“Secure Your Future: Smartly Shift Your 401(k) from Stocks to Bonds at 65!”

Introduction

As individuals approach retirement age, the question of whether to rebalance a 401(k) from stocks to bonds becomes increasingly pertinent. At age 65, many are on the cusp of transitioning from the accumulation phase of their financial journey to the distribution phase, where preserving capital and generating income take precedence over aggressive growth. The decision to shift asset allocation from stocks to bonds involves weighing factors such as risk tolerance, life expectancy, income needs, and market conditions. Understanding the potential benefits and drawbacks of rebalancing can help retirees make informed decisions that align with their financial goals and retirement plans.

Understanding the Importance of Rebalancing Your 401(k) at Age 65

As individuals approach the age of 65, the question of whether to rebalance their 401(k) from stocks to bonds becomes increasingly pertinent. This decision is crucial, as it can significantly impact one’s financial security during retirement. Understanding the importance of rebalancing your 401(k) at this stage involves considering several factors, including risk tolerance, life expectancy, and income needs. By examining these elements, retirees can make informed decisions that align with their financial goals and ensure a stable retirement.

To begin with, risk tolerance plays a vital role in determining the appropriate asset allocation for a 401(k) portfolio. As individuals age, their ability to withstand market volatility typically decreases. Stocks, while offering higher potential returns, also come with greater risk. Conversely, bonds are generally considered safer investments, providing more predictable income streams. At age 65, many individuals prefer to reduce their exposure to the stock market to preserve their capital and minimize the risk of significant losses. Transitioning a portion of the portfolio from stocks to bonds can help achieve this balance, offering a more stable financial foundation.

Moreover, life expectancy is another critical factor to consider when rebalancing a 401(k). With advancements in healthcare and an increasing emphasis on healthy living, people are living longer than ever before. This extended lifespan necessitates a retirement strategy that ensures sufficient income throughout one’s later years. While bonds provide stability, they may not offer the growth potential required to outpace inflation over a prolonged retirement period. Therefore, maintaining some exposure to stocks can be beneficial, as it allows for potential growth that can support a longer retirement horizon.

In addition to risk tolerance and life expectancy, retirees must also assess their income needs. At age 65, many individuals transition from earning a regular paycheck to relying on their retirement savings for income. This shift necessitates a careful evaluation of how much income is required to maintain one’s desired lifestyle. Bonds, with their fixed interest payments, can provide a reliable income stream, making them an attractive option for retirees seeking stability. However, it is essential to strike a balance between income generation and growth potential. A diversified portfolio that includes both stocks and bonds can help achieve this equilibrium, ensuring that retirees have access to the income they need while still benefiting from potential market gains.

Furthermore, it is important to consider the current economic environment when deciding whether to rebalance a 401(k) from stocks to bonds. Interest rates, inflation, and market conditions can all influence the performance of different asset classes. For instance, in a low-interest-rate environment, the returns on bonds may be less attractive, prompting some retirees to maintain a higher allocation in stocks. Conversely, during periods of economic uncertainty, a shift towards bonds may provide the security and peace of mind that retirees seek.

In conclusion, rebalancing a 401(k) from stocks to bonds at age 65 is a decision that requires careful consideration of various factors, including risk tolerance, life expectancy, income needs, and the current economic climate. By evaluating these elements, retirees can develop a strategy that aligns with their financial goals and provides the stability and growth necessary for a secure retirement. Ultimately, the key is to create a well-diversified portfolio that balances risk and reward, ensuring that retirees can enjoy their golden years with confidence and peace of mind.

Stocks vs. Bonds: Which Is Better for Your 401(k) at Retirement?

As individuals approach retirement, the question of whether to rebalance a 401(k) from stocks to bonds becomes increasingly pertinent. At age 65, many are on the cusp of transitioning from the accumulation phase of their financial lives to the distribution phase, where preserving capital often takes precedence over aggressive growth. Understanding the dynamics between stocks and bonds is crucial in making an informed decision about rebalancing one’s portfolio.

Stocks have long been heralded for their potential to deliver higher returns over the long term. Historically, equities have outperformed bonds, providing investors with the opportunity to grow their wealth significantly. However, with this potential for higher returns comes increased volatility. As retirement nears, the ability to withstand market fluctuations diminishes, making the stability of bonds more appealing. Bonds, in contrast to stocks, are generally considered safer investments. They offer fixed interest payments and return the principal upon maturity, providing a predictable income stream that can be particularly attractive during retirement.

Transitioning from a stock-heavy portfolio to one that includes a greater proportion of bonds can help mitigate risk. This shift can protect against the adverse effects of a market downturn, which could be particularly detrimental if it occurs early in retirement. The sequence of returns risk, where poor market performance in the initial years of retirement can significantly impact the longevity of a retirement portfolio, underscores the importance of having a more conservative asset allocation.

Nevertheless, it is essential to consider the current economic environment when deciding whether to rebalance. Interest rates, inflation, and market conditions can all influence the performance of stocks and bonds. For instance, in a low-interest-rate environment, the returns on bonds may be insufficient to keep pace with inflation, potentially eroding purchasing power over time. Conversely, if interest rates are expected to rise, bond prices may fall, impacting the value of a bond-heavy portfolio.

Moreover, life expectancy and retirement goals should also play a role in this decision. With people living longer, the need for a portfolio that continues to grow throughout retirement becomes more pronounced. A balanced approach that includes both stocks and bonds may provide the growth necessary to sustain a longer retirement while still offering some protection against market volatility.

Additionally, personal risk tolerance is a critical factor. Some individuals may feel more comfortable maintaining a higher allocation in stocks, even in retirement, if they have other sources of income or a strong financial safety net. Others may prefer the peace of mind that comes with a more conservative portfolio, even if it means potentially lower returns.

Ultimately, there is no one-size-fits-all answer to whether one should rebalance their 401(k) from stocks to bonds at age 65. It requires a careful assessment of individual circumstances, including financial goals, risk tolerance, and the broader economic landscape. Consulting with a financial advisor can provide personalized guidance, helping to ensure that the transition into retirement is as smooth and financially secure as possible. By weighing these factors thoughtfully, retirees can make informed decisions that align with their long-term financial well-being.

How Market Conditions Affect Your 401(k) Rebalancing Decisions

As individuals approach retirement age, the question of whether to rebalance a 401(k) from stocks to bonds becomes increasingly pertinent. At age 65, many are on the cusp of transitioning from wealth accumulation to wealth preservation, making the decision to adjust asset allocation crucial. Market conditions play a significant role in this decision-making process, influencing the potential risks and rewards associated with different investment strategies.

In times of economic stability and growth, stocks generally offer higher returns compared to bonds, which are typically more conservative investments. However, as market conditions fluctuate, the risk associated with stocks can increase, potentially leading to significant losses. For those nearing retirement, such volatility can be particularly concerning, as there is less time to recover from market downturns. Consequently, understanding current market conditions is essential when considering rebalancing a 401(k) portfolio.

During periods of economic uncertainty or recession, bonds often become more attractive due to their relative stability and lower risk. They provide a fixed income and are less susceptible to market swings, offering a safer haven for those looking to preserve their capital. As interest rates rise, bond yields can also increase, making them a more appealing option for retirees seeking steady income. Therefore, if market conditions suggest a downturn or increased volatility, shifting a portion of a 401(k) from stocks to bonds might be a prudent move.

Conversely, in a bullish market where economic indicators are strong and growth is anticipated, maintaining a higher allocation in stocks could be beneficial. Stocks have the potential for greater appreciation, which can help sustain a retirement portfolio over the long term. However, even in favorable market conditions, it is important to consider one’s risk tolerance and financial goals. A balanced approach that aligns with personal circumstances and market outlook can help mitigate risks while capitalizing on potential gains.

Moreover, inflation is another critical factor to consider when rebalancing a 401(k). In an inflationary environment, the purchasing power of fixed-income investments like bonds can erode over time. Stocks, on the other hand, have historically outpaced inflation, offering a hedge against rising prices. Therefore, understanding the current inflationary trends and projections can guide the decision on whether to maintain a higher stock allocation or shift towards bonds.

Additionally, the timing of rebalancing is crucial. Making adjustments during market highs or lows can significantly impact the overall performance of a retirement portfolio. It is advisable to avoid making hasty decisions based on short-term market fluctuations. Instead, a strategic approach that considers long-term trends and personal financial objectives is recommended. Consulting with a financial advisor can provide valuable insights and help tailor a rebalancing strategy that aligns with both market conditions and individual retirement goals.

In conclusion, while rebalancing a 401(k) from stocks to bonds at age 65 is a common consideration, it is not a one-size-fits-all decision. Market conditions, including economic stability, interest rates, and inflation, play a pivotal role in shaping the optimal asset allocation strategy. By carefully evaluating these factors and aligning them with personal risk tolerance and financial objectives, individuals can make informed decisions that support a secure and sustainable retirement.

The Role of Risk Tolerance in Rebalancing Your 401(k) Portfolio

As individuals approach retirement, the question of whether to rebalance a 401(k) portfolio from stocks to bonds becomes increasingly pertinent. At age 65, the role of risk tolerance in this decision cannot be overstated. Understanding one’s risk tolerance is crucial, as it influences the ability to withstand market fluctuations and impacts the overall financial security during retirement. Traditionally, financial advisors have recommended shifting from stocks to bonds as one nears retirement, primarily because bonds are generally considered less volatile and provide a more stable income stream. However, this conventional wisdom may not suit everyone, as individual risk tolerance varies significantly.

Risk tolerance is essentially the degree of variability in investment returns that an individual is willing to withstand. It is influenced by several factors, including financial goals, investment horizon, and personal comfort with market volatility. At age 65, many individuals are on the cusp of retirement or have already retired, which typically means a shorter investment horizon and a greater need for income stability. Consequently, a lower risk tolerance might suggest a heavier allocation to bonds. However, it is essential to consider that people are living longer, and retirement can span several decades. This longevity risk implies that maintaining some exposure to stocks could be beneficial for growth and to outpace inflation.

Moreover, the current economic environment plays a significant role in determining the appropriate asset allocation. Interest rates, inflation, and market conditions can all influence the performance of stocks and bonds. For instance, in a low-interest-rate environment, bonds may offer lower returns, which could impact the income generated from a bond-heavy portfolio. Conversely, stocks, while more volatile, have historically provided higher returns over the long term. Therefore, understanding the broader economic context is vital when considering rebalancing strategies.

Another critical aspect to consider is the diversification of the portfolio. A well-diversified portfolio can help mitigate risks and provide a balance between growth and income. Diversification does not only mean holding a mix of stocks and bonds but also considering different sectors, geographies, and asset classes. This approach can help cushion the portfolio against market downturns and provide more consistent returns.

Furthermore, it is important to regularly review and adjust the portfolio to align with changing financial goals and risk tolerance. Life events, such as changes in health, lifestyle, or financial needs, can significantly impact one’s risk tolerance and investment strategy. Therefore, periodic reassessment of the portfolio is crucial to ensure it remains aligned with one’s retirement objectives.

In conclusion, while the traditional advice of shifting from stocks to bonds at age 65 is rooted in the desire for stability, it is not a one-size-fits-all solution. The decision to rebalance a 401(k) portfolio should be guided by an individual’s risk tolerance, financial goals, and the current economic environment. By carefully considering these factors and maintaining a diversified portfolio, individuals can better position themselves to achieve a secure and fulfilling retirement. Ultimately, consulting with a financial advisor can provide personalized guidance tailored to one’s unique circumstances, ensuring that the investment strategy aligns with both current needs and future aspirations.

Tax Implications of Rebalancing Your 401(k) from Stocks to Bonds

As individuals approach retirement age, the question of whether to rebalance a 401(k) from stocks to bonds becomes increasingly pertinent. At age 65, many are considering this shift to reduce risk and preserve capital. However, an often-overlooked aspect of this decision is the tax implications that accompany rebalancing. Understanding these implications is crucial for making informed financial decisions that align with one’s retirement goals.

To begin with, it is important to recognize that 401(k) accounts are tax-advantaged retirement savings plans. Contributions to a traditional 401(k) are typically made with pre-tax dollars, meaning that taxes are deferred until withdrawals are made during retirement. This tax-deferred growth allows the account to compound over time without the immediate burden of taxes. However, when rebalancing a 401(k) from stocks to bonds, it is essential to consider how this action might affect the account’s tax status.

Rebalancing within a 401(k) does not trigger immediate tax consequences, as the transactions occur within the tax-advantaged account. This is a significant advantage compared to taxable investment accounts, where selling assets to rebalance can result in capital gains taxes. In a 401(k), investors can adjust their asset allocation without worrying about incurring taxes on gains, allowing for greater flexibility in managing risk as retirement approaches.

Nevertheless, it is crucial to consider the long-term tax implications of shifting from stocks to bonds. While bonds are generally considered safer investments, they often provide lower returns compared to stocks. This lower return potential can impact the overall growth of the 401(k) and, consequently, the amount of taxable income available during retirement. As withdrawals from a traditional 401(k) are taxed as ordinary income, a lower account balance could result in less taxable income, potentially affecting one’s tax bracket and overall tax liability in retirement.

Moreover, the decision to rebalance should also take into account the Required Minimum Distributions (RMDs) that begin at age 73, as per current regulations. RMDs are mandatory withdrawals from retirement accounts, and they are calculated based on the account balance and life expectancy. A portfolio heavily weighted in bonds may grow at a slower rate, potentially reducing the size of RMDs and, consequently, the tax burden. However, this must be balanced against the need for sufficient income to support one’s lifestyle in retirement.

In addition to these considerations, it is advisable to consult with a financial advisor or tax professional when contemplating rebalancing a 401(k). These experts can provide personalized advice that takes into account an individual’s entire financial picture, including other sources of retirement income, tax considerations, and estate planning goals. They can also help navigate the complexities of tax laws and ensure that the rebalancing strategy aligns with both short-term needs and long-term objectives.

In conclusion, while rebalancing a 401(k) from stocks to bonds at age 65 can be a prudent move to reduce risk, it is essential to carefully consider the tax implications. By understanding how these changes affect the account’s growth and future tax liabilities, individuals can make informed decisions that support a secure and comfortable retirement.

Expert Opinions on Rebalancing Your 401(k) at Age 65

As individuals approach retirement age, the question of whether to rebalance a 401(k) from stocks to bonds becomes increasingly pertinent. At age 65, many are on the cusp of transitioning from the accumulation phase of their financial lives to the distribution phase, where preserving capital often takes precedence over aggressive growth. The decision to rebalance a 401(k) is not one-size-fits-all and should be informed by a variety of factors, including risk tolerance, life expectancy, and income needs.

To begin with, it is essential to understand the fundamental differences between stocks and bonds. Stocks represent ownership in a company and offer the potential for high returns, albeit with greater volatility. Bonds, on the other hand, are debt instruments that typically provide more stable, albeit lower, returns. As individuals age, the conventional wisdom suggests shifting from stocks to bonds to reduce exposure to market volatility. However, this strategy may not be suitable for everyone.

One of the primary considerations in deciding whether to rebalance is risk tolerance. At age 65, some individuals may still have a high tolerance for risk, especially if they have other sources of income or a longer investment horizon. For these individuals, maintaining a higher allocation in stocks might be appropriate, as it allows for continued growth potential. Conversely, those with a lower risk tolerance or who rely heavily on their 401(k) for retirement income may benefit from a more conservative allocation, emphasizing bonds to preserve capital.

Moreover, life expectancy plays a crucial role in this decision. With advancements in healthcare, many people are living longer, which means their retirement savings need to last longer as well. For those who anticipate a longer retirement, maintaining some exposure to stocks can help ensure that their portfolio continues to grow and outpace inflation. On the other hand, individuals with health concerns or a family history of shorter life expectancy might prioritize capital preservation and opt for a higher bond allocation.

Income needs are another critical factor to consider. At age 65, some individuals may have already started drawing from their 401(k), while others may delay withdrawals to maximize their savings. Those who require immediate income from their retirement accounts might prefer the steady income stream that bonds can provide. In contrast, individuals who can afford to delay withdrawals might choose to keep a higher percentage in stocks to benefit from potential market gains.

Additionally, it is important to consider the current economic environment. Interest rates, inflation, and market conditions can all influence the decision to rebalance. For instance, in a low-interest-rate environment, the returns on bonds may be less attractive, prompting some to maintain a higher allocation in stocks. Conversely, in times of high market volatility, a shift towards bonds might offer more stability.

In conclusion, the decision to rebalance a 401(k) from stocks to bonds at age 65 is a complex one that should be tailored to individual circumstances. By carefully considering factors such as risk tolerance, life expectancy, income needs, and the economic environment, individuals can make informed decisions that align with their retirement goals. Consulting with a financial advisor can also provide valuable insights and help ensure that one’s retirement strategy is both prudent and personalized.

Steps to Effectively Rebalance Your 401(k) for Retirement Security

As individuals approach the age of 65, the question of whether to rebalance a 401(k) from stocks to bonds becomes increasingly pertinent. This decision is crucial for ensuring retirement security, as it involves adjusting the risk profile of one’s investment portfolio to align with changing financial goals and risk tolerance. To effectively rebalance a 401(k) for retirement security, it is essential to consider several key steps that can guide this transition.

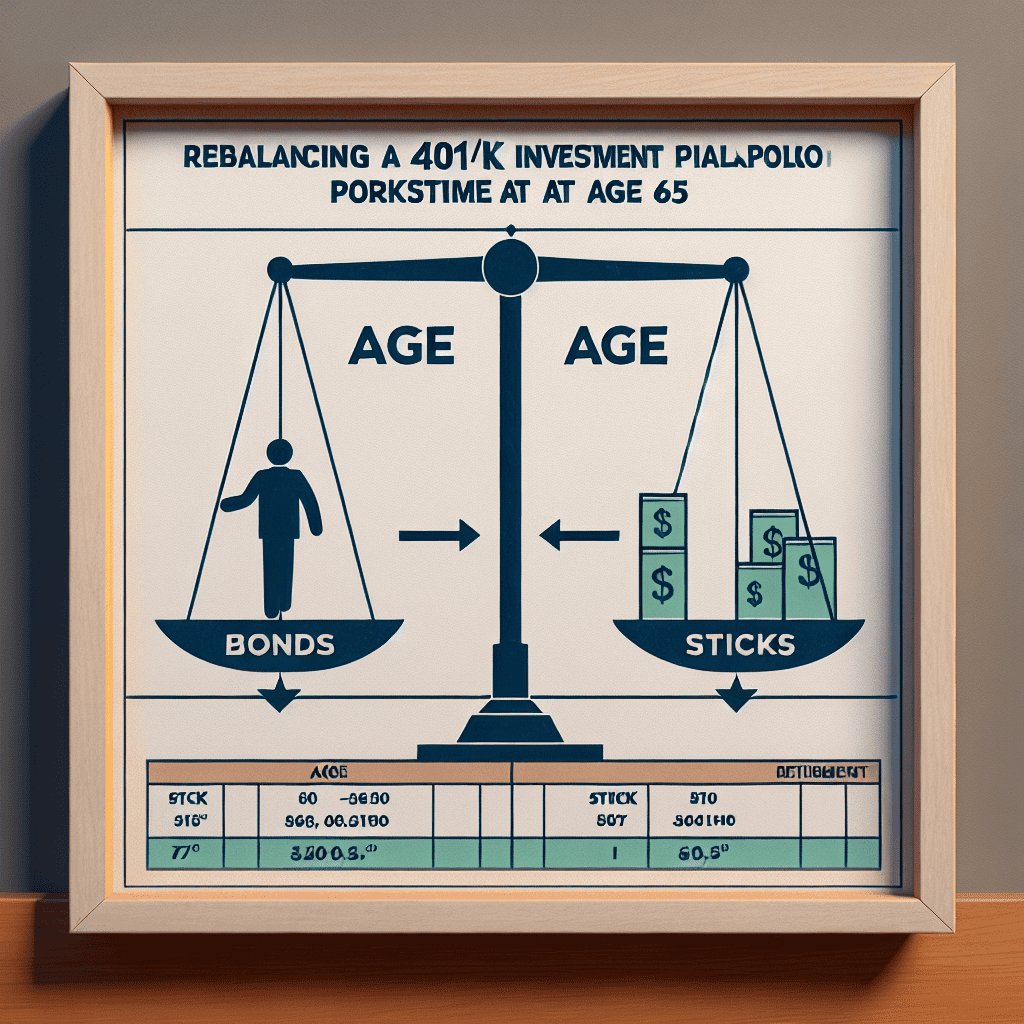

First and foremost, it is important to assess your current financial situation and retirement goals. At age 65, many individuals are either on the cusp of retirement or have already retired, which means their investment strategy should prioritize capital preservation and income generation over aggressive growth. Evaluating your financial needs, such as expected living expenses, healthcare costs, and any other financial obligations, will provide a clearer picture of how much risk you can afford to take. This assessment will serve as the foundation for determining the appropriate asset allocation between stocks and bonds.

Once you have a clear understanding of your financial needs, the next step is to review your current 401(k) portfolio. This involves analyzing the existing allocation of assets and identifying any imbalances that may have occurred over time due to market fluctuations. Stocks, for instance, tend to be more volatile than bonds, and their value can increase or decrease significantly, leading to a shift in the original asset allocation. By reviewing your portfolio, you can determine whether it still aligns with your risk tolerance and retirement objectives.

After reviewing your portfolio, consider the benefits of shifting a portion of your investments from stocks to bonds. Bonds are generally considered safer investments compared to stocks, as they provide a fixed income and are less susceptible to market volatility. This makes them an attractive option for individuals nearing retirement who seek to protect their capital. However, it is important to strike a balance, as maintaining some exposure to stocks can still offer growth potential and help combat inflation over the long term.

In addition to reallocating assets, it is crucial to stay informed about market conditions and economic trends. Interest rates, inflation, and other economic indicators can impact the performance of both stocks and bonds. By staying informed, you can make more educated decisions about when and how to rebalance your portfolio. Consulting with a financial advisor can also provide valuable insights and personalized advice tailored to your specific situation.

Furthermore, it is essential to regularly monitor and adjust your portfolio as needed. Rebalancing is not a one-time event but rather an ongoing process that requires periodic review. As you progress through retirement, your financial needs and risk tolerance may change, necessitating further adjustments to your asset allocation. By maintaining a proactive approach, you can ensure that your 401(k) remains aligned with your retirement goals.

In conclusion, rebalancing a 401(k) from stocks to bonds at age 65 is a strategic move that can enhance retirement security. By assessing your financial situation, reviewing your portfolio, considering the benefits of bonds, staying informed about market conditions, and regularly monitoring your investments, you can effectively navigate this transition. This thoughtful approach will help safeguard your financial future and provide peace of mind as you embark on this new chapter of life.

Q&A

1. **What is rebalancing in a 401(k)?**

Rebalancing involves adjusting the allocation of assets in your 401(k) to maintain a desired level of risk and return, often by shifting investments between stocks and bonds.

2. **Why consider rebalancing from stocks to bonds at age 65?**

At age 65, many individuals are nearing or entering retirement, so shifting to bonds can reduce risk and provide more stable income.

3. **What are the benefits of holding bonds in a 401(k) at age 65?**

Bonds typically offer lower volatility and more predictable returns, which can help preserve capital and provide steady income during retirement.

4. **What are the risks of holding too many stocks at age 65?**

Stocks can be volatile, and a market downturn could significantly impact your retirement savings if you are heavily invested in equities.

5. **How often should you rebalance your 401(k)?**

Many financial advisors recommend rebalancing annually or when your asset allocation deviates significantly from your target.

6. **What factors should influence your decision to rebalance?**

Consider your risk tolerance, retirement goals, life expectancy, and other income sources when deciding whether to rebalance.

7. **Should everyone at age 65 rebalance from stocks to bonds?**

Not necessarily; the decision depends on individual circumstances, including financial needs, risk tolerance, and investment strategy. Consulting a financial advisor is often recommended.

Conclusion

Rebalancing your 401(k) from stocks to bonds at age 65 can be a prudent decision, as it aligns with the common investment strategy of reducing risk as retirement approaches. At this age, preserving capital becomes more critical than aggressive growth, and bonds typically offer more stability and lower volatility compared to stocks. However, the decision should also consider your individual financial situation, risk tolerance, life expectancy, and income needs during retirement. Consulting with a financial advisor can provide personalized guidance to ensure your investment strategy aligns with your retirement goals.