the Financial Stability Oversight Council has been actively assessing the risks posed by stablecoins to the broader financial system. Similarly, the European Union has proposed the Markets in Crypto-Assets (MiCA) regulation, which aims to establish a comprehensive framework for the issuance and operation of stablecoins within its member states.

Despite these regulatory efforts, there remains a lack of consensus on how best to approach stablecoin regulation. Some countries advocate for a stringent regulatory framework that treats stablecoins akin to traditional financial instruments, requiring issuers to adhere to strict capital and liquidity requirements. Others propose a more flexible approach, recognizing the innovative potential of stablecoins and seeking to foster their development while mitigating associated risks.

Looking ahead, the future outlook for stablecoin regulation is likely to be shaped by ongoing dialogue between regulators, industry stakeholders, and policymakers. As stablecoins continue to evolve, so too will the regulatory landscape. It is anticipated that future regulations will focus on ensuring transparency and accountability among stablecoin issuers, particularly concerning the reserves backing these digital currencies. Additionally, there may be increased emphasis on consumer protection measures to safeguard users from potential fraud or misuse.

Moreover, international cooperation will be essential in developing a cohesive regulatory framework for stablecoins. Given their global nature, stablecoins cannot be effectively regulated by any single jurisdiction. Collaborative efforts among countries will be necessary to address cross-border challenges and ensure that stablecoin regulations are harmonized to prevent regulatory arbitrage.

In conclusion, while stablecoins offer significant benefits to the crypto markets, their growing prominence necessitates careful regulatory consideration. The current landscape is characterized by a patchwork of regulatory approaches, reflecting differing national priorities and perspectives. However, as the dialogue around stablecoin regulation continues to evolve, there is hope for a more unified and effective regulatory framework that balances innovation with financial stability and consumer protection. This will be crucial in ensuring that stablecoins can fulfill their potential as the backbone of the crypto markets while maintaining the integrity of the global financial system.

The Impact Of Stablecoins On Global Financial Systems

Stablecoins have emerged as a pivotal component in the rapidly evolving landscape of cryptocurrency markets, offering a bridge between the volatile world of digital assets and the stability of traditional fiat currencies. As their name suggests, stablecoins are designed to maintain a stable value, typically pegged to a reserve of assets such as the US dollar, euro, or even commodities like gold. This stability is achieved through various mechanisms, including collateralization and algorithmic adjustments, which help mitigate the price fluctuations commonly associated with cryptocurrencies like Bitcoin and Ethereum. Consequently, stablecoins have become an essential tool for traders and investors seeking to navigate the crypto markets with reduced risk.

The impact of stablecoins extends beyond the realm of cryptocurrency trading, influencing global financial systems in several significant ways. Firstly, they facilitate seamless cross-border transactions, offering a faster and more cost-effective alternative to traditional banking systems. By eliminating the need for intermediaries and reducing transaction fees, stablecoins enable individuals and businesses to transfer funds across borders with greater efficiency. This capability is particularly beneficial for remittances, where high fees and slow processing times have long been a challenge for migrant workers sending money to their families in different countries.

Moreover, stablecoins have the potential to enhance financial inclusion by providing access to financial services for the unbanked and underbanked populations. In regions where traditional banking infrastructure is lacking or unreliable, stablecoins offer a viable solution for storing and transferring value securely. With the proliferation of smartphones and internet connectivity, individuals in remote areas can participate in the global economy, accessing services such as savings, loans, and insurance through blockchain-based platforms. This democratization of financial services can contribute to reducing poverty and fostering economic growth in underserved communities.

In addition to their role in facilitating transactions and promoting financial inclusion, stablecoins are increasingly being integrated into the operations of central banks and financial institutions. Some central banks are exploring the issuance of their own digital currencies, known as central bank digital currencies (CBDCs), which are essentially stablecoins backed by the full faith and credit of the issuing government. These CBDCs aim to modernize payment systems, enhance monetary policy effectiveness, and provide a secure digital alternative to cash. The introduction of CBDCs could potentially reshape the global financial landscape, influencing everything from monetary policy to the structure of financial markets.

However, the rise of stablecoins also presents challenges and risks that need to be addressed. Regulatory concerns have been raised regarding their potential impact on financial stability, money laundering, and consumer protection. The lack of a standardized regulatory framework across jurisdictions complicates efforts to oversee stablecoin activities and ensure their safe integration into the financial system. As stablecoins continue to gain traction, it is imperative for regulators, policymakers, and industry stakeholders to collaborate in developing comprehensive guidelines that balance innovation with risk management.

In conclusion, stablecoins have become a cornerstone of the cryptocurrency ecosystem, offering stability and utility that extend beyond digital asset trading. Their influence on global financial systems is profound, with the potential to revolutionize cross-border transactions, enhance financial inclusion, and reshape central banking. As the adoption of stablecoins grows, it is crucial to address the associated challenges through thoughtful regulation and collaboration, ensuring that their benefits are realized while safeguarding the integrity of the financial system.

Risks And Opportunities In The Stablecoin Market

Stablecoins have emerged as a pivotal component in the cryptocurrency ecosystem, offering a bridge between the volatile world of digital currencies and the relative stability of traditional fiat currencies. As their name suggests, stablecoins are designed to maintain a stable value, typically pegged to a reserve of assets such as the US dollar, euro, or even commodities like gold. This stability is achieved through various mechanisms, including collateralization and algorithmic adjustments, which aim to mitigate the price fluctuations commonly associated with cryptocurrencies like Bitcoin and Ethereum. However, while stablecoins present numerous opportunities, they also come with inherent risks that must be carefully considered.

One of the primary opportunities presented by stablecoins is their potential to facilitate seamless transactions across borders. By providing a digital currency that maintains a consistent value, stablecoins enable users to conduct international transactions without the need for currency conversion, thereby reducing transaction costs and time delays. This capability is particularly beneficial for individuals and businesses in regions with unstable local currencies, as it offers a reliable alternative for preserving value and conducting trade. Furthermore, stablecoins can enhance the efficiency of remittances, allowing individuals to send money to family members in other countries quickly and at a lower cost than traditional banking systems.

In addition to their transactional benefits, stablecoins also play a crucial role in the broader cryptocurrency market by providing liquidity and acting as a safe haven during periods of market volatility. Traders and investors often use stablecoins to hedge against the unpredictable price swings of other cryptocurrencies, thereby preserving their capital and maintaining purchasing power. This function is essential for the stability and growth of the crypto market, as it encourages participation by reducing the risk associated with digital asset investments.

Despite these advantages, the stablecoin market is not without its risks. One significant concern is the lack of regulatory oversight, which can lead to issues of transparency and trust. Many stablecoin issuers operate in a regulatory gray area, raising questions about the adequacy of their reserves and the mechanisms in place to maintain the peg. This uncertainty can undermine confidence in stablecoins, potentially leading to market instability if users suddenly lose trust in a particular stablecoin’s value.

Moreover, the centralization of some stablecoin projects poses additional risks. While decentralization is a core principle of the cryptocurrency movement, many stablecoins are issued and controlled by centralized entities, which can be vulnerable to regulatory actions, operational failures, or even fraudulent activities. This centralization can also lead to concerns about censorship and the potential for these entities to freeze or seize user funds.

In light of these risks, it is crucial for stakeholders in the stablecoin market, including issuers, regulators, and users, to work collaboratively to establish robust frameworks that ensure transparency, security, and compliance. By addressing these challenges, the stablecoin market can continue to grow and evolve, unlocking new opportunities for innovation and financial inclusion.

In conclusion, while stablecoins offer significant opportunities for enhancing the efficiency and accessibility of financial transactions, they also present a range of risks that must be carefully managed. As the stablecoin market matures, it will be essential for all participants to remain vigilant and proactive in addressing these challenges, ensuring that stablecoins can fulfill their potential as the backbone of the crypto markets.

Q&A

1. **What are stablecoins?**

Stablecoins are a type of cryptocurrency designed to maintain a stable value by pegging them to a reserve of assets, such as fiat currencies like the US dollar, or commodities like gold.

2. **How do stablecoins maintain their value?**

Stablecoins maintain their value through various mechanisms, including collateralization with fiat or crypto assets, algorithmic adjustments of supply, or a combination of these methods.

3. **What are the main types of stablecoins?**

The main types of stablecoins are fiat-collateralized (backed by fiat currencies), crypto-collateralized (backed by other cryptocurrencies), and algorithmic (using algorithms to control supply).

4. **Why are stablecoins important in crypto markets?**

Stablecoins provide stability in the volatile crypto market, enabling easier trading, acting as a medium of exchange, and serving as a store of value without the volatility of other cryptocurrencies.

5. **What are some popular stablecoins?**

Some popular stablecoins include Tether (USDT), USD Coin (USDC), Binance USD (BUSD), and DAI.

6. **What are the risks associated with stablecoins?**

Risks include regulatory scrutiny, the potential for de-pegging, lack of transparency in reserves, and reliance on centralized entities for fiat-backed stablecoins.

7. **How do stablecoins impact the broader financial system?**

Stablecoins can facilitate faster and cheaper cross-border transactions, enhance financial inclusion, and potentially disrupt traditional banking systems by providing an alternative to fiat currencies.

Conclusion

Stablecoins have emerged as a crucial component of the cryptocurrency ecosystem, providing stability and reliability in a market known for its volatility. By pegging their value to traditional assets like fiat currencies, stablecoins offer a bridge between the traditional financial system and the digital asset world, facilitating transactions, trading, and lending with reduced risk. Their role in enhancing liquidity, enabling decentralized finance (DeFi) applications, and offering a stable medium of exchange underscores their importance in the broader adoption of cryptocurrencies. As the crypto market continues to evolve, stablecoins are likely to remain integral, driving innovation while ensuring stability and trust within the digital economy.