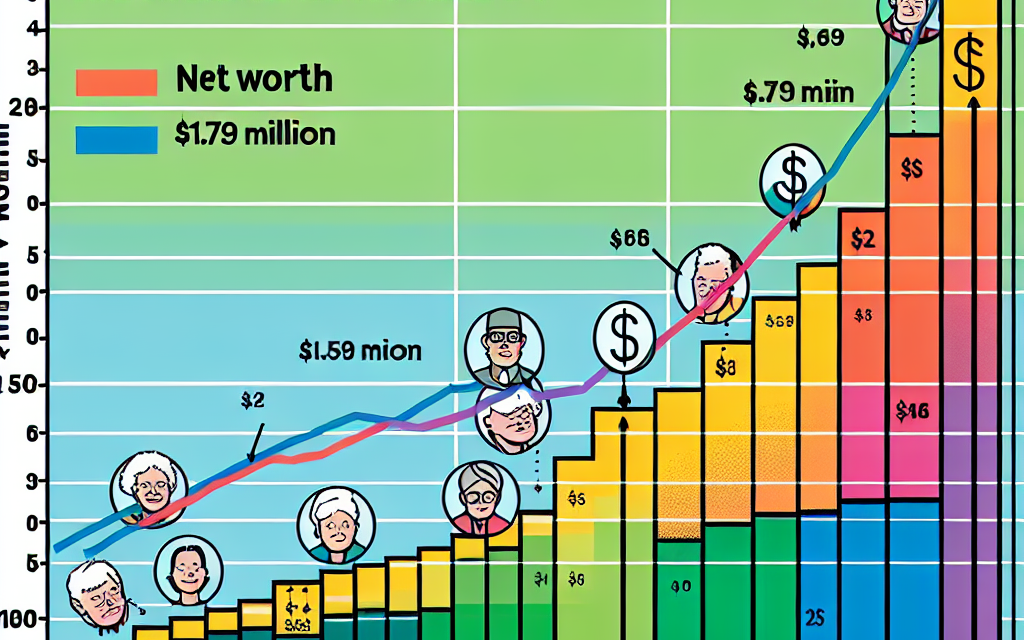

“Is Your Net Worth Surpassing the Average Retiree’s $1.79 Million? Discover Your Financial Edge!”

Introduction

As retirement approaches, understanding your financial standing becomes crucial, particularly in relation to the average net worth of retirees. With the average retiree boasting a net worth of approximately $1.79 million, it’s essential to evaluate whether your financial assets are keeping pace with or exceeding this benchmark. This assessment not only provides insight into your financial health but also helps in planning for a comfortable and secure retirement. By comparing your net worth to this average, you can better gauge your readiness for retirement and make informed decisions about your financial future.

Understanding Net Worth: What It Means for Retirement

Understanding net worth is crucial for anyone planning for retirement, as it serves as a comprehensive measure of financial health. Net worth is calculated by subtracting total liabilities from total assets, providing a snapshot of an individual’s financial standing at a given moment. For retirees, this figure is particularly significant, as it reflects the resources available to sustain their lifestyle after leaving the workforce. With the average retiree’s net worth reported at approximately $1.79 million, it is essential to evaluate whether your own financial situation aligns with or exceeds this benchmark.

To begin with, it is important to recognize that net worth encompasses various components, including real estate, investments, savings, and other assets. For many retirees, the family home represents a substantial portion of their net worth. However, it is vital to consider the liquidity of these assets, as not all can be easily converted into cash. Investments in stocks, bonds, and retirement accounts, such as 401(k)s and IRAs, often provide more immediate access to funds, which can be critical during retirement when regular income from employment ceases. Therefore, while a high net worth is advantageous, the composition of that wealth plays a significant role in determining financial security.

Moreover, understanding net worth in the context of retirement involves recognizing the importance of expenses. As individuals transition into retirement, their spending patterns often change. While some may find that their expenses decrease due to the absence of work-related costs, others may experience increased healthcare expenses or wish to allocate funds for travel and leisure activities. Consequently, a retiree’s net worth should not only be evaluated in isolation but also in relation to their anticipated expenses. This relationship underscores the necessity of creating a comprehensive retirement plan that accounts for both income and expenditures.

In addition to evaluating personal net worth, it is beneficial to consider broader economic factors that may influence financial stability during retirement. Inflation, for instance, can erode purchasing power over time, making it essential for retirees to invest wisely and ensure that their assets grow at a rate that outpaces inflation. Furthermore, market volatility can impact investment portfolios, necessitating a diversified approach to asset allocation. By understanding these external factors, retirees can make informed decisions that enhance their financial resilience.

As individuals assess their net worth in relation to the average retiree’s figure, it is also important to set realistic financial goals. Establishing a target net worth can provide motivation and a clear benchmark for progress. However, it is equally crucial to remain adaptable, as life circumstances can change unexpectedly. Factors such as health issues, family obligations, or shifts in the economy can all necessitate adjustments to retirement plans. Therefore, maintaining flexibility and regularly reviewing one’s financial situation can help ensure that retirees remain on track to meet their goals.

In conclusion, understanding net worth is a fundamental aspect of retirement planning. By comprehensively evaluating assets and liabilities, considering anticipated expenses, and remaining aware of external economic factors, individuals can better position themselves for a secure and fulfilling retirement. As you reflect on your financial standing, remember that achieving a net worth that outpaces the average retiree’s $1.79 million is not merely about reaching a number; it is about ensuring that you have the resources necessary to enjoy your retirement years with confidence and peace of mind.

Comparing Your Net Worth to the Average Retiree

As individuals approach retirement, understanding their financial standing becomes increasingly crucial, particularly in relation to the average net worth of retirees. Currently, the average net worth for retirees stands at approximately $1.79 million, a figure that encompasses various assets, including savings, investments, and property. This benchmark serves as a useful reference point for assessing one’s financial readiness for retirement. However, it is essential to recognize that net worth is not merely a number; it reflects a lifetime of financial decisions, savings habits, and investment strategies.

When comparing your net worth to that of the average retiree, it is important to consider the factors that contribute to this figure. For instance, the average net worth can be significantly influenced by home equity, which often constitutes a substantial portion of an individual’s assets. Many retirees have paid off their homes, allowing them to enjoy a higher net worth due to the appreciation of property values over time. Therefore, if you own a home, it is vital to factor in its current market value when evaluating your financial position.

Moreover, retirement accounts such as 401(k)s and IRAs play a pivotal role in shaping net worth. The contributions made during one’s working years, coupled with the power of compound interest, can lead to significant growth in these accounts. If your retirement savings are on par with or exceed the average contributions, you may find that your net worth is not only competitive but potentially advantageous. However, it is equally important to consider how withdrawals from these accounts during retirement can impact your overall financial health.

In addition to savings and investments, other assets such as stocks, bonds, and mutual funds contribute to net worth. The performance of these investments can fluctuate based on market conditions, which means that retirees must remain vigilant about their portfolios. If your investment strategy has yielded returns that surpass the average market performance, this could indicate a net worth that exceeds the average retiree’s figure. Conversely, if your investments have underperformed, it may be necessary to reassess your financial strategy to ensure that you are on track for a comfortable retirement.

Furthermore, liabilities such as debt can significantly affect net worth. Many retirees may carry mortgages, credit card debt, or other financial obligations that detract from their overall wealth. If you have managed to minimize or eliminate debt, this can enhance your net worth and provide greater financial freedom in retirement. Therefore, evaluating your liabilities in conjunction with your assets is essential for a comprehensive understanding of your financial situation.

Ultimately, comparing your net worth to the average retiree’s $1.79 million is not merely an exercise in numbers; it is an opportunity to reflect on your financial journey and future goals. By analyzing your assets, liabilities, and investment strategies, you can gain valuable insights into your financial health. If your net worth is below the average, it may serve as a catalyst for developing a more robust savings plan or investment strategy. Conversely, if you find that your net worth exceeds the average, it can provide reassurance that you are on a solid path toward a secure and fulfilling retirement. In either case, the key lies in continuous evaluation and adjustment of your financial strategies to ensure that you are well-prepared for the years ahead.

Strategies to Increase Your Net Worth Before Retirement

As individuals approach retirement, the importance of a robust net worth becomes increasingly evident, particularly in light of the average retiree’s net worth of $1.79 million. To ensure financial security and the ability to maintain a desired lifestyle, it is essential to adopt effective strategies that can enhance one’s net worth prior to retirement. One of the most fundamental approaches is to prioritize saving and investing early in one’s career. By consistently setting aside a portion of income, individuals can take advantage of compound interest, which allows savings to grow exponentially over time. This principle underscores the value of starting early, as even modest contributions can accumulate significantly when given sufficient time to mature.

In addition to saving, diversifying investments is a critical strategy for increasing net worth. Relying solely on traditional savings accounts may not yield the returns necessary to outpace inflation and grow wealth. Instead, individuals should consider a balanced portfolio that includes stocks, bonds, real estate, and other investment vehicles. This diversification not only mitigates risk but also positions investors to capitalize on various market conditions. Furthermore, engaging with a financial advisor can provide tailored insights and strategies that align with personal financial goals, ensuring that investment choices are both informed and strategic.

Moreover, it is essential to manage expenses effectively. By adopting a frugal lifestyle and minimizing unnecessary expenditures, individuals can redirect those savings into investments or retirement accounts. Creating a budget that tracks income and expenses can illuminate areas where spending can be reduced, thereby increasing the amount available for savings. This practice not only enhances net worth but also fosters a mindset of financial discipline that can be beneficial throughout one’s life.

Another significant strategy involves maximizing contributions to retirement accounts, such as 401(k)s and IRAs. Many employers offer matching contributions, which can effectively double the amount saved. Taking full advantage of these employer matches is a straightforward way to enhance net worth without incurring additional costs. Additionally, individuals should consider increasing their contributions as their income grows, ensuring that they are consistently prioritizing retirement savings.

Furthermore, investing in education and skills development can yield substantial returns in terms of career advancement and income potential. By enhancing one’s qualifications, individuals can position themselves for promotions or new job opportunities that offer higher salaries. This investment in personal development not only increases earning potential but also contributes to a more secure financial future.

As individuals approach retirement, it is also prudent to reassess and optimize existing assets. This may involve selling underperforming investments or properties that no longer align with financial goals. By actively managing assets and making informed decisions, individuals can ensure that their net worth reflects their financial aspirations.

In conclusion, increasing net worth before retirement requires a multifaceted approach that encompasses saving, investing, expense management, and personal development. By implementing these strategies, individuals can work towards surpassing the average retiree’s net worth of $1.79 million, thereby securing a more comfortable and fulfilling retirement. Ultimately, the key lies in proactive financial planning and a commitment to making informed decisions that align with long-term goals.

The Importance of Asset Allocation in Retirement Planning

In the realm of retirement planning, understanding the significance of asset allocation is paramount, particularly as individuals strive to ensure their net worth outpaces the average retiree’s $1.79 million. Asset allocation refers to the strategic distribution of an individual’s investment portfolio across various asset classes, such as stocks, bonds, real estate, and cash equivalents. This approach is not merely a matter of diversification; it is a critical component that can significantly influence the sustainability of one’s retirement savings and overall financial health.

To begin with, the rationale behind asset allocation lies in the inherent risk and return characteristics of different asset classes. Stocks, for instance, are generally associated with higher potential returns but also come with increased volatility. Conversely, bonds tend to offer more stability and predictable income, albeit with lower returns. By carefully balancing these assets, retirees can create a portfolio that aligns with their risk tolerance and financial goals. This balance is particularly crucial as individuals transition into retirement, where the focus shifts from wealth accumulation to wealth preservation and income generation.

Moreover, the importance of asset allocation becomes even more pronounced in the context of market fluctuations. Economic conditions can change rapidly, impacting the performance of various asset classes. A well-structured asset allocation strategy allows retirees to weather these fluctuations more effectively. For instance, during periods of economic downturn, a portfolio with a significant allocation to bonds may provide a buffer against stock market losses, thereby preserving capital. This strategic positioning can be vital for maintaining a steady income stream throughout retirement, ensuring that individuals do not outlive their savings.

In addition to mitigating risk, asset allocation also plays a crucial role in optimizing returns. By diversifying investments across different asset classes, retirees can capitalize on the growth potential of various sectors while minimizing the impact of underperforming investments. This approach not only enhances the likelihood of achieving financial goals but also contributes to the overall stability of the portfolio. As retirees seek to maintain or even grow their net worth, a thoughtful asset allocation strategy can serve as a powerful tool in navigating the complexities of the financial landscape.

Furthermore, it is essential to recognize that asset allocation is not a one-time decision but rather a dynamic process that requires ongoing assessment and adjustment. As individuals age and their financial circumstances evolve, so too should their investment strategies. For instance, younger retirees may opt for a more aggressive allocation, favoring equities to capitalize on long-term growth. In contrast, as they approach their later years, a shift towards more conservative investments may be warranted to safeguard their assets. Regularly reviewing and rebalancing the portfolio ensures that it remains aligned with changing goals and market conditions.

In conclusion, the importance of asset allocation in retirement planning cannot be overstated. As individuals strive to surpass the average retiree’s net worth of $1.79 million, a well-considered asset allocation strategy becomes a cornerstone of their financial success. By balancing risk and return, optimizing growth potential, and adapting to changing circumstances, retirees can enhance their financial security and enjoy a more comfortable retirement. Ultimately, a proactive approach to asset allocation not only safeguards one’s wealth but also empowers individuals to navigate the complexities of retirement with confidence and peace of mind.

Common Mistakes That Can Affect Your Net Worth

As individuals approach retirement, understanding and managing net worth becomes increasingly critical. While many aspire to achieve a net worth that exceeds the average retiree’s $1.79 million, several common mistakes can hinder this goal. Recognizing these pitfalls is essential for anyone looking to secure their financial future.

One prevalent mistake is underestimating the importance of budgeting. Many individuals fail to create a comprehensive budget that accounts for both income and expenses. Without a clear understanding of where money is being spent, it becomes challenging to identify areas for potential savings. This lack of awareness can lead to overspending, which, over time, erodes net worth. By establishing a detailed budget, individuals can track their financial habits, allowing them to make informed decisions that contribute positively to their net worth.

Another significant error is neglecting to invest wisely. While saving is crucial, merely accumulating cash in a savings account often does not yield sufficient returns to outpace inflation. Many retirees mistakenly believe that conservative investments are the safest route, yet this approach can limit growth potential. Instead, diversifying investments across various asset classes, such as stocks, bonds, and real estate, can enhance returns and help build a more robust net worth. It is essential to strike a balance between risk and reward, ensuring that investments align with long-term financial goals.

Additionally, failing to account for healthcare costs can have a detrimental impact on net worth. As individuals age, healthcare expenses typically increase, and many underestimate the financial burden these costs can impose. Without proper planning, unexpected medical bills can deplete savings and significantly reduce net worth. To mitigate this risk, it is advisable to explore health insurance options, including long-term care insurance, which can provide financial protection against unforeseen medical expenses.

Moreover, overlooking the importance of debt management can also hinder net worth growth. Many retirees carry debt into their golden years, which can strain finances and limit the ability to save or invest. High-interest debt, such as credit card balances, can be particularly damaging, as it compounds quickly and can consume a significant portion of monthly income. Prioritizing debt repayment and adopting a strategy to minimize liabilities can free up resources for savings and investments, ultimately enhancing net worth.

Furthermore, individuals often make the mistake of not seeking professional financial advice. Navigating the complexities of retirement planning can be daunting, and many individuals attempt to manage their finances without adequate knowledge or expertise. Engaging with a financial advisor can provide valuable insights and strategies tailored to individual circumstances. Advisors can help identify potential pitfalls, recommend investment strategies, and ensure that retirement plans are on track to meet desired financial goals.

In conclusion, while striving for a net worth that surpasses the average retiree’s $1.79 million is a commendable goal, it is essential to be aware of the common mistakes that can impede progress. By establishing a solid budget, investing wisely, planning for healthcare costs, managing debt effectively, and seeking professional guidance, individuals can enhance their financial standing. Ultimately, proactive financial management not only contributes to a more secure retirement but also fosters peace of mind as individuals navigate the complexities of their financial futures.

How Inflation Impacts Your Retirement Savings

Inflation is a critical factor that can significantly impact retirement savings, and understanding its effects is essential for anyone planning for their financial future. As prices rise over time, the purchasing power of money diminishes, which means that the same amount of money will buy fewer goods and services in the future than it does today. This erosion of purchasing power can be particularly concerning for retirees, who often rely on fixed incomes from savings, pensions, or Social Security. Therefore, it is crucial to consider how inflation can affect your net worth and overall financial security during retirement.

To begin with, it is important to recognize that inflation rates can vary significantly over time. Historical data shows that inflation has averaged around 3% per year in the United States, but there have been periods of both higher and lower inflation. For instance, during the 1970s, inflation rates soared, reaching double digits, which severely impacted the financial well-being of retirees at that time. Consequently, if you are planning for retirement, it is prudent to factor in potential inflation rates when estimating your future expenses and required savings.

Moreover, the impact of inflation is not uniform across all expenses. While some costs, such as healthcare and housing, tend to rise faster than the general inflation rate, others may increase at a slower pace. For retirees, healthcare costs are particularly concerning, as they often represent a significant portion of overall expenses. According to various studies, healthcare inflation has consistently outpaced general inflation, meaning that retirees may need to allocate a larger portion of their savings to cover these rising costs. Therefore, it is essential to plan for these specific expenses when calculating how much you will need to save for retirement.

In addition to rising costs, inflation can also affect the returns on your investments. For instance, if your investment portfolio generates a nominal return of 6% per year but inflation is running at 3%, your real return—the return adjusted for inflation—would only be 3%. This means that while your investments may be growing, the actual increase in your purchasing power is much less than it appears. Consequently, retirees must be strategic in their investment choices, seeking opportunities that can potentially outpace inflation over the long term. This often involves a diversified portfolio that includes equities, real estate, and other assets that historically provide higher returns than inflation.

Furthermore, retirees should consider the timing of their withdrawals from retirement accounts. If you withdraw funds during a period of high inflation, you may deplete your savings more quickly than anticipated. This scenario underscores the importance of having a well-thought-out withdrawal strategy that accounts for both market conditions and inflationary pressures. By carefully managing withdrawals and maintaining a flexible budget, retirees can better navigate the challenges posed by inflation.

In conclusion, inflation is a significant factor that can impact retirement savings and overall financial security. As you plan for retirement, it is essential to consider how inflation may affect your purchasing power, the rising costs of essential services, and the real returns on your investments. By taking these factors into account and developing a comprehensive financial strategy, you can work towards ensuring that your net worth not only meets but ideally exceeds the average retiree’s $1.79 million, allowing for a comfortable and secure retirement.

Planning for Healthcare Costs in Retirement and Their Effect on Net Worth

As individuals approach retirement, one of the most pressing concerns is the management of healthcare costs, which can significantly impact net worth. The average retiree’s net worth stands at approximately $1.79 million, but this figure can be misleading if one does not account for the rising expenses associated with healthcare. Planning for these costs is essential, as they can erode savings and affect overall financial stability during retirement years.

Healthcare expenses are often underestimated by retirees, leading to financial strain. According to various studies, a couple retiring at age 65 can expect to spend an average of $300,000 on healthcare throughout their retirement. This figure does not include long-term care, which can add an additional layer of financial burden. As such, it is crucial for individuals to incorporate potential healthcare costs into their retirement planning to ensure that their net worth remains sufficient to cover these expenses.

One effective strategy for managing healthcare costs in retirement is to consider the various insurance options available. Medicare, for instance, provides essential coverage for individuals aged 65 and older, but it does not cover all healthcare expenses. Retirees often find themselves responsible for premiums, deductibles, and co-pays, which can accumulate quickly. Therefore, it is advisable to explore supplemental insurance plans, such as Medigap, which can help cover out-of-pocket costs that Medicare does not address. By understanding the nuances of these insurance options, retirees can better prepare for the financial implications of healthcare.

In addition to insurance, it is prudent to establish a Health Savings Account (HSA) during one’s working years. HSAs offer tax advantages and can be used to save specifically for medical expenses in retirement. Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free. This dual benefit makes HSAs a valuable tool for retirees looking to mitigate healthcare costs and preserve their net worth. By strategically funding an HSA, individuals can create a financial buffer that allows them to manage unexpected medical expenses without jeopardizing their overall financial health.

Moreover, it is essential to consider the impact of lifestyle choices on healthcare costs in retirement. Engaging in regular physical activity, maintaining a balanced diet, and avoiding smoking can lead to better health outcomes and potentially lower medical expenses. By prioritizing wellness, retirees can not only enhance their quality of life but also reduce the likelihood of incurring high healthcare costs that could diminish their net worth.

As individuals navigate the complexities of retirement planning, it is vital to remain informed about the evolving landscape of healthcare costs. Staying abreast of changes in Medicare and other insurance options can empower retirees to make informed decisions that protect their financial well-being. Additionally, consulting with financial advisors who specialize in retirement planning can provide valuable insights into managing healthcare expenses effectively.

In conclusion, planning for healthcare costs in retirement is a critical component of maintaining a healthy net worth. By understanding the potential expenses, exploring insurance options, utilizing HSAs, and adopting a proactive approach to health, retirees can safeguard their financial future. Ultimately, being well-prepared for healthcare costs not only enhances the likelihood of achieving a comfortable retirement but also ensures that individuals can enjoy their golden years without the looming worry of financial instability.

Q&A

1. **What is the average net worth of retirees?**

The average net worth of retirees is approximately $1.79 million.

2. **How can I determine if my net worth is outpacing the average?**

Compare your total assets (including savings, investments, and property) minus liabilities (debts) to the average retiree’s net worth.

3. **What factors contribute to a higher net worth in retirement?**

Factors include consistent saving, investment growth, property ownership, and delayed retirement.

4. **What is considered a healthy net worth for retirement?**

A healthy net worth varies by individual circumstances, but generally, having at least $1 million is often seen as a good benchmark.

5. **How does inflation affect net worth in retirement?**

Inflation can erode purchasing power, making it essential to have investments that outpace inflation to maintain or grow net worth.

6. **What strategies can help increase net worth before retirement?**

Strategies include maximizing retirement account contributions, diversifying investments, and reducing debt.

7. **Is it common for retirees to have a net worth below $1.79 million?**

Yes, many retirees have a net worth below this average due to various factors such as lower lifetime earnings and insufficient savings.

Conclusion

In conclusion, evaluating whether your net worth is outpacing the average retiree’s $1.79 million involves assessing your financial position in relation to retirement goals, lifestyle expectations, and potential longevity. If your net worth exceeds this benchmark, it may indicate a strong financial foundation for retirement, allowing for greater flexibility and security. Conversely, if it falls short, it may necessitate a reassessment of savings strategies and investment plans to ensure a comfortable retirement.