“2025: Higher Standard Deductions, But Modest Gains for Taxpayers”

Introduction

In 2025, taxpayers are set to experience an increase in standard deductions, although the gains will be more modest compared to recent years. This adjustment is part of the regular inflation indexing of tax provisions, aimed at easing the tax burden by reflecting changes in the cost of living. However, the anticipated increase is smaller than the substantial hikes seen in previous years, which were influenced by significant legislative changes and economic conditions. As taxpayers prepare for the upcoming tax year, understanding these adjustments is crucial for effective financial planning and maximizing potential tax benefits.

Understanding the 2025 Standard Deduction Increase for Taxpayers

In 2025, taxpayers in the United States will experience an increase in the standard deduction, albeit a more modest one compared to recent years. This adjustment, while beneficial, reflects a shift in the trend of significant annual increases that taxpayers have become accustomed to. The standard deduction is a critical component of the tax code, allowing individuals to reduce their taxable income, thereby potentially lowering their overall tax liability. As such, any changes to this deduction are of considerable interest to taxpayers across the nation.

The standard deduction is adjusted annually to account for inflation, ensuring that taxpayers are not unduly burdened by rising costs of living. In recent years, these adjustments have been relatively substantial, providing taxpayers with noticeable relief. However, the increase slated for 2025 is expected to be smaller, a reflection of the current economic climate and inflationary trends. This change is significant as it indicates a stabilization in the rate of inflation, which has been a concern for both policymakers and the public.

Despite the smaller increase, the adjustment remains an essential tool for taxpayers, particularly those who do not itemize deductions. For many, the standard deduction simplifies the tax filing process, eliminating the need to track and document individual expenses. This simplification is especially beneficial for middle and lower-income taxpayers, who may not have the resources or need to itemize deductions. Therefore, even a modest increase in the standard deduction can provide meaningful financial relief to these individuals.

Moreover, the standard deduction serves as a buffer against inflation, ensuring that taxpayers’ purchasing power is not eroded by rising prices. By adjusting the deduction annually, the tax code helps maintain a level of fairness and equity, preventing taxpayers from being penalized by economic conditions beyond their control. In this context, the 2025 increase, though smaller, continues to uphold this principle, offering taxpayers a measure of protection against inflation.

It is also important to consider the broader implications of this adjustment within the context of fiscal policy. The standard deduction is a key element of the tax system, influencing government revenue and, by extension, public spending. A smaller increase in the deduction may have implications for budgetary planning, as it could affect the amount of revenue collected by the government. Policymakers must balance the need to provide relief to taxpayers with the necessity of funding essential public services and programs.

In conclusion, while the increase in the standard deduction for 2025 may be smaller than in recent years, it remains a vital component of the tax system. It continues to offer taxpayers a degree of financial relief and protection against inflation, even as economic conditions evolve. As taxpayers prepare for the upcoming tax year, understanding these changes and their implications will be crucial. By staying informed, individuals can better navigate the complexities of the tax system and make informed decisions about their financial planning. Ultimately, the standard deduction serves as a reminder of the ongoing efforts to balance taxpayer relief with fiscal responsibility, ensuring a fair and equitable tax system for all.

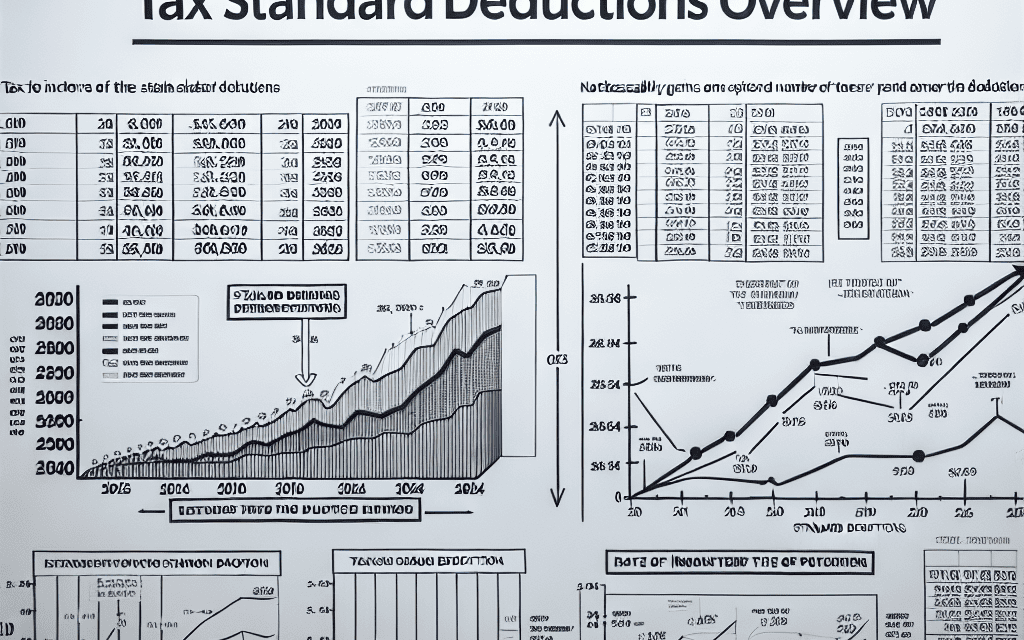

Comparing 2025 Standard Deduction Gains to Previous Years

In 2025, taxpayers in the United States will experience an increase in the standard deduction, albeit with gains that are more modest compared to recent years. This adjustment is part of the routine inflation indexing that the Internal Revenue Service (IRS) undertakes annually to account for changes in the cost of living. However, the upcoming increase in the standard deduction is notably smaller than the adjustments seen in the past few years, reflecting a shift in economic conditions and inflationary trends.

To understand the context of these changes, it is essential to consider the historical adjustments to the standard deduction. In recent years, taxpayers have benefited from significant increases in the standard deduction, largely driven by the Tax Cuts and Jobs Act (TCJA) of 2017. This legislation nearly doubled the standard deduction, providing substantial tax relief to millions of Americans. Following the TCJA, annual adjustments continued to reflect relatively high inflation rates, further boosting the standard deduction and offering additional financial relief to taxpayers.

However, as we approach 2025, the economic landscape has evolved. Inflation rates, which had been a driving force behind larger increases in the standard deduction, have begun to stabilize. Consequently, the IRS’s inflation indexing for 2025 reflects this stabilization, resulting in a more modest increase in the standard deduction compared to the previous years. This change underscores the dynamic nature of economic conditions and their impact on tax policy.

While the increase in the standard deduction for 2025 may be smaller, it remains a crucial component of the tax system, providing a baseline level of income that is not subject to federal income tax. This deduction simplifies the tax filing process for many individuals and families, as it reduces the need to itemize deductions. For taxpayers who do not have significant deductible expenses, the standard deduction offers a straightforward way to lower taxable income and, consequently, their overall tax liability.

Moreover, the standard deduction plays a vital role in ensuring that low- and moderate-income taxpayers are not unduly burdened by federal income taxes. By increasing the amount of income that is shielded from taxation, the standard deduction helps to maintain the progressivity of the tax system, ensuring that those with lower incomes pay a smaller proportion of their earnings in taxes compared to higher-income individuals.

As taxpayers prepare for the 2025 tax year, it is important to remain informed about these changes and consider their implications for personal financial planning. While the increase in the standard deduction may be smaller than in recent years, it still represents an important adjustment that can impact tax liabilities. Taxpayers should review their financial situations and consider how the updated standard deduction, along with other tax provisions, may affect their overall tax strategy.

In conclusion, the increase in the standard deduction for 2025, though smaller than in recent years, continues to play a significant role in the U.S. tax system. It reflects the ongoing adjustments to economic conditions and serves as a critical tool for simplifying tax filing and providing relief to taxpayers. As economic conditions continue to evolve, taxpayers should stay informed about these changes and consider their broader financial implications.

How the 2025 Standard Deduction Changes Affect Taxpayers

In 2025, taxpayers will experience an increase in the standard deduction, although the gains are expected to be more modest compared to recent years. This change is part of the regular adjustments made by the Internal Revenue Service (IRS) to account for inflation and other economic factors. While the increase in the standard deduction is generally welcomed by taxpayers, it is important to understand the implications of these changes and how they might affect individual tax situations.

The standard deduction is a crucial component of the U.S. tax system, offering taxpayers a simplified way to reduce their taxable income. By opting for the standard deduction, taxpayers can avoid the complexities of itemizing deductions, which can be a time-consuming and often confusing process. In recent years, the standard deduction has seen significant increases, largely due to the Tax Cuts and Jobs Act of 2017, which nearly doubled the deduction amounts. However, the upcoming changes in 2025 are expected to be less dramatic, reflecting a return to more typical annual adjustments.

For many taxpayers, the increase in the standard deduction will result in a slight reduction in their taxable income, potentially lowering their overall tax liability. This can be particularly beneficial for those who do not have enough deductible expenses to justify itemizing. However, it is essential to note that while the standard deduction is increasing, other factors, such as changes in tax brackets and personal exemptions, can also influence the final tax outcome. Therefore, taxpayers should consider their entire financial picture when evaluating the impact of these changes.

Moreover, the modest increase in the standard deduction may not be sufficient to offset other rising costs that taxpayers face, such as healthcare, education, and housing expenses. As a result, some individuals may find that their overall financial situation remains largely unchanged, despite the higher deduction. It is also worth noting that the benefits of the increased standard deduction may vary depending on a taxpayer’s filing status. For instance, married couples filing jointly typically receive a larger deduction than single filers, which can lead to different outcomes for different households.

In addition to understanding the direct effects of the standard deduction increase, taxpayers should also be aware of potential changes in tax planning strategies. With the standard deduction becoming more attractive, fewer taxpayers may choose to itemize deductions, which could impact decisions related to charitable giving, mortgage interest payments, and other deductible expenses. Taxpayers who have traditionally itemized may need to reassess their strategies to ensure they are maximizing their tax benefits under the new rules.

Furthermore, it is advisable for taxpayers to stay informed about any additional tax law changes that may accompany the adjustment in the standard deduction. Legislative developments can introduce new credits, deductions, or other provisions that could further influence tax liabilities. Consulting with a tax professional or financial advisor can provide valuable insights and help taxpayers navigate these complexities.

In conclusion, while the increase in the standard deduction for 2025 offers some relief to taxpayers, the gains are expected to be smaller than in recent years. Understanding the broader context of these changes and their potential impact on individual tax situations is essential for effective tax planning. By staying informed and considering the full range of factors that affect their taxes, taxpayers can make more informed decisions and optimize their financial outcomes.

Analyzing the Impact of Smaller Standard Deduction Gains in 2025

In 2025, taxpayers will experience an increase in the standard deduction, albeit at a slower pace than in recent years. This change, while still beneficial, may not provide the same level of financial relief that taxpayers have grown accustomed to. Understanding the implications of this adjustment requires a closer examination of the factors contributing to the smaller gains and how they might affect different segments of the population.

To begin with, the standard deduction is a critical component of the tax code, designed to simplify the filing process and reduce taxable income for individuals and families. It serves as a baseline deduction that taxpayers can claim without itemizing expenses, thus streamlining the process for many. Over the past few years, the standard deduction has seen significant increases, largely due to legislative changes and inflation adjustments. These increases have provided substantial tax relief, particularly for middle and lower-income households, by effectively lowering their taxable income and, consequently, their tax liability.

However, the anticipated increase in 2025 is expected to be more modest. This change can be attributed to several factors, including slower inflation rates and the absence of major legislative overhauls akin to those seen in previous years. Inflation adjustments play a crucial role in determining the standard deduction, as they are intended to ensure that the deduction keeps pace with the rising cost of living. When inflation rates are lower, the corresponding adjustments to the standard deduction are also smaller, resulting in less pronounced increases.

Moreover, the lack of significant legislative changes in recent years has contributed to the smaller gains. In the past, tax reforms have often included provisions to substantially raise the standard deduction as a means of providing broad-based tax relief. Without such reforms on the horizon, the increases are likely to remain modest, reflecting only the necessary adjustments for inflation.

The impact of these smaller gains will vary across different taxpayer demographics. For high-income earners, who are more likely to itemize deductions, the change in the standard deduction may have a negligible effect. However, for middle and lower-income taxpayers, who typically rely on the standard deduction, the smaller increase could mean less relief from their overall tax burden. This demographic may find that their tax savings are not as significant as in previous years, potentially affecting their disposable income and financial planning.

Furthermore, the implications of these changes extend beyond individual taxpayers. The broader economy could also feel the effects, as reduced tax savings might lead to decreased consumer spending. Consumer spending is a vital component of economic growth, and any reduction in disposable income could have a ripple effect, impacting various sectors of the economy.

In conclusion, while the increase in the standard deduction in 2025 will still provide some level of tax relief, the gains are expected to be smaller than in recent years. This change is primarily due to slower inflation rates and the absence of major legislative reforms. As a result, middle and lower-income taxpayers may experience less financial relief, which could, in turn, influence their spending habits and the broader economy. Understanding these dynamics is crucial for taxpayers as they plan for the future and navigate the evolving landscape of tax policy.

Strategies for Taxpayers to Maximize Benefits from 2025 Deductions

As taxpayers look ahead to the 2025 tax year, they will notice an increase in the standard deduction, albeit a more modest one compared to recent years. This change, while not as substantial as some might have hoped, still presents an opportunity for individuals and families to optimize their tax strategies. Understanding how to maximize the benefits from these deductions is crucial for taxpayers aiming to minimize their taxable income and, consequently, their tax liability.

To begin with, it is essential to recognize the role of the standard deduction in simplifying the tax filing process. By allowing taxpayers to reduce their taxable income without itemizing deductions, the standard deduction streamlines the process and often results in a lower tax bill. In 2025, the increase in the standard deduction, though smaller, still provides a valuable opportunity for taxpayers to reassess their financial strategies. For many, this will involve a careful evaluation of whether to take the standard deduction or to itemize deductions, a decision that hinges on individual financial circumstances.

For those who typically itemize deductions, it is important to consider whether the increased standard deduction might now offer a more advantageous option. This decision requires a thorough analysis of potential itemized deductions, such as mortgage interest, state and local taxes, and charitable contributions. Taxpayers should compare the total of these itemized deductions against the new standard deduction to determine which option yields the greatest tax benefit. In some cases, the increased standard deduction may surpass the total of itemized deductions, making it the more beneficial choice.

Moreover, taxpayers should explore strategies to maximize their deductions, regardless of whether they choose to itemize or take the standard deduction. One effective approach is to bunch deductions, a strategy that involves timing deductible expenses to maximize their impact in a given tax year. For instance, taxpayers might choose to make charitable contributions or pay property taxes in advance to increase their itemized deductions in a particular year. This strategy can be particularly useful in years when the standard deduction increase is less significant, as it allows taxpayers to optimize their deductions strategically.

Additionally, taxpayers should remain vigilant about changes in tax laws and regulations that could impact their deductions. Staying informed about legislative developments and consulting with tax professionals can provide valuable insights into how to navigate these changes effectively. Tax professionals can offer personalized advice tailored to individual financial situations, helping taxpayers make informed decisions about their deductions.

Furthermore, taxpayers should consider the broader context of their financial planning when evaluating their deduction strategies. This includes taking into account retirement contributions, health savings accounts, and other tax-advantaged savings options. By integrating these elements into their overall tax strategy, taxpayers can enhance their financial well-being while maximizing their deductions.

In conclusion, while the increase in the standard deduction for 2025 may be smaller than in recent years, it still presents an opportunity for taxpayers to optimize their tax strategies. By carefully evaluating their options, considering the benefits of bunching deductions, staying informed about tax law changes, and integrating their deduction strategies into broader financial planning, taxpayers can make the most of the available deductions. Ultimately, these efforts can lead to a more favorable tax outcome and contribute to long-term financial stability.

The Future of Standard Deductions: What to Expect Beyond 2025

As taxpayers look toward the future, the landscape of standard deductions is poised for change, with notable adjustments set to take effect in 2025. While these increases are anticipated, they are expected to be more modest compared to the significant gains witnessed in recent years. This shift in the trajectory of standard deductions is a reflection of broader economic trends and legislative decisions that have shaped the tax code over the past decade.

To understand the implications of these changes, it is essential to consider the historical context. In recent years, taxpayers have benefited from substantial increases in standard deductions, largely due to the Tax Cuts and Jobs Act (TCJA) of 2017. This legislation nearly doubled the standard deduction, providing significant tax relief to millions of Americans and simplifying the filing process for many. However, as the provisions of the TCJA are set to expire in 2025, the future of standard deductions is under scrutiny.

The anticipated increases in standard deductions in 2025, while welcome, are expected to be more incremental. This is partly due to the expiration of the TCJA’s temporary provisions, which means that any adjustments will likely be influenced by inflation and other economic factors rather than sweeping legislative changes. Consequently, taxpayers may not experience the same level of relief that characterized the post-2017 period.

Moreover, the economic environment plays a crucial role in shaping tax policy. Inflation, for instance, has been a significant factor in recent years, affecting the purchasing power of households and prompting adjustments in tax brackets and deductions. As inflation rates stabilize, the adjustments to standard deductions may become more predictable, albeit smaller in scale. This stabilization could lead to a more gradual increase in deductions, aligning with historical norms rather than the dramatic shifts seen in the past decade.

In addition to economic factors, political considerations will also influence the future of standard deductions. As lawmakers debate the merits of extending or modifying the provisions of the TCJA, the outcome will have a direct impact on taxpayers. The political climate, characterized by differing priorities between parties, adds a layer of complexity to the decision-making process. While some policymakers advocate for maintaining higher deductions to support middle-class families, others emphasize the need for fiscal responsibility and deficit reduction.

Looking beyond 2025, taxpayers should prepare for a tax landscape that may be less dynamic than in recent years. The potential for smaller gains in standard deductions suggests a return to a more stable and predictable tax environment. However, this does not preclude the possibility of future reforms that could once again reshape the tax code. As such, it is crucial for taxpayers to stay informed about legislative developments and economic trends that could impact their financial planning.

In conclusion, while the increases in standard deductions in 2025 are expected to be smaller than those seen in recent years, they represent an important aspect of the evolving tax landscape. By understanding the factors driving these changes, taxpayers can better navigate the complexities of the tax system and make informed decisions about their financial future. As the expiration of the TCJA approaches, the interplay between economic conditions and political priorities will continue to shape the future of standard deductions, offering both challenges and opportunities for taxpayers.

Tax Planning Tips in Light of 2025 Standard Deduction Adjustments

In 2025, taxpayers will experience an increase in the standard deduction, albeit a more modest one compared to the significant adjustments seen in recent years. This change, while beneficial, necessitates a strategic approach to tax planning to maximize potential savings. Understanding the implications of these adjustments is crucial for taxpayers aiming to optimize their financial strategies.

The standard deduction serves as a critical component in the tax filing process, offering a reduction in taxable income and simplifying the filing process for many individuals. In recent years, substantial increases in the standard deduction have provided considerable relief to taxpayers, effectively reducing their taxable income and, consequently, their tax liability. However, the upcoming adjustments in 2025, though still beneficial, represent a smaller increment than what taxpayers have become accustomed to. This shift underscores the importance of proactive tax planning to ensure that individuals and families can continue to benefit from available deductions and credits.

One of the primary considerations for taxpayers in light of the 2025 adjustments is the potential impact on itemized deductions. With a smaller increase in the standard deduction, some taxpayers may find it advantageous to revisit their itemized deductions to determine if they can achieve greater tax savings. This involves a careful evaluation of eligible expenses, such as mortgage interest, state and local taxes, and charitable contributions, to ascertain whether itemizing would result in a lower taxable income compared to taking the standard deduction.

Moreover, taxpayers should consider the timing of their deductible expenses. By strategically planning the payment of certain expenses, individuals can potentially maximize their deductions in a given tax year. For instance, bunching charitable contributions or prepaying property taxes can increase the total amount of itemized deductions, making it more beneficial than the standard deduction. This approach requires careful planning and foresight, but it can lead to significant tax savings.

In addition to evaluating deductions, taxpayers should also be mindful of potential changes in tax credits. Credits, unlike deductions, directly reduce the amount of tax owed, making them a powerful tool in tax planning. Staying informed about available credits and any changes to their eligibility criteria is essential for taxpayers seeking to minimize their tax liability. This includes exploring credits related to education, energy efficiency, and family care, among others.

Furthermore, taxpayers should not overlook the importance of retirement contributions in their tax planning strategy. Contributions to retirement accounts such as 401(k)s and IRAs can reduce taxable income, providing an immediate tax benefit while also securing financial stability for the future. As the standard deduction increases, albeit modestly, maximizing retirement contributions can serve as an effective means of reducing taxable income and enhancing long-term financial security.

In conclusion, while the increase in the standard deduction for 2025 may be smaller than in previous years, it remains a valuable tool for taxpayers. However, to fully capitalize on potential tax savings, individuals must engage in thoughtful and strategic tax planning. By carefully evaluating deductions, credits, and retirement contributions, taxpayers can navigate the changing landscape and optimize their financial outcomes. As tax laws continue to evolve, staying informed and proactive will be key to achieving the best possible tax position.

Q&A

1. **What is happening to the standard deduction in 2025?**

The standard deduction for taxpayers is set to increase in 2025.

2. **How does the increase in 2025 compare to recent years?**

The gains in the standard deduction for 2025 are smaller compared to the increases seen in recent years.

3. **Why are the increases smaller in 2025?**

The smaller increases are likely due to adjustments in inflation rates or changes in tax policy.

4. **Who will be affected by the changes in the standard deduction?**

All taxpayers who opt for the standard deduction on their tax returns will be affected.

5. **What is the purpose of the standard deduction?**

The standard deduction reduces the amount of income on which taxpayers are taxed, thereby lowering their overall tax liability.

6. **How often are standard deductions adjusted?**

Standard deductions are typically adjusted annually to account for inflation.

7. **What should taxpayers do in response to these changes?**

Taxpayers should review their tax situation to determine whether taking the standard deduction or itemizing deductions will be more beneficial for them in 2025.

Conclusion

In 2025, taxpayers will experience an increase in standard deductions, although the increments will be smaller compared to those in recent years. This change reflects adjustments for inflation and cost-of-living increases, but the reduced rate of growth in deductions may result in a less significant impact on taxpayers’ overall tax liabilities. Consequently, while taxpayers will benefit from some relief, the smaller gains may not substantially offset other potential increases in tax burdens or living expenses.