“Skyrocketing Spirits: Unveiling the Catalysts Behind Today’s Stock Surge!”

Introduction

Spirit Airlines’ stock experienced a notable surge today, driven by a confluence of factors that have captured the attention of investors and market analysts. Key among these reasons is the announcement of a potential merger or acquisition, which has sparked speculation about enhanced market positioning and operational synergies. Additionally, recent financial reports have shown improved earnings and revenue growth, reflecting a robust recovery in travel demand post-pandemic. The airline’s strategic initiatives, such as expanding its route network and optimizing cost structures, have also contributed to increased investor confidence. Furthermore, positive industry trends, including a rebound in leisure travel and favorable fuel price dynamics, have provided a supportive backdrop for Spirit Airlines’ stock performance. These elements combined have fueled optimism about the airline’s future prospects, leading to the observed uptick in its stock value.

Improved Financial Performance

Spirit Airlines has recently experienced a notable surge in its stock price, a development that has captured the attention of investors and market analysts alike. This upward trajectory can be attributed to several key factors, with improved financial performance standing out as a primary driver. As the airline industry continues to recover from the unprecedented challenges posed by the COVID-19 pandemic, Spirit Airlines has demonstrated resilience and adaptability, positioning itself favorably in the competitive landscape.

One of the most significant contributors to Spirit Airlines’ improved financial performance is its strategic cost management. The airline has long been known for its ultra-low-cost business model, which emphasizes operational efficiency and cost-effectiveness. By maintaining a lean operational structure, Spirit has been able to offer competitive pricing while still achieving profitability. This approach has become even more critical in the current economic climate, where consumers are increasingly price-sensitive. As a result, Spirit’s ability to keep costs low without compromising service quality has resonated well with budget-conscious travelers, leading to increased passenger volumes and, consequently, higher revenues.

In addition to cost management, Spirit Airlines has also benefited from a rebound in travel demand. As vaccination rates have increased and travel restrictions have eased, there has been a noticeable uptick in both leisure and business travel. Spirit, with its extensive network of domestic and international routes, has been well-positioned to capitalize on this resurgence. The airline’s focus on popular leisure destinations has further bolstered its appeal, attracting travelers eager to explore new locales or revisit favorite spots. This surge in demand has translated into higher load factors and improved yield management, both of which have positively impacted the airline’s financial performance.

Moreover, Spirit Airlines has made strategic investments in its fleet and technology, enhancing its operational capabilities and customer experience. The acquisition of more fuel-efficient aircraft has not only reduced operating costs but also aligned with growing environmental concerns among consumers. By modernizing its fleet, Spirit has been able to offer a more reliable and comfortable travel experience, which has contributed to increased customer satisfaction and loyalty. Additionally, the airline’s investment in digital platforms and customer service technology has streamlined operations and improved the overall passenger experience, further strengthening its competitive position.

Furthermore, Spirit Airlines’ financial performance has been bolstered by its disciplined approach to capacity management. By carefully aligning capacity with demand, the airline has been able to optimize its route network and maximize revenue opportunities. This strategic alignment has allowed Spirit to maintain a strong balance sheet, providing the financial flexibility needed to navigate potential challenges and seize growth opportunities.

In conclusion, the recent surge in Spirit Airlines’ stock price can be largely attributed to its improved financial performance, driven by strategic cost management, a rebound in travel demand, and targeted investments in fleet and technology. As the airline industry continues to recover, Spirit’s ability to adapt to changing market dynamics and maintain its competitive edge will be crucial in sustaining its upward momentum. Investors and stakeholders will undoubtedly be watching closely as Spirit Airlines continues to navigate the evolving landscape, with its recent successes serving as a testament to its resilience and strategic foresight.

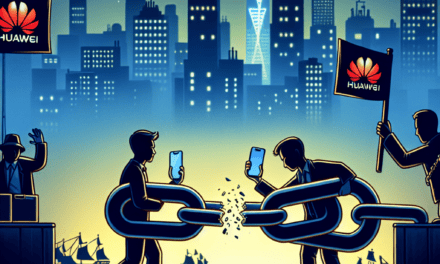

Strategic Partnerships

Spirit Airlines has recently experienced a notable surge in its stock value, a development that can be largely attributed to its strategic partnerships. These alliances have played a crucial role in enhancing the airline’s market position and operational efficiency, thereby boosting investor confidence. To understand the impact of these partnerships, it is essential to examine the various dimensions through which they contribute to Spirit Airlines’ growth.

Firstly, strategic partnerships have enabled Spirit Airlines to expand its network and reach new markets. By collaborating with other airlines and travel companies, Spirit has been able to offer its customers a wider range of destinations and more convenient travel options. This expansion not only attracts new customers but also enhances the loyalty of existing ones, as they are provided with more choices and flexibility. Consequently, the increased customer base and improved service offerings have translated into higher revenues, which are reflected in the rising stock prices.

Moreover, these partnerships have facilitated cost-sharing and operational efficiencies. By working closely with other industry players, Spirit Airlines can leverage shared resources, such as maintenance facilities and ground services, to reduce operational costs. This collaboration allows the airline to maintain its competitive edge in offering low-cost travel options, a core aspect of its business model. The resulting cost savings contribute to improved profit margins, which are a key factor in the positive performance of Spirit’s stock.

In addition to operational benefits, strategic partnerships have also enhanced Spirit Airlines’ technological capabilities. Collaborations with technology firms have enabled the airline to integrate advanced systems for booking, customer service, and in-flight operations. These technological advancements improve the overall customer experience by streamlining processes and reducing wait times. As a result, customer satisfaction levels rise, leading to increased brand loyalty and repeat business. Investors view these improvements as indicators of long-term growth potential, further driving up the stock value.

Furthermore, Spirit Airlines’ partnerships have opened up opportunities for joint marketing and promotional activities. By aligning with other brands, Spirit can tap into new customer segments and increase its visibility in the market. These joint efforts not only enhance brand recognition but also create synergies that amplify the impact of marketing campaigns. The increased brand presence and customer engagement contribute to a stronger market position, which is positively perceived by investors.

It is also worth noting that strategic partnerships have provided Spirit Airlines with access to valuable industry insights and expertise. Collaborating with established players allows Spirit to benefit from their experience and knowledge, which can be instrumental in navigating the complexities of the aviation industry. This access to expertise helps Spirit make informed decisions and adapt to changing market conditions, thereby ensuring its continued success and stability.

In conclusion, the recent surge in Spirit Airlines’ stock can be largely attributed to the airline’s strategic partnerships. These alliances have enabled Spirit to expand its network, reduce costs, enhance technological capabilities, and improve its market presence. As a result, the airline has strengthened its competitive position and demonstrated significant growth potential, which has been positively received by investors. As Spirit continues to leverage these partnerships, it is likely to sustain its upward trajectory in the stock market, further solidifying its status as a key player in the aviation industry.

Expansion of Flight Routes

Spirit Airlines has recently experienced a notable surge in its stock value, a development that has captured the attention of investors and market analysts alike. One of the primary factors contributing to this upward trend is the airline’s strategic expansion of its flight routes. This expansion is not merely a matter of increasing the number of destinations served; it is a comprehensive approach that involves careful market analysis, strategic partnerships, and a keen understanding of consumer demand.

To begin with, Spirit Airlines has identified key markets that are underserved or have untapped potential. By focusing on these areas, the airline is able to offer new routes that not only meet existing demand but also stimulate new interest in air travel. This approach allows Spirit to capture a larger share of the market, thereby increasing its revenue potential. Moreover, by entering markets with less competition, Spirit can establish a strong foothold and build brand loyalty among travelers who may not have previously considered the airline.

In addition to identifying new markets, Spirit Airlines has also been proactive in forming strategic partnerships with other carriers and travel-related businesses. These partnerships enable Spirit to offer more comprehensive travel options to its customers, such as seamless connections to international destinations or bundled travel packages that include accommodations and car rentals. By enhancing the overall travel experience, Spirit is able to attract a broader customer base, which in turn contributes to increased ticket sales and higher load factors on its flights.

Furthermore, the expansion of flight routes is supported by Spirit’s investment in its fleet. The airline has been steadily acquiring new, fuel-efficient aircraft that not only reduce operational costs but also allow for longer-haul flights. This investment in modern technology ensures that Spirit can offer competitive pricing while maintaining a high standard of service. As a result, the airline is well-positioned to capitalize on the growing demand for affordable air travel, particularly in the post-pandemic era where cost-consciousness is a significant factor for many travelers.

Another aspect of Spirit’s route expansion strategy is its focus on enhancing connectivity between major hubs and secondary cities. By offering direct flights between these locations, Spirit is able to provide more convenient travel options for passengers who would otherwise have to endure lengthy layovers or multiple connections. This increased connectivity not only improves the customer experience but also boosts the airline’s operational efficiency, as it can optimize its flight schedules and reduce turnaround times.

Moreover, Spirit Airlines has been leveraging data analytics to refine its route expansion strategy. By analyzing passenger data, market trends, and competitive dynamics, the airline can make informed decisions about which routes to prioritize and how to price them effectively. This data-driven approach ensures that Spirit’s expansion efforts are aligned with market demand, thereby maximizing the potential for profitability.

In conclusion, the recent surge in Spirit Airlines’ stock can be largely attributed to its strategic expansion of flight routes. By identifying new markets, forming strategic partnerships, investing in its fleet, enhancing connectivity, and leveraging data analytics, Spirit has positioned itself as a formidable player in the airline industry. As the company continues to execute its expansion strategy, it is likely to see sustained growth in both its market share and stock value, making it an attractive option for investors seeking opportunities in the aviation sector.

Cost-Cutting Measures

Spirit Airlines has recently witnessed a notable surge in its stock prices, a development that has captured the attention of investors and market analysts alike. This upward trajectory can be largely attributed to a series of strategic cost-cutting measures implemented by the airline, which have significantly bolstered its financial performance and investor confidence. As the airline industry continues to navigate the challenges posed by fluctuating fuel prices, evolving consumer preferences, and heightened competition, Spirit Airlines’ approach to cost management offers valuable insights into how companies can adapt and thrive in a dynamic market environment.

One of the primary cost-cutting strategies employed by Spirit Airlines involves optimizing its operational efficiency. By streamlining its flight operations and enhancing fuel efficiency, the airline has managed to reduce its overall operating expenses. This has been achieved through the adoption of more fuel-efficient aircraft and the implementation of advanced flight planning technologies, which have collectively contributed to a reduction in fuel consumption. Consequently, Spirit Airlines has been able to mitigate the impact of volatile fuel prices, thereby stabilizing its cost structure and improving its profit margins.

In addition to operational efficiencies, Spirit Airlines has also focused on renegotiating supplier contracts to secure more favorable terms. By leveraging its position as a major player in the low-cost carrier segment, the airline has successfully negotiated lower rates for essential services such as aircraft maintenance, ground handling, and catering. These renegotiated contracts have not only reduced the airline’s direct costs but have also provided it with greater flexibility to adapt to changing market conditions. As a result, Spirit Airlines has been able to maintain its competitive edge while simultaneously enhancing its financial resilience.

Moreover, Spirit Airlines has embraced technological advancements to further drive cost reductions. The airline has invested in digital solutions that streamline various aspects of its operations, from ticketing and check-in processes to customer service and baggage handling. By automating these functions, Spirit Airlines has been able to reduce labor costs and improve operational efficiency, leading to significant savings. Furthermore, the use of data analytics has enabled the airline to better understand customer preferences and optimize its pricing strategies, thereby maximizing revenue potential while keeping costs in check.

Another critical aspect of Spirit Airlines’ cost-cutting measures is its focus on maintaining a lean organizational structure. The airline has implemented a series of initiatives aimed at reducing administrative overhead and eliminating redundancies. This has involved a thorough review of its corporate structure and the implementation of process improvements to enhance productivity. By fostering a culture of efficiency and accountability, Spirit Airlines has been able to achieve substantial cost savings without compromising on service quality or customer satisfaction.

In conclusion, the recent surge in Spirit Airlines’ stock can be largely attributed to its successful implementation of cost-cutting measures that have strengthened its financial position and enhanced investor confidence. Through a combination of operational efficiencies, strategic supplier negotiations, technological advancements, and organizational streamlining, the airline has demonstrated its ability to adapt to the challenges of the modern aviation landscape. As Spirit Airlines continues to refine its cost management strategies, it is well-positioned to capitalize on emerging opportunities and sustain its growth trajectory in the competitive airline industry.

Positive Industry Trends

Spirit Airlines has recently experienced a notable surge in its stock value, a development that can be attributed to several positive industry trends. This upward trajectory in Spirit Airlines’ stock is reflective of broader dynamics within the aviation sector, which have collectively contributed to a more favorable market environment for the airline.

To begin with, the resurgence in travel demand has played a pivotal role in boosting Spirit Airlines’ stock. As the world gradually emerges from the constraints imposed by the COVID-19 pandemic, there has been a marked increase in both domestic and international travel. This resurgence is driven by a combination of factors, including the widespread distribution of vaccines, the easing of travel restrictions, and a growing consumer confidence in the safety of air travel. Consequently, airlines like Spirit, which cater to budget-conscious travelers, have seen a significant uptick in passenger numbers. This increase in demand has translated into higher revenues, thereby positively impacting the airline’s stock performance.

Moreover, the airline industry has witnessed a strategic shift towards cost optimization and operational efficiency. Spirit Airlines, known for its ultra-low-cost carrier model, has been at the forefront of this trend. By maintaining a lean operational structure and focusing on cost-effective measures, Spirit has been able to offer competitive pricing while maintaining profitability. This strategic focus on efficiency has not only enhanced the airline’s financial health but has also made it an attractive option for investors seeking value in the aviation sector.

In addition to operational efficiencies, the airline industry is benefiting from favorable economic conditions. The global economy is showing signs of recovery, with many countries reporting positive GDP growth. This economic upswing has led to increased consumer spending, particularly in the travel and leisure sectors. As disposable incomes rise, more individuals are willing to allocate funds towards travel, further fueling the demand for air travel services. Spirit Airlines, with its affordable pricing model, is well-positioned to capitalize on this trend, thereby bolstering its stock value.

Furthermore, technological advancements have played a crucial role in enhancing the operational capabilities of airlines. Spirit Airlines has invested in modernizing its fleet and incorporating advanced technologies to improve fuel efficiency and reduce operational costs. These technological upgrades not only contribute to environmental sustainability but also enhance the airline’s overall competitiveness. As investors increasingly prioritize companies with sustainable practices, Spirit’s commitment to technological innovation has positively influenced its stock performance.

Additionally, the airline industry is experiencing a wave of consolidation and strategic partnerships. Mergers and alliances are becoming more prevalent as airlines seek to expand their market reach and optimize resources. Spirit Airlines has been actively exploring strategic partnerships to enhance its network and service offerings. Such collaborations have the potential to drive growth and create synergies, further boosting investor confidence in the airline’s future prospects.

In conclusion, the surge in Spirit Airlines’ stock can be attributed to a confluence of positive industry trends. The recovery in travel demand, coupled with strategic cost management, favorable economic conditions, technological advancements, and strategic partnerships, has created a conducive environment for the airline’s growth. As these trends continue to unfold, Spirit Airlines is well-positioned to capitalize on emerging opportunities, thereby sustaining its positive stock momentum in the foreseeable future.

Enhanced Customer Experience

Spirit Airlines has recently experienced a notable surge in its stock value, a development that can be attributed to several strategic initiatives aimed at enhancing the customer experience. This upward trend in stock performance reflects the airline’s commitment to transforming its service offerings and improving its reputation among travelers. By focusing on customer satisfaction, Spirit Airlines has managed to capture the attention of investors and market analysts alike.

One of the primary factors contributing to this surge is Spirit Airlines’ investment in upgrading its fleet. The introduction of newer, more fuel-efficient aircraft not only reduces operational costs but also provides passengers with a more comfortable flying experience. These modern planes are equipped with advanced technology and amenities that cater to the needs of today’s travelers, thereby enhancing overall customer satisfaction. As a result, the airline has been able to attract a broader customer base, which in turn has positively impacted its financial performance.

In addition to fleet upgrades, Spirit Airlines has made significant strides in improving its in-flight services. Recognizing the importance of a pleasant travel experience, the airline has revamped its menu offerings, providing passengers with a wider variety of food and beverage options. This move has been well-received by customers, who appreciate the enhanced quality and selection. Furthermore, Spirit Airlines has invested in training its staff to deliver exceptional service, ensuring that passengers feel valued and respected throughout their journey. This focus on customer service excellence has played a crucial role in boosting the airline’s reputation and, consequently, its stock value.

Moreover, Spirit Airlines has embraced digital innovation to streamline the travel experience for its customers. The airline has developed a user-friendly mobile app that allows passengers to easily book flights, manage reservations, and access real-time flight information. This digital transformation has not only improved operational efficiency but also empowered customers to have greater control over their travel plans. By leveraging technology to enhance convenience, Spirit Airlines has successfully differentiated itself in a competitive market, thereby attracting more customers and investors.

Another key aspect of Spirit Airlines’ strategy is its commitment to transparency and affordability. The airline has introduced a simplified pricing structure that eliminates hidden fees and provides customers with a clear understanding of the costs associated with their travel. This approach has resonated with budget-conscious travelers who value transparency and appreciate the ability to customize their travel experience according to their preferences and budget. By prioritizing affordability without compromising on quality, Spirit Airlines has managed to strengthen its market position and drive stock growth.

Furthermore, Spirit Airlines has expanded its route network, offering more destinations and increased flight frequencies. This expansion not only provides customers with greater travel options but also enhances the airline’s competitive edge. By strategically targeting high-demand markets and underserved regions, Spirit Airlines has been able to capture new revenue streams and improve its overall market share. This growth strategy has been instrumental in boosting investor confidence and contributing to the recent surge in stock value.

In conclusion, Spirit Airlines’ recent stock surge can be attributed to its comprehensive efforts to enhance the customer experience. Through fleet upgrades, improved in-flight services, digital innovation, transparent pricing, and strategic route expansion, the airline has successfully positioned itself as a customer-centric carrier. These initiatives have not only improved customer satisfaction but also strengthened the airline’s financial performance, making it an attractive investment opportunity. As Spirit Airlines continues to prioritize customer experience, it is likely to maintain its upward trajectory in the stock market.

Stronger Market Position

Spirit Airlines has recently experienced a notable surge in its stock value, a development that can be attributed to several key factors enhancing its market position. This upward trajectory is not merely a reflection of short-term market fluctuations but rather a testament to strategic decisions and broader industry trends that have collectively strengthened Spirit Airlines’ standing in the competitive airline sector.

To begin with, Spirit Airlines has successfully capitalized on the growing demand for low-cost travel options. As the global economy continues to recover from the disruptions caused by the COVID-19 pandemic, there has been a marked increase in consumer interest in budget-friendly travel alternatives. Spirit Airlines, with its ultra-low-cost carrier model, is well-positioned to meet this demand. By offering competitive pricing and a no-frills travel experience, the airline has attracted a significant number of cost-conscious travelers, thereby boosting its revenue streams and, consequently, its stock value.

Moreover, Spirit Airlines has made strategic investments in expanding its route network, which has further solidified its market position. The airline has been proactive in identifying and entering underserved markets, both domestically and internationally. This expansion strategy not only increases Spirit’s market share but also enhances its brand visibility and customer base. By tapping into new markets, Spirit Airlines is able to diversify its revenue sources and reduce its reliance on any single geographic region, thereby mitigating risks associated with regional economic downturns.

In addition to route expansion, Spirit Airlines has also focused on operational efficiency, which has played a crucial role in its improved market position. The airline has implemented cost-saving measures, such as optimizing fuel consumption and streamlining its fleet operations. These efforts have resulted in lower operational costs, allowing Spirit to maintain its competitive pricing while improving profit margins. Investors have taken note of these efficiency gains, which are reflected in the airline’s enhanced financial performance and, subsequently, its rising stock price.

Furthermore, Spirit Airlines has embraced technological advancements to enhance the customer experience, a move that has resonated well with passengers and investors alike. The airline has invested in upgrading its digital platforms, making it easier for customers to book flights, manage reservations, and access customer support. By leveraging technology to improve service delivery, Spirit Airlines has not only increased customer satisfaction but also fostered brand loyalty, which is crucial for long-term success in the airline industry.

Additionally, the broader airline industry has witnessed a rebound in travel demand, which has positively impacted Spirit Airlines’ market position. As travel restrictions continue to ease and vaccination rates increase globally, there is a resurgence in both leisure and business travel. Spirit Airlines, with its focus on leisure travel, is particularly well-suited to benefit from this trend. The increase in passenger volumes has translated into higher load factors and improved financial performance, further contributing to the surge in the airline’s stock value.

In conclusion, the recent surge in Spirit Airlines’ stock can be attributed to a combination of strategic initiatives and favorable industry dynamics. By capitalizing on the growing demand for low-cost travel, expanding its route network, enhancing operational efficiency, and leveraging technology to improve customer experience, Spirit Airlines has strengthened its market position. As the airline continues to navigate the evolving landscape of the aviation industry, its ability to adapt and innovate will be key to sustaining its upward momentum in the stock market.

Q&A

1. **Improved Financial Performance**: Spirit Airlines reported better-than-expected quarterly earnings, indicating strong financial health and operational efficiency.

2. **Increased Travel Demand**: A surge in travel demand, particularly for budget-friendly options, has boosted investor confidence in Spirit Airlines’ growth prospects.

3. **Strategic Partnerships**: Announcements of new strategic partnerships or alliances with other airlines or travel companies have positively impacted investor sentiment.

4. **Expansion Plans**: Spirit Airlines revealed plans for expanding its route network, including new destinations and increased flight frequencies, which are expected to drive future revenue growth.

5. **Cost Management Initiatives**: Effective cost-cutting measures and operational efficiencies have improved the airline’s profitability outlook, attracting investor interest.

6. **Positive Industry Trends**: Favorable trends in the airline industry, such as lower fuel prices or regulatory changes, have created a more optimistic environment for Spirit Airlines.

7. **Analyst Upgrades**: Upgrades or positive reports from financial analysts have led to increased investor confidence and buying activity in Spirit Airlines stock.

Conclusion

Spirit Airlines’ stock surge today can be attributed to several key factors. Firstly, there may have been positive developments in the airline industry, such as increased travel demand or favorable economic indicators, which boost investor confidence. Additionally, Spirit Airlines might have reported strong financial results, such as higher-than-expected earnings or revenue growth, signaling robust operational performance. Strategic initiatives, such as cost-cutting measures, expansion plans, or partnerships, could also play a role in enhancing investor sentiment. Furthermore, broader market trends, such as a rally in airline stocks or positive news regarding fuel prices, may contribute to the stock’s upward movement. Overall, a combination of industry dynamics, company-specific achievements, and market conditions likely underpins the rise in Spirit Airlines’ stock today.