“Solventum Shares Soar as Activist Investor Sparks Market Momentum!”

Introduction

Solventum’s shares have experienced a significant surge following the involvement of an activist investor, signaling a renewed interest in the company’s potential for growth and value creation. This development has captured the attention of market analysts and investors alike, as the activist investor’s strategies often aim to enhance shareholder value through operational improvements and strategic changes. The uptick in Solventum’s stock price reflects investor optimism regarding the company’s future prospects and the potential for transformative initiatives driven by the activist’s influence.

Solventum’s Stock Performance Post-Activist Investor Engagement

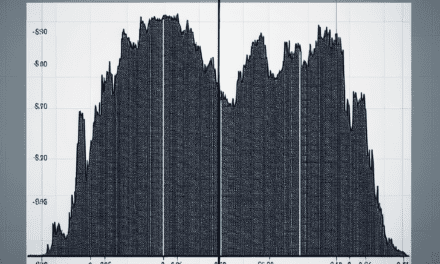

In recent weeks, Solventum has experienced a notable surge in its stock performance, a development that can be largely attributed to the involvement of an activist investor. This engagement has not only captured the attention of market analysts but has also sparked renewed interest among existing and potential shareholders. The activist investor, known for their strategic approach to enhancing shareholder value, has initiated a series of proposals aimed at restructuring the company’s operations and governance. As a result, Solventum’s stock has seen a significant uptick, reflecting investor optimism regarding the potential for improved financial performance.

The initial announcement of the activist investor’s stake in Solventum sent ripples through the market, leading to an immediate increase in trading volume. Investors, both institutional and retail, began to reassess their positions in light of the new developments. This heightened interest was further fueled by the investor’s track record of successfully advocating for change in other companies, which has historically led to substantial increases in stock prices. Consequently, many analysts began to issue bullish forecasts for Solventum, predicting that the company’s stock could continue to rise as the activist investor’s proposals are implemented.

Moreover, the activist investor’s involvement has prompted Solventum’s management to reevaluate its strategic priorities. In response to the investor’s suggestions, the company has begun to explore various avenues for operational efficiency, including cost-cutting measures and potential divestitures of underperforming assets. This proactive approach has not only reassured investors but has also positioned Solventum to capitalize on emerging market opportunities. As a result, the stock has gained momentum, with many analysts noting that the company is now better aligned with industry trends and shareholder expectations.

In addition to operational changes, the activist investor has also called for enhancements in corporate governance. This includes advocating for a more independent board of directors and increased transparency in decision-making processes. Such changes are likely to foster greater trust among investors, as they signal a commitment to accountability and long-term value creation. The market has responded positively to these developments, with Solventum’s stock price reflecting a growing confidence in the company’s future prospects.

Furthermore, the broader market conditions have also played a role in Solventum’s stock performance. As economic indicators show signs of recovery, investor sentiment has generally improved, leading to increased capital inflows into equities. In this context, Solventum’s recent developments have positioned it favorably within the market landscape. The combination of activist involvement and favorable economic conditions has created a conducive environment for the company’s stock to thrive.

As Solventum continues to implement the activist investor’s recommendations, it will be crucial for the company to maintain open lines of communication with its shareholders. Transparency regarding progress and challenges will be essential in sustaining investor confidence. In conclusion, the surge in Solventum’s stock performance following the activist investor’s engagement highlights the significant impact that strategic involvement can have on a company’s trajectory. With a renewed focus on operational efficiency and corporate governance, Solventum appears poised for continued growth, making it an intriguing prospect for investors looking to capitalize on the evolving landscape of the market.

Key Strategies of Activist Investors in Solventum

The recent surge in Solventum’s shares can be attributed to the strategic involvement of activist investors, who have a history of influencing corporate governance and driving significant changes within companies. These investors typically seek to enhance shareholder value by advocating for various initiatives, and their engagement with Solventum is no exception. One of the key strategies employed by activist investors is the identification of underperforming assets or inefficiencies within a company. In the case of Solventum, these investors have meticulously analyzed the company’s operations and financial performance, pinpointing areas where improvements can be made. By highlighting these inefficiencies, they not only draw attention to potential value creation opportunities but also position themselves as knowledgeable stakeholders committed to the company’s long-term success.

Moreover, activist investors often advocate for changes in management or board composition. This strategy is predicated on the belief that fresh perspectives and new leadership can reinvigorate a company’s strategic direction. In Solventum’s situation, the involvement of activist investors has led to discussions about board restructuring, with calls for the inclusion of members who possess relevant industry experience and a track record of driving growth. Such changes can instill confidence among shareholders and signal a commitment to enhancing corporate governance practices, ultimately contributing to the company’s improved market performance.

In addition to advocating for management changes, activist investors frequently push for strategic shifts that align with shareholder interests. This may involve advocating for divestitures of non-core business units or the pursuit of mergers and acquisitions that can create synergies and enhance competitive positioning. For Solventum, the activist investors have proposed a thorough review of its portfolio, suggesting that divesting underperforming segments could free up capital for reinvestment in more profitable areas. This strategic realignment not only aims to optimize resource allocation but also seeks to enhance overall shareholder value, which is a primary objective of activist engagement.

Furthermore, activist investors often emphasize the importance of transparent communication with shareholders. They recognize that fostering a culture of openness can build trust and encourage greater investor participation. In the context of Solventum, the activists have urged the company to improve its communication strategies, ensuring that shareholders are kept informed about strategic initiatives, financial performance, and future growth prospects. By enhancing transparency, Solventum can cultivate a more engaged shareholder base, which is essential for sustaining long-term value creation.

Another critical aspect of activist investors’ strategies is their ability to mobilize support from other shareholders. By rallying a coalition of investors who share similar concerns or objectives, they can exert significant pressure on management to implement desired changes. In Solventum’s case, the activist investors have successfully garnered support from a diverse group of shareholders, amplifying their influence and increasing the likelihood of achieving their strategic goals. This collective action not only strengthens their position but also underscores the importance of shareholder activism in shaping corporate strategies.

In conclusion, the involvement of activist investors in Solventum has introduced a range of strategies aimed at enhancing shareholder value. Through their focus on operational efficiencies, management changes, strategic realignment, improved communication, and coalition-building, these investors are poised to drive meaningful transformations within the company. As Solventum navigates this period of change, the impact of activist engagement will likely continue to resonate, shaping its future trajectory in the competitive landscape.

Market Reactions to Solventum’s Share Price Surge

The recent surge in Solventum’s share price has captured the attention of investors and analysts alike, prompting a flurry of market reactions that reflect both optimism and caution. Following the announcement of an activist investor’s involvement, the company’s stock experienced a notable increase, signaling a shift in market sentiment. This development has not only invigorated existing shareholders but has also attracted new investors eager to capitalize on the potential for enhanced corporate governance and strategic direction.

As the news broke, market analysts began to assess the implications of the activist investor’s engagement. Typically, such involvement is viewed as a catalyst for change, often leading to improved operational efficiencies and a more focused business strategy. In Solventum’s case, the activist investor’s track record of successfully advocating for shareholder interests has instilled a sense of confidence among market participants. Consequently, many analysts have revised their forecasts for the company’s future performance, suggesting that the stock may continue to rise as the investor pushes for reforms.

Moreover, the broader market context has played a significant role in shaping reactions to Solventum’s share price surge. In an environment characterized by heightened volatility and uncertainty, the prospect of a proactive investor taking an active role in a company’s governance can be particularly appealing. Investors are increasingly seeking opportunities that promise not only stability but also the potential for substantial returns. As a result, Solventum’s stock has become a focal point for those looking to navigate the complexities of the current market landscape.

In addition to the immediate financial implications, the activist investor’s involvement has sparked discussions about the long-term strategic vision for Solventum. Stakeholders are now contemplating how the investor’s influence might reshape the company’s priorities, particularly in areas such as innovation, sustainability, and market expansion. This dialogue has been further fueled by the investor’s previous successes in similar situations, where they have effectively driven companies toward more sustainable growth trajectories. As such, the market is keenly observing how Solventum will respond to the investor’s proposals and whether these changes will translate into tangible benefits for shareholders.

Furthermore, the surge in Solventum’s share price has also prompted a reevaluation of the competitive landscape within the industry. Other companies may now feel pressured to enhance their own governance structures and shareholder engagement strategies in response to the heightened expectations set by Solventum’s recent developments. This ripple effect could lead to a broader shift in corporate behavior across the sector, as firms strive to align themselves with best practices in governance and stakeholder relations.

As the situation unfolds, it is essential for investors to remain vigilant and informed. While the initial market reactions to Solventum’s share price surge are largely positive, the true test will come as the activist investor begins to implement their strategies. Stakeholders will be closely monitoring the company’s performance metrics and any announcements regarding strategic initiatives. Ultimately, the interplay between the activist investor’s influence and Solventum’s operational execution will determine whether the current optimism translates into sustained growth and value creation for shareholders.

In conclusion, the market reactions to Solventum’s share price surge reflect a complex interplay of investor sentiment, strategic considerations, and broader industry dynamics. As the company navigates this pivotal moment, the outcomes will likely have lasting implications not only for Solventum but also for the wider market landscape. Investors and analysts alike will be watching closely, eager to see how this narrative unfolds in the coming months.

The Role of Activist Investors in Corporate Governance

The recent surge in Solventum’s shares can be attributed, in part, to the involvement of activist investors, a phenomenon that has increasingly shaped corporate governance in contemporary markets. Activist investors are typically individuals or investment firms that acquire significant stakes in publicly traded companies with the intent to influence management decisions and drive strategic changes. Their involvement often signals a shift in the dynamics of corporate governance, as they advocate for practices that they believe will enhance shareholder value.

One of the primary roles of activist investors is to challenge existing management practices and push for reforms that align with shareholder interests. This can include advocating for changes in corporate strategy, restructuring operations, or even altering the composition of the board of directors. By leveraging their ownership stakes, these investors can exert considerable pressure on company leadership, often leading to a reevaluation of priorities and practices. In the case of Solventum, the recent engagement of an activist investor has prompted a closer examination of the company’s strategic direction, resulting in a renewed focus on operational efficiency and profitability.

Moreover, the presence of activist investors can serve as a catalyst for change within a company. Their involvement often brings to light inefficiencies or misalignments between management actions and shareholder expectations. This scrutiny can lead to a more transparent and accountable governance structure, as companies are compelled to justify their decisions to a more engaged and watchful investor base. In Solventum’s situation, the activist investor’s push for greater transparency has likely contributed to the positive market response, as investors perceive a commitment to improved governance and enhanced shareholder returns.

Additionally, activist investors often advocate for the implementation of best practices in corporate governance, which can include measures such as adopting more rigorous financial reporting standards, enhancing board diversity, and establishing clearer performance metrics. These initiatives not only align with the interests of shareholders but also contribute to the long-term sustainability of the company. As Solventum navigates this period of transformation, the influence of the activist investor may lead to the adoption of such practices, further bolstering investor confidence and driving share price appreciation.

It is also important to recognize that the relationship between activist investors and corporate management is not always adversarial. While conflicts can arise, there are instances where both parties find common ground in their objectives. In many cases, management may welcome the insights and expertise that activist investors bring to the table, viewing them as partners in the pursuit of enhanced performance. This collaborative approach can lead to innovative strategies that benefit both the company and its shareholders. For Solventum, the engagement with the activist investor may foster a more constructive dialogue between management and shareholders, ultimately leading to a more robust governance framework.

In conclusion, the involvement of activist investors plays a significant role in shaping corporate governance, as evidenced by the recent developments at Solventum. Their ability to influence management decisions and advocate for best practices can lead to meaningful changes that enhance shareholder value. As the market continues to respond positively to these developments, it becomes increasingly clear that the presence of activist investors can serve as a powerful force for good in the realm of corporate governance, driving companies toward greater accountability and performance.

Solventum’s Future Outlook After Investor Activism

In recent months, Solventum has experienced a notable surge in its share price, a development largely attributed to the involvement of an activist investor. This shift in the company’s financial landscape has prompted analysts and stakeholders alike to reassess the future outlook for Solventum. The presence of an activist investor often signals a potential for significant change within a company, as these investors typically advocate for strategic alterations aimed at enhancing shareholder value. Consequently, the implications of this activism extend beyond immediate financial gains, suggesting a transformative period for Solventum.

As the activist investor has begun to exert influence, the company is likely to undergo a thorough evaluation of its operational strategies. This scrutiny may lead to a reallocation of resources, a reassessment of existing projects, and potentially, the divestiture of underperforming assets. Such measures are often essential for optimizing efficiency and ensuring that capital is directed toward initiatives with the highest potential for return on investment. Moreover, the activist’s involvement may encourage Solventum to adopt a more aggressive growth strategy, focusing on innovation and market expansion. This could involve exploring new product lines or entering untapped markets, thereby diversifying revenue streams and reducing dependency on existing offerings.

In addition to operational changes, the activist investor’s presence may also catalyze a shift in corporate governance practices. Enhanced transparency and accountability are often hallmarks of activist-led initiatives, as these investors typically advocate for improved communication between management and shareholders. As a result, Solventum may implement more robust reporting mechanisms and engage in regular dialogues with its investor base. This increased engagement can foster a culture of trust and collaboration, ultimately benefiting the company’s long-term sustainability.

Furthermore, the activist investor’s involvement may lead to a reevaluation of Solventum’s leadership structure. If the investor identifies areas where management could be strengthened, it may advocate for changes at the executive level. This could involve bringing in new talent with fresh perspectives or enhancing the capabilities of existing leaders. Such changes can invigorate the organization, instilling a sense of urgency and purpose that aligns with the activist’s vision for the company.

As Solventum navigates this period of transformation, it is essential to consider the broader market context. The chemical industry, in which Solventum operates, is characterized by rapid technological advancements and shifting consumer preferences. In this dynamic environment, companies must remain agile and responsive to emerging trends. The activist investor’s involvement may provide the impetus for Solventum to embrace innovation more fully, positioning the company to capitalize on new opportunities and mitigate potential risks.

In conclusion, the surge in Solventum’s share price following the activist investor’s involvement marks the beginning of a potentially transformative chapter for the company. With a focus on operational efficiency, enhanced governance, and strategic growth initiatives, Solventum is poised to navigate the challenges and opportunities that lie ahead. As stakeholders monitor these developments, the emphasis will likely remain on how effectively the company can leverage this activism to create sustainable value in an ever-evolving market landscape. Ultimately, the future outlook for Solventum appears promising, contingent upon its ability to adapt and thrive in response to both internal and external pressures.

Case Studies: Successful Activist Investor Campaigns

In recent months, the financial landscape has witnessed a notable surge in the shares of Solventum, a company that has become the focal point of an activist investor campaign. This development not only highlights the potential impact of activist investors on corporate governance but also serves as a case study in the effectiveness of strategic engagement with management. The involvement of the activist investor, who has a history of successfully influencing corporate strategies, has prompted a reevaluation of Solventum’s operational practices and long-term vision.

Activist investors often seek to unlock shareholder value by advocating for changes in management, restructuring, or strategic pivots. In the case of Solventum, the activist investor identified several areas where the company could enhance its performance. By conducting a thorough analysis of Solventum’s financials and market position, the investor was able to present a compelling case for change. This included recommendations for cost-cutting measures, improved capital allocation, and a more aggressive approach to innovation. The investor’s proposals resonated with other shareholders, leading to a growing consensus that change was necessary.

As the campaign unfolded, the activist investor engaged in dialogue with Solventum’s management team, emphasizing the importance of transparency and collaboration. This approach not only fostered a constructive relationship but also allowed for the exploration of mutually beneficial solutions. The management team, initially resistant to external pressure, began to recognize the potential benefits of aligning their strategies with shareholder interests. Consequently, they agreed to implement several of the proposed changes, which included a commitment to enhancing operational efficiency and prioritizing shareholder returns.

The positive response from management, coupled with the activist investor’s ongoing support, led to a significant uptick in Solventum’s stock price. Investors began to regain confidence in the company’s future prospects, as the market reacted favorably to the anticipated improvements in performance. This case exemplifies how effective communication and collaboration between management and activist investors can lead to tangible results, ultimately benefiting all stakeholders involved.

Moreover, the Solventum case underscores the broader trend of increasing shareholder activism in corporate governance. As institutional investors become more vocal about their expectations for accountability and performance, companies are finding it increasingly necessary to engage with these stakeholders proactively. The success of the activist investor’s campaign at Solventum serves as a reminder that constructive engagement can lead to positive outcomes, even in situations where initial resistance may be present.

In conclusion, the surge in Solventum’s shares following the involvement of an activist investor illustrates the potential for transformative change within a company when strategic engagement is prioritized. This case study not only highlights the effectiveness of activist campaigns but also emphasizes the importance of collaboration between management and shareholders. As the landscape of corporate governance continues to evolve, the lessons learned from Solventum’s experience may serve as a blueprint for other companies facing similar challenges. Ultimately, the interplay between activist investors and corporate management can lead to enhanced performance, increased shareholder value, and a more robust approach to long-term strategic planning.

Analyzing Solventum’s Financial Health Amidst Share Price Growth

In recent weeks, Solventum has experienced a notable surge in its share price, a development largely attributed to the involvement of an activist investor. This sudden increase has prompted analysts and investors alike to closely examine the company’s financial health, seeking to understand the underlying factors contributing to this positive momentum. As the market reacts to the activist’s strategies, it is essential to assess Solventum’s financial metrics, operational efficiency, and overall market position to gauge the sustainability of this growth.

To begin with, Solventum’s revenue streams have shown resilience in a competitive landscape. The company has consistently reported steady revenue growth over the past few quarters, driven by a combination of innovative product offerings and strategic market expansions. This upward trajectory is particularly significant in light of the broader economic challenges that have affected many firms in the sector. By diversifying its product lines and enhancing its service offerings, Solventum has positioned itself to capture a larger market share, which is a positive indicator of its financial health.

Moreover, the company’s profitability metrics further bolster the case for its financial stability. Solventum has maintained a healthy gross margin, reflecting its ability to manage production costs effectively while maximizing sales revenue. This efficiency is crucial, especially in an environment where input costs can fluctuate dramatically. Additionally, the company’s operating margin has shown improvement, suggesting that management is not only focused on top-line growth but is also committed to controlling expenses and optimizing operational processes. Such financial discipline is likely to resonate well with investors, particularly in light of the activist investor’s push for enhanced shareholder value.

In addition to revenue and profitability, Solventum’s balance sheet presents a favorable picture. The company has managed to maintain a strong liquidity position, with a current ratio that exceeds industry averages. This liquidity is essential for supporting ongoing operations and funding future growth initiatives without resorting to excessive debt. Furthermore, Solventum’s debt-to-equity ratio remains within a manageable range, indicating that the company is not overly reliant on leverage to finance its activities. This prudent financial management is likely to instill confidence among investors, particularly those who are wary of companies with high levels of indebtedness.

Transitioning to the broader market context, it is important to consider how external factors may influence Solventum’s financial outlook. The recent involvement of an activist investor has not only sparked interest in the company’s stock but has also prompted discussions around potential strategic changes. Activist investors often advocate for operational improvements, cost-cutting measures, or even restructuring initiatives that can enhance shareholder value. As Solventum navigates this new dynamic, the company’s management will need to balance the demands of the activist with the long-term vision for sustainable growth.

In conclusion, while the surge in Solventum’s share price is undoubtedly a positive development, it is essential to analyze the company’s financial health to determine the sustainability of this growth. With solid revenue generation, improving profitability, and a robust balance sheet, Solventum appears well-positioned to capitalize on the current market enthusiasm. However, as the company engages with its activist investor, the strategic decisions made in the coming months will be critical in shaping its future trajectory. Investors will be closely monitoring these developments, as they could have significant implications for Solventum’s financial performance and overall market standing.

Q&A

1. **What caused the surge in Solventum shares?**

The surge in Solventum shares was primarily driven by the involvement of an activist investor who acquired a significant stake in the company.

2. **Who is the activist investor involved with Solventum?**

The activist investor is a well-known firm that specializes in taking stakes in companies to influence management and drive strategic changes.

3. **What strategies is the activist investor likely to propose?**

The activist investor is expected to propose strategies aimed at improving operational efficiency, enhancing shareholder value, and possibly restructuring the company’s management.

4. **How did the market react to the news of the activist investor’s involvement?**

The market reacted positively, leading to a notable increase in Solventum’s stock price as investors anticipated potential improvements and value creation.

5. **What are the potential risks associated with activist investor involvement?**

Potential risks include increased volatility in stock prices, possible conflicts with management, and the uncertainty of whether proposed changes will be successfully implemented.

6. **Have there been similar cases in the past?**

Yes, there have been several instances where activist investors have successfully influenced companies, leading to significant stock price increases and operational changes.

7. **What should investors consider moving forward with Solventum shares?**

Investors should consider the potential for positive changes driven by the activist investor, but also weigh the risks and uncertainties associated with such involvement.

Conclusion

Solventum’s shares have experienced a significant surge following the involvement of an activist investor, indicating increased market confidence and potential for strategic changes that could enhance shareholder value. This development suggests that the investor’s influence may lead to improved corporate governance and operational efficiencies, ultimately benefiting the company’s long-term performance.