“Procter & Gamble: Earnings Soar Amidst Sales Slump and Rising Prices”

Introduction

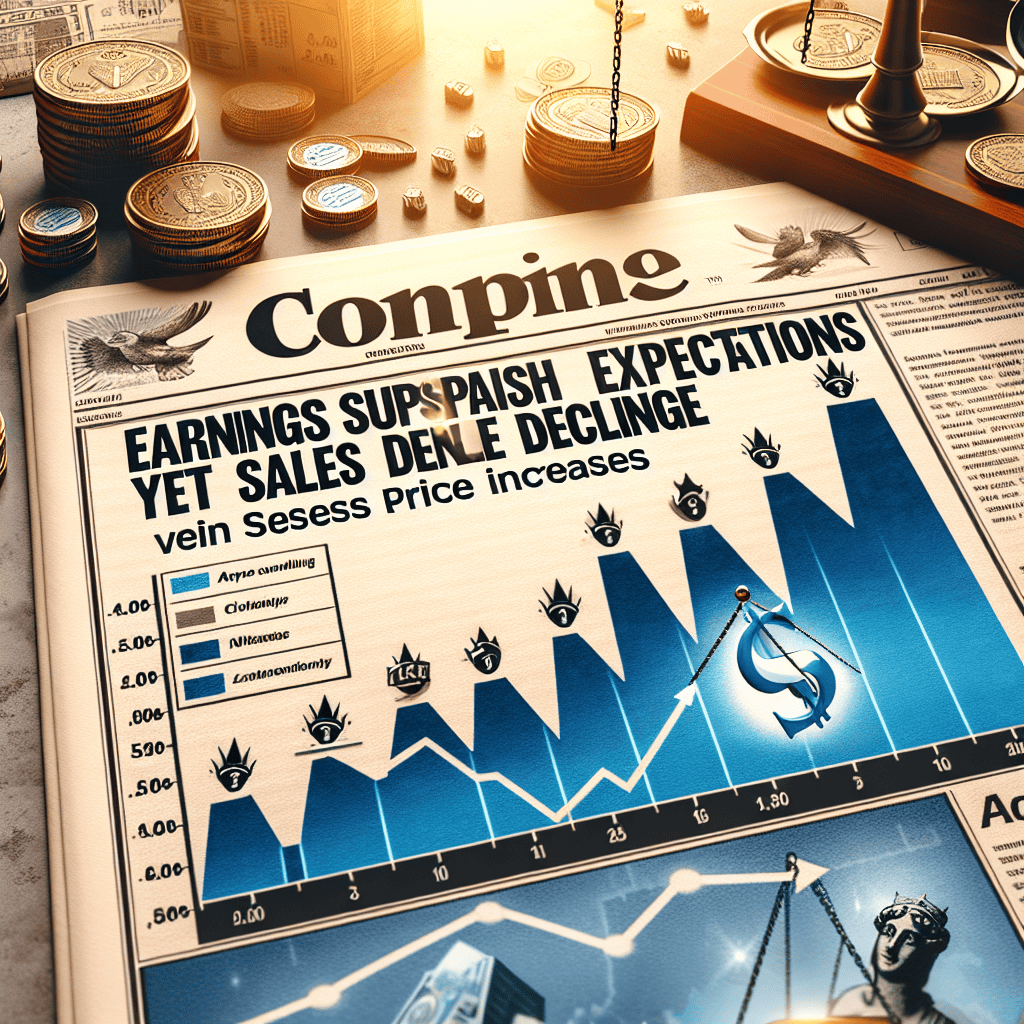

Procter & Gamble (P&G), a leading multinational consumer goods corporation, recently reported earnings that exceeded market expectations, showcasing the company’s robust financial management and operational efficiency. However, this positive earnings report was tempered by a decline in sales, highlighting a challenging market environment. Despite implementing price increases across various product lines to counterbalance rising costs and inflationary pressures, P&G faced a dip in consumer demand, reflecting broader economic uncertainties and shifting consumer behaviors. This mixed financial performance underscores the complexities P&G navigates in balancing profitability with market share retention in a competitive global landscape.

Analyzing Procter & Gamble’s Earnings Beat Amidst Sales Decline

Procter & Gamble (P&G), a global leader in consumer goods, recently reported earnings that surpassed market expectations, showcasing the company’s ability to navigate a challenging economic landscape. However, this positive financial performance was juxtaposed with a decline in sales, despite the implementation of price increases across various product lines. This duality in P&G’s financial results highlights the complex dynamics at play in the current consumer market, where inflationary pressures and shifting consumer behaviors are influencing corporate strategies and outcomes.

To begin with, P&G’s earnings beat can be attributed to several strategic initiatives that the company has undertaken to enhance operational efficiency and maintain profitability. Cost-cutting measures, supply chain optimizations, and a focus on high-margin products have collectively contributed to the company’s robust bottom line. Furthermore, P&G’s diverse portfolio, which includes well-established brands in categories such as beauty, grooming, and household care, has provided a buffer against market volatility. This diversification allows P&G to leverage strong performance in certain segments to offset weaknesses in others, thereby stabilizing overall earnings.

Despite these positive earnings, P&G faced a decline in sales volume, a trend that can be largely attributed to the company’s decision to raise prices in response to rising input costs. While price increases are a common strategy employed by companies to protect margins in inflationary environments, they can also lead to reduced consumer demand. In P&G’s case, the higher prices may have prompted some consumers to seek more affordable alternatives, thereby impacting sales volumes. This phenomenon underscores the delicate balance that companies must strike between maintaining profitability and preserving market share.

Moreover, the decline in sales volume reflects broader consumer trends that have emerged in the wake of the COVID-19 pandemic. As consumers become more price-sensitive and prioritize value, they are increasingly turning to private labels and discount brands. This shift in consumer behavior presents a challenge for established brands like P&G, which must continuously innovate and differentiate their offerings to retain customer loyalty. In response, P&G has been investing in product innovation and marketing efforts to reinforce brand value and appeal to evolving consumer preferences.

In addition to these internal factors, external economic conditions have also played a role in shaping P&G’s financial performance. Global supply chain disruptions, fluctuating commodity prices, and geopolitical tensions have created an uncertain business environment, necessitating agile and adaptive strategies. P&G’s ability to navigate these challenges and deliver strong earnings is a testament to its resilience and strategic foresight.

Looking ahead, P&G faces the task of sustaining its earnings momentum while addressing the decline in sales volume. This will likely involve a combination of strategic pricing, continued investment in innovation, and efforts to enhance customer engagement. By focusing on these areas, P&G can position itself to capitalize on emerging opportunities and mitigate potential risks.

In conclusion, Procter & Gamble’s recent earnings report highlights the company’s adeptness at managing profitability amidst a decline in sales. While the earnings beat is a positive indicator of P&G’s operational strength, the sales decline serves as a reminder of the challenges posed by price increases and shifting consumer behaviors. As P&G navigates this complex landscape, its ability to adapt and innovate will be crucial in maintaining its leadership position in the consumer goods industry.

The Impact of Price Increases on Procter & Gamble’s Sales Performance

Procter & Gamble, a leading multinational consumer goods corporation, recently reported earnings that exceeded market expectations, despite a noticeable decline in sales. This intriguing financial outcome has sparked discussions about the impact of price increases on consumer behavior and overall sales performance. As the company navigates the complexities of a fluctuating global economy, it becomes essential to understand the dynamics at play.

In recent quarters, Procter & Gamble has implemented a series of price increases across its diverse product portfolio. These adjustments were primarily driven by rising costs of raw materials, transportation, and labor, which have been exacerbated by global supply chain disruptions. By passing these costs onto consumers, the company aimed to protect its profit margins and maintain financial stability. However, this strategy has had mixed results, as evidenced by the latest earnings report.

While the company’s earnings surpassed expectations, indicating effective cost management and operational efficiency, the decline in sales volume suggests a more nuanced consumer response to price hikes. It appears that while some consumers are willing to absorb higher prices for essential goods, others are opting for more affordable alternatives or reducing their overall consumption. This shift in consumer behavior highlights the delicate balance companies must strike between maintaining profitability and ensuring customer retention.

Moreover, the decline in sales volume raises questions about brand loyalty and the elasticity of demand for Procter & Gamble’s products. As prices rise, consumers may reassess their purchasing decisions, leading to increased competition from private labels and other cost-effective brands. This scenario underscores the importance of brand differentiation and value proposition in retaining market share amidst price-sensitive consumers.

Transitioning to a broader perspective, Procter & Gamble’s experience reflects a common challenge faced by many companies in today’s economic climate. Inflationary pressures and supply chain constraints are compelling businesses to reevaluate their pricing strategies. While price increases can bolster short-term financial performance, they also risk alienating consumers and eroding brand loyalty over time. Therefore, companies must carefully consider the long-term implications of their pricing decisions and explore alternative strategies to mitigate cost pressures.

In light of these challenges, Procter & Gamble may need to explore innovative approaches to sustain its market position. Investing in research and development to enhance product quality and differentiation could help justify higher prices and reinforce brand loyalty. Additionally, leveraging digital platforms and data analytics to gain insights into consumer preferences and behavior can enable more targeted marketing strategies and personalized customer experiences.

Furthermore, enhancing supply chain resilience and operational efficiency can help mitigate the impact of rising costs, reducing the need for frequent price adjustments. By optimizing production processes and exploring sustainable sourcing options, Procter & Gamble can better manage cost fluctuations and maintain competitive pricing.

In conclusion, Procter & Gamble’s recent earnings report underscores the complex interplay between price increases and sales performance. While the company has successfully navigated cost pressures to exceed earnings expectations, the decline in sales volume highlights the challenges of balancing profitability with consumer retention. As the company moves forward, it must continue to adapt its strategies to address evolving consumer preferences and market dynamics. By focusing on innovation, brand differentiation, and operational efficiency, Procter & Gamble can position itself for sustained success in an increasingly competitive landscape.

Understanding Procter & Gamble’s Financial Strategy in a Challenging Market

Procter & Gamble (P&G), a global leader in consumer goods, recently reported earnings that exceeded market expectations, even as the company faced a decline in sales. This intriguing financial outcome highlights the complex dynamics at play within the company’s strategic approach to navigating a challenging market environment. As the company grapples with fluctuating consumer demand and economic pressures, understanding the underlying factors contributing to its financial performance becomes essential.

To begin with, P&G’s ability to surpass earnings expectations can be attributed to its strategic focus on cost management and operational efficiency. By streamlining its supply chain and optimizing production processes, the company has managed to reduce operational costs significantly. This focus on efficiency has allowed P&G to maintain healthy profit margins despite the pressures of a competitive market. Furthermore, the company has been proactive in leveraging technology and data analytics to enhance decision-making processes, thereby improving overall productivity and profitability.

In addition to cost management, P&G has implemented a series of price increases across its product portfolio. These price adjustments have been a critical component of the company’s strategy to offset rising input costs, including raw materials and transportation expenses. While these price hikes have contributed to improved earnings, they have also led to a decline in sales volume. Consumers, facing their own financial constraints, have become more price-sensitive, leading to a reduction in demand for some of P&G’s products. This shift in consumer behavior underscores the delicate balance that companies must strike between maintaining profitability and sustaining sales growth.

Moreover, P&G’s diverse product range has played a pivotal role in its financial resilience. The company’s extensive portfolio, which includes well-known brands such as Tide, Pampers, and Gillette, allows it to cater to a broad spectrum of consumer needs and preferences. This diversity not only mitigates the impact of declining sales in specific categories but also provides opportunities for growth in emerging markets. By capitalizing on its strong brand equity and expanding its presence in regions with growing consumer bases, P&G is well-positioned to capture new market opportunities and drive future growth.

Despite these strategic efforts, the broader economic landscape presents ongoing challenges for P&G. Inflationary pressures, supply chain disruptions, and geopolitical uncertainties continue to impact the global market, creating an environment of volatility and unpredictability. In response, P&G has been actively investing in innovation and sustainability initiatives to enhance its competitive edge. By prioritizing research and development, the company aims to introduce new products that meet evolving consumer demands and preferences, thereby fostering long-term growth and stability.

In conclusion, Procter & Gamble’s recent financial performance reflects a nuanced interplay of strategic initiatives aimed at navigating a complex market environment. While the company has successfully managed to exceed earnings expectations through cost management and price adjustments, the decline in sales highlights the challenges of balancing profitability with consumer demand. As P&G continues to adapt to the evolving economic landscape, its focus on innovation, sustainability, and market expansion will be crucial in sustaining its competitive advantage. Ultimately, the company’s ability to remain agile and responsive to market dynamics will determine its success in achieving sustained growth and profitability in the years to come.

How Procter & Gamble’s Earnings Surpassed Expectations Despite Sales Challenges

Procter & Gamble (P&G), a global leader in consumer goods, recently reported earnings that exceeded market expectations, even as the company faced a decline in sales. This intriguing financial performance can be attributed to a combination of strategic pricing adjustments and cost management initiatives. As the company navigates a challenging economic landscape, understanding the factors that contributed to its earnings success provides valuable insights into its operational strategies and market positioning.

To begin with, P&G’s ability to surpass earnings expectations is largely due to its strategic decision to implement price increases across its product portfolio. In response to rising input costs and inflationary pressures, the company adjusted its pricing strategy to maintain profit margins. This move, while potentially risky in terms of consumer demand, proved effective in bolstering the company’s bottom line. By carefully analyzing market conditions and consumer behavior, P&G was able to implement price hikes without significantly eroding its customer base. Consequently, the increased revenue per unit offset the decline in overall sales volume, allowing the company to report stronger-than-anticipated earnings.

Moreover, P&G’s focus on cost management played a crucial role in its financial performance. The company has been actively pursuing efficiency improvements and cost-saving measures across its operations. By optimizing its supply chain, streamlining production processes, and leveraging economies of scale, P&G has managed to reduce operational expenses. These efforts have not only helped mitigate the impact of declining sales but also contributed to the company’s ability to deliver robust earnings. Furthermore, P&G’s commitment to innovation and product differentiation has enabled it to maintain a competitive edge in the market. By investing in research and development, the company continues to introduce new and improved products that resonate with consumers. This focus on innovation has allowed P&G to command premium pricing for its offerings, further supporting its earnings growth.

In addition to these internal strategies, P&G’s global presence has provided a buffer against regional economic fluctuations. The company’s diversified portfolio and extensive geographic reach have allowed it to capitalize on growth opportunities in emerging markets, even as mature markets face stagnation. This geographic diversification has been instrumental in offsetting sales declines in certain regions, thereby contributing to the overall stability of P&G’s financial performance.

However, it is important to acknowledge the challenges that P&G faces in the current economic environment. The decline in sales volume highlights the potential risks associated with price increases, particularly in a competitive market where consumers have numerous alternatives. As inflationary pressures persist and consumer spending patterns evolve, P&G must continue to balance pricing strategies with consumer demand to sustain its earnings momentum.

Looking ahead, P&G’s ability to navigate these challenges will be critical to its long-term success. The company must remain agile and responsive to changing market dynamics, while continuing to invest in innovation and operational efficiency. By doing so, P&G can maintain its position as a leader in the consumer goods industry and continue to deliver value to its shareholders.

In conclusion, Procter & Gamble’s recent earnings performance underscores the effectiveness of its strategic pricing and cost management initiatives. Despite facing sales challenges, the company’s ability to adapt to economic conditions and leverage its global presence has enabled it to surpass earnings expectations. As P&G moves forward, its focus on innovation, efficiency, and market responsiveness will be key to sustaining its financial success in an ever-evolving landscape.

The Role of Cost Management in Procter & Gamble’s Recent Earnings Success

Procter & Gamble’s recent earnings report has captured the attention of investors and analysts alike, as the company managed to surpass earnings expectations despite facing a decline in sales. This intriguing financial performance can be largely attributed to the company’s adept cost management strategies, which have played a pivotal role in bolstering its bottom line. As the global economic landscape continues to present challenges, Procter & Gamble’s approach offers valuable insights into how effective cost management can offset adverse market conditions.

To begin with, Procter & Gamble has demonstrated a keen ability to navigate the complexities of a fluctuating market by implementing strategic cost-cutting measures. These measures have been instrumental in maintaining profitability, even as sales volumes have experienced a downturn. By focusing on streamlining operations and optimizing supply chain efficiencies, the company has been able to reduce overhead costs significantly. This focus on operational efficiency has allowed Procter & Gamble to maintain a competitive edge, ensuring that its products remain accessible to consumers despite rising production costs.

Moreover, Procter & Gamble’s commitment to innovation has further enhanced its cost management capabilities. The company has invested in advanced technologies and automation processes that have not only improved production efficiency but also reduced waste. These technological advancements have enabled Procter & Gamble to produce high-quality products at a lower cost, thereby mitigating the impact of declining sales on overall profitability. Additionally, the company’s emphasis on sustainability has led to the adoption of eco-friendly practices that have resulted in cost savings, further contributing to its financial success.

In addition to operational efficiencies, Procter & Gamble has also employed strategic pricing strategies to navigate the current economic environment. While the company has implemented price increases across various product lines, it has done so in a manner that minimizes the impact on consumer demand. By carefully analyzing market trends and consumer behavior, Procter & Gamble has been able to adjust its pricing strategies to ensure that its products remain attractive to consumers. This delicate balance between price adjustments and consumer retention has been crucial in maintaining revenue streams, even as sales volumes have declined.

Furthermore, Procter & Gamble’s robust portfolio diversification has played a significant role in its earnings success. By offering a wide range of products across different categories, the company has been able to mitigate the risks associated with declining sales in specific segments. This diversification strategy has allowed Procter & Gamble to capitalize on growth opportunities in emerging markets and adapt to changing consumer preferences. As a result, the company has been able to sustain its financial performance despite the challenges posed by a volatile market environment.

In conclusion, Procter & Gamble’s recent earnings success, despite a decline in sales, underscores the importance of effective cost management in navigating economic uncertainties. Through strategic cost-cutting measures, innovative technologies, and prudent pricing strategies, the company has demonstrated its ability to maintain profitability in the face of adversity. As the global economy continues to evolve, Procter & Gamble’s approach serves as a testament to the power of cost management in achieving financial resilience. By prioritizing operational efficiency and portfolio diversification, the company has positioned itself to thrive in an ever-changing market landscape, offering valuable lessons for businesses seeking to enhance their financial performance amidst challenging conditions.

Procter & Gamble’s Market Position: Navigating Earnings and Sales Dynamics

Procter & Gamble (P&G), a global leader in consumer goods, recently reported earnings that exceeded market expectations, showcasing the company’s robust financial management and strategic prowess. However, this positive earnings report was juxtaposed with a decline in sales, a development that has raised questions about the company’s market position and future strategies. The duality of these financial results highlights the complex dynamics P&G faces as it navigates an evolving economic landscape.

To begin with, P&G’s ability to surpass earnings expectations can be attributed to several key factors. The company has implemented a series of cost-cutting measures and operational efficiencies that have bolstered its bottom line. Additionally, P&G has strategically increased prices across its product lines, a move that has helped offset rising production costs and inflationary pressures. These price hikes have been carefully calibrated to maintain profitability without significantly eroding consumer demand. As a result, P&G has managed to deliver strong earnings, reflecting its adeptness at balancing cost management with revenue generation.

Despite these earnings achievements, P&G has experienced a decline in sales volume, a trend that underscores the challenges of sustaining growth in a competitive market. The decrease in sales can be partly attributed to the price increases, which, while beneficial for earnings, have led to some consumer pushback. In an environment where consumers are increasingly price-sensitive, P&G’s higher prices may have prompted some customers to seek more affordable alternatives. This shift in consumer behavior highlights the delicate balance P&G must strike between maintaining profitability and ensuring its products remain accessible to a broad customer base.

Moreover, the sales decline also reflects broader market trends and economic conditions. The consumer goods sector is facing headwinds from supply chain disruptions, fluctuating raw material costs, and changing consumer preferences. These factors have created a challenging environment for companies like P&G, which must continuously adapt to maintain their market position. In response, P&G has been investing in innovation and product development, aiming to differentiate its offerings and capture new market segments. By focusing on product quality and sustainability, P&G seeks to enhance its brand appeal and drive long-term growth.

In addition to these strategic initiatives, P&G is also leveraging digital transformation to strengthen its market position. The company is increasingly utilizing data analytics and digital marketing to better understand consumer needs and tailor its offerings accordingly. This digital focus not only enhances P&G’s ability to engage with consumers but also provides valuable insights that inform product development and marketing strategies. As the digital landscape continues to evolve, P&G’s commitment to innovation and technology positions it well to navigate future challenges and opportunities.

In conclusion, Procter & Gamble’s recent financial performance underscores the complexities of managing earnings and sales dynamics in a rapidly changing market. While the company has successfully exceeded earnings expectations through strategic price increases and cost management, the accompanying decline in sales highlights the challenges of maintaining growth amid economic uncertainties. By focusing on innovation, digital transformation, and consumer engagement, P&G is well-positioned to address these challenges and sustain its market leadership. As the company continues to adapt to the evolving landscape, its ability to balance profitability with consumer accessibility will be crucial in shaping its future success.

Future Outlook: Procter & Gamble’s Strategy to Address Sales Decline

Procter & Gamble (P&G), a global leader in consumer goods, recently reported earnings that exceeded market expectations, even as the company faced a decline in sales. This paradoxical situation has prompted analysts and stakeholders to scrutinize the company’s strategic approach to navigating the current economic landscape. Despite implementing price increases across various product lines, P&G has experienced a dip in sales volume, a trend that raises questions about consumer behavior and market dynamics. As the company looks to the future, it is essential to understand the strategies P&G plans to employ to address these challenges and sustain its market position.

To begin with, P&G’s ability to surpass earnings expectations can be attributed to its strategic pricing decisions, which have helped offset the impact of rising production costs and inflationary pressures. By carefully adjusting prices, P&G has managed to maintain its profit margins, demonstrating a keen understanding of its cost structure and market positioning. However, the decline in sales volume suggests that consumers are becoming more price-sensitive, potentially opting for more affordable alternatives or reducing their overall consumption. This shift in consumer behavior necessitates a reevaluation of P&G’s pricing strategy to ensure it remains competitive while still achieving its financial objectives.

In response to these challenges, P&G is likely to focus on enhancing its value proposition to consumers. This could involve investing in product innovation and differentiation, ensuring that its offerings stand out in a crowded marketplace. By introducing new products or improving existing ones, P&G can create a compelling reason for consumers to choose its brands over competitors, even at higher price points. Additionally, the company may explore opportunities to expand its presence in emerging markets, where there is potential for growth despite economic uncertainties. By tapping into these markets, P&G can diversify its revenue streams and reduce its reliance on more saturated markets.

Moreover, P&G’s commitment to sustainability and corporate responsibility could play a crucial role in its future strategy. As consumers increasingly prioritize environmentally friendly and socially responsible products, P&G has the opportunity to align its business practices with these values. By integrating sustainability into its core operations and product offerings, the company can strengthen its brand reputation and appeal to a broader audience. This approach not only addresses consumer demand but also positions P&G as a leader in sustainable business practices, potentially opening up new avenues for growth.

Furthermore, P&G’s digital transformation initiatives are expected to be a key component of its strategy to address the sales decline. By leveraging data analytics and digital marketing, the company can gain deeper insights into consumer preferences and tailor its offerings accordingly. This data-driven approach allows P&G to optimize its marketing efforts, ensuring that it reaches the right audience with the right message at the right time. Additionally, enhancing its e-commerce capabilities can help P&G capture a larger share of the growing online market, providing a convenient shopping experience for consumers and driving sales growth.

In conclusion, while Procter & Gamble faces the challenge of declining sales despite price increases, the company’s strategic focus on innovation, sustainability, and digital transformation offers a promising path forward. By adapting to changing consumer preferences and market conditions, P&G can continue to thrive in an increasingly competitive landscape. As the company implements these strategies, it will be crucial to monitor their effectiveness and make necessary adjustments to ensure long-term success. Through a combination of strategic foresight and operational excellence, P&G is well-positioned to address its current challenges and capitalize on future opportunities.

Q&A

1. **What were Procter & Gamble’s earnings results?**

Procter & Gamble’s earnings surpassed expectations, indicating strong profitability.

2. **How did Procter & Gamble’s sales perform?**

Sales declined despite the company implementing price increases.

3. **What was the reason for the sales decline?**

The sales decline was attributed to reduced consumer demand, possibly due to higher prices.

4. **How did price increases affect Procter & Gamble’s financial performance?**

Price increases helped boost earnings but were not enough to prevent a decline in sales volume.

5. **What sectors or products were most affected by the sales decline?**

Specific sectors or products were not detailed, but typically, consumer staples like household and personal care products could be impacted.

6. **How did the market react to Procter & Gamble’s earnings report?**

The market reaction would depend on investor sentiment, but generally, surpassing earnings expectations could lead to a positive response despite sales declines.

7. **What strategies might Procter & Gamble consider to address the sales decline?**

Procter & Gamble might consider strategies such as promotional offers, product innovation, or cost management to stimulate sales and maintain profitability.

Conclusion

Procter & Gamble’s recent earnings report reveals a complex financial landscape where the company has managed to surpass earnings expectations, primarily driven by cost management and operational efficiencies. However, this positive outcome is juxtaposed with a decline in sales volume, indicating that despite implementing price increases, consumer demand has softened. This suggests that while the company is effectively managing its profitability, it faces challenges in maintaining or growing its market share in a competitive environment where consumers may be sensitive to price changes. The situation underscores the need for Procter & Gamble to balance pricing strategies with efforts to stimulate demand and enhance customer loyalty to sustain long-term growth.