“Market Shock: Dow Jones Plummets 500 Points as Bond Yields Spike After Robust Jobs Data!”

Introduction

In a significant market shift, the Dow Jones Industrial Average experienced a sharp decline of 500 points, reflecting investor concerns as bond yields surged in response to a robust jobs report. The strong employment data has raised expectations for continued interest rate hikes by the Federal Reserve, prompting a sell-off in equities as traders reassess their strategies in light of rising borrowing costs. This volatility underscores the ongoing tension between economic growth indicators and monetary policy adjustments, leaving market participants on edge as they navigate the evolving financial landscape.

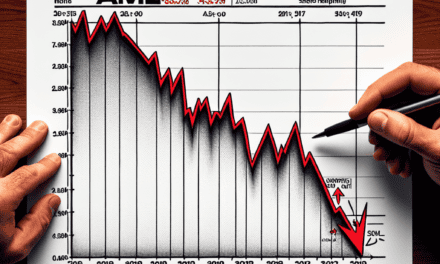

Dow Jones Decline: Analyzing the 500-Point Drop

In a significant turn of events, the Dow Jones Industrial Average experienced a sharp decline of 500 points, reflecting a broader trend of volatility in the stock market. This downturn can be largely attributed to the recent surge in bond yields, which followed the release of a robust jobs report. The report indicated stronger-than-expected job growth, prompting investors to reassess their expectations regarding interest rates and economic stability. As a result, the bond market reacted swiftly, with yields climbing, which in turn exerted downward pressure on equities.

The strong jobs report, while a positive indicator of economic health, raised concerns among investors about the potential for the Federal Reserve to maintain or even increase interest rates in response to sustained economic growth. Higher interest rates typically lead to increased borrowing costs for consumers and businesses, which can dampen spending and investment. Consequently, the anticipation of tighter monetary policy has historically led to declines in stock prices, as seen in the current market reaction.

Moreover, the rise in bond yields has made fixed-income investments more attractive relative to equities. As yields on government bonds increase, investors often shift their portfolios to favor these safer assets, leading to a sell-off in stocks. This shift in investment strategy is particularly pronounced in a market environment characterized by uncertainty, where the allure of guaranteed returns becomes more appealing. The 500-point drop in the Dow Jones serves as a stark reminder of how quickly market sentiment can change in response to economic data.

In addition to the immediate impact of the jobs report, broader economic indicators also play a crucial role in shaping market dynamics. For instance, inflationary pressures remain a concern, as rising prices can erode purchasing power and influence the Federal Reserve’s policy decisions. The interplay between job growth, inflation, and interest rates creates a complex landscape for investors, who must navigate these factors while making informed decisions about their portfolios.

Furthermore, the decline in the Dow Jones is not an isolated event; it reflects a larger trend of market volatility that has characterized recent months. Investors are grappling with a myriad of challenges, including geopolitical tensions, supply chain disruptions, and the ongoing effects of the pandemic. Each of these factors contributes to an environment of uncertainty, prompting many to adopt a more cautious approach to investing.

As the market continues to react to economic data and policy signals, it is essential for investors to remain vigilant and informed. Understanding the implications of rising bond yields and their relationship with stock market performance can provide valuable insights into potential future movements. While the current decline in the Dow Jones may be disconcerting, it also presents opportunities for those who are willing to engage with the market strategically.

In conclusion, the recent 500-point drop in the Dow Jones Industrial Average underscores the intricate relationship between economic indicators and market performance. As bond yields surge in response to a strong jobs report, investors must navigate the complexities of interest rates and economic growth. This situation serves as a reminder of the ever-changing nature of the financial landscape, where informed decision-making and adaptability are crucial for success. As we move forward, the focus will remain on how these economic trends will shape market behavior in the coming weeks and months.

Impact of Rising Bond Yields on Stock Market

The recent surge in bond yields has had a significant impact on the stock market, particularly following the release of a robust jobs report that has raised concerns about inflation and interest rates. As investors digest the implications of this economic data, the Dow Jones Industrial Average experienced a notable decline, dropping 500 points in response to the rising yields. This reaction underscores the intricate relationship between bond markets and equities, where shifts in one can lead to pronounced movements in the other.

To understand the dynamics at play, it is essential to recognize that bond yields often serve as a barometer for investor sentiment regarding future economic conditions. When bond yields rise, it typically indicates that investors expect stronger economic growth, which can lead to higher inflation. In this context, the recent jobs report, which showcased an increase in employment figures, has fueled expectations that the Federal Reserve may need to tighten monetary policy more aggressively to combat potential inflationary pressures. Consequently, the anticipation of higher interest rates has led to a sell-off in stocks, as higher borrowing costs can dampen corporate profits and consumer spending.

Moreover, the relationship between bond yields and stock valuations is critical to understanding the current market environment. As yields increase, the attractiveness of fixed-income investments rises, prompting investors to reassess their portfolios. This shift can lead to a rotation out of equities and into bonds, particularly if the yields on government securities begin to offer more competitive returns compared to the potential gains from stocks. In this scenario, the opportunity cost of holding equities increases, leading to downward pressure on stock prices.

Additionally, sectors that are particularly sensitive to interest rate changes, such as technology and real estate, have been disproportionately affected by the rise in bond yields. These sectors often rely on cheap borrowing to fuel growth and expansion. As yields climb, the cost of financing increases, which can hinder growth prospects and lead to a reevaluation of future earnings potential. Consequently, investors may choose to pivot away from these high-growth sectors in favor of more stable, dividend-paying stocks that can provide a buffer against rising rates.

Furthermore, the psychological impact of rising bond yields cannot be overlooked. Market sentiment plays a crucial role in driving stock prices, and the perception of an impending economic slowdown or increased volatility can lead to heightened risk aversion among investors. This shift in sentiment can exacerbate market declines, as seen in the recent drop in the Dow Jones. As investors grapple with the implications of rising yields, they may adopt a more cautious approach, leading to further selling pressure in the equity markets.

In conclusion, the interplay between rising bond yields and the stock market is complex and multifaceted. The recent drop in the Dow Jones Industrial Average serves as a stark reminder of how economic indicators, such as a strong jobs report, can influence investor behavior and market dynamics. As bond yields continue to rise, the stock market may face ongoing challenges, particularly in sectors sensitive to interest rate fluctuations. Investors will need to remain vigilant and adaptable in this evolving landscape, as the implications of rising yields will likely continue to reverberate throughout the financial markets.

Strong Jobs Report: Implications for Investors

The recent strong jobs report has sent ripples through the financial markets, particularly impacting the stock market and bond yields. As the Dow Jones Industrial Average experienced a significant drop of 500 points, investors are left to grapple with the implications of this robust employment data. The report, which indicated a surge in job creation and a decrease in unemployment rates, initially seemed to signal a healthy economy. However, the subsequent rise in bond yields has raised concerns among investors, leading to a reevaluation of market positions.

To understand the implications of the strong jobs report, it is essential to consider the relationship between employment data and interest rates. Typically, a strong jobs report suggests that the economy is performing well, which can lead to increased consumer spending and, consequently, inflationary pressures. In response to these pressures, the Federal Reserve may feel compelled to raise interest rates to keep inflation in check. This potential for higher interest rates is what has driven bond yields upward, as investors adjust their expectations for future monetary policy.

As bond yields rise, the attractiveness of fixed-income investments increases, drawing capital away from equities. This shift in investor sentiment can lead to a sell-off in the stock market, as seen with the Dow’s significant decline. The correlation between rising bond yields and falling stock prices is not new; it reflects a broader trend where investors seek safer, more stable returns in the face of uncertainty. Consequently, the strong jobs report, while indicative of economic strength, has inadvertently triggered a wave of caution among equity investors.

Moreover, the implications of this jobs report extend beyond immediate market reactions. For long-term investors, the data may signal a shift in the economic landscape that warrants a reassessment of investment strategies. With the potential for rising interest rates, sectors that are sensitive to borrowing costs, such as real estate and utilities, may face headwinds. Conversely, financial institutions could benefit from a higher interest rate environment, as they can charge more for loans while maintaining their profit margins. Thus, investors may need to consider sector rotation as they navigate this evolving economic scenario.

In addition to sector considerations, the strong jobs report also raises questions about consumer behavior and spending patterns. A robust labor market typically leads to increased disposable income, which can drive economic growth. However, if rising interest rates dampen consumer confidence or spending, the anticipated economic expansion may not materialize as expected. This uncertainty adds another layer of complexity for investors, who must weigh the potential for growth against the risks associated with tightening monetary policy.

In conclusion, the strong jobs report has significant implications for investors, particularly in light of the subsequent rise in bond yields and the resulting volatility in the stock market. As the Dow Jones dropped sharply, it became evident that the interplay between employment data and interest rates is a critical factor in shaping market dynamics. Investors must remain vigilant, adapting their strategies to navigate the potential challenges and opportunities that arise from this evolving economic landscape. Ultimately, the ability to respond to these changes will be crucial for maintaining a balanced and resilient investment portfolio in the face of uncertainty.

Market Reactions: Understanding the Dow’s Volatility

In recent trading sessions, the stock market has exhibited notable volatility, particularly highlighted by the Dow Jones Industrial Average’s significant drop of 500 points. This decline can be attributed to a confluence of factors, most prominently the surge in bond yields following the release of a robust jobs report. Understanding the dynamics of this market reaction requires a closer examination of the interplay between economic indicators and investor sentiment.

The strong jobs report, which indicated a higher-than-expected increase in employment figures, initially sparked optimism among investors. Such data typically suggests a strengthening economy, which can lead to increased consumer spending and corporate profits. However, this positive outlook was quickly overshadowed by rising bond yields, which are often viewed as a harbinger of higher interest rates. When bond yields increase, it signals that investors are demanding higher returns for holding government debt, often in anticipation of tighter monetary policy from the Federal Reserve.

As bond yields surged, the attractiveness of equities diminished, leading to a sell-off in the stock market. Investors began to reassess their portfolios, shifting their focus from stocks to bonds, which are perceived as safer investments in a rising interest rate environment. This shift in sentiment was particularly pronounced in sectors that are sensitive to interest rates, such as technology and real estate, which experienced sharper declines compared to more defensive sectors.

Moreover, the volatility in the Dow Jones can also be attributed to the broader context of economic uncertainty. While the jobs report was strong, other economic indicators have been mixed, leading to concerns about the sustainability of growth. Inflation remains a persistent issue, and the Federal Reserve’s response to rising prices continues to loom large over market expectations. As investors grapple with the potential for further rate hikes, the market’s reaction becomes increasingly sensitive to any economic data that could influence the Fed’s decision-making process.

In addition to these macroeconomic factors, geopolitical tensions and global economic conditions also play a crucial role in shaping market reactions. For instance, ongoing trade disputes and uncertainties surrounding international relations can exacerbate market volatility. Investors are often on edge, reacting swiftly to news that could impact economic stability, which further contributes to the fluctuations observed in the Dow.

As the market continues to navigate these complexities, it is essential for investors to remain vigilant and informed. Understanding the underlying factors driving market movements can provide valuable insights into potential future trends. While the recent drop in the Dow may seem alarming, it is important to recognize that such volatility is not uncommon in the stock market, particularly in response to significant economic developments.

In conclusion, the recent decline in the Dow Jones Industrial Average serves as a reminder of the intricate relationship between economic indicators, investor sentiment, and market dynamics. The surge in bond yields following a strong jobs report illustrates how quickly market perceptions can shift, leading to pronounced volatility. As investors continue to monitor economic conditions and adjust their strategies accordingly, the stock market will likely remain a reflection of the broader economic landscape, characterized by both opportunities and challenges.

Economic Indicators: What the Jobs Report Means for the Future

The recent jobs report has sent ripples through the financial markets, particularly impacting the stock market as evidenced by the Dow Jones Industrial Average’s significant drop of 500 points. This decline can be attributed to a surge in bond yields, which often reflects investor sentiment regarding economic growth and inflation expectations. As the labor market continues to show resilience, the implications of this report extend beyond immediate market reactions, prompting a closer examination of economic indicators and their potential influence on future monetary policy.

The jobs report revealed stronger-than-expected employment figures, indicating that the economy is maintaining its momentum despite various headwinds. This robust job growth suggests that consumer spending, a critical driver of economic activity, is likely to remain strong. However, the positive news surrounding employment has also raised concerns about inflationary pressures. When the labor market is tight, wages tend to rise as employers compete for talent, which can lead to increased consumer spending and, consequently, higher prices. This scenario is particularly relevant in the current economic climate, where inflation has already been a focal point for policymakers.

In light of these developments, bond yields have surged, reflecting investor expectations that the Federal Reserve may need to adopt a more aggressive stance in its monetary policy. Higher bond yields typically indicate that investors anticipate rising interest rates, which can have a cascading effect on various sectors of the economy. For instance, as borrowing costs increase, both consumers and businesses may scale back on spending and investment, potentially slowing economic growth. This interplay between employment data and interest rates underscores the delicate balance that the Federal Reserve must navigate as it seeks to foster economic stability while curbing inflation.

Moreover, the strong jobs report may compel the Federal Reserve to reassess its current approach to interest rates. While the central bank has been cautious in its rate hikes, the persistent strength in the labor market could lead to a reassessment of this strategy. If the Fed perceives that inflation is becoming entrenched, it may opt for more aggressive rate increases, which could further impact the stock market and overall economic sentiment. Investors are acutely aware of this possibility, as evidenced by the immediate reaction in the equity markets following the jobs report.

In addition to the implications for monetary policy, the jobs report also highlights the ongoing shifts within the labor market itself. Certain sectors, such as technology and healthcare, continue to experience robust growth, while others may be facing challenges. This divergence can create opportunities for investors who are attuned to these trends, allowing them to position their portfolios in alignment with the evolving economic landscape. As such, understanding the nuances of the jobs report and its broader implications is essential for making informed investment decisions.

In conclusion, the recent jobs report serves as a critical economic indicator that not only reflects the current state of the labor market but also provides insights into future monetary policy and market dynamics. The surge in bond yields and the subsequent drop in the Dow Jones underscore the interconnectedness of these economic factors. As investors navigate this complex environment, staying informed about economic indicators will be paramount in anticipating potential shifts in market conditions and making strategic investment choices. The road ahead may be fraught with uncertainty, but a keen understanding of these dynamics will be invaluable in charting a course through the evolving economic landscape.

Strategies for Navigating a Tumultuous Stock Market

In the wake of the recent stock market fluctuations, particularly the notable drop of 500 points in the Dow Jones Industrial Average, investors are faced with the challenge of navigating a tumultuous financial landscape. This decline, largely attributed to surging bond yields following a robust jobs report, underscores the intricate relationship between economic indicators and market performance. As such, it becomes imperative for investors to adopt strategic approaches to mitigate risks and capitalize on potential opportunities during periods of volatility.

One effective strategy is diversification, which involves spreading investments across various asset classes, sectors, and geographic regions. By diversifying, investors can reduce the impact of a downturn in any single investment or sector. For instance, while equities may be experiencing turbulence, other asset classes such as real estate or commodities might perform better, thereby providing a buffer against losses. Furthermore, incorporating international investments can also enhance diversification, as global markets may not always move in tandem with domestic trends.

In addition to diversification, maintaining a long-term perspective is crucial during times of market instability. Short-term fluctuations can often lead to emotional decision-making, which may result in hasty actions that could undermine an investor’s overall strategy. By focusing on long-term goals and adhering to a well-defined investment plan, individuals can better withstand the pressures of market volatility. This approach encourages investors to remain committed to their investment thesis, even when faced with temporary setbacks.

Moreover, it is essential for investors to stay informed about macroeconomic trends and their potential implications for the market. The recent surge in bond yields, for instance, signals a shift in investor sentiment regarding interest rates and inflation expectations. Understanding these dynamics can help investors make more informed decisions about asset allocation and risk management. For example, rising yields may prompt a reevaluation of fixed-income investments, leading some to consider reallocating funds into equities or alternative investments that may offer better returns in a higher interest rate environment.

Another prudent strategy is to employ a systematic approach to investing, such as dollar-cost averaging. This technique involves consistently investing a fixed amount of money at regular intervals, regardless of market conditions. By doing so, investors can mitigate the effects of market volatility, as they purchase more shares when prices are low and fewer shares when prices are high. This disciplined approach not only reduces the risk of making poor investment decisions based on market timing but also fosters a sense of financial stability.

Additionally, it is vital for investors to assess their risk tolerance and adjust their portfolios accordingly. In times of heightened uncertainty, some may find it beneficial to shift towards more conservative investments, such as high-quality bonds or dividend-paying stocks, which can provide a steady income stream. Conversely, those with a higher risk appetite may choose to explore growth-oriented sectors that could offer substantial returns in the long run.

Ultimately, navigating a tumultuous stock market requires a combination of strategic planning, informed decision-making, and emotional resilience. By embracing diversification, maintaining a long-term perspective, staying informed about economic trends, employing systematic investment strategies, and aligning portfolios with individual risk tolerances, investors can better position themselves to weather the storms of market volatility. As the financial landscape continues to evolve, those who remain adaptable and proactive will likely find themselves better equipped to seize opportunities and achieve their investment objectives.

The Relationship Between Bond Yields and Stock Performance

The relationship between bond yields and stock performance is a critical aspect of financial markets that investors closely monitor. When bond yields rise, it often signals a shift in investor sentiment, which can lead to significant movements in stock prices. This dynamic was vividly illustrated in the recent market reaction following a robust jobs report, which propelled bond yields higher and contributed to a notable decline in the Dow Jones Industrial Average.

To understand this relationship, it is essential to recognize that bond yields represent the return investors can expect from holding government debt. When economic indicators, such as employment figures, suggest a strengthening economy, investors may anticipate that the Federal Reserve will raise interest rates to curb inflation. Consequently, this expectation leads to an increase in bond yields, as new bonds are issued at higher rates to attract buyers. As yields rise, existing bonds with lower rates become less attractive, prompting investors to sell them, which further drives up yields.

This increase in bond yields can have a cascading effect on the stock market. Higher yields often lead to increased borrowing costs for companies, which can dampen their profitability and growth prospects. As a result, investors may reassess the value of equities, leading to a sell-off in stocks. In the case of the recent market downturn, the surge in bond yields following the strong jobs report prompted investors to reevaluate their positions, resulting in a sharp decline in the Dow Jones.

Moreover, the relationship between bond yields and stock performance is influenced by the concept of opportunity cost. When bond yields rise, the fixed income from bonds becomes more appealing compared to the potential returns from stocks. Investors may shift their portfolios to favor bonds over equities, further exacerbating the downward pressure on stock prices. This shift is particularly pronounced in sectors that are sensitive to interest rates, such as utilities and real estate, which often see their valuations decline as yields increase.

Additionally, the psychological aspect of market behavior cannot be overlooked. Rising bond yields can create a sense of uncertainty among investors, leading to increased volatility in the stock market. As investors react to changing economic conditions, their collective behavior can amplify market movements, resulting in sharp declines or rallies. The recent drop in the Dow Jones serves as a reminder of how quickly market sentiment can shift in response to economic data.

In conclusion, the interplay between bond yields and stock performance is a fundamental aspect of financial markets that requires careful consideration. The recent surge in bond yields, driven by a strong jobs report, illustrates how economic indicators can influence investor behavior and lead to significant market movements. As investors navigate this complex landscape, understanding the relationship between bonds and stocks will be crucial for making informed decisions. The current environment underscores the importance of remaining vigilant and adaptable, as shifts in economic data can have far-reaching implications for both bond and equity markets.

Q&A

1. **Question:** What caused the Dow Jones to drop 500 points recently?

**Answer:** The drop was primarily due to surging bond yields following a strong jobs report.

2. **Question:** How do bond yields affect the stock market?

**Answer:** Rising bond yields can lead to higher borrowing costs and make bonds more attractive compared to stocks, prompting investors to sell equities.

3. **Question:** What was the impact of the strong jobs report on investor sentiment?

**Answer:** The strong jobs report raised concerns about potential interest rate hikes, leading to increased volatility in the stock market.

4. **Question:** What are bond yields?

**Answer:** Bond yields represent the return an investor can expect from holding a bond, often influenced by interest rates and economic conditions.

5. **Question:** How did the Dow Jones perform in the days following the jobs report?

**Answer:** The Dow Jones experienced a significant decline, dropping 500 points in response to the economic data.

6. **Question:** What sectors were most affected by the drop in the Dow Jones?

**Answer:** Interest-sensitive sectors, such as technology and real estate, were particularly impacted by the rise in bond yields.

7. **Question:** What should investors consider in light of the recent market movements?

**Answer:** Investors should assess their portfolios for interest rate sensitivity and consider the potential for continued volatility in response to economic indicators.

Conclusion

The significant drop of 500 points in the Dow Jones, coupled with rising bond yields following a robust jobs report, indicates heightened investor concern over potential interest rate hikes and inflationary pressures. This market reaction underscores the delicate balance between economic growth and monetary policy, suggesting that while the labor market remains strong, it may lead to tighter financial conditions that could impact stock valuations moving forward.