“Navigating the Horizon: A Bullish Technical Outlook for Intermediate-Term Gains.”

Introduction

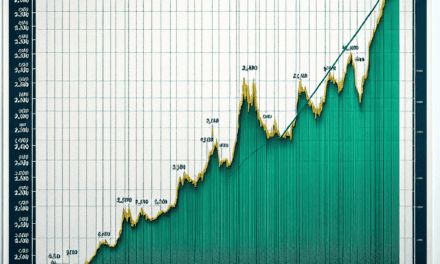

The Intermediate-Term Outlook presents a bullish technical assessment, indicating a positive trajectory for market performance over the coming months. This outlook is characterized by key technical indicators suggesting upward momentum, including strong support levels, favorable moving averages, and bullish chart patterns. Market sentiment is reinforced by increasing trading volumes and positive divergences in momentum indicators, signaling potential for sustained gains. Investors may find opportunities in sectors exhibiting resilience and growth potential, as the overall market environment appears conducive to upward price movements.

Market Trends: Analyzing Bullish Patterns

In the realm of financial markets, the analysis of bullish patterns is crucial for investors seeking to navigate the complexities of price movements and trends. As we delve into the intermediate-term outlook, it becomes evident that a bullish technical assessment is warranted based on several key indicators and patterns that have emerged in recent months. These indicators not only reflect the current market sentiment but also provide insights into potential future movements, thereby guiding investment strategies.

To begin with, one of the most significant bullish patterns observed is the formation of higher highs and higher lows in price charts. This pattern indicates a consistent upward trajectory, suggesting that buyers are gaining control over the market. As prices break through previous resistance levels, it reinforces the notion of sustained bullish momentum. Furthermore, the presence of strong volume accompanying these price movements serves as a confirmation of the trend, indicating that the buying interest is robust and likely to continue.

In addition to price patterns, technical indicators such as moving averages play a pivotal role in assessing market trends. The convergence of short-term moving averages above long-term moving averages, often referred to as a “golden cross,” is a classic bullish signal. This phenomenon suggests that the momentum is shifting in favor of buyers, and it often attracts additional market participants who may have been waiting for confirmation before entering positions. As these moving averages continue to diverge, the bullish sentiment is further solidified, providing a strong foundation for potential price appreciation.

Moreover, the analysis of relative strength index (RSI) levels can offer valuable insights into market conditions. An RSI reading above 50 typically indicates that the market is in a bullish phase, while readings approaching 70 may suggest overbought conditions. However, it is essential to interpret these signals within the context of prevailing market trends. A sustained period of RSI readings above 50, coupled with price increases, can indicate a healthy bullish environment, suggesting that the upward momentum is likely to persist.

Transitioning to broader market trends, it is important to consider macroeconomic factors that may influence investor sentiment. For instance, favorable economic indicators such as low unemployment rates, rising consumer confidence, and robust corporate earnings can create a conducive environment for bullish trends to flourish. When investors perceive a stable economic backdrop, they are more inclined to engage in riskier assets, further fueling bullish patterns in the market.

Additionally, geopolitical stability and favorable monetary policies can enhance the bullish outlook. Central banks’ commitment to maintaining accommodative monetary policies, such as low interest rates and quantitative easing, can provide the necessary liquidity to support market growth. As capital flows into equities and other risk assets, the resulting demand can drive prices higher, reinforcing the bullish sentiment.

In conclusion, the intermediate-term outlook for the market appears bullish, supported by a confluence of technical patterns, favorable economic indicators, and supportive macroeconomic conditions. As investors analyze these trends, it is crucial to remain vigilant and adaptable, as market dynamics can shift rapidly. However, the current landscape suggests that the bullish momentum is likely to continue, providing opportunities for those who are prepared to capitalize on the prevailing trends. By closely monitoring these indicators and patterns, investors can position themselves strategically to benefit from the anticipated upward movement in the market.

Key Indicators: Identifying Bullish Signals

In the realm of financial markets, the ability to discern bullish signals is paramount for investors seeking to capitalize on upward price movements. As we delve into the intermediate-term outlook, it becomes essential to identify key indicators that suggest a bullish trend may be on the horizon. These indicators serve as vital tools for traders and analysts alike, providing insights that can guide investment decisions and strategies.

One of the most significant indicators to consider is the moving average convergence divergence (MACD). This momentum indicator not only helps in identifying the direction of the trend but also signals potential reversals. When the MACD line crosses above the signal line, it often indicates a bullish momentum shift, suggesting that upward price movement may be forthcoming. Furthermore, when the MACD histogram turns positive, it reinforces the notion that buying pressure is increasing, thereby bolstering the case for a bullish outlook.

In addition to the MACD, the relative strength index (RSI) plays a crucial role in assessing market conditions. The RSI measures the speed and change of price movements, oscillating between values of 0 and 100. A reading above 70 typically indicates that an asset is overbought, while a reading below 30 suggests it is oversold. However, when the RSI begins to trend upwards from an oversold condition, it can signal a potential bullish reversal. This upward movement, particularly when accompanied by increasing volume, can provide further confirmation of a strengthening bullish sentiment in the market.

Moreover, analyzing volume trends is essential in validating price movements. An increase in volume accompanying price rises often indicates strong buying interest, which can be a precursor to sustained upward momentum. Conversely, if prices rise but volume remains stagnant or declines, it may suggest a lack of conviction among buyers, potentially leading to a price correction. Therefore, observing volume patterns alongside price action can provide critical insights into the strength of a bullish trend.

Another key indicator to consider is the formation of bullish chart patterns. Patterns such as ascending triangles, double bottoms, and cup-and-handle formations often signal potential bullish breakouts. When these patterns emerge, they can indicate that buyers are gaining control over sellers, setting the stage for a significant price increase. Traders often look for confirmation through a breakout above resistance levels, accompanied by increased volume, to validate the bullish signal.

Furthermore, the broader market context cannot be overlooked. Economic indicators, such as GDP growth, employment rates, and consumer confidence, can significantly influence market sentiment. A robust economic backdrop often correlates with bullish market conditions, as investors tend to be more optimistic about future earnings and growth prospects. Therefore, keeping an eye on macroeconomic trends can provide additional layers of insight into the potential for bullish movements.

In conclusion, identifying bullish signals requires a multifaceted approach that encompasses various technical indicators, volume analysis, chart patterns, and macroeconomic factors. By synthesizing these elements, investors can develop a more comprehensive understanding of market dynamics and enhance their decision-making processes. As the intermediate-term outlook appears increasingly bullish, remaining vigilant in monitoring these key indicators will be essential for capitalizing on potential opportunities in the market. Ultimately, a disciplined approach to analysis can empower investors to navigate the complexities of financial markets with greater confidence and foresight.

Sector Performance: Which Industries Are Leading?

In the current market landscape, a comprehensive analysis of sector performance reveals a distinct pattern of leadership among various industries, underscoring the bullish technical assessment for the intermediate term. As investors seek to navigate the complexities of the financial environment, understanding which sectors are poised for growth becomes paramount. Notably, technology and healthcare sectors have emerged as frontrunners, demonstrating resilience and potential for continued upward momentum.

The technology sector, in particular, has been a beacon of strength, driven by rapid advancements in innovation and an increasing reliance on digital solutions across various industries. Companies within this sector are not only benefiting from heightened demand for cloud computing and artificial intelligence but are also capitalizing on the ongoing digital transformation that businesses are undergoing. This shift has led to robust earnings reports and positive forward guidance, which further bolsters investor confidence. As a result, technology stocks have consistently outperformed the broader market, establishing a solid foundation for future growth.

Transitioning to the healthcare sector, it is evident that this industry is also experiencing a significant upswing. The ongoing focus on health and wellness, exacerbated by recent global events, has catalyzed investment in biotechnology and pharmaceutical companies. These firms are at the forefront of developing innovative treatments and vaccines, which not only address immediate health concerns but also promise long-term growth potential. Furthermore, the aging population and increasing healthcare expenditures are likely to sustain demand for healthcare services and products, positioning this sector favorably in the intermediate term.

In addition to technology and healthcare, the consumer discretionary sector is also showing signs of strength. As economic conditions improve and consumer confidence rises, spending in this sector is expected to increase. Retailers, particularly those with a strong online presence, are well-positioned to capitalize on this trend. The shift towards e-commerce has transformed the retail landscape, allowing companies that adapt quickly to changing consumer preferences to thrive. Consequently, this sector’s performance is likely to remain robust, contributing positively to the overall market outlook.

Moreover, the energy sector is beginning to regain traction, driven by a combination of rising oil prices and a renewed focus on sustainable energy solutions. As the world transitions towards greener alternatives, companies that invest in renewable energy sources are likely to benefit from both regulatory support and increasing consumer demand. This dual focus on traditional energy and sustainable practices positions the energy sector as a potential leader in the coming months.

While these sectors exhibit promising performance, it is essential to remain cognizant of potential risks that could impact their trajectories. Geopolitical tensions, inflationary pressures, and shifts in monetary policy could introduce volatility into the market. However, the underlying fundamentals of the leading sectors suggest that they are equipped to weather such challenges. Investors should consider diversifying their portfolios to include exposure to these high-performing industries, as they are likely to drive market gains in the intermediate term.

In conclusion, the current sector performance indicates a bullish technical assessment, with technology, healthcare, consumer discretionary, and energy leading the charge. As these industries continue to evolve and adapt to changing market dynamics, they present compelling opportunities for investors seeking growth. By focusing on these sectors, one can position themselves advantageously in a market that is poised for upward movement.

Risk Management: Strategies for Bullish Markets

In the context of a bullish market, effective risk management becomes paramount for investors seeking to capitalize on upward price movements while safeguarding their capital. As market conditions evolve, it is essential to adopt strategies that not only enhance potential returns but also mitigate the inherent risks associated with bullish trends. One of the primary strategies involves diversification, which serves as a foundational principle in risk management. By spreading investments across various asset classes, sectors, and geographic regions, investors can reduce the impact of adverse movements in any single investment. This approach not only helps in capturing gains from multiple sources but also cushions the portfolio against volatility that may arise from concentrated positions.

Moreover, employing stop-loss orders is another prudent strategy in a bullish market. These orders allow investors to set predetermined exit points for their positions, thereby limiting potential losses should the market take an unexpected downturn. By establishing stop-loss levels based on technical analysis or a percentage of the investment, investors can maintain discipline and avoid emotional decision-making during periods of market fluctuation. This technique is particularly beneficial in a bullish environment, where prices may rise rapidly, but corrections can occur just as swiftly.

In addition to diversification and stop-loss orders, position sizing plays a critical role in risk management. Investors should carefully consider the size of each position relative to their overall portfolio and risk tolerance. By allocating a smaller percentage of the portfolio to higher-risk investments, investors can protect their capital while still participating in the potential upside of bullish trends. This method not only helps in managing risk but also allows for greater flexibility in adjusting positions as market conditions change.

Furthermore, utilizing options as a hedging strategy can provide an additional layer of protection in a bullish market. Options allow investors to hedge against potential declines in their equity positions while still benefiting from upward price movements. For instance, purchasing put options can provide a safety net, enabling investors to limit losses if the market reverses. This strategy is particularly advantageous in a bullish environment, where the potential for profit is significant, yet the risk of sudden corrections remains.

As investors navigate a bullish market, it is also essential to remain vigilant and continuously monitor market conditions. Regularly reviewing economic indicators, market sentiment, and technical signals can provide valuable insights into potential shifts in the market landscape. By staying informed, investors can make timely adjustments to their strategies, ensuring that they remain aligned with their risk tolerance and investment objectives.

In conclusion, effective risk management in a bullish market requires a multifaceted approach that encompasses diversification, stop-loss orders, position sizing, and hedging strategies. By implementing these techniques, investors can enhance their potential for profit while safeguarding their capital against unforeseen market fluctuations. As the market continues to evolve, maintaining a disciplined and informed approach will be crucial for navigating the complexities of bullish trends. Ultimately, the goal is to strike a balance between seizing opportunities for growth and managing the risks that accompany them, thereby fostering a sustainable investment strategy that can withstand the test of time.

Technical Analysis: Chart Patterns to Watch

In the realm of technical analysis, chart patterns serve as vital indicators for traders and investors seeking to navigate the complexities of market movements. As we delve into the intermediate-term outlook, it becomes increasingly evident that certain chart patterns are emerging, suggesting a bullish technical assessment. These patterns not only provide insights into potential price movements but also help in formulating strategic entry and exit points.

One of the most prominent patterns to observe is the ascending triangle, characterized by a horizontal resistance line and an upward-sloping support line. This formation typically indicates a consolidation phase where buyers gradually gain strength, leading to a potential breakout above the resistance level. As the price approaches the apex of the triangle, the likelihood of a bullish move increases, making it a critical pattern for traders to monitor. The volume accompanying the breakout is also essential; a surge in volume can confirm the strength of the move, reinforcing the bullish sentiment.

In addition to the ascending triangle, the cup and handle pattern is another significant formation that warrants attention. This pattern resembles the shape of a cup, followed by a consolidation phase that forms the handle. The cup and handle pattern often signifies a period of accumulation, where investors are positioning themselves for a potential upward movement. When the price breaks above the resistance level formed by the handle, it typically signals a strong bullish trend. Traders should be vigilant for this pattern, as it has historically provided substantial profit opportunities.

Moreover, the double bottom pattern is a classic reversal formation that can indicate a shift from a bearish to a bullish trend. This pattern occurs when the price hits a low point, rebounds, and then revisits the same low before making a decisive move upward. The confirmation of a double bottom is often marked by a breakout above the resistance level established during the rebound. As such, this pattern can serve as a powerful signal for traders looking to capitalize on a potential trend reversal.

Transitioning from these specific patterns, it is also crucial to consider the broader context of market indicators. For instance, moving averages can provide additional confirmation of bullish trends. When the short-term moving average crosses above the long-term moving average, it generates a golden cross, which is often interpreted as a strong bullish signal. This crossover can serve as a reliable indicator for traders to enter positions, particularly when aligned with the aforementioned chart patterns.

Furthermore, the Relative Strength Index (RSI) can be an invaluable tool in assessing market momentum. An RSI reading above 50 typically indicates bullish momentum, while readings approaching 70 may suggest overbought conditions. By integrating the RSI with chart patterns, traders can enhance their decision-making process, ensuring that they are not only relying on price action but also on momentum indicators.

In conclusion, the intermediate-term outlook appears bullish, supported by various chart patterns that signal potential upward movements. The ascending triangle, cup and handle, and double bottom patterns are particularly noteworthy, as they provide traders with actionable insights into market dynamics. Coupled with moving averages and momentum indicators like the RSI, these technical tools can empower investors to make informed decisions in a fluctuating market environment. As always, prudent risk management and a comprehensive analysis of market conditions remain essential for navigating the complexities of trading.

Economic Factors: Supporting a Bullish Outlook

The intermediate-term outlook for various financial markets appears increasingly bullish, driven by a confluence of economic factors that support this optimistic assessment. As we delve into the intricacies of these elements, it becomes evident that a robust economic environment is fostering investor confidence and encouraging market participation. One of the primary drivers of this bullish sentiment is the sustained recovery from the disruptions caused by the global pandemic. As economies around the world continue to reopen and adapt to new norms, indicators such as GDP growth, employment rates, and consumer spending are showing signs of resilience and upward momentum.

Moreover, central banks have played a pivotal role in shaping the economic landscape. With interest rates remaining at historically low levels, borrowing costs for both consumers and businesses have decreased significantly. This environment not only stimulates spending but also encourages investment in capital projects, which can lead to job creation and further economic expansion. As businesses take advantage of favorable financing conditions, the ripple effect can be seen across various sectors, contributing to a more vibrant economic climate.

In addition to monetary policy, fiscal measures implemented by governments worldwide have bolstered economic recovery efforts. Stimulus packages aimed at supporting individuals and businesses have injected liquidity into the economy, enhancing consumer confidence and spending power. This influx of capital has been particularly beneficial for sectors that were hard-hit during the pandemic, such as travel, hospitality, and retail. As these industries rebound, they contribute to overall economic growth, reinforcing the bullish outlook for the markets.

Furthermore, the labor market is showing signs of improvement, with unemployment rates gradually declining and job openings reaching record highs. This trend not only reflects a recovering economy but also indicates that businesses are optimistic about future demand. As more individuals secure employment, disposable income rises, leading to increased consumer spending. This cycle of growth is essential for sustaining the bullish sentiment in the markets, as consumer spending accounts for a significant portion of economic activity.

Another critical factor supporting a bullish outlook is the ongoing advancements in technology and innovation. The rapid digital transformation accelerated by the pandemic has created new opportunities for businesses to thrive. Companies that have embraced technology are not only enhancing their operational efficiencies but are also tapping into new revenue streams. This shift towards a more tech-driven economy is likely to attract investment, further propelling market growth.

Additionally, global supply chain disruptions, while initially a concern, are gradually being addressed. As companies adapt to new logistics and sourcing strategies, the resilience of supply chains is improving. This stabilization is crucial for maintaining production levels and meeting consumer demand, which in turn supports economic growth and market optimism.

In conclusion, the intermediate-term outlook remains bullish, underpinned by a variety of economic factors that collectively foster a conducive environment for growth. The combination of low interest rates, supportive fiscal policies, a recovering labor market, technological advancements, and improving supply chains creates a robust foundation for sustained market performance. As these elements continue to evolve, they will likely reinforce investor confidence and drive further participation in the markets, solidifying the bullish sentiment that characterizes the current economic landscape.

Investor Sentiment: Gauging Market Confidence

Investor sentiment plays a crucial role in shaping market dynamics, influencing both short-term fluctuations and intermediate-term trends. As we assess the current landscape, it becomes evident that a bullish technical assessment is underpinned by a growing sense of confidence among investors. This sentiment is not merely a reflection of market movements; rather, it encapsulates the collective psychology of market participants, which can significantly impact trading behavior and investment decisions.

To begin with, the prevailing investor sentiment is often gauged through various indicators, including surveys, market volume, and volatility measures. Recent data suggests that a substantial portion of investors are adopting a more optimistic outlook, driven by a combination of favorable economic indicators and positive corporate earnings reports. For instance, as companies continue to report better-than-expected earnings, investor confidence tends to rise, leading to increased buying activity. This phenomenon is particularly evident in sectors that have shown resilience in the face of economic challenges, further reinforcing the bullish sentiment.

Moreover, the technical indicators themselves are reflecting this optimism. Key metrics such as moving averages and relative strength indices are signaling upward momentum, suggesting that the market may be poised for further gains. When these technical signals align with positive investor sentiment, it creates a powerful synergy that can propel markets higher. Consequently, as more investors recognize these bullish signals, they are likely to enter the market, thereby amplifying the upward trajectory.

In addition to technical indicators, the broader economic context cannot be overlooked. Factors such as low unemployment rates, stable inflation, and accommodative monetary policy contribute to a favorable environment for investment. As these economic conditions persist, they bolster investor confidence, encouraging a more aggressive approach to asset allocation. This shift in sentiment is particularly important in the intermediate term, as it suggests that investors are willing to look beyond short-term volatility and focus on the potential for sustained growth.

Furthermore, the role of institutional investors should be highlighted, as their actions often set the tone for market sentiment. When large institutional players exhibit confidence in the market, it can create a ripple effect, encouraging retail investors to follow suit. This collective behavior can lead to increased market participation, further solidifying the bullish outlook. As institutional investors continue to allocate capital towards equities, their confidence serves as a barometer for the overall market sentiment.

However, it is essential to remain cognizant of potential headwinds that could impact this bullish sentiment. Geopolitical tensions, regulatory changes, and unexpected economic data releases can introduce uncertainty, which may lead to fluctuations in investor confidence. Nevertheless, the current technical assessment suggests that, barring significant disruptions, the prevailing sentiment is likely to remain positive in the intermediate term.

In conclusion, gauging investor sentiment reveals a landscape characterized by optimism and confidence, which is reflected in the bullish technical assessment of the market. As investors respond to favorable economic indicators and positive corporate performance, the interplay between sentiment and technical signals creates a conducive environment for growth. While vigilance is necessary to navigate potential challenges, the current outlook remains promising, suggesting that the market may continue to thrive in the coming months. Ultimately, understanding the nuances of investor sentiment will be key for market participants as they position themselves for future opportunities.

Q&A

1. **Question:** What does a bullish technical assessment indicate for the intermediate-term outlook?

**Answer:** It suggests that prices are expected to rise based on technical indicators and market trends.

2. **Question:** Which technical indicators are commonly used to support a bullish outlook?

**Answer:** Moving averages, Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence) are commonly used.

3. **Question:** How can support and resistance levels influence a bullish assessment?

**Answer:** A strong support level indicates that prices are likely to bounce back, while breaking through resistance can signal further upward movement.

4. **Question:** What role does volume play in a bullish technical assessment?

**Answer:** Increased trading volume during price increases can confirm the strength of a bullish trend.

5. **Question:** How does market sentiment affect a bullish technical outlook?

**Answer:** Positive market sentiment can drive buying pressure, reinforcing a bullish trend.

6. **Question:** What is the significance of chart patterns in a bullish assessment?

**Answer:** Bullish chart patterns, such as ascending triangles or cup-and-handle formations, can indicate potential price increases.

7. **Question:** How should investors approach risk management in a bullish technical scenario?

**Answer:** Investors should set stop-loss orders and diversify their portfolios to mitigate potential losses while capitalizing on upward trends.

Conclusion

The intermediate-term outlook is bullish based on strong technical indicators, including upward momentum in price trends, positive moving averages, and robust support levels. Market sentiment appears favorable, with increasing buying pressure and a lack of significant resistance. Overall, the technical assessment suggests a continued upward trajectory in the near term.