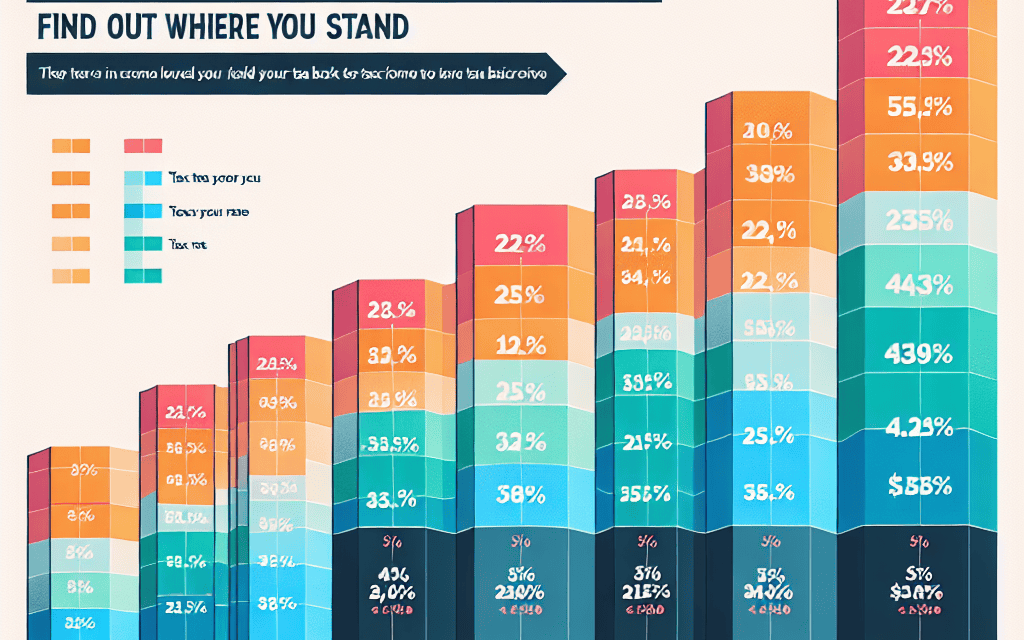

“Navigate Your Future: Uncover Your 2025 Tax Bracket Today!”

Introduction

In the ever-evolving landscape of personal finance, understanding your tax bracket is crucial for effective financial planning. As we approach 2025, it’s essential to stay informed about potential changes in tax laws and how they might impact your financial situation. “Discover Your 2025 Tax Bracket: Find Out Where You Stand” is designed to guide you through the complexities of the tax system, helping you identify your current tax bracket and anticipate any shifts that may occur. By gaining a clear understanding of your tax obligations, you can make informed decisions about investments, savings, and expenditures, ensuring that you are well-prepared for the financial year ahead.

Understanding Tax Brackets: A Guide to 2025 Changes

As we approach 2025, understanding the nuances of tax brackets becomes increasingly important for individuals and families aiming to manage their finances effectively. Tax brackets, which determine the rate at which your income is taxed, are subject to periodic adjustments due to inflation, legislative changes, and economic conditions. Therefore, staying informed about these changes is crucial for accurate financial planning and compliance with tax obligations.

In 2025, several key changes to the tax brackets are anticipated, reflecting broader economic trends and policy shifts. These adjustments are designed to ensure that the tax system remains equitable and responsive to the evolving economic landscape. As such, taxpayers should familiarize themselves with the new thresholds and rates to accurately assess their tax liabilities and potential refunds.

To begin with, it is essential to understand how tax brackets function. The United States employs a progressive tax system, meaning that income is taxed at increasing rates as it rises through different brackets. Each bracket corresponds to a specific range of income, with higher income levels subject to higher tax rates. This system is intended to distribute the tax burden more equitably across different income groups, ensuring that those with greater financial resources contribute a fairer share to public revenues.

In 2025, the tax brackets are expected to undergo inflation adjustments, which are routine modifications made to account for the rising cost of living. These adjustments prevent “bracket creep,” a situation where inflation pushes taxpayers into higher tax brackets, increasing their tax burden without a corresponding increase in real income. By aligning the brackets with inflation, the tax system maintains its intended progressivity and fairness.

Moreover, legislative changes may also influence the 2025 tax brackets. Policymakers often adjust tax rates and thresholds to achieve various economic and social objectives, such as stimulating economic growth, reducing income inequality, or funding public services. As a result, taxpayers should remain vigilant about potential legislative developments that could impact their tax liabilities.

To determine where you stand in the 2025 tax brackets, it is important to consider your total taxable income, which includes wages, salaries, bonuses, and other sources of income, minus any deductions and exemptions for which you qualify. By calculating your taxable income, you can identify the bracket that applies to you and estimate your tax liability accordingly.

Furthermore, understanding the implications of your tax bracket can inform your financial decisions throughout the year. For instance, if you anticipate moving into a higher bracket due to an increase in income, you might consider strategies to minimize your tax liability, such as maximizing contributions to retirement accounts or exploring eligible tax credits and deductions.

In conclusion, staying informed about the 2025 tax brackets is essential for effective financial planning and compliance. By understanding how these brackets function and anticipating potential changes, taxpayers can better navigate their financial responsibilities and make informed decisions. As we move closer to 2025, keeping abreast of inflation adjustments and legislative developments will ensure that you are well-prepared to manage your tax obligations and optimize your financial well-being.

How to Calculate Your 2025 Tax Bracket

Understanding your tax bracket is an essential aspect of financial planning, as it helps you anticipate your tax liabilities and make informed decisions about your finances. As we approach 2025, it is crucial to familiarize yourself with the process of calculating your tax bracket to ensure you are well-prepared for any changes in your financial situation. The tax bracket system in the United States is progressive, meaning that different portions of your income are taxed at different rates. Therefore, knowing how to calculate your tax bracket can provide clarity on how much of your income will be subject to taxation.

To begin calculating your 2025 tax bracket, you must first determine your taxable income. Taxable income is your gross income minus any deductions or exemptions you are eligible for. Gross income includes wages, dividends, capital gains, business income, and other sources of income. Once you have your gross income, you can subtract deductions such as the standard deduction or itemized deductions, which may include mortgage interest, state and local taxes, and charitable contributions. The result is your taxable income, which is the figure used to determine your tax bracket.

Next, it is important to understand the tax rates and brackets for 2025. The Internal Revenue Service (IRS) typically adjusts tax brackets annually to account for inflation, so it is essential to refer to the most recent tax tables provided by the IRS. These tables will outline the income ranges for each tax bracket and the corresponding tax rates. For instance, if the tax brackets for 2025 are similar to those in previous years, you might find that the lowest bracket is taxed at 10%, while the highest bracket could be taxed at 37%. By comparing your taxable income to these ranges, you can identify which bracket you fall into.

It is crucial to note that being in a particular tax bracket does not mean that all of your income is taxed at that rate. Instead, only the portion of your income that falls within a specific bracket is taxed at that rate. For example, if your taxable income places you in the 24% bracket, only the income exceeding the threshold of the previous bracket is taxed at 24%. The rest of your income is taxed at the lower rates of the preceding brackets. This progressive system ensures that taxpayers with higher incomes pay a higher percentage of their income in taxes, while those with lower incomes pay a smaller percentage.

In addition to understanding the tax brackets, it is beneficial to explore strategies that can help you manage your taxable income effectively. For instance, contributing to retirement accounts such as a 401(k) or an IRA can reduce your taxable income, potentially placing you in a lower tax bracket. Similarly, taking advantage of tax credits, which directly reduce your tax liability, can also be a valuable strategy. Credits such as the Earned Income Tax Credit or the Child Tax Credit can significantly impact your overall tax burden.

In conclusion, calculating your 2025 tax bracket involves determining your taxable income and understanding the current tax rates and brackets. By familiarizing yourself with these concepts and exploring strategies to manage your taxable income, you can make informed financial decisions and optimize your tax situation. As tax laws and rates may change, staying informed and consulting with a tax professional can further enhance your financial planning efforts.

Key Factors Influencing Your 2025 Tax Bracket

As we approach the year 2025, understanding the factors that influence your tax bracket becomes increasingly important for effective financial planning. The tax bracket you fall into determines the rate at which your income is taxed, and several key elements can influence this classification. By examining these factors, you can gain a clearer picture of where you might stand in the 2025 tax landscape.

To begin with, your taxable income is the primary determinant of your tax bracket. This figure is calculated by taking your total income and subtracting any deductions and exemptions you are eligible for. As such, changes in your income level, whether through salary increases, bonuses, or investment returns, can shift you into a different tax bracket. It is crucial to monitor these changes closely, as they can have significant implications for your tax obligations.

In addition to income, the tax code itself plays a pivotal role in determining your tax bracket. Tax laws are subject to change, and legislative adjustments can alter the thresholds and rates associated with each bracket. For instance, if Congress enacts new tax legislation, it could redefine the income ranges for each bracket or modify the rates applied to them. Staying informed about potential changes in tax policy is essential, as these adjustments can directly impact your financial situation.

Moreover, your filing status is another critical factor influencing your tax bracket. Whether you file as a single individual, married filing jointly, married filing separately, or head of household, each status has its own set of tax brackets. Changes in your personal circumstances, such as marriage or divorce, can therefore affect your filing status and, consequently, your tax bracket. It is important to consider how life events might alter your filing status and plan accordingly.

Deductions and credits also play a significant role in determining your taxable income and, by extension, your tax bracket. Deductions reduce your taxable income, while credits directly reduce the amount of tax you owe. Understanding which deductions and credits you qualify for can help lower your taxable income and potentially place you in a lower tax bracket. For example, contributions to retirement accounts, mortgage interest, and charitable donations are common deductions that can influence your tax situation.

Furthermore, inflation adjustments are another factor to consider. The IRS typically adjusts tax brackets annually to account for inflation, which can affect the income thresholds for each bracket. These adjustments are designed to prevent “bracket creep,” where inflation pushes taxpayers into higher brackets despite no real increase in purchasing power. Keeping an eye on these adjustments can help you anticipate changes in your tax obligations.

Finally, state taxes should not be overlooked when considering your overall tax bracket. While federal tax brackets are uniform across the country, state tax rates and brackets vary significantly. Depending on where you reside, state taxes can have a substantial impact on your total tax liability. It is advisable to familiarize yourself with your state’s tax system to fully understand your tax position.

In conclusion, several key factors influence your 2025 tax bracket, including your taxable income, changes in tax legislation, filing status, deductions and credits, inflation adjustments, and state taxes. By staying informed and proactive, you can better navigate the complexities of the tax system and make informed decisions that align with your financial goals. Understanding these elements will empower you to anticipate changes and optimize your tax strategy for the year ahead.

Strategies to Optimize Your 2025 Tax Bracket

As we approach the year 2025, understanding your tax bracket and implementing strategies to optimize it becomes increasingly important. Navigating the complexities of the tax system can be daunting, but with careful planning and informed decision-making, you can effectively manage your tax liabilities. The first step in this process is to determine your tax bracket, which is based on your taxable income. Tax brackets are structured progressively, meaning that different portions of your income are taxed at varying rates. By identifying where you stand within these brackets, you can begin to explore strategies to minimize your tax burden.

One effective strategy to optimize your tax bracket is to maximize contributions to retirement accounts. Contributions to traditional IRAs and 401(k) plans are made with pre-tax dollars, which can reduce your taxable income and potentially lower your tax bracket. Additionally, these contributions grow tax-deferred, allowing you to benefit from compound interest over time. It is important to be aware of the contribution limits set by the IRS, as exceeding these limits can result in penalties. By strategically planning your contributions, you can not only save for retirement but also manage your current tax obligations.

Another approach to consider is the timing of income and deductions. If you anticipate being in a lower tax bracket in the future, it may be advantageous to defer income to a later year. Conversely, if you expect to be in a higher bracket, accelerating income into the current year could be beneficial. Similarly, timing your deductions can have a significant impact. Bunching deductions, or concentrating deductible expenses into a single year, can help you exceed the standard deduction threshold and maximize your itemized deductions. This strategy requires careful planning and a thorough understanding of your financial situation.

Charitable contributions also offer a valuable opportunity to optimize your tax bracket. Donations to qualified charitable organizations are tax-deductible, which can reduce your taxable income. To maximize the benefits, consider donating appreciated assets, such as stocks, instead of cash. This allows you to avoid capital gains taxes while still receiving a deduction for the full market value of the asset. It is essential to keep detailed records of your contributions and ensure that the organizations you support are eligible to receive tax-deductible donations.

Furthermore, tax credits can play a crucial role in optimizing your tax bracket. Unlike deductions, which reduce your taxable income, tax credits directly reduce your tax liability. Familiarize yourself with available credits, such as the Child Tax Credit or the Earned Income Tax Credit, and determine your eligibility. These credits can significantly lower your tax bill and, in some cases, result in a refund.

In addition to these strategies, it is advisable to stay informed about changes in tax laws and regulations. Tax policies can shift with new legislation, impacting brackets, rates, and available deductions or credits. Regularly reviewing your financial situation and consulting with a tax professional can help you adapt to these changes and make informed decisions.

In conclusion, optimizing your 2025 tax bracket requires a proactive approach and a comprehensive understanding of available strategies. By maximizing retirement contributions, strategically timing income and deductions, leveraging charitable contributions, and utilizing tax credits, you can effectively manage your tax liabilities. Staying informed and seeking professional advice will further enhance your ability to navigate the complexities of the tax system, ultimately allowing you to achieve greater financial stability.

Common Misconceptions About 2025 Tax Brackets

As we approach the year 2025, understanding the nuances of tax brackets becomes increasingly important for individuals seeking to manage their finances effectively. However, there are several common misconceptions about tax brackets that can lead to confusion and misinformed financial decisions. By addressing these misconceptions, taxpayers can gain a clearer understanding of where they stand and how to optimize their tax strategies.

One prevalent misconception is the belief that being in a higher tax bracket means all of one’s income is taxed at that higher rate. In reality, the United States employs a progressive tax system, which means that income is taxed at different rates as it moves through various brackets. For instance, if an individual falls into the 25% tax bracket, only the portion of their income that exceeds the threshold for the previous bracket is taxed at 25%. The rest is taxed at lower rates. This tiered approach ensures that taxpayers benefit from lower rates on portions of their income, which can significantly affect overall tax liability.

Another misunderstanding involves the impact of tax bracket changes on take-home pay. Some individuals fear that earning more money will result in a lower net income due to higher taxes. However, because only the income exceeding the bracket threshold is taxed at the higher rate, the increase in earnings generally results in a net gain, even after accounting for additional taxes. This misconception often leads to unnecessary anxiety about salary increases or additional income sources, such as bonuses or freelance work.

Additionally, many taxpayers are unaware of the various deductions and credits available that can effectively lower their taxable income, potentially placing them in a lower tax bracket. Deductions such as those for mortgage interest, student loan interest, and retirement contributions can significantly reduce taxable income. Similarly, tax credits, which directly reduce the amount of tax owed, can also play a crucial role in managing one’s tax bracket. Understanding and utilizing these financial tools can lead to substantial savings and a more favorable tax position.

Furthermore, there is often confusion surrounding the annual adjustments to tax brackets. Each year, the IRS adjusts tax brackets to account for inflation, which can alter the income thresholds for each bracket. These adjustments are designed to prevent “bracket creep,” where inflation pushes taxpayers into higher brackets without an actual increase in real income. Staying informed about these changes is essential for accurate tax planning and ensuring that one’s financial strategies remain effective.

Finally, it is important to recognize that tax brackets are just one component of a comprehensive tax strategy. While understanding where one falls within the brackets is crucial, it is equally important to consider other factors such as capital gains taxes, alternative minimum tax, and state taxes. A holistic approach to tax planning, which includes these elements, can provide a more complete picture of one’s tax obligations and opportunities for savings.

In conclusion, dispelling common misconceptions about tax brackets is vital for effective financial planning. By understanding the progressive nature of the tax system, the impact of deductions and credits, and the annual adjustments for inflation, taxpayers can make informed decisions that optimize their tax situation. As 2025 approaches, taking the time to educate oneself about these aspects will ensure a more accurate assessment of one’s tax bracket and a more strategic approach to managing personal finances.

The Impact of Inflation on 2025 Tax Brackets

As we approach 2025, understanding the implications of inflation on tax brackets becomes increasingly important for taxpayers aiming to navigate their financial landscape effectively. Inflation, the gradual increase in prices and the corresponding decrease in purchasing power, plays a significant role in shaping tax policies and, consequently, the tax brackets that determine how much individuals owe to the government. In 2025, the impact of inflation on tax brackets is expected to be particularly pronounced, given the economic fluctuations experienced in recent years.

To begin with, it is essential to recognize that tax brackets are adjusted annually to account for inflation. This adjustment, known as “indexing,” is designed to prevent “bracket creep,” a situation where inflation pushes taxpayers into higher tax brackets, resulting in increased tax liabilities without a corresponding rise in real income. The Internal Revenue Service (IRS) uses the Consumer Price Index (CPI) to measure inflation and adjust tax brackets accordingly. As inflation rates have varied significantly over the past few years, the adjustments for 2025 are anticipated to reflect these changes, potentially altering where taxpayers find themselves within the tax bracket spectrum.

Moreover, the impact of inflation on tax brackets is not uniform across all income levels. For lower-income individuals, even a slight increase in inflation can lead to a more noticeable shift in their tax obligations. This is because the lower tax brackets are narrower, meaning that a small change in income can result in a move to a higher bracket. Conversely, for higher-income earners, the broader brackets mean that inflation-induced changes may have a less immediate impact on their tax liabilities. Nevertheless, understanding these dynamics is crucial for all taxpayers, as it allows for better financial planning and preparation.

In addition to the direct impact on tax brackets, inflation also influences other aspects of the tax code, such as deductions and credits. For instance, the standard deduction and various tax credits are also indexed for inflation, which can affect the overall tax burden for individuals and families. As these elements are adjusted, taxpayers may find that their eligibility for certain deductions or credits changes, further complicating the tax planning process. Therefore, staying informed about these adjustments is vital for making informed financial decisions.

Furthermore, the broader economic context in which these changes occur cannot be overlooked. Inflation is often influenced by a myriad of factors, including monetary policy, supply chain disruptions, and global economic conditions. As such, the adjustments to tax brackets in 2025 will likely reflect not only domestic economic trends but also international developments. This interconnectedness underscores the importance of a comprehensive understanding of both national and global economic indicators when assessing the potential impact on personal finances.

In conclusion, as we look ahead to 2025, the impact of inflation on tax brackets is a critical consideration for taxpayers seeking to optimize their financial strategies. By understanding how inflation affects tax brackets and related aspects of the tax code, individuals can better anticipate changes in their tax liabilities and make informed decisions. As the economic landscape continues to evolve, staying informed and proactive will be key to successfully navigating the complexities of the tax system in the coming years.

Preparing for 2025: Tax Bracket Planning Tips

As we approach the year 2025, it becomes increasingly important to understand the nuances of the tax brackets that will affect your financial planning. Navigating the complexities of tax brackets can be daunting, yet it is essential for effective financial management. By understanding where you stand within these brackets, you can make informed decisions that optimize your tax liabilities and enhance your financial well-being.

To begin with, tax brackets are essentially the ranges of income that are taxed at specific rates. These brackets are designed to ensure a progressive tax system, where individuals with higher incomes pay a larger percentage in taxes compared to those with lower incomes. As we look towards 2025, it is crucial to familiarize yourself with the anticipated changes in these brackets, as they can significantly impact your financial strategy.

One of the first steps in preparing for the 2025 tax brackets is to assess your current income and project any potential changes. This involves not only considering your salary but also any additional sources of income such as investments, rental properties, or side businesses. By having a comprehensive understanding of your income streams, you can better predict which tax bracket you will fall into and plan accordingly.

Moreover, it is important to consider the potential adjustments to the tax brackets themselves. Tax laws are subject to change, and staying informed about any legislative updates is crucial. For instance, inflation adjustments can alter the income thresholds for each bracket, which may affect your tax obligations. Keeping abreast of these changes will enable you to adapt your financial plans and avoid any unexpected tax burdens.

In addition to understanding your income and the tax brackets, exploring tax deductions and credits is a vital component of tax planning. Deductions reduce your taxable income, while credits directly reduce the amount of tax you owe. By strategically utilizing these tools, you can potentially lower your tax liability and retain more of your hard-earned money. For example, contributing to retirement accounts or making charitable donations can provide valuable deductions that may shift you into a lower tax bracket.

Furthermore, it is advisable to consult with a tax professional who can provide personalized guidance tailored to your specific financial situation. A tax advisor can help you navigate the intricacies of the tax code, identify opportunities for savings, and ensure compliance with all relevant regulations. Their expertise can be invaluable in optimizing your tax strategy and preparing for any changes that may arise in 2025.

As you plan for the future, it is also beneficial to consider the long-term implications of your tax strategy. While minimizing your tax liability is important, it should not come at the expense of your overall financial goals. Balancing short-term tax savings with long-term financial planning is key to achieving sustainable financial success.

In conclusion, preparing for the 2025 tax brackets requires a proactive approach that encompasses understanding your income, staying informed about legislative changes, and leveraging deductions and credits. By taking these steps, you can position yourself to navigate the evolving tax landscape with confidence and ensure that your financial plans align with your goals. As the year 2025 approaches, now is the time to evaluate your tax strategy and make any necessary adjustments to secure your financial future.

Q&A

1. **What is a tax bracket?**

A tax bracket is a range of income that is taxed at a specific rate. In a progressive tax system, as income increases, it is taxed at higher rates.

2. **How are tax brackets determined for 2025?**

Tax brackets for 2025 are determined by the IRS and are based on inflation adjustments, legislative changes, and economic factors.

3. **What are the expected tax brackets for 2025?**

While specific rates for 2025 are not available, they typically follow a progressive structure with multiple brackets, such as 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

4. **How can I find out my 2025 tax bracket?**

To find your 2025 tax bracket, estimate your taxable income for that year and compare it to the IRS’s published tax bracket ranges for 2025.

5. **What factors influence which tax bracket I fall into?**

Factors include your total taxable income, filing status (single, married, etc.), deductions, and any applicable credits.

6. **How do tax brackets affect my overall tax liability?**

Your tax liability is calculated by applying the tax rate of each bracket to the portion of your income that falls within that bracket, resulting in a blended tax rate.

7. **Can tax planning help me manage my tax bracket?**

Yes, tax planning strategies such as income deferral, maximizing deductions, and utilizing tax credits can help manage your taxable income and potentially lower your tax bracket.

Conclusion

The conclusion about “Discover Your 2025 Tax Bracket: Find Out Where You Stand” is that understanding your tax bracket is crucial for effective financial planning and decision-making. By identifying your tax bracket for 2025, you can better anticipate your tax liabilities, optimize your income strategies, and explore potential deductions or credits to minimize your tax burden. This proactive approach allows you to align your financial goals with tax obligations, ensuring a more secure and informed financial future.