“From Vision to Value: Witness the Growth of Your 1984 Eli Lilly Investment.”

Introduction

Investing in Eli Lilly and Company in 1984 would have been a strategic decision that capitalized on the pharmaceutical giant’s potential for growth and innovation. Over the decades, Eli Lilly has established itself as a leader in the healthcare industry, consistently delivering groundbreaking treatments and expanding its global footprint. This growth trajectory has been reflected in its stock performance, with significant appreciation driven by successful product launches, strategic acquisitions, and a robust pipeline of new drugs. Additionally, Eli Lilly’s commitment to research and development has ensured a steady stream of innovative therapies, further enhancing its market position and investor confidence. As a result, an investment made in 1984 would have experienced substantial growth, benefiting from the company’s resilience, adaptability, and sustained financial performance, ultimately yielding impressive returns for long-term shareholders.

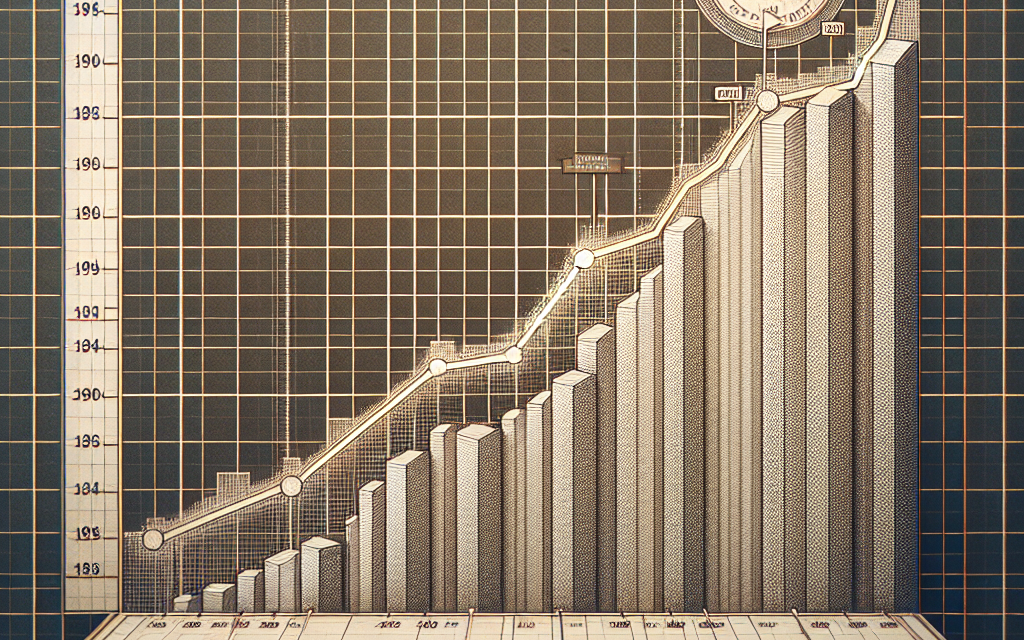

Historical Overview Of Eli Lilly’s Stock Performance

In 1984, an investment in Eli Lilly, a prominent pharmaceutical company, would have been a strategic decision for any investor seeking long-term growth. Over the decades, Eli Lilly has demonstrated a robust performance in the stock market, driven by its commitment to innovation and its ability to adapt to the ever-evolving pharmaceutical landscape. To understand how an investment in Eli Lilly has grown over time, it is essential to examine the historical context and the factors that have contributed to its sustained success.

During the mid-1980s, Eli Lilly was already a well-established player in the pharmaceutical industry, known for its pioneering work in insulin production and other therapeutic areas. The company’s stock was considered a solid investment, reflecting its strong market position and promising pipeline of new drugs. As the years progressed, Eli Lilly continued to expand its portfolio, introducing groundbreaking medications that addressed a wide range of medical conditions. This commitment to research and development has been a key driver of the company’s stock performance.

Transitioning into the 1990s, Eli Lilly faced both challenges and opportunities. The pharmaceutical industry was undergoing significant changes, with increased competition and regulatory scrutiny. However, Eli Lilly’s strategic focus on innovation allowed it to navigate these challenges effectively. The introduction of blockbuster drugs, such as Prozac, a widely prescribed antidepressant, significantly boosted the company’s revenues and, consequently, its stock price. This period marked a phase of substantial growth for Eli Lilly, as it capitalized on its research capabilities and market demand for new therapies.

As the new millennium approached, Eli Lilly continued to build on its legacy of innovation. The company invested heavily in biotechnology and personalized medicine, positioning itself at the forefront of cutting-edge medical advancements. This strategic shift not only diversified its product offerings but also enhanced its competitive edge in the industry. Consequently, Eli Lilly’s stock performance remained resilient, even amidst economic downturns and market volatility. The company’s ability to consistently deliver value to its shareholders is a testament to its sound management and forward-thinking approach.

In recent years, Eli Lilly has further solidified its position as a leader in the pharmaceutical sector. The company’s focus on addressing unmet medical needs, particularly in areas such as oncology and diabetes, has driven its continued success. Moreover, Eli Lilly’s strategic acquisitions and partnerships have expanded its global reach and strengthened its research capabilities. These efforts have translated into sustained stock growth, rewarding long-term investors who recognized the company’s potential early on.

Reflecting on the journey from 1984 to the present, an investment in Eli Lilly has proven to be a wise decision. The company’s unwavering commitment to innovation, coupled with its ability to adapt to changing market dynamics, has resulted in impressive stock performance over the years. Investors who held onto their shares have witnessed significant appreciation in value, underscoring the importance of a long-term investment strategy in the pharmaceutical sector.

In conclusion, Eli Lilly’s historical stock performance is a testament to its resilience and strategic vision. The company’s ability to consistently innovate and deliver value to its shareholders has made it a standout performer in the pharmaceutical industry. As Eli Lilly continues to push the boundaries of medical science, its stock remains a compelling choice for investors seeking growth and stability in an ever-evolving market.

Key Milestones In Eli Lilly’s Growth Since 1984

In 1984, an investment in Eli Lilly represented a strategic decision to engage with a company that was already a significant player in the pharmaceutical industry. Over the decades, Eli Lilly has demonstrated remarkable growth, driven by innovation, strategic acquisitions, and a commitment to addressing unmet medical needs. This growth can be traced through several key milestones that have not only enhanced the company’s market position but also significantly increased the value of investments made during that period.

Initially, Eli Lilly’s focus on research and development laid the groundwork for its future success. In the late 1980s, the company introduced Prozac, a groundbreaking antidepressant that quickly became one of the best-selling drugs worldwide. This product not only revolutionized the treatment of depression but also established Eli Lilly as a leader in the field of neuroscience. The success of Prozac marked a pivotal moment, as it significantly boosted the company’s revenues and stock value, providing substantial returns to its investors.

Transitioning into the 1990s, Eli Lilly continued to expand its portfolio through strategic acquisitions and partnerships. The acquisition of PCS Health Systems in 1994, a major pharmacy benefits manager, allowed Eli Lilly to diversify its offerings and strengthen its position in the healthcare market. This move was instrumental in broadening the company’s reach and enhancing its ability to deliver comprehensive healthcare solutions. As a result, investors who maintained their positions saw their investments grow as the company capitalized on these new opportunities.

As the new millennium approached, Eli Lilly’s commitment to innovation remained unwavering. The introduction of Zyprexa, an antipsychotic medication, further solidified the company’s reputation for developing life-changing therapies. Zyprexa’s success in treating schizophrenia and bipolar disorder contributed to Eli Lilly’s financial growth, reinforcing investor confidence. Moreover, the company’s strategic focus on biotechnology and the development of insulin products, such as Humalog, underscored its dedication to addressing chronic conditions like diabetes, which affected millions globally.

In the 2000s, Eli Lilly’s growth trajectory was further bolstered by its expansion into emerging markets. Recognizing the potential of these regions, the company invested in infrastructure and tailored its product offerings to meet local needs. This strategic move not only diversified its revenue streams but also positioned Eli Lilly as a global leader in the pharmaceutical industry. Consequently, investors who had placed their trust in the company witnessed their investments appreciate as Eli Lilly capitalized on these burgeoning markets.

More recently, Eli Lilly’s focus on innovation has been exemplified by its advancements in oncology and immunology. The development of drugs such as Verzenio for breast cancer and Taltz for psoriasis and arthritis has demonstrated the company’s ability to address complex medical challenges. These products have not only contributed to Eli Lilly’s financial success but have also reinforced its reputation as a pioneer in pharmaceutical research. As a result, the value of investments made in 1984 has continued to grow, reflecting the company’s sustained commitment to innovation and excellence.

In conclusion, an investment in Eli Lilly in 1984 has proven to be a lucrative decision, thanks to the company’s strategic milestones and unwavering focus on innovation. From the introduction of groundbreaking drugs to strategic acquisitions and global expansion, Eli Lilly has consistently demonstrated its ability to adapt and thrive in a dynamic industry. As the company continues to push the boundaries of medical science, investors can remain confident in the enduring value of their investment.

Impact Of Eli Lilly’s Innovations On Shareholder Value

Investing in pharmaceutical companies has long been considered a strategic move for those looking to capitalize on the ever-evolving landscape of healthcare and medicine. Among these companies, Eli Lilly and Company stands out as a beacon of innovation and growth. For those who invested in Eli Lilly back in 1984, the journey has been nothing short of remarkable, with the company’s continuous advancements in medical science significantly impacting shareholder value over the decades.

In 1984, Eli Lilly was already a well-established name in the pharmaceutical industry, known for its commitment to research and development. This commitment laid the foundation for a series of groundbreaking innovations that would not only transform the company but also enhance its market value. One of the pivotal moments in Eli Lilly’s history was the introduction of Prozac in 1987. As the first selective serotonin reuptake inhibitor (SSRI) approved for the treatment of depression, Prozac revolutionized mental health treatment and became a blockbuster drug. This innovation not only solidified Eli Lilly’s reputation as a leader in pharmaceuticals but also significantly boosted its stock price, rewarding early investors with substantial returns.

As the years progressed, Eli Lilly continued to build on its legacy of innovation. The company’s strategic focus on developing treatments for chronic diseases such as diabetes further underscored its commitment to addressing global health challenges. The introduction of Humalog, a rapid-acting insulin analog, in 1996 marked another milestone. This product not only improved the quality of life for millions of diabetes patients but also contributed to the company’s financial growth. The success of Humalog and subsequent diabetes treatments reinforced Eli Lilly’s position in the market, driving shareholder value upward.

Moreover, Eli Lilly’s investment in biotechnology and personalized medicine has played a crucial role in its sustained growth. The acquisition of ImClone Systems in 2008, for instance, expanded Eli Lilly’s oncology portfolio and opened new avenues for innovation. This strategic move allowed the company to develop targeted cancer therapies, which have become increasingly important in modern medicine. The success of these therapies has not only improved patient outcomes but also enhanced the company’s financial performance, further benefiting shareholders.

In addition to its product innovations, Eli Lilly’s strategic partnerships and collaborations have been instrumental in maintaining its competitive edge. By collaborating with other leading research institutions and biotech firms, Eli Lilly has been able to accelerate the development of new treatments and expand its product pipeline. These partnerships have not only driven scientific advancements but also contributed to the company’s financial success, thereby increasing shareholder value.

Furthermore, Eli Lilly’s commitment to sustainability and corporate responsibility has also played a role in its long-term success. By prioritizing ethical business practices and environmental stewardship, the company has built a strong reputation that resonates with investors who value corporate responsibility. This commitment has helped Eli Lilly maintain investor confidence and attract new shareholders, contributing to the overall growth of its stock value.

In conclusion, the impact of Eli Lilly’s innovations on shareholder value since 1984 has been profound. Through a combination of groundbreaking product developments, strategic acquisitions, and a commitment to corporate responsibility, Eli Lilly has consistently delivered value to its investors. Those who had the foresight to invest in the company in 1984 have witnessed their investment grow significantly, underscoring the importance of innovation and strategic vision in driving long-term shareholder value.

Dividend Growth And Reinvestment Strategies

Investing in Eli Lilly in 1984 has proven to be a remarkably astute decision for those who recognized the company’s potential early on. Over the decades, Eli Lilly has not only demonstrated robust growth but has also consistently rewarded its shareholders through dividends. Understanding how this investment has grown over time requires an examination of both the company’s dividend growth and the impact of reinvestment strategies.

In 1984, Eli Lilly was already a well-established pharmaceutical company, known for its innovative approach to drug development. Investors who purchased shares at that time were likely attracted by the company’s strong pipeline and commitment to research and development. As the years progressed, Eli Lilly continued to expand its portfolio, introducing groundbreaking medications that addressed a variety of health conditions. This consistent innovation has been a key driver of the company’s financial success, leading to substantial increases in its stock price.

However, the growth of an investment in Eli Lilly is not solely attributable to capital appreciation. A significant component of the total return has been the company’s dividend policy. Eli Lilly has a long history of paying dividends, and it has consistently increased its dividend payouts over the years. This commitment to returning capital to shareholders has made Eli Lilly an attractive option for income-focused investors. The power of compounding through dividend reinvestment cannot be overstated. By reinvesting dividends, investors have been able to purchase additional shares over time, thereby increasing their ownership stake in the company. This strategy has allowed investors to benefit from both the rising stock price and the growing dividend payments, creating a compounding effect that significantly enhances total returns.

Moreover, Eli Lilly’s ability to maintain and grow its dividend payments is a testament to its financial health and operational efficiency. The company has managed to achieve this even in the face of industry challenges, such as regulatory changes and competitive pressures. This resilience has provided investors with a sense of security, knowing that their investment is backed by a company with a strong balance sheet and a strategic vision for the future.

In addition to the direct financial benefits, investing in Eli Lilly has also offered investors the opportunity to support a company that is making a positive impact on global health. Eli Lilly’s commitment to addressing unmet medical needs and improving patient outcomes aligns with the values of many socially conscious investors. This alignment of financial and ethical considerations has further enhanced the appeal of Eli Lilly as a long-term investment.

As we reflect on the growth of an investment in Eli Lilly since 1984, it becomes clear that a combination of factors has contributed to its success. The company’s consistent innovation, robust dividend policy, and strategic reinvestment opportunities have all played crucial roles in driving shareholder value. For those who have held onto their shares and reinvested dividends over the years, the rewards have been substantial. Looking ahead, Eli Lilly’s continued focus on research and development, coupled with its commitment to shareholder returns, suggests that the company is well-positioned to sustain its growth trajectory. Thus, the story of Eli Lilly’s investment growth serves as a compelling example of how a well-executed dividend growth and reinvestment strategy can yield impressive long-term results.

Analyzing Market Trends Affecting Eli Lilly’s Valuation

Investing in the pharmaceutical industry has long been considered a strategic move for those looking to capitalize on the ever-growing demand for healthcare solutions. Among the prominent players in this sector, Eli Lilly and Company has consistently demonstrated its ability to adapt and thrive amidst changing market dynamics. For investors who placed their trust in Eli Lilly back in 1984, the journey has been nothing short of remarkable. To understand how an investment in Eli Lilly has grown over time, it is essential to analyze the market trends that have influenced its valuation.

In the mid-1980s, Eli Lilly was already a well-established name in the pharmaceutical industry, known for its innovative approach to drug development. The company’s commitment to research and development laid a strong foundation for future growth. During this period, the pharmaceutical industry was experiencing a wave of innovation, with biotechnology emerging as a transformative force. Eli Lilly’s strategic investments in biotechnology and its focus on developing groundbreaking therapies positioned the company to capitalize on these trends.

As the years progressed, the pharmaceutical landscape continued to evolve, driven by advancements in medical research and an increasing global demand for healthcare solutions. Eli Lilly’s ability to adapt to these changes played a crucial role in its sustained growth. The company’s emphasis on developing treatments for chronic diseases, such as diabetes and cancer, aligned with the growing prevalence of these conditions worldwide. This strategic focus not only expanded Eli Lilly’s product portfolio but also enhanced its market valuation.

Moreover, regulatory changes and healthcare reforms in various countries have significantly impacted the pharmaceutical industry. Eli Lilly’s proactive approach to navigating these regulatory landscapes has been instrumental in maintaining its competitive edge. By ensuring compliance with evolving regulations and investing in quality assurance, the company has built a reputation for reliability and trustworthiness, further bolstering its market position.

In addition to regulatory factors, economic conditions have also played a pivotal role in shaping Eli Lilly’s valuation. The global financial crises of the late 20th and early 21st centuries posed challenges for many industries, including pharmaceuticals. However, Eli Lilly’s resilience and ability to weather economic downturns have been key to its long-term success. The company’s prudent financial management and strategic investments in research and development have allowed it to emerge stronger from economic uncertainties.

Furthermore, Eli Lilly’s commitment to innovation has been a driving force behind its sustained growth. The company’s focus on developing novel therapies and expanding its research capabilities has enabled it to stay ahead of the competition. By investing in cutting-edge technologies and forging strategic partnerships, Eli Lilly has consistently delivered value to its shareholders.

In recent years, the rise of personalized medicine and advancements in genomics have opened new avenues for growth in the pharmaceutical industry. Eli Lilly’s proactive approach to embracing these trends has positioned it as a leader in the development of targeted therapies. This forward-thinking strategy has not only enhanced the company’s market valuation but also reinforced its reputation as a pioneer in the field of medicine.

In conclusion, an investment in Eli Lilly in 1984 has grown significantly over time, driven by a combination of strategic foresight, adaptability to market trends, and a steadfast commitment to innovation. By analyzing the various factors that have influenced Eli Lilly’s valuation, it becomes evident that the company’s ability to navigate changing market dynamics has been instrumental in its remarkable growth trajectory. As the pharmaceutical industry continues to evolve, Eli Lilly’s strategic vision and dedication to advancing healthcare solutions are likely to sustain its upward trajectory, offering continued value to its investors.

Comparing Eli Lilly’s Growth To Industry Peers

Investing in the pharmaceutical industry has long been considered a strategic move for those looking to capitalize on the ever-growing demand for healthcare solutions. Among the prominent players in this sector, Eli Lilly and Company has consistently demonstrated robust growth and resilience. To understand the magnitude of this growth, it is insightful to compare Eli Lilly’s performance with its industry peers over the decades.

In 1984, an investment in Eli Lilly would have been a forward-thinking decision, given the company’s strong pipeline of innovative drugs and its commitment to research and development. Over the years, Eli Lilly has not only expanded its portfolio but also strategically navigated the challenges and opportunities within the pharmaceutical landscape. This growth trajectory can be attributed to several factors, including successful product launches, strategic acquisitions, and a focus on emerging markets.

When comparing Eli Lilly’s growth to its industry peers, it is essential to consider the broader context of the pharmaceutical industry. The 1980s and 1990s were characterized by significant advancements in biotechnology and a surge in demand for new therapies. During this period, Eli Lilly capitalized on these trends by investing heavily in research and development, which led to the introduction of groundbreaking drugs such as Prozac and Humalog. These products not only solidified Eli Lilly’s position in the market but also contributed significantly to its revenue growth.

In contrast, some of Eli Lilly’s peers faced challenges in maintaining a steady pipeline of new products. Companies like Pfizer and Merck, while also successful, encountered periods of stagnation due to patent expirations and increased competition. Eli Lilly, however, managed to sustain its growth by diversifying its product offerings and entering into strategic partnerships. This adaptability allowed the company to remain competitive and continue its upward trajectory.

Moreover, Eli Lilly’s commitment to innovation has been a key differentiator in its growth compared to industry peers. The company’s focus on developing treatments for complex diseases such as diabetes, cancer, and autoimmune disorders has positioned it as a leader in these therapeutic areas. This emphasis on addressing unmet medical needs has not only driven revenue growth but also enhanced Eli Lilly’s reputation as a pioneer in pharmaceutical research.

In recent years, Eli Lilly’s growth has been further bolstered by its strategic expansion into global markets. Recognizing the potential of emerging economies, the company has invested in building a strong presence in regions such as Asia and Latin America. This global expansion has provided Eli Lilly with access to new customer bases and diversified its revenue streams, setting it apart from some of its more domestically focused peers.

In conclusion, an investment in Eli Lilly in 1984 would have yielded substantial returns, thanks to the company’s consistent growth and strategic foresight. By comparing Eli Lilly’s performance with its industry peers, it becomes evident that the company’s success can be attributed to its commitment to innovation, strategic partnerships, and global expansion. As the pharmaceutical industry continues to evolve, Eli Lilly’s ability to adapt and thrive serves as a testament to its enduring strength and potential for future growth.

Future Prospects For Eli Lilly Investors

Investing in Eli Lilly back in 1984 has proven to be a remarkably astute decision, as the pharmaceutical giant has consistently demonstrated its ability to adapt and thrive in the ever-evolving healthcare landscape. Over the decades, Eli Lilly has not only weathered economic fluctuations but has also capitalized on its robust research and development pipeline, strategic acquisitions, and a commitment to innovation. As we look to the future, the prospects for Eli Lilly investors appear promising, driven by several key factors that continue to bolster the company’s growth trajectory.

To begin with, Eli Lilly’s unwavering focus on research and development has been a cornerstone of its success. The company has consistently invested a significant portion of its revenue into R&D, ensuring a steady stream of new and innovative products. This commitment has resulted in a diverse portfolio of drugs that address a wide range of medical conditions, from diabetes and oncology to immunology and neuroscience. As the global demand for effective treatments continues to rise, Eli Lilly’s strong pipeline positions it well to capture a substantial share of the market, thereby enhancing its long-term growth prospects.

Moreover, Eli Lilly’s strategic acquisitions have played a pivotal role in its expansion and diversification. By acquiring companies with complementary expertise and technologies, Eli Lilly has been able to broaden its product offerings and enter new therapeutic areas. These acquisitions not only enhance the company’s competitive edge but also provide opportunities for synergies that can drive operational efficiencies and cost savings. As the pharmaceutical industry continues to consolidate, Eli Lilly’s ability to identify and integrate valuable acquisitions will be crucial in maintaining its market leadership.

In addition to its internal capabilities, Eli Lilly’s partnerships and collaborations with other industry leaders and research institutions further strengthen its position. By leveraging external expertise and resources, the company can accelerate the development of new therapies and expand its reach into emerging markets. These collaborations also enable Eli Lilly to share risks and costs associated with drug development, thereby enhancing its financial stability and resilience.

Furthermore, Eli Lilly’s commitment to sustainability and corporate responsibility is increasingly becoming a differentiating factor in the eyes of investors. As environmental, social, and governance (ESG) considerations gain prominence in investment decisions, Eli Lilly’s efforts to reduce its environmental footprint, promote diversity and inclusion, and ensure ethical business practices are likely to enhance its appeal to socially conscious investors. This focus on sustainability not only aligns with global trends but also positions Eli Lilly as a forward-thinking company that is well-prepared to navigate future challenges.

Looking ahead, the global healthcare landscape presents both opportunities and challenges for Eli Lilly. The aging population, rising prevalence of chronic diseases, and increasing access to healthcare in emerging markets are expected to drive demand for innovative treatments. However, the company must also contend with regulatory pressures, pricing scrutiny, and competition from both established players and new entrants. Nevertheless, Eli Lilly’s strong foundation, strategic vision, and adaptability provide a solid platform for continued growth.

In conclusion, the future prospects for Eli Lilly investors remain bright, underpinned by the company’s robust R&D pipeline, strategic acquisitions, collaborative partnerships, and commitment to sustainability. As the healthcare industry continues to evolve, Eli Lilly’s ability to innovate and adapt will be key to sustaining its growth and delivering value to its shareholders. For those who invested in Eli Lilly back in 1984, the journey has been rewarding, and the road ahead promises further opportunities for growth and success.

Q&A

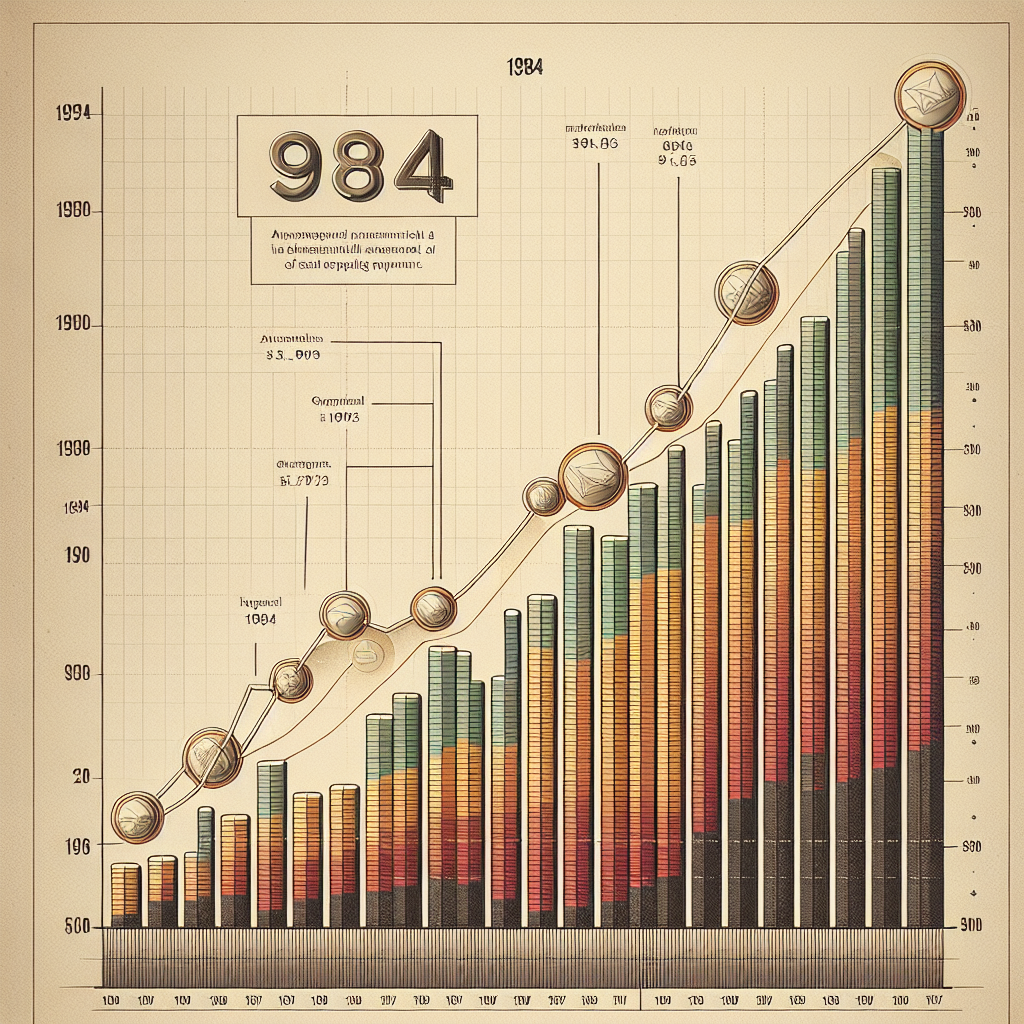

1. **Initial Investment Value**: If you invested $1,000 in Eli Lilly in 1984, your initial investment would have been based on the stock price at that time.

2. **Stock Splits**: Eli Lilly has undergone several stock splits since 1984, which would have increased the number of shares you own. Notable splits include a 2-for-1 split in 1989 and another 2-for-1 split in 1997.

3. **Dividend Reinvestment**: If you opted to reinvest dividends, your investment would have grown more significantly due to the compounding effect of purchasing additional shares over time.

4. **Share Price Appreciation**: Eli Lilly’s stock price has appreciated significantly over the decades, contributing to the growth of your investment.

5. **Market Performance**: The pharmaceutical industry, including Eli Lilly, has generally performed well, driven by innovation, drug approvals, and market demand, which has positively impacted stock value.

6. **Current Value Estimate**: As of 2023, your initial $1,000 investment in 1984 could be worth several hundred thousand dollars, depending on the exact purchase price, stock splits, and dividend reinvestment.

7. **Factors Influencing Growth**: The growth of your investment has been influenced by Eli Lilly’s successful product launches, strategic acquisitions, and overall market conditions in the healthcare sector.

Conclusion

Investing in Eli Lilly in 1984 would have proven to be a highly lucrative decision. Over the decades, the company has consistently demonstrated strong financial performance, driven by its robust pipeline of pharmaceutical products and strategic innovations. Eli Lilly’s focus on research and development, particularly in areas like diabetes, oncology, and neuroscience, has led to the successful launch of several blockbuster drugs. Additionally, the company has maintained a commitment to shareholder returns through dividends and stock buybacks. As a result, an investment in Eli Lilly in 1984 would have experienced significant capital appreciation and dividend income, reflecting the company’s growth and resilience in the pharmaceutical industry. This growth trajectory underscores the value of long-term investment in well-managed, innovative companies within the healthcare sector.