“Oil Prices Edge Upward Amid Investor Speculation on US Inventory Insights”

Introduction

Oil prices experienced a modest increase as market participants turned their attention to the upcoming U.S. inventory report, which is expected to provide insights into the current supply and demand dynamics. This slight uptick reflects investor anticipation and speculation regarding potential changes in crude stockpiles, which could influence global oil markets. The report, released by the U.S. Energy Information Administration, is a key indicator for traders and analysts, offering a snapshot of the nation’s oil reserves and consumption patterns. As the energy sector closely monitors these developments, the data could have significant implications for pricing strategies and future market trends.

Impact Of US Inventory Reports On Global Oil Prices

Oil prices have experienced a modest increase as investors keenly await the upcoming U.S. inventory report, a key indicator that often influences global oil markets. The anticipation surrounding this report underscores the significant role that U.S. oil inventories play in shaping market dynamics. As one of the largest consumers and producers of oil, the United States holds a pivotal position in the global energy landscape. Consequently, fluctuations in its oil inventory levels can send ripples across international markets, affecting prices and influencing trading strategies.

The U.S. Energy Information Administration (EIA) releases weekly data on crude oil inventories, providing insights into supply and demand dynamics. When inventories rise, it typically signals a surplus in supply, which can exert downward pressure on prices. Conversely, a decline in inventories suggests tighter supply conditions, often leading to upward price movements. This week, market participants are particularly attentive to the report, as it may offer clues about future price trends amid ongoing geopolitical tensions and economic uncertainties.

In recent months, oil prices have been subject to a complex interplay of factors, including production cuts by the Organization of the Petroleum Exporting Countries (OPEC) and its allies, as well as fluctuating demand patterns driven by global economic conditions. The U.S. inventory report serves as a critical piece of this puzzle, providing a snapshot of domestic supply levels that can either reinforce or counteract these broader trends. As such, traders and analysts closely scrutinize the data, looking for any signs of imbalance that could impact market sentiment.

Moreover, the influence of U.S. inventory reports extends beyond immediate price reactions. They also play a role in shaping longer-term expectations about market fundamentals. For instance, a consistent pattern of declining inventories might suggest robust demand or constrained supply, prompting analysts to revise their forecasts for future price movements. On the other hand, persistent inventory builds could indicate weaker demand or increased production, leading to more bearish outlooks.

In addition to their direct impact on prices, U.S. inventory reports can also affect the behavior of other market participants, such as hedge funds and institutional investors. These entities often adjust their positions based on the latest data, seeking to capitalize on anticipated price movements. As a result, the release of the inventory report can trigger heightened trading activity, contributing to increased volatility in the market.

Furthermore, the implications of U.S. inventory levels are not confined to domestic markets. Given the interconnected nature of the global oil industry, changes in U.S. supply can influence international trade flows and pricing structures. For example, a significant drawdown in U.S. inventories might lead to increased imports from other regions, thereby affecting supply-demand balances elsewhere. Similarly, a build in inventories could result in reduced import needs, impacting exporters who rely on the U.S. as a key market.

In conclusion, the anticipation surrounding the U.S. inventory report highlights its critical role in the global oil market. As investors await the latest data, the modest rise in oil prices reflects the market’s sensitivity to potential shifts in supply dynamics. By providing valuable insights into domestic inventory levels, the report not only influences immediate price movements but also shapes broader market expectations and trading strategies. As such, it remains an essential tool for understanding the complex forces driving the global oil industry.

Investor Reactions To Slight Oil Price Increases

Oil prices have experienced a modest increase as investors keenly await the upcoming U.S. inventory report, a key indicator that often influences market dynamics. This slight uptick in prices reflects a complex interplay of factors, including geopolitical tensions, production adjustments by major oil-producing nations, and the ever-evolving landscape of global demand. As investors navigate these waters, their reactions are shaped by both immediate market conditions and broader economic indicators.

The anticipation surrounding the U.S. inventory report is not without reason. Historically, these reports have provided critical insights into the supply-demand balance within the oil market. A decrease in inventories typically signals higher demand or reduced supply, often leading to an increase in prices. Conversely, an increase in inventories might suggest a surplus, potentially exerting downward pressure on prices. As such, investors closely monitor these reports to adjust their strategies accordingly, seeking to capitalize on emerging trends.

In recent weeks, geopolitical factors have also played a significant role in shaping investor sentiment. Tensions in key oil-producing regions can lead to supply disruptions, which in turn can drive prices upward. For instance, any instability in the Middle East, a region that holds a substantial portion of the world’s oil reserves, can lead to heightened concerns about supply security. Investors, therefore, remain vigilant, factoring in these geopolitical developments as they assess potential risks and opportunities in the market.

Moreover, the actions of major oil-producing countries, particularly those within the Organization of the Petroleum Exporting Countries (OPEC) and its allies, continue to influence market dynamics. Decisions regarding production cuts or increases are closely scrutinized by investors, as they can significantly impact global supply levels. Recent discussions among OPEC members about potential production adjustments have added another layer of complexity to the market, prompting investors to remain attentive to any announcements that could sway prices.

In addition to these supply-side considerations, global demand trends are equally pivotal in shaping investor reactions. The ongoing recovery from the COVID-19 pandemic has led to fluctuations in demand, with some regions experiencing robust economic growth while others face challenges. As economies reopen and travel resumes, the demand for oil is expected to rise, potentially supporting higher prices. However, concerns about inflation and potential economic slowdowns in certain areas add an element of uncertainty, prompting investors to weigh these factors carefully.

As investors digest these various elements, their strategies often reflect a blend of caution and opportunism. Some may choose to adopt a wait-and-see approach, holding off on major decisions until the U.S. inventory report provides clearer insights. Others might seize the opportunity to make strategic investments, anticipating that current conditions could lead to favorable outcomes. In either case, the slight rise in oil prices serves as a reminder of the market’s inherent volatility and the need for astute analysis.

In conclusion, the recent increase in oil prices underscores the multifaceted nature of the market, where investor reactions are shaped by a confluence of factors ranging from geopolitical tensions to production decisions and demand trends. As the U.S. inventory report looms, investors remain poised to adjust their strategies, navigating the complexities of a market that is both dynamic and unpredictable. Through careful analysis and strategic decision-making, they aim to position themselves advantageously in a landscape that continues to evolve.

Analyzing The Factors Behind Recent Oil Price Fluctuations

Oil prices have experienced a modest increase recently, driven by investor anticipation of the upcoming U.S. inventory report. This development is part of a broader trend of fluctuations in the oil market, influenced by a complex interplay of factors. Understanding these dynamics requires a closer examination of both global and domestic elements that contribute to the ebb and flow of oil prices.

To begin with, the anticipation surrounding the U.S. inventory report plays a significant role in shaping market expectations. Investors closely monitor these reports as they provide critical insights into the supply and demand balance within the world’s largest oil-consuming nation. A report indicating a drawdown in inventories typically suggests increased demand or reduced supply, which can lead to upward pressure on prices. Conversely, a build-up in inventories might signal weaker demand or oversupply, potentially driving prices down. As such, the mere expectation of the report can lead to preemptive market movements, as traders position themselves based on their predictions.

In addition to inventory levels, geopolitical factors continue to exert considerable influence over oil prices. Tensions in key oil-producing regions, such as the Middle East, can lead to supply disruptions or fears thereof, prompting price increases. For instance, any escalation in conflicts or sanctions affecting major producers like Iran or Saudi Arabia can create uncertainty in the market, leading to speculative buying and, consequently, higher prices. Moreover, the actions of the Organization of the Petroleum Exporting Countries (OPEC) and its allies, collectively known as OPEC+, are pivotal. Decisions regarding production cuts or increases are closely watched, as they directly impact global supply levels.

Furthermore, economic indicators from major economies also play a crucial role in determining oil price trends. Economic growth in countries such as China and India, which are significant consumers of oil, can lead to increased demand, thereby supporting higher prices. Conversely, economic slowdowns or recessions can dampen demand, exerting downward pressure on prices. In this context, the health of the global economy, as reflected in GDP growth rates, industrial output, and trade volumes, becomes a key determinant of oil market dynamics.

Another important factor to consider is the role of technological advancements and shifts in energy policy. The increasing emphasis on renewable energy sources and the transition towards a low-carbon economy have long-term implications for oil demand. As countries invest more in alternative energy and electric vehicles, the demand for oil may face structural declines. However, in the short term, oil remains a critical component of the global energy mix, and fluctuations in its price continue to have significant economic implications.

Finally, currency fluctuations, particularly the strength of the U.S. dollar, can also impact oil prices. Since oil is traded globally in dollars, a stronger dollar makes oil more expensive for holders of other currencies, potentially reducing demand and putting downward pressure on prices. Conversely, a weaker dollar can make oil cheaper internationally, boosting demand and supporting price increases.

In conclusion, the recent slight rise in oil prices, as investors await the U.S. inventory report, underscores the multifaceted nature of the oil market. A combination of inventory expectations, geopolitical tensions, economic indicators, technological shifts, and currency movements all contribute to the complex landscape of oil price fluctuations. Understanding these factors is essential for stakeholders seeking to navigate the ever-evolving energy market.

The Role Of US Oil Inventories In Market Predictions

Oil prices have experienced a modest increase as investors keenly await the forthcoming U.S. inventory report, a crucial indicator that often influences market predictions. The anticipation surrounding this report underscores the significant role that U.S. oil inventories play in shaping global oil market dynamics. As one of the largest consumers and producers of oil, the United States holds a pivotal position in the global energy landscape. Consequently, fluctuations in its oil inventories can send ripples across international markets, affecting prices and influencing trading strategies.

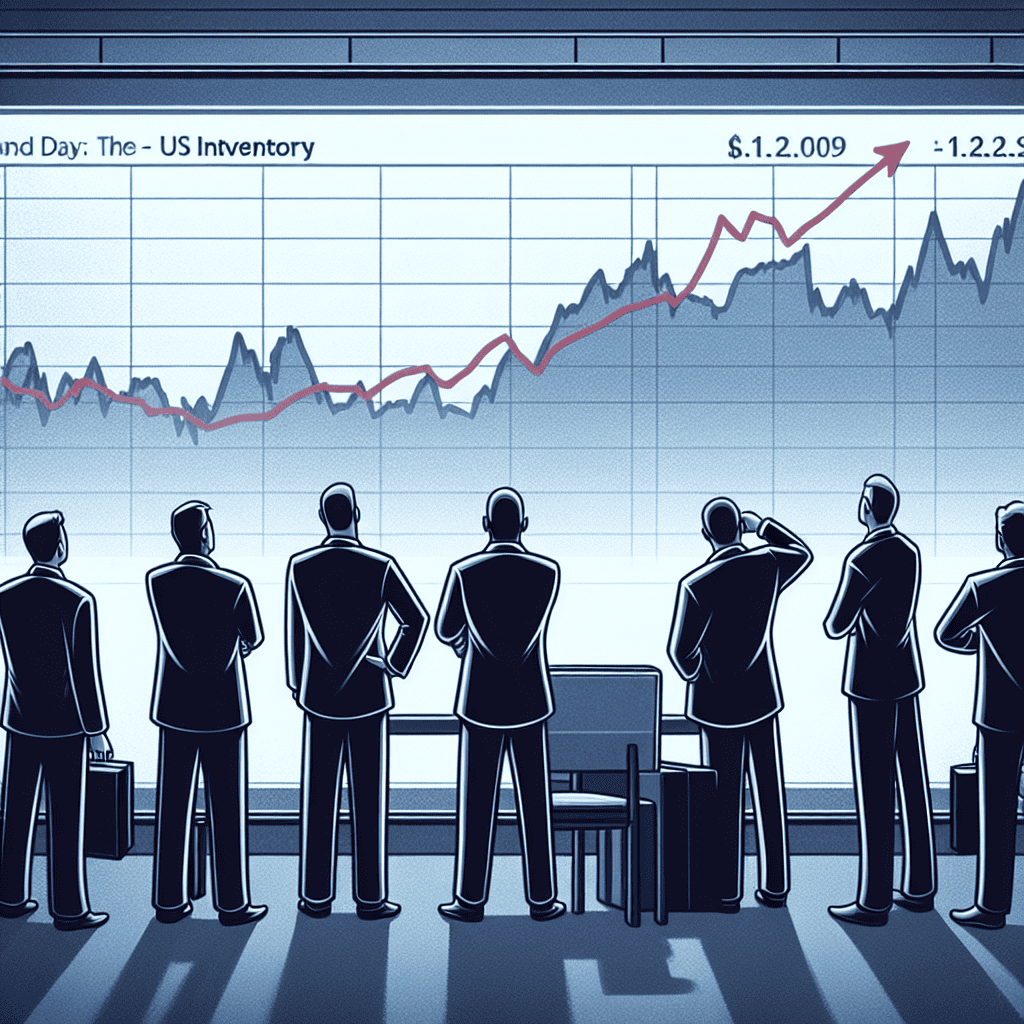

The U.S. Energy Information Administration (EIA) releases weekly data on crude oil inventories, providing insights into supply and demand dynamics. This report is closely monitored by investors, traders, and analysts alike, as it offers a snapshot of the current state of the oil market. A rise in inventories typically signals an oversupply, which can lead to downward pressure on prices. Conversely, a decline in stockpiles often suggests increased demand or reduced production, potentially driving prices upward. Therefore, the inventory report serves as a barometer for market sentiment, guiding investment decisions and shaping expectations.

In recent weeks, oil prices have been subject to a variety of influences, including geopolitical tensions, production cuts by major oil-producing nations, and shifts in global demand patterns. However, the U.S. inventory report remains a key focal point for market participants. As the report’s release approaches, investors engage in speculative trading, attempting to position themselves advantageously based on anticipated outcomes. This speculative activity can lead to price volatility, as market participants react to both actual data and prevailing expectations.

Moreover, the role of U.S. oil inventories in market predictions extends beyond immediate price movements. The data also provides valuable insights into broader economic trends. For instance, a sustained increase in inventories might indicate weakening demand, potentially reflecting broader economic slowdowns or shifts in consumer behavior. Conversely, declining inventories could suggest robust economic activity, with increased industrial output and consumer consumption driving demand for energy.

In addition to its impact on market predictions, the U.S. inventory report also influences policy decisions and strategic planning within the energy sector. Policymakers and industry leaders rely on this data to assess the effectiveness of existing strategies and to formulate future plans. For example, significant changes in inventory levels might prompt adjustments in production targets or influence decisions regarding strategic reserves. Thus, the report not only guides market participants but also informs broader energy policy and planning.

As investors await the latest U.S. inventory report, the modest rise in oil prices reflects a cautious optimism tempered by uncertainty. While the report’s findings will undoubtedly shape short-term market movements, its implications extend far beyond immediate price fluctuations. By providing a window into supply and demand dynamics, the report plays a crucial role in informing market predictions, guiding investment strategies, and shaping energy policy. As such, it remains an indispensable tool for understanding the complex and ever-evolving landscape of the global oil market. In conclusion, the anticipation surrounding the U.S. inventory report highlights its enduring significance in the world of energy trading and market analysis.

How Oil Price Changes Affect The Global Economy

The recent slight rise in oil prices, as investors keenly await the upcoming US inventory report, serves as a reminder of the intricate web of economic factors influenced by fluctuations in oil prices. Oil, often referred to as the lifeblood of the global economy, plays a pivotal role in shaping economic landscapes across the world. As prices shift, the ripple effects are felt far and wide, impacting everything from consumer behavior to national economic policies.

To begin with, oil price changes directly affect the cost of transportation and production. When oil prices rise, the cost of fuel increases, leading to higher transportation expenses for goods. This, in turn, can result in increased prices for consumer products, as businesses pass on the additional costs to consumers. Consequently, inflationary pressures may build up, affecting purchasing power and consumer spending patterns. In economies heavily reliant on oil imports, such as many in Europe and Asia, rising oil prices can exacerbate trade deficits, putting further strain on national budgets and potentially leading to currency depreciation.

Moreover, oil-exporting countries experience a different set of economic dynamics. For these nations, higher oil prices can lead to increased revenue, bolstering national budgets and enabling greater public spending on infrastructure, social programs, and other development projects. This can stimulate economic growth and create jobs, contributing to overall economic stability. However, reliance on oil revenue can also pose risks, as economies may become vulnerable to price volatility. A sudden drop in oil prices can lead to budget shortfalls, forcing governments to cut spending or increase borrowing, which can have long-term economic consequences.

In addition to these direct effects, oil price changes can influence monetary policy decisions. Central banks closely monitor inflation indicators, and significant shifts in oil prices can prompt adjustments in interest rates. For instance, if rising oil prices lead to higher inflation, central banks may consider raising interest rates to curb inflationary pressures. Conversely, if oil prices fall and inflation remains subdued, central banks might opt for lower interest rates to stimulate economic activity. These monetary policy decisions, in turn, affect borrowing costs for businesses and consumers, influencing investment and spending behaviors.

Furthermore, the energy sector itself is directly impacted by oil price fluctuations. Higher prices can incentivize investment in oil exploration and production, as well as in alternative energy sources. This can lead to technological advancements and increased energy efficiency, contributing to a more sustainable energy future. On the other hand, lower oil prices may discourage investment in renewable energy, as traditional fossil fuels become more economically attractive. This dynamic underscores the complex interplay between oil prices and the transition to a greener economy.

In conclusion, the slight rise in oil prices, as investors anticipate the US inventory report, highlights the multifaceted impact of oil price changes on the global economy. From influencing consumer prices and trade balances to shaping monetary policy and energy investments, the effects are far-reaching and interconnected. As the world continues to navigate the challenges of economic growth and sustainability, understanding the implications of oil price fluctuations remains crucial for policymakers, businesses, and consumers alike. Through careful analysis and strategic planning, economies can better adapt to the ever-changing landscape of global oil markets.

Strategies For Investors Amidst Rising Oil Prices

As oil prices experience a modest increase, investors are keenly observing the market dynamics, particularly in anticipation of the upcoming U.S. inventory report. This report is expected to provide crucial insights into the supply-demand balance, which could further influence oil prices. In this context, investors are exploring various strategies to navigate the complexities of the oil market. Understanding these strategies is essential for making informed decisions that align with both short-term gains and long-term investment goals.

To begin with, diversification remains a fundamental strategy for investors looking to mitigate risks associated with fluctuating oil prices. By spreading investments across different asset classes, such as stocks, bonds, and commodities, investors can cushion the impact of volatility in the oil market. This approach not only reduces exposure to oil price swings but also enhances the potential for stable returns. Moreover, within the energy sector itself, diversification can be achieved by investing in a mix of oil producers, refiners, and service companies, each of which may respond differently to changes in oil prices.

In addition to diversification, investors are increasingly turning to futures contracts as a means of hedging against price volatility. Futures contracts allow investors to lock in prices for oil at a future date, providing a degree of certainty in an otherwise unpredictable market. This strategy is particularly useful for businesses that rely heavily on oil, as it enables them to manage costs more effectively. However, it is important to note that trading in futures requires a deep understanding of the market and carries its own set of risks, which must be carefully managed.

Another strategy gaining traction is the focus on energy efficiency and sustainability. As the world gradually shifts towards renewable energy sources, companies that are investing in sustainable practices are likely to be more resilient to oil price fluctuations. Investors are therefore increasingly considering the environmental, social, and governance (ESG) criteria when making investment decisions. By supporting companies that prioritize sustainability, investors not only contribute to a more sustainable future but also position themselves to benefit from the long-term growth potential of these companies.

Furthermore, keeping a close eye on geopolitical developments is crucial for investors in the oil market. Political tensions in oil-producing regions can lead to supply disruptions, which in turn can cause significant price fluctuations. By staying informed about global events and understanding their potential impact on oil supply, investors can make more strategic decisions. This involves not only monitoring news and reports but also analyzing historical data to identify patterns and trends that could influence future market movements.

Lastly, maintaining a long-term perspective is essential for investors navigating the oil market. While short-term price movements can be influenced by a variety of factors, including inventory reports and geopolitical events, the long-term outlook is shaped by broader trends such as technological advancements and shifts in consumer behavior. By focusing on long-term trends, investors can better align their strategies with the evolving energy landscape and capitalize on emerging opportunities.

In conclusion, as oil prices rise slightly amidst anticipation of the U.S. inventory report, investors are employing a range of strategies to manage risks and capitalize on opportunities. Through diversification, hedging, a focus on sustainability, geopolitical awareness, and a long-term perspective, investors can navigate the complexities of the oil market with greater confidence. These strategies not only help in mitigating risks but also enhance the potential for achieving sustainable returns in an ever-evolving energy sector.

Future Projections For Oil Prices Based On Current Trends

Oil prices have experienced a modest increase recently, driven by investor anticipation of the upcoming U.S. inventory report. This report is expected to provide crucial insights into the current supply and demand dynamics within the oil market. As market participants eagerly await the data, the slight uptick in prices reflects a broader trend of cautious optimism among investors. This optimism is underpinned by several factors, including geopolitical developments, economic indicators, and production adjustments by major oil-producing nations.

To begin with, geopolitical tensions continue to play a significant role in shaping oil price trajectories. Recent developments in the Middle East, a region that remains a pivotal player in the global oil market, have contributed to heightened uncertainty. Any potential disruptions in oil supply from this region can lead to price volatility, as markets react to the possibility of reduced availability. Consequently, investors are closely monitoring these geopolitical dynamics, which, in turn, influence their expectations for future oil prices.

In addition to geopolitical factors, economic indicators from major economies are also influencing oil price projections. The global economic recovery, albeit uneven, has led to an increase in energy demand. As countries emerge from the economic downturn caused by the COVID-19 pandemic, industrial activity and transportation have picked up pace, driving up the demand for oil. However, this recovery is not uniform across all regions, with some areas experiencing slower growth due to lingering pandemic-related challenges. As a result, investors are carefully analyzing economic data to gauge the potential impact on oil demand and, consequently, prices.

Moreover, production decisions by the Organization of the Petroleum Exporting Countries (OPEC) and its allies, collectively known as OPEC+, are crucial in determining the future direction of oil prices. The group has been actively managing production levels to balance the market and support prices. Recent meetings have resulted in agreements to gradually increase production, reflecting a cautious approach to meeting rising demand while avoiding oversupply. These production adjustments are closely watched by investors, as they provide valuable insights into the supply side of the market equation.

Furthermore, technological advancements and the global push towards renewable energy sources are also shaping the long-term outlook for oil prices. As countries strive to reduce their carbon footprints and transition to cleaner energy alternatives, the demand for oil may face headwinds in the future. However, this transition is expected to be gradual, allowing oil to remain a significant energy source in the near to medium term. Investors are thus weighing the potential impact of these trends on future oil demand and prices.

In conclusion, the recent slight rise in oil prices reflects a complex interplay of factors that are shaping investor expectations. Geopolitical developments, economic indicators, production decisions by OPEC+, and the global energy transition are all contributing to the current market dynamics. As investors await the U.S. inventory report, they are keenly aware of these influences and their potential implications for future oil prices. While uncertainties remain, the cautious optimism observed in the market suggests that investors are navigating these complexities with a focus on both short-term developments and long-term trends. As such, the future projections for oil prices will likely continue to evolve in response to these multifaceted factors.

Q&A

1. **What caused the recent slight rise in oil prices?**

Oil prices rose slightly due to investor anticipation of the upcoming US inventory report.

2. **What are investors expecting from the US inventory report?**

Investors are expecting the report to provide insights into supply levels, which could influence market dynamics.

3. **How do inventory levels affect oil prices?**

Lower inventory levels can indicate higher demand or reduced supply, potentially driving prices up, while higher inventories might suggest the opposite.

4. **What other factors might influence oil prices besides inventory reports?**

Geopolitical events, OPEC decisions, global economic conditions, and changes in energy policies can also impact oil prices.

5. **How often are US oil inventory reports released?**

The US Energy Information Administration (EIA) typically releases weekly inventory reports.

6. **What role do speculators play in oil price movements?**

Speculators can influence oil prices by trading futures contracts based on their expectations of future market conditions.

7. **How might a significant change in the inventory report impact the market?**

A significant change could lead to increased volatility, with prices adjusting rapidly based on perceived supply and demand shifts.

Conclusion

Oil prices experienced a modest increase as market participants awaited the upcoming U.S. inventory report, which is expected to provide insights into supply and demand dynamics. This anticipation reflects investor sentiment and market speculation regarding potential changes in inventory levels, which could influence future pricing trends. The slight rise in prices suggests cautious optimism among investors, who are closely monitoring economic indicators and geopolitical factors that could impact oil supply and demand. Overall, the market remains sensitive to inventory data, which continues to play a crucial role in shaping oil price movements.