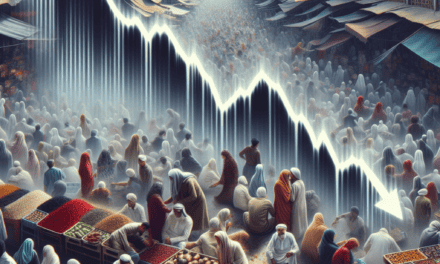

“Constellation Brands Shares Plummet After Earnings Miss Expectations.”

Introduction

Constellation Brands, a leading beverage alcohol company known for its portfolio of beer, wine, and spirits, recently experienced a significant decline in its stock shares following the release of its latest earnings report. The disappointing financial results, which fell short of market expectations, raised concerns among investors about the company’s growth prospects and operational challenges. Factors contributing to the earnings miss included increased production costs, shifts in consumer preferences, and heightened competition in the beverage industry. As a result, analysts and shareholders are closely monitoring the company’s strategic responses to these challenges and the potential impact on its future performance.

Constellation Brands Earnings Report Analysis

Constellation Brands, a prominent player in the beverage alcohol industry, recently released its earnings report, which has sparked considerable concern among investors and analysts alike. The report revealed a significant shortfall in earnings compared to market expectations, leading to a notable decline in the company’s stock price. This downturn has raised questions about the underlying factors contributing to the disappointing results and the potential implications for the company’s future performance.

To begin with, the earnings report indicated that Constellation Brands experienced a decline in sales across several key product lines, particularly in its beer segment, which has traditionally been a stronghold for the company. The decline in sales can be attributed to a combination of factors, including increased competition in the craft beer market and shifting consumer preferences towards healthier beverage options. As consumers become more health-conscious, there has been a noticeable trend away from traditional alcoholic beverages, which has put pressure on Constellation’s flagship brands. This shift in consumer behavior is not only affecting sales but also challenging the company’s marketing strategies, as it seeks to adapt to a rapidly changing landscape.

Moreover, the earnings report highlighted rising production costs, which have further squeezed profit margins. The inflationary pressures affecting the broader economy have not spared the beverage industry, with increased costs for raw materials and transportation impacting Constellation’s bottom line. As the company grapples with these rising expenses, it faces the difficult task of balancing price increases with the risk of losing price-sensitive customers. This delicate balancing act is crucial, as any misstep could exacerbate the decline in sales and further erode investor confidence.

In addition to these operational challenges, Constellation Brands is also navigating a complex regulatory environment. Changes in alcohol regulations, particularly concerning distribution and marketing, can have significant implications for the company’s ability to reach consumers effectively. As the regulatory landscape continues to evolve, Constellation must remain agile and responsive to ensure compliance while also capitalizing on new market opportunities. This adaptability will be essential for the company to regain its footing in a competitive market.

Furthermore, the earnings report has prompted analysts to reassess their outlook for Constellation Brands. Many have downgraded their ratings, reflecting a more cautious stance on the company’s growth prospects. This shift in sentiment is evident in the stock market, where shares have taken a hit following the announcement. Investors are now closely monitoring the company’s strategic initiatives aimed at revitalizing growth, including potential acquisitions and product innovations. The success of these initiatives will be critical in determining whether Constellation can recover from this earnings disappointment and restore investor confidence.

In conclusion, Constellation Brands’ recent earnings report has unveiled a series of challenges that the company must address to navigate the current market landscape successfully. With declining sales, rising production costs, and a complex regulatory environment, the path forward is fraught with obstacles. However, the company’s ability to adapt to changing consumer preferences and implement effective strategies will be pivotal in shaping its future trajectory. As investors and analysts continue to scrutinize Constellation’s performance, the coming months will be crucial in determining whether the company can rebound from this setback and reclaim its position as a leader in the beverage alcohol industry.

Impact of Earnings Disappointment on Stock Performance

The recent earnings report from Constellation Brands has sent shockwaves through the financial markets, leading to a significant decline in the company’s stock performance. This downturn can be attributed to a combination of factors that investors and analysts have closely scrutinized. When a company fails to meet earnings expectations, it often triggers a cascade of reactions among stakeholders, resulting in a reevaluation of the stock’s value. In the case of Constellation Brands, the disappointing earnings report not only fell short of analysts’ forecasts but also raised concerns about the company’s future growth prospects.

Investors typically react swiftly to earnings reports, particularly when the results deviate from anticipated figures. In this instance, Constellation Brands reported lower-than-expected revenue and profit margins, which prompted immediate selling pressure on its shares. The market’s reaction was exacerbated by the broader economic context, where inflationary pressures and changing consumer preferences have already created a challenging environment for beverage companies. As a result, the stock experienced a sharp decline, reflecting the market’s loss of confidence in the company’s ability to navigate these headwinds effectively.

Moreover, the disappointment in earnings has led to a reassessment of Constellation Brands’ strategic initiatives. Investors are now questioning the effectiveness of the company’s growth strategies, particularly in the highly competitive alcoholic beverage sector. The company’s efforts to diversify its product offerings and expand into new markets have been met with skepticism, especially in light of the recent performance. This uncertainty has further fueled the stock’s decline, as investors weigh the potential risks against the company’s long-term growth trajectory.

In addition to immediate stock price reactions, earnings disappointments can have lasting effects on investor sentiment. The decline in Constellation Brands’ shares may lead to a more cautious approach from institutional investors, who often play a significant role in stock price movements. If these investors decide to reduce their holdings or shift their focus to more promising opportunities, the stock could face additional downward pressure. This shift in sentiment can create a feedback loop, where declining stock prices lead to further selling, compounding the initial impact of the earnings report.

Furthermore, the earnings disappointment has implications for analysts’ ratings and target prices. Following the report, several analysts have revised their forecasts for Constellation Brands, downgrading their ratings and lowering target prices. This shift in analyst sentiment can influence retail investors’ perceptions and decisions, leading to a broader sell-off. As analysts reassess the company’s fundamentals, the potential for recovery may seem distant, further contributing to the stock’s volatility.

In conclusion, the impact of Constellation Brands’ earnings disappointment on its stock performance is multifaceted and significant. The immediate reaction of investors, coupled with a reassessment of the company’s strategic direction and analyst sentiment, has created a challenging environment for the stock. As the market digests the implications of the earnings report, it remains to be seen how Constellation Brands will respond to these challenges and whether it can regain investor confidence in the future. The path forward will likely require a concerted effort to address the underlying issues that have led to this disappointing performance, as well as a clear communication of the company’s vision for sustainable growth.

Investor Reactions to Constellation Brands’ Latest Results

Constellation Brands, a prominent player in the beverage alcohol industry, recently reported its latest earnings, which fell short of market expectations, leading to a notable decline in its share price. Investors, who had anticipated a robust performance given the company’s strong portfolio of brands, reacted swiftly to the disappointing results. The earnings report revealed a combination of factors that contributed to the underwhelming performance, including rising costs, supply chain challenges, and shifts in consumer preferences. As a result, the company’s stock experienced a significant drop, reflecting the market’s immediate response to the news.

In the wake of the earnings announcement, analysts and investors alike began to reassess their outlook on Constellation Brands. Many had previously viewed the company as a resilient entity capable of weathering economic fluctuations, thanks to its diverse range of products, which includes popular beer brands and premium wines. However, the latest results prompted a reevaluation of this perception, as investors grappled with the implications of the company’s inability to meet growth expectations. The decline in share price was not merely a reaction to the earnings miss; it also signaled a broader concern regarding the company’s strategic direction and its ability to adapt to changing market dynamics.

Moreover, the investor community expressed apprehension about the potential long-term impact of these results on Constellation Brands’ competitive positioning. The beverage alcohol market is characterized by intense competition, and any signs of weakness can lead to a loss of investor confidence. As competitors continue to innovate and capture market share, Constellation Brands must demonstrate its capacity to respond effectively to these challenges. The disappointing earnings report raised questions about the company’s operational efficiency and its ability to manage costs in an increasingly complex environment.

In addition to the immediate financial implications, the earnings disappointment also sparked discussions among investors regarding the company’s future growth prospects. Many analysts pointed to the need for Constellation Brands to refine its product offerings and enhance its marketing strategies to better align with evolving consumer preferences. The rise of health-conscious drinking trends and the growing popularity of alternative beverages have shifted the landscape, and investors are keenly aware that the company must adapt to these changes to maintain its market relevance. Consequently, the focus has shifted from short-term performance to long-term strategic planning, as stakeholders seek reassurance that Constellation Brands can navigate these challenges effectively.

As the dust settles from the earnings report, it is clear that investor sentiment has been significantly impacted. The sharp decline in share price serves as a reminder of the volatility inherent in the stock market, particularly for companies operating in sectors subject to rapid change. Moving forward, Constellation Brands will need to communicate a clear and compelling strategy to regain investor confidence. This may involve not only addressing the immediate concerns raised by the earnings miss but also outlining a vision for sustainable growth that resonates with both consumers and investors alike.

In conclusion, the recent earnings disappointment has prompted a critical reassessment of Constellation Brands by investors. The combination of rising costs, supply chain issues, and shifting consumer preferences has raised concerns about the company’s ability to maintain its competitive edge. As investors look to the future, the focus will undoubtedly be on how Constellation Brands responds to these challenges and whether it can successfully navigate the evolving landscape of the beverage alcohol industry.

Future Outlook for Constellation Brands After Earnings Miss

Constellation Brands recently faced a significant setback following its latest earnings report, which fell short of analysts’ expectations. This disappointing performance has raised concerns among investors and market analysts regarding the company’s future trajectory. As the dust settles from the earnings miss, it is essential to evaluate the potential implications for Constellation Brands and its strategic direction moving forward.

In the wake of the earnings report, Constellation Brands must address several critical factors that could influence its future performance. One of the primary areas of focus will be the company’s ability to adapt to changing consumer preferences. The beverage industry is experiencing a notable shift, with consumers increasingly gravitating towards healthier options and premium products. This trend presents both challenges and opportunities for Constellation Brands, which has historically relied on its strong portfolio of beer and wine products. To remain competitive, the company may need to innovate and diversify its offerings, potentially exploring new categories such as hard seltzers or low-alcohol beverages that align with current consumer demands.

Moreover, the competitive landscape within the beverage sector is intensifying. Constellation Brands faces pressure not only from established players but also from emerging craft brands that are capturing market share with unique and innovative products. In this context, the company must enhance its marketing strategies and brand positioning to resonate with a broader audience. By leveraging its existing distribution channels and investing in targeted advertising campaigns, Constellation Brands can strengthen its market presence and appeal to younger consumers who prioritize authenticity and quality.

Additionally, the company’s international expansion efforts will play a crucial role in shaping its future outlook. Constellation Brands has made significant investments in the Mexican beer market, particularly with its ownership stake in Grupo Modelo. As the global demand for beer continues to rise, particularly in emerging markets, the company has the opportunity to capitalize on this growth. However, navigating international markets comes with its own set of challenges, including regulatory hurdles and cultural differences. Therefore, a well-thought-out strategy that considers local preferences and market dynamics will be essential for Constellation Brands to succeed in its global endeavors.

Financially, the company must also focus on improving its operational efficiency and cost management. The recent earnings miss highlighted potential weaknesses in its cost structure, which could hinder profitability if not addressed promptly. By streamlining operations and optimizing supply chain processes, Constellation Brands can enhance its margins and create a more resilient business model. Furthermore, maintaining a strong balance sheet will be vital for the company to pursue strategic acquisitions or investments that could bolster its growth prospects.

In conclusion, while the recent earnings disappointment has cast a shadow over Constellation Brands, it also presents an opportunity for reflection and recalibration. By embracing innovation, enhancing marketing efforts, pursuing international growth, and improving operational efficiency, the company can position itself for a more favorable future. As it navigates these challenges, stakeholders will be closely monitoring Constellation Brands’ strategic decisions and their impact on the company’s long-term viability. Ultimately, the ability to adapt to a rapidly evolving market landscape will determine whether Constellation Brands can regain its footing and emerge stronger in the years to come.

Comparison of Constellation Brands with Industry Peers

Constellation Brands, a prominent player in the beverage alcohol industry, has recently faced significant challenges, particularly following a disappointing earnings report that led to a notable decline in its stock shares. This downturn invites a closer examination of Constellation Brands in relation to its industry peers, providing insights into its competitive positioning and operational strategies. When comparing Constellation Brands to other major companies in the sector, such as Anheuser-Busch InBev and Diageo, several key factors emerge that highlight both strengths and weaknesses.

To begin with, Constellation Brands has carved out a niche in the premium segment of the market, particularly with its strong portfolio of beer brands, including Corona and Modelo. This focus on premium offerings has allowed the company to capitalize on the growing consumer trend toward higher-quality products. In contrast, Anheuser-Busch InBev, while also offering premium brands, has a broader portfolio that includes a significant number of value and mainstream products. This diversification enables Anheuser-Busch to appeal to a wider audience, potentially mitigating risks associated with shifts in consumer preferences. Consequently, while Constellation Brands has excelled in premiumization, it may face challenges in maintaining market share against a competitor with a more extensive product range.

Moreover, when examining financial performance, it is essential to consider the impact of operational efficiency and cost management. Constellation Brands has made strides in optimizing its supply chain and reducing costs, yet it has struggled to match the scale and efficiency of larger competitors like Diageo. Diageo, with its vast global footprint and established distribution networks, benefits from economies of scale that allow it to operate more efficiently. This operational advantage can translate into better pricing strategies and higher margins, which are critical in a competitive landscape where profit margins are often under pressure.

In addition to operational efficiency, brand strength plays a crucial role in the competitive dynamics of the beverage alcohol industry. Constellation Brands boasts a robust portfolio of well-recognized brands, particularly in the beer segment. However, Diageo’s extensive range of spirits, including iconic brands like Johnnie Walker and Smirnoff, provides it with a diverse revenue stream that can cushion against downturns in any single category. This brand diversification is particularly relevant in times of economic uncertainty, where consumer spending patterns may shift. As such, while Constellation Brands has a strong brand presence, its reliance on a narrower product range could pose risks in fluctuating market conditions.

Furthermore, the evolving landscape of consumer preferences, particularly the increasing demand for low-alcohol and non-alcoholic beverages, presents both challenges and opportunities for Constellation Brands. While the company has begun to explore these segments, it lags behind some competitors who have already established a foothold in this growing market. For instance, Anheuser-Busch InBev has made significant investments in non-alcoholic options, positioning itself as a leader in this emerging category. As consumer trends continue to evolve, Constellation Brands must adapt swiftly to remain competitive.

In conclusion, while Constellation Brands has demonstrated strengths in premiumization and brand recognition, its recent earnings disappointment underscores the need for a strategic reassessment in comparison to its industry peers. The competitive advantages held by companies like Anheuser-Busch InBev and Diageo, particularly in terms of operational efficiency, brand diversification, and responsiveness to consumer trends, highlight the challenges Constellation Brands faces moving forward. As the beverage alcohol industry continues to evolve, the ability of Constellation Brands to adapt and innovate will be critical in determining its future success in a crowded marketplace.

Key Factors Behind Constellation Brands’ Earnings Decline

Constellation Brands, a prominent player in the beverage alcohol industry, recently experienced a significant decline in its share price following the release of its latest earnings report. This downturn has raised concerns among investors and analysts alike, prompting a closer examination of the key factors contributing to the company’s disappointing financial performance. One of the primary elements influencing Constellation Brands’ earnings decline is the shifting consumer preferences within the alcoholic beverage market. In recent years, there has been a noticeable trend toward healthier lifestyle choices, leading many consumers to seek alternatives to traditional alcoholic beverages. This shift has particularly impacted the sales of beer, a core segment for Constellation, which has historically relied on its flagship brands such as Corona and Modelo. As consumers gravitate toward low-alcohol and non-alcoholic options, Constellation has found itself at a crossroads, struggling to adapt its product offerings to meet these evolving demands.

Moreover, the competitive landscape within the beverage industry has intensified, further complicating Constellation’s efforts to maintain its market share. The rise of craft breweries and innovative beverage startups has created a saturated market, making it increasingly challenging for established brands to capture consumer attention. As new entrants continue to emerge with unique flavors and marketing strategies, Constellation’s traditional approach may no longer resonate with a younger demographic that values authenticity and novelty. Consequently, the company has faced pressure to innovate and diversify its portfolio, yet the pace of change has not been sufficient to offset the decline in its core beer sales.

In addition to changing consumer preferences and heightened competition, Constellation Brands has also grappled with supply chain disruptions that have affected its operational efficiency. The COVID-19 pandemic exposed vulnerabilities within global supply chains, leading to delays and increased costs for many companies, including Constellation. These disruptions have not only impacted the availability of raw materials but have also hindered the company’s ability to meet consumer demand in a timely manner. As a result, the company has experienced inventory shortages, which have further exacerbated its earnings challenges.

Furthermore, rising inflation has played a significant role in Constellation Brands’ earnings decline. As costs for raw materials, transportation, and labor continue to rise, the company has faced pressure to pass these expenses onto consumers. However, doing so risks alienating price-sensitive customers, particularly in a market where many consumers are already feeling the pinch of increased living costs. This delicate balancing act has left Constellation in a precarious position, as it seeks to maintain profitability while remaining competitive in a challenging economic environment.

Lastly, the company’s strategic decisions regarding acquisitions and investments have also come under scrutiny. While Constellation has made significant investments in the cannabis sector, the anticipated returns have not materialized as quickly as expected. This has led to questions about the effectiveness of its diversification strategy and whether it has diverted attention and resources away from its core beverage business. As investors reassess the company’s direction, the uncertainty surrounding its future growth prospects has contributed to the decline in share price.

In conclusion, the combination of shifting consumer preferences, increased competition, supply chain disruptions, rising inflation, and strategic missteps has culminated in a challenging landscape for Constellation Brands. As the company navigates these obstacles, it will be crucial for management to implement effective strategies that not only address current challenges but also position the brand for sustainable growth in the future.

Strategies for Investors Following Constellation Brands’ Stock Drop

Following the recent earnings disappointment that led to a significant decline in Constellation Brands’ stock, investors are faced with a challenging landscape. The company’s underperformance has raised concerns about its future growth prospects, prompting many to reassess their investment strategies. In light of this situation, it is essential for investors to consider a multifaceted approach to navigate the aftermath of the stock drop effectively.

First and foremost, investors should conduct a thorough analysis of Constellation Brands’ financial health. This involves examining key performance indicators such as revenue growth, profit margins, and cash flow. By understanding the underlying factors that contributed to the earnings miss, investors can better gauge whether the decline is a temporary setback or indicative of deeper issues within the company. Additionally, it is prudent to compare these metrics with industry benchmarks and competitors to contextualize Constellation’s performance within the broader market landscape.

Moreover, diversification remains a cornerstone of sound investment strategy, particularly in volatile markets. Investors who have a significant portion of their portfolio tied to Constellation Brands may want to consider reallocating some of their investments to other sectors or companies. This approach not only mitigates risk but also allows investors to capitalize on opportunities in industries that may be experiencing growth, thereby balancing their overall portfolio performance.

In addition to diversification, investors should keep a close eye on market trends and consumer behavior, especially in the beverage industry. As consumer preferences evolve, companies that adapt quickly to changing tastes often emerge as market leaders. For instance, the growing demand for craft beverages and low-alcohol options presents opportunities for companies that can innovate and respond to these trends. Investors should evaluate whether Constellation Brands is positioned to capitalize on such shifts or if it risks falling behind its competitors.

Furthermore, it is essential for investors to remain informed about the company’s strategic initiatives and management decisions. Following the earnings report, Constellation Brands may implement changes to its operational strategy, marketing efforts, or product offerings in response to investor feedback and market conditions. Staying updated on these developments can provide valuable insights into the company’s direction and potential for recovery. Engaging with earnings calls, investor presentations, and analyst reports can enhance an investor’s understanding of the company’s trajectory.

Another critical aspect to consider is the long-term outlook for Constellation Brands. While short-term fluctuations can be disconcerting, it is vital to assess the company’s fundamentals and growth potential over a more extended period. Investors should evaluate whether the current stock price reflects the company’s intrinsic value and whether there are opportunities for capital appreciation in the future. A long-term perspective can help investors avoid making impulsive decisions based on temporary market reactions.

Lastly, it may be beneficial for investors to consult with financial advisors or investment professionals who can provide tailored guidance based on individual risk tolerance and investment goals. Professional insights can help investors navigate the complexities of the market and make informed decisions regarding their positions in Constellation Brands and other investments.

In conclusion, while the recent earnings disappointment has undoubtedly impacted Constellation Brands’ stock, investors have several strategies at their disposal to respond effectively. By conducting thorough analyses, diversifying portfolios, staying informed about market trends, and maintaining a long-term perspective, investors can position themselves to weather the storm and potentially capitalize on future opportunities.

Q&A

1. **What caused Constellation Brands’ shares to dive?**

– The shares dropped due to disappointing earnings results that fell short of analysts’ expectations.

2. **What specific earnings metrics were below expectations?**

– The company reported lower-than-expected revenue and earnings per share (EPS) for the quarter.

3. **How did the market react to the earnings report?**

– Investors reacted negatively, leading to a significant decline in the stock price.

4. **What factors contributed to the earnings disappointment?**

– Factors included increased production costs, supply chain issues, and weaker demand for certain products.

5. **What is the outlook for Constellation Brands following the earnings report?**

– Analysts have mixed outlooks, with some suggesting potential recovery while others remain cautious due to ongoing challenges.

6. **How did Constellation Brands’ competitors perform in comparison?**

– Competitors generally reported stronger earnings, highlighting Constellation’s struggles in the market.

7. **What steps is Constellation Brands taking to address the issues?**

– The company is focusing on cost-cutting measures, improving supply chain efficiency, and enhancing product offerings to regain market confidence.

Conclusion

Constellation Brands’ shares experienced a significant decline following disappointing earnings results, reflecting investor concerns over the company’s performance and future growth prospects. The earnings miss may indicate challenges in the company’s operational strategy and market conditions, leading to a reassessment of its valuation and potential for recovery. This downturn highlights the importance of consistent performance in maintaining investor confidence and the impact of earnings reports on stock prices.