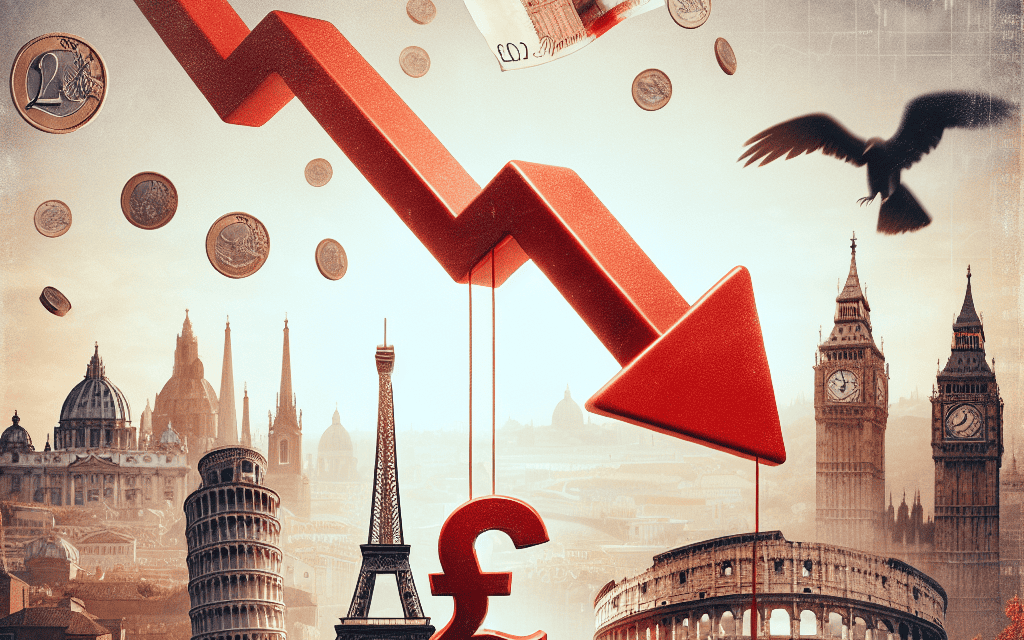

“European Stocks Tumble on Disappointing Earnings; Pound Slips in Market Jitters”

Introduction

European stocks experienced a downturn as weak corporate earnings reports weighed on investor sentiment, leading to a broad sell-off across major indices. The disappointing financial results from key companies underscored concerns about the region’s economic resilience amid ongoing global uncertainties. Concurrently, the British pound faced downward pressure, reflecting market apprehensions about the UK’s economic outlook and potential policy shifts. This market wrap highlights the challenges facing European equities and currency markets as they navigate a complex landscape of economic indicators and geopolitical developments.

European Stocks Decline Amid Weak Earnings Reports

European stocks experienced a notable decline as investors reacted to a series of disappointing earnings reports, which have cast a shadow over market sentiment. The downturn in stock performance was further exacerbated by a weakening British pound, adding to the complexities faced by market participants. As companies across various sectors released their quarterly results, it became evident that many had failed to meet analysts’ expectations, thereby triggering a wave of sell-offs.

The financial sector, in particular, bore the brunt of the negative sentiment, with several major banks reporting lower-than-anticipated profits. This underperformance was attributed to a combination of factors, including rising operational costs and a challenging macroeconomic environment. Consequently, investors have become increasingly cautious, reassessing their portfolios in light of these developments. Moreover, the energy sector also faced headwinds, as fluctuating oil prices and regulatory uncertainties weighed heavily on companies’ earnings. This sector’s struggles further contributed to the overall decline in European stock indices.

In addition to sector-specific challenges, broader economic concerns have also played a role in the market’s downturn. The ongoing geopolitical tensions and trade disputes have created an atmosphere of uncertainty, prompting investors to adopt a more risk-averse stance. This cautious approach has been reflected in the reduced trading volumes and increased volatility observed in recent sessions. Furthermore, the weakening of the British pound has compounded these issues, as it has raised concerns about the potential impact on multinational companies with significant exposure to the UK market.

The decline in the pound can be attributed to several factors, including the recent economic data that painted a less-than-optimistic picture of the UK’s economic health. Inflationary pressures, coupled with sluggish growth, have led to speculation about the future direction of monetary policy. As a result, currency traders have been adjusting their positions, leading to increased volatility in the foreign exchange markets. This depreciation of the pound has had a ripple effect, influencing investor sentiment and contributing to the broader decline in European stocks.

Despite these challenges, some market analysts remain cautiously optimistic about the long-term prospects for European equities. They argue that while the current earnings season has been disappointing, it is important to consider the underlying fundamentals of the companies involved. Many firms have demonstrated resilience in the face of adversity, implementing strategic measures to navigate the turbulent economic landscape. Additionally, the potential for policy interventions by central banks could provide a much-needed boost to market confidence, helping to stabilize the situation.

In conclusion, the recent drop in European stocks, driven by weak earnings reports and a declining pound, underscores the complex interplay of factors influencing market dynamics. While the immediate outlook may appear bleak, it is crucial for investors to maintain a balanced perspective, considering both the challenges and opportunities that lie ahead. As the global economic environment continues to evolve, market participants will need to remain vigilant, adapting their strategies to navigate the uncertainties that characterize the current landscape. Through careful analysis and prudent decision-making, investors can position themselves to capitalize on potential opportunities, even amidst the prevailing market turbulence.

Impact of Weak Earnings on European Stock Markets

European stock markets experienced a notable decline as weak earnings reports from several major companies dampened investor sentiment. This downturn in the markets underscores the sensitivity of stock prices to corporate performance, particularly in an economic environment already fraught with uncertainty. As investors digest these earnings reports, the broader implications for the European economy become increasingly apparent.

The recent wave of earnings announcements revealed that many companies are grappling with challenges such as rising costs, supply chain disruptions, and fluctuating consumer demand. These factors have collectively contributed to disappointing financial results, which in turn have exerted downward pressure on stock prices. For instance, several key players in the manufacturing and retail sectors reported lower-than-expected profits, citing increased raw material costs and logistical bottlenecks as primary obstacles. Consequently, their stock prices tumbled, dragging down market indices across the continent.

Moreover, the financial sector has not been immune to these challenges. Banks and financial institutions have faced a complex landscape characterized by low interest rates and regulatory pressures. As a result, their earnings have also fallen short of market expectations, further contributing to the overall decline in European stock markets. This confluence of factors has led to a cautious approach among investors, who are now reassessing their portfolios in light of these developments.

In addition to the impact of weak earnings, the European stock markets have been influenced by broader macroeconomic concerns. The ongoing geopolitical tensions and uncertainties surrounding trade policies have added another layer of complexity to the investment landscape. These external factors have heightened market volatility, making it more difficult for investors to predict future trends and allocate resources effectively. As a result, many investors are adopting a wait-and-see approach, opting to hold off on significant investment decisions until there is greater clarity on these issues.

Meanwhile, the currency markets have also been affected by these developments. The British pound, in particular, has experienced a decline, reflecting concerns over the economic outlook and the potential implications of weak corporate earnings. The depreciation of the pound can be attributed to a combination of factors, including the aforementioned earnings reports and broader economic uncertainties. This decline in the currency’s value has further complicated the investment landscape, as it affects the purchasing power of investors and the competitiveness of British exports.

In light of these challenges, policymakers and market participants are closely monitoring the situation, seeking to understand the underlying causes and potential solutions. Central banks may consider adjusting monetary policies to support economic growth and stabilize financial markets. Additionally, companies are likely to explore strategies to mitigate the impact of rising costs and supply chain disruptions, such as diversifying suppliers or investing in technology to enhance operational efficiency.

In conclusion, the recent drop in European stock markets, driven by weak earnings reports, highlights the interconnectedness of corporate performance, investor sentiment, and broader economic conditions. As companies navigate these challenges, the implications for the European economy and financial markets will continue to unfold. Investors, policymakers, and businesses alike must remain vigilant and adaptable in this dynamic environment, as they seek to chart a course through these uncertain times.

Factors Contributing to the Decline in European Stocks

European stocks experienced a notable decline recently, driven by a confluence of factors that have unsettled investors and contributed to a broader sense of uncertainty in the markets. At the forefront of these factors is the disappointing earnings season, which has seen several major companies across the continent report weaker-than-expected financial results. This has raised concerns about the overall health of the European economy and its ability to sustain growth in the face of mounting challenges.

One of the primary reasons for the weak earnings reports is the ongoing impact of global supply chain disruptions. Many European companies, particularly those in the manufacturing and automotive sectors, have been grappling with shortages of key components and raw materials. These disruptions have not only hindered production but have also led to increased costs, squeezing profit margins and dampening investor sentiment. As a result, companies have struggled to meet market expectations, leading to a sell-off in their stocks.

In addition to supply chain issues, the energy crisis in Europe has further exacerbated the situation. With energy prices soaring to unprecedented levels, businesses across various sectors are facing significantly higher operating costs. This has been particularly detrimental to energy-intensive industries, which are now forced to either absorb these costs or pass them on to consumers, potentially dampening demand. The uncertainty surrounding energy supply and pricing has added another layer of complexity to the economic landscape, making it difficult for companies to forecast future performance accurately.

Moreover, the recent tightening of monetary policy by the European Central Bank (ECB) has also played a role in the decline of European stocks. In an effort to combat rising inflation, the ECB has signaled a shift towards higher interest rates, which has led to increased borrowing costs for businesses and consumers alike. This move, while necessary to curb inflationary pressures, has raised concerns about its potential impact on economic growth. Investors are wary that higher interest rates could stifle investment and consumer spending, further weighing on corporate earnings.

Compounding these challenges is the geopolitical tension that continues to loom over the region. The ongoing conflict in Ukraine has not only disrupted trade and investment flows but has also heightened uncertainty regarding the future of European security and economic stability. Sanctions imposed on Russia have had ripple effects across various sectors, particularly in energy and agriculture, further straining the European economy. The potential for further escalation of the conflict remains a significant risk factor that investors are closely monitoring.

As if these factors were not enough, the recent depreciation of the British pound has added another layer of complexity to the market dynamics. The pound’s decline has been attributed to a combination of factors, including concerns over the UK’s economic outlook and the impact of Brexit-related uncertainties. A weaker pound can have mixed effects on European stocks, benefiting exporters by making their goods more competitive abroad, while simultaneously increasing the cost of imports and potentially squeezing profit margins for companies reliant on foreign goods.

In conclusion, the decline in European stocks can be attributed to a myriad of interconnected factors, each contributing to an environment of heightened uncertainty and volatility. From weak earnings reports and supply chain disruptions to energy crises and geopolitical tensions, the challenges facing European markets are multifaceted and complex. As investors navigate this turbulent landscape, they remain vigilant, seeking to understand and adapt to the evolving economic conditions that continue to shape the future of European stocks.

Analysis of the Pound’s Fall in the Current Market

In recent weeks, the financial markets have been closely monitoring the performance of European stocks, which have experienced a notable decline due to weak earnings reports. This downturn has been accompanied by a significant fall in the value of the British pound, prompting investors and analysts to scrutinize the underlying factors contributing to these market movements. The interplay between these elements is crucial for understanding the broader economic implications and the potential future trajectory of the markets.

The decline in European stocks can be attributed to a series of disappointing earnings reports from major companies across various sectors. These reports have highlighted challenges such as rising costs, supply chain disruptions, and geopolitical tensions, all of which have weighed heavily on corporate profitability. As a result, investor sentiment has been dampened, leading to a sell-off in equities. This negative sentiment has not been confined to a single industry but has permeated across the board, reflecting a broader concern about the economic outlook in the region.

Simultaneously, the British pound has experienced a significant depreciation against major currencies, further complicating the market landscape. Several factors have contributed to this decline, with economic data playing a pivotal role. Recent reports have indicated a slowdown in the UK economy, with growth forecasts being revised downward. This has been exacerbated by persistent inflationary pressures, which have eroded consumer purchasing power and increased the cost of living. Consequently, the Bank of England faces a challenging balancing act between curbing inflation and supporting economic growth, a dilemma that has added to the uncertainty surrounding the pound.

Moreover, the political landscape in the UK has also influenced the pound’s performance. Ongoing debates over fiscal policy, particularly in the context of post-Brexit trade agreements and domestic spending plans, have created an environment of uncertainty. Investors are wary of potential policy shifts that could impact the economic stability of the country. This uncertainty has been reflected in the currency markets, where the pound has struggled to maintain its value amidst fluctuating investor confidence.

In addition to domestic factors, global economic conditions have also played a role in the pound’s decline. The strength of the US dollar, driven by robust economic data and expectations of further interest rate hikes by the Federal Reserve, has exerted downward pressure on the pound. As investors seek safer assets, the dollar has emerged as a preferred choice, leading to capital outflows from the UK and further weakening the pound.

Looking ahead, the outlook for the pound remains uncertain, with several variables at play. The trajectory of inflation, the pace of economic recovery, and the policy decisions of the Bank of England will all be critical in determining the currency’s future performance. Additionally, geopolitical developments, such as trade negotiations and international relations, will continue to influence market sentiment.

In conclusion, the recent drop in European stocks and the fall of the British pound are indicative of broader economic challenges facing the region. While weak earnings have directly impacted stock performance, the pound’s decline is a result of a complex interplay of domestic and global factors. As markets navigate this uncertain landscape, investors and policymakers alike will need to remain vigilant, adapting to evolving conditions to mitigate risks and capitalize on potential opportunities.

How Weak Earnings Affect Investor Confidence in Europe

The recent downturn in European stocks, precipitated by a series of weak earnings reports, has sent ripples through the financial markets, raising concerns about investor confidence across the continent. As companies release their quarterly results, the figures have largely fallen short of market expectations, leading to a palpable sense of unease among investors. This trend has been further exacerbated by the concurrent decline in the value of the British pound, adding another layer of complexity to the already volatile market environment.

To understand the impact of weak earnings on investor confidence, it is essential to consider the role that corporate performance plays in shaping market sentiment. Earnings reports are a critical barometer of a company’s financial health and operational efficiency. When these reports reveal underperformance, it often signals underlying issues such as declining sales, increased costs, or strategic missteps. Consequently, investors may begin to question the company’s future prospects, leading to a sell-off of shares and a subsequent drop in stock prices.

Moreover, weak earnings can have a cascading effect on the broader market. As individual companies report disappointing results, sector-wide concerns may arise, particularly if the underperformance is concentrated in key industries such as finance, technology, or manufacturing. This can lead to a broader market downturn as investors reassess their portfolios and seek to mitigate risk by reallocating assets. The resulting volatility can further erode confidence, creating a feedback loop that perpetuates market instability.

In addition to the direct impact on stock prices, weak earnings can also influence investor confidence through their effect on economic indicators. For instance, lower corporate profits can lead to reduced capital expenditure, which in turn may slow economic growth. This can have a knock-on effect on employment rates and consumer spending, both of which are critical components of a healthy economy. As these indicators weaken, investors may become increasingly cautious, opting to hold off on new investments until there is greater clarity about the economic outlook.

The recent decline in the British pound adds another dimension to the challenges facing European markets. A weaker currency can have mixed implications for investors. On one hand, it can make exports more competitive, potentially boosting revenue for companies with significant international exposure. On the other hand, it can increase the cost of imports, leading to higher input costs and squeezing profit margins. For investors, the uncertainty surrounding currency fluctuations can complicate decision-making, particularly for those with exposure to multiple markets.

In navigating this complex landscape, investors must weigh the risks and opportunities presented by weak earnings and currency volatility. While some may choose to adopt a more defensive strategy, focusing on sectors with stable cash flows and strong balance sheets, others may see the current environment as an opportunity to identify undervalued assets with potential for long-term growth. Ultimately, the key to maintaining investor confidence lies in the ability to adapt to changing market conditions and to make informed decisions based on a comprehensive understanding of the factors at play.

In conclusion, the recent drop in European stocks, driven by weak earnings and a declining pound, underscores the intricate relationship between corporate performance, market sentiment, and economic indicators. As investors grapple with these challenges, their confidence will hinge on the ability to navigate uncertainty and to identify opportunities amidst the volatility.

The Relationship Between Earnings Reports and Currency Fluctuations

The intricate relationship between corporate earnings reports and currency fluctuations is a subject of considerable interest to investors and economists alike. This dynamic interplay was recently highlighted when European stocks experienced a decline following a series of weak earnings reports, while concurrently, the British pound also saw a decrease in value. Understanding the mechanisms behind these movements requires an exploration of how earnings reports can influence investor sentiment and, subsequently, currency markets.

Earnings reports serve as a critical barometer of a company’s financial health and operational performance. When companies report earnings that fall short of market expectations, it often triggers a wave of investor concern. This concern can lead to a sell-off in stocks, as investors seek to mitigate potential losses by reallocating their portfolios. In the context of European markets, the recent spate of disappointing earnings reports from key sectors such as manufacturing and technology has led to a notable decline in stock prices. This decline is not merely a reflection of individual company performance but also an indicator of broader economic challenges that may be affecting the region.

As stock prices fall, the ripple effects extend beyond equity markets and into currency markets. The value of a currency is influenced by a multitude of factors, including investor confidence and economic stability. When earnings reports suggest that companies are struggling, it can lead to a perception of economic weakness. This perception, in turn, can diminish investor confidence in the region’s economic prospects, prompting a shift in capital flows. Investors may choose to move their assets to markets perceived as more stable or promising, leading to a decrease in demand for the local currency.

In the case of the British pound, its recent decline can be partially attributed to the weak earnings reports emanating from Europe. As investors reassess their risk exposure in light of these reports, the pound has faced downward pressure. Additionally, the interconnectedness of European economies means that poor performance in one area can have cascading effects on others, further exacerbating currency volatility. The pound’s decline is also influenced by other factors, such as ongoing political uncertainties and economic data releases, which can compound the effects of weak corporate earnings.

Moreover, the relationship between earnings reports and currency fluctuations is not unidirectional. Currency movements can also impact corporate earnings, creating a feedback loop. A weaker currency can make exports more competitive, potentially boosting revenue for companies with significant international exposure. Conversely, it can increase the cost of imports, squeezing profit margins for businesses reliant on foreign goods and services. This interplay underscores the complexity of financial markets, where multiple variables interact in often unpredictable ways.

In conclusion, the recent drop in European stocks and the concurrent fall of the British pound illustrate the intricate relationship between earnings reports and currency fluctuations. Weak earnings reports can undermine investor confidence, leading to stock sell-offs and shifts in currency valuations. These movements are further influenced by broader economic and political factors, highlighting the multifaceted nature of global financial markets. As investors navigate these complexities, understanding the interconnectedness of earnings and currency dynamics remains crucial for making informed decisions.

Strategies for Investors During European Market Volatility

In the face of recent market turbulence, European stocks have experienced a notable decline, primarily driven by weaker-than-expected earnings reports from several key sectors. This downturn has been further compounded by the depreciation of the British pound, creating a challenging environment for investors. As market volatility becomes a more prominent feature of the European financial landscape, it is crucial for investors to adopt strategic approaches to navigate these uncertain times effectively.

One of the primary strategies investors might consider is diversification. By spreading investments across a variety of asset classes, sectors, and geographical regions, investors can mitigate the risks associated with market volatility. Diversification helps to cushion the impact of poor performance in any single area, as gains in other areas can offset losses. For instance, while European equities may be underperforming, investments in other regions or asset classes such as bonds or commodities might provide more stable returns.

In addition to diversification, investors should also focus on maintaining a long-term perspective. Market volatility can often lead to impulsive decision-making, driven by short-term fluctuations. However, history has shown that markets tend to recover over time, and those who remain patient and committed to their investment strategies are often rewarded. By keeping a long-term outlook, investors can avoid the pitfalls of reacting hastily to market swings and instead focus on the underlying fundamentals of their investments.

Moreover, it is essential for investors to stay informed about the macroeconomic factors influencing market movements. Understanding the broader economic context, such as central bank policies, geopolitical developments, and economic indicators, can provide valuable insights into potential market trends. For example, the recent decline in the British pound may be attributed to concerns over economic growth and monetary policy decisions. By staying abreast of such developments, investors can make more informed decisions and adjust their strategies accordingly.

Another important consideration is the role of risk management in an investment strategy. During periods of heightened volatility, it is crucial to reassess risk tolerance and ensure that investment portfolios are aligned with individual risk profiles. This may involve rebalancing portfolios to reduce exposure to high-risk assets or increasing allocations to more stable investments. Additionally, employing hedging strategies, such as options or futures contracts, can provide a layer of protection against adverse market movements.

Furthermore, investors should not overlook the potential opportunities that market volatility can present. While declining stock prices may be a cause for concern, they can also offer attractive entry points for long-term investors seeking to acquire quality assets at a discount. Conducting thorough research and analysis to identify undervalued stocks or sectors with strong growth potential can lead to profitable investment opportunities.

In conclusion, navigating the challenges posed by European market volatility requires a well-considered and disciplined approach. By embracing diversification, maintaining a long-term perspective, staying informed about macroeconomic factors, managing risk effectively, and seeking out opportunities amidst the turbulence, investors can position themselves to weather the storm and potentially benefit from the eventual market recovery. As the financial landscape continues to evolve, these strategies will be essential tools for investors aiming to achieve their financial goals in an uncertain environment.

Q&A

1. **What caused European stocks to drop?**

European stocks dropped due to weak earnings reports from several major companies.

2. **Which sectors were most affected by the weak earnings?**

Sectors such as technology, consumer goods, and financials were among the most affected by the weak earnings.

3. **How did the weak earnings impact investor sentiment?**

The weak earnings led to a decline in investor confidence, resulting in a sell-off in the stock market.

4. **What was the performance of the British pound in the market?**

The British pound fell against major currencies, reflecting concerns over the economic outlook.

5. **Were there any specific companies mentioned that contributed to the stock drop?**

Specific companies that reported disappointing earnings and contributed to the stock drop included major European banks and multinational corporations.

6. **How did other global markets react to the European stock drop?**

Other global markets experienced mixed reactions, with some Asian and U.S. markets also seeing declines, while others remained stable.

7. **What are analysts predicting for the future of European stocks?**

Analysts are cautious about the near-term outlook for European stocks, citing ongoing economic uncertainties and potential further earnings disappointments.

Conclusion

European stocks experienced a decline due to disappointing earnings reports, which contributed to a negative market sentiment. The weak performance in corporate earnings raised concerns about the economic outlook and investor confidence, leading to a sell-off in equities. Additionally, the British pound fell, reflecting broader market uncertainties and potential economic challenges. This market wrap highlights the sensitivity of European markets to earnings performance and currency fluctuations, underscoring the interconnectedness of financial markets and the impact of economic indicators on investor behavior.