“Bitcoin Halving: Paving the Path to a Scarcer, Stronger Crypto Future.”

Introduction

Bitcoin halving is a pivotal event in the cryptocurrency world, occurring approximately every four years, where the reward for mining new Bitcoin blocks is halved. This process is integral to Bitcoin’s monetary policy, designed to control inflation by gradually reducing the number of new coins introduced into circulation. As the supply of new Bitcoin decreases, scarcity is expected to increase, potentially driving up demand and price. The halving event not only impacts miners, who receive fewer rewards for their efforts, but also influences market dynamics, investor sentiment, and the broader crypto ecosystem. Understanding Bitcoin halving is crucial for anticipating its long-term effects on the cryptocurrency market, as it plays a significant role in shaping the economic landscape of digital assets.

Understanding Bitcoin Halving: A Key Event in Cryptocurrency

Bitcoin halving is a pivotal event in the cryptocurrency world, occurring approximately every four years, and it plays a crucial role in the economic model of Bitcoin. To understand its significance, one must first grasp the basic mechanics of Bitcoin mining. Bitcoin operates on a decentralized network where transactions are verified by miners who use computational power to solve complex mathematical problems. In return for their efforts, miners are rewarded with newly minted bitcoins. This process not only secures the network but also introduces new bitcoins into circulation.

The concept of halving is embedded in Bitcoin’s code, designed by its pseudonymous creator, Satoshi Nakamoto. It refers to the reduction of the block reward given to miners by 50%. Initially, miners received 50 bitcoins per block, but this reward has been halved every 210,000 blocks, or roughly every four years. The first halving occurred in 2012, reducing the reward to 25 bitcoins, followed by another in 2016, bringing it down to 12.5 bitcoins. The most recent halving in 2020 further reduced the reward to 6.25 bitcoins. This systematic reduction will continue until the maximum supply of 21 million bitcoins is reached, projected to occur around the year 2140.

The implications of Bitcoin halving are profound, affecting both the supply dynamics and the market behavior of Bitcoin. By reducing the rate at which new bitcoins are created, halving introduces a deflationary aspect to the cryptocurrency. This scarcity is a fundamental characteristic that differentiates Bitcoin from traditional fiat currencies, which can be printed in unlimited quantities by central banks. Consequently, many investors view Bitcoin as a hedge against inflation, akin to digital gold.

Moreover, the halving event often influences Bitcoin’s price. Historically, halvings have been followed by significant price increases, as the reduced supply of new bitcoins entering the market creates upward pressure on the price. This phenomenon can be attributed to the basic economic principle of supply and demand. As the supply of new bitcoins diminishes, assuming demand remains constant or increases, the price is likely to rise. However, it is essential to note that past performance is not indicative of future results, and various factors can influence market dynamics.

In addition to price implications, halving also impacts the mining ecosystem. As block rewards decrease, miners must rely more on transaction fees to sustain their operations. This shift could lead to increased competition among miners, driving innovation and efficiency in mining technology. However, it may also result in smaller or less efficient mining operations becoming unprofitable, potentially leading to a more centralized mining landscape.

Looking ahead, Bitcoin halving events will continue to shape the cryptocurrency’s trajectory. As the supply of new bitcoins dwindles, the focus may shift towards the utility and adoption of Bitcoin as a medium of exchange and store of value. Furthermore, the broader cryptocurrency market may experience ripple effects, as Bitcoin’s performance often influences other digital assets.

In conclusion, Bitcoin halving is a fundamental event that underscores the unique economic model of Bitcoin. By systematically reducing the supply of new bitcoins, it introduces scarcity, influences market dynamics, and impacts the mining ecosystem. As the cryptocurrency landscape evolves, understanding the implications of halving will be crucial for investors, miners, and enthusiasts alike, as they navigate the future of crypto.

The Impact of Bitcoin Halving on Market Prices

Bitcoin halving is a pivotal event in the cryptocurrency world, occurring approximately every four years, and it has significant implications for market prices. This event, embedded in Bitcoin’s code by its pseudonymous creator, Satoshi Nakamoto, reduces the reward miners receive for adding new blocks to the blockchain by half. As a result, the rate at which new bitcoins are introduced into circulation slows down, ultimately capping the total supply at 21 million bitcoins. Understanding the impact of Bitcoin halving on market prices requires a comprehensive analysis of supply and demand dynamics, investor sentiment, and historical trends.

To begin with, the reduction in the supply of new bitcoins is a fundamental factor influencing market prices. By design, Bitcoin’s scarcity is enhanced with each halving, as fewer bitcoins are mined over time. This scarcity is akin to precious metals like gold, where limited supply can drive up prices if demand remains constant or increases. Consequently, many investors anticipate that Bitcoin’s price will rise following a halving event, as the reduced supply exerts upward pressure on the market. This expectation is often reflected in the months leading up to a halving, as traders and investors position themselves to capitalize on potential price increases.

Moreover, historical data provides valuable insights into the impact of Bitcoin halving on market prices. The first halving in 2012 and the second in 2016 were both followed by significant bull runs, with Bitcoin reaching new all-time highs in the subsequent years. These historical precedents have contributed to a prevailing belief among market participants that halving events are bullish for Bitcoin’s price. However, it is essential to recognize that past performance is not always indicative of future results, and various factors can influence market dynamics.

In addition to supply constraints, investor sentiment plays a crucial role in shaping market prices around halving events. The anticipation of a price increase can lead to speculative buying, driving prices higher even before the halving occurs. This phenomenon, often referred to as “buy the rumor, sell the news,” can result in heightened volatility as traders react to both the anticipation and the actual event. Furthermore, media coverage and public discourse surrounding Bitcoin halving can amplify these effects, drawing in new investors and increasing market participation.

Nevertheless, it is important to consider external factors that may impact Bitcoin’s price trajectory following a halving. Macroeconomic conditions, regulatory developments, and technological advancements within the cryptocurrency space can all influence market sentiment and price movements. For instance, increased regulatory scrutiny or adverse economic conditions could dampen investor enthusiasm, counteracting the bullish effects of a halving. Conversely, positive developments such as institutional adoption or technological innovations could bolster confidence and drive prices higher.

In conclusion, Bitcoin halving is a significant event with the potential to impact market prices through its effects on supply dynamics and investor sentiment. While historical trends suggest a bullish outlook, it is crucial for investors to remain cognizant of the broader market environment and the myriad factors that can influence price movements. As the cryptocurrency landscape continues to evolve, understanding the implications of Bitcoin halving will remain essential for market participants seeking to navigate the complexities of this dynamic and rapidly changing market.

How Bitcoin Halving Affects Mining and Miners

Bitcoin halving is a pivotal event in the cryptocurrency world, occurring approximately every four years, and it has profound implications for both mining and miners. This event, embedded in Bitcoin’s code by its pseudonymous creator, Satoshi Nakamoto, reduces the reward miners receive for adding a new block to the blockchain by half. As a result, the supply of new bitcoins entering circulation is curtailed, which can have significant effects on the mining ecosystem and the broader cryptocurrency market.

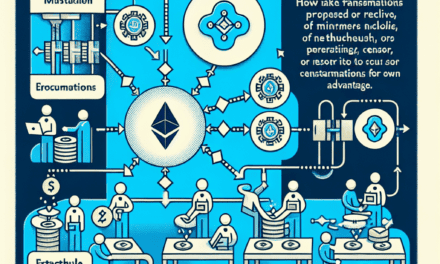

To understand the impact of Bitcoin halving on mining, it is essential to first grasp the concept of mining itself. Bitcoin mining is the process by which transactions are verified and added to the public ledger, known as the blockchain. Miners use powerful computers to solve complex mathematical problems, and in return, they are rewarded with newly minted bitcoins. This reward serves as an incentive for miners to continue validating transactions and securing the network. However, with each halving event, the reward is reduced, which directly affects the profitability of mining operations.

The reduction in block rewards means that miners must rely more heavily on transaction fees to maintain their revenue streams. As the reward decreases, the cost of mining a single bitcoin increases, making it less profitable for miners who do not have access to the most efficient hardware or the cheapest electricity. Consequently, some miners may be forced to shut down their operations, especially those with higher operational costs. This can lead to a temporary decrease in the network’s hash rate, which is a measure of the computational power being used to mine and process transactions.

However, it is important to note that Bitcoin halving also has the potential to drive innovation within the mining industry. As miners seek to maintain profitability, they are incentivized to develop more efficient mining technologies and explore renewable energy sources to reduce costs. This drive for efficiency can lead to advancements that benefit the entire network, making it more secure and sustainable in the long run.

Moreover, Bitcoin halving can have a significant impact on the price of Bitcoin itself, which in turn affects miners. Historically, halving events have been associated with substantial price increases, as the reduction in supply can lead to increased demand. If the price of Bitcoin rises sufficiently, it can offset the reduced block rewards, allowing miners to remain profitable despite the halving. This potential for price appreciation can attract new participants to the mining industry, further contributing to the network’s security and resilience.

In addition to these economic considerations, Bitcoin halving also plays a crucial role in reinforcing the cryptocurrency’s deflationary nature. By systematically reducing the rate at which new bitcoins are created, halving events ensure that the total supply of Bitcoin remains capped at 21 million. This scarcity is a fundamental aspect of Bitcoin’s value proposition, distinguishing it from traditional fiat currencies that can be printed at will by central banks.

In conclusion, Bitcoin halving is a critical event that affects mining and miners in multiple ways. While it poses challenges by reducing block rewards and increasing operational costs, it also drives innovation and can lead to price appreciation that benefits the entire ecosystem. As the cryptocurrency landscape continues to evolve, understanding the implications of Bitcoin halving will be essential for miners and investors alike, as they navigate the complexities of this dynamic and rapidly changing market.

Bitcoin Halving and Its Influence on Supply and Demand

Bitcoin halving is a pivotal event in the cryptocurrency world, occurring approximately every four years, or after every 210,000 blocks are mined. This event is integral to Bitcoin’s monetary policy, as it systematically reduces the reward miners receive for adding new blocks to the blockchain by half. The halving mechanism is embedded in Bitcoin’s code, ensuring a finite supply of 21 million coins, which is expected to be fully mined by the year 2140. As the reward diminishes, the rate at which new bitcoins enter circulation slows, influencing both supply and demand dynamics in the market.

To understand the implications of Bitcoin halving on supply and demand, it is essential to consider the basic economic principle of scarcity. By design, Bitcoin is a deflationary asset, meaning its supply is limited and decreases over time. Each halving event accentuates this scarcity, as fewer bitcoins are introduced into the market. Consequently, if demand remains constant or increases, the reduced supply can lead to upward pressure on Bitcoin’s price. Historically, past halving events have been followed by significant price rallies, as market participants anticipate the reduced supply and adjust their expectations accordingly.

Moreover, the halving event has a profound impact on miners, who play a crucial role in maintaining the Bitcoin network. As the block reward decreases, miners must rely more heavily on transaction fees to sustain their operations. This shift can lead to increased competition among miners, driving innovation and efficiency in mining technology. However, it also poses challenges, particularly for smaller mining operations that may struggle to remain profitable. As a result, the mining landscape may consolidate, with larger, more efficient miners dominating the network.

In addition to affecting miners, Bitcoin halving influences investor sentiment and market behavior. The anticipation of a halving event often generates significant media attention and speculation, attracting new investors to the market. This influx of interest can lead to increased demand, further amplifying the potential for price appreciation. However, it is important to note that while historical patterns suggest a correlation between halving events and price increases, past performance is not indicative of future results. Market conditions, regulatory developments, and macroeconomic factors can all influence Bitcoin’s price trajectory.

Furthermore, Bitcoin halving has broader implications for the cryptocurrency ecosystem as a whole. As the flagship cryptocurrency, Bitcoin often sets the tone for the market, with its price movements impacting other digital assets. A successful halving event can bolster confidence in the cryptocurrency market, encouraging investment and innovation across the sector. Conversely, any negative outcomes, such as a significant drop in mining activity or network security concerns, could have ripple effects throughout the industry.

In conclusion, Bitcoin halving is a critical event that shapes the supply and demand dynamics of the cryptocurrency market. By reducing the rate at which new bitcoins are introduced, it reinforces Bitcoin’s scarcity and can influence price movements. The event also impacts miners, investors, and the broader cryptocurrency ecosystem, highlighting the interconnected nature of these elements. As the next halving approaches, market participants will closely monitor its effects, seeking to understand its implications for the future of crypto. While the outcome remains uncertain, the halving event undeniably plays a significant role in shaping the trajectory of Bitcoin and the wider digital asset landscape.

Historical Analysis: Past Bitcoin Halvings and Their Outcomes

Bitcoin halving events have historically played a pivotal role in shaping the cryptocurrency landscape, influencing both market dynamics and investor sentiment. To understand the potential implications of future halvings, it is essential to examine the outcomes of past events. Bitcoin halvings occur approximately every four years, reducing the reward miners receive for adding a new block to the blockchain by half. This mechanism is integral to Bitcoin’s design, ensuring a finite supply and mimicking the scarcity of precious metals like gold.

The first Bitcoin halving took place in November 2012, reducing the block reward from 50 to 25 bitcoins. Prior to this event, Bitcoin was largely an obscure digital currency, with limited mainstream recognition. However, the halving marked a turning point, as it coincided with a significant price increase. In the months following the event, Bitcoin’s price surged from around $12 to over $1,000 by late 2013. This dramatic rise can be attributed to the reduced supply of new bitcoins entering the market, coupled with growing interest from early adopters and tech enthusiasts. The first halving demonstrated the potential for supply constraints to drive up prices, setting a precedent for future events.

The second halving occurred in July 2016, further reducing the block reward to 12.5 bitcoins. Leading up to this event, the market experienced a period of relative stability, with Bitcoin’s price hovering around $600. However, the post-halving period saw a gradual increase in price, culminating in the historic bull run of 2017, where Bitcoin reached an all-time high of nearly $20,000. This second halving reinforced the notion that reduced supply, combined with increasing demand, could lead to substantial price appreciation. Additionally, it highlighted the growing interest from institutional investors and the broader public, as Bitcoin began to gain recognition as a legitimate asset class.

The most recent halving took place in May 2020, cutting the block reward to 6.25 bitcoins. This event occurred amidst the global economic uncertainty caused by the COVID-19 pandemic. Despite initial volatility, Bitcoin’s price embarked on a remarkable upward trajectory, reaching new all-time highs in 2021. The 2020 halving underscored the resilience of Bitcoin as a store of value, particularly in times of economic turmoil. It also highlighted the increasing role of macroeconomic factors, such as inflation concerns and monetary policy, in driving demand for Bitcoin.

In analyzing these past halvings, several key patterns emerge. Firstly, each halving has been followed by a significant price increase, although the timing and magnitude of these increases have varied. This suggests that while halvings are a critical factor in Bitcoin’s price dynamics, they are not the sole determinant. Market sentiment, technological developments, and regulatory changes also play crucial roles. Secondly, the growing involvement of institutional investors and the maturation of the cryptocurrency market have amplified the impact of halvings, as larger pools of capital respond to supply constraints.

Looking ahead, future halvings are likely to continue influencing Bitcoin’s trajectory. As the block reward diminishes, the importance of transaction fees for miners will increase, potentially affecting network security and transaction costs. Moreover, as Bitcoin’s supply approaches its 21 million cap, the scarcity narrative will become even more pronounced, potentially driving further adoption. In conclusion, while past halvings provide valuable insights, the evolving landscape of the cryptocurrency market means that future outcomes may differ, shaped by a complex interplay of factors beyond mere supply reductions.

Future Predictions: What the Next Bitcoin Halving Could Mean

The phenomenon of Bitcoin halving is a pivotal event in the cryptocurrency world, occurring approximately every four years. This event, which reduces the reward for mining new blocks by half, has significant implications for the future of Bitcoin and the broader cryptocurrency market. As we approach the next halving, it is crucial to understand its potential impact on the market dynamics and the future of digital currencies.

To begin with, Bitcoin halving is designed to control the supply of Bitcoin, ensuring that it remains a deflationary asset. By reducing the rate at which new Bitcoins are created, halving events contribute to the scarcity of the cryptocurrency. This scarcity is often compared to precious metals like gold, which are finite in supply. Consequently, many investors anticipate that the reduced supply will lead to an increase in Bitcoin’s price, as demand outpaces the available supply. Historically, past halving events have been followed by significant price rallies, although it is important to note that past performance is not always indicative of future results.

Moreover, the upcoming halving could have profound effects on the mining industry. As the reward for mining decreases, miners may face increased pressure to maintain profitability. This could lead to a consolidation of mining operations, with smaller miners potentially being pushed out of the market due to higher operational costs. Larger mining pools, with more efficient operations and economies of scale, may dominate the landscape. This shift could have implications for the decentralization of the Bitcoin network, as fewer entities control a larger share of the mining power.

In addition to affecting miners, the halving event could also influence investor behavior. As the supply of new Bitcoins diminishes, investors may perceive Bitcoin as a more attractive store of value, akin to digital gold. This perception could drive increased institutional interest and investment in Bitcoin, further legitimizing it as an asset class. Furthermore, as Bitcoin’s scarcity becomes more pronounced, it may attract investors seeking a hedge against inflation and currency devaluation, particularly in uncertain economic times.

However, it is essential to consider the potential risks and uncertainties associated with the halving. While many anticipate a price increase, the market could react unpredictably. External factors, such as regulatory changes, macroeconomic conditions, and technological advancements, could influence Bitcoin’s price trajectory. Additionally, the cryptocurrency market is known for its volatility, and unexpected events could lead to significant price fluctuations.

Looking beyond Bitcoin, the halving event could have broader implications for the cryptocurrency ecosystem. As Bitcoin’s price potentially rises, it may lead to increased interest and investment in other cryptocurrencies, often referred to as altcoins. This could result in a more vibrant and diverse crypto market, with new projects and innovations emerging. However, it could also lead to speculative bubbles, as investors seek quick profits in a rapidly changing market.

In conclusion, the next Bitcoin halving is poised to be a significant event with far-reaching implications for the future of cryptocurrency. While it presents opportunities for price appreciation and increased adoption, it also poses challenges and uncertainties for miners and investors alike. As the crypto landscape continues to evolve, it will be crucial for stakeholders to remain informed and adaptable, navigating the complexities of this dynamic market. Ultimately, the halving serves as a reminder of Bitcoin’s unique design and its potential to shape the future of finance.

Bitcoin Halving and Its Role in Long-Term Cryptocurrency Adoption

Bitcoin halving is a pivotal event in the cryptocurrency world, occurring approximately every four years, and it plays a crucial role in shaping the future of digital currencies. This event, embedded in Bitcoin’s code by its pseudonymous creator, Satoshi Nakamoto, reduces the reward miners receive for adding new blocks to the blockchain by half. As a result, the rate at which new bitcoins are introduced into circulation slows down, ultimately capping the total supply at 21 million coins. Understanding the implications of Bitcoin halving is essential for grasping its potential impact on long-term cryptocurrency adoption.

To begin with, Bitcoin halving directly influences the supply and demand dynamics of the cryptocurrency market. By reducing the number of new bitcoins entering circulation, halving events create a scarcity effect, which can lead to increased demand and, consequently, a rise in Bitcoin’s price. Historically, past halving events have been followed by significant price surges, as seen in 2012, 2016, and 2020. This pattern suggests that investors anticipate the reduced supply and adjust their strategies accordingly, often leading to heightened interest and investment in Bitcoin. Consequently, the anticipation of future halvings can drive long-term adoption as both institutional and retail investors seek to capitalize on potential price increases.

Moreover, Bitcoin halving serves as a mechanism to control inflation within the cryptocurrency ecosystem. Unlike traditional fiat currencies, which can be printed at will by central banks, Bitcoin’s fixed supply ensures that its inflation rate decreases over time. This deflationary characteristic is appealing to those who view Bitcoin as a store of value, akin to digital gold. As inflationary pressures mount in traditional economies, Bitcoin’s predictable supply schedule becomes increasingly attractive to investors seeking to hedge against currency devaluation. This perception of Bitcoin as a reliable store of value can bolster its adoption as a long-term investment vehicle.

In addition to its economic implications, Bitcoin halving also impacts the mining industry. As the reward for mining new blocks diminishes, miners must adapt to maintain profitability. This often leads to increased competition and innovation within the sector, as miners seek more efficient hardware and energy sources to offset reduced earnings. While some smaller mining operations may struggle to survive post-halving, larger and more efficient miners can thrive, contributing to the network’s overall security and stability. This evolution within the mining industry underscores the resilience and adaptability of the Bitcoin network, further solidifying its role in the broader cryptocurrency landscape.

Furthermore, Bitcoin halving events can influence public perception and awareness of cryptocurrencies. As these events garner media attention and spark discussions about Bitcoin’s future, they serve as educational opportunities for the general public. Increased awareness can lead to greater acceptance and understanding of cryptocurrencies, paving the way for broader adoption. As more individuals and institutions become familiar with Bitcoin’s unique attributes, such as its decentralized nature and limited supply, the likelihood of its integration into mainstream financial systems increases.

In conclusion, Bitcoin halving is a fundamental aspect of the cryptocurrency’s design, with far-reaching implications for its long-term adoption. By influencing supply and demand dynamics, controlling inflation, driving innovation in the mining industry, and raising public awareness, halving events play a critical role in shaping the future of Bitcoin and the broader cryptocurrency ecosystem. As the world continues to grapple with economic uncertainties and technological advancements, Bitcoin’s halving mechanism remains a key factor in its potential to revolutionize the financial landscape.

Q&A

1. **What is Bitcoin Halving?**

Bitcoin halving is an event that occurs approximately every four years, reducing the reward miners receive for adding a new block to the blockchain by half. This process is built into Bitcoin’s protocol to control inflation and ensure a finite supply of 21 million bitcoins.

2. **How does Bitcoin Halving affect the supply of Bitcoin?**

By halving the block reward, the rate at which new bitcoins are introduced into circulation is reduced, leading to a slower increase in the total supply. This scarcity mechanism is intended to mimic the supply dynamics of precious metals like gold.

3. **What impact does Bitcoin Halving have on miners?**

Miners receive fewer bitcoins for their efforts, which can impact their profitability, especially if the price of Bitcoin does not increase to offset the reduced rewards. This can lead to some miners exiting the market or upgrading to more efficient mining equipment.

4. **How does Bitcoin Halving influence Bitcoin’s price?**

Historically, Bitcoin halving events have been followed by significant price increases, as the reduced supply growth can lead to higher demand. However, past performance is not indicative of future results, and various market factors can influence price movements.

5. **What are the potential long-term effects of Bitcoin Halving on the crypto market?**

Over the long term, Bitcoin halving can contribute to increased scarcity and potentially higher prices, which may attract more investors and drive broader adoption of cryptocurrencies. It also reinforces Bitcoin’s deflationary nature compared to traditional fiat currencies.

6. **How does Bitcoin Halving affect transaction fees?**

As block rewards decrease, miners may rely more on transaction fees for revenue. This could lead to higher transaction fees, especially during periods of high network congestion, as miners prioritize transactions with higher fees.

7. **What are the implications of Bitcoin Halving for the future of crypto?**

Bitcoin halving events highlight the importance of scarcity and supply control in cryptocurrency economics. They can influence market sentiment, drive technological advancements in mining, and shape the narrative around Bitcoin as a store of value, potentially impacting the broader crypto ecosystem.

Conclusion

Bitcoin halving is a critical event in the cryptocurrency ecosystem, occurring approximately every four years, where the reward for mining new Bitcoin blocks is halved. This process reduces the rate at which new Bitcoins are generated, effectively decreasing the supply and increasing scarcity. Historically, halvings have been associated with significant price increases due to the supply-demand dynamics, as reduced supply coupled with steady or increasing demand tends to drive prices up. For the future of crypto, Bitcoin halving underscores the importance of scarcity and deflationary mechanisms in digital currencies, potentially enhancing Bitcoin’s appeal as a store of value akin to digital gold. It also highlights the maturation and stabilization of the cryptocurrency market, as participants anticipate and react to these predictable supply changes. As Bitcoin continues to gain mainstream acceptance, the implications of halving events may extend beyond price movements, influencing broader market trends, investment strategies, and the development of blockchain technology.