“Gold Loses Shine as Trump’s Triumph Steers Markets”

Introduction

Following the decisive victory of Donald Trump, gold prices have experienced a notable decline. This shift in the precious metal’s value comes as markets react to the political and economic implications of Trump’s win. Traditionally seen as a safe-haven asset during times of uncertainty, gold’s allure appears to be waning in the face of renewed investor confidence and optimism about potential policy changes under the Trump administration. The election outcome has sparked expectations of fiscal stimulus, regulatory reforms, and tax cuts, which are anticipated to boost economic growth and strengthen the U.S. dollar. As a result, investors are reallocating their portfolios, moving away from gold and towards riskier assets, contributing to the metal’s diminished luster in the post-election landscape.

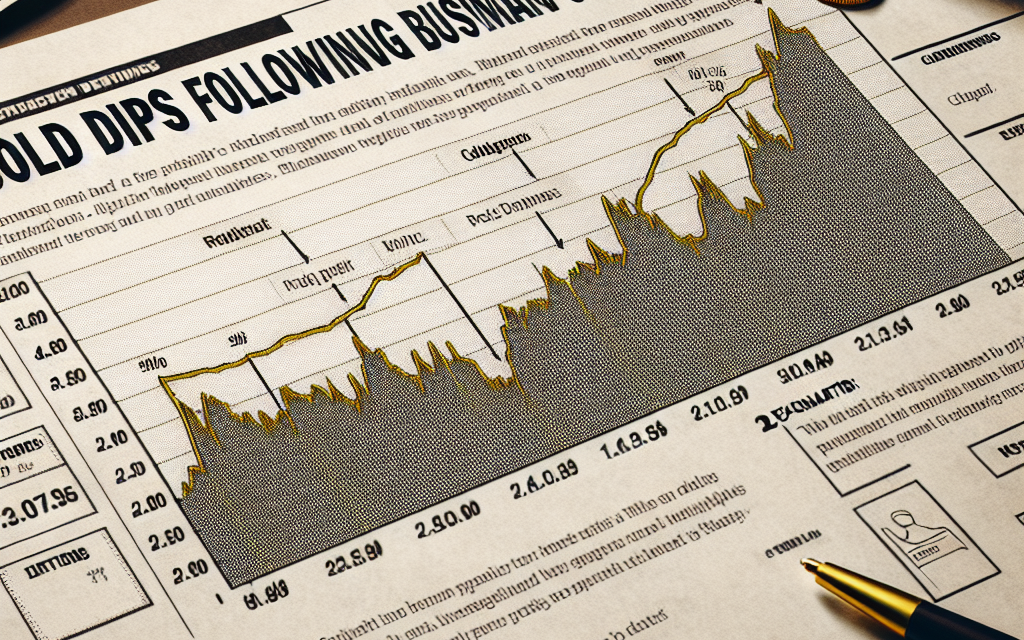

Analyzing Market Reactions: Gold Prices Post-Election

In the wake of Donald Trump’s clear victory in the recent presidential election, the financial markets have been abuzz with activity, particularly in the commodities sector. Among the most notable reactions has been the movement in gold prices, which have experienced a noticeable decline. This shift in gold’s value can be attributed to a confluence of factors, each playing a significant role in shaping investor sentiment and market dynamics.

To begin with, it is essential to understand the traditional role of gold as a safe-haven asset. Investors typically flock to gold during times of uncertainty or economic instability, seeking refuge from volatile markets. However, Trump’s decisive win has, paradoxically, instilled a sense of certainty, at least in the short term, among investors. This newfound clarity regarding the political landscape has led to a reduced demand for gold, as market participants feel more confident in pursuing riskier assets, such as equities.

Moreover, the anticipation of Trump’s economic policies has further influenced gold prices. His administration is expected to prioritize fiscal stimulus measures, including tax cuts and increased infrastructure spending. These policies are likely to spur economic growth, which, in turn, could lead to higher interest rates as the Federal Reserve seeks to manage inflationary pressures. Higher interest rates tend to diminish the appeal of non-yielding assets like gold, as investors can achieve better returns through interest-bearing instruments.

In addition to domestic factors, global market conditions have also played a role in the recent decline in gold prices. The U.S. dollar has strengthened in response to Trump’s victory, driven by expectations of robust economic growth and higher interest rates. A stronger dollar makes gold more expensive for foreign investors, thereby reducing its attractiveness and contributing to the downward pressure on prices.

Furthermore, the equity markets have responded positively to the election outcome, with major indices reaching new highs. This bullish sentiment in the stock market has diverted capital away from gold, as investors seek to capitalize on the potential for higher returns in equities. The shift in capital allocation underscores the inverse relationship between gold and stock market performance, where gains in one often coincide with losses in the other.

It is also worth noting that geopolitical tensions, which often drive investors towards gold, have not escalated significantly following the election. While uncertainties remain on the international front, particularly concerning trade relations and foreign policy, the immediate post-election period has not witnessed any major crises that would typically boost gold’s appeal as a safe-haven asset.

In conclusion, the decline in gold prices following Donald Trump’s clear victory can be attributed to a combination of domestic economic expectations, a stronger U.S. dollar, and a buoyant stock market. As investors adjust to the new political and economic landscape, the demand for gold as a protective asset has waned, at least for the time being. However, it is important to recognize that market conditions are inherently dynamic, and future developments could once again alter the trajectory of gold prices. As such, investors and analysts alike will continue to closely monitor the evolving interplay of factors influencing this precious metal’s value.

The Impact of Political Stability on Precious Metals

In the wake of Donald Trump’s clear victory, the financial markets have responded with a notable shift, particularly in the realm of precious metals. Gold, often regarded as a safe haven during times of uncertainty, has experienced a dimming in its luster as political stability appears to be on the horizon. This development underscores the intricate relationship between political climates and the valuation of precious metals, a dynamic that investors and analysts closely monitor.

Historically, gold has been a refuge for investors seeking to protect their wealth against geopolitical turmoil and economic instability. The metal’s allure is largely due to its intrinsic value and its ability to retain worth over time, even when fiat currencies falter. However, when political landscapes stabilize, the urgency to hold gold often diminishes, leading to a decrease in demand and, consequently, a drop in prices. This phenomenon is evident in the current scenario following Trump’s decisive electoral win, which has seemingly quelled some of the uncertainties that previously loomed over the market.

The perception of political stability can significantly influence investor behavior. With Trump’s victory, there is a renewed sense of predictability regarding policy directions and economic strategies. This predictability reduces the perceived risks that typically drive investors towards gold. As a result, capital that might have been allocated to gold as a protective measure is now being redirected towards more growth-oriented investments, such as equities and bonds, which are perceived to offer better returns in a stable political environment.

Moreover, the impact of political stability on gold is not solely confined to domestic markets. Global investors also react to shifts in the U.S. political landscape, given the country’s significant influence on the world stage. A stable U.S. administration can lead to a stronger dollar, which inversely affects gold prices. As the dollar strengthens, gold becomes more expensive for holders of other currencies, thereby reducing its attractiveness and further contributing to the decline in demand.

In addition to the immediate effects of political stability, the long-term implications for gold are also noteworthy. A stable political environment can foster economic growth, which in turn can lead to higher interest rates as central banks adjust monetary policies to prevent overheating. Higher interest rates increase the opportunity cost of holding non-yielding assets like gold, prompting investors to seek alternatives that offer better returns. This shift in investment strategy can exert downward pressure on gold prices over an extended period.

However, it is important to recognize that while political stability can lead to a decrease in gold’s appeal, it does not entirely eliminate the metal’s role in a diversified investment portfolio. Gold continues to serve as a hedge against inflation and currency devaluation, and its value can be bolstered by other factors such as supply constraints and geopolitical tensions that may arise independently of U.S. politics.

In conclusion, the relationship between political stability and the valuation of precious metals is complex and multifaceted. Trump’s clear victory has introduced a sense of stability that has dimmed gold’s immediate appeal, as investors pivot towards assets perceived to offer higher returns in a predictable environment. Nevertheless, gold’s enduring qualities ensure that it remains a vital component of investment strategies, particularly as a safeguard against unforeseen economic shifts. As the political and economic landscapes continue to evolve, the interplay between these factors will undoubtedly shape the future trajectory of precious metals.

Investor Sentiment: Shifting from Gold to Equities

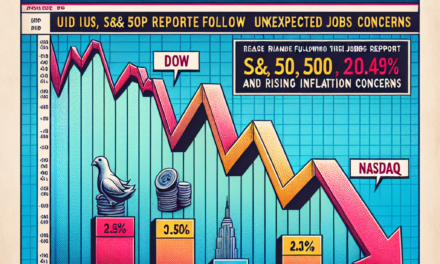

In the wake of Donald Trump’s decisive victory, investor sentiment has experienced a notable shift, with a discernible movement away from gold and towards equities. This transition is emblematic of the broader economic optimism that often accompanies a clear political outcome, particularly one that promises pro-business policies. Historically, gold has been perceived as a safe-haven asset, a refuge for investors during times of uncertainty and economic instability. However, with the clarity provided by Trump’s win, the allure of gold has dimmed, prompting investors to reassess their portfolios and consider the potential benefits of equities.

The rationale behind this shift is multifaceted. Firstly, Trump’s victory has been interpreted by many as a harbinger of economic growth, driven by anticipated tax cuts, deregulation, and infrastructure spending. These policies are expected to stimulate business activity and, consequently, corporate earnings. As a result, equities, which are directly tied to the performance of companies, have become more attractive to investors seeking to capitalize on this potential growth. In contrast, gold, which does not generate income or dividends, appears less appealing in an environment where economic expansion is anticipated.

Moreover, the stock market’s initial reaction to Trump’s victory has been overwhelmingly positive, further reinforcing the shift in investor sentiment. Major indices have surged, reflecting the market’s confidence in the new administration’s ability to deliver on its economic promises. This bullish sentiment has been bolstered by the prospect of increased fiscal spending, which is expected to drive demand across various sectors, from construction to technology. Consequently, investors are increasingly viewing equities as a more lucrative opportunity compared to the relatively stagnant returns offered by gold.

In addition to these economic considerations, the psychological aspect of investor behavior cannot be overlooked. The certainty provided by a clear electoral outcome often reduces the perceived risk associated with investing in equities. With the political landscape now more predictable, investors are more willing to embrace riskier assets in pursuit of higher returns. This shift in risk appetite is further amplified by the low-interest-rate environment, which has persisted for several years. With traditional fixed-income investments offering meager returns, equities present a more compelling alternative for yield-seeking investors.

However, it is important to acknowledge that while the current sentiment favors equities, the dynamics of the market are inherently fluid. Factors such as geopolitical tensions, unexpected policy shifts, or economic data releases can quickly alter investor perceptions and trigger a renewed interest in gold. As such, while the present trend indicates a movement away from gold, prudent investors remain vigilant, ready to adapt their strategies in response to changing conditions.

In conclusion, the aftermath of Trump’s clear victory has catalyzed a shift in investor sentiment from gold to equities, driven by expectations of economic growth and a more predictable political environment. This transition underscores the complex interplay between political developments and market behavior, highlighting the need for investors to remain informed and adaptable. As the global economic landscape continues to evolve, the ability to navigate these shifts will be crucial for those seeking to optimize their investment portfolios.

Economic Policies and Their Influence on Gold Valuation

In the wake of Donald Trump’s clear victory, the economic landscape is poised for significant shifts, particularly in the valuation of gold. Historically, gold has been perceived as a safe-haven asset, a refuge for investors during times of economic uncertainty and political upheaval. However, Trump’s decisive win has introduced a new dynamic into the market, prompting a reevaluation of gold’s role in the current economic climate.

To understand the impact of Trump’s victory on gold valuation, it is essential to consider the broader economic policies he is likely to implement. Trump’s administration has consistently advocated for pro-business policies, including tax cuts, deregulation, and increased infrastructure spending. These measures are designed to stimulate economic growth, boost corporate profits, and create jobs. As a result, investor confidence in the economy is expected to rise, leading to increased investment in riskier assets such as stocks and bonds.

Consequently, as investors shift their focus towards equities and other growth-oriented investments, the demand for gold may diminish. This shift is already evident in the market, as gold prices have experienced a decline following the election results. The rationale behind this trend is that a robust economy reduces the need for safe-haven assets, as investors feel more secure in the stability and growth potential of the market.

Moreover, Trump’s economic policies are likely to influence interest rates, which play a crucial role in gold valuation. The Federal Reserve may respond to the anticipated economic growth by raising interest rates to prevent the economy from overheating. Higher interest rates increase the opportunity cost of holding non-yielding assets like gold, making them less attractive to investors. As a result, gold prices may face further downward pressure as interest rates rise.

In addition to domestic economic policies, Trump’s victory also has implications for international trade and relations, which can indirectly affect gold valuation. Trump’s stance on trade, characterized by protectionist measures and renegotiation of trade agreements, could lead to tensions with key trading partners. While such tensions might initially create uncertainty and support gold prices, the long-term impact of successful trade negotiations could bolster economic growth and further reduce the appeal of gold as a safe-haven asset.

Furthermore, the strength of the U.S. dollar, which is closely tied to Trump’s economic policies, is another factor influencing gold valuation. A stronger dollar, driven by increased investor confidence and higher interest rates, makes gold more expensive for foreign investors, thereby reducing its demand. As the dollar appreciates, gold prices are likely to face additional downward pressure.

In conclusion, while gold has traditionally served as a hedge against economic and political uncertainty, Trump’s clear victory and the anticipated economic policies of his administration are reshaping the landscape. The focus on economic growth, potential interest rate hikes, and a stronger dollar are all contributing to a dimming of gold’s luster in the eyes of investors. As the market adjusts to these new realities, the valuation of gold will continue to be influenced by the evolving economic policies and their broader implications. Investors must remain vigilant, assessing the interplay between these factors to navigate the shifting terrain of gold valuation in the post-election era.

Historical Trends: Gold Prices After Presidential Elections

In the aftermath of presidential elections, financial markets often experience fluctuations as investors react to the anticipated policies of the incoming administration. Historically, the price of gold, a traditional safe-haven asset, has been particularly sensitive to such political changes. Following Donald Trump’s clear victory in the presidential election, the gold market exhibited a notable dimming, reflecting a complex interplay of investor sentiment and economic expectations.

To understand this phenomenon, it is essential to consider the historical trends of gold prices in relation to presidential elections. Typically, gold prices tend to rise during periods of political uncertainty, as investors seek stability amidst potential economic upheaval. However, once the election results are clear and the political landscape becomes more predictable, gold prices often stabilize or decline. This pattern was evident following Trump’s victory, as the initial uncertainty surrounding the election gave way to a more defined economic outlook.

Trump’s campaign promises, which included significant tax cuts, deregulation, and increased infrastructure spending, were perceived by many investors as pro-growth. These policies were expected to stimulate the economy, potentially leading to higher interest rates as the Federal Reserve sought to manage inflationary pressures. Higher interest rates generally make non-yielding assets like gold less attractive, as investors shift their focus towards interest-bearing investments. Consequently, the anticipation of such economic policies contributed to the decline in gold prices following the election.

Moreover, the strength of the U.S. dollar plays a crucial role in determining gold prices. As Trump’s victory became apparent, the dollar strengthened significantly, driven by expectations of robust economic growth and higher interest rates. A stronger dollar makes gold more expensive for foreign investors, thereby reducing demand and exerting downward pressure on prices. This inverse relationship between the dollar and gold was a key factor in the post-election dimming of gold prices.

It is also important to consider the broader global context in which these events unfolded. At the time of Trump’s election, the global economy was experiencing a gradual recovery from the financial crisis of 2008. This recovery, coupled with Trump’s proposed economic policies, contributed to a sense of optimism among investors, further diminishing the appeal of gold as a safe-haven asset. Additionally, geopolitical tensions, which often drive investors towards gold, were relatively subdued, allowing for a more risk-on sentiment in the markets.

While the immediate reaction to Trump’s victory was a decline in gold prices, it is crucial to recognize that the gold market is influenced by a myriad of factors beyond presidential elections. Economic indicators, central bank policies, and geopolitical developments all play significant roles in shaping the trajectory of gold prices. Therefore, while historical trends provide valuable insights, they are not definitive predictors of future movements.

In conclusion, the dimming of gold prices following Donald Trump’s clear victory in the presidential election can be attributed to a combination of factors, including anticipated economic policies, a strengthening U.S. dollar, and a broader global economic recovery. As investors adjusted their portfolios in response to these developments, the traditional safe-haven appeal of gold diminished, leading to a decline in prices. However, the dynamic nature of financial markets means that gold’s allure can quickly resurface in response to changing economic and geopolitical conditions.

The Role of Safe-Haven Assets in a Bullish Market

In the wake of Donald Trump’s clear victory, the financial markets have experienced a notable shift, particularly in the realm of safe-haven assets such as gold. Traditionally, gold has been perceived as a refuge for investors during times of uncertainty and economic instability. However, with the recent political developments and the subsequent bullish market sentiment, the allure of gold as a safe-haven asset appears to be diminishing. This phenomenon can be attributed to several interrelated factors that are reshaping investor behavior and market dynamics.

To begin with, Trump’s victory has instilled a sense of optimism among investors, primarily due to his pro-business policies and promises of economic growth. This optimism has translated into a bullish market, characterized by rising stock prices and increased investor confidence. As a result, the demand for riskier assets, such as equities, has surged, drawing capital away from traditional safe-haven assets like gold. Investors are now more inclined to seek higher returns in the stock market, which is perceived to offer greater potential for growth in the current economic climate.

Moreover, the anticipation of fiscal stimulus measures under the Trump administration has further fueled this bullish sentiment. Expectations of tax cuts, deregulation, and infrastructure spending have led to projections of accelerated economic growth, which in turn have bolstered investor confidence. In such an environment, the appeal of gold as a hedge against economic uncertainty diminishes, as investors are more willing to embrace risk in pursuit of higher returns. Consequently, the demand for gold has waned, leading to a decline in its price.

In addition to these factors, the strengthening of the U.S. dollar has also played a significant role in the dimming of gold’s luster. As the dollar appreciates, the price of gold, which is typically denominated in dollars, becomes more expensive for foreign investors. This dynamic reduces the attractiveness of gold as an investment, further contributing to its declining demand. The dollar’s strength is largely attributed to expectations of interest rate hikes by the Federal Reserve, which are anticipated to follow the economic growth spurred by Trump’s policies. Higher interest rates tend to attract foreign capital, thereby boosting the dollar’s value and exerting downward pressure on gold prices.

Furthermore, the global economic landscape has also influenced the role of gold as a safe-haven asset. With major economies showing signs of recovery and geopolitical tensions relatively subdued, the perceived need for a protective asset like gold has diminished. Investors are increasingly confident in the stability of the global economy, prompting a shift towards riskier assets that promise higher returns. This shift is evident in the performance of global stock markets, which have generally trended upwards in response to positive economic indicators.

In conclusion, the clear victory of Donald Trump has ushered in a period of bullish market sentiment, leading to a reevaluation of the role of safe-haven assets such as gold. The combination of pro-business policies, anticipated fiscal stimulus, a strengthening U.S. dollar, and a recovering global economy has diminished the appeal of gold as a refuge for investors. As market dynamics continue to evolve, the interplay between political developments, economic policies, and investor sentiment will undoubtedly shape the future trajectory of safe-haven assets in a bullish market environment.

Future Predictions: Will Gold Rebound or Continue to Decline?

In the wake of Donald Trump’s clear victory, the financial markets have been abuzz with speculation and analysis, particularly concerning the future trajectory of gold prices. Historically, gold has been perceived as a safe-haven asset, a refuge for investors during times of political uncertainty and economic instability. However, Trump’s decisive win has introduced a new dynamic into the equation, prompting a reevaluation of gold’s role in the current economic landscape.

Initially, Trump’s victory was expected to create a wave of uncertainty, potentially driving investors towards gold. Yet, contrary to these expectations, gold prices have experienced a decline. This unexpected trend can be attributed to several factors that have emerged in the aftermath of the election. Firstly, the markets have responded positively to Trump’s pro-business stance, which includes promises of tax cuts, deregulation, and infrastructure spending. These policies have bolstered investor confidence in the U.S. economy, leading to a shift away from gold and towards riskier assets such as stocks.

Moreover, the strengthening of the U.S. dollar has played a significant role in the diminishing allure of gold. As the dollar appreciates, gold becomes more expensive for holders of other currencies, thereby reducing its attractiveness as an investment. The anticipation of rising interest rates under Trump’s administration further compounds this effect. Higher interest rates tend to increase the opportunity cost of holding non-yielding assets like gold, prompting investors to seek returns elsewhere.

Despite these factors, it is essential to consider the potential for gold to rebound in the future. While the current economic outlook appears favorable, the inherent volatility of global markets cannot be overlooked. Geopolitical tensions, trade disputes, and unforeseen economic challenges could quickly alter the landscape, reigniting demand for gold as a safe-haven asset. Additionally, inflationary pressures resulting from expansive fiscal policies could enhance gold’s appeal as a hedge against inflation.

Furthermore, the global context must be taken into account. While the U.S. economy may be on an upward trajectory, other regions face varying degrees of economic uncertainty. In Europe, for instance, ongoing challenges such as Brexit and political fragmentation could drive European investors towards gold. Similarly, in emerging markets, currency fluctuations and economic instability may bolster gold’s status as a reliable store of value.

In conclusion, while gold has dimmed following Trump’s clear victory, its future trajectory remains uncertain. The interplay of domestic economic policies, global market dynamics, and geopolitical factors will ultimately determine whether gold rebounds or continues to decline. Investors must remain vigilant, closely monitoring these variables to make informed decisions. As history has shown, gold’s role as a financial asset is multifaceted, and its fortunes can change rapidly in response to shifting economic and political landscapes. Therefore, while the current trend may suggest a decline, the potential for a rebound cannot be discounted, underscoring the need for a nuanced and adaptable investment strategy.

Q&A

1. **What is “Gold Dims Following Trump’s Clear Victory”?**

– It refers to the decline in gold prices following a clear electoral victory by Donald Trump, as markets react to anticipated economic policies.

2. **Why would gold prices decrease after Trump’s victory?**

– Investors might expect stronger economic growth and higher interest rates, reducing the appeal of gold as a safe-haven asset.

3. **How do Trump’s policies impact gold prices?**

– Policies favoring economic growth, deregulation, and tax cuts can boost the stock market and dollar, leading to lower gold demand.

4. **What role does the U.S. dollar play in gold pricing?**

– A stronger U.S. dollar makes gold more expensive for foreign buyers, often leading to decreased demand and lower prices.

5. **How do interest rates affect gold prices?**

– Higher interest rates increase the opportunity cost of holding non-yielding assets like gold, often leading to price declines.

6. **What are safe-haven assets?**

– Safe-haven assets are investments that retain or increase in value during market turbulence, with gold being a traditional example.

7. **Could geopolitical tensions reverse the trend in gold prices?**

– Yes, increased geopolitical tensions or economic uncertainty can drive investors back to gold, potentially increasing its price.

Conclusion

Donald Trump’s clear victory in the election has led to a decline in gold prices. This outcome has likely bolstered investor confidence in the stability of the U.S. economy, reducing the demand for gold as a safe-haven asset. As a result, investors may be shifting their focus towards riskier assets, anticipating favorable economic policies and growth prospects under Trump’s leadership. Consequently, the diminished appeal of gold reflects a broader market sentiment of optimism and reduced uncertainty.