“Nasdaq Soars Amidst Narrow Market Gains: Resilience in Uncertainty”

Introduction

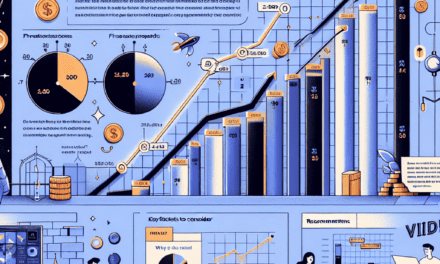

The Nasdaq Composite Index has experienced a notable rise, defying broader market trends characterized by weak breadth. This phenomenon highlights a divergence where a select group of technology and growth stocks have driven the index higher, even as many other sectors struggle to gain traction. Investors are closely monitoring this disparity, as it raises questions about the sustainability of the rally and the overall health of the market. Despite concerns over market breadth, the Nasdaq’s ascent reflects ongoing investor confidence in key tech companies and their potential for growth in a challenging economic environment.

Nasdaq Resilience Amid Market Weakness

In recent trading sessions, the Nasdaq Composite has demonstrated a remarkable resilience, even as broader market indicators reveal signs of weakness. This divergence between the performance of the Nasdaq and the overall market breadth raises intriguing questions about the underlying dynamics driving these trends. While many investors typically look to market breadth as a barometer of overall market health, the Nasdaq’s ability to maintain upward momentum suggests that specific sectors and stocks are exhibiting strength, even in a challenging environment.

One of the primary factors contributing to the Nasdaq’s resilience is the continued performance of technology stocks, which have historically been a significant component of the index. Companies in the tech sector have shown robust earnings growth, driven by ongoing digital transformation and increased demand for innovative solutions. This trend has been particularly pronounced in areas such as cloud computing, artificial intelligence, and cybersecurity, where firms are capitalizing on the need for enhanced digital infrastructure. As a result, even as other sectors struggle, the tech-heavy Nasdaq has managed to attract investor interest, bolstering its performance.

Moreover, the concentration of market leadership within a select group of large-cap technology companies has further insulated the Nasdaq from broader market weaknesses. These companies, often referred to as “FAANG” stocks—Facebook (now Meta), Apple, Amazon, Netflix, and Google (now Alphabet)—have consistently delivered strong financial results, which has helped to prop up the index. Their substantial market capitalizations mean that their performance can significantly influence the overall movement of the Nasdaq, allowing it to rise even when smaller stocks are faltering.

In addition to the strength of individual stocks, macroeconomic factors also play a crucial role in shaping market dynamics. Despite concerns about inflation and interest rate hikes, the tech sector has shown a remarkable ability to adapt to changing economic conditions. Investors are increasingly viewing technology as a defensive play, particularly in an environment where traditional sectors may be more vulnerable to economic fluctuations. This shift in perception has led to increased capital inflows into tech stocks, further supporting the Nasdaq’s upward trajectory.

However, it is essential to recognize that the disparity between the Nasdaq’s performance and broader market breadth may not be sustainable in the long term. A narrow leadership can create vulnerabilities, as excessive reliance on a few key stocks can lead to increased volatility. If these leading companies were to experience setbacks, the impact on the Nasdaq could be pronounced, potentially leading to a sharp correction. Therefore, while the current resilience of the Nasdaq is noteworthy, investors should remain vigilant and consider the implications of market concentration.

Furthermore, the current environment underscores the importance of diversification in investment strategies. As the Nasdaq continues to rise, it serves as a reminder that not all sectors are created equal, and investors may benefit from exploring opportunities beyond the tech space. By broadening their focus to include other industries, investors can better position themselves to navigate potential market shifts and mitigate risks associated with concentrated exposure.

In conclusion, the Nasdaq’s ability to rise amid weak market breadth highlights the complexities of the current investment landscape. While technology stocks continue to drive the index’s performance, the potential risks associated with market concentration warrant careful consideration. As investors navigate these dynamics, maintaining a diversified portfolio may prove essential in achieving long-term financial goals while managing exposure to market volatility.

Analyzing Nasdaq’s Performance in a Challenging Market

In recent trading sessions, the Nasdaq has demonstrated a notable resilience, rising even amidst a backdrop of weak market breadth. This phenomenon raises important questions about the underlying dynamics of the index and the broader market environment. To understand this performance, it is essential to analyze the factors contributing to the Nasdaq’s upward trajectory, despite the challenges posed by a lack of widespread participation from other sectors.

One of the primary drivers of the Nasdaq’s strength can be attributed to the dominance of technology stocks within the index. Companies such as Apple, Microsoft, and Alphabet have consistently shown robust earnings and growth potential, which has bolstered investor confidence. As these tech giants continue to innovate and expand their market share, they have become critical components of the Nasdaq’s overall performance. Consequently, even when other sectors struggle, the success of these leading firms can propel the index higher, creating a divergence between the Nasdaq and the broader market.

Moreover, the current economic landscape has favored technology and growth-oriented companies. With interest rates remaining relatively low, investors are increasingly drawn to sectors that promise higher returns, often found in technology and innovation-driven industries. This trend has led to a concentration of capital in a select group of stocks, further amplifying the Nasdaq’s gains. As a result, while the overall market may exhibit signs of weakness, the Nasdaq’s performance reflects a more optimistic outlook for the technology sector.

In addition to sector-specific factors, investor sentiment plays a crucial role in shaping market dynamics. The Nasdaq’s rise can also be seen as a response to broader economic indicators that suggest resilience in certain areas, such as consumer spending and corporate earnings. Despite concerns about inflation and potential economic slowdowns, the tech sector has managed to maintain a positive narrative, attracting both institutional and retail investors. This influx of capital has provided the necessary support for the Nasdaq to continue its upward momentum, even as other indices struggle to gain traction.

However, it is important to acknowledge the implications of weak market breadth. When a small number of stocks drive the performance of an index, it raises concerns about sustainability. A narrow leadership can signal potential vulnerabilities, as any adverse developments affecting these key players could lead to significant corrections. Therefore, while the Nasdaq’s rise is commendable, it is essential for investors to remain vigilant and consider the broader market context.

Furthermore, the divergence between the Nasdaq and other indices highlights the importance of diversification in investment strategies. Relying heavily on a concentrated group of stocks can expose investors to heightened risks, particularly in volatile market conditions. As such, a balanced approach that includes exposure to various sectors may provide a more stable investment framework, mitigating the risks associated with market fluctuations.

In conclusion, the Nasdaq’s performance in a challenging market underscores the complexities of current economic conditions. While the index has managed to rise due to the strength of its technology components and favorable investor sentiment, the weak market breadth serves as a cautionary reminder of the potential risks involved. As investors navigate this landscape, a careful analysis of both sector performance and broader market trends will be essential in making informed decisions. Ultimately, understanding the interplay between these factors will be crucial for anyone looking to capitalize on the opportunities presented by the Nasdaq’s recent gains.

Factors Driving Nasdaq Higher Despite Breadth Concerns

In recent trading sessions, the Nasdaq Composite has demonstrated a remarkable resilience, rising even in the face of weak market breadth. This phenomenon raises questions about the underlying factors propelling the index upward despite a lack of broad-based support from other sectors. One of the primary drivers of this divergence is the continued strength of technology stocks, which have historically been the backbone of the Nasdaq. Companies within this sector, particularly those involved in cloud computing, artificial intelligence, and e-commerce, have shown robust earnings growth and strong demand, which have contributed significantly to the index’s performance.

Moreover, the ongoing digital transformation across various industries has created a favorable environment for tech companies. As businesses increasingly adopt digital solutions to enhance efficiency and reach consumers, the demand for innovative technologies has surged. This trend has not only bolstered the revenues of leading tech firms but has also attracted investor interest, further fueling the Nasdaq’s ascent. Consequently, while the broader market may exhibit signs of weakness, the concentrated strength of a few key players within the Nasdaq has been sufficient to drive the index higher.

In addition to the strength of technology stocks, macroeconomic factors have also played a crucial role in supporting the Nasdaq’s rise. The Federal Reserve’s monetary policy, characterized by low interest rates and a commitment to supporting economic growth, has created a favorable environment for equities. Low borrowing costs have encouraged both consumer spending and business investment, which in turn has benefited technology companies that thrive in such conditions. Furthermore, the Fed’s cautious approach to tightening monetary policy has alleviated concerns about potential disruptions to the market, allowing investors to maintain confidence in growth-oriented sectors.

Another significant factor contributing to the Nasdaq’s upward trajectory is the increasing focus on innovation and sustainability. Investors are increasingly drawn to companies that prioritize environmental, social, and governance (ESG) criteria, which has led to a surge in interest for firms that are at the forefront of sustainable technologies. This shift in investor sentiment has provided a tailwind for many Nasdaq-listed companies that are pioneering advancements in renewable energy, electric vehicles, and other sustainable practices. As a result, the Nasdaq has benefited from a wave of capital inflows directed toward these innovative sectors, further enhancing its performance.

Additionally, the global economic recovery from the pandemic has created a favorable backdrop for technology stocks. As economies reopen and consumer behavior shifts, companies that can adapt quickly to changing market dynamics are well-positioned to capture growth opportunities. This adaptability has been particularly evident in the tech sector, where firms have leveraged their digital capabilities to meet evolving consumer demands. Consequently, the Nasdaq has emerged as a beneficiary of this recovery, with investors increasingly favoring growth stocks that promise long-term potential.

In conclusion, while the broader market may exhibit signs of weakness, the Nasdaq’s rise can be attributed to a confluence of factors, including the strength of technology stocks, supportive macroeconomic conditions, a focus on innovation and sustainability, and the ongoing global economic recovery. These elements have combined to create a unique environment where the Nasdaq can thrive, even as market breadth remains narrow. As investors continue to navigate these dynamics, the resilience of the Nasdaq serves as a testament to the enduring appeal of growth-oriented sectors in an ever-evolving economic landscape.

The Impact of Tech Stocks on Nasdaq’s Rise

The Nasdaq Composite Index has recently experienced a notable rise, a phenomenon that can be largely attributed to the performance of technology stocks. Despite the overall market breadth showing signs of weakness, the tech sector has managed to maintain its upward trajectory, significantly influencing the index’s performance. This divergence between the Nasdaq and broader market trends raises important questions about the underlying dynamics at play and the implications for investors.

To begin with, it is essential to recognize the dominant role that technology companies play within the Nasdaq. The index is heavily weighted towards tech stocks, which means that their performance can disproportionately affect the overall index. Companies such as Apple, Microsoft, and Amazon have consistently demonstrated robust earnings and growth potential, which has bolstered investor confidence. As these tech giants continue to innovate and expand their market share, they not only drive their own stock prices higher but also contribute to the overall strength of the Nasdaq.

Moreover, the recent rise in the Nasdaq can be linked to a broader trend of digital transformation accelerated by the pandemic. As businesses and consumers increasingly rely on technology for communication, commerce, and entertainment, tech companies have seen a surge in demand for their products and services. This shift has led to impressive earnings reports, which in turn have attracted more investment into the sector. Consequently, even as other sectors struggle with economic uncertainties, technology stocks have emerged as a safe haven for investors seeking growth.

In addition to the strong performance of individual tech stocks, the overall sentiment surrounding the sector has been buoyed by favorable macroeconomic conditions. Low interest rates and a supportive monetary policy environment have created a conducive atmosphere for growth-oriented companies. Investors are more willing to allocate capital to tech stocks, viewing them as a means to capitalize on future growth potential. This influx of capital has further propelled the Nasdaq upward, even as other indices reflect a more cautious market sentiment.

However, it is crucial to consider the implications of this narrow market breadth. While the rise of the Nasdaq may seem promising, it raises concerns about the sustainability of such growth. A market that is heavily reliant on a few key players can be vulnerable to volatility. If any of the major tech companies were to experience setbacks, the impact on the Nasdaq could be significant. This concentration risk highlights the importance of diversification in investment strategies, as relying solely on tech stocks may expose investors to heightened risks.

Furthermore, the disparity between the performance of the Nasdaq and other indices underscores the need for a comprehensive understanding of market dynamics. Investors should remain vigilant and consider the broader economic landscape, including potential regulatory changes and shifts in consumer behavior. As the tech sector continues to evolve, it is essential to assess how these factors may influence future performance.

In conclusion, the rise of the Nasdaq, driven primarily by the strength of technology stocks, presents both opportunities and challenges for investors. While the tech sector’s resilience in the face of broader market weakness is commendable, it also serves as a reminder of the inherent risks associated with concentrated investments. As the market continues to navigate these complexities, a balanced approach that considers both growth potential and diversification will be crucial for long-term success.

Market Breadth Explained: Why Nasdaq Defies Trends

Market breadth is a critical indicator in the analysis of stock market performance, reflecting the overall health of the market by measuring the number of stocks advancing versus those declining. In recent times, the Nasdaq has exhibited a remarkable ability to rise even in the face of weak market breadth, prompting investors and analysts alike to delve deeper into the underlying factors contributing to this phenomenon. Understanding market breadth is essential for grasping why the Nasdaq can defy broader market trends, particularly when the number of advancing stocks is outpaced by those declining.

To begin with, it is important to recognize that the Nasdaq is heavily weighted towards technology and growth-oriented companies. This sector has shown resilience and, in many cases, robust earnings growth, which can significantly influence the index’s performance. When a handful of large-cap tech stocks, such as Apple, Microsoft, and Amazon, report strong earnings or positive outlooks, their substantial market capitalizations can propel the Nasdaq higher, even if the majority of stocks within the index are not performing as well. This concentration of performance among a few key players can create a scenario where the index rises despite a lack of broad-based participation.

Moreover, the dynamics of investor sentiment play a crucial role in this context. In periods of uncertainty or market volatility, investors often gravitate towards perceived safe havens, which in today’s market often include established technology firms. This flight to quality can lead to increased buying pressure on these stocks, further driving the Nasdaq upward while other sectors may struggle. Consequently, even if the overall market breadth appears weak, the concentrated strength of a few dominant stocks can overshadow broader declines, resulting in a net gain for the index.

Additionally, the current macroeconomic environment has contributed to this divergence. With interest rates remaining relatively low, borrowing costs for companies are reduced, allowing for continued investment and expansion, particularly in the tech sector. This favorable environment encourages capital inflows into growth stocks, which are often more sensitive to interest rate changes. As a result, the Nasdaq can continue to rise, supported by strong fundamentals in its leading companies, while other sectors may be adversely affected by rising rates or economic headwinds.

Furthermore, the rise of passive investing strategies has also influenced market breadth. Exchange-traded funds (ETFs) and index funds that track the Nasdaq have gained popularity, leading to increased buying of the index’s largest constituents. This trend can create a feedback loop where the performance of a few large stocks drives more investment into those stocks, further enhancing their prices and contributing to the index’s upward trajectory. In this way, even if the broader market is experiencing weakness, the Nasdaq can continue to climb as a result of this concentrated buying activity.

In conclusion, the Nasdaq’s ability to rise despite weak market breadth can be attributed to several interrelated factors, including the dominance of large-cap technology stocks, shifts in investor sentiment towards quality, favorable macroeconomic conditions, and the influence of passive investing strategies. As investors navigate this complex landscape, understanding the nuances of market breadth and its implications for index performance will be essential for making informed investment decisions. While the Nasdaq may defy broader market trends in the short term, ongoing vigilance is necessary to assess the sustainability of such movements in the context of overall market health.

Investor Sentiment: Nasdaq’s Strength in a Weak Market

In recent trading sessions, the Nasdaq Composite has demonstrated a remarkable resilience, rising even as broader market indicators reflect a more subdued sentiment. This divergence between the Nasdaq’s performance and the overall market breadth raises intriguing questions about investor sentiment and the underlying dynamics driving this technology-heavy index. While many sectors are grappling with headwinds, the Nasdaq’s ascent suggests a selective optimism among investors, particularly in technology and growth-oriented stocks.

One of the primary factors contributing to the Nasdaq’s strength is the continued dominance of major technology companies. Giants such as Apple, Microsoft, and Alphabet have consistently reported robust earnings, which not only bolster their individual stock prices but also lend support to the index as a whole. As these companies continue to innovate and expand their market share, they attract significant investor interest, creating a ripple effect that can overshadow the struggles faced by other sectors. This phenomenon illustrates how a concentrated group of high-performing stocks can drive an index higher, even when the broader market is experiencing a downturn.

Moreover, the current economic landscape has prompted investors to seek refuge in technology stocks, which are often perceived as more resilient during periods of uncertainty. With inflationary pressures and interest rate hikes weighing on consumer spending, many investors are turning to companies that can leverage digital transformation and automation to maintain growth. This shift in focus has led to increased capital inflows into the Nasdaq, further reinforcing its upward trajectory. As a result, the index has become a barometer for investor confidence in the tech sector, even as other areas of the market struggle to gain traction.

In addition to the performance of individual stocks, macroeconomic factors also play a crucial role in shaping investor sentiment. The Federal Reserve’s monetary policy decisions, particularly regarding interest rates, have significant implications for growth stocks. As the central bank navigates the delicate balance between curbing inflation and supporting economic growth, investors are closely monitoring any signals that could impact the tech sector. The Nasdaq’s ability to rise in this environment suggests that investors are optimistic about the long-term prospects of technology companies, viewing them as capable of weathering economic fluctuations.

Furthermore, the ongoing trend of digitalization across various industries has created a favorable backdrop for technology stocks. As businesses increasingly adopt digital solutions to enhance efficiency and reach consumers, the demand for innovative technologies continues to grow. This trend not only supports the earnings potential of Nasdaq-listed companies but also reinforces investor confidence in their ability to thrive in a rapidly changing economic landscape. Consequently, the Nasdaq’s performance can be seen as a reflection of broader societal shifts towards technology adoption, which bodes well for its future growth.

However, it is essential to acknowledge the risks associated with this concentrated performance. The disparity between the Nasdaq and the broader market could signal underlying vulnerabilities, particularly if the momentum in technology stocks falters. Investors must remain vigilant, as shifts in sentiment can occur rapidly, influenced by changes in economic indicators or corporate earnings reports. Nevertheless, for the time being, the Nasdaq’s rise amidst weak market breadth underscores a complex interplay of factors that continue to shape investor sentiment, highlighting the index’s role as a leading indicator of technological advancement and economic resilience. As the market evolves, the ability of the Nasdaq to maintain its upward trajectory will depend on both the performance of its constituent stocks and the broader economic environment.

Future Outlook: Can Nasdaq Maintain Its Momentum?

As the Nasdaq continues to show resilience in the face of a challenging market environment, investors are left pondering whether this momentum can be sustained in the coming months. The recent performance of the Nasdaq composite index has been noteworthy, particularly as it has managed to rise despite a backdrop of weak market breadth. This phenomenon, where a small number of stocks drive the index higher while the majority lag behind, raises questions about the sustainability of such gains.

To understand the future outlook for the Nasdaq, it is essential to consider the underlying factors contributing to its current trajectory. One significant element is the ongoing strength of technology stocks, which have historically been the backbone of the Nasdaq. Companies in sectors such as cloud computing, artificial intelligence, and e-commerce have demonstrated robust earnings growth, attracting investor interest even amid broader economic uncertainties. This concentration of strength in a few high-performing stocks can create a misleading sense of overall market health, yet it also highlights the potential for continued upward movement if these companies maintain their growth trajectories.

Moreover, the macroeconomic landscape plays a crucial role in shaping investor sentiment and market dynamics. As central banks navigate the complexities of inflation and interest rates, their policies will undoubtedly influence market performance. Should interest rates remain low or stabilize, it could provide a conducive environment for growth-oriented stocks to thrive. Conversely, any unexpected shifts in monetary policy could lead to increased volatility, particularly for the tech sector, which is often sensitive to changes in borrowing costs. Therefore, investors must remain vigilant and adaptable to these economic signals as they assess the Nasdaq’s potential for sustained growth.

In addition to macroeconomic factors, investor psychology and market sentiment are pivotal in determining the Nasdaq’s future. The current environment is characterized by a mix of optimism and caution, as many investors are eager to capitalize on the gains seen in technology stocks while simultaneously wary of potential corrections. This duality can lead to increased volatility, as market participants react to news and trends in real-time. If investor confidence remains strong, it could bolster the Nasdaq’s momentum; however, any signs of weakness or negative sentiment could quickly reverse the gains made.

Furthermore, the competitive landscape within the technology sector is evolving rapidly. As new players emerge and existing companies innovate, the dynamics of market leadership can shift. This constant evolution means that while some stocks may currently be driving the Nasdaq higher, their dominance is not guaranteed. Investors must keep a close eye on emerging trends and potential disruptors that could alter the competitive balance, impacting the index’s performance.

In conclusion, while the Nasdaq has shown impressive resilience despite weak market breadth, its ability to maintain this momentum hinges on a complex interplay of factors. The strength of technology stocks, macroeconomic conditions, investor sentiment, and the competitive landscape will all play critical roles in shaping the index’s future. As investors navigate this uncertain terrain, a balanced approach that considers both opportunities and risks will be essential. Ultimately, the coming months will reveal whether the Nasdaq can continue its ascent or if it will face headwinds that challenge its current trajectory.

Q&A

1. **Question:** What does it mean when the Nasdaq rises despite weak market breadth?

**Answer:** It indicates that while the overall market may be struggling, a few large-cap stocks, particularly in the tech sector, are driving the Nasdaq index higher.

2. **Question:** What is market breadth?

**Answer:** Market breadth refers to the number of stocks advancing versus those declining in a given market, providing insight into the overall health of the market.

3. **Question:** Why is weak market breadth concerning for investors?

**Answer:** Weak market breadth suggests that the gains in the index are not supported by a broad base of stocks, which can indicate potential instability or a lack of sustainability in the rally.

4. **Question:** Which sectors typically influence the Nasdaq index?

**Answer:** The technology sector, along with consumer discretionary and communication services, typically has a significant influence on the Nasdaq index.

5. **Question:** What could be a reason for the Nasdaq’s rise despite weak breadth?

**Answer:** Strong earnings reports or positive news from major tech companies can lead to a rise in the Nasdaq, even if other stocks are not performing well.

6. **Question:** How can investors interpret a rise in the Nasdaq with weak breadth?

**Answer:** Investors may view it as a warning sign that the market could be vulnerable to corrections, as it relies heavily on a few stocks rather than a broad-based rally.

7. **Question:** What strategies might investors consider in such a market environment?

**Answer:** Investors might consider diversifying their portfolios, focusing on sectors with stronger breadth, or being cautious with new investments until market conditions improve.

Conclusion

The Nasdaq’s rise despite weak market breadth indicates a concentration of strength among a select group of large-cap technology stocks, which are driving the index higher. This divergence suggests potential underlying vulnerabilities in the broader market, as many stocks may not be participating in the rally. Investors should remain cautious, as a narrow market advance can signal instability and may not be sustainable in the long term.