“Decoding Tesla’s Stock Decline: Charting Insights for Tomorrow’s Trends.”

Introduction

Analyzing Tesla’s stock decline involves a comprehensive examination of market trends, investor sentiment, and technical indicators that have influenced its performance. By delving into historical price movements and chart patterns, we can uncover critical insights into the factors driving the recent downturn. This analysis not only highlights the challenges Tesla faces in a competitive automotive landscape but also provides a framework for predicting future trends. Understanding these dynamics is essential for investors looking to navigate the complexities of Tesla’s stock and make informed decisions moving forward.

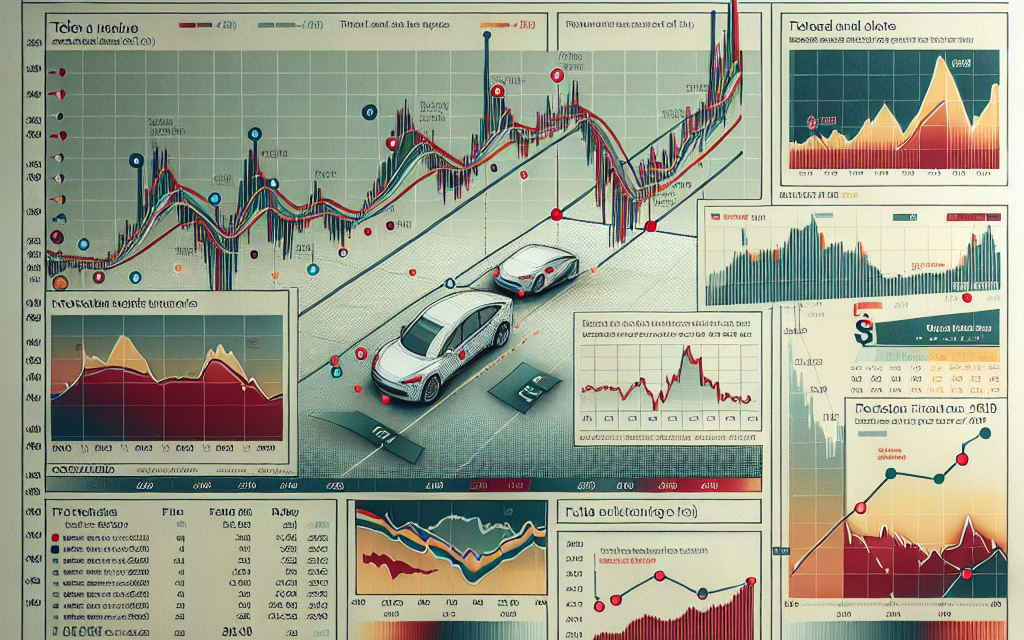

Technical Analysis of Tesla’s Stock Decline

Tesla’s stock has experienced notable fluctuations in recent months, prompting investors and analysts alike to delve into the technical aspects of its decline. By examining the charts, one can glean insights that may illuminate potential future trends for this electric vehicle giant. The technical analysis of Tesla’s stock reveals patterns and indicators that are crucial for understanding the underlying market sentiment and potential price movements.

Initially, it is essential to recognize the significance of support and resistance levels in the context of Tesla’s stock. Support levels represent price points where buying interest is strong enough to prevent the stock from declining further, while resistance levels indicate where selling pressure may emerge. In recent months, Tesla’s stock has tested several support levels, notably around the $200 mark. This level has historically acted as a psychological barrier, and its repeated testing suggests that investors are closely monitoring this threshold. If the stock were to breach this support level, it could signal a more profound decline, prompting further selling pressure.

Moreover, moving averages serve as vital tools in technical analysis, providing insights into the stock’s overall trend. The 50-day and 200-day moving averages are particularly significant, as they help smooth out price fluctuations and highlight the stock’s trajectory over time. Currently, Tesla’s stock is trading below both the 50-day and 200-day moving averages, indicating a bearish trend. This positioning suggests that the stock may continue to face downward pressure unless a substantial catalyst emerges to reverse this trend. Investors should remain vigilant, as a crossover of these moving averages could signal a potential shift in momentum.

In addition to moving averages, the Relative Strength Index (RSI) is another critical indicator that can provide insights into Tesla’s stock performance. The RSI measures the speed and change of price movements, helping to identify overbought or oversold conditions. A reading above 70 typically indicates that a stock is overbought, while a reading below 30 suggests it is oversold. Currently, Tesla’s RSI hovers around the mid-40s, indicating that the stock is neither overbought nor oversold. This neutral position may suggest that there is still room for price movement in either direction, depending on market sentiment and external factors.

Furthermore, volume analysis plays a crucial role in understanding the strength of price movements. An increase in trading volume during a price decline can indicate strong selling pressure, while a decrease in volume may suggest a lack of conviction among sellers. In Tesla’s case, recent trading sessions have shown a spike in volume during downward movements, reinforcing the notion that bearish sentiment is prevalent among investors. This trend could continue to exert downward pressure on the stock unless a shift in sentiment occurs.

As one analyzes the technical indicators surrounding Tesla’s stock decline, it becomes evident that the interplay of support and resistance levels, moving averages, RSI, and volume provides a comprehensive view of the current market landscape. While the charts reveal a bearish trend, it is essential to consider external factors such as macroeconomic conditions, competitive pressures, and company-specific news that could influence future price movements. Ultimately, investors must remain attentive to these technical signals while also integrating broader market dynamics into their decision-making processes. By doing so, they can better navigate the complexities of Tesla’s stock and position themselves for potential opportunities in the evolving landscape of electric vehicles.

Key Support and Resistance Levels for Tesla

Analyzing Tesla’s stock decline reveals critical insights into its future trends, particularly when examining key support and resistance levels. These levels serve as essential indicators for traders and investors, providing a framework for understanding potential price movements. Support levels are price points where a stock tends to stop falling and may even rebound, while resistance levels are where the stock typically struggles to rise above. For Tesla, identifying these levels is crucial, especially in light of its recent volatility.

In the context of Tesla’s stock, the first significant support level can be observed around the $200 mark. This level has historically acted as a psychological barrier, where buying interest tends to increase as the price approaches this threshold. The stock has tested this level multiple times, and each time it has shown resilience, suggesting that investors view this price as an attractive entry point. However, if Tesla’s stock were to break below this support level, it could signal a more profound bearish trend, potentially leading to further declines. Such a scenario would likely prompt a reevaluation of investor sentiment and could trigger stop-loss orders, exacerbating the downward momentum.

Conversely, resistance levels for Tesla are equally important in understanding its price dynamics. The $300 mark has emerged as a significant resistance level, where selling pressure has historically intensified. Each time the stock approaches this level, it encounters increased selling activity, indicating that many investors are willing to take profits at this price point. This pattern suggests that for Tesla to regain upward momentum, it must not only reach this level but also convincingly break through it. A successful breach of the $300 resistance could pave the way for a more bullish outlook, potentially attracting new buyers and reinvigorating investor confidence.

Moreover, the interplay between these support and resistance levels can provide valuable insights into market psychology. For instance, if Tesla’s stock were to oscillate between the $200 support and the $300 resistance, it would create a trading range that could attract both short-term traders and long-term investors. Traders might capitalize on this volatility by buying near the support level and selling near the resistance level, while long-term investors may view the stock’s ability to maintain this range as a sign of stability amidst broader market fluctuations.

Additionally, it is essential to consider the broader market context when analyzing Tesla’s stock. Factors such as macroeconomic conditions, interest rates, and industry trends can significantly influence investor behavior and, consequently, the stock’s performance. For example, if the electric vehicle market continues to expand and Tesla maintains its competitive edge, it could bolster investor confidence, leading to a potential breakout above the $300 resistance. Conversely, if economic headwinds persist, the stock may struggle to maintain its support levels, prompting a reassessment of its valuation.

In conclusion, understanding the key support and resistance levels for Tesla is vital for anticipating future trends in its stock performance. The $200 support level serves as a critical threshold for potential rebounds, while the $300 resistance level represents a significant barrier to upward movement. By closely monitoring these levels and considering the broader market dynamics, investors can make more informed decisions regarding their positions in Tesla, ultimately navigating the complexities of its stock with greater confidence.

Historical Patterns in Tesla’s Stock Performance

Tesla’s stock performance has been a subject of intense scrutiny and analysis, particularly in light of its recent decline. To understand the current situation, it is essential to examine historical patterns that have characterized Tesla’s stock movements over the years. By delving into these patterns, investors can glean insights that may inform future trends and expectations.

Historically, Tesla’s stock has exhibited significant volatility, often influenced by a combination of market sentiment, company performance, and broader economic factors. For instance, the stock experienced remarkable growth during the early years of its public offering, driven by increasing consumer interest in electric vehicles and the company’s innovative approach to technology. This initial surge set a precedent for the stock’s future behavior, establishing a pattern of rapid ascents followed by sharp corrections. Such fluctuations are not uncommon in the tech and automotive sectors, where investor enthusiasm can lead to inflated valuations.

Moreover, examining specific time frames reveals that Tesla’s stock has often reacted to key events and announcements. For example, quarterly earnings reports have historically served as pivotal moments for the stock, with prices soaring or plummeting based on the results. In some instances, positive earnings surprises have led to significant upward momentum, while disappointing results have triggered sell-offs. This pattern underscores the importance of earnings as a catalyst for stock price movements, highlighting the need for investors to remain vigilant during these periods.

In addition to earnings reports, broader market trends have also played a crucial role in shaping Tesla’s stock trajectory. The rise of environmental consciousness and the push for sustainable energy solutions have created a favorable backdrop for electric vehicle manufacturers. However, as competition in the electric vehicle market intensifies, Tesla’s ability to maintain its market share has come under scrutiny. This competitive landscape has contributed to fluctuations in stock performance, as investors weigh the potential for growth against the risks posed by emerging rivals.

Furthermore, macroeconomic factors, such as interest rates and inflation, have historically influenced Tesla’s stock. For instance, rising interest rates can lead to increased borrowing costs for consumers, potentially dampening demand for high-ticket items like electric vehicles. Consequently, shifts in monetary policy can create ripple effects in the stock market, impacting investor sentiment and stock valuations. As such, understanding these economic indicators is vital for predicting future trends in Tesla’s stock performance.

Another noteworthy aspect of Tesla’s historical patterns is the role of investor sentiment and market psychology. The stock has often been subject to speculative trading, with retail investors playing a significant role in driving price movements. This phenomenon can lead to rapid price swings, as enthusiasm or fear can quickly shift market dynamics. Consequently, the interplay between investor sentiment and stock performance is a critical factor to consider when analyzing Tesla’s historical trends.

In conclusion, Tesla’s stock decline can be better understood through a comprehensive analysis of its historical performance patterns. By examining the interplay of earnings reports, market trends, macroeconomic factors, and investor sentiment, one can gain valuable insights into the forces shaping Tesla’s stock trajectory. As investors look to the future, recognizing these historical patterns may provide a framework for navigating the complexities of Tesla’s stock and anticipating potential trends in the ever-evolving landscape of electric vehicles and sustainable energy.

Impact of Market Sentiment on Tesla’s Price Trends

The stock market is often influenced by a myriad of factors, with market sentiment playing a pivotal role in shaping price trends, particularly for high-profile companies like Tesla. As investors navigate the complexities of the market, their perceptions and emotions can significantly impact stock performance, leading to fluctuations that may not always align with a company’s fundamental value. In the case of Tesla, recent declines in its stock price can be attributed, in part, to shifting market sentiment, which is reflected in various technical indicators and chart patterns.

To begin with, it is essential to recognize that Tesla’s stock has historically been subject to volatility, driven by both its innovative business model and the broader electric vehicle market’s dynamics. However, as market sentiment shifts, the stock’s price can experience pronounced movements. For instance, when investor confidence is high, driven by positive news such as strong quarterly earnings or advancements in technology, Tesla’s stock tends to rally. Conversely, negative sentiment, often triggered by concerns over competition, regulatory challenges, or macroeconomic factors, can lead to sharp declines. This cyclical nature of sentiment underscores the importance of understanding how it influences price trends.

Moreover, technical analysis provides valuable insights into how market sentiment manifests in Tesla’s stock charts. Traders often look for patterns such as support and resistance levels, moving averages, and volume trends to gauge investor behavior. For example, if Tesla’s stock consistently fails to break through a resistance level, it may indicate that market sentiment is turning bearish, prompting investors to reassess their positions. Similarly, a decline in trading volume during a price drop can suggest a lack of conviction among sellers, hinting at potential reversals or consolidations in the future.

In addition to technical indicators, broader market trends can also affect sentiment surrounding Tesla. The electric vehicle sector is increasingly competitive, with traditional automakers ramping up their electric offerings and new entrants emerging. As these developments unfold, investor sentiment can shift rapidly, leading to increased volatility in Tesla’s stock price. For instance, news of a competitor launching a new electric vehicle model may trigger concerns about Tesla’s market share, resulting in a sell-off. This reaction illustrates how external factors can exacerbate sentiment-driven price movements.

Furthermore, macroeconomic conditions, such as interest rates and inflation, can influence market sentiment and, consequently, Tesla’s stock performance. In an environment of rising interest rates, for example, investors may become more risk-averse, leading to a flight from growth stocks like Tesla. This shift in sentiment can create downward pressure on the stock, as seen in recent months. As investors recalibrate their expectations in response to changing economic indicators, the impact on Tesla’s stock can be pronounced.

In conclusion, the interplay between market sentiment and Tesla’s stock price trends is a complex yet critical aspect of understanding its recent decline. By analyzing technical indicators and considering external factors, investors can gain insights into how sentiment shapes price movements. As Tesla continues to navigate a rapidly evolving market landscape, staying attuned to shifts in investor sentiment will be essential for predicting future trends and making informed investment decisions. Ultimately, recognizing the significance of market sentiment can provide a clearer perspective on Tesla’s stock trajectory and its potential for recovery or further decline.

Comparing Tesla’s Decline to Industry Peers

In recent months, Tesla’s stock has experienced a notable decline, prompting investors and analysts alike to scrutinize the underlying factors contributing to this downturn. To gain a comprehensive understanding of Tesla’s performance, it is essential to compare its decline with that of its industry peers. This comparative analysis not only sheds light on Tesla’s unique challenges but also contextualizes its performance within the broader automotive and technology sectors.

When examining Tesla’s stock trajectory, it becomes evident that the company has faced headwinds that are not entirely dissimilar to those affecting other electric vehicle (EV) manufacturers. For instance, companies like Rivian and Lucid Motors have also seen fluctuations in their stock prices, driven by a combination of production challenges, supply chain disruptions, and shifting consumer demand. However, while these companies have struggled to establish a foothold in the market, Tesla’s decline is particularly striking given its established position as a market leader. This disparity raises questions about the sustainability of Tesla’s growth and its ability to maintain its competitive edge.

Moreover, the broader automotive industry has been grappling with economic uncertainties, including rising interest rates and inflationary pressures. These macroeconomic factors have led to a decrease in consumer spending, which has inevitably impacted the demand for new vehicles, including electric models. In this context, Tesla’s stock decline can be viewed as part of a larger trend affecting the entire sector. However, it is crucial to note that Tesla’s decline has been more pronounced than that of some traditional automakers, which have shown resilience in adapting to changing market conditions. This divergence suggests that Tesla may be facing unique challenges that require further investigation.

In addition to external economic factors, internal issues have also played a significant role in Tesla’s stock performance. For instance, production delays and quality control concerns have plagued the company, leading to negative sentiment among investors. While other automakers have similarly faced production hurdles, Tesla’s reputation for innovation and quality has made these issues particularly impactful. Consequently, the market’s reaction to Tesla’s struggles has been more severe, reflecting heightened expectations for a company that has long been viewed as a pioneer in the EV space.

Furthermore, the competitive landscape for electric vehicles is evolving rapidly, with traditional automakers increasingly investing in EV technology. Companies such as Ford and General Motors are ramping up their electric offerings, which could potentially erode Tesla’s market share. As these competitors gain traction, investors may be reassessing Tesla’s growth prospects, leading to increased volatility in its stock price. This shift in investor sentiment underscores the importance of monitoring industry trends and competitor strategies as they relate to Tesla’s future performance.

In conclusion, while Tesla’s stock decline can be partially attributed to broader economic challenges affecting the automotive industry, it is essential to recognize the unique factors at play within the company itself. By comparing Tesla’s performance to that of its industry peers, it becomes clear that the company faces a complex array of challenges that could shape its trajectory moving forward. As the electric vehicle market continues to evolve, investors will need to remain vigilant, analyzing both external market conditions and internal operational dynamics to make informed decisions about Tesla’s future. Ultimately, understanding these nuances will be critical for navigating the uncertainties that lie ahead in the ever-changing landscape of the automotive industry.

Future Price Predictions Based on Chart Analysis

In the realm of stock market analysis, chart patterns serve as invaluable tools for predicting future price movements. Tesla, a company that has captured the attention of investors and analysts alike, has recently experienced a notable decline in its stock price. To understand the potential future trends for Tesla’s stock, it is essential to delve into the insights provided by technical chart analysis. By examining historical price movements, key support and resistance levels, and various technical indicators, we can glean valuable information about the stock’s trajectory.

Firstly, it is crucial to identify significant support and resistance levels on Tesla’s price chart. Support levels represent price points where buying interest is strong enough to prevent the stock from falling further, while resistance levels indicate where selling pressure may emerge. In Tesla’s case, recent price action has shown that the stock has tested several support levels, which, if breached, could signal further declines. Conversely, if the stock manages to hold above these levels, it may indicate a potential reversal or stabilization in price. Analysts often look for confirmation through volume trends; a rise in volume accompanying a bounce off support can suggest a stronger likelihood of a price recovery.

Moreover, moving averages are another critical component of chart analysis that can provide insights into future price movements. The 50-day and 200-day moving averages are particularly significant, as they help to smooth out price fluctuations and identify the overall trend. Currently, Tesla’s stock is trading below both of these moving averages, which typically signals a bearish trend. However, if the stock can break above these averages, it may indicate a shift in momentum and a potential bullish reversal. Investors should closely monitor these moving averages, as they can serve as dynamic support and resistance levels.

In addition to support and resistance levels and moving averages, various technical indicators can further enhance our understanding of Tesla’s stock potential. The Relative Strength Index (RSI) is one such indicator that measures the speed and change of price movements. An RSI reading below 30 typically indicates that a stock is oversold, suggesting that a price correction may be imminent. Conversely, an RSI above 70 indicates overbought conditions, which could lead to a price pullback. Currently, Tesla’s RSI is hovering in the lower range, hinting at potential oversold conditions. This could suggest that a rebound may be on the horizon, although caution is warranted as market sentiment can shift rapidly.

Furthermore, chart patterns such as head and shoulders or double bottoms can provide additional context for future price predictions. For instance, if Tesla’s stock forms a double bottom pattern, it may indicate a strong reversal signal, suggesting that the stock could regain upward momentum. Conversely, a head and shoulders pattern could signal a continuation of the downtrend. Therefore, recognizing these patterns can be instrumental in making informed investment decisions.

In conclusion, while Tesla’s recent stock decline raises concerns among investors, chart analysis offers a framework for understanding potential future trends. By examining support and resistance levels, moving averages, technical indicators, and chart patterns, investors can gain insights into the stock’s trajectory. Although predicting stock movements is inherently uncertain, the information gleaned from chart analysis can help investors navigate the complexities of the market and make more informed decisions regarding their investments in Tesla. As always, it is essential to combine technical analysis with fundamental insights to develop a comprehensive view of the stock’s potential.

Investor Sentiment and Its Role in Tesla’s Stock Movement

Investor sentiment plays a crucial role in the movement of Tesla’s stock, influencing both short-term fluctuations and long-term trends. As a company that has consistently captured the public’s imagination, Tesla’s stock is often subject to the whims of market psychology. This phenomenon is particularly evident during periods of volatility, where investor emotions can lead to rapid price changes that may not necessarily align with the company’s fundamental performance. Understanding the dynamics of investor sentiment is essential for analyzing Tesla’s recent stock decline and predicting future trends.

To begin with, it is important to recognize that investor sentiment is shaped by a variety of factors, including news events, earnings reports, and broader market conditions. For Tesla, announcements related to production targets, technological advancements, or regulatory changes can significantly sway investor perceptions. For instance, when Tesla reported lower-than-expected delivery numbers, the market reacted swiftly, leading to a decline in stock price. This reaction underscores how sensitive investors are to news that may impact the company’s growth trajectory. Consequently, even minor setbacks can trigger a wave of selling, as investors reassess their positions based on perceived risks.

Moreover, the role of social media and online forums cannot be overlooked in the context of Tesla’s stock movement. Platforms like Twitter and Reddit have become influential in shaping investor sentiment, particularly among retail investors. The rapid dissemination of information, whether positive or negative, can create a feedback loop that amplifies price movements. For example, a viral post highlighting concerns about Tesla’s production capabilities can lead to panic selling, while optimistic projections can spur buying frenzies. This phenomenon illustrates how sentiment can sometimes overshadow fundamental analysis, leading to price volatility that may not reflect the company’s actual performance.

In addition to external factors, internal company dynamics also play a significant role in shaping investor sentiment. Leadership decisions, such as Elon Musk’s public statements or strategic shifts, can have immediate repercussions on stock performance. Musk’s tendency to communicate directly with investors and the public can create both excitement and uncertainty. While his visionary approach has garnered a loyal following, it can also lead to skepticism when his statements do not align with market expectations. This duality highlights the complex relationship between leadership and investor sentiment, where enthusiasm can quickly turn to doubt.

Furthermore, the broader economic environment influences investor sentiment towards Tesla. Economic indicators, such as interest rates and inflation, can affect consumer spending and, by extension, demand for electric vehicles. When economic conditions are uncertain, investors may become more risk-averse, leading to a decline in stock prices. In this context, Tesla’s stock is not only a reflection of the company’s performance but also a barometer of investor confidence in the overall market.

As we analyze Tesla’s stock decline, it becomes evident that investor sentiment is a multifaceted force that can drive significant price movements. The interplay of news events, social media influence, leadership dynamics, and economic conditions creates a complex landscape for investors. Understanding these factors is essential for making informed decisions about Tesla’s future trends. While the stock may experience fluctuations based on sentiment, a deeper analysis of the company’s fundamentals will ultimately provide a clearer picture of its long-term potential. As investors navigate this landscape, recognizing the impact of sentiment will be key to anticipating future movements in Tesla’s stock price.

Q&A

1. **What recent trend has been observed in Tesla’s stock price?**

Tesla’s stock has experienced a significant decline over the past several months, with a notable drop in value.

2. **What technical indicators suggest a potential reversal in Tesla’s stock?**

Key indicators such as the Relative Strength Index (RSI) and moving averages show signs of oversold conditions, which may indicate a potential reversal.

3. **How has market sentiment affected Tesla’s stock performance?**

Negative market sentiment, driven by concerns over production issues and competition, has contributed to the stock’s decline.

4. **What chart patterns are evident in Tesla’s stock analysis?**

Patterns such as head and shoulders or descending triangles may indicate bearish trends and potential further declines.

5. **What support levels should investors watch for in Tesla’s stock?**

Key support levels around $200 and $180 are critical, as breaking below these could signal further declines.

6. **What role do macroeconomic factors play in Tesla’s stock decline?**

Rising interest rates and inflation concerns have impacted investor confidence, leading to a broader sell-off in growth stocks like Tesla.

7. **What are the potential future trends for Tesla’s stock based on current analysis?**

If the stock can hold above key support levels and market sentiment improves, there may be a potential for recovery; otherwise, further declines could occur.

Conclusion

In conclusion, analyzing Tesla’s stock decline through chart patterns reveals critical insights into potential future trends. The observed bearish signals, coupled with key support and resistance levels, suggest that while short-term volatility may persist, long-term investors should remain vigilant for signs of recovery or further decline. Monitoring market sentiment, macroeconomic factors, and company performance will be essential in forecasting Tesla’s trajectory moving forward.