“Netflix Stock: Ready to Stream Back to Success!”

Introduction

Netflix stock is showing signs of a potential comeback as the company navigates a rapidly evolving streaming landscape. After facing challenges such as increased competition, subscriber losses, and market saturation, Netflix has implemented strategic changes, including content diversification, international expansion, and the introduction of ad-supported subscription tiers. These initiatives, coupled with a renewed focus on original programming and partnerships, position Netflix to regain its footing and attract a broader audience. As the streaming giant adapts to consumer preferences and market dynamics, investors are closely watching for signs of recovery and growth in its stock performance.

Netflix’s Strategic Content Investments

Netflix has long been recognized as a leader in the streaming industry, but recent challenges have prompted the company to reevaluate its strategies, particularly in the realm of content investment. As competition intensifies and viewer preferences evolve, Netflix’s commitment to producing high-quality, original content has become a cornerstone of its strategy. This focus not only aims to retain existing subscribers but also to attract new audiences, thereby positioning the company for a potential comeback in the stock market.

One of the most significant aspects of Netflix’s strategic content investments is its dedication to diverse storytelling. By investing in a wide array of genres and formats, Netflix has successfully catered to a global audience. This approach is evident in its extensive library, which includes everything from gripping dramas and comedies to documentaries and international films. By embracing cultural diversity and showcasing stories from various regions, Netflix not only enhances its content offerings but also fosters a sense of inclusivity among its subscribers. This strategy is particularly important in an era where viewers are increasingly seeking authentic and relatable narratives.

Moreover, Netflix has recognized the importance of collaborating with renowned creators and established filmmakers. By partnering with high-profile directors, writers, and actors, the platform has been able to produce critically acclaimed content that resonates with audiences. These collaborations have resulted in award-winning series and films, which not only elevate Netflix’s brand but also serve to attract new subscribers who are eager to experience top-tier entertainment. The success of original series such as “The Crown” and “Stranger Things” exemplifies how strategic partnerships can yield significant returns on investment, reinforcing the notion that quality content is paramount in the competitive streaming landscape.

In addition to fostering relationships with established talent, Netflix has also made substantial investments in emerging creators. By providing platforms for new voices and innovative storytelling, the company is not only diversifying its content but also ensuring a steady pipeline of fresh ideas. This commitment to nurturing talent is crucial for maintaining relevance in an industry that is constantly evolving. As audiences become more discerning, the ability to offer unique and engaging content will be a key differentiator for Netflix, setting it apart from competitors.

Furthermore, Netflix’s strategic content investments extend beyond traditional programming. The company has increasingly ventured into interactive content, allowing viewers to engage with stories in new and immersive ways. This innovative approach not only enhances the viewing experience but also positions Netflix as a pioneer in the realm of interactive entertainment. By exploring new formats and technologies, Netflix is not only appealing to tech-savvy audiences but also setting the stage for future growth opportunities.

As Netflix continues to refine its content strategy, it is also paying close attention to data analytics and viewer preferences. By leveraging insights from its vast user base, the company can make informed decisions about which projects to greenlight and how to tailor its offerings to meet audience demands. This data-driven approach not only maximizes the potential for success but also minimizes the risks associated with content production.

In conclusion, Netflix’s strategic content investments are pivotal to its potential comeback in the stock market. By focusing on diverse storytelling, collaborating with established and emerging talent, exploring innovative formats, and utilizing data analytics, the company is well-positioned to navigate the challenges of the streaming landscape. As it continues to evolve and adapt, Netflix’s commitment to delivering high-quality content will remain a key factor in its ability to attract and retain subscribers, ultimately driving its stock performance in the future.

The Impact of Global Expansion on Netflix Stock

As Netflix continues to navigate the complexities of the global streaming market, its stock appears poised for a potential comeback, largely driven by the company’s strategic global expansion efforts. Over the past few years, Netflix has made significant inroads into international markets, recognizing that growth opportunities outside the United States are essential for sustaining its competitive edge. This expansion has not only diversified its subscriber base but has also positioned the company to capitalize on the increasing demand for streaming content worldwide.

One of the most notable impacts of global expansion on Netflix stock is the surge in subscriber growth from international markets. As the company has localized its content offerings, producing original series and films tailored to specific regions, it has successfully attracted a broader audience. For instance, the popularity of shows like “Money Heist” in Spain and “Squid Game” in South Korea has demonstrated that Netflix can create culturally relevant content that resonates with diverse viewers. This localized approach not only enhances subscriber retention but also drives new sign-ups, ultimately contributing to revenue growth. As more international subscribers join the platform, the potential for increased earnings becomes a compelling factor for investors, thereby positively influencing Netflix’s stock performance.

Moreover, the global expansion strategy has allowed Netflix to tap into emerging markets where internet penetration is on the rise. Countries in Asia, Africa, and Latin America present vast opportunities for subscriber growth, as more consumers gain access to affordable internet and smart devices. By investing in these regions, Netflix is not only expanding its market share but also establishing itself as a leader in the global streaming landscape. This proactive approach to market entry is likely to yield long-term benefits, as early investments in these burgeoning markets can lead to substantial returns as the subscriber base grows.

In addition to subscriber growth, Netflix’s global expansion has also enhanced its content library, making it more appealing to a wider audience. The company has invested heavily in acquiring and producing content from various countries, which has enriched its offerings and attracted viewers with diverse tastes. This extensive library not only helps retain existing subscribers but also draws in new ones who are eager to explore international content. As Netflix continues to innovate and diversify its programming, the potential for increased viewership and engagement becomes a significant driver of stock performance.

Furthermore, the competitive landscape of the streaming industry is evolving, with numerous players vying for market share. However, Netflix’s early and aggressive global expansion has given it a first-mover advantage in many regions. While competitors may attempt to replicate this strategy, Netflix’s established brand recognition and extensive content library provide it with a unique position in the market. As the company continues to strengthen its foothold in international markets, investors may view its stock as a more attractive option, anticipating that Netflix will maintain its leadership role in the streaming sector.

In conclusion, the impact of global expansion on Netflix stock is multifaceted, encompassing subscriber growth, content diversification, and competitive positioning. As the company continues to explore new markets and adapt its offerings to meet the needs of diverse audiences, it is well-positioned for a potential comeback. Investors are likely to take note of these developments, recognizing that Netflix’s strategic initiatives could lead to sustained growth and increased shareholder value in the years to come.

Analyzing Netflix’s Subscriber Growth Trends

Netflix has long been a dominant player in the streaming industry, but its recent subscriber growth trends have raised questions about its future trajectory. To understand the potential for a comeback, it is essential to analyze the factors influencing subscriber growth and the strategies Netflix has employed to adapt to a rapidly changing market. Over the past few years, Netflix has experienced fluctuations in subscriber numbers, with significant growth during the early stages of the pandemic, followed by a plateau and even declines in certain quarters. This volatility can be attributed to various factors, including increased competition, market saturation, and changing consumer preferences.

One of the most significant challenges Netflix faces is the rise of competitors such as Disney+, Amazon Prime Video, and HBO Max. These platforms have not only entered the market with substantial content libraries but have also attracted audiences with exclusive offerings and competitive pricing. As a result, Netflix has had to reassess its content strategy to retain existing subscribers and attract new ones. The company has responded by investing heavily in original programming, which has become a cornerstone of its value proposition. By producing high-quality, exclusive content, Netflix aims to differentiate itself from competitors and create a loyal subscriber base.

Moreover, Netflix’s international expansion has played a crucial role in its subscriber growth trends. As the company seeks to penetrate new markets, it has tailored its content to resonate with diverse audiences. This localization strategy has proven effective, as evidenced by the success of international hits like “Money Heist” and “Squid Game.” By catering to regional tastes and preferences, Netflix not only broadens its appeal but also mitigates the risks associated with market saturation in more mature regions. Consequently, the company has seen a steady increase in subscribers from international markets, which bodes well for its overall growth trajectory.

In addition to content diversification and international expansion, Netflix has also explored innovative pricing strategies to attract and retain subscribers. The introduction of ad-supported tiers is a notable example of this approach. By offering a lower-cost subscription option, Netflix aims to capture price-sensitive consumers who may have previously hesitated to join the platform. This move not only broadens the potential subscriber base but also provides an additional revenue stream that can be reinvested into content creation. As the streaming landscape continues to evolve, such adaptive strategies will be critical for Netflix to maintain its competitive edge.

Furthermore, the company’s commitment to data-driven decision-making enhances its ability to understand subscriber preferences and behaviors. By leveraging analytics, Netflix can refine its content offerings and marketing strategies, ensuring that it meets the evolving demands of its audience. This focus on personalization not only improves user experience but also fosters subscriber loyalty, which is essential for long-term growth.

In conclusion, while Netflix has faced challenges in recent years, its proactive strategies in content creation, international expansion, pricing innovation, and data utilization position it well for a potential comeback. As the streaming industry continues to evolve, Netflix’s ability to adapt to changing market dynamics will be crucial in regaining momentum and achieving sustainable subscriber growth. By focusing on these key areas, Netflix can not only weather the current competitive landscape but also emerge stronger, reaffirming its status as a leader in the streaming space.

Competitive Landscape: How Netflix Stands Against Rivals

In the ever-evolving landscape of streaming services, Netflix has faced significant challenges from a multitude of competitors that have emerged in recent years. As the streaming market becomes increasingly saturated, it is essential to examine how Netflix positions itself against these rivals and what strategies it employs to maintain its status as a leading player in the industry. The competitive landscape is marked by the presence of formidable contenders such as Disney+, Amazon Prime Video, Hulu, and HBO Max, each offering unique content and features that appeal to diverse audiences.

Despite the influx of competitors, Netflix has managed to retain a substantial subscriber base, thanks in part to its extensive library of original content. The company has invested heavily in producing high-quality series and films that resonate with viewers, thereby creating a loyal following. This commitment to original programming has not only differentiated Netflix from its competitors but has also established it as a pioneer in the industry. For instance, critically acclaimed series like “Stranger Things” and “The Crown” have garnered significant attention and accolades, reinforcing Netflix’s reputation as a provider of premium content.

Moreover, Netflix’s global reach has been a crucial factor in its competitive strategy. While many of its rivals focus primarily on the North American market, Netflix has successfully expanded its services to over 190 countries. This international presence allows the company to tap into diverse markets and cater to varying tastes and preferences. By producing localized content that reflects the culture and interests of different regions, Netflix has been able to attract subscribers worldwide, thereby enhancing its competitive edge.

In addition to its content strategy, Netflix has also embraced technological advancements to improve user experience. The platform’s user-friendly interface, personalized recommendations, and seamless streaming capabilities have set it apart from competitors. By leveraging data analytics, Netflix can offer tailored suggestions that keep viewers engaged and encourage them to explore new titles. This focus on user experience is critical in an era where consumers have numerous options at their fingertips, and it plays a significant role in retaining subscribers.

However, the competitive landscape is not without its challenges. Rivals like Disney+ have made significant strides by leveraging their existing franchises and fan bases. Disney’s extensive catalog of beloved characters and stories has attracted a considerable number of subscribers, particularly families seeking content for children. Similarly, Amazon Prime Video benefits from its integration with the broader Amazon ecosystem, offering additional value to subscribers through bundled services. As these competitors continue to innovate and expand their offerings, Netflix must remain vigilant and adaptable to sustain its market position.

In response to these challenges, Netflix has begun exploring new avenues for growth, including the introduction of ad-supported subscription tiers. This strategic move aims to attract price-sensitive consumers while diversifying revenue streams. By offering a more affordable option, Netflix can potentially capture a larger audience and mitigate the impact of subscriber churn. Furthermore, the company is continuously evaluating its content strategy, seeking to strike a balance between original productions and licensed content to keep its library fresh and appealing.

In conclusion, while Netflix faces a competitive landscape filled with formidable rivals, its commitment to original content, global reach, and focus on user experience provide a solid foundation for potential growth. As the streaming industry continues to evolve, Netflix’s ability to adapt and innovate will be crucial in maintaining its status as a leader in the market. With strategic initiatives in place, the company is poised for a potential comeback, reaffirming its position in an increasingly crowded field.

Financial Metrics Indicating a Potential Stock Recovery

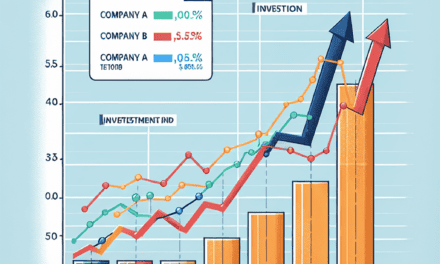

As Netflix navigates the complexities of a rapidly evolving entertainment landscape, several financial metrics suggest that the company may be poised for a potential comeback. Investors and analysts alike are closely monitoring these indicators, which could signal a shift in the company’s fortunes. One of the most telling metrics is the subscriber growth rate, which has shown signs of stabilization after a period of decline. Following a series of strategic content investments and a renewed focus on international markets, Netflix has begun to attract new subscribers, particularly in regions where it previously faced stiff competition. This resurgence in subscriber numbers not only bolsters revenue but also enhances the company’s overall market position.

In addition to subscriber growth, Netflix’s revenue per user has demonstrated resilience. The company has successfully implemented price increases in various markets without significantly impacting subscriber retention. This ability to raise prices while maintaining a loyal customer base is a strong indicator of the brand’s value proposition and its competitive edge in the streaming industry. Furthermore, as Netflix continues to diversify its content offerings, including original programming and partnerships with established studios, the potential for increased revenue streams becomes more pronounced. This diversification not only attracts new viewers but also encourages existing subscribers to remain engaged, thereby enhancing lifetime customer value.

Moreover, Netflix’s operating margin has shown signs of improvement, reflecting the company’s commitment to cost management and operational efficiency. By streamlining production processes and leveraging data analytics to inform content decisions, Netflix has been able to reduce costs while still delivering high-quality programming. This focus on efficiency is crucial, especially in an environment where content production costs are rising. As the company continues to refine its operational strategies, the potential for improved profitability becomes increasingly likely, further supporting the case for a stock recovery.

Another critical metric to consider is Netflix’s cash flow position. Historically, the company has invested heavily in content creation, often leading to negative cash flow. However, recent reports indicate that Netflix is moving towards a more sustainable cash flow model. By balancing its content investments with revenue growth, the company is beginning to generate positive cash flow, which is essential for funding future projects and reducing reliance on external financing. This shift not only enhances financial stability but also instills confidence among investors regarding the company’s long-term viability.

Additionally, the broader market trends in the streaming industry are also favorable for Netflix. As competition intensifies, many new entrants are struggling to gain traction, while established players are facing challenges in retaining their audiences. This environment presents an opportunity for Netflix to solidify its leadership position by capitalizing on its extensive library and brand recognition. As consumers continue to seek high-quality content, Netflix’s established reputation and commitment to innovation may allow it to capture a larger share of the market.

In conclusion, the combination of stabilizing subscriber growth, resilient revenue per user, improving operating margins, and a positive cash flow trajectory paints a promising picture for Netflix’s financial health. As the company adapts to the changing dynamics of the entertainment industry, these metrics suggest that it is well-positioned for a potential comeback. Investors should remain vigilant, as the unfolding narrative around Netflix’s performance could lead to renewed interest in its stock, ultimately paving the way for a recovery that many have anticipated.

The Role of Original Programming in Netflix’s Future

As Netflix navigates the ever-evolving landscape of the entertainment industry, the role of original programming emerges as a pivotal factor in its potential resurgence. In recent years, the streaming giant has invested heavily in creating exclusive content, a strategy that has not only differentiated it from competitors but also solidified its brand identity. This commitment to original programming has proven essential in attracting and retaining subscribers, particularly in an era where consumer preferences are shifting rapidly.

The success of Netflix’s original series and films has been remarkable, with titles such as “Stranger Things,” “The Crown,” and “Bridgerton” capturing the attention of global audiences. These productions have not only garnered critical acclaim but have also fostered a sense of community among viewers, who eagerly anticipate new seasons and episodes. This communal experience is vital in an age where social media amplifies discussions around popular culture, allowing Netflix to leverage its original content as a catalyst for engagement and subscriber growth.

Moreover, original programming serves as a strategic tool for Netflix to combat the increasing competition in the streaming market. With the emergence of platforms like Disney+, HBO Max, and Amazon Prime Video, the battle for viewer attention has intensified. In this context, Netflix’s ability to produce unique and compelling content becomes a significant advantage. By offering exclusive shows and films that cannot be found elsewhere, Netflix not only retains its existing subscriber base but also attracts new viewers who are drawn to its diverse and innovative offerings.

In addition to enhancing subscriber numbers, original programming plays a crucial role in Netflix’s global expansion strategy. As the company seeks to penetrate international markets, it has recognized the importance of localized content. By investing in original programming that resonates with specific cultural contexts, Netflix can appeal to a broader audience. For instance, productions like “Money Heist” from Spain and “Lupin” from France have not only achieved international success but have also underscored the platform’s commitment to diverse storytelling. This approach not only enriches the viewing experience but also positions Netflix as a global leader in the streaming industry.

Furthermore, the financial implications of original programming cannot be overlooked. While the initial investment in creating high-quality content can be substantial, the long-term benefits often outweigh the costs. Successful original series can generate significant revenue through merchandise, licensing deals, and international distribution rights. Additionally, as Netflix continues to build its library of original content, it reduces its reliance on third-party licensing agreements, which can be unpredictable and costly. This shift towards self-produced content enhances the company’s financial stability and allows for greater creative control.

As Netflix looks to the future, the importance of original programming will only continue to grow. The streaming landscape is likely to become even more competitive, making it imperative for Netflix to innovate and adapt. By focusing on high-quality, diverse, and engaging original content, the company can not only maintain its current subscriber base but also attract new viewers. In conclusion, the role of original programming is central to Netflix’s strategy for a potential comeback, as it seeks to redefine the viewing experience and solidify its position as a leader in the streaming industry. Through a commitment to creativity and quality, Netflix is poised to navigate the challenges ahead and emerge stronger than ever.

Market Sentiment and Analyst Predictions for Netflix Stock

As the streaming landscape continues to evolve, market sentiment surrounding Netflix stock has shown signs of potential recovery, prompting analysts to reassess their predictions for the company’s future. Following a period of volatility, characterized by subscriber losses and increased competition, there is a growing belief that Netflix may be on the cusp of a comeback. This optimism is largely fueled by strategic initiatives the company has undertaken, including content diversification and international expansion, which are expected to bolster its subscriber base and revenue streams.

In recent months, analysts have noted a shift in consumer behavior, with many viewers returning to Netflix as the platform rolls out a slate of highly anticipated original programming. The success of recent series and films has not only rekindled interest among existing subscribers but has also attracted new viewers. This resurgence in content quality and variety is critical, as it positions Netflix to reclaim its status as a leader in the streaming industry. Furthermore, the company’s commitment to investing in diverse genres and formats, including documentaries, animated series, and international productions, has broadened its appeal, catering to a wider audience.

Moreover, the implementation of an ad-supported subscription tier has opened new avenues for revenue generation. This strategic move allows Netflix to tap into a demographic that may be price-sensitive, thereby expanding its market reach. Analysts are optimistic that this initiative will not only enhance subscriber growth but also improve overall profitability. By diversifying its revenue model, Netflix is better equipped to navigate the challenges posed by competitors who have also adopted similar strategies. As a result, market sentiment has shifted positively, with many investors viewing the ad-supported tier as a pivotal step toward long-term sustainability.

In addition to these strategic initiatives, analysts are closely monitoring Netflix’s international expansion efforts. The company has made significant inroads into various global markets, particularly in regions such as Asia and Latin America, where streaming adoption is on the rise. By tailoring content to local tastes and preferences, Netflix is not only enhancing its global footprint but also positioning itself to capture a larger share of the international streaming market. This focus on localization is expected to yield substantial returns, as evidenced by the growing popularity of non-English language content on the platform.

Furthermore, the overall market sentiment towards technology stocks, including those in the streaming sector, has shown signs of recovery. As economic conditions stabilize and consumer spending rebounds, investors are increasingly optimistic about the potential for growth in the tech space. This broader trend is likely to benefit Netflix, as it aligns with the company’s efforts to innovate and adapt to changing market dynamics. Analysts are projecting that if Netflix can maintain its momentum and continue to deliver compelling content, the stock could see significant appreciation in the coming quarters.

In conclusion, the combination of strategic initiatives, a renewed focus on content quality, and a favorable market environment has positioned Netflix stock for a potential comeback. As analysts revise their predictions and market sentiment shifts positively, investors are encouraged to keep a close eye on the company’s performance. With the right strategies in place, Netflix may not only recover from its recent challenges but also emerge stronger in the competitive streaming landscape. The coming months will be crucial in determining whether this optimism translates into tangible results for the company and its shareholders.

Q&A

1. **Question:** What factors indicate that Netflix stock may be poised for a comeback?

**Answer:** Factors include increased subscriber growth, successful original content, expansion into new markets, and improvements in profitability.

2. **Question:** How has Netflix’s content strategy contributed to its stock performance?

**Answer:** Netflix’s investment in high-quality original programming has attracted and retained subscribers, boosting revenue and stock performance.

3. **Question:** What role does international expansion play in Netflix’s potential recovery?

**Answer:** International expansion opens new revenue streams and subscriber bases, which can significantly enhance overall growth and stock value.

4. **Question:** How has competition affected Netflix’s stock outlook?

**Answer:** While competition has intensified, Netflix’s strong brand loyalty and unique content offerings can help it maintain market share and drive stock recovery.

5. **Question:** What financial metrics should investors look at to assess Netflix’s comeback potential?

**Answer:** Investors should focus on subscriber growth rates, revenue growth, profit margins, and free cash flow.

6. **Question:** How might changes in pricing strategy impact Netflix’s stock?

**Answer:** A well-timed price increase could enhance revenue without significantly impacting subscriber growth, positively influencing stock performance.

7. **Question:** What external market conditions could influence Netflix’s stock recovery?

**Answer:** Economic recovery, changes in consumer spending habits, and shifts in entertainment consumption trends can all impact Netflix’s stock positively.

Conclusion

Netflix stock is poised for a potential comeback due to several key factors: a strong content pipeline, strategic international expansion, improvements in subscriber growth, and a focus on profitability through ad-supported tiers. As the company adapts to changing market dynamics and consumer preferences, it may regain investor confidence and drive stock performance upward.