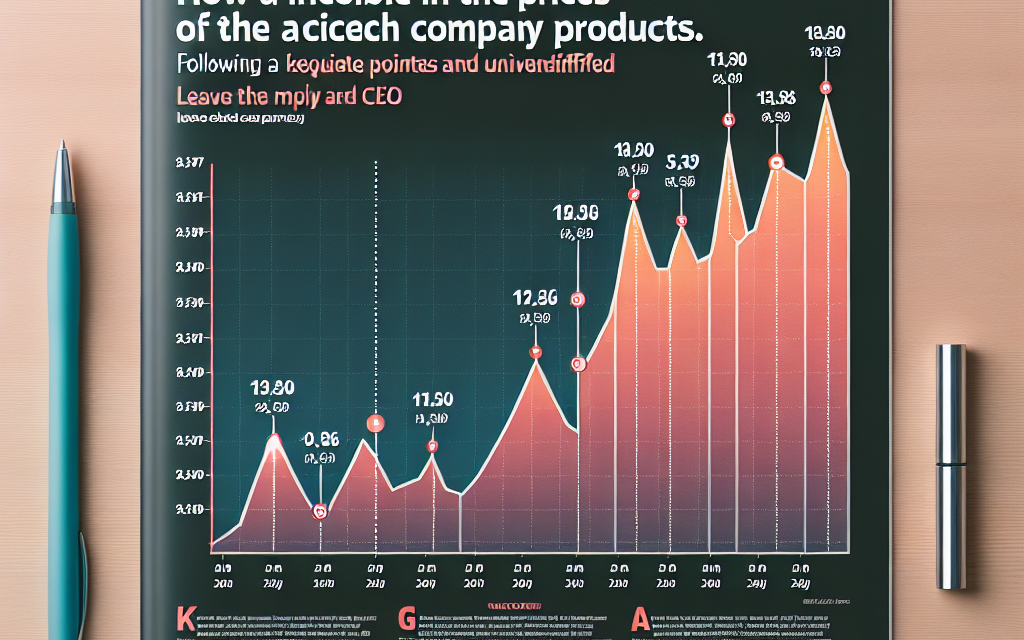

“Stay Ahead: Track Nvidia’s Price Points Post-Keynote Surge!”

Introduction

In the wake of a highly anticipated keynote address by Nvidia’s CEO, the company’s stock price has experienced significant fluctuations, reflecting investor sentiment and market reactions to the announcements made. This introduction aims to analyze the price points of Nvidia’s shares following the keynote, exploring the factors that contributed to the surge, including product innovations, strategic partnerships, and future growth projections. By examining these elements, we can gain insights into Nvidia’s market positioning and the potential implications for investors in the tech sector.

Nvidia’s Stock Surge: Analyzing Keynote Impact

Nvidia’s stock has experienced a notable surge following the recent keynote address delivered by its CEO, a development that has captured the attention of investors and analysts alike. This surge can be attributed to several factors, including the unveiling of innovative technologies, strategic partnerships, and the overall market sentiment surrounding the semiconductor industry. As Nvidia continues to solidify its position as a leader in graphics processing units (GPUs) and artificial intelligence (AI), understanding the implications of this keynote on its stock price becomes essential for stakeholders.

During the keynote, the CEO highlighted groundbreaking advancements in AI and machine learning, showcasing how Nvidia’s products are at the forefront of these technologies. The introduction of new GPUs designed specifically for AI applications not only demonstrates Nvidia’s commitment to innovation but also positions the company to capitalize on the growing demand for AI solutions across various sectors. This strategic focus on AI has resonated with investors, leading to increased confidence in Nvidia’s future growth prospects. Consequently, the stock price surged as market participants reacted positively to the potential for increased revenue streams stemming from these advancements.

Moreover, the keynote also emphasized Nvidia’s collaborations with major tech companies, which further bolstered investor sentiment. By partnering with industry giants, Nvidia is not only enhancing its product offerings but also expanding its market reach. These collaborations signal to investors that Nvidia is well-positioned to leverage its technology in diverse applications, from gaming to data centers and autonomous vehicles. As a result, the stock’s upward trajectory reflects a broader recognition of Nvidia’s strategic initiatives and their potential to drive long-term growth.

In addition to the technological advancements and partnerships discussed, the overall market environment has played a significant role in Nvidia’s stock performance. The semiconductor industry has been experiencing a resurgence, driven by increased demand for chips in various applications, including consumer electronics, automotive, and cloud computing. This favorable market backdrop has created a conducive environment for Nvidia’s growth, allowing the company to capitalize on its strengths while navigating the competitive landscape. Investors are keenly aware of these dynamics, and as such, Nvidia’s stock has become a focal point for those looking to capitalize on the broader trends within the semiconductor sector.

As Nvidia’s stock continues to respond to the positive sentiment generated by the keynote, it is crucial for investors to monitor price points closely. The stock’s performance in the days and weeks following the keynote will likely be influenced by a combination of factors, including market reactions, analyst ratings, and broader economic indicators. Additionally, any subsequent announcements or developments from Nvidia will further shape investor perceptions and could lead to fluctuations in stock price.

In conclusion, Nvidia’s stock surge following the CEO’s keynote address underscores the importance of innovation, strategic partnerships, and market dynamics in shaping investor sentiment. As the company continues to push the boundaries of technology, particularly in AI and machine learning, stakeholders must remain vigilant in monitoring price points and market trends. By doing so, investors can better position themselves to navigate the evolving landscape and capitalize on the opportunities presented by Nvidia’s ongoing growth trajectory.

Price Trends: Nvidia’s Market Response Post-Keynote

Following the recent keynote address by Nvidia’s CEO, the market has witnessed significant fluctuations in the company’s stock price, prompting investors and analysts alike to closely monitor these trends. The keynote, which highlighted groundbreaking advancements in artificial intelligence and graphics processing technology, served as a catalyst for renewed interest in Nvidia’s offerings. As a result, the stock experienced an immediate surge, reflecting heightened investor confidence and optimism about the company’s future prospects.

In the days following the keynote, Nvidia’s stock price exhibited a notable upward trajectory, driven by a combination of positive sentiment and robust demand for its products. This surge can be attributed to the CEO’s emphasis on the company’s strategic initiatives, particularly in the realms of AI and machine learning. By showcasing innovative applications and partnerships, Nvidia positioned itself as a leader in a rapidly evolving market, which resonated well with investors. Consequently, the stock’s performance became a focal point for market analysts, who began to reassess their forecasts and price targets based on the new information presented.

However, as with any market response, it is essential to consider the potential for volatility. While the initial reaction to the keynote was overwhelmingly positive, historical trends suggest that such surges can be followed by corrections. Investors are advised to remain vigilant, as fluctuations in stock prices can occur due to a variety of factors, including broader market conditions and shifts in investor sentiment. Therefore, monitoring Nvidia’s price points in the aftermath of the keynote is crucial for understanding the sustainability of its recent gains.

Moreover, the competitive landscape in the technology sector adds another layer of complexity to Nvidia’s market response. As competitors also strive to innovate and capture market share, Nvidia’s ability to maintain its momentum will depend on its continued investment in research and development. The company’s commitment to pushing the boundaries of technology will be a key determinant of its long-term success. Consequently, investors should keep an eye on not only Nvidia’s stock price but also its strategic moves and product launches in the coming months.

In addition to external competition, macroeconomic factors can also influence Nvidia’s stock performance. Economic indicators, interest rates, and global supply chain dynamics play a significant role in shaping investor perceptions. For instance, any signs of economic slowdown or inflationary pressures could lead to increased market volatility, impacting Nvidia’s stock price. Therefore, it is prudent for investors to consider these broader economic trends while evaluating Nvidia’s market response post-keynote.

As the dust settles from the keynote address, it becomes increasingly important for stakeholders to analyze Nvidia’s price trends in conjunction with the company’s operational performance. Quarterly earnings reports, product announcements, and strategic partnerships will provide further insights into the company’s trajectory. By synthesizing this information, investors can make informed decisions regarding their positions in Nvidia.

In conclusion, the market response to Nvidia’s CEO keynote has set the stage for a period of heightened scrutiny regarding the company’s stock price. While the initial surge reflects strong investor confidence, ongoing monitoring of price trends, competitive dynamics, and macroeconomic factors will be essential for understanding the sustainability of Nvidia’s market position. As the technology landscape continues to evolve, Nvidia’s ability to adapt and innovate will ultimately determine its success in the eyes of investors.

CEO Insights: How Leadership Affects Nvidia’s Valuation

The influence of leadership on a company’s valuation cannot be overstated, particularly in the case of Nvidia, a titan in the technology sector. Following a recent keynote address by CEO Jensen Huang, the market witnessed a notable surge in Nvidia’s stock price, underscoring the profound impact that executive insights can have on investor sentiment and company valuation. Huang’s ability to articulate a compelling vision for the future of artificial intelligence and graphics processing has not only captivated audiences but has also instilled confidence among investors, leading to a reevaluation of Nvidia’s market position.

In the realm of technology, where innovation is paramount, the role of a CEO extends beyond mere management; it encompasses the ability to inspire and galvanize stakeholders. Huang’s keynote was a masterclass in this regard, as he outlined Nvidia’s strategic direction and highlighted the company’s advancements in AI and machine learning. By effectively communicating the potential applications of Nvidia’s technology, he positioned the company as a leader in a rapidly evolving market. This clarity of vision is crucial, as it allows investors to align their expectations with the company’s trajectory, thereby influencing stock performance.

Moreover, Huang’s emphasis on the transformative power of AI resonated deeply with investors, many of whom are keenly aware of the technology’s potential to disrupt various industries. As Nvidia continues to innovate and expand its product offerings, the CEO’s insights serve as a barometer for the company’s future growth prospects. Investors are likely to respond positively to leadership that not only understands the technological landscape but also articulates a clear path forward. This dynamic is particularly evident in the tech sector, where rapid advancements can lead to significant shifts in market valuation.

Furthermore, the relationship between leadership and valuation is often reflected in the company’s financial performance. Following Huang’s keynote, Nvidia’s stock experienced a surge, suggesting that investor confidence was bolstered by the CEO’s vision and the company’s recent achievements. This correlation between leadership communication and market response highlights the importance of strategic messaging in shaping investor perceptions. When a CEO effectively conveys a narrative of growth and innovation, it can lead to increased demand for the company’s shares, thereby enhancing its overall valuation.

In addition to inspiring confidence, effective leadership also plays a critical role in navigating challenges. The technology sector is fraught with competition and rapid change, making it essential for CEOs to demonstrate adaptability and foresight. Huang’s ability to address potential challenges while maintaining an optimistic outlook further solidified investor trust. By acknowledging the competitive landscape and outlining strategies to maintain Nvidia’s edge, he reinforced the notion that strong leadership is integral to sustaining long-term growth.

As Nvidia continues to evolve, monitoring the company’s price points in relation to leadership insights will be essential for investors. The interplay between Huang’s vision and market performance serves as a reminder of the significant role that executive leadership plays in shaping a company’s valuation. In an era where technology is advancing at an unprecedented pace, the ability of a CEO to effectively communicate and inspire can be the difference between stagnation and growth. Therefore, as Nvidia navigates its future, the insights provided by its leadership will remain a critical factor in determining its market trajectory and overall valuation.

Investor Reactions: Nvidia’s Price Movements After the Keynote

Following the recent keynote address by Nvidia’s CEO, investor reactions have been closely monitored, particularly in light of the company’s significant price movements. The keynote, which highlighted advancements in artificial intelligence and the strategic direction of Nvidia, served as a catalyst for heightened interest among investors. As the presentation unfolded, it became evident that Nvidia’s commitment to innovation and leadership in the semiconductor industry resonated strongly with market participants.

In the immediate aftermath of the keynote, Nvidia’s stock experienced a notable surge, reflecting a wave of optimism among investors. This uptick can be attributed to the CEO’s emphasis on the company’s robust growth trajectory and its pivotal role in powering AI applications across various sectors. Investors, keen to capitalize on the potential for future earnings, responded positively, driving the stock price higher. This reaction underscores the market’s sensitivity to corporate communications, particularly when they align with broader technological trends.

Moreover, the keynote provided insights into Nvidia’s strategic initiatives, including partnerships and product developments that are expected to enhance its competitive edge. As the CEO articulated the company’s vision for the future, investors were quick to assess the implications for Nvidia’s market position. The announcement of new product lines and enhancements to existing technologies further fueled investor enthusiasm, leading to increased trading volumes and a subsequent rise in share price. This phenomenon illustrates how investor sentiment can be significantly influenced by corporate narratives, particularly in a rapidly evolving industry.

However, as the initial excitement began to stabilize, it became essential for investors to adopt a more measured approach. The volatility observed in Nvidia’s stock price following the keynote serves as a reminder of the inherent risks associated with investing in high-growth technology companies. While the immediate reaction was overwhelmingly positive, market participants must consider the long-term sustainability of Nvidia’s growth. Analysts began to scrutinize the company’s financial metrics, including revenue projections and profit margins, to gauge whether the stock’s elevated price was justified.

In addition to financial performance, external factors such as market conditions and competitive dynamics also play a crucial role in shaping investor sentiment. As Nvidia continues to navigate a landscape marked by rapid technological advancements and increasing competition, investors are advised to remain vigilant. The potential for market corrections or shifts in investor sentiment can lead to fluctuations in stock price, making it imperative for stakeholders to stay informed about both internal developments and external market trends.

Furthermore, the broader economic environment, including interest rates and inflation, can significantly impact investor behavior. As these macroeconomic factors evolve, they may influence Nvidia’s stock performance in ways that are not immediately apparent. Therefore, investors should consider a holistic view of the market when evaluating Nvidia’s price movements post-keynote.

In conclusion, the investor reactions to Nvidia’s price movements following the CEO’s keynote reflect a complex interplay of optimism and caution. While the initial surge in stock price highlights the market’s enthusiasm for Nvidia’s future prospects, it is essential for investors to remain grounded in their analysis. By balancing excitement with a thorough examination of financial fundamentals and external influences, investors can make informed decisions that align with their long-term investment strategies. As Nvidia continues to innovate and expand its market presence, ongoing monitoring of its price points will be crucial for understanding the evolving landscape of this dynamic sector.

Competitive Landscape: Nvidia’s Positioning Post-Keynote

In the wake of Nvidia’s recent keynote address, the competitive landscape within the semiconductor and artificial intelligence sectors has shifted significantly, prompting analysts and investors alike to closely monitor the company’s price points. Nvidia, a leader in graphics processing units (GPUs) and AI technologies, has consistently demonstrated its ability to innovate and adapt to market demands. Following the keynote, which showcased groundbreaking advancements and strategic initiatives, the company’s positioning appears even more robust, setting the stage for potential growth and increased market share.

As Nvidia continues to solidify its dominance, it faces competition from several key players in the industry. Companies such as AMD and Intel are vying for a larger slice of the GPU and AI markets, each attempting to leverage their unique strengths. AMD, for instance, has made significant strides in developing competitive graphics cards and has been gaining traction in the gaming sector. Meanwhile, Intel is investing heavily in AI and machine learning capabilities, aiming to enhance its product offerings and capture a share of the lucrative data center market. Despite these challenges, Nvidia’s recent innovations, particularly in AI-driven applications, have positioned it favorably against its rivals.

Moreover, the keynote highlighted Nvidia’s commitment to expanding its ecosystem, which is crucial in maintaining its competitive edge. By fostering partnerships with major cloud service providers and software developers, Nvidia is not only enhancing the functionality of its products but also ensuring that its technologies are integrated into a wide array of applications. This strategic approach not only reinforces customer loyalty but also creates barriers for competitors attempting to penetrate the same markets. As a result, Nvidia’s ability to leverage its ecosystem could prove pivotal in sustaining its market leadership.

In addition to its partnerships, Nvidia’s focus on research and development is another critical factor that sets it apart from competitors. The company has consistently allocated substantial resources to R&D, enabling it to stay ahead of technological trends and consumer demands. This commitment was evident during the keynote, where Nvidia unveiled several cutting-edge products and solutions that promise to redefine industry standards. By prioritizing innovation, Nvidia not only enhances its product lineup but also cultivates a reputation as a forward-thinking leader in the tech space.

Furthermore, the growing demand for AI and machine learning solutions presents a significant opportunity for Nvidia to capitalize on its strengths. As businesses across various sectors increasingly adopt AI technologies, the need for powerful GPUs and optimized software solutions has surged. Nvidia’s ability to provide comprehensive solutions tailored to these emerging needs positions it favorably in a rapidly evolving market. Consequently, investors are keenly observing Nvidia’s price points, as any fluctuations may reflect broader trends in the tech industry and the company’s ongoing performance.

In conclusion, Nvidia’s positioning in the competitive landscape following its recent keynote is characterized by a combination of strategic partnerships, a strong focus on R&D, and an acute awareness of market demands. While competition remains fierce, Nvidia’s proactive approach to innovation and ecosystem development suggests that it is well-equipped to navigate the challenges ahead. As the market continues to evolve, monitoring Nvidia’s price points will be essential for understanding its trajectory and the broader implications for the semiconductor and AI sectors. The company’s ability to maintain its leadership position will ultimately depend on its responsiveness to competitive pressures and its commitment to delivering cutting-edge solutions that meet the needs of an increasingly digital world.

Future Projections: Nvidia’s Price Points in 2024

As Nvidia continues to solidify its position as a leader in the technology sector, particularly in graphics processing units (GPUs) and artificial intelligence (AI), investors and analysts are keenly observing the company’s price points following the recent surge in interest spurred by the CEO’s keynote address. The keynote not only highlighted Nvidia’s innovative advancements but also set the stage for future projections regarding its stock performance in 2024. Given the current trajectory of the tech industry, several factors will likely influence Nvidia’s price points in the coming year.

To begin with, the demand for AI and machine learning technologies is expected to escalate significantly. Nvidia has positioned itself at the forefront of this trend, with its GPUs being integral to the development and deployment of AI applications. As businesses increasingly adopt AI solutions to enhance efficiency and drive innovation, Nvidia’s products are likely to see heightened demand. This surge in demand could translate into increased revenue, thereby positively impacting the company’s stock price. Analysts predict that if Nvidia can maintain its competitive edge and continue to innovate, its stock could experience substantial growth throughout 2024.

Moreover, the expansion of cloud computing services is another critical factor that could influence Nvidia’s price points. As more companies migrate to cloud-based infrastructures, the need for powerful processing capabilities becomes paramount. Nvidia’s GPUs are essential for cloud service providers, enabling them to deliver high-performance computing solutions. Consequently, as the cloud computing market expands, Nvidia stands to benefit significantly, which could further bolster its stock price. Investors should closely monitor developments in this sector, as any positive news regarding partnerships or contracts with major cloud providers could lead to a favorable shift in Nvidia’s market valuation.

In addition to these industry trends, Nvidia’s strategic initiatives will also play a crucial role in shaping its future price points. The company has been actively pursuing acquisitions and collaborations that enhance its technological capabilities and market reach. For instance, any successful integration of new technologies or expansion into emerging markets could provide Nvidia with additional revenue streams. Such strategic moves not only strengthen the company’s position but also instill confidence among investors, potentially leading to an upward trajectory in stock prices.

Furthermore, it is essential to consider the broader economic landscape when evaluating Nvidia’s future price points. Factors such as interest rates, inflation, and overall market sentiment can significantly impact investor behavior. If the economy remains stable and growth-oriented, investors may be more inclined to invest in tech stocks like Nvidia, driving up demand and, consequently, the stock price. Conversely, any economic downturn or uncertainty could lead to a more cautious approach from investors, which might suppress Nvidia’s stock performance.

In conclusion, as Nvidia navigates the complexities of the tech landscape, its price points in 2024 will likely be influenced by a confluence of factors, including the growing demand for AI technologies, the expansion of cloud computing, strategic initiatives, and the overall economic environment. Investors should remain vigilant and informed, as these elements will play a pivotal role in determining Nvidia’s market performance in the coming year. By closely monitoring these dynamics, stakeholders can make more informed decisions regarding their investments in this dynamic and rapidly evolving sector.

Market Sentiment: Understanding Nvidia’s Price Fluctuations After the Keynote

In the ever-evolving landscape of technology stocks, Nvidia has emerged as a focal point for investors, particularly following the recent keynote address by its CEO. This event not only showcased the company’s innovative advancements but also significantly influenced market sentiment, leading to notable price fluctuations in Nvidia’s stock. Understanding these price movements requires a closer examination of the factors that contribute to investor behavior and market dynamics.

Following the keynote, Nvidia’s stock experienced a surge, reflecting heightened investor enthusiasm and optimism about the company’s future prospects. This surge can be attributed to several key announcements made during the presentation, including advancements in artificial intelligence, gaming technology, and data center solutions. As the CEO articulated the company’s vision and strategic direction, investors were quick to respond, driving up demand for Nvidia shares. This immediate reaction underscores the importance of leadership communication in shaping market perceptions and influencing stock performance.

However, it is essential to recognize that such price surges are often followed by volatility. As investors digest the information presented during the keynote, they may reassess their positions, leading to fluctuations in stock prices. This phenomenon is particularly evident in the technology sector, where rapid innovation and competitive pressures can create an environment of uncertainty. Consequently, while the initial response to the keynote may be overwhelmingly positive, subsequent trading sessions may reveal a more nuanced picture as investors weigh the long-term implications of the announcements.

Moreover, market sentiment is not solely influenced by the content of the keynote itself but also by broader economic indicators and trends within the technology sector. For instance, macroeconomic factors such as interest rates, inflation, and overall market conditions can significantly impact investor confidence. In the wake of the keynote, analysts and investors alike will be closely monitoring these external factors to gauge their potential effects on Nvidia’s stock price. This interconnectedness highlights the complexity of market dynamics, where a single event can trigger a cascade of reactions influenced by both internal and external variables.

In addition to macroeconomic considerations, investor sentiment can also be shaped by competitive developments within the industry. As Nvidia continues to innovate, it faces competition from other technology giants, which can create pressure on its stock price. Investors will be keenly aware of how Nvidia’s advancements stack up against those of its competitors, and this comparative analysis will play a crucial role in shaping their investment decisions. Therefore, while the keynote may have provided a temporary boost to Nvidia’s stock, ongoing developments in the competitive landscape will be critical in determining its long-term trajectory.

As the dust settles from the keynote address, it becomes increasingly important for investors to adopt a measured approach to Nvidia’s stock. Monitoring price points in the days and weeks following the event will provide valuable insights into market sentiment and investor confidence. By analyzing trading volumes, price movements, and broader market trends, investors can better understand the underlying forces driving Nvidia’s stock fluctuations. Ultimately, while the keynote may have sparked initial enthusiasm, the true test for Nvidia will lie in its ability to sustain momentum and navigate the complexities of an ever-changing market environment. In this context, vigilance and informed decision-making will be paramount for those looking to capitalize on Nvidia’s potential in the technology sector.

Q&A

1. **Question:** What was the primary focus of Nvidia’s CEO during the keynote?

**Answer:** The primary focus was on advancements in AI technology and their impact on the market.

2. **Question:** How did Nvidia’s stock price react following the keynote?

**Answer:** Nvidia’s stock price surged significantly after the keynote, reflecting investor optimism.

3. **Question:** What specific product announcements contributed to the price surge?

**Answer:** Announcements related to new GPU models and AI-driven software solutions contributed to the surge.

4. **Question:** What was the percentage increase in Nvidia’s stock price post-keynote?

**Answer:** Nvidia’s stock price increased by approximately 10% following the keynote.

5. **Question:** How did analysts respond to the keynote and price surge?

**Answer:** Analysts expressed bullish sentiments, raising price targets for Nvidia shares.

6. **Question:** What market trends were highlighted during the keynote that could affect Nvidia’s pricing?

**Answer:** Trends in AI adoption and increased demand for high-performance computing were highlighted.

7. **Question:** What are the potential risks to Nvidia’s stock price following the surge?

**Answer:** Potential risks include market volatility, competition, and regulatory challenges in the tech sector.

Conclusion

Following the CEO’s keynote, Nvidia’s price points are likely to experience significant fluctuations driven by market sentiment, investor reactions, and the company’s strategic announcements. Monitoring these price movements will be crucial for understanding the impact of the keynote on Nvidia’s market position and future growth potential.