“Unlocking the 1%: Discover the Journey to a $4 Million Milestone”

Introduction

In today’s world, the accumulation of wealth is a topic of significant interest and discussion. Achieving a net worth of $4 million is considered a major financial milestone, representing a level of affluence that many aspire to but few attain. Understanding the percentage of people who reach this level of wealth provides insight into economic disparities, the distribution of wealth, and the factors that contribute to financial success. This exploration delves into the demographics and characteristics of those who have amassed $4 million, offering a glimpse into the economic landscape and the pathways to achieving such a substantial financial goal.

Understanding Wealth Distribution: How Many People Actually Have $4 Million?

Understanding the distribution of wealth across different populations provides valuable insights into economic disparities and financial success. One intriguing question that often arises is how many individuals actually reach the significant milestone of having $4 million in net worth. This figure, while seemingly arbitrary, represents a level of financial security and affluence that many aspire to achieve. To comprehend the rarity of this achievement, it is essential to delve into the broader context of wealth distribution and the factors that contribute to reaching such a milestone.

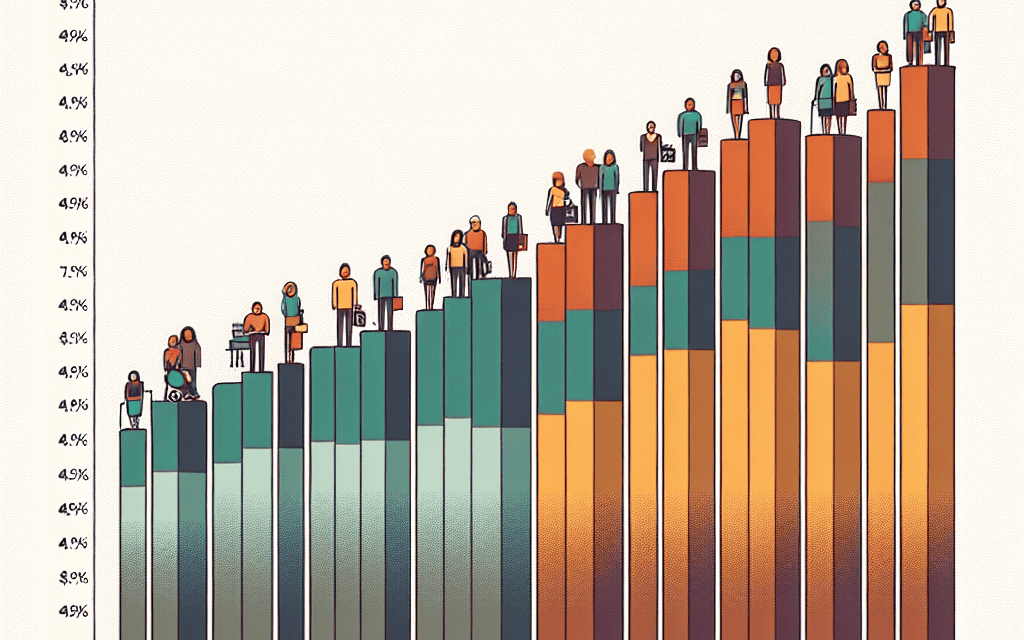

Globally, wealth distribution is highly uneven, with a small percentage of individuals controlling a substantial portion of the world’s resources. According to recent studies, the top 1% of the global population holds more wealth than the remaining 99% combined. Within this elite group, the number of individuals possessing a net worth of $4 million or more is even more limited. In the United States, for instance, which is home to a significant number of high-net-worth individuals, only a small fraction of the population reaches this level of wealth. Estimates suggest that approximately 1.5% to 2% of American households have a net worth of $4 million or more, highlighting the exclusivity of this financial echelon.

Several factors contribute to the ability to amass such wealth. Firstly, income plays a crucial role, as higher earnings provide more opportunities for savings and investments. However, income alone is not sufficient; prudent financial management, strategic investments, and a long-term perspective are equally important. Many individuals who reach the $4 million mark have diversified their portfolios, invested in real estate, or built successful businesses. Additionally, inheritance and family wealth can significantly impact one’s ability to achieve this milestone, as generational wealth transfer remains a powerful driver of financial success.

Moreover, the economic environment and market conditions also influence wealth accumulation. Periods of economic growth and stability often provide favorable conditions for wealth creation, while economic downturns can pose significant challenges. For instance, the stock market’s performance can greatly affect investment portfolios, impacting the net worth of individuals striving to reach or maintain the $4 million threshold.

It is also important to consider the role of education and access to resources in wealth accumulation. Higher education levels often correlate with higher earning potential, providing individuals with the skills and knowledge necessary to navigate complex financial landscapes. Furthermore, access to financial advice and resources can empower individuals to make informed decisions about investments and wealth management.

While reaching a net worth of $4 million is a notable achievement, it is crucial to recognize that wealth is not solely a measure of financial success. Factors such as quality of life, personal fulfillment, and contributions to society also play significant roles in defining success. Nonetheless, understanding the distribution of wealth and the factors that contribute to reaching such milestones can provide valuable insights into economic disparities and the opportunities available to individuals.

In conclusion, the percentage of people who achieve a net worth of $4 million is relatively small, reflecting the broader patterns of wealth distribution and the various factors that influence financial success. By examining these elements, we gain a deeper understanding of the economic landscape and the challenges and opportunities that individuals face in their pursuit of financial milestones.

The Journey to $4 Million: What It Takes to Reach This Wealth Milestone

Reaching a net worth of $4 million is a significant financial milestone that few individuals achieve. This level of wealth often signifies not only financial security but also the ability to enjoy a lifestyle that includes luxury, philanthropy, and the freedom to pursue personal passions without the constraints of financial limitations. However, the journey to amassing such wealth is complex and multifaceted, involving a combination of strategic planning, disciplined saving, and often, a bit of luck.

To understand how many people reach this milestone, it is essential to consider the broader context of wealth distribution. According to recent data, only a small percentage of the population achieves a net worth of $4 million or more. In the United States, for instance, estimates suggest that less than 5% of households reach this level of wealth. This statistic underscores the rarity of such financial success and highlights the challenges involved in accumulating substantial assets.

Several factors contribute to the ability to reach a $4 million net worth. First and foremost, income plays a crucial role. High earners, particularly those in lucrative fields such as technology, finance, and entrepreneurship, have a greater potential to save and invest significant sums of money. However, income alone is not sufficient. Effective wealth accumulation requires prudent financial management, including budgeting, saving, and investing wisely. Individuals who reach this milestone often exhibit a strong understanding of financial markets and employ strategies that maximize returns while minimizing risks.

Moreover, the power of compounding cannot be overstated. Those who start investing early in life and consistently contribute to their investment portfolios are more likely to see their wealth grow exponentially over time. This long-term approach to investing, often coupled with a diversified portfolio, helps mitigate market volatility and enhances the potential for substantial wealth accumulation.

In addition to income and investment strategies, lifestyle choices also play a significant role in reaching a $4 million net worth. Many individuals who achieve this level of wealth prioritize living below their means, allowing them to save and invest a larger portion of their income. This often involves making conscious decisions about spending, such as avoiding unnecessary debt and focusing on value-driven purchases.

Furthermore, entrepreneurship and business ownership can be powerful vehicles for wealth creation. Many of those who reach the $4 million mark have either started their own businesses or invested in successful ventures. The potential for significant financial returns in entrepreneurship, while accompanied by risks, can far exceed the limitations of a traditional salary.

Inheritance and family wealth also contribute to reaching this financial milestone for some individuals. While not everyone has the advantage of receiving a substantial inheritance, those who do often have a head start in building their wealth. However, it is important to note that inheriting wealth does not guarantee financial success; effective management and growth of these assets are crucial.

In conclusion, reaching a net worth of $4 million is a notable achievement that requires a combination of high income, strategic investment, disciplined saving, and often entrepreneurial endeavors. While only a small percentage of the population attains this level of wealth, understanding the factors that contribute to such success can provide valuable insights for those aspiring to achieve similar financial goals. The journey to $4 million is not solely about financial acumen but also about making informed decisions and maintaining a long-term perspective on wealth accumulation.

Global Wealth Statistics: A Closer Look at the $4 Million Mark

In the realm of global wealth, reaching a net worth of $4 million is a significant milestone that few achieve. This figure represents not just financial security but also a level of affluence that allows for a comfortable lifestyle, investment opportunities, and the ability to influence economic and social spheres. Understanding how many people reach this level of wealth provides insight into the distribution of wealth worldwide and highlights the economic disparities that exist across different regions and demographics.

To begin with, it is essential to recognize that the global distribution of wealth is highly uneven. According to recent studies, only a small fraction of the world’s population can claim a net worth of $4 million or more. In fact, estimates suggest that less than 1% of the global population reaches this level of wealth. This statistic underscores the concentration of wealth in the hands of a few and reflects broader economic trends that have persisted over the years.

The factors contributing to this concentration are multifaceted. Economic growth, access to education, and investment opportunities play crucial roles in wealth accumulation. In developed countries, where economic systems are more stable and opportunities for wealth creation are more abundant, individuals are more likely to reach the $4 million mark. Conversely, in developing nations, systemic challenges such as limited access to quality education, political instability, and inadequate financial infrastructure hinder wealth accumulation.

Moreover, the path to accumulating $4 million is often influenced by inheritance and family background. Many individuals who reach this wealth milestone have benefited from generational wealth transfers, which provide a significant head start in building their financial portfolios. This aspect of wealth accumulation further perpetuates economic inequality, as those without such advantages face greater challenges in achieving similar financial success.

In addition to these factors, the role of entrepreneurship and innovation cannot be overlooked. Many of those who reach the $4 million mark have done so through successful business ventures and investments in emerging markets. The ability to identify and capitalize on new opportunities is a hallmark of wealth creation, and it is often those with the resources and networks to take risks who succeed in this arena.

While the percentage of people with $4 million is small, the impact of this wealth on the global economy is substantial. High-net-worth individuals often have significant influence over economic policies and market trends. Their investment decisions can drive innovation, create jobs, and stimulate economic growth. However, this concentration of wealth also raises questions about economic equity and the responsibilities of the wealthy in addressing global challenges such as poverty and climate change.

In conclusion, reaching a net worth of $4 million is a milestone that few achieve, reflecting broader patterns of wealth distribution and economic disparity. The factors contributing to this level of wealth are complex and interrelated, encompassing economic opportunities, family background, and entrepreneurial success. As we continue to examine global wealth statistics, it is crucial to consider not only the numbers but also the implications for economic equity and social responsibility. Understanding these dynamics can inform policies and initiatives aimed at creating a more equitable distribution of wealth and opportunities for all.

Financial Strategies: How to Join the $4 Million Club

Reaching a net worth of $4 million is a significant financial milestone that many aspire to achieve. However, the reality is that only a small percentage of the population manages to reach this level of wealth. Understanding the factors that contribute to such financial success can provide valuable insights for those aiming to join this exclusive club. According to recent studies, only about 1% of individuals in the United States have a net worth of $4 million or more. This statistic underscores the rarity of achieving such a financial status, highlighting the challenges and strategic planning required to reach this goal.

One of the primary factors contributing to the accumulation of substantial wealth is a disciplined approach to saving and investing. Individuals who reach the $4 million mark often start by setting clear financial goals and developing a comprehensive plan to achieve them. This typically involves a combination of consistent saving, prudent investing, and careful management of expenses. By prioritizing long-term financial security over short-term gratification, these individuals are able to build a solid financial foundation that supports wealth accumulation over time.

Moreover, investing plays a crucial role in reaching the $4 million milestone. Those who achieve this level of wealth often diversify their investment portfolios, balancing risk and reward to maximize returns. They may invest in a mix of stocks, bonds, real estate, and other assets, taking advantage of compound interest and market growth. Additionally, these individuals tend to stay informed about market trends and economic conditions, allowing them to make informed investment decisions that align with their financial goals.

In addition to saving and investing, many individuals who reach the $4 million mark also focus on increasing their income. This can be achieved through career advancement, entrepreneurship, or side ventures that generate additional revenue streams. By continuously seeking opportunities for professional growth and development, these individuals are able to increase their earning potential, which in turn accelerates their journey toward financial independence.

Furthermore, effective tax planning is another critical component of wealth accumulation. High-net-worth individuals often work with financial advisors and tax professionals to develop strategies that minimize their tax liabilities. This may involve taking advantage of tax-deferred retirement accounts, utilizing tax credits and deductions, and strategically timing the sale of investments to optimize tax outcomes. By reducing their tax burden, these individuals are able to retain more of their earnings, which can be reinvested to further grow their wealth.

While reaching a net worth of $4 million is undoubtedly challenging, it is not an unattainable goal. By adopting a disciplined approach to saving, investing, and income generation, individuals can increase their chances of joining the $4 million club. It is important to remember that financial success is a journey that requires patience, perseverance, and a willingness to adapt to changing circumstances. By staying focused on their long-term goals and making informed financial decisions, individuals can work towards achieving this major wealth milestone and securing their financial future.

The Psychology of Wealth: Why $4 Million Is a Significant Benchmark

In the realm of personal finance, reaching a net worth of $4 million is often considered a significant milestone. This figure, while seemingly arbitrary, holds substantial psychological and practical implications for those who achieve it. To understand why $4 million is a noteworthy benchmark, it is essential to explore the psychology of wealth and the factors that contribute to this perception.

Firstly, the concept of wealth is inherently subjective, varying greatly depending on individual circumstances and societal norms. However, $4 million is frequently cited as a threshold for financial independence, a point at which individuals can comfortably sustain their lifestyle without the need for active income. This perception is rooted in the idea that such a sum, when invested wisely, can generate sufficient passive income to cover living expenses, thereby providing a sense of security and freedom.

Moreover, the significance of $4 million is amplified by its relative rarity. According to recent studies, only a small percentage of the population achieves this level of wealth. While exact figures can vary depending on the source and methodology, estimates suggest that less than 1% of individuals in developed countries possess a net worth of $4 million or more. This exclusivity contributes to the allure and prestige associated with reaching this financial milestone.

Transitioning from the psychological to the practical, it is important to consider the factors that enable individuals to amass such wealth. Accumulating $4 million typically requires a combination of strategic financial planning, disciplined saving, and prudent investing. Many who reach this level of wealth have benefited from a high income, often derived from successful careers or entrepreneurial ventures. However, income alone is rarely sufficient; effective wealth management, including diversification of assets and minimization of liabilities, plays a crucial role in achieving and maintaining this financial status.

Furthermore, the journey to $4 million is often marked by a long-term perspective and a willingness to embrace calculated risks. Those who attain this level of wealth frequently exhibit a strong understanding of market dynamics and a capacity to adapt to changing economic conditions. This adaptability is particularly important in an era characterized by rapid technological advancements and global economic shifts, which can present both opportunities and challenges for wealth accumulation.

In addition to financial acumen, psychological traits such as resilience, patience, and a growth mindset are instrumental in reaching the $4 million mark. The path to significant wealth is seldom linear, often requiring individuals to navigate setbacks and uncertainties. Those who succeed in this endeavor typically demonstrate an ability to learn from failures and persist in the face of adversity.

In conclusion, the $4 million benchmark is significant not only for its practical implications but also for its psychological impact. It represents a level of financial security and independence that is both aspirational and attainable for a select few. Understanding the factors that contribute to reaching this milestone, from strategic financial planning to psychological resilience, provides valuable insights into the nature of wealth and the mindset required to achieve it. As such, while only a small percentage of people reach this level of wealth, the lessons gleaned from their experiences can offer guidance and inspiration to those on their own financial journeys.

Comparing Wealth: $4 Million in Different Economies

In the realm of personal finance, reaching a net worth of $4 million is often considered a significant milestone, symbolizing financial security and success. However, the percentage of individuals who achieve this level of wealth varies considerably across different economies, influenced by factors such as economic development, income distribution, and cultural attitudes towards wealth accumulation. To understand the rarity of this achievement, it is essential to examine the economic landscapes of various countries and how they shape the distribution of wealth.

In highly developed economies, such as the United States, the number of individuals with a net worth of $4 million or more is relatively higher compared to less developed nations. This can be attributed to a combination of factors, including higher average incomes, more robust financial markets, and a greater prevalence of entrepreneurial opportunities. In the U.S., for instance, the concentration of wealth is significant, with a substantial portion of the population holding considerable assets. According to recent data, approximately 1.5% of American households have a net worth of $4 million or more. This figure, while seemingly small, represents a significant number of individuals given the country’s large population.

Transitioning to other parts of the world, the picture changes dramatically. In emerging economies, such as India and Brazil, the percentage of individuals reaching this wealth milestone is markedly lower. These countries, while experiencing rapid economic growth, still face challenges such as income inequality and limited access to financial resources for a large segment of their populations. Consequently, the concentration of wealth tends to be more pronounced, with a smaller elite holding a significant portion of the nation’s assets. In these contexts, the percentage of people with a net worth of $4 million is often less than 0.1%, highlighting the stark contrast in wealth distribution compared to more developed nations.

Furthermore, cultural factors also play a role in how wealth is accumulated and perceived. In some societies, there is a strong emphasis on saving and investing, which can facilitate the accumulation of wealth over time. In contrast, other cultures may prioritize immediate consumption or have less access to financial education, which can hinder long-term wealth accumulation. These cultural attitudes can significantly impact the number of individuals who reach the $4 million milestone.

Moreover, government policies and taxation systems can either encourage or discourage wealth accumulation. In countries with favorable tax policies for investments and savings, individuals may find it easier to grow their wealth over time. Conversely, high taxation on income and capital gains can act as a deterrent, making it more challenging for individuals to reach higher net worth levels.

In conclusion, the percentage of people who achieve a net worth of $4 million varies widely across different economies, influenced by a complex interplay of economic, cultural, and policy factors. While developed nations tend to have a higher proportion of individuals reaching this milestone, emerging economies face greater challenges in wealth distribution. Understanding these dynamics provides valuable insights into the global landscape of wealth and the factors that contribute to financial success. As economies continue to evolve, it will be interesting to observe how these patterns shift and what new opportunities may arise for individuals striving to reach this significant financial milestone.

The Impact of $4 Million: Lifestyle Changes and Opportunities

Reaching a net worth of $4 million is a significant financial milestone that few individuals achieve. This level of wealth opens up a myriad of lifestyle changes and opportunities that can dramatically alter one’s quality of life. To understand the impact of having $4 million, it is essential to first consider the rarity of this achievement. According to various financial studies and wealth distribution data, only a small percentage of the population reaches this level of affluence. Estimates suggest that less than 1% of individuals in the United States have a net worth of $4 million or more. This elite group enjoys a range of benefits and opportunities that are often out of reach for the average person.

One of the most immediate lifestyle changes for those with $4 million is financial security. This level of wealth provides a substantial safety net, allowing individuals to weather economic downturns, unexpected expenses, and other financial challenges with relative ease. Moreover, it offers the freedom to make life choices without the constraints of financial necessity. For instance, individuals can choose to retire early, pursue passion projects, or invest in new business ventures without the pressure of needing immediate financial returns.

In addition to financial security, having $4 million can significantly enhance one’s lifestyle through access to luxury goods and services. This includes the ability to purchase high-end real estate, travel extensively, and enjoy premium experiences that are often reserved for the wealthy. Furthermore, this level of wealth allows for greater investment in personal well-being, such as access to top-tier healthcare, fitness programs, and wellness retreats. These opportunities contribute to an overall higher quality of life and can lead to improved physical and mental health.

Beyond personal benefits, reaching a net worth of $4 million also opens up opportunities for philanthropy and social impact. Individuals with this level of wealth have the means to support charitable causes and contribute to their communities in meaningful ways. This can include establishing foundations, funding scholarships, or supporting local initiatives. The ability to make a positive impact on society can be a fulfilling aspect of wealth, providing a sense of purpose and legacy.

However, it is important to recognize that with great wealth comes increased responsibility. Managing a $4 million portfolio requires careful planning and strategic decision-making to ensure that the wealth is preserved and continues to grow. This often involves working with financial advisors, tax professionals, and estate planners to navigate the complexities of wealth management. Additionally, individuals must be mindful of the potential social and familial dynamics that can arise with significant wealth, such as managing expectations and relationships with family and friends.

In conclusion, reaching a net worth of $4 million is a rare and significant achievement that brings about profound lifestyle changes and opportunities. While it offers financial security, luxury, and the ability to make a positive impact, it also requires careful management and responsibility. For those who achieve this milestone, the benefits are substantial, providing a foundation for a life of comfort, fulfillment, and influence. As such, understanding the impact of $4 million is not only about recognizing the privileges it affords but also appreciating the responsibilities it entails.

Q&A

1. What percentage of people have $4 million or more in net worth?

– Approximately 0.5% to 1% of the global population.

2. How many people in the United States have a net worth of $4 million or more?

– Around 1.5 million to 2 million people.

3. What factors contribute to reaching a net worth of $4 million?

– High income, investments, real estate, inheritance, and business ownership.

4. Is $4 million considered a significant wealth milestone?

– Yes, it is considered a significant milestone, often associated with financial independence.

5. How does the percentage of people with $4 million compare to those with $1 million?

– The percentage is significantly lower; more people have $1 million than $4 million.

6. What age group is most likely to have a net worth of $4 million?

– Typically, individuals aged 50 and above.

7. How does the distribution of $4 million in net worth vary globally?

– It varies widely, with higher concentrations in developed countries like the United States and Western Europe.

Conclusion

Reaching a net worth of $4 million is a significant financial milestone that only a small percentage of the population achieves. According to various wealth distribution studies and data, a very limited portion of individuals, often less than 1% in many countries, possess this level of wealth. This concentration of wealth highlights the disparities in income and asset accumulation, influenced by factors such as inheritance, investment strategies, career choices, and economic conditions. Understanding these dynamics is crucial for addressing economic inequality and creating opportunities for broader wealth accumulation.