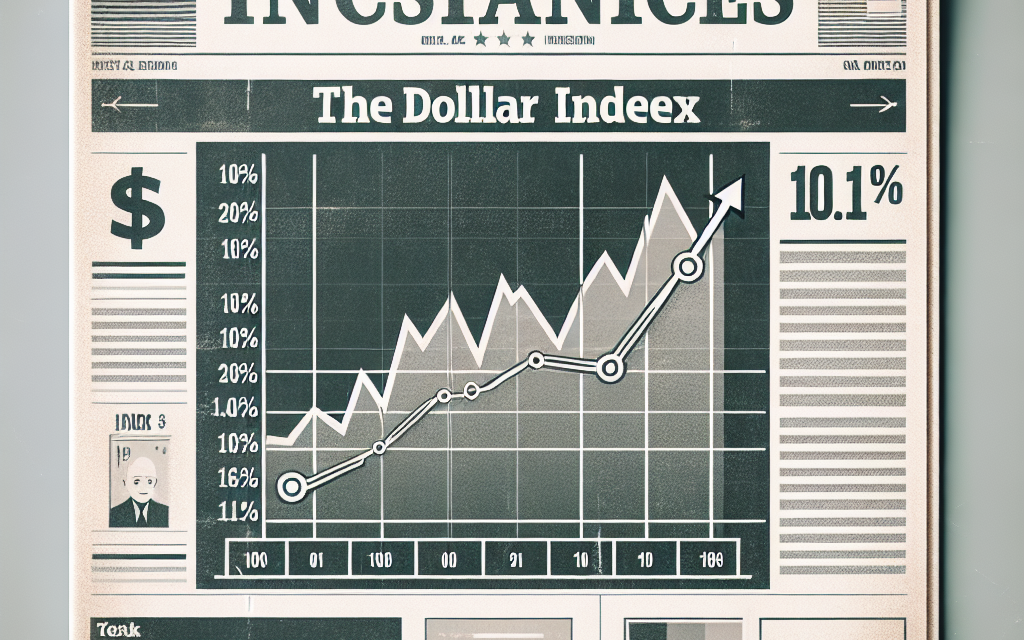

“WSJ Dollar Index Climbs 0.1% to Hit 103.24: A Steady Rise in Currency Strength.”

Introduction

The WSJ Dollar Index, a key measure of the U.S. dollar’s performance against a basket of major currencies, has seen a modest increase of 0.1%, reaching a value of 103.24. This uptick reflects ongoing fluctuations in the foreign exchange market, influenced by various economic indicators and geopolitical developments. The index serves as a barometer for the dollar’s strength, impacting international trade, investment decisions, and economic policies.

Impact of WSJ Dollar Index on Global Markets

The recent increase of 0.1% in the WSJ Dollar Index, bringing it to a level of 103.24, has significant implications for global markets. This index, which measures the value of the U.S. dollar against a basket of foreign currencies, serves as a critical barometer for economic health and investor sentiment. As the dollar strengthens, it can lead to a ripple effect across various sectors, influencing everything from trade balances to investment flows.

Firstly, a rising dollar often impacts international trade dynamics. When the dollar appreciates, U.S. exports become more expensive for foreign buyers, potentially leading to a decrease in demand for American goods. Conversely, imports become cheaper for U.S. consumers, which can result in an increase in the volume of goods entering the country. This shift can widen the trade deficit, as American manufacturers may struggle to compete with lower-priced foreign products. Consequently, businesses that rely heavily on exports may face challenges, prompting them to adjust their strategies in response to changing market conditions.

Moreover, the strength of the dollar can significantly affect commodity prices. Many commodities, including oil and gold, are priced in dollars. As the dollar strengthens, these commodities become more expensive for foreign buyers, which can lead to a decrease in demand and subsequently lower prices. This relationship is particularly important for countries that are heavily reliant on commodity exports, as a decline in prices can adversely affect their economies. For instance, nations in the Middle East that depend on oil revenues may experience budgetary constraints if oil prices fall due to a stronger dollar.

In addition to trade and commodity prices, the WSJ Dollar Index’s movements can influence capital flows and investment decisions. A stronger dollar often attracts foreign investment into U.S. assets, as investors seek to capitalize on the currency’s strength. This influx of capital can lead to increased demand for U.S. stocks and bonds, driving up their prices. However, this scenario can also create volatility in emerging markets, where a stronger dollar may lead to capital outflows. Investors in these markets may seek to convert their holdings into dollars, leading to currency depreciation and potential economic instability.

Furthermore, the implications of a rising dollar extend to monetary policy considerations. Central banks around the world closely monitor the dollar’s strength, as it can influence their own currency policies. For instance, if the dollar continues to rise, central banks may feel pressured to adjust interest rates to maintain competitiveness. This interconnectedness highlights the importance of the WSJ Dollar Index as a tool for understanding global economic trends and central bank actions.

In conclusion, the recent increase in the WSJ Dollar Index to 103.24 underscores the complex interplay between currency values and global markets. As the dollar strengthens, it affects trade balances, commodity prices, capital flows, and monetary policy decisions. Investors and policymakers alike must remain vigilant in monitoring these developments, as the implications of a fluctuating dollar can reverberate across economies worldwide. Understanding these dynamics is essential for navigating the intricacies of the global financial landscape, where the strength of the dollar plays a pivotal role in shaping economic outcomes.

Factors Driving the Recent Increase in the WSJ Dollar Index

The recent increase in the WSJ Dollar Index, which rose by 0.1% to reach 103.24, can be attributed to a confluence of economic factors that have influenced currency markets. One of the primary drivers of this uptick is the ongoing strength of the U.S. economy, which has shown resilience in the face of global uncertainties. As economic indicators such as employment rates and consumer spending remain robust, investor confidence in the dollar has strengthened, leading to increased demand for the currency.

Moreover, the Federal Reserve’s monetary policy plays a crucial role in shaping the dollar’s value. In recent months, the Fed has signaled a more hawkish stance, indicating potential interest rate hikes in response to persistent inflationary pressures. This shift in policy not only bolsters the dollar’s appeal as a safe-haven asset but also attracts foreign investment, further driving up its value. As interest rates rise, the yield on dollar-denominated assets becomes more attractive, prompting investors to favor the dollar over other currencies.

In addition to domestic factors, global economic conditions have also contributed to the dollar’s strength. Many economies around the world are grappling with challenges such as geopolitical tensions, supply chain disruptions, and inflationary pressures. As a result, investors often seek refuge in the U.S. dollar during times of uncertainty, viewing it as a stable and reliable currency. This flight to safety has been particularly pronounced in recent weeks, as concerns over economic slowdowns in major markets have prompted a reevaluation of risk exposure.

Furthermore, the performance of other major currencies has also influenced the WSJ Dollar Index. For instance, the euro has faced headwinds due to the European Central Bank’s cautious approach to monetary policy amid sluggish growth prospects in the Eurozone. Similarly, the Japanese yen has struggled against the dollar, primarily due to Japan’s prolonged low-interest-rate environment. As these currencies weaken, the dollar naturally gains strength, contributing to the overall increase in the WSJ Dollar Index.

Another factor worth noting is the impact of commodity prices on currency valuations. The dollar often moves inversely to commodity prices, particularly oil and gold. As commodity prices fluctuate, they can influence the dollar’s strength. Recently, a decline in oil prices has led to a stronger dollar, as countries that rely heavily on oil exports face economic challenges, thereby weakening their currencies against the dollar.

In conclusion, the recent increase in the WSJ Dollar Index to 103.24 is a reflection of a complex interplay of domestic economic strength, Federal Reserve policy, global uncertainties, and the performance of other currencies. As investors navigate these multifaceted dynamics, the dollar’s status as a safe-haven asset continues to be reinforced. Looking ahead, it will be essential to monitor these factors closely, as shifts in economic indicators or geopolitical developments could lead to further fluctuations in the dollar’s value. Ultimately, the resilience of the U.S. economy and the strategic decisions made by the Federal Reserve will remain pivotal in determining the trajectory of the dollar in the coming months.

Historical Trends of the WSJ Dollar Index

The WSJ Dollar Index, a comprehensive measure of the value of the U.S. dollar against a basket of major currencies, has exhibited significant fluctuations over the years, reflecting broader economic trends and geopolitical developments. As of the latest report, the index has increased by 0.1% to reach 103.24, a figure that underscores the dollar’s resilience in the face of various challenges. To understand the implications of this recent uptick, it is essential to examine the historical trends of the WSJ Dollar Index and the factors that have influenced its movements.

Historically, the WSJ Dollar Index has served as a barometer for the strength of the U.S. dollar, which is often viewed as a safe haven during times of economic uncertainty. For instance, during periods of global financial crises, such as the 2008 recession, the index experienced a notable surge as investors flocked to the dollar, seeking stability. This trend was further amplified by the Federal Reserve’s monetary policy decisions, which often play a pivotal role in shaping currency values. When the Fed implements interest rate hikes, the dollar typically strengthens, as higher rates attract foreign capital, thereby increasing demand for the currency.

Moreover, the index has also been influenced by international trade dynamics. As the U.S. engages in trade negotiations and navigates tariffs and trade agreements, the dollar’s value can fluctuate significantly. For example, during the trade tensions between the U.S. and China, the dollar experienced volatility as market participants reacted to news and developments surrounding tariffs and trade policies. This interplay between trade relations and currency valuation highlights the interconnectedness of global economies and the dollar’s role as a key player in international finance.

In addition to economic factors, geopolitical events have historically impacted the WSJ Dollar Index. Political instability, conflicts, and changes in government leadership can lead to fluctuations in investor confidence, which in turn affects currency values. For instance, during times of heightened geopolitical tensions, such as military conflicts or diplomatic crises, the dollar often strengthens as investors seek refuge in what they perceive to be a more stable asset. This phenomenon illustrates how external factors can create ripples in the currency markets, influencing the index’s trajectory.

Furthermore, the index’s historical performance can also be analyzed through the lens of inflation and economic growth. In periods of robust economic expansion, the dollar may weaken as inflationary pressures mount, prompting the Federal Reserve to adjust its monetary policy. Conversely, during economic downturns, the dollar may strengthen as investors prioritize safety over risk. This cyclical nature of the dollar’s value reflects broader economic conditions and the Fed’s response to changing circumstances.

As we consider the recent increase of 0.1% in the WSJ Dollar Index to 103.24, it is essential to recognize that this movement is not merely a standalone event but rather part of a larger narrative that encompasses historical trends and economic indicators. The index’s fluctuations serve as a reminder of the complex interplay between domestic policies, international relations, and market sentiment. In conclusion, understanding the historical context of the WSJ Dollar Index provides valuable insights into the current state of the dollar and its potential trajectory in the ever-evolving landscape of global finance.

Implications of a Stronger Dollar for U.S. Exports

The recent increase in the WSJ Dollar Index by 0.1% to reach 103.24 has significant implications for U.S. exports, a sector that plays a crucial role in the overall health of the American economy. A stronger dollar typically means that U.S. goods become more expensive for foreign buyers, which can lead to a decrease in demand for American products abroad. This phenomenon occurs because as the dollar appreciates, it takes more of a foreign currency to purchase the same amount of U.S. goods, effectively making them less competitive in the global market.

As a result, exporters may face challenges in maintaining their market share in international markets. For instance, industries such as agriculture, manufacturing, and technology, which rely heavily on exports, could see a decline in sales as foreign consumers and businesses turn to cheaper alternatives from other countries. This shift can have a cascading effect on the U.S. economy, potentially leading to reduced production levels, layoffs, and a slowdown in economic growth. Consequently, businesses that depend on exports may need to reevaluate their pricing strategies and consider ways to enhance their competitiveness, such as improving product quality or increasing marketing efforts in foreign markets.

Moreover, a stronger dollar can also impact the balance of trade. When exports decline due to higher prices, the trade deficit may widen, as imports become relatively cheaper for U.S. consumers. This situation can create a challenging environment for policymakers who aim to promote economic growth while managing trade relationships. A persistent trade deficit can lead to increased scrutiny of trade policies and may prompt calls for protective measures, which could further complicate the dynamics of international trade.

In addition to these immediate effects, a stronger dollar can influence investment decisions. Foreign investors may be less inclined to invest in U.S. assets if they perceive that the dollar’s strength will erode their returns when converted back to their local currencies. This hesitance can lead to reduced capital inflows, which are essential for funding domestic projects and stimulating economic growth. As a result, U.S. companies may find it more challenging to secure financing for expansion or innovation, further stifling their ability to compete on a global scale.

However, it is essential to recognize that a stronger dollar is not solely detrimental. For U.S. consumers, a stronger dollar can lead to lower prices for imported goods, which can enhance purchasing power and contribute to consumer spending. This increase in consumer spending can, in turn, stimulate domestic economic activity, offsetting some of the negative impacts on exports. Additionally, companies that rely on imported raw materials or components may benefit from lower costs, potentially improving their profit margins.

In conclusion, while the recent rise in the WSJ Dollar Index to 103.24 presents challenges for U.S. exports, it also offers opportunities for consumers and certain sectors of the economy. The interplay between a stronger dollar and its implications for trade, investment, and consumer behavior underscores the complexity of the global economic landscape. As businesses and policymakers navigate these dynamics, it will be crucial to adopt strategies that balance the benefits of a strong dollar with the need to maintain competitiveness in international markets. Ultimately, the ability to adapt to these changes will determine the long-term success of U.S. exports and the broader economy.

How the WSJ Dollar Index Affects Inflation Rates

The WSJ Dollar Index, which recently increased by 0.1% to reach 103.24, serves as a crucial barometer for understanding the value of the U.S. dollar against a basket of major currencies. This index not only reflects the strength of the dollar but also has significant implications for inflation rates both domestically and globally. As the dollar appreciates, it can lead to a complex interplay of economic factors that influence inflation.

To begin with, a stronger dollar typically makes imported goods cheaper. When the dollar gains value, it takes fewer dollars to purchase foreign goods, which can lead to lower prices for consumers. This reduction in import costs can help to mitigate inflationary pressures, as businesses may pass on these savings to consumers. Consequently, when the WSJ Dollar Index rises, it often signals a potential decrease in inflation rates, particularly in sectors heavily reliant on imports, such as consumer electronics, automobiles, and clothing.

Moreover, the relationship between the dollar’s strength and commodity prices is another critical aspect to consider. Many commodities, including oil and gold, are priced in dollars. Therefore, when the dollar strengthens, the price of these commodities tends to fall, as they become more expensive for foreign buyers. This decline in commodity prices can further contribute to lower inflation rates, as energy and raw material costs decrease, leading to reduced production costs for businesses. As a result, companies may lower their prices, which can help keep overall inflation in check.

However, it is essential to recognize that the effects of a stronger dollar are not universally beneficial. While lower import prices can ease inflation, they can also negatively impact U.S. exporters. When the dollar appreciates, American goods become more expensive for foreign buyers, potentially leading to a decrease in export demand. This decline can adversely affect domestic production and employment, which may, in turn, create upward pressure on inflation if businesses respond by raising prices to maintain profit margins. Thus, the dynamics of the WSJ Dollar Index and its influence on inflation are multifaceted and can lead to varying outcomes depending on the broader economic context.

Additionally, the Federal Reserve closely monitors the WSJ Dollar Index as part of its monetary policy framework. A rising dollar can influence the Fed’s decisions regarding interest rates. If the dollar’s strength contributes to lower inflation, the Fed may feel less pressure to raise interest rates aggressively. Conversely, if the dollar’s appreciation leads to significant disruptions in the export sector, the Fed may need to consider the potential for economic slowdown and adjust its policies accordingly. This delicate balancing act underscores the importance of the WSJ Dollar Index in shaping not only inflation expectations but also broader economic policy.

In conclusion, the recent increase in the WSJ Dollar Index to 103.24 highlights its critical role in influencing inflation rates. While a stronger dollar can lead to lower import prices and reduced inflationary pressures, it also poses challenges for exporters and may complicate monetary policy decisions. As such, understanding the implications of fluctuations in the WSJ Dollar Index is essential for policymakers, businesses, and consumers alike, as it provides valuable insights into the complex relationship between currency strength and inflation dynamics.

The Role of Interest Rates in the WSJ Dollar Index Movement

The recent increase of 0.1% in the WSJ Dollar Index, bringing it to a level of 103.24, underscores the intricate relationship between interest rates and currency valuation. Interest rates play a pivotal role in shaping investor sentiment and influencing the flow of capital across borders. When a central bank, such as the Federal Reserve in the United States, raises interest rates, it typically leads to a stronger currency. This phenomenon occurs because higher interest rates offer better returns on investments denominated in that currency, attracting foreign capital and increasing demand for the currency itself.

Conversely, when interest rates are lowered, the opposite effect can take place. Investors may seek higher yields elsewhere, leading to a depreciation of the currency as demand wanes. This dynamic is particularly relevant in the context of the WSJ Dollar Index, which measures the value of the U.S. dollar against a basket of major currencies. As interest rates fluctuate, so too does the attractiveness of holding U.S. dollars compared to other currencies, thereby impacting the index’s movement.

Moreover, the expectations surrounding future interest rate changes can also significantly influence the WSJ Dollar Index. For instance, if market participants anticipate that the Federal Reserve will raise rates in the near future, the dollar may strengthen in advance of the actual policy change. This preemptive movement occurs as traders position themselves to benefit from the expected increase in yields. Therefore, the index can reflect not only current interest rates but also market sentiment regarding future monetary policy.

In addition to domestic interest rates, global interest rate trends also play a crucial role in the dollar’s valuation. For example, if other central banks, such as the European Central Bank or the Bank of Japan, maintain lower interest rates while the Federal Reserve raises rates, the differential in interest rates can lead to a stronger dollar. Investors often compare yields across different economies, and a higher yield in the U.S. can make the dollar more appealing, thereby driving up its value in the WSJ Dollar Index.

Furthermore, the interplay between interest rates and inflation expectations cannot be overlooked. When inflation is anticipated to rise, central banks may respond by increasing interest rates to curb inflationary pressures. This response can bolster the currency as investors seek to protect their purchasing power. In this context, the WSJ Dollar Index may reflect not only the current interest rate environment but also the broader economic outlook, including inflation expectations and growth prospects.

As we analyze the recent movement of the WSJ Dollar Index, it becomes evident that interest rates are a fundamental driver of currency valuation. The interplay between domestic and global interest rates, market expectations, and inflation dynamics creates a complex landscape that influences the dollar’s strength. Consequently, as the index reaches 103.24, it serves as a barometer of investor sentiment shaped by these multifaceted factors. Understanding this relationship is essential for investors and policymakers alike, as it provides insights into the broader economic environment and the potential implications for trade, investment, and economic growth. In conclusion, the recent increase in the WSJ Dollar Index highlights the critical role that interest rates play in shaping currency movements and underscores the importance of monitoring these trends for a comprehensive understanding of the financial landscape.

Comparing the WSJ Dollar Index with Other Currency Indices

The recent increase of 0.1% in the WSJ Dollar Index, bringing it to a level of 103.24, invites a closer examination of its performance in relation to other currency indices. The WSJ Dollar Index, which measures the value of the U.S. dollar against a basket of major currencies, serves as a critical barometer for understanding the dollar’s strength in the global market. This index is particularly noteworthy because it encompasses a diverse range of currencies, including the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc. By comparing the WSJ Dollar Index with other currency indices, one can gain valuable insights into the dynamics of currency valuation and the broader economic implications.

In contrast to the WSJ Dollar Index, the DXY Index, or the U.S. Dollar Index, is another widely recognized measure of the dollar’s performance. The DXY Index also tracks the dollar against a basket of six major currencies, but it places a heavier emphasis on the euro, which constitutes a significant portion of its weighting. As a result, fluctuations in the euro can disproportionately influence the DXY Index, making it less representative of the dollar’s overall strength compared to the WSJ Dollar Index. This distinction is crucial for investors and analysts who seek to understand the nuances of currency movements and their potential impact on international trade and investment.

Moreover, the Bloomberg Dollar Spot Index offers another perspective on the dollar’s performance. This index includes a broader array of currencies, providing a more comprehensive view of the dollar’s strength against a wider selection of global currencies. While the WSJ Dollar Index focuses on a specific set of major currencies, the Bloomberg Dollar Spot Index captures the dollar’s performance against emerging market currencies as well. Consequently, this index can provide additional context for understanding how the dollar is faring in different economic environments, particularly in relation to developing economies.

Transitioning from these comparisons, it is essential to consider the implications of the WSJ Dollar Index’s recent increase. A rise in the index often signals a strengthening dollar, which can have far-reaching effects on global trade dynamics. For instance, a stronger dollar can make U.S. exports more expensive for foreign buyers, potentially leading to a decrease in demand for American goods. Conversely, it can make imports cheaper for U.S. consumers, which may contribute to a widening trade deficit. Therefore, fluctuations in the WSJ Dollar Index not only reflect changes in currency valuation but also influence economic policies and strategies for businesses engaged in international trade.

Furthermore, the interplay between the WSJ Dollar Index and other currency indices highlights the interconnectedness of global financial markets. As investors react to changes in economic indicators, interest rates, and geopolitical events, the movements of the dollar can reverberate across various asset classes, including equities, commodities, and bonds. Consequently, understanding the performance of the WSJ Dollar Index in relation to other indices is vital for market participants seeking to navigate the complexities of the global economy.

In conclusion, the recent increase in the WSJ Dollar Index to 103.24 underscores the importance of comparing it with other currency indices to gain a comprehensive understanding of the dollar’s performance. By examining the nuances of different indices, investors and analysts can better appreciate the factors influencing currency movements and their broader economic implications. As the global financial landscape continues to evolve, such comparisons will remain essential for informed decision-making in the realm of international finance.

Q&A

1. **What is the WSJ Dollar Index?**

The WSJ Dollar Index measures the value of the U.S. dollar against a basket of major currencies.

2. **What does an increase of 0.1% indicate?**

An increase of 0.1% indicates a slight appreciation of the U.S. dollar relative to the currencies in the index.

3. **What is the new value of the WSJ Dollar Index after the increase?**

The new value of the WSJ Dollar Index is 103.24.

4. **Why is the WSJ Dollar Index important?**

It provides insights into the strength of the U.S. dollar and its impact on global trade and investment.

5. **What factors can influence changes in the WSJ Dollar Index?**

Economic data, interest rates, geopolitical events, and market sentiment can all influence the index.

6. **How often is the WSJ Dollar Index updated?**

The WSJ Dollar Index is typically updated regularly, reflecting real-time market conditions.

7. **What does a higher WSJ Dollar Index value generally mean for U.S. exports?**

A higher index value usually makes U.S. exports more expensive for foreign buyers, potentially reducing demand.

Conclusion

The increase of the WSJ Dollar Index by 0.1% to reach 103.24 indicates a slight strengthening of the U.S. dollar against a basket of major currencies, reflecting market dynamics and economic factors influencing currency valuation.