“Street Insights Recap: Your Compass Through Market Uncertainty.”

Introduction

Street Insights Recap: Navigating Uncertainty provides a comprehensive overview of the current market landscape, highlighting key trends, challenges, and opportunities that investors and businesses face in an unpredictable economic environment. This recap synthesizes expert analyses and data-driven insights, offering a strategic framework for understanding the complexities of market dynamics. By examining various sectors and their responses to ongoing uncertainties, the report aims to equip stakeholders with the knowledge needed to make informed decisions and adapt to evolving conditions.

Market Trends Analysis

In the ever-evolving landscape of financial markets, the analysis of market trends serves as a crucial tool for investors and analysts alike. As we navigate through periods of uncertainty, understanding the underlying dynamics that drive market behavior becomes increasingly important. Recent observations indicate that various factors, including geopolitical tensions, economic indicators, and shifts in consumer sentiment, have significantly influenced market trends.

To begin with, geopolitical tensions have emerged as a prominent factor affecting market stability. Events such as trade disputes, military conflicts, and diplomatic negotiations can create ripples across global markets. For instance, the ongoing trade negotiations between major economies have led to fluctuations in stock prices, as investors react to news and speculation regarding potential outcomes. This volatility underscores the importance of staying informed about international relations and their potential impact on market performance.

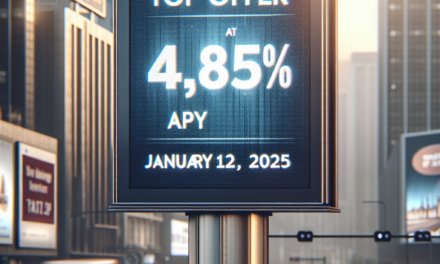

In addition to geopolitical factors, economic indicators play a vital role in shaping market trends. Key metrics such as unemployment rates, inflation figures, and gross domestic product (GDP) growth provide insights into the overall health of an economy. Recently released data indicating a rise in inflation has prompted concerns among investors, leading to increased volatility in equity markets. As central banks respond to these economic signals, their decisions regarding interest rates can further influence market dynamics. For example, a potential increase in interest rates may lead to a shift in investor sentiment, prompting a reevaluation of asset allocations.

Moreover, shifts in consumer sentiment cannot be overlooked when analyzing market trends. Consumer confidence is a critical driver of economic activity, and fluctuations in this sentiment can have immediate effects on market performance. Recent surveys have indicated a decline in consumer confidence, which may signal potential challenges for retail and service sectors. As consumers become more cautious in their spending habits, businesses may face pressure to adapt their strategies, ultimately impacting stock performance and market trends.

Transitioning from these macroeconomic factors, it is essential to consider the role of technological advancements in shaping market behavior. The rapid evolution of technology has not only transformed industries but has also altered the way investors access information and make decisions. The rise of algorithmic trading and the proliferation of financial technology platforms have introduced new dynamics into the market, enabling faster and more efficient trading. However, this technological shift also brings about challenges, as market participants must navigate the complexities of automated trading systems and their potential impact on market volatility.

Furthermore, the increasing emphasis on sustainability and environmental, social, and governance (ESG) factors is reshaping investment strategies. Investors are increasingly prioritizing companies that demonstrate a commitment to sustainable practices, leading to a shift in capital flows. This trend highlights the growing recognition that long-term value creation is closely tied to responsible business practices. As a result, companies that fail to adapt to these changing expectations may find themselves at a disadvantage in the marketplace.

In conclusion, the analysis of market trends in the context of uncertainty requires a multifaceted approach that considers geopolitical factors, economic indicators, consumer sentiment, technological advancements, and sustainability. As investors and analysts strive to make informed decisions, staying attuned to these interconnected elements will be essential for navigating the complexities of the financial landscape. By understanding the nuances of market behavior, stakeholders can better position themselves to respond to emerging trends and capitalize on opportunities in an increasingly uncertain environment.

Consumer Behavior Shifts

In recent months, consumer behavior has undergone significant shifts, reflecting the complexities of navigating uncertainty in an ever-evolving economic landscape. As individuals grapple with fluctuating economic conditions, their purchasing decisions have become increasingly influenced by a myriad of factors, including inflation, supply chain disruptions, and changing social dynamics. These elements have not only altered the way consumers approach spending but have also prompted businesses to adapt their strategies in response to these evolving preferences.

One of the most notable changes in consumer behavior is the heightened focus on value and quality. As inflationary pressures continue to impact household budgets, consumers are becoming more discerning about their purchases. This shift is evident in the growing popularity of private-label brands, which often offer comparable quality at a lower price point. Consequently, retailers are responding by enhancing their private-label offerings, ensuring that they meet the rising expectations of quality-conscious shoppers. This trend underscores a broader movement towards mindful consumption, where consumers prioritize essential items and seek to maximize the value of their expenditures.

Moreover, the pandemic has accelerated the adoption of digital shopping channels, fundamentally transforming the retail landscape. As consumers became accustomed to the convenience of online shopping, many have continued to embrace this mode of purchasing even as physical stores reopened. This shift has prompted businesses to invest heavily in their e-commerce platforms, enhancing user experience and streamlining logistics to meet the demands of a digitally savvy consumer base. Additionally, the rise of social commerce, where consumers discover and purchase products through social media platforms, has further reshaped the way brands engage with their audiences. This evolution highlights the necessity for businesses to remain agile and responsive to the changing dynamics of consumer interaction.

In tandem with these trends, there has been a noticeable shift towards sustainability and ethical consumption. As awareness of environmental issues grows, consumers are increasingly seeking products that align with their values. This has led to a surge in demand for sustainable goods, prompting companies to adopt more environmentally friendly practices and transparently communicate their efforts to consumers. Brands that successfully convey their commitment to sustainability are likely to foster stronger connections with their customers, as consumers are more inclined to support businesses that reflect their ethical beliefs.

Furthermore, the impact of social media cannot be overlooked in understanding consumer behavior shifts. The proliferation of influencers and user-generated content has transformed the way consumers perceive brands and make purchasing decisions. As individuals turn to social media for recommendations and reviews, businesses must navigate this landscape carefully, recognizing the power of authentic engagement. Brands that cultivate genuine relationships with their audiences and leverage social proof are better positioned to thrive in this competitive environment.

As we look ahead, it is clear that consumer behavior will continue to evolve in response to ongoing uncertainties. Businesses must remain vigilant, adapting their strategies to align with the shifting preferences and values of their customers. By prioritizing value, embracing digital transformation, committing to sustainability, and leveraging the influence of social media, companies can navigate the complexities of the current landscape. Ultimately, understanding these consumer behavior shifts will be crucial for businesses seeking to thrive in an era marked by uncertainty and change. As the market continues to evolve, those who remain attuned to the needs and desires of consumers will be best equipped to succeed.

Economic Indicators Overview

In the current economic landscape, understanding the nuances of various economic indicators is crucial for navigating the prevailing uncertainty. Economic indicators serve as vital tools that provide insights into the health and direction of an economy, allowing policymakers, businesses, and investors to make informed decisions. Among the most significant indicators are gross domestic product (GDP), unemployment rates, inflation rates, and consumer confidence indices, each offering a unique perspective on economic performance.

To begin with, GDP remains one of the most comprehensive measures of economic activity. It reflects the total value of all goods and services produced over a specific time period, thereby serving as a barometer for economic growth. Recent trends indicate fluctuations in GDP growth rates, which can be attributed to various factors, including changes in consumer spending, business investment, and government expenditures. As economies grapple with the aftereffects of global disruptions, such as the COVID-19 pandemic, GDP figures have become increasingly volatile, prompting analysts to closely monitor quarterly reports for signs of recovery or contraction.

In conjunction with GDP, the unemployment rate is another critical indicator that sheds light on the labor market’s health. A rising unemployment rate often signals economic distress, as it reflects a decrease in job opportunities and consumer spending power. Conversely, a declining unemployment rate typically suggests a robust economy where businesses are hiring and expanding. However, it is essential to consider the broader context, as the unemployment rate alone may not capture the full picture. For instance, underemployment and labor force participation rates also play significant roles in assessing the labor market’s overall strength.

Inflation rates, measured by the Consumer Price Index (CPI) and the Producer Price Index (PPI), are equally important in understanding economic dynamics. Inflation reflects the rate at which prices for goods and services rise, eroding purchasing power. In recent months, inflation has emerged as a pressing concern for many economies, driven by supply chain disruptions, increased demand, and rising energy prices. Central banks often respond to inflationary pressures by adjusting interest rates, which can have far-reaching implications for borrowing costs, investment decisions, and overall economic growth. Therefore, monitoring inflation trends is essential for anticipating potential shifts in monetary policy.

Moreover, consumer confidence indices provide valuable insights into the sentiment of households regarding their financial situation and the economy at large. High consumer confidence typically correlates with increased spending, which can stimulate economic growth. Conversely, low confidence may lead to reduced consumer spending, thereby slowing economic activity. Recent surveys have indicated fluctuating levels of consumer confidence, influenced by factors such as job security, inflation concerns, and geopolitical tensions. Understanding these sentiments can help businesses tailor their strategies to align with consumer expectations and preferences.

In conclusion, navigating the complexities of the current economic environment requires a keen understanding of various economic indicators. By closely monitoring GDP, unemployment rates, inflation, and consumer confidence, stakeholders can gain valuable insights into the economy’s trajectory. As uncertainty continues to loom, these indicators will remain essential for making informed decisions and adapting to the ever-changing economic landscape. Ultimately, a comprehensive analysis of these indicators will empower individuals and organizations to better navigate the challenges and opportunities that lie ahead.

Competitive Landscape Review

In the ever-evolving business environment, understanding the competitive landscape is crucial for organizations aiming to navigate uncertainty effectively. As companies strive to maintain their market positions, they must continuously assess their competitors, market trends, and consumer behaviors. This ongoing analysis not only informs strategic decision-making but also helps organizations identify potential opportunities and threats. In recent months, several key developments have emerged that warrant attention, as they significantly impact the competitive dynamics across various industries.

To begin with, the rise of digital transformation has reshaped the competitive landscape in profound ways. Companies that have embraced technology and innovation are often better positioned to respond to market fluctuations and consumer demands. For instance, businesses that have integrated advanced analytics and artificial intelligence into their operations can glean insights that drive efficiency and enhance customer experiences. Consequently, organizations that lag in digital adoption may find themselves at a disadvantage, struggling to keep pace with more agile competitors. This shift underscores the importance of not only investing in technology but also fostering a culture of innovation that encourages adaptability.

Moreover, the increasing emphasis on sustainability has become a pivotal factor in shaping competitive strategies. As consumers become more environmentally conscious, companies are compelled to align their practices with sustainable principles. This trend has led to the emergence of new market players that prioritize eco-friendly products and services, thereby challenging established brands to rethink their value propositions. In this context, organizations that proactively adopt sustainable practices are likely to gain a competitive edge, as they resonate with a growing segment of consumers who prioritize ethical consumption. Thus, the integration of sustainability into business models is not merely a trend but a strategic imperative that can influence market positioning.

In addition to technological advancements and sustainability, the geopolitical landscape has also introduced layers of complexity to the competitive environment. Trade tensions, regulatory changes, and shifting alliances can create uncertainty for businesses operating on a global scale. Companies must remain vigilant and adaptable, as these factors can impact supply chains, pricing strategies, and market access. For instance, organizations that have diversified their supply chains to mitigate risks associated with geopolitical instability are better equipped to navigate disruptions. This proactive approach not only enhances resilience but also positions companies to capitalize on emerging markets and opportunities.

Furthermore, the competitive landscape is increasingly characterized by collaboration and partnerships. In response to the challenges posed by rapid technological advancements and shifting consumer preferences, companies are recognizing the value of strategic alliances. Collaborations can take various forms, from joint ventures to co-branding initiatives, and they often enable organizations to leverage complementary strengths. By pooling resources and expertise, companies can accelerate innovation and enhance their competitive positioning. This trend highlights the importance of fostering relationships within the industry, as collaboration can serve as a catalyst for growth in an uncertain environment.

In conclusion, navigating the competitive landscape requires a multifaceted approach that encompasses technological innovation, sustainability, geopolitical awareness, and strategic collaboration. As organizations strive to adapt to an ever-changing environment, they must remain vigilant in monitoring their competitors and market dynamics. By embracing these elements, companies can not only mitigate risks but also seize opportunities that arise amidst uncertainty. Ultimately, a comprehensive understanding of the competitive landscape will empower organizations to thrive in a complex and dynamic business world.

Risk Management Strategies

In the ever-evolving landscape of finance and investment, the importance of effective risk management strategies cannot be overstated. As market conditions fluctuate and uncertainties loom, investors and organizations must adopt a proactive approach to safeguard their assets and ensure long-term sustainability. One of the fundamental principles of risk management is the identification of potential risks, which can range from market volatility to geopolitical tensions. By recognizing these risks early, stakeholders can develop tailored strategies to mitigate their impact.

To begin with, diversification stands out as a cornerstone of risk management. By spreading investments across various asset classes, sectors, and geographical regions, investors can reduce their exposure to any single point of failure. This strategy not only helps in cushioning against market downturns but also enhances the potential for returns. For instance, during periods of economic instability, certain sectors may perform better than others, allowing a diversified portfolio to weather the storm more effectively. Consequently, diversification serves as a buffer, enabling investors to navigate uncertainty with greater confidence.

In addition to diversification, the implementation of hedging techniques is another vital strategy in risk management. Hedging involves taking offsetting positions in related assets to minimize potential losses. For example, options and futures contracts can be utilized to protect against adverse price movements in underlying assets. By employing these financial instruments, investors can create a safety net that mitigates the risks associated with market fluctuations. This proactive stance not only preserves capital but also allows for more strategic decision-making in uncertain environments.

Moreover, the role of scenario analysis and stress testing cannot be overlooked. These techniques enable organizations to evaluate how different market conditions could impact their financial health. By simulating various scenarios, including worst-case situations, stakeholders can identify vulnerabilities within their portfolios and develop contingency plans accordingly. This forward-thinking approach fosters resilience, as it prepares investors to respond swiftly and effectively to unforeseen challenges.

Furthermore, maintaining a robust risk management framework is essential for organizations operating in complex environments. This framework should encompass clear policies, procedures, and governance structures that facilitate effective risk assessment and response. Regular monitoring and reporting mechanisms are also crucial, as they provide insights into emerging risks and the effectiveness of existing strategies. By fostering a culture of risk awareness, organizations can empower their teams to make informed decisions that align with their risk appetite and strategic objectives.

In addition to these strategies, the integration of technology into risk management practices has gained significant traction. Advanced analytics and artificial intelligence can enhance risk assessment processes by providing real-time data and predictive insights. These tools enable organizations to identify trends and anomalies that may indicate potential risks, allowing for timely interventions. As technology continues to evolve, its role in risk management will likely expand, offering new opportunities for innovation and efficiency.

In conclusion, navigating uncertainty in today’s financial landscape necessitates a comprehensive approach to risk management. By employing strategies such as diversification, hedging, scenario analysis, and leveraging technology, investors and organizations can better position themselves to withstand market volatility. Ultimately, a proactive and informed approach to risk management not only protects assets but also fosters confidence in decision-making, paving the way for sustainable growth in an unpredictable world.

Future Outlook Predictions

As we look ahead to the future, the landscape of economic and social dynamics presents a complex tapestry of uncertainty, shaped by various factors that influence market behavior and consumer sentiment. Analysts and experts are increasingly focused on understanding these variables to provide informed predictions that can guide businesses and individuals alike. One of the most significant elements impacting future outlook predictions is the ongoing evolution of global economic conditions. The interplay between inflation rates, interest rates, and employment figures creates a delicate balance that can either foster growth or stifle it. For instance, as central banks adjust their monetary policies in response to inflationary pressures, the ripple effects can be felt across various sectors, influencing everything from consumer spending to investment strategies.

Moreover, geopolitical tensions continue to play a crucial role in shaping economic forecasts. The interconnectedness of global markets means that events in one region can have far-reaching implications elsewhere. Trade agreements, sanctions, and diplomatic relations are all factors that can alter the trajectory of economic growth. As businesses navigate these uncertainties, they must remain agile and adaptable, ready to pivot in response to changing conditions. This adaptability is not only essential for survival but also for capitalizing on emerging opportunities that may arise from shifts in the global landscape.

In addition to economic and geopolitical factors, technological advancements are reshaping industries at an unprecedented pace. The rise of artificial intelligence, automation, and digital transformation is revolutionizing how businesses operate and interact with consumers. As companies invest in these technologies, they must also consider the implications for their workforce and the skills required in the future. The demand for a tech-savvy workforce is likely to increase, prompting educational institutions and training programs to evolve in tandem. This shift not only affects employment patterns but also influences consumer behavior, as individuals become more accustomed to digital interactions and online services.

Furthermore, environmental considerations are becoming increasingly prominent in future outlook predictions. The urgency of addressing climate change and sustainability is prompting businesses to rethink their strategies and operations. Companies that prioritize sustainable practices are likely to gain a competitive edge, as consumers increasingly favor brands that demonstrate a commitment to environmental responsibility. This trend is not merely a passing phase; it represents a fundamental shift in consumer values that will shape market dynamics for years to come.

As we navigate this uncertain future, it is essential to recognize the importance of data-driven decision-making. The ability to analyze trends and patterns can provide valuable insights that inform strategic planning. Businesses that leverage data analytics to understand consumer preferences and market conditions will be better positioned to anticipate changes and respond proactively. This analytical approach can also enhance risk management, allowing organizations to identify potential challenges before they escalate.

In conclusion, the future outlook predictions are inherently complex, influenced by a myriad of factors ranging from economic conditions to technological advancements and environmental considerations. As we move forward, it is crucial for businesses and individuals to remain vigilant and adaptable, embracing change while leveraging data-driven insights to navigate the uncertainties that lie ahead. By doing so, they can not only survive but thrive in an ever-evolving landscape, turning challenges into opportunities for growth and innovation.

Key Takeaways for Businesses

In the ever-evolving landscape of business, navigating uncertainty has become a critical skill for organizations striving to maintain their competitive edge. The recent Street Insights Recap has illuminated several key takeaways that can serve as guiding principles for businesses facing unpredictable market conditions. Understanding these insights is essential for leaders aiming to foster resilience and adaptability within their organizations.

One of the foremost takeaways is the importance of agility in decision-making. In an environment characterized by rapid changes, businesses must be prepared to pivot quickly in response to new information or shifting market dynamics. This agility not only involves the ability to alter strategies but also requires a culture that encourages innovation and experimentation. By fostering an environment where employees feel empowered to propose new ideas and challenge the status quo, organizations can better position themselves to respond to unforeseen challenges.

Moreover, the recap emphasized the significance of data-driven decision-making. In times of uncertainty, relying on intuition alone can lead to missteps. Instead, businesses should leverage analytics and market research to inform their strategies. By utilizing data to identify trends and consumer behaviors, organizations can make more informed decisions that align with market demands. This approach not only mitigates risks but also enhances the likelihood of achieving desired outcomes.

In addition to agility and data utilization, the recap highlighted the necessity of strong communication channels within organizations. Clear and transparent communication fosters trust and collaboration among team members, which is particularly vital during uncertain times. When employees are well-informed about the company’s direction and the rationale behind decisions, they are more likely to remain engaged and committed to the organization’s goals. Furthermore, effective communication extends beyond internal stakeholders; businesses must also maintain open lines of communication with customers and partners to navigate challenges collaboratively.

Another critical insight from the recap is the value of scenario planning. By anticipating various potential futures and developing strategies for each, businesses can better prepare for uncertainty. This proactive approach allows organizations to identify potential risks and opportunities, enabling them to respond more effectively when faced with unexpected developments. Scenario planning not only enhances strategic foresight but also cultivates a mindset of resilience, equipping businesses to weather storms with greater confidence.

Additionally, the recap underscored the importance of investing in employee well-being. In uncertain times, stress and anxiety can significantly impact productivity and morale. Therefore, organizations should prioritize mental health resources and create a supportive work environment. By demonstrating a commitment to employee well-being, businesses can foster loyalty and enhance overall performance, ultimately contributing to long-term success.

Lastly, the insights reiterated the necessity of continuous learning and adaptation. The business landscape is in a constant state of flux, and organizations must remain vigilant in their pursuit of knowledge. By encouraging a culture of continuous improvement and professional development, businesses can equip their teams with the skills and insights needed to navigate uncertainty effectively.

In conclusion, the Street Insights Recap has provided valuable guidance for businesses seeking to thrive amidst uncertainty. By embracing agility, leveraging data, fostering strong communication, engaging in scenario planning, prioritizing employee well-being, and committing to continuous learning, organizations can enhance their resilience and adaptability. As the business environment continues to evolve, these key takeaways will serve as essential tools for leaders aiming to steer their organizations toward sustained success.

Q&A

1. **What is the main focus of the Street Insights Recap: Navigating Uncertainty?**

– The main focus is to analyze current market trends and economic indicators that contribute to uncertainty in the financial landscape.

2. **What are some key economic indicators discussed in the recap?**

– Key economic indicators include inflation rates, unemployment figures, consumer spending, and interest rates.

3. **How does geopolitical tension impact market stability according to the recap?**

– Geopolitical tensions can lead to increased volatility in markets, affecting investor confidence and leading to fluctuations in stock prices.

4. **What strategies are suggested for investors to navigate uncertainty?**

– Suggested strategies include diversifying portfolios, focusing on defensive stocks, and maintaining a long-term investment perspective.

5. **What role does central bank policy play in managing economic uncertainty?**

– Central bank policy, particularly interest rate adjustments and quantitative easing, plays a crucial role in stabilizing the economy and influencing market liquidity.

6. **How does consumer sentiment affect market performance?**

– Consumer sentiment can significantly impact market performance, as higher confidence typically leads to increased spending and investment, while lower confidence can result in economic slowdown.

7. **What are the potential risks highlighted in the recap for the upcoming quarter?**

– Potential risks include rising inflation, supply chain disruptions, and the possibility of recession, all of which could adversely affect market performance.

Conclusion

The Street Insights Recap: Navigating Uncertainty highlights the importance of adaptability and strategic foresight in an unpredictable economic landscape. It emphasizes the need for businesses to remain agile, leverage data-driven insights, and foster innovation to effectively respond to market fluctuations and consumer behavior changes. Ultimately, organizations that embrace uncertainty as an opportunity for growth and transformation are more likely to thrive in challenging times.