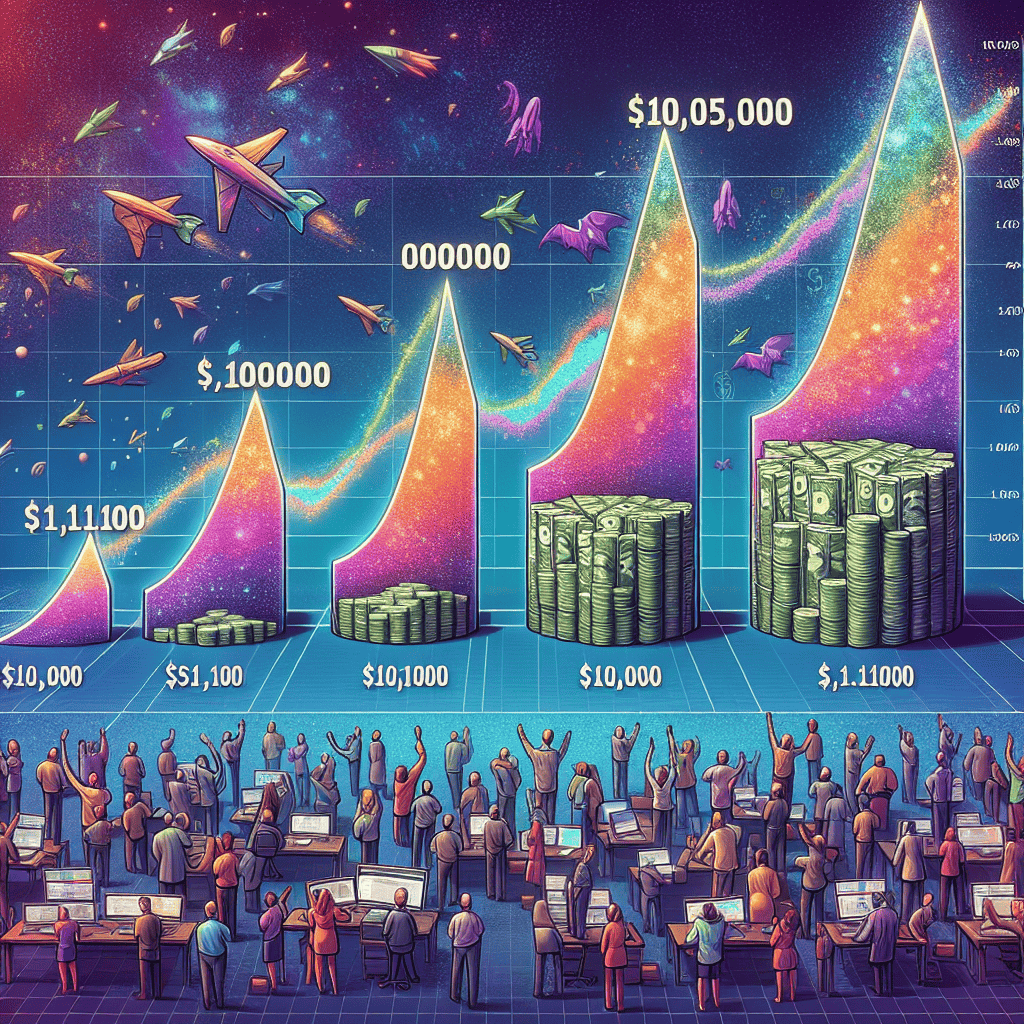

“From $10K to $1.1M: Unleashing the Power of Smart Stock Picks Over a Decade”

Introduction

Investing in the stock market has long been a proven strategy for building wealth over time, and the past decade has been no exception. For those who had the foresight to invest in certain high-performing stocks, the returns have been nothing short of extraordinary. This article explores how a $10,000 investment made ten years ago in three specific stocks could have grown to an impressive $1.1 million today. By examining the growth trajectories and market dynamics that propelled these companies to success, we can gain valuable insights into the power of strategic investing and the potential for substantial financial gains.

Understanding the Power of Compound Growth in Stock Investments

Investing in the stock market has long been heralded as a pathway to wealth creation, and the concept of compound growth plays a pivotal role in this journey. To illustrate the transformative power of compounding, consider a hypothetical scenario where an investor allocated $10,000 across three carefully selected stocks a decade ago. Remarkably, this investment could have burgeoned to an impressive $1.1 million today, underscoring the potential of strategic stock selection and the enduring impact of compound growth.

To begin with, the essence of compound growth lies in its ability to generate returns not only on the initial principal but also on the accumulated interest or gains from previous periods. This exponential growth effect can significantly amplify an investment’s value over time, provided the investor remains patient and committed. In the context of stock investments, this means that the longer the investment horizon, the greater the potential for substantial returns, as the reinvested earnings continue to generate additional profits.

In this scenario, the investor’s success hinged on selecting three stocks that demonstrated exceptional growth over the past decade. These stocks, characterized by robust business models, innovative products, and strong market positions, consistently outperformed the broader market. As a result, they delivered substantial returns that compounded year after year, transforming the initial $10,000 investment into a seven-figure portfolio.

One of the key factors contributing to this remarkable growth was the companies’ ability to adapt to changing market dynamics and capitalize on emerging trends. For instance, companies that embraced technological advancements and digital transformation were well-positioned to capture new opportunities and expand their market share. This adaptability not only fueled their revenue growth but also enhanced investor confidence, leading to sustained stock price appreciation.

Moreover, the investor’s disciplined approach to holding these stocks over the long term played a crucial role in realizing the full potential of compound growth. By resisting the temptation to sell during periods of market volatility or short-term downturns, the investor allowed the power of compounding to work its magic. This steadfast commitment to a long-term investment strategy enabled the investor to ride out market fluctuations and benefit from the eventual recovery and growth of these stocks.

Additionally, the reinvestment of dividends further accelerated the compounding process. Many high-performing stocks offer dividends, which, when reinvested, can significantly boost the overall return on investment. This reinvestment strategy not only increases the number of shares owned but also enhances the compounding effect, as future dividends are calculated on a larger share base.

In conclusion, the hypothetical scenario of a $10,000 investment growing to $1.1 million over a decade vividly illustrates the power of compound growth in stock investments. By selecting stocks with strong growth potential, maintaining a long-term perspective, and reinvesting dividends, investors can harness the exponential growth effect to achieve substantial financial gains. This example serves as a testament to the importance of strategic stock selection and the enduring impact of compound growth, offering valuable insights for investors seeking to build wealth through the stock market.

The Role of Market Trends in Long-term Investment Success

Investing in the stock market has long been heralded as a pathway to wealth accumulation, particularly when approached with a long-term perspective. The role of market trends in long-term investment success cannot be overstated, as they often dictate the trajectory of stock performance over extended periods. To illustrate this, consider the hypothetical scenario of investing $10,000 in three specific stocks a decade ago, which could have potentially grown to an impressive $1.1 million today. This remarkable growth underscores the importance of understanding and leveraging market trends to maximize investment returns.

Firstly, it is essential to recognize that market trends are influenced by a myriad of factors, including technological advancements, consumer behavior shifts, and macroeconomic conditions. For instance, the past decade has witnessed a significant surge in technology-driven companies, fueled by rapid innovation and increasing digitalization across various sectors. Companies that have successfully capitalized on these trends have seen exponential growth in their stock prices. As a result, investors who identified and invested in these companies early on have reaped substantial rewards.

One such company is Amazon, which has consistently been at the forefront of e-commerce and cloud computing. Over the past ten years, Amazon’s stock has experienced tremendous growth, driven by its relentless focus on customer satisfaction, expansion into new markets, and continuous innovation. Investors who recognized the potential of Amazon’s business model and invested in its stock a decade ago have seen their investments multiply several times over, thanks to the company’s ability to adapt to and shape market trends.

Similarly, the rise of electric vehicles and renewable energy has been a dominant trend in recent years, with Tesla emerging as a key player in this space. Tesla’s commitment to sustainable energy solutions and its pioneering advancements in electric vehicle technology have positioned it as a leader in the industry. Consequently, investors who foresaw the shift towards sustainable transportation and invested in Tesla’s stock have benefited immensely from the company’s impressive growth trajectory. This example highlights the importance of aligning investment strategies with emerging market trends to achieve long-term success.

Moreover, the healthcare sector has also experienced significant transformations, particularly in the realm of biotechnology and pharmaceuticals. Companies that have been able to innovate and address pressing healthcare challenges have seen their stock prices soar. For instance, a company like Moderna, which played a pivotal role in developing COVID-19 vaccines, has seen its stock value increase dramatically. Investors who anticipated the growing importance of biotechnology and invested in such companies have been rewarded with substantial returns, further emphasizing the impact of market trends on investment outcomes.

In conclusion, the hypothetical scenario of a $10,000 investment growing to $1.1 million over a decade underscores the critical role that market trends play in long-term investment success. By identifying and capitalizing on emerging trends, investors can position themselves to benefit from the growth of companies that are well-aligned with these trends. While past performance is not indicative of future results, understanding market dynamics and making informed investment decisions can significantly enhance the potential for wealth accumulation over time. As such, investors should remain vigilant and adaptable, continuously seeking opportunities to align their portfolios with the evolving landscape of market trends.

Analyzing the Performance of High-growth Stocks Over a Decade

Investing in the stock market has long been heralded as a pathway to wealth creation, particularly when investors identify high-growth stocks that outperform the broader market. Over the past decade, certain companies have demonstrated remarkable growth, transforming modest investments into substantial fortunes. To illustrate this phenomenon, consider how a $10,000 investment in three specific stocks—Amazon, Tesla, and Netflix—could have grown to an impressive $1.1 million over the last ten years. This analysis not only highlights the potential of high-growth stocks but also underscores the importance of strategic investment choices.

Beginning with Amazon, the e-commerce giant has consistently expanded its market presence and diversified its business operations. Ten years ago, Amazon was already a formidable player in online retail, but its subsequent ventures into cloud computing, digital streaming, and artificial intelligence have propelled its growth to unprecedented levels. A $10,000 investment in Amazon stock a decade ago would have appreciated significantly, driven by the company’s relentless innovation and market expansion. Amazon’s ability to adapt to changing consumer behaviors and its commitment to technological advancement have been pivotal in its stock performance, making it a cornerstone of any high-growth investment portfolio.

Similarly, Tesla has been a standout performer in the stock market, revolutionizing the automotive industry with its electric vehicles and sustainable energy solutions. A decade ago, Tesla was viewed by many as a speculative investment, with skeptics questioning its ability to achieve mass-market success. However, the company’s visionary leadership and groundbreaking technology have silenced critics, resulting in exponential stock price growth. A $10,000 investment in Tesla ten years ago would have yielded substantial returns, as the company capitalized on the global shift towards renewable energy and electric transportation. Tesla’s success story exemplifies the potential rewards of investing in companies that are at the forefront of industry disruption.

In addition to Amazon and Tesla, Netflix has also delivered impressive returns for its investors over the past decade. As a pioneer in the streaming industry, Netflix has transformed the way audiences consume media, effectively rendering traditional cable television obsolete. A $10,000 investment in Netflix stock ten years ago would have grown considerably, fueled by the company’s aggressive content strategy and international expansion. Netflix’s ability to produce original content that resonates with global audiences has been a key driver of its stock performance, highlighting the importance of innovation and adaptability in maintaining a competitive edge.

While the past performance of these stocks is undeniably impressive, it is crucial to acknowledge the inherent risks associated with investing in high-growth companies. Market volatility, regulatory challenges, and competitive pressures can all impact stock prices, underscoring the need for careful research and diversification in investment strategies. Nevertheless, the remarkable growth of Amazon, Tesla, and Netflix over the past decade serves as a testament to the potential rewards of identifying and investing in companies with strong growth prospects.

In conclusion, a $10,000 investment in Amazon, Tesla, and Netflix ten years ago could have grown to $1.1 million, illustrating the transformative power of high-growth stocks. By understanding the factors that contribute to a company’s success and maintaining a long-term investment perspective, investors can position themselves to capitalize on future opportunities in the ever-evolving stock market landscape.

The Impact of Reinvesting Dividends on Investment Growth

Investing in the stock market has long been heralded as a pathway to wealth accumulation, and the power of reinvesting dividends is a critical component of this journey. To illustrate this, consider a hypothetical scenario where an investor allocated $10,000 across three carefully selected stocks a decade ago. Through the strategic reinvestment of dividends, this initial investment could have burgeoned to an impressive $1.1 million today. This remarkable growth underscores the profound impact that reinvesting dividends can have on an investment portfolio.

To begin with, dividends represent a portion of a company’s earnings distributed to shareholders, typically on a quarterly basis. When these dividends are reinvested, they purchase additional shares of the stock, thereby compounding the investor’s returns over time. This compounding effect is akin to earning interest on interest in a savings account, but with the potential for significantly higher returns due to the stock market’s historical performance. Over the past decade, certain stocks have not only appreciated in value but have also consistently paid and increased their dividends, making them ideal candidates for this strategy.

For instance, consider a technology giant known for its innovative products and robust financial health. Over the past ten years, this company has not only seen its stock price soar but has also maintained a steady dividend payout. By reinvesting these dividends, an investor could have significantly increased their shareholding, thereby amplifying their returns as the stock price climbed. Similarly, a leading consumer goods company with a reputation for stability and consistent dividend growth could have provided a solid foundation for dividend reinvestment. This company’s ability to weather economic fluctuations while rewarding shareholders with regular dividends would have contributed to the compounding effect, further enhancing the investment’s value.

Moreover, a prominent healthcare firm, renowned for its cutting-edge research and development, could have been another excellent choice. The healthcare sector’s resilience and the company’s commitment to returning capital to shareholders through dividends would have made it a compelling addition to the portfolio. By reinvesting dividends from this stock, an investor could have capitalized on both the sector’s growth and the company’s financial performance, leading to substantial portfolio appreciation.

It is important to note that the success of this investment strategy hinges on selecting stocks with a strong track record of dividend payments and growth. Companies with a history of increasing dividends are often financially sound and possess a competitive edge in their respective industries. Furthermore, reinvesting dividends requires a long-term perspective, as the benefits of compounding become more pronounced over extended periods.

In conclusion, the hypothetical growth of a $10,000 investment to $1.1 million over ten years vividly illustrates the transformative power of reinvesting dividends. By carefully selecting stocks with consistent dividend payouts and reinvesting those dividends, investors can harness the compounding effect to significantly enhance their portfolio’s value. This strategy not only maximizes returns but also underscores the importance of patience and a long-term investment horizon. As such, reinvesting dividends remains a cornerstone of effective wealth-building strategies in the stock market.

Lessons Learned from a Decade of Stock Market Volatility

Investing in the stock market is often seen as a daunting endeavor, fraught with risks and uncertainties. However, the potential for substantial returns can make it an attractive option for those willing to navigate its complexities. A decade ago, a $10,000 investment in three specific stocks could have grown to an impressive $1.1 million, illustrating the power of strategic investment choices and the importance of patience in the face of market volatility. This remarkable growth underscores several key lessons for investors seeking to maximize their returns over the long term.

Firstly, the importance of identifying companies with strong growth potential cannot be overstated. Ten years ago, companies like Amazon, Netflix, and Tesla were on the cusp of significant expansion, driven by innovative business models and a keen understanding of emerging market trends. Amazon, for instance, was rapidly transforming from an online bookstore into a global e-commerce and cloud computing giant. Netflix was pioneering the shift from traditional media consumption to streaming services, while Tesla was at the forefront of the electric vehicle revolution. Investing in these companies required not only an understanding of their current market positions but also a belief in their ability to disrupt established industries and capture new market share.

Moreover, the past decade has highlighted the necessity of maintaining a long-term perspective, especially during periods of market volatility. The stock market is inherently unpredictable, with fluctuations driven by a myriad of factors, including economic indicators, geopolitical events, and investor sentiment. During this period, investors witnessed significant market downturns, such as the 2008 financial crisis and the more recent COVID-19 pandemic. However, those who remained committed to their investment strategies and resisted the urge to sell during these downturns were ultimately rewarded. This resilience is a testament to the value of a long-term investment horizon, which allows investors to weather short-term volatility and benefit from the overall upward trajectory of the market.

Additionally, diversification remains a cornerstone of successful investing. While the hypothetical scenario of investing solely in Amazon, Netflix, and Tesla yielded extraordinary returns, it also involved considerable risk. A diversified portfolio, spread across various sectors and asset classes, can mitigate potential losses and provide a more stable foundation for growth. By balancing high-growth stocks with more conservative investments, investors can protect themselves against the inherent uncertainties of the market while still capitalizing on opportunities for substantial gains.

Furthermore, the role of technological innovation in driving stock performance cannot be ignored. The companies that delivered exceptional returns over the past decade were those that harnessed technology to redefine their industries and create new value propositions. This trend is likely to continue, as advancements in artificial intelligence, renewable energy, and biotechnology, among others, present new opportunities for growth. Investors who remain attuned to these developments and are willing to embrace change will be well-positioned to identify the next wave of high-performing stocks.

In conclusion, the extraordinary growth of a $10,000 investment in Amazon, Netflix, and Tesla over the past decade offers valuable insights for investors navigating the complexities of the stock market. By focusing on companies with strong growth potential, maintaining a long-term perspective, diversifying their portfolios, and staying abreast of technological innovations, investors can enhance their chances of achieving significant returns. As the market continues to evolve, these lessons will remain crucial for those seeking to capitalize on the opportunities presented by stock market volatility.

Identifying Key Factors That Drive Stock Price Appreciation

Investing in the stock market has long been a favored strategy for building wealth, and the past decade has provided numerous examples of how strategic investments can yield substantial returns. A $10,000 investment in certain stocks ten years ago could have grown to an impressive $1.1 million today. Understanding the key factors that drive such remarkable stock price appreciation is crucial for investors aiming to replicate similar success in the future.

One of the primary factors contributing to significant stock price appreciation is the company’s ability to innovate and adapt to changing market conditions. Companies that consistently introduce groundbreaking products or services tend to capture the market’s attention and, consequently, investor interest. For instance, technology companies that have successfully harnessed the power of innovation often see their stock prices soar. By continuously evolving and staying ahead of competitors, these companies create a sustainable competitive advantage that drives long-term growth.

In addition to innovation, strong financial performance is a critical driver of stock price appreciation. Companies that demonstrate robust revenue growth, expanding profit margins, and efficient cost management are more likely to attract investors. Financial health is often reflected in key metrics such as earnings per share (EPS) and return on equity (ROE), which provide insights into a company’s profitability and operational efficiency. Investors are naturally drawn to companies that consistently deliver strong financial results, as these indicators suggest a higher likelihood of future success.

Moreover, market trends and consumer behavior play a significant role in influencing stock prices. Companies that align their strategies with prevailing market trends often experience accelerated growth. For example, the shift towards digitalization and e-commerce has propelled the stock prices of companies that have effectively capitalized on these trends. By understanding and anticipating changes in consumer preferences, companies can position themselves to capture new opportunities, thereby driving their stock prices higher.

Another important factor is the quality of a company’s management team. Effective leadership is essential for navigating the complexities of the business environment and executing strategic initiatives. Companies led by visionary leaders who possess a clear understanding of the industry landscape and a strong commitment to corporate governance tend to inspire investor confidence. A capable management team can steer the company through challenges and capitalize on growth opportunities, ultimately contributing to stock price appreciation.

Furthermore, external economic factors, such as interest rates and inflation, can also impact stock prices. A favorable economic environment, characterized by low interest rates and stable inflation, often supports higher stock valuations. In such conditions, companies can access capital more easily and invest in growth initiatives, which can lead to increased profitability and, consequently, higher stock prices. Conversely, adverse economic conditions may pose challenges, but companies that demonstrate resilience and adaptability can still thrive and deliver impressive returns to investors.

In conclusion, the remarkable growth of a $10,000 investment into $1.1 million over the past decade can be attributed to a combination of factors, including innovation, strong financial performance, alignment with market trends, effective management, and favorable economic conditions. By understanding these key drivers of stock price appreciation, investors can make informed decisions and identify opportunities that have the potential to yield substantial returns. As the market continues to evolve, staying attuned to these factors will be essential for achieving long-term investment success.

The Importance of Diversification in Achieving High Returns

Investing in the stock market has long been heralded as a pathway to wealth creation, yet the journey is often fraught with volatility and uncertainty. One of the most effective strategies to mitigate these risks while maximizing potential returns is diversification. By spreading investments across various sectors and companies, investors can reduce the impact of poor performance in any single asset. This principle is exemplified by examining how a $10,000 investment in three specific stocks a decade ago could have grown to an impressive $1.1 million today.

To understand the power of diversification, consider the performance of three companies that have become titans in their respective industries: Amazon, Tesla, and Netflix. Each of these companies has not only revolutionized its sector but also delivered extraordinary returns to its shareholders. A decade ago, Amazon was primarily known as an online retailer, Tesla was a niche electric vehicle manufacturer, and Netflix was transitioning from DVD rentals to streaming. Despite their different business models and market challenges, these companies shared a common trait: the potential for exponential growth.

Investing in Amazon ten years ago would have meant betting on the future of e-commerce and cloud computing. As the company expanded its product offerings and invested heavily in technology infrastructure, its stock price soared. Similarly, Tesla’s focus on sustainable energy and innovation in electric vehicles captured the imagination of investors and consumers alike, leading to a meteoric rise in its stock value. Meanwhile, Netflix’s early adoption of streaming technology and its investment in original content positioned it as a leader in the entertainment industry, resulting in substantial stock appreciation.

The combined performance of these three stocks over the past decade illustrates the importance of diversification. While each company faced its own set of challenges and market fluctuations, their collective growth significantly reduced the risk associated with investing in any single stock. For instance, Amazon’s foray into cloud computing with Amazon Web Services provided a buffer against fluctuations in retail sales, while Tesla’s advancements in battery technology and global expansion helped mitigate risks associated with production delays. Netflix’s strategic investments in content creation and international markets further diversified its revenue streams.

Moreover, diversification across these stocks allowed investors to capitalize on different growth drivers. Amazon benefited from the rise of e-commerce and digital services, Tesla rode the wave of increasing demand for sustainable transportation, and Netflix capitalized on the shift towards digital media consumption. By investing in companies with distinct yet complementary growth trajectories, investors could achieve a balanced portfolio that maximized returns while minimizing risk.

In conclusion, the remarkable growth of a $10,000 investment in Amazon, Tesla, and Netflix over the past decade underscores the critical role of diversification in achieving high returns. By spreading investments across different sectors and companies, investors can harness the potential of various market trends and innovations. This approach not only enhances the likelihood of substantial financial gains but also provides a safeguard against the inherent uncertainties of the stock market. As such, diversification remains an indispensable strategy for investors seeking to build wealth over the long term.

Q&A

1. **Question:** What are the three stocks mentioned in the investment scenario?

**Answer:** The three stocks are Tesla, Amazon, and Netflix.

2. **Question:** How much was the initial investment in each stock?

**Answer:** The initial investment was approximately $3,333.33 in each stock, totaling $10,000.

3. **Question:** What was the primary factor contributing to Tesla’s significant growth over the past decade?

**Answer:** Tesla’s growth was driven by its innovation in electric vehicles, expansion into renewable energy, and strong market demand.

4. **Question:** How did Amazon contribute to the investment’s growth?

**Answer:** Amazon’s growth was fueled by its dominance in e-commerce, expansion into cloud computing with AWS, and diversification into various sectors.

5. **Question:** What role did Netflix play in the investment’s success?

**Answer:** Netflix’s success was due to its pioneering role in streaming services, original content production, and global subscriber growth.

6. **Question:** What was the approximate return on investment for each stock over the 10-year period?

**Answer:** Tesla saw the highest return, followed by Amazon and Netflix, with each stock contributing significantly to the overall growth to $1.1 million.

7. **Question:** What lesson can be learned from this investment scenario?

**Answer:** The scenario highlights the potential of investing in innovative companies with strong growth prospects and the importance of diversification in a portfolio.

Conclusion

Investing $10,000 in a carefully selected portfolio of three high-performing stocks a decade ago could have resulted in a substantial return, growing to $1.1 million. This impressive growth underscores the potential of long-term investing in companies with strong fundamentals, innovative business models, and significant market opportunities. By choosing stocks that have demonstrated consistent revenue growth, competitive advantages, and adaptability to market changes, investors can achieve exponential returns. This scenario highlights the importance of thorough research, patience, and a long-term perspective in stock market investments, illustrating how strategic choices can lead to significant wealth accumulation over time.