-

Table of Contents

- Introduction

- Understanding Discover Lands Servicer: A Comprehensive Overview

- How Discover Lands Servicer Manages Your Student Loan Portfolio

- Benefits Of Using Discover Lands Servicer For Student Loans

- Navigating Repayment Options With Discover Lands Servicer

- Discover Lands Servicer: Tips For Effective Loan Management

- Common Challenges With Discover Lands Servicer And How To Overcome Them

- Comparing Discover Lands Servicer To Other Student Loan Servicers

- How Discover Lands Servicer Supports Borrowers During Financial Hardship

- The Role Of Discover Lands Servicer In Federal And Private Student Loans

- Customer Reviews And Experiences With Discover Lands Servicer

- Q&A

- Conclusion

“Empowering Your Education Journey with Seamless Loan Management”

Introduction

Discover Student Loans is a prominent financial service provider specializing in offering private student loans to help students and their families cover the costs of higher education. As a part of Discover Financial Services, a leading direct banking and payment services company, Discover Student Loans provides a range of loan options with competitive interest rates, flexible repayment terms, and various borrower benefits. The service is designed to complement federal student loans and other financial aid, ensuring that students have access to the necessary funds to pursue their educational goals. With a focus on customer service and financial literacy, Discover Student Loans also offers resources and tools to help borrowers make informed decisions about their education financing and manage their student loan debt effectively.

Understanding Discover Lands Servicer: A Comprehensive Overview

In the ever-evolving landscape of student loans, the introduction of Discover Lands Servicer marks a significant development for borrowers seeking efficient management of their student loan portfolios. As the complexities of student loans continue to grow, the need for a reliable and comprehensive servicer becomes increasingly apparent. Discover Lands Servicer emerges as a pivotal player in this domain, offering a suite of services designed to streamline the loan management process and provide borrowers with a seamless experience.

To begin with, Discover Lands Servicer distinguishes itself through its commitment to transparency and borrower-centric solutions. In an industry often criticized for its opacity, Discover Lands Servicer prioritizes clear communication and accessibility. Borrowers are provided with detailed information about their loans, repayment options, and any changes that may affect their financial obligations. This transparency is crucial in empowering borrowers to make informed decisions about their financial futures.

Moreover, Discover Lands Servicer offers a range of tools and resources aimed at simplifying the repayment process. With user-friendly online platforms and mobile applications, borrowers can easily access their loan information, make payments, and explore various repayment plans. This digital accessibility ensures that borrowers can manage their loans at their convenience, reducing the stress and confusion often associated with student loan repayment.

In addition to its digital offerings, Discover Lands Servicer places a strong emphasis on personalized customer support. Recognizing that each borrower’s situation is unique, the servicer provides tailored assistance to address individual needs. Whether it’s navigating complex repayment plans or understanding the implications of deferment and forbearance, borrowers can rely on knowledgeable representatives to guide them through the process. This personalized approach not only enhances the borrower experience but also fosters a sense of trust and reliability.

Furthermore, Discover Lands Servicer is committed to helping borrowers achieve long-term financial success. By offering financial literacy resources and educational materials, the servicer empowers borrowers to make sound financial decisions beyond their student loans. These resources cover a wide range of topics, from budgeting and saving to understanding credit scores and managing debt. By equipping borrowers with this knowledge, Discover Lands Servicer aims to promote financial well-being and stability.

Another noteworthy aspect of Discover Lands Servicer is its proactive approach to addressing potential challenges. The servicer actively monitors changes in federal and state regulations, ensuring that borrowers are informed of any developments that may impact their loans. This vigilance allows borrowers to stay ahead of potential issues and adapt their repayment strategies accordingly. By keeping borrowers informed and prepared, Discover Lands Servicer mitigates the risk of unexpected financial setbacks.

In conclusion, Discover Lands Servicer represents a significant advancement in the management of student loan portfolios. Through its commitment to transparency, digital accessibility, personalized support, and financial education, the servicer provides borrowers with the tools and resources necessary to navigate the complexities of student loans. As the landscape of student loans continues to evolve, Discover Lands Servicer stands as a reliable partner, dedicated to helping borrowers achieve financial success and stability. With its comprehensive approach and borrower-centric focus, Discover Lands Servicer is poised to make a lasting impact on the student loan industry, offering a beacon of hope for those seeking to manage their educational debt effectively.

How Discover Lands Servicer Manages Your Student Loan Portfolio

Discover Financial Services, a prominent player in the financial services industry, has expanded its reach into the realm of student loan servicing, offering a comprehensive solution for managing student loan portfolios. This strategic move is designed to streamline the often complex and cumbersome process of student loan management, providing borrowers with a more efficient and user-friendly experience. As student loan debt continues to be a significant financial burden for many individuals, Discover’s entry into this sector is both timely and beneficial.

To begin with, Discover’s approach to student loan servicing is rooted in its commitment to customer-centric solutions. By leveraging its extensive experience in financial services, Discover aims to simplify the loan management process for borrowers. This is achieved through a combination of advanced technology and personalized customer support, ensuring that borrowers have access to the resources they need to effectively manage their loans. The integration of digital tools allows borrowers to easily track their loan balances, make payments, and explore repayment options, all from a single platform.

Moreover, Discover’s student loan servicing platform is designed to be intuitive and accessible, catering to the diverse needs of borrowers. Whether individuals are recent graduates just beginning their repayment journey or seasoned professionals seeking to refinance their loans, Discover offers tailored solutions to meet their unique circumstances. This flexibility is a key component of Discover’s strategy, as it recognizes that no two borrowers are alike and that personalized service is essential in addressing the varied challenges faced by borrowers.

In addition to its user-friendly platform, Discover places a strong emphasis on financial education. Understanding that informed borrowers are better equipped to manage their debt, Discover provides a wealth of educational resources aimed at enhancing financial literacy. These resources cover a wide range of topics, from budgeting and saving strategies to understanding the nuances of loan repayment plans. By empowering borrowers with knowledge, Discover helps them make informed decisions that align with their financial goals.

Furthermore, Discover’s commitment to transparency is evident in its approach to communication. Borrowers are kept informed about their loan status through regular updates and notifications, ensuring that they are always aware of any changes or important deadlines. This proactive communication strategy not only helps borrowers stay on top of their loans but also fosters a sense of trust and reliability between Discover and its customers.

Another noteworthy aspect of Discover’s student loan servicing is its focus on innovation. By continuously exploring new technologies and methodologies, Discover seeks to enhance the overall borrower experience. This includes the development of mobile applications, automated payment systems, and other digital tools that simplify the loan management process. By staying at the forefront of technological advancements, Discover ensures that its services remain relevant and effective in an ever-evolving financial landscape.

In conclusion, Discover’s entry into the student loan servicing market represents a significant advancement in the way student loans are managed. Through a combination of customer-centric solutions, financial education, transparent communication, and innovative technology, Discover is well-positioned to provide borrowers with the tools and support they need to successfully navigate their student loan journey. As the demand for efficient and effective loan management solutions continues to grow, Discover’s comprehensive approach offers a promising solution for borrowers seeking to take control of their financial future.

Benefits Of Using Discover Lands Servicer For Student Loans

The decision to manage student loans effectively is crucial for graduates and current students alike, as it can significantly impact their financial future. One of the emerging options in the realm of student loan management is the Discover Lands Servicer, which offers a range of benefits that can make the process of handling student loans more efficient and less stressful. By understanding these advantages, borrowers can make informed decisions about their loan servicing options.

To begin with, Discover Lands Servicer provides a user-friendly platform that simplifies the loan management process. This ease of use is particularly beneficial for borrowers who may be overwhelmed by the complexities of student loans. The platform offers intuitive navigation and clear instructions, allowing users to access their loan information, make payments, and explore repayment options with minimal hassle. This streamlined approach not only saves time but also reduces the likelihood of errors that can occur when managing loans manually.

Moreover, Discover Lands Servicer offers a variety of repayment plans tailored to meet the diverse needs of borrowers. These plans include standard, graduated, and income-driven repayment options, each designed to accommodate different financial situations. For instance, income-driven plans adjust monthly payments based on the borrower’s income and family size, providing a level of flexibility that can be particularly advantageous for those with fluctuating earnings. This adaptability ensures that borrowers can select a plan that aligns with their current financial circumstances, thereby reducing the risk of default.

In addition to flexible repayment options, Discover Lands Servicer is committed to providing exceptional customer service. Borrowers can access support through multiple channels, including phone, email, and online chat, ensuring that assistance is readily available when needed. The customer service team is trained to address a wide range of inquiries, from basic account questions to more complex issues related to repayment strategies. This level of support can be invaluable for borrowers who require guidance in navigating the intricacies of student loan management.

Furthermore, Discover Lands Servicer places a strong emphasis on financial education, offering resources that empower borrowers to make informed decisions about their loans. These resources include online tools, calculators, and educational materials that cover topics such as budgeting, loan consolidation, and interest rate management. By equipping borrowers with the knowledge they need to understand their financial obligations, Discover Lands Servicer helps them develop strategies to manage their debt effectively and work towards financial stability.

Another notable benefit of using Discover Lands Servicer is the potential for interest rate reductions through various incentives. For example, borrowers who enroll in automatic payments may qualify for a discount on their interest rate, which can lead to significant savings over the life of the loan. This incentive not only encourages timely payments but also rewards borrowers for their commitment to responsible financial management.

In conclusion, Discover Lands Servicer offers a comprehensive suite of benefits that can greatly enhance the student loan management experience. From its user-friendly platform and flexible repayment options to its commitment to customer service and financial education, Discover Lands Servicer provides borrowers with the tools and support they need to navigate the complexities of student loans. By leveraging these advantages, borrowers can take control of their financial future and work towards achieving their long-term goals.

Navigating Repayment Options With Discover Lands Servicer

Navigating the complex landscape of student loan repayment can be a daunting task for many borrowers. With the introduction of Discover Lands Servicer, a new player in the student loan servicing arena, borrowers now have an additional resource to help manage their student loan portfolios effectively. This development is particularly significant as it offers a fresh perspective on how student loans can be serviced, potentially easing the repayment process for many.

Discover Lands Servicer aims to provide a comprehensive suite of services designed to assist borrowers in understanding and managing their student loans. One of the primary benefits of this new servicer is its commitment to offering personalized support. By focusing on individual borrower needs, Discover Lands Servicer seeks to tailor repayment plans that align with each borrower’s financial situation. This personalized approach is crucial, as it acknowledges that no two borrowers are alike, and therefore, a one-size-fits-all solution is often inadequate.

Moreover, Discover Lands Servicer emphasizes transparency and accessibility in its operations. Borrowers can expect clear communication regarding their loan terms, repayment options, and any changes that may occur over the life of the loan. This transparency is vital in building trust between the borrower and the servicer, ensuring that borrowers are well-informed and can make educated decisions about their repayment strategies. Additionally, the servicer’s user-friendly online platform allows borrowers to easily access their account information, make payments, and explore various repayment options at their convenience.

In addition to personalized support and transparency, Discover Lands Servicer offers a range of repayment options designed to accommodate different financial circumstances. For instance, borrowers may have the opportunity to choose from income-driven repayment plans, which adjust monthly payments based on the borrower’s income and family size. This flexibility can be particularly beneficial for those who may be experiencing financial hardship or have fluctuating incomes. Furthermore, the servicer provides guidance on loan consolidation and refinancing options, which can simplify the repayment process and potentially reduce interest rates.

Another noteworthy aspect of Discover Lands Servicer is its focus on financial education. Recognizing that informed borrowers are more likely to successfully manage their loans, the servicer offers a variety of educational resources. These resources include webinars, articles, and interactive tools designed to enhance borrowers’ understanding of their loans and the repayment process. By empowering borrowers with knowledge, Discover Lands Servicer aims to foster a sense of confidence and control over their financial futures.

As borrowers navigate the repayment process with Discover Lands Servicer, they may also benefit from the servicer’s proactive approach to customer service. The servicer’s team of knowledgeable representatives is available to assist borrowers with any questions or concerns they may have, ensuring that support is readily accessible when needed. This level of customer service is essential in helping borrowers feel supported and valued throughout their repayment journey.

In conclusion, Discover Lands Servicer represents a promising addition to the student loan servicing landscape. By offering personalized support, transparency, a variety of repayment options, and a strong emphasis on financial education, the servicer is well-positioned to assist borrowers in effectively managing their student loan portfolios. As borrowers explore their repayment options with Discover Lands Servicer, they can do so with the confidence that they have a reliable partner in their corner, dedicated to helping them achieve financial success.

Discover Lands Servicer: Tips For Effective Loan Management

Navigating the complexities of student loan management can be a daunting task for many borrowers. With the recent announcement that Discover has landed a new role as a servicer for a significant student loan portfolio, it is crucial for borrowers to understand how this change might impact their loan management strategies. Effective loan management is essential for maintaining financial health and ensuring timely repayment, and with Discover’s entry into the servicing landscape, borrowers have an opportunity to reassess and optimize their approach.

First and foremost, borrowers should familiarize themselves with Discover’s servicing platform and resources. Discover, known for its robust financial products and customer service, is expected to bring a high level of efficiency and support to its loan servicing operations. Borrowers can benefit from exploring the tools and resources available on Discover’s platform, such as online account management, payment calculators, and educational materials. These resources can provide valuable insights into repayment options and help borrowers make informed decisions about their loans.

Moreover, it is important for borrowers to maintain open lines of communication with their loan servicer. Discover’s reputation for customer service suggests that borrowers will have access to knowledgeable representatives who can assist with any questions or concerns. Regular communication with the servicer can help borrowers stay informed about their loan status, upcoming payments, and any changes in terms or conditions. Additionally, reaching out to the servicer can be particularly beneficial if borrowers encounter financial difficulties, as Discover may offer options such as deferment, forbearance, or alternative repayment plans.

In addition to leveraging Discover’s resources and maintaining communication, borrowers should also take a proactive approach to managing their loans. This includes creating a comprehensive budget that accounts for monthly loan payments and other financial obligations. By understanding their financial situation, borrowers can identify areas where they may be able to cut costs or allocate additional funds toward loan repayment. Furthermore, setting up automatic payments can ensure that payments are made on time, helping borrowers avoid late fees and potential damage to their credit scores.

Another key aspect of effective loan management is staying informed about potential changes in the student loan landscape. With Discover’s entry as a servicer, there may be shifts in policies or practices that could affect borrowers. Keeping abreast of industry news and updates can help borrowers anticipate and adapt to any changes that may arise. Additionally, borrowers should be aware of any federal or state programs that may offer relief or assistance, such as income-driven repayment plans or loan forgiveness programs.

Finally, borrowers should consider seeking professional financial advice if they feel overwhelmed by their student loan obligations. Financial advisors can provide personalized guidance and strategies for managing debt, budgeting, and achieving long-term financial goals. By taking a holistic approach to their financial health, borrowers can better navigate the challenges of student loan repayment and work toward a more secure financial future.

In conclusion, Discover’s role as a new servicer for student loans presents an opportunity for borrowers to enhance their loan management strategies. By utilizing Discover’s resources, maintaining communication, proactively managing finances, staying informed about industry changes, and seeking professional advice when needed, borrowers can effectively manage their student loans and work toward financial stability.

Common Challenges With Discover Lands Servicer And How To Overcome Them

Navigating the complexities of student loan management can be a daunting task for many borrowers, especially when dealing with a servicer like Discover Lands. As a prominent player in the student loan industry, Discover Lands Servicer is responsible for managing a significant number of student loan portfolios. However, borrowers often encounter several common challenges when interacting with this servicer. Understanding these challenges and learning how to effectively address them can significantly ease the burden of student loan management.

One of the primary challenges borrowers face with Discover Lands Servicer is communication. Many borrowers report difficulties in reaching customer service representatives or receiving timely responses to their inquiries. This can lead to frustration and confusion, particularly when borrowers need immediate assistance or clarification on their loan terms. To overcome this challenge, borrowers should consider utilizing multiple communication channels. While phone calls are a traditional method, leveraging email or online chat options can sometimes yield quicker responses. Additionally, keeping detailed records of all communications can help ensure that any issues are addressed promptly and accurately.

Another common issue is the complexity of loan repayment options. Discover Lands Servicer offers a variety of repayment plans, each with its own set of terms and conditions. Borrowers may find it challenging to determine which plan best suits their financial situation. To navigate this complexity, borrowers should take the time to thoroughly research each available option. Utilizing online resources, such as the servicer’s website or financial literacy tools, can provide valuable insights into the benefits and drawbacks of each plan. Furthermore, consulting with a financial advisor or a student loan counselor can offer personalized guidance tailored to individual circumstances.

In addition to communication and repayment complexities, borrowers often encounter difficulties with loan consolidation and refinancing. Discover Lands Servicer provides options for both, but the process can be intricate and time-consuming. Borrowers may struggle with understanding the eligibility criteria or the potential impact on their overall financial health. To address these challenges, it is crucial for borrowers to educate themselves on the nuances of consolidation and refinancing. This includes understanding the differences between federal and private loans, as well as the potential benefits and risks associated with each option. Engaging with a knowledgeable advisor can also help borrowers make informed decisions that align with their long-term financial goals.

Moreover, borrowers sometimes face issues related to loan forgiveness programs. While Discover Lands Servicer may offer information on such programs, the application process can be cumbersome and confusing. To overcome this hurdle, borrowers should meticulously review the eligibility requirements and necessary documentation for each forgiveness program. Staying organized and proactive in gathering and submitting the required paperwork can significantly streamline the process. Additionally, reaching out to the servicer for clarification on any unclear aspects of the program can prevent unnecessary delays or complications.

In conclusion, while managing a student loan portfolio with Discover Lands Servicer presents several challenges, borrowers can take proactive steps to overcome them. By improving communication strategies, thoroughly researching repayment options, understanding consolidation and refinancing processes, and diligently pursuing loan forgiveness opportunities, borrowers can effectively navigate the complexities of their student loans. Ultimately, being informed and proactive can empower borrowers to manage their loans more efficiently and achieve financial stability.

Comparing Discover Lands Servicer To Other Student Loan Servicers

In the realm of student loan management, the choice of a loan servicer can significantly impact the borrower’s experience. Discover Lands Servicer, a relatively new entrant in the student loan servicing landscape, has garnered attention for its approach to managing student loan portfolios. To understand its position in the market, it is essential to compare Discover Lands Servicer with other established student loan servicers, examining various aspects such as customer service, repayment options, and technological integration.

To begin with, customer service is a critical factor for borrowers when dealing with loan servicers. Discover Lands Servicer has made strides in this area by emphasizing personalized service and responsiveness. Borrowers often report shorter wait times and more direct communication channels compared to some of the larger, more traditional servicers. This focus on customer satisfaction is a distinguishing feature, as many borrowers have expressed frustration with the impersonal and bureaucratic nature of interactions with other servicers. In contrast, established servicers like Navient and FedLoan Servicing have faced criticism for their customer service practices, with complaints often centered around delayed responses and lack of clarity in communication.

Moreover, repayment options are a crucial consideration for borrowers seeking flexibility in managing their student loans. Discover Lands Servicer offers a range of repayment plans, including income-driven options that adjust monthly payments based on the borrower’s income and family size. This flexibility is comparable to that offered by other major servicers, such as Nelnet and Great Lakes, which also provide a variety of plans to accommodate different financial situations. However, Discover Lands Servicer distinguishes itself by offering more user-friendly online tools that help borrowers easily navigate and select the most suitable repayment plan. This technological edge is particularly appealing to tech-savvy borrowers who prefer managing their loans digitally.

In addition to customer service and repayment options, technological integration plays a significant role in the efficiency and convenience of loan servicing. Discover Lands Servicer has invested in developing a robust digital platform that allows borrowers to manage their accounts seamlessly. Features such as mobile app access, real-time payment tracking, and automated notifications enhance the borrower experience by providing greater control and transparency. While other servicers like MOHELA and CornerStone have also made efforts to improve their digital offerings, Discover Lands Servicer’s platform is often praised for its intuitive design and ease of use.

Furthermore, the reputation and reliability of a loan servicer are paramount for borrowers who seek assurance that their loans are being managed competently. Discover Lands Servicer, though newer to the market, has quickly established a reputation for reliability and integrity. This is in part due to its commitment to compliance with federal regulations and its proactive approach to addressing borrower concerns. In comparison, some long-standing servicers have faced legal challenges and regulatory scrutiny, which can undermine borrower confidence.

In conclusion, while Discover Lands Servicer is a relatively new player in the student loan servicing industry, it has made a notable impact by prioritizing customer service, offering flexible repayment options, and leveraging technology to enhance the borrower experience. When compared to other established servicers, Discover Lands Servicer stands out for its commitment to innovation and borrower satisfaction. As the student loan landscape continues to evolve, borrowers may find Discover Lands Servicer to be a compelling choice for managing their student loan portfolios effectively.

How Discover Lands Servicer Supports Borrowers During Financial Hardship

In the complex landscape of student loans, borrowers often find themselves navigating financial challenges that can feel overwhelming. Recognizing this, Discover Lands Servicer has developed a comprehensive support system designed to assist borrowers during periods of financial hardship. This initiative is not only a testament to Discover’s commitment to its clients but also a reflection of its understanding of the multifaceted nature of financial difficulties.

To begin with, Discover Lands Servicer offers a range of flexible repayment options tailored to meet the diverse needs of borrowers. These options are particularly beneficial for those experiencing temporary financial setbacks. For instance, borrowers can explore income-driven repayment plans, which adjust monthly payments based on income and family size, thereby ensuring that payments remain manageable. This approach not only alleviates immediate financial pressure but also helps borrowers maintain their credit standing over time.

Moreover, Discover Lands Servicer provides deferment and forbearance options, which allow borrowers to temporarily pause or reduce their loan payments. These options are especially useful for individuals facing unexpected life events such as unemployment, medical emergencies, or other significant financial disruptions. By offering these temporary relief measures, Discover enables borrowers to focus on stabilizing their financial situation without the added stress of looming loan payments.

In addition to these practical solutions, Discover Lands Servicer emphasizes the importance of financial education and empowerment. The servicer offers a wealth of resources designed to enhance borrowers’ financial literacy, including online tools, webinars, and personalized counseling sessions. These resources equip borrowers with the knowledge and skills necessary to make informed financial decisions, ultimately fostering a sense of control and confidence in managing their student loans.

Furthermore, Discover Lands Servicer’s commitment to personalized support is evident in its dedicated customer service team. Borrowers can access one-on-one assistance from knowledgeable representatives who are trained to provide guidance tailored to individual circumstances. This personalized approach ensures that borrowers receive the support they need, when they need it, and fosters a sense of trust and reliability in the servicer-borrower relationship.

Another noteworthy aspect of Discover Lands Servicer’s support system is its proactive communication strategy. The servicer regularly reaches out to borrowers with updates, reminders, and tips on managing their loans effectively. This consistent communication helps borrowers stay informed about their options and responsibilities, reducing the likelihood of missed payments or default. By maintaining an open line of communication, Discover ensures that borrowers are never left in the dark about their loan status or available support options.

In conclusion, Discover Lands Servicer’s comprehensive approach to supporting borrowers during financial hardship is characterized by flexibility, education, personalized assistance, and proactive communication. By offering a range of repayment options, temporary relief measures, and educational resources, Discover empowers borrowers to navigate financial challenges with confidence and resilience. This commitment to borrower support not only enhances the overall loan repayment experience but also underscores Discover’s dedication to helping individuals achieve financial stability and success. As borrowers continue to face an ever-evolving economic landscape, Discover Lands Servicer remains a steadfast partner in their journey toward financial well-being.

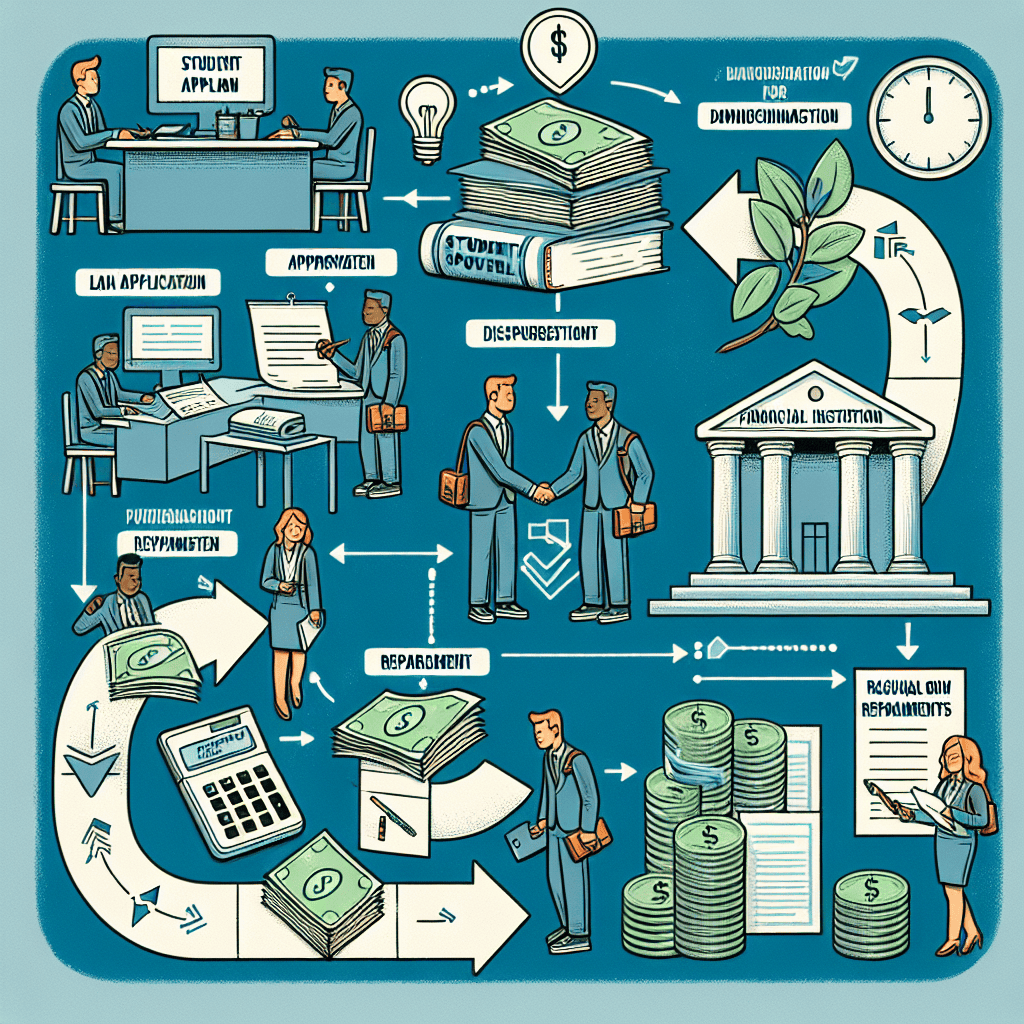

The Role Of Discover Lands Servicer In Federal And Private Student Loans

Discover Lands Servicer plays a pivotal role in the management of both federal and private student loans, offering a comprehensive suite of services designed to streamline the loan repayment process for borrowers. As the landscape of student loans continues to evolve, the need for efficient and reliable loan servicing becomes increasingly critical. Discover Lands Servicer steps into this role by providing a range of services that cater to the diverse needs of borrowers, ensuring that they can navigate the complexities of loan repayment with greater ease.

One of the primary functions of Discover Lands Servicer is to act as an intermediary between borrowers and lenders. This involves managing the day-to-day operations of loan accounts, including processing payments, maintaining records, and providing customer service. By handling these tasks, Discover Lands Servicer alleviates the administrative burden on both borrowers and lenders, allowing them to focus on their respective priorities. Moreover, the servicer’s expertise in loan management ensures that all transactions are conducted in compliance with federal regulations and industry standards, thereby safeguarding the interests of all parties involved.

In addition to its administrative responsibilities, Discover Lands Servicer plays a crucial role in educating borrowers about their loan options and repayment strategies. This is particularly important given the complexity of student loan products and the myriad of repayment plans available. By offering personalized guidance and support, Discover Lands Servicer empowers borrowers to make informed decisions about their financial futures. This includes helping them understand the implications of different repayment plans, such as income-driven repayment options, and advising them on strategies to minimize interest accrual and reduce overall debt.

Furthermore, Discover Lands Servicer is instrumental in facilitating communication between borrowers and lenders. This is achieved through the provision of user-friendly online platforms and customer service channels that enable borrowers to access their account information, make payments, and seek assistance with any issues they may encounter. By fostering open lines of communication, Discover Lands Servicer helps to build trust and transparency between borrowers and lenders, which is essential for maintaining a positive borrower experience.

Another significant aspect of Discover Lands Servicer’s role is its commitment to innovation and technology. In an era where digital solutions are transforming the financial services industry, Discover Lands Servicer leverages cutting-edge technology to enhance its service offerings. This includes the use of data analytics to identify trends and patterns in borrower behavior, which can inform the development of new products and services tailored to meet the evolving needs of borrowers. Additionally, the integration of artificial intelligence and machine learning into its operations allows Discover Lands Servicer to automate routine tasks, thereby improving efficiency and reducing the potential for human error.

In conclusion, Discover Lands Servicer is a key player in the student loan ecosystem, providing essential services that support both borrowers and lenders. Through its comprehensive approach to loan management, borrower education, and technological innovation, Discover Lands Servicer not only simplifies the repayment process but also contributes to the overall stability and sustainability of the student loan market. As the demand for higher education continues to grow, the role of Discover Lands Servicer will remain vital in ensuring that borrowers can successfully manage their student loan obligations and achieve their educational and financial goals.

Customer Reviews And Experiences With Discover Lands Servicer

In recent years, the landscape of student loan servicing has undergone significant changes, with various financial institutions stepping up to offer more streamlined and efficient services. Among these, Discover Lands Servicer has emerged as a notable player, garnering attention for its approach to managing student loan portfolios. As borrowers navigate the complexities of student loans, understanding customer reviews and experiences with Discover Lands Servicer can provide valuable insights into its effectiveness and reliability.

To begin with, many borrowers have expressed satisfaction with the user-friendly interface provided by Discover Lands Servicer. The platform’s intuitive design allows users to easily access their loan information, make payments, and explore repayment options. This ease of use is particularly beneficial for individuals who may not be well-versed in financial management, as it reduces the likelihood of errors and missed payments. Furthermore, the availability of online resources and tools has been praised for empowering borrowers to make informed decisions about their repayment strategies.

In addition to the platform’s functionality, customer service is a critical aspect of any loan servicer’s reputation. Discover Lands Servicer has received commendations for its responsive and knowledgeable customer support team. Borrowers have reported positive experiences when seeking assistance, noting that representatives are often able to provide clear and concise answers to their queries. This level of support is crucial, especially for those who may be facing financial difficulties or are unfamiliar with the intricacies of loan repayment. The ability to speak with a representative who can offer personalized guidance can significantly alleviate the stress associated with managing student loans.

Moreover, Discover Lands Servicer has been recognized for its proactive communication with borrowers. Regular updates and reminders about payment due dates, changes in interest rates, and available repayment plans help ensure that borrowers remain informed and engaged with their loan obligations. This transparency fosters a sense of trust between the servicer and its clients, as borrowers feel confident that they are being kept in the loop regarding any developments that may affect their financial situation.

However, it is important to acknowledge that not all experiences with Discover Lands Servicer have been entirely positive. Some borrowers have reported challenges with the processing of payments, citing delays or errors that have led to temporary financial strain. While these instances appear to be relatively infrequent, they highlight the importance of maintaining robust systems to handle the volume and complexity of student loan transactions. In response to such feedback, Discover Lands Servicer has reportedly taken steps to enhance its payment processing infrastructure, aiming to minimize disruptions and improve overall service reliability.

In conclusion, Discover Lands Servicer has made a significant impact on the student loan servicing industry by offering a user-friendly platform, responsive customer support, and transparent communication. While there are areas for improvement, particularly in payment processing, the overall customer reviews and experiences suggest that Discover Lands Servicer is a reliable option for borrowers seeking to manage their student loan portfolios effectively. As the company continues to refine its services, it is likely to further solidify its position as a trusted partner for individuals navigating the often daunting world of student loans.

Q&A

1. **What is Discover Lands Servicer?**

Discover Lands Servicer is a company that manages and services student loan portfolios, handling tasks such as billing, payment processing, and customer service.

2. **What types of student loans does Discover Lands Servicer manage?**

They manage both federal and private student loans, providing services to borrowers throughout the repayment process.

3. **How can borrowers contact Discover Lands Servicer?**

Borrowers can contact them via phone, email, or through their online portal for account management and customer service inquiries.

4. **What online services does Discover Lands Servicer offer?**

They offer an online portal where borrowers can make payments, view account details, and access resources for managing their loans.

5. **Does Discover Lands Servicer offer repayment plans?**

Yes, they offer various repayment plans, including income-driven repayment options for federal loans and flexible plans for private loans.

6. **Can borrowers consolidate their loans with Discover Lands Servicer?**

Borrowers can consolidate their federal loans through the federal Direct Consolidation Loan program, but private loan consolidation options depend on the lender.

7. **What happens if a borrower misses a payment with Discover Lands Servicer?**

Missing a payment can lead to late fees, negative credit reporting, and potential default, but borrowers should contact the servicer to discuss options.

8. **Does Discover Lands Servicer offer deferment or forbearance options?**

Yes, they provide deferment and forbearance options for eligible borrowers facing financial hardship or other qualifying circumstances.

9. **How does Discover Lands Servicer handle loan forgiveness programs?**

They assist borrowers in applying for federal loan forgiveness programs, such as Public Service Loan Forgiveness, if they meet the eligibility criteria.

10. **What resources does Discover Lands Servicer provide for financial education?**

They offer resources and tools to help borrowers understand their loans, manage their finances, and plan for repayment effectively.

Conclusion

Discover Financial Services’ student loan portfolio, managed by its subsidiary Discover Student Loans, has established itself as a significant player in the private student loan market. The servicer is known for offering competitive interest rates, flexible repayment options, and a user-friendly online platform, which enhances the borrower experience. Discover’s commitment to customer service is evident through its various support channels and resources aimed at helping borrowers manage their loans effectively. However, like many private lenders, Discover faces challenges related to borrower default rates and the competitive landscape of student lending. Overall, Discover’s student loan servicing is characterized by its strong customer-centric approach and adaptability in a dynamic financial environment.