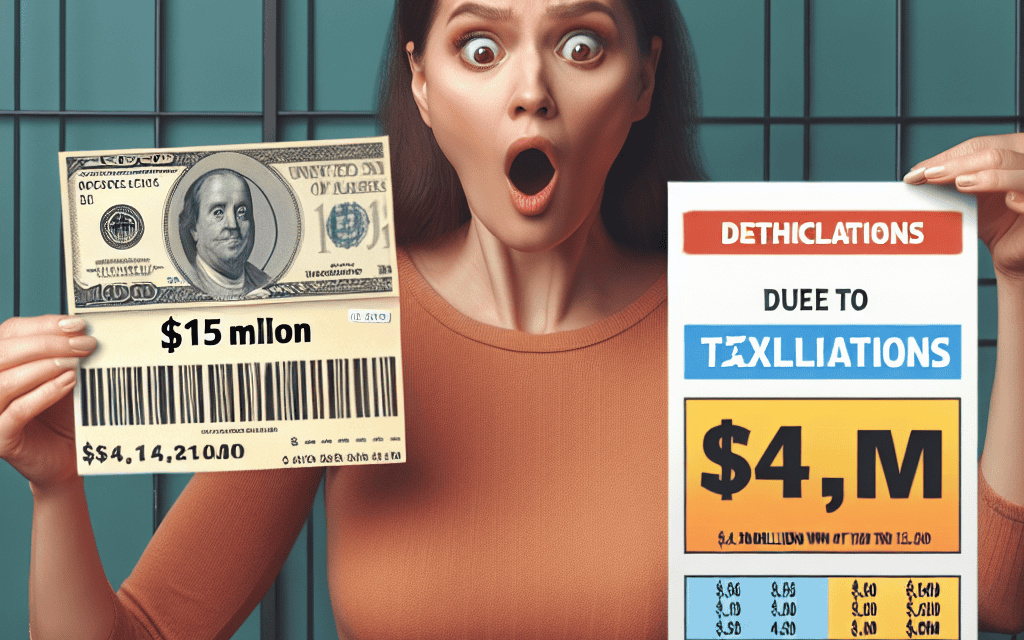

“From Jackpot to Just Enough: The Taxing Tale of Ohio’s $15M Lottery Win”

Introduction

An Ohio woman recently experienced the thrill of winning a $15 million lottery jackpot, only to see her windfall significantly reduced after taxes. While the initial excitement of such a substantial prize is undeniable, the reality of tax obligations quickly set in, leaving her with a net amount of $4.5 million. This dramatic reduction highlights the often-overlooked impact of federal and state taxes on lottery winnings. The breakdown of her prize reveals the substantial portion claimed by the government, underscoring the importance of understanding tax implications when it comes to large financial gains.

Understanding Lottery Taxation: Why Ohio Winners Take Home Less

Winning the lottery is often seen as a life-changing event, a moment when dreams of financial freedom and luxury become a reality. However, for many winners, the initial excitement can be tempered by the realization of how much of their prize will be claimed by taxes. This was the case for an Ohio woman who recently won a $15 million lottery jackpot, only to see her winnings reduced to $4.5 million after taxes. Understanding the taxation process for lottery winnings is crucial for anyone hoping to strike it rich, as it provides insight into why winners often take home significantly less than the advertised jackpot.

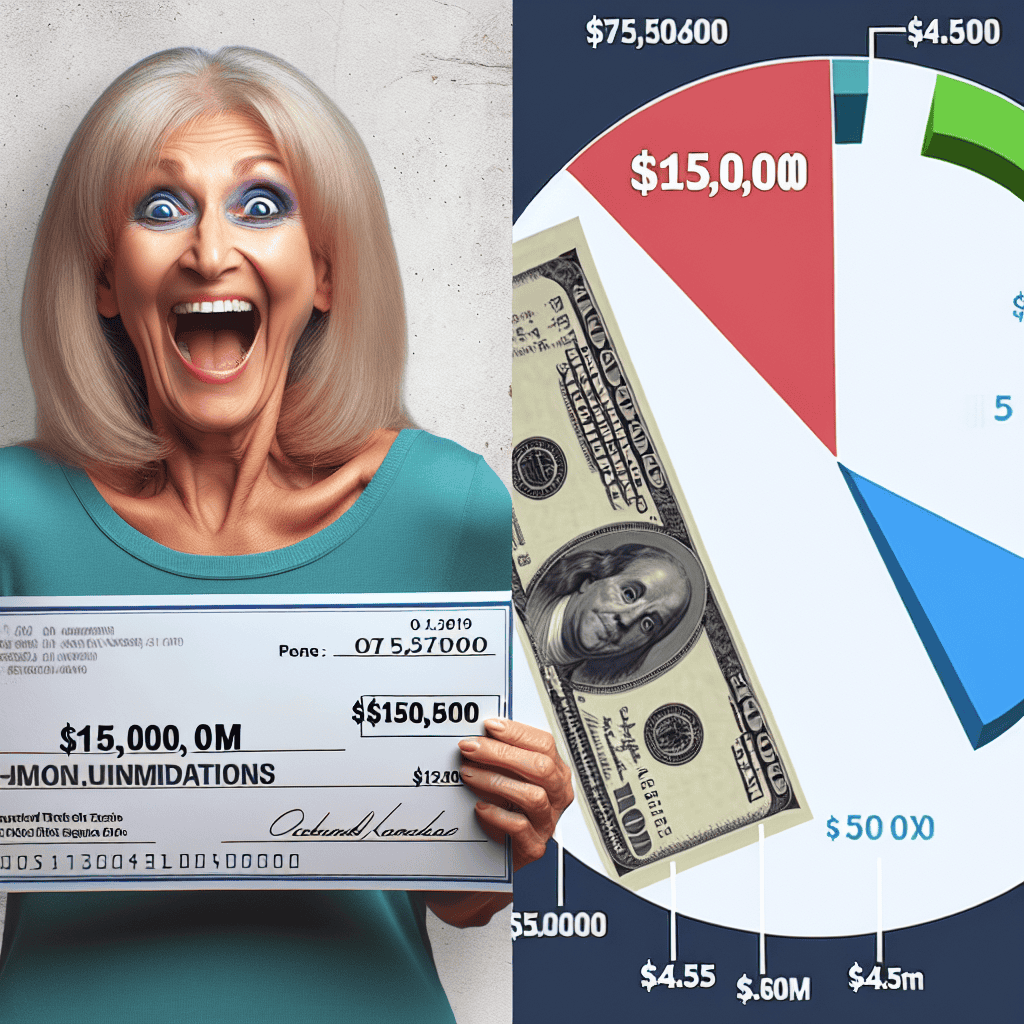

To begin with, lottery winnings are considered taxable income by the federal government. The Internal Revenue Service (IRS) requires that 24% of any lottery prize over $5,000 be withheld for federal taxes. In the case of the Ohio woman, this means that $3.6 million of her $15 million prize was immediately withheld by the federal government. However, this is just the beginning of the tax obligations for lottery winners. Depending on the winner’s total income for the year, they may be subject to a higher federal tax rate, potentially up to 37%, which could result in additional taxes owed when filing their annual tax return.

In addition to federal taxes, state taxes also play a significant role in reducing lottery winnings. Ohio, like many states, imposes its own tax on lottery prizes. The state of Ohio withholds 4% of lottery winnings for state taxes, which in this case amounts to $600,000. This further reduces the winner’s take-home amount. It’s important to note that some states have higher tax rates, while others, like Florida and Texas, do not tax lottery winnings at all. Therefore, the location of the winner can significantly impact the final amount they receive.

Moreover, local taxes may also apply, depending on where the winner resides. Some cities and municipalities impose additional taxes on lottery winnings, further decreasing the net amount. While these local taxes are generally smaller than federal and state taxes, they can still contribute to the overall reduction in the winner’s prize.

Another factor to consider is the choice between taking the lottery prize as a lump sum or as an annuity. The Ohio woman opted for the lump sum, which is typically less than the advertised jackpot amount. In this case, the lump sum was $10.8 million, rather than the full $15 million. This choice is common among lottery winners who prefer immediate access to their winnings, despite the reduced amount. However, choosing the annuity option would have spread the payments over several years, potentially resulting in a different tax situation.

In conclusion, while winning the lottery can indeed be a transformative event, it is essential for winners to understand the tax implications that accompany such a windfall. The Ohio woman’s experience highlights the significant impact that federal, state, and potentially local taxes can have on lottery winnings. By being informed about these factors, potential lottery winners can better prepare for the financial realities of their newfound wealth and make informed decisions about how to manage their prize.

The Impact of Federal Taxes on Lottery Winnings

Winning the lottery is often seen as a life-changing event, a moment when dreams of financial freedom and luxury become a reality. However, the excitement of winning can quickly be tempered by the realization of the significant tax implications that accompany such a windfall. This was the case for an Ohio woman who recently won a $15 million lottery prize, only to see her winnings reduced to $4.5 million after taxes. Understanding the impact of federal taxes on lottery winnings is crucial for anyone who dreams of hitting the jackpot.

When an individual wins a lottery, the Internal Revenue Service (IRS) considers the winnings as taxable income. This means that the federal government is entitled to a portion of the prize, which is subject to federal income tax. In the United States, lottery winnings are taxed as ordinary income, and the amount withheld depends on the winner’s total income for the year. For substantial lottery prizes, such as the $15 million won by the Ohio woman, the federal tax rate can be as high as 37%, which is the top marginal tax rate for individuals.

To illustrate the impact of federal taxes on lottery winnings, consider the Ohio woman’s situation. Upon winning the $15 million prize, the first deduction she faced was the mandatory federal withholding tax, which is typically 24% for lottery winnings. This initial deduction reduced her prize by $3.6 million, leaving her with $11.4 million. However, this is not the end of the tax obligations. The remaining amount is still subject to additional federal income tax, which is calculated based on her total income for the year, including the lottery winnings.

Assuming the Ohio woman had no other significant sources of income, her $15 million prize would place her in the highest federal tax bracket. Consequently, she would owe an additional 13% in federal taxes on the remaining $11.4 million, amounting to approximately $1.482 million. After accounting for both the initial withholding and the additional federal taxes, her total federal tax liability would be around $5.082 million, reducing her net winnings to approximately $9.918 million.

However, the tax implications do not end with federal taxes. State taxes also play a significant role in determining the final amount a lottery winner takes home. In Ohio, lottery winnings are subject to a state income tax rate of 4.797%. Applying this rate to the $15 million prize results in an additional tax liability of approximately $719,550. After deducting state taxes, the Ohio woman’s net winnings would be further reduced to approximately $9.198 million.

Moreover, local taxes may also apply, depending on the winner’s place of residence. In some cases, cities or municipalities impose their own taxes on lottery winnings, further diminishing the final amount. While these additional taxes vary widely, they can have a noticeable impact on the net prize.

In conclusion, while winning the lottery is undoubtedly a thrilling experience, it is essential to be aware of the substantial tax obligations that accompany such a windfall. The case of the Ohio woman serves as a stark reminder that federal, state, and potentially local taxes can significantly reduce the amount of money a lottery winner ultimately receives. Understanding these tax implications is crucial for effective financial planning and ensuring that the excitement of winning is not overshadowed by unexpected financial burdens.

State Taxes and Their Role in Reducing Lottery Payouts

In the realm of lottery winnings, the initial excitement of hitting the jackpot is often tempered by the reality of taxes, which can significantly reduce the final payout. This was the case for an Ohio woman who recently won a $15 million lottery prize, only to see her windfall shrink to $4.5 million after taxes. Understanding the breakdown of these deductions provides insight into how state and federal taxes play a crucial role in determining the actual amount a lottery winner takes home.

When a lottery winner is announced, the advertised jackpot is typically the pre-tax amount. In the case of the Ohio woman, her $15 million prize was subject to both federal and state taxes, which together accounted for a substantial portion of her winnings. The federal government imposes a mandatory withholding tax of 24% on lottery prizes, which is the first deduction from the total amount. For the Ohio winner, this federal withholding amounted to $3.6 million, reducing her prize to $11.4 million.

However, the federal withholding is just the beginning. Lottery winnings are considered ordinary income, and the winner is responsible for paying the difference between the withheld amount and their actual tax liability, which is determined by their total income for the year. For high-income earners, this can mean an additional federal tax rate of up to 37%. Assuming the Ohio woman falls into this bracket, she would owe an additional 13% in federal taxes, further reducing her winnings by approximately $1.95 million.

In addition to federal taxes, state taxes also play a significant role in diminishing lottery payouts. Ohio, like many states, imposes its own tax on lottery winnings. The state tax rate for lottery prizes in Ohio is 4%, which in this case amounts to $600,000. This deduction further reduces the winner’s take-home amount to $8.85 million.

Moreover, local taxes can also impact the final payout, depending on the winner’s place of residence. Some municipalities in Ohio levy their own taxes on lottery winnings, which can range from 1% to 3%. If the winner resides in a locality with a 2% tax rate, for example, this would result in an additional deduction of $300,000, bringing the total down to $8.55 million.

Beyond these immediate tax obligations, winners must also consider the potential impact of other financial responsibilities, such as estate taxes, should they choose to pass on their winnings to heirs. Additionally, financial advisors often recommend setting aside a portion of the winnings for future tax liabilities, as well as for investment and savings purposes.

In conclusion, while the prospect of winning a lottery jackpot is undeniably thrilling, the reality of taxes significantly alters the final payout. For the Ohio woman, her $15 million prize was reduced to $4.5 million after accounting for federal, state, and local taxes. This case underscores the importance of understanding the tax implications of lottery winnings and highlights the role that state taxes play in reducing the amount that winners ultimately receive. As such, potential lottery winners should be prepared for the substantial impact of taxes and seek professional financial advice to navigate the complexities of their newfound wealth.

How Lump Sum Payments Affect Lottery Winnings

When an Ohio woman recently won a $15 million lottery jackpot, the initial excitement was palpable. However, the reality of lottery winnings is often more complex than it appears at first glance. The decision to take a lump sum payment, rather than an annuity, significantly impacts the final amount received. In this case, the winner opted for a lump sum, which is a common choice among lottery winners. This decision, while providing immediate access to a substantial amount of money, also comes with its own set of financial implications.

To begin with, lottery winners who choose a lump sum payment receive a reduced amount compared to the advertised jackpot. This is because the advertised jackpot is based on the total amount that would be paid out over a period of time, typically 20 to 30 years, if the winner chooses an annuity. The lump sum option, on the other hand, provides a one-time payment that is significantly less than the total annuity amount. In the case of the Ohio woman, the lump sum payment was approximately $7.5 million, which is half of the advertised $15 million jackpot.

However, the reduction in winnings does not stop there. Once the lump sum amount is determined, taxes come into play. Lottery winnings are subject to federal income tax, and in many states, including Ohio, state taxes as well. The federal government withholds 24% of lottery winnings for tax purposes, but the actual tax rate can be higher depending on the winner’s total income for the year. In this instance, the federal tax withholding reduced the Ohio woman’s winnings by approximately $1.8 million.

Moreover, Ohio state taxes further decreased the amount. Ohio imposes a state tax rate of 4% on lottery winnings, which resulted in an additional reduction of about $300,000. Consequently, after both federal and state taxes were applied, the Ohio woman’s $7.5 million lump sum was reduced to approximately $4.5 million. This substantial decrease highlights the significant impact that taxes have on lottery winnings, particularly when opting for a lump sum payment.

While the immediate availability of a large sum of money can be appealing, it is crucial for lottery winners to understand the financial implications of their choices. Opting for a lump sum payment provides immediate liquidity, which can be advantageous for those who wish to invest or make large purchases. However, it also requires careful financial planning to ensure that the reduced amount is managed wisely.

In contrast, choosing an annuity provides a steady stream of income over several years, which can offer financial stability and reduce the risk of quickly depleting the winnings. Each option has its own benefits and drawbacks, and the best choice depends on the individual’s financial situation and goals.

In conclusion, while winning the lottery is undoubtedly a life-changing event, it is essential to consider the financial realities that accompany such a windfall. The decision between a lump sum and an annuity, along with the impact of taxes, plays a crucial role in determining the actual amount a winner takes home. Understanding these factors can help lottery winners make informed decisions that align with their long-term financial objectives.

Comparing Ohio’s Lottery Taxation to Other States

In the realm of lottery winnings, the initial euphoria of hitting the jackpot is often tempered by the reality of taxation. This is particularly evident in the case of an Ohio woman who recently won a $15 million lottery prize, only to see her windfall reduced to $4.5 million after taxes. This significant reduction highlights the impact of state and federal taxes on lottery winnings, prompting a closer examination of how Ohio’s taxation policies compare to those of other states.

To begin with, it is essential to understand the basic structure of lottery taxation in the United States. Lottery winnings are subject to federal income tax, which can claim up to 37% of the prize, depending on the winner’s total income. In addition to federal taxes, state taxes further diminish the winnings. Ohio, for instance, imposes a state tax rate of 4% on lottery prizes. This combination of federal and state taxes can significantly reduce the net amount a winner takes home.

In the case of the Ohio woman, the federal tax would have claimed approximately $5.55 million of her $15 million prize, assuming she falls into the highest tax bracket. Subsequently, Ohio’s state tax would take an additional $600,000. After these deductions, the winner is left with approximately $8.85 million. However, this figure does not account for potential local taxes or other financial obligations that may further reduce the net amount.

Comparatively, Ohio’s state tax rate on lottery winnings is relatively moderate. Some states, such as California and Delaware, do not impose any state tax on lottery prizes, allowing winners to retain a larger portion of their winnings after federal taxes. Conversely, states like New York have a much higher state tax rate, with New York City residents facing a combined state and local tax rate of over 12%. This stark difference in taxation policies can lead to significant disparities in the net amount lottery winners receive across different states.

Moreover, the method of payment can also influence the final amount a winner receives. Lottery winners typically have the option to receive their prize as a lump sum or as an annuity paid over several years. Choosing a lump sum results in a larger immediate tax burden, as the entire amount is taxed in the year it is received. On the other hand, opting for an annuity spreads the tax liability over multiple years, potentially reducing the overall tax rate if the winner’s income fluctuates.

In conclusion, while winning the lottery is undoubtedly a life-changing event, the impact of taxes cannot be overlooked. The Ohio woman’s experience serves as a poignant reminder of the substantial effect that federal and state taxes can have on lottery winnings. By comparing Ohio’s taxation policies to those of other states, it becomes evident that the net amount a winner receives can vary significantly based on their location and financial decisions. As such, potential lottery winners should carefully consider the tax implications and consult with financial advisors to maximize their post-tax winnings. This understanding is crucial for making informed decisions that align with their long-term financial goals.

Financial Planning for Lottery Winners: What to Consider

Winning the lottery is often seen as a dream come true, a sudden windfall that promises financial freedom and the ability to fulfill lifelong aspirations. However, the reality of such a win is more complex, as illustrated by the recent case of an Ohio woman whose $15 million lottery win was significantly reduced to $4.5 million after taxes. This scenario underscores the importance of financial planning for lottery winners, who must navigate a myriad of financial considerations to maximize their newfound wealth.

Initially, the excitement of winning a substantial lottery prize can overshadow the practicalities that follow. The first and most immediate consideration is the impact of taxes. In the United States, lottery winnings are subject to federal income tax, which can claim up to 37% of the prize, depending on the winner’s total income. Additionally, state taxes may apply, further reducing the net amount. In Ohio, for instance, state taxes on lottery winnings can be as high as 4%, which, when combined with federal taxes, can significantly diminish the initial prize. This was precisely the case for the Ohio woman, whose $15 million win was reduced to $4.5 million after accounting for these deductions.

Beyond taxes, lottery winners must also decide between taking a lump sum payment or an annuity. The lump sum option provides immediate access to a reduced amount, typically around 60% of the total prize, while the annuity offers the full amount spread over several years. Each option has its advantages and drawbacks. A lump sum allows for immediate investment opportunities and the potential for significant growth if managed wisely. However, it also requires careful financial planning to avoid the risk of quickly depleting the funds. On the other hand, an annuity provides a steady income stream, which can be beneficial for long-term financial stability but may limit immediate financial flexibility.

Moreover, winners should consider the importance of assembling a team of financial advisors, including tax professionals, financial planners, and legal experts. This team can provide invaluable guidance on managing the windfall, ensuring compliance with tax obligations, and making informed investment decisions. For instance, a financial planner can help create a diversified investment portfolio that balances risk and return, while a tax professional can offer strategies to minimize tax liabilities.

Additionally, it is crucial for lottery winners to establish a comprehensive financial plan that aligns with their long-term goals. This plan should address debt repayment, savings, investments, and charitable contributions. By setting clear financial objectives, winners can avoid the common pitfall of overspending and ensure that their wealth is preserved for future generations.

In conclusion, while winning the lottery can be a life-changing event, it also presents a unique set of financial challenges. The case of the Ohio woman serves as a reminder of the significant impact taxes can have on lottery winnings and highlights the necessity of strategic financial planning. By understanding the tax implications, carefully considering payout options, and seeking professional advice, lottery winners can effectively manage their windfall and secure their financial future.

The Psychological Impact of Reduced Lottery Winnings

Winning the lottery is often perceived as a life-changing event, a moment when dreams transform into reality with the promise of financial freedom. However, the reality of such windfalls can be more complex, as illustrated by the recent case of an Ohio woman whose $15 million lottery win was significantly reduced to $4.5 million after taxes. This substantial reduction in expected winnings can have profound psychological effects on the winner, influencing their emotional well-being and financial decision-making.

Initially, the exhilaration of winning a large sum of money can lead to a euphoric state, where the winner envisions a future free from financial constraints. However, the subsequent realization that a significant portion of the winnings will be claimed by taxes can lead to feelings of disappointment and frustration. In the case of the Ohio woman, federal and state taxes combined to reduce her winnings by 70%, a figure that can be startling to those unprepared for such deductions. This unexpected reduction can create a sense of loss, as the winner grapples with the disparity between the anticipated and actual amounts received.

Moreover, the psychological impact of reduced lottery winnings is not limited to the initial shock. It can also affect long-term financial planning and decision-making. Winners may experience anxiety about how to best manage their reduced funds, fearing that poor financial choices could lead to squandering their once-in-a-lifetime opportunity. This anxiety can be compounded by the pressure to meet the expectations of family and friends, who may have anticipated sharing in the financial boon. The Ohio woman’s experience underscores the importance of financial literacy and planning, as winners must navigate the complexities of taxes and investments to preserve their wealth.

In addition to financial concerns, the social dynamics surrounding lottery winnings can also contribute to psychological stress. Winners may find themselves the subject of increased attention, both from acquaintances seeking financial assistance and from the media. This scrutiny can lead to feelings of isolation, as winners struggle to discern genuine relationships from those motivated by financial gain. The Ohio woman’s situation highlights the need for emotional support and guidance, as winners adjust to their new social reality.

Furthermore, the psychological impact of reduced lottery winnings can extend to the winner’s sense of identity and self-worth. The initial thrill of winning can lead to an inflated sense of self, as individuals perceive themselves as more successful or deserving. However, the subsequent reduction in winnings can challenge this perception, leading to feelings of inadequacy or self-doubt. It is crucial for winners to maintain a balanced perspective, recognizing that their worth is not solely defined by their financial status.

In conclusion, while winning the lottery can be an exhilarating experience, the reality of reduced winnings due to taxes can have significant psychological implications. The Ohio woman’s experience serves as a poignant reminder of the complexities involved in managing sudden wealth. By understanding the potential emotional and financial challenges, lottery winners can better prepare themselves to navigate this transformative experience. Ultimately, with careful planning and support, they can mitigate the psychological impact and make the most of their newfound fortune.

Q&A

1. **What was the original lottery win amount?**

$15 million.

2. **What is the total amount after taxes?**

$4.5 million.

3. **What percentage of the winnings was taken as taxes?**

Approximately 70%.

4. **What types of taxes are typically deducted from lottery winnings?**

Federal taxes, state taxes, and sometimes local taxes.

5. **What is the federal tax rate on lottery winnings?**

The federal tax rate is typically 24% for lottery winnings.

6. **Does Ohio have a state tax on lottery winnings?**

Yes, Ohio has a state tax on lottery winnings.

7. **Why do lottery winnings often result in a significantly reduced amount after taxes?**

Lottery winnings are subject to high federal and state tax rates, which can significantly reduce the net amount received.

Conclusion

The Ohio woman’s $15 million lottery win was significantly reduced to $4.5 million after taxes due to federal and state tax obligations. Initially, the lottery winnings are subject to a mandatory federal withholding tax of 24%, which immediately reduces the amount. Additionally, state taxes in Ohio further decrease the total, along with any applicable local taxes. This substantial reduction highlights the impact of tax liabilities on lottery winnings, underscoring the importance of understanding tax implications when receiving large sums of money.