“American Express: Riding High on Card Member Confidence and Q3 Profit Surge!”

Introduction

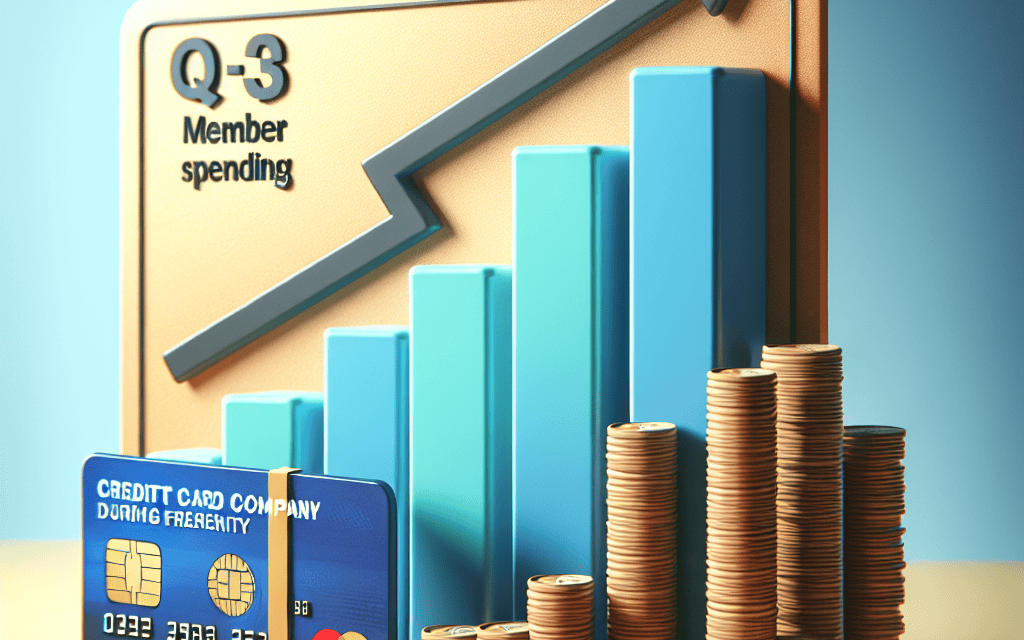

American Express reported a significant increase in its third-quarter profits, driven by robust spending among its card members. The financial services giant attributed the profit boost to a surge in consumer and business expenditures, reflecting a strong economic environment and increased confidence among its customer base. This growth was further supported by strategic investments in digital innovation and customer engagement initiatives, which enhanced user experience and loyalty. As a result, American Express continues to solidify its position as a leader in the global payments industry, demonstrating resilience and adaptability in a competitive market.

American Express Q3 Profit Surge: Key Factors Behind the Growth

American Express has reported a notable surge in its third-quarter profits, driven primarily by robust card member spending. This financial upswing underscores the company’s strategic initiatives and its ability to capitalize on consumer behavior trends. As the global economy continues to recover from the disruptions caused by the pandemic, American Express has positioned itself advantageously to benefit from increased consumer confidence and spending.

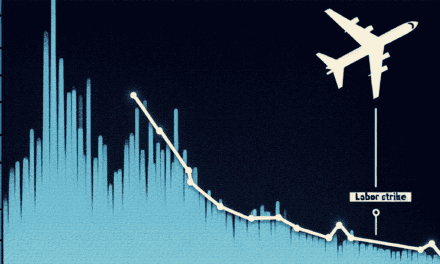

One of the key factors contributing to the profit boost is the significant rise in travel and entertainment expenditures. As restrictions have eased and vaccination rates have increased, consumers are more willing to spend on experiences they missed during the pandemic. American Express, with its strong presence in the travel and hospitality sectors, has effectively captured this pent-up demand. The company’s travel-related services have seen a substantial uptick, reflecting a broader trend of consumers prioritizing experiences over material goods.

Moreover, American Express has successfully leveraged its premium brand positioning to attract high-spending customers. The company’s focus on providing exceptional customer service and exclusive benefits has resonated well with affluent consumers, who are less sensitive to economic fluctuations. This demographic has shown a propensity to maintain or even increase their spending levels, contributing to the overall growth in card member spending. Additionally, American Express’s strategic partnerships with luxury brands and high-end retailers have further enhanced its appeal to this segment.

In addition to consumer spending, American Express’s investment in digital innovation has played a crucial role in its financial performance. The company has made significant strides in enhancing its digital platforms, making it easier for card members to manage their accounts and access rewards. This digital transformation has not only improved customer satisfaction but also increased engagement, leading to higher transaction volumes. Furthermore, American Express’s focus on data analytics has enabled it to better understand customer preferences and tailor its offerings accordingly, thereby driving loyalty and repeat business.

Another important aspect of American Express’s growth strategy is its commitment to expanding its merchant network. By increasing the number of businesses that accept American Express cards, the company has broadened its reach and provided card members with more opportunities to use their cards. This expansion has been particularly effective in attracting small and medium-sized enterprises, which are increasingly recognizing the value of accepting American Express as a payment option. The company’s efforts to reduce merchant fees have also contributed to this growth, making it more attractive for businesses to join the network.

While American Express’s third-quarter performance is impressive, it is not without challenges. The company must navigate a complex economic landscape, characterized by inflationary pressures and potential interest rate hikes. These factors could impact consumer spending patterns and, consequently, the company’s revenue streams. However, American Express’s strong financial position and strategic initiatives provide a solid foundation to address these challenges.

In conclusion, American Express’s third-quarter profit surge is a testament to its ability to adapt to changing market dynamics and capitalize on emerging opportunities. The company’s focus on enhancing customer experiences, expanding its digital capabilities, and growing its merchant network has positioned it well for continued success. As the economic recovery progresses, American Express is poised to maintain its momentum and deliver value to its shareholders and card members alike.

Analyzing Card Member Spending Trends in American Express’s Q3 Report

In the third quarter of 2023, American Express reported a notable increase in profits, driven primarily by robust card member spending. This financial upswing underscores the resilience of consumer behavior in the face of economic uncertainties and highlights the strategic initiatives undertaken by American Express to enhance customer engagement and loyalty. As the global economy continues to navigate post-pandemic challenges, the spending patterns of American Express card members offer valuable insights into broader consumer trends.

The company’s Q3 report reveals that card member spending surged across various categories, with travel and entertainment leading the charge. This resurgence in travel-related expenditures reflects a pent-up demand for experiences that were curtailed during the pandemic. As international borders reopened and travel restrictions eased, American Express cardholders demonstrated a strong appetite for leisure and business travel, contributing significantly to the company’s revenue growth. Moreover, the increase in spending on dining and entertainment further indicates a shift towards experiential consumption, as consumers prioritize activities that offer personal fulfillment and social engagement.

In addition to travel and entertainment, American Express observed a steady rise in retail spending. This trend is indicative of a broader consumer confidence in the economy, as individuals feel more secure in their financial standing and are willing to make discretionary purchases. The company’s strategic partnerships with key retailers and the introduction of targeted promotions have played a crucial role in driving this spending momentum. By leveraging data analytics and customer insights, American Express has been able to tailor its offerings to meet the evolving preferences of its card members, thereby enhancing the overall customer experience.

Furthermore, the Q3 report highlights the growing importance of digital transactions in shaping consumer behavior. With the proliferation of e-commerce platforms and the increasing adoption of contactless payments, American Express has invested significantly in digital infrastructure to support seamless and secure transactions. This investment has not only facilitated a smoother user experience but has also positioned the company to capitalize on the ongoing shift towards digital-first spending. As consumers continue to embrace online shopping and digital payment solutions, American Express is well-positioned to capture a larger share of this expanding market.

Another noteworthy aspect of the report is the emphasis on sustainability and corporate responsibility. American Express has made concerted efforts to align its business practices with environmental, social, and governance (ESG) principles, recognizing the growing importance of sustainability in consumer decision-making. Initiatives such as carbon offset programs and partnerships with eco-friendly brands have resonated with environmentally conscious card members, further driving engagement and loyalty. This focus on sustainability not only enhances the company’s brand image but also contributes to long-term value creation.

In conclusion, American Express’s Q3 profit boost is a testament to the company’s ability to adapt to changing consumer dynamics and leverage strategic initiatives to drive growth. The strong card member spending observed in this quarter reflects a broader trend of increased consumer confidence and a shift towards experiential and digital consumption. As American Express continues to innovate and align its offerings with customer preferences, it is well-positioned to maintain its competitive edge in the evolving financial landscape. The insights gleaned from this report provide a valuable lens through which to understand the current state of consumer behavior and the future trajectory of the payments industry.

How American Express’s Strategic Initiatives Drove Q3 Profit Increase

American Express has reported a notable increase in its third-quarter profits, a development largely attributed to robust card member spending. This financial upswing underscores the effectiveness of the company’s strategic initiatives aimed at enhancing customer engagement and expanding its market presence. As consumer confidence continues to rebound, American Express has adeptly positioned itself to capitalize on this trend, leveraging its brand strength and innovative offerings to drive growth.

One of the key factors contributing to the profit boost is the company’s focus on expanding its customer base through targeted marketing campaigns and partnerships. By aligning with popular brands and offering exclusive benefits, American Express has successfully attracted a diverse range of card members. This strategy not only enhances customer loyalty but also encourages increased spending, as card members are more likely to use their American Express cards to take advantage of these unique offers.

Moreover, American Express has invested significantly in digital transformation, recognizing the growing importance of technology in the financial services sector. By enhancing its digital platforms and mobile applications, the company has improved the overall customer experience, making it more convenient for card members to manage their accounts and access services. This digital push has also enabled American Express to gather valuable data insights, allowing for more personalized marketing efforts and product offerings that resonate with individual customer preferences.

In addition to these initiatives, American Express has placed a strong emphasis on expanding its global footprint. By entering new markets and strengthening its presence in existing ones, the company has tapped into a broader customer base, thereby increasing transaction volumes. This global expansion strategy is complemented by strategic partnerships with international financial institutions, which facilitate seamless cross-border transactions and enhance the brand’s appeal to global travelers.

Furthermore, American Express’s commitment to corporate social responsibility has played a role in its financial success. By prioritizing sustainability and community engagement, the company has bolstered its reputation as a socially responsible brand. This commitment resonates with consumers who are increasingly making purchasing decisions based on a company’s ethical practices. As a result, American Express has not only attracted new customers but also deepened its relationship with existing ones, fostering a sense of trust and loyalty.

The company’s focus on premium services and products has also contributed to its profit increase. By offering high-value rewards programs and exclusive experiences, American Express has positioned itself as a preferred choice for affluent consumers. This focus on premium offerings not only drives higher spending per card member but also enhances the brand’s prestige, further differentiating it from competitors in the crowded financial services market.

In conclusion, American Express’s strategic initiatives have been instrumental in driving its third-quarter profit increase. Through targeted marketing, digital transformation, global expansion, corporate social responsibility, and a focus on premium services, the company has effectively harnessed the power of consumer spending. As the economic landscape continues to evolve, American Express’s ability to adapt and innovate will be crucial in maintaining its growth trajectory and sustaining its competitive edge. The company’s success in this quarter serves as a testament to its strategic vision and operational excellence, setting a strong foundation for future growth.

The Role of Consumer Confidence in American Express’s Q3 Performance

In the third quarter of 2023, American Express reported a notable increase in profits, driven primarily by robust card member spending. This financial upswing underscores the pivotal role of consumer confidence in shaping the company’s performance. As the global economy continues to navigate post-pandemic recovery, consumer behavior has emerged as a critical determinant of financial outcomes for companies like American Express. The correlation between consumer confidence and spending patterns is particularly evident in the context of American Express’s recent financial results.

Consumer confidence, a measure of how optimistic individuals feel about the overall state of the economy and their personal financial situation, significantly influences spending behavior. When confidence is high, consumers are more likely to make discretionary purchases, travel, and invest in experiences, all of which contribute to increased transaction volumes for credit card companies. In the case of American Express, the third quarter saw a surge in spending across various categories, including travel and entertainment, which are traditionally strong sectors for the company. This uptick in spending can be attributed to a combination of factors, including a stable job market, rising wages, and a general sense of economic optimism.

Moreover, American Express has strategically positioned itself to capitalize on these favorable conditions by enhancing its value proposition to card members. The company has introduced a range of new benefits and rewards programs designed to incentivize spending and foster loyalty among its customer base. These initiatives have not only attracted new card members but have also encouraged existing ones to increase their usage, thereby driving up transaction volumes. Additionally, American Express’s focus on premium services and exclusive experiences has resonated well with consumers seeking value beyond traditional financial products.

However, it is important to recognize that consumer confidence is inherently volatile and can be influenced by a myriad of external factors. Economic indicators such as inflation rates, interest rates, and geopolitical events can swiftly alter consumer sentiment, thereby impacting spending behavior. In this regard, American Express’s ability to sustain its growth trajectory will depend on its agility in adapting to changing economic conditions and its capacity to continuously innovate its offerings to meet evolving consumer preferences.

Furthermore, the company’s strong performance in the third quarter also highlights the importance of digital transformation in enhancing customer engagement and operational efficiency. American Express has invested significantly in digital platforms and technologies to streamline transactions, improve customer service, and provide personalized experiences. These efforts have not only improved customer satisfaction but have also enabled the company to capture valuable data insights, which can be leveraged to refine marketing strategies and drive further growth.

In conclusion, the impressive profit boost reported by American Express in the third quarter of 2023 can be largely attributed to strong card member spending, underpinned by heightened consumer confidence. As the company continues to navigate the complexities of the global economic landscape, maintaining a keen focus on consumer sentiment and leveraging digital innovation will be crucial in sustaining its competitive edge. By aligning its strategic initiatives with the evolving needs and expectations of its customers, American Express is well-positioned to capitalize on future opportunities and continue its trajectory of growth.

American Express’s Q3 Financial Results: A Deep Dive into Card Member Behavior

American Express has reported a notable increase in its third-quarter profits, driven primarily by robust card member spending. This financial upswing underscores the resilience of consumer behavior in the face of economic uncertainties. As the global economy continues to navigate the complexities of post-pandemic recovery, American Express’s performance offers valuable insights into consumer confidence and spending patterns.

The company’s financial results reveal a significant boost in revenue, attributed largely to increased spending by card members across various sectors. This trend highlights a broader economic recovery, as consumers appear more willing to engage in discretionary spending. Notably, travel and entertainment sectors have seen a resurgence, with card members demonstrating a renewed appetite for experiences that were largely inaccessible during the height of the pandemic. This shift in spending behavior is indicative of a growing confidence among consumers, who are gradually returning to pre-pandemic lifestyles.

Moreover, American Express’s strategic initiatives have played a crucial role in capitalizing on this spending momentum. The company has invested in enhancing its rewards programs, offering card members greater incentives to use their cards for everyday purchases and larger expenditures alike. These efforts have not only bolstered customer loyalty but have also attracted new card members, contributing to the overall growth in transaction volumes. By aligning its offerings with evolving consumer preferences, American Express has effectively positioned itself to capture a larger share of the market.

In addition to consumer spending, American Express’s focus on digital innovation has further strengthened its financial performance. The company has made significant strides in expanding its digital capabilities, providing card members with seamless and secure payment solutions. This emphasis on technology has not only improved the customer experience but has also enhanced operational efficiency, allowing American Express to better serve its growing customer base. As digital payments continue to gain traction, the company’s commitment to innovation positions it well for sustained growth in the future.

However, it is important to consider the potential challenges that may impact American Express’s trajectory. Economic uncertainties, such as inflationary pressures and fluctuating interest rates, could influence consumer spending patterns in the coming months. Additionally, the competitive landscape in the financial services industry remains intense, with other major players vying for market share through similar strategies. To maintain its competitive edge, American Express will need to continue adapting to these dynamic conditions while staying attuned to the needs and preferences of its card members.

In conclusion, American Express’s third-quarter financial results reflect a positive trend in card member spending, driven by a combination of strategic initiatives and a recovering economy. The company’s ability to leverage consumer confidence and enhance its digital offerings has been instrumental in achieving this profit boost. As American Express navigates the evolving economic landscape, its focus on innovation and customer-centric strategies will be key to sustaining its growth momentum. While challenges remain, the company’s strong performance in the third quarter provides a solid foundation for future success, underscoring its resilience and adaptability in a rapidly changing world.

Comparing American Express’s Q3 Success with Industry Peers

In the third quarter of 2023, American Express reported a notable increase in profits, driven primarily by robust card member spending. This financial performance stands out in the competitive landscape of the credit card industry, where peers have experienced varying degrees of success. To understand the significance of American Express’s achievements, it is essential to compare its performance with that of its industry counterparts.

American Express’s Q3 results were bolstered by a strategic focus on premium card offerings and a loyal customer base that values the brand’s unique benefits. The company’s ability to attract high-spending consumers has been a key differentiator, allowing it to capitalize on increased consumer confidence and spending. This strategy has proven effective, as evidenced by the rise in transaction volumes and the subsequent boost in revenue. In contrast, some of its competitors have struggled to maintain similar growth, often due to a broader focus on a diverse range of customer segments, which can dilute brand identity and customer loyalty.

Moreover, American Express’s investment in digital innovation has played a crucial role in enhancing the customer experience, thereby driving higher engagement and spending. The seamless integration of technology into its services has not only improved transaction efficiency but also provided valuable insights into consumer behavior. This data-driven approach has enabled American Express to tailor its offerings more precisely, further strengthening its competitive edge. While other industry players have also embraced digital transformation, American Express’s targeted approach has yielded more immediate and tangible results.

Additionally, American Express’s strong performance can be attributed to its effective risk management strategies. The company has maintained a prudent approach to credit risk, ensuring that its portfolio remains resilient even in uncertain economic conditions. This cautious stance has allowed American Express to sustain profitability while minimizing potential losses. In comparison, some competitors have faced challenges related to rising delinquencies and credit losses, which have adversely impacted their financial outcomes.

Furthermore, American Express’s global presence has been a significant factor in its Q3 success. The company’s ability to leverage international markets has provided a buffer against regional economic fluctuations, allowing it to capture growth opportunities across diverse geographies. This global strategy contrasts with some peers who have a more concentrated market focus, limiting their ability to mitigate regional economic downturns.

In the broader context of the credit card industry, American Express’s Q3 performance underscores the importance of a well-defined brand strategy, technological innovation, and effective risk management. While the industry as a whole has benefited from increased consumer spending, American Express’s targeted approach has enabled it to outpace many of its competitors. As the economic landscape continues to evolve, the company’s strategic initiatives position it well for sustained growth.

In conclusion, American Express’s Q3 profit boost highlights its ability to navigate the complexities of the credit card industry successfully. By focusing on premium offerings, leveraging digital innovation, and maintaining robust risk management practices, the company has set itself apart from its peers. As the industry continues to face challenges and opportunities, American Express’s strategic direction will likely serve as a benchmark for others seeking to achieve similar success.

Future Outlook: Sustaining Growth After American Express’s Q3 Profit Boost

American Express has recently reported a notable increase in its third-quarter profits, driven primarily by robust card member spending. This financial upswing underscores the company’s resilience and adaptability in a competitive market. As the company basks in the success of its recent performance, the focus now shifts to sustaining this growth trajectory in the coming quarters. To maintain momentum, American Express must navigate a landscape characterized by evolving consumer behaviors, technological advancements, and economic uncertainties.

One of the key factors contributing to the company’s recent success is the increase in consumer spending, particularly in travel and entertainment sectors. As global travel restrictions have eased, there has been a resurgence in travel-related expenditures, which has significantly benefited American Express. The company’s strategic partnerships with airlines and hotels have further bolstered its position in this sector. However, to ensure continued growth, American Express must remain vigilant and responsive to any shifts in consumer preferences, especially as economic conditions fluctuate.

In addition to capitalizing on current spending trends, American Express is also investing in digital innovation to enhance customer experience and operational efficiency. The integration of advanced technologies such as artificial intelligence and machine learning into its services is expected to streamline processes and offer personalized solutions to card members. This technological evolution not only aims to improve customer satisfaction but also to attract a younger demographic that values digital convenience. As the financial services industry becomes increasingly digitized, American Express’s commitment to innovation will be crucial in maintaining its competitive edge.

Moreover, American Express’s focus on expanding its global footprint presents another avenue for growth. By tapping into emerging markets, the company can diversify its revenue streams and mitigate risks associated with market saturation in developed regions. However, this expansion must be approached with careful consideration of local market dynamics and regulatory environments. Establishing strong partnerships with local businesses and understanding cultural nuances will be essential for American Express to successfully penetrate these markets.

While the current economic climate presents opportunities, it also poses challenges that American Express must address to sustain its growth. Inflationary pressures and potential interest rate hikes could impact consumer spending patterns, thereby affecting the company’s revenue. Additionally, the competitive landscape of the credit card industry is intensifying, with new entrants and fintech companies offering innovative solutions that appeal to tech-savvy consumers. To counter these challenges, American Express must continue to differentiate itself through superior customer service, exclusive benefits, and a strong brand reputation.

Furthermore, American Express’s commitment to corporate social responsibility and sustainability initiatives can play a pivotal role in its future success. As consumers become more environmentally conscious, aligning business practices with sustainable values can enhance brand loyalty and attract socially responsible investors. By integrating sustainability into its core strategy, American Express can not only contribute positively to society but also strengthen its market position.

In conclusion, while American Express’s third-quarter profit boost is a testament to its strategic acumen and market adaptability, sustaining this growth requires a multifaceted approach. By leveraging technological advancements, expanding globally, and addressing economic challenges, the company can continue to thrive in an ever-evolving financial landscape. As American Express navigates these complexities, its ability to innovate and adapt will be key to maintaining its status as a leader in the credit card industry.

Q&A

1. **What was the main driver for American Express’s Q3 profit boost?**

Strong card member spending was the main driver for the profit boost.

2. **How did American Express’s revenue perform in Q3?**

Revenue increased due to higher spending by card members.

3. **What impact did travel and entertainment spending have on American Express’s Q3 results?**

Travel and entertainment spending significantly contributed to the increase in card member spending.

4. **Did American Express see an increase in new card members during Q3?**

Yes, there was an increase in new card members, contributing to the overall growth.

5. **How did American Express’s Q3 performance compare to analyst expectations?**

The performance exceeded analyst expectations due to higher-than-anticipated spending.

6. **What was the effect of the Q3 results on American Express’s stock price?**

The stock price likely saw a positive impact following the strong Q3 results.

7. **Did American Express make any changes to its financial outlook following the Q3 results?**

American Express may have adjusted its financial outlook positively based on the strong performance.

Conclusion

American Express reported a significant increase in its third-quarter profits, driven by robust spending from card members. The company’s financial performance was bolstered by a surge in consumer and business expenditures, reflecting strong economic activity and consumer confidence. This growth in spending led to higher transaction volumes and increased revenue from fees and interest, contributing to the overall profit boost. American Express’s strategic focus on expanding its customer base and enhancing its rewards programs also played a crucial role in attracting and retaining high-spending card members. As a result, the company remains well-positioned to capitalize on continued consumer spending trends, despite potential economic uncertainties.