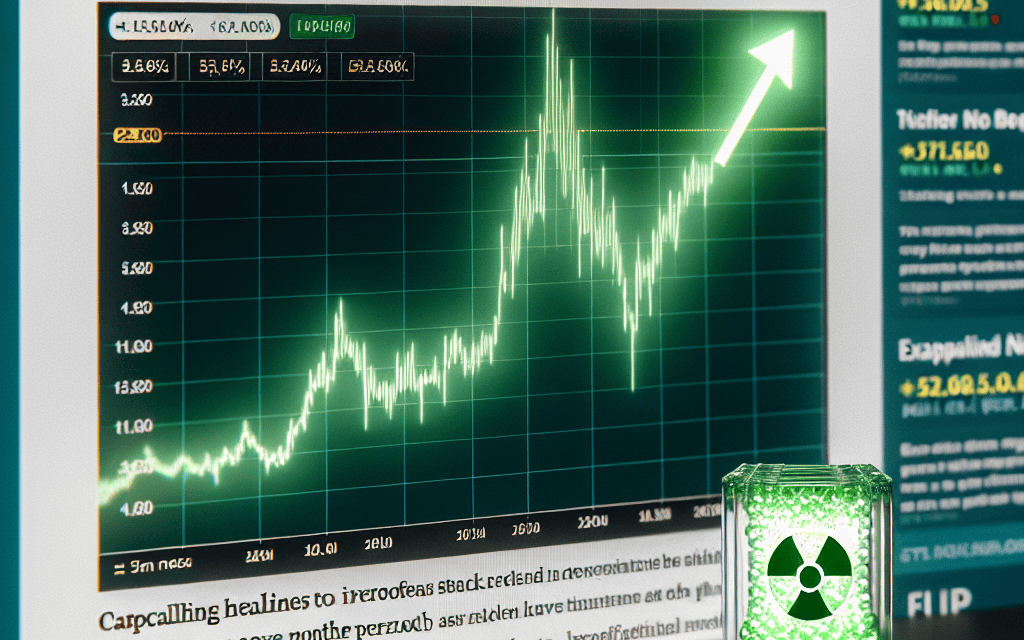

“Sam Altman’s Nuclear Bet: Powering Profits with a 150% Surge!”

Introduction

In a remarkable financial surge, a nuclear power stock backed by tech entrepreneur Sam Altman has experienced a dramatic 150% increase in value over the past month. This unprecedented growth highlights the burgeoning interest and investment in nuclear energy as a viable solution to global energy challenges. Altman, known for his influential role in the tech industry, has turned his focus towards sustainable energy solutions, and his endorsement has significantly boosted investor confidence. The stock’s meteoric rise reflects a broader trend of increasing recognition of nuclear power’s potential to provide clean, reliable energy in the face of climate change and growing energy demands.

Impact Of Sam Altman’s Investment On Nuclear Power Stocks

The recent surge in the stock price of a nuclear power company, backed by prominent tech entrepreneur Sam Altman, has captured the attention of investors and industry analysts alike. Over the past month, the stock has skyrocketed by an impressive 150%, reflecting a growing interest in nuclear energy as a viable solution to the world’s energy challenges. This remarkable increase can be attributed to several factors, including Altman’s influential backing, the evolving perception of nuclear power, and the broader market dynamics at play.

Sam Altman, known for his leadership roles in technology and venture capital, has a reputation for identifying and supporting transformative technologies. His investment in the nuclear power sector signals a significant endorsement, suggesting that nuclear energy could play a crucial role in the transition to sustainable energy sources. Altman’s involvement has undoubtedly contributed to the heightened investor confidence, as his track record of successful ventures lends credibility to the potential of nuclear power.

Moreover, the perception of nuclear energy is undergoing a transformation. Traditionally viewed with skepticism due to safety concerns and high costs, nuclear power is now being reconsidered as a clean and reliable energy source. As the world grapples with the urgent need to reduce carbon emissions and combat climate change, nuclear energy offers a compelling alternative to fossil fuels. It provides a consistent and large-scale power supply without the intermittent issues associated with renewable sources like wind and solar. This shift in perception is further bolstered by advancements in nuclear technology, which promise safer and more efficient reactors.

In addition to Altman’s backing and the changing perception of nuclear energy, broader market dynamics have also played a role in the stock’s meteoric rise. The global energy crisis, exacerbated by geopolitical tensions and supply chain disruptions, has underscored the need for energy diversification. As countries seek to secure their energy futures, nuclear power is increasingly being considered a strategic asset. This has led to increased government support and investment in nuclear infrastructure, further boosting investor confidence.

Furthermore, the financial markets have been particularly volatile, with investors seeking refuge in sectors perceived as resilient to economic fluctuations. Nuclear power, with its potential for long-term growth and stability, has emerged as an attractive option. The combination of these factors has created a perfect storm, propelling the stock to new heights.

However, it is important to note that while the recent surge is promising, the nuclear power sector still faces significant challenges. Regulatory hurdles, public perception, and the high initial costs of nuclear projects remain obstacles that must be addressed. Nevertheless, the involvement of influential figures like Sam Altman and the growing recognition of nuclear energy’s potential are positive indicators for the industry’s future.

In conclusion, the 150% increase in the stock price of a nuclear power company backed by Sam Altman highlights the impact of his investment and the evolving landscape of nuclear energy. As the world seeks sustainable solutions to its energy needs, nuclear power is gaining traction as a viable option. While challenges remain, the recent surge in stock price reflects a broader shift in perception and market dynamics, suggesting a promising future for the nuclear power sector.

Analyzing The 150% Surge In Nuclear Power Stocks

The recent surge in nuclear power stocks, particularly those backed by prominent figures such as Sam Altman, has captured the attention of investors and analysts alike. Over the past month, these stocks have experienced an impressive 150% increase, prompting a closer examination of the factors contributing to this remarkable growth. As we delve into the dynamics behind this surge, it is essential to consider the broader context of the energy sector, the role of influential backers, and the evolving perception of nuclear power as a viable energy source.

To begin with, the global energy landscape is undergoing a significant transformation, driven by the urgent need to transition to cleaner and more sustainable energy sources. Amidst growing concerns about climate change and the environmental impact of fossil fuels, nuclear power is increasingly being viewed as a critical component of the energy mix. Unlike traditional fossil fuels, nuclear energy offers a low-carbon alternative that can provide a stable and reliable power supply. This shift in perception has been instrumental in driving investor interest in nuclear power stocks, as stakeholders recognize the potential for long-term growth in this sector.

Moreover, the involvement of high-profile investors such as Sam Altman has further fueled the surge in nuclear power stocks. Altman, known for his successful ventures in technology and innovation, brings a level of credibility and confidence to the companies he supports. His backing is often seen as a vote of confidence in the potential of nuclear energy to address some of the world’s most pressing energy challenges. Consequently, Altman’s endorsement has attracted a wave of investment, propelling stock prices to new heights.

In addition to the influence of key investors, advancements in nuclear technology have also played a crucial role in the recent stock surge. Innovations in reactor design, safety measures, and waste management have addressed many of the historical concerns associated with nuclear power. These technological advancements have not only improved the safety and efficiency of nuclear plants but have also reduced costs, making nuclear energy more competitive with other renewable sources. As a result, companies at the forefront of these innovations are experiencing increased investor interest, contributing to the overall rise in stock prices.

Furthermore, government policies and regulatory frameworks are increasingly supportive of nuclear energy development. Many countries are revisiting their energy strategies, recognizing the need for a diverse energy portfolio that includes nuclear power. This policy shift is reflected in increased funding for nuclear research and development, as well as streamlined regulatory processes for new projects. Such favorable policy environments create a conducive atmosphere for growth in the nuclear sector, further boosting investor confidence.

While the recent surge in nuclear power stocks is undoubtedly impressive, it is important to approach this growth with a degree of caution. The energy sector is inherently volatile, and external factors such as geopolitical tensions, regulatory changes, and technological disruptions can significantly impact stock performance. Therefore, investors should remain vigilant and consider the long-term prospects of nuclear energy within the broader context of the global energy transition.

In conclusion, the 150% increase in nuclear power stocks backed by figures like Sam Altman can be attributed to a confluence of factors, including the growing recognition of nuclear energy’s role in a sustainable future, the influence of high-profile investors, technological advancements, and supportive government policies. As the world continues to grapple with the challenges of climate change and energy security, nuclear power is poised to play an increasingly important role, making it a compelling area for investment and innovation.

The Future Of Nuclear Energy Investments

In recent weeks, the nuclear power sector has witnessed a remarkable surge in investor interest, particularly following the news that a nuclear power stock, backed by prominent tech entrepreneur Sam Altman, has skyrocketed by 150% in just one month. This unprecedented growth has sparked discussions about the future of nuclear energy investments and the potential for this sector to play a pivotal role in the global energy landscape. As the world grapples with the urgent need to transition to cleaner energy sources, nuclear power is increasingly being viewed as a viable solution to meet rising energy demands while reducing carbon emissions.

The involvement of Sam Altman, a well-known figure in the technology and investment community, has undoubtedly contributed to the heightened attention on this particular nuclear power stock. Altman’s endorsement is seen as a vote of confidence in the potential of nuclear energy to drive innovation and sustainability. His backing has not only attracted investors but also brought renewed focus to the advancements in nuclear technology that promise to address some of the longstanding concerns associated with traditional nuclear power.

One of the key factors driving the renewed interest in nuclear energy is the development of advanced nuclear reactors, such as small modular reactors (SMRs) and next-generation reactors. These technologies offer significant improvements in safety, efficiency, and waste management compared to conventional nuclear reactors. SMRs, for instance, are designed to be more flexible and scalable, allowing for easier integration into existing energy grids. Moreover, they have a smaller physical footprint and can be deployed in remote locations, making them an attractive option for countries with limited infrastructure.

In addition to technological advancements, the growing emphasis on decarbonization and energy security is propelling the nuclear energy sector forward. As countries strive to meet their climate goals and reduce reliance on fossil fuels, nuclear power presents a reliable and low-carbon alternative. Unlike intermittent renewable sources such as wind and solar, nuclear power provides a stable and continuous supply of electricity, which is crucial for maintaining grid stability and meeting base-load energy demands.

Furthermore, the geopolitical landscape is also influencing the dynamics of nuclear energy investments. With concerns over energy independence and the volatility of fossil fuel markets, many nations are reevaluating their energy strategies. Nuclear power, with its potential to provide a steady and domestically sourced energy supply, is gaining traction as a strategic asset. This shift is evident in the increasing number of countries that are revisiting their nuclear energy policies and exploring new projects.

However, despite the promising outlook, challenges remain in the widespread adoption of nuclear energy. Public perception and regulatory hurdles continue to pose significant obstacles. The legacy of past nuclear accidents has left a lasting impact on public opinion, necessitating robust safety measures and transparent communication to build trust. Additionally, the high initial costs and long development timelines associated with nuclear projects require substantial financial commitments and policy support.

In conclusion, the recent surge in the nuclear power stock backed by Sam Altman underscores the growing interest and potential of nuclear energy investments. As technological innovations and global energy priorities align, nuclear power is poised to play a crucial role in the transition to a sustainable energy future. While challenges persist, the combination of advanced reactor designs, a focus on decarbonization, and shifting geopolitical considerations presents a compelling case for the continued exploration and investment in nuclear energy. As the world seeks to balance energy needs with environmental responsibilities, nuclear power stands as a promising contender in the quest for a cleaner and more secure energy landscape.

Sam Altman’s Influence On The Energy Sector

Sam Altman, a prominent figure in the technology and investment sectors, has recently made waves in the energy industry, particularly in nuclear power. Known for his role as the CEO of OpenAI and his involvement in various successful ventures, Altman’s influence extends beyond the realms of artificial intelligence and into the critical domain of sustainable energy. His backing of a nuclear power company has resulted in a remarkable 150% increase in the company’s stock value within just one month, underscoring his significant impact on the energy sector.

Altman’s investment in nuclear power is not merely a financial maneuver but a strategic endorsement of nuclear energy as a viable solution to the world’s growing energy demands and climate change challenges. As the global community grapples with the urgent need to transition to cleaner energy sources, nuclear power presents a compelling option due to its ability to generate large amounts of electricity with minimal carbon emissions. Altman’s support for this sector highlights his commitment to fostering innovation and sustainability, aligning with broader efforts to combat climate change.

The nuclear power company in question, which has seen its stock skyrocket, is at the forefront of developing advanced nuclear technologies. These innovations aim to address some of the traditional concerns associated with nuclear energy, such as safety, waste management, and high costs. By investing in cutting-edge research and development, the company seeks to make nuclear power more accessible and acceptable to the public and policymakers alike. Altman’s involvement has not only provided the company with financial resources but also increased its visibility and credibility in the competitive energy market.

Moreover, Altman’s influence extends beyond mere financial backing. His reputation as a visionary leader and his extensive network within the technology and investment communities have attracted additional interest and investment in the nuclear power sector. This influx of attention and capital is crucial for driving the development of next-generation nuclear technologies, which promise to be safer, more efficient, and more sustainable than their predecessors. As a result, Altman’s endorsement has catalyzed a broader movement towards embracing nuclear power as a key component of the global energy transition.

In addition to the immediate financial impact on the company’s stock, Altman’s involvement has sparked a renewed dialogue about the role of nuclear energy in achieving a sustainable future. Policymakers, industry leaders, and environmental advocates are increasingly recognizing the potential of nuclear power to complement renewable energy sources such as wind and solar. By providing a stable and reliable energy supply, nuclear power can help bridge the gap between intermittent renewable generation and consistent energy demand, thereby enhancing the resilience of the energy grid.

In conclusion, Sam Altman’s backing of a nuclear power company has not only resulted in a dramatic increase in the company’s stock value but has also reinvigorated interest in nuclear energy as a critical component of the global energy landscape. His influence in the energy sector underscores the importance of visionary leadership and strategic investment in driving innovation and sustainability. As the world continues to seek solutions to its energy and environmental challenges, Altman’s involvement in nuclear power serves as a powerful reminder of the potential for technology and investment to shape a cleaner, more sustainable future.

Market Reactions To Nuclear Power Stock Growth

The recent surge in the stock price of a nuclear power company, backed by prominent tech entrepreneur Sam Altman, has captured the attention of investors and market analysts alike. Over the past month, the stock has skyrocketed by an impressive 150%, prompting discussions about the factors driving this remarkable growth and the broader implications for the nuclear power industry. As investors scramble to understand the dynamics at play, several key elements have emerged as pivotal in shaping market reactions.

To begin with, the endorsement by Sam Altman, a well-respected figure in the technology and investment sectors, has undoubtedly played a significant role in boosting investor confidence. Altman’s involvement is perceived as a strong vote of confidence in the company’s potential, given his track record of successful investments and his reputation for identifying transformative technologies. This endorsement has not only attracted attention from individual investors but has also piqued the interest of institutional investors seeking to capitalize on emerging opportunities in the energy sector.

Moreover, the growing global emphasis on clean energy solutions has created a favorable environment for nuclear power companies. As countries strive to meet ambitious carbon reduction targets, nuclear energy is increasingly being recognized as a viable and necessary component of a sustainable energy mix. This shift in perception has led to renewed interest in nuclear power as a reliable and low-carbon energy source, further fueling investor enthusiasm for companies operating in this space.

In addition to these broader trends, the specific advancements and innovations within the company itself have contributed to its stock price surge. Reports suggest that the company has made significant strides in developing next-generation nuclear technologies, which promise to enhance safety, efficiency, and cost-effectiveness. These technological advancements have the potential to address longstanding concerns associated with nuclear power, thereby increasing its appeal to both policymakers and the public. As a result, investors are increasingly optimistic about the company’s ability to capture a substantial share of the growing nuclear energy market.

Furthermore, the company’s strategic partnerships and collaborations have also played a crucial role in its recent success. By aligning with key industry players and research institutions, the company has been able to leverage additional expertise and resources, accelerating its progress and enhancing its competitive position. These partnerships not only bolster the company’s credibility but also provide valuable opportunities for knowledge exchange and innovation, further strengthening its market prospects.

While the stock’s rapid ascent has generated excitement, it has also prompted caution among some market observers. The volatility inherent in such dramatic price movements raises questions about the sustainability of the current valuation. Some analysts warn that the stock may be overvalued, urging investors to carefully consider the underlying fundamentals and potential risks before making investment decisions. Nonetheless, the overall sentiment remains largely positive, with many viewing the stock’s performance as indicative of a broader shift towards clean energy investments.

In conclusion, the 150% increase in the stock price of the nuclear power company backed by Sam Altman reflects a confluence of factors, including influential endorsements, favorable market conditions, technological advancements, and strategic partnerships. As the world continues to grapple with the challenges of climate change and energy transition, the nuclear power industry is poised to play an increasingly important role. Consequently, the market reactions to this stock’s growth serve as a microcosm of the evolving landscape of energy investments, highlighting both the opportunities and challenges that lie ahead.

Investment Strategies In The Nuclear Power Sector

In recent weeks, the nuclear power sector has captured the attention of investors worldwide, particularly following the remarkable surge of a nuclear power stock backed by Sam Altman, which has skyrocketed by 150% in just one month. This unprecedented growth has prompted a reevaluation of investment strategies within the nuclear power sector, as stakeholders seek to understand the factors driving this surge and the potential implications for future investments. As the world grapples with the dual challenges of energy security and climate change, nuclear power is increasingly being viewed as a viable solution, offering a reliable and low-carbon energy source. Consequently, the sector is experiencing renewed interest from investors who are eager to capitalize on its potential.

The involvement of Sam Altman, a prominent figure in the technology and investment landscape, has undoubtedly played a significant role in the stock’s meteoric rise. Altman’s endorsement is often seen as a vote of confidence, attracting attention from both institutional and retail investors. His backing suggests a belief in the long-term viability and profitability of nuclear power, which aligns with the growing consensus that nuclear energy is essential for achieving global carbon reduction targets. This endorsement has not only boosted investor confidence but has also highlighted the importance of strategic partnerships and influential backers in the nuclear power sector.

Moreover, the recent surge in the stock’s value can be attributed to several key developments within the nuclear power industry. Technological advancements have led to the emergence of next-generation nuclear reactors, which promise enhanced safety features, greater efficiency, and reduced waste. These innovations are crucial in addressing public concerns about nuclear safety and environmental impact, thereby making nuclear power a more attractive option for energy generation. Additionally, government policies and international agreements aimed at reducing carbon emissions have created a favorable regulatory environment for nuclear power, further bolstering investor confidence.

As investors consider their strategies in the nuclear power sector, it is essential to recognize the potential risks and rewards associated with this dynamic industry. While the recent stock surge is promising, it is important to approach investments with a long-term perspective, given the complex regulatory landscape and the significant capital requirements associated with nuclear power projects. Diversification within the sector can also mitigate risks, as it allows investors to spread their exposure across different technologies and companies, thereby reducing the impact of any single investment’s underperformance.

Furthermore, understanding the broader energy market dynamics is crucial for making informed investment decisions. The transition to a low-carbon economy is driving demand for clean energy sources, and nuclear power is poised to play a pivotal role in this transition. However, competition from other renewable energy sources, such as wind and solar, remains a factor to consider. Investors must weigh the advantages of nuclear power, such as its reliability and capacity for large-scale energy production, against the rapid advancements and decreasing costs of alternative energy technologies.

In conclusion, the recent surge of the nuclear power stock backed by Sam Altman underscores the growing interest and potential within the nuclear power sector. As investors navigate this evolving landscape, it is imperative to consider the technological advancements, regulatory environment, and broader energy market trends that will shape the future of nuclear power. By adopting a strategic and informed approach, investors can position themselves to capitalize on the opportunities presented by this critical component of the global energy mix.

The Role Of Innovation In Nuclear Power’s Market Performance

In recent weeks, the nuclear power sector has witnessed a remarkable surge in market performance, particularly highlighted by a nuclear power stock that has skyrocketed by 150% in just one month. This unprecedented growth can be attributed to the backing of Sam Altman, a prominent figure in the tech industry known for his visionary investments and leadership. Altman’s involvement has not only brought significant attention to the nuclear power industry but has also underscored the critical role of innovation in driving market performance.

The nuclear power industry, traditionally viewed as a stable yet stagnant sector, has been undergoing a transformation fueled by technological advancements and innovative approaches. This shift is crucial as the world grapples with the dual challenges of meeting increasing energy demands while reducing carbon emissions. Nuclear power, with its potential to provide a reliable and low-carbon energy source, is being re-evaluated through the lens of modern innovation. Altman’s endorsement of nuclear power is a testament to the sector’s evolving landscape, where cutting-edge technologies are being integrated to enhance efficiency, safety, and sustainability.

One of the key innovations propelling the nuclear power industry forward is the development of small modular reactors (SMRs). These reactors offer a more flexible and cost-effective alternative to traditional large-scale nuclear plants. SMRs are designed to be built in factories and transported to sites, reducing construction times and costs. Moreover, their modular nature allows for incremental capacity additions, aligning with fluctuating energy demands. This adaptability is particularly appealing to investors like Altman, who recognize the potential of SMRs to revolutionize the energy market.

In addition to SMRs, advancements in nuclear fuel technology are playing a pivotal role in enhancing the performance of nuclear power. Researchers are exploring the use of accident-tolerant fuels, which are designed to withstand extreme conditions and reduce the risk of nuclear accidents. These innovations not only improve the safety profile of nuclear power but also increase public confidence in its viability as a sustainable energy source. As safety concerns are addressed through technological breakthroughs, the nuclear power industry is poised to attract more investment and support from both the public and private sectors.

Furthermore, the integration of artificial intelligence (AI) and machine learning in nuclear power operations is another area where innovation is making a significant impact. AI-driven analytics can optimize reactor performance, predict maintenance needs, and enhance safety protocols. By leveraging data-driven insights, nuclear power plants can operate more efficiently and with greater reliability. This technological synergy aligns with Altman’s investment philosophy, which emphasizes the transformative potential of AI across various industries.

The recent surge in the nuclear power stock backed by Sam Altman serves as a compelling example of how innovation can drive market performance. As the industry continues to embrace new technologies and innovative approaches, it is likely to attract further investment and interest. This momentum not only benefits investors but also contributes to the broader goal of achieving a sustainable and low-carbon energy future. In conclusion, the role of innovation in the nuclear power sector is pivotal, as it not only enhances market performance but also positions nuclear energy as a key player in the global transition towards cleaner and more efficient energy solutions.

Q&A

1. **What is the name of the nuclear power stock backed by Sam Altman?**

– Oklo Inc.

2. **By how much did the stock price increase in one month?**

– 150%

3. **Who is Sam Altman?**

– Sam Altman is a prominent entrepreneur and investor, known for his role as the CEO of OpenAI and his involvement in various tech ventures.

4. **What is Oklo Inc. known for?**

– Oklo Inc. is known for developing advanced nuclear reactors, specifically microreactors, aimed at providing clean and efficient energy solutions.

5. **What is the significance of the stock’s performance?**

– The significant increase in stock price indicates strong investor interest and confidence in Oklo Inc.’s technology and potential market impact.

6. **What type of nuclear technology is Oklo Inc. focusing on?**

– Oklo Inc. is focusing on microreactors, which are small, advanced nuclear reactors designed for efficient and flexible power generation.

7. **Why might investors be interested in nuclear power stocks like Oklo Inc.?**

– Investors might be interested due to the growing demand for clean energy solutions, advancements in nuclear technology, and the potential for nuclear power to play a significant role in reducing carbon emissions.

Conclusion

The recent surge of 150% in the stock value of a nuclear power company backed by Sam Altman highlights growing investor confidence and interest in the nuclear energy sector. This significant increase may be attributed to a combination of factors, including advancements in nuclear technology, increased focus on sustainable and clean energy solutions, and Altman’s influential backing, which likely enhances the company’s credibility and visibility. The rapid appreciation in stock value suggests a positive market sentiment towards nuclear power as a viable component of future energy strategies, reflecting broader trends in energy investment and innovation.