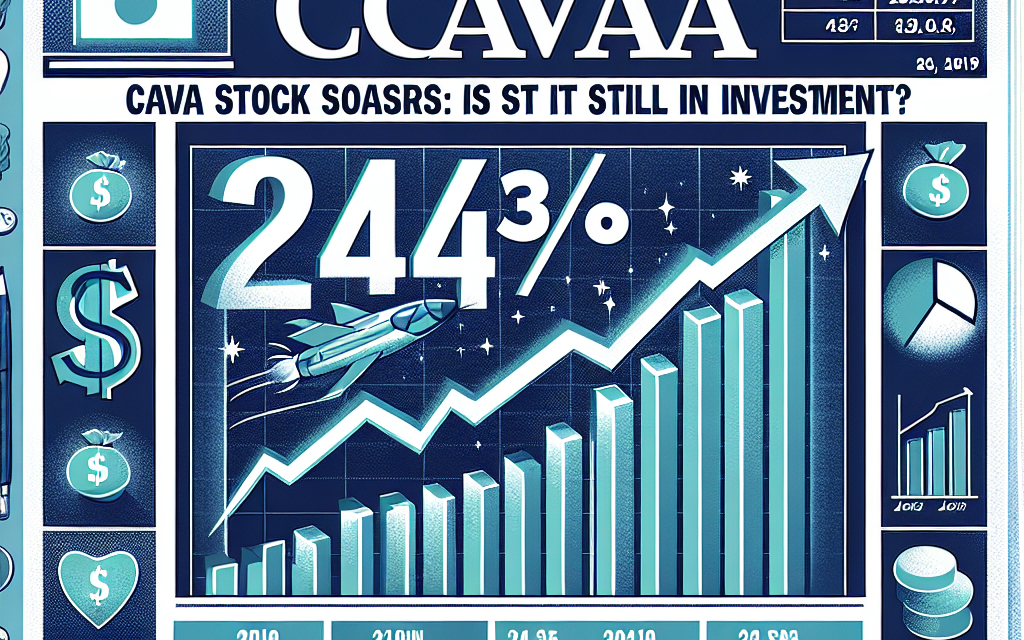

“From Sizzle to Soar: Evaluating Cava’s 243% Surge and Future Potential”

Introduction

In 2024, Cava Group Inc., a prominent player in the fast-casual dining sector, has captured significant attention from investors as its stock price soared by an impressive 243%. This remarkable surge reflects the company’s robust growth trajectory and its successful expansion strategy, which has resonated well with consumers seeking healthy and flavorful dining options. As Cava continues to capitalize on the growing demand for Mediterranean cuisine, investors are keenly evaluating whether the current stock valuation still presents a viable investment opportunity. With the market dynamics rapidly evolving, the question remains: Is Cava’s stock still a good investment, or has the window of opportunity closed?

Understanding Cava’s Business Model: Key Factors Behind the 243% Surge

Cava, a Mediterranean fast-casual restaurant chain, has captured the attention of investors with its remarkable 243% stock surge in 2024. To understand the factors driving this impressive growth, it is essential to delve into Cava’s business model and the strategic decisions that have propelled its success. At the core of Cava’s business model is its commitment to offering fresh, customizable, and health-conscious meals that cater to the evolving preferences of modern consumers. This focus on quality and customization has resonated with a broad demographic, particularly millennials and Gen Z, who prioritize healthy eating and sustainability. By aligning its offerings with these consumer values, Cava has successfully differentiated itself in the competitive fast-casual dining sector.

Moreover, Cava’s strategic expansion efforts have played a crucial role in its stock’s meteoric rise. The company has aggressively pursued growth by opening new locations in key urban markets, thereby increasing its footprint and brand visibility. This expansion strategy has been complemented by a robust digital presence, with Cava investing heavily in technology to enhance the customer experience. The integration of a user-friendly mobile app and an efficient online ordering system has streamlined operations and attracted tech-savvy customers, further boosting sales and customer loyalty.

In addition to its expansion and digital initiatives, Cava’s commitment to sustainability and ethical sourcing has bolstered its reputation and appeal. The company has made significant strides in reducing its environmental impact by implementing sustainable practices across its supply chain. This includes sourcing ingredients from local and organic farms, minimizing food waste, and utilizing eco-friendly packaging. These efforts have not only enhanced Cava’s brand image but have also attracted environmentally conscious investors who are increasingly factoring sustainability into their investment decisions.

Furthermore, Cava’s financial performance has been a key driver of its stock surge. The company has consistently reported strong revenue growth and profitability, which has instilled confidence among investors. This financial success can be attributed to Cava’s efficient operational model, which emphasizes cost control and scalability. By maintaining a lean operational structure and optimizing supply chain efficiencies, Cava has been able to achieve impressive margins while continuing to invest in growth initiatives.

However, despite the positive momentum, potential investors must consider whether Cava remains a viable investment opportunity at its current valuation. The stock’s rapid ascent has raised questions about its sustainability and whether the market has already priced in future growth prospects. Investors should carefully evaluate Cava’s ability to maintain its competitive edge in an increasingly crowded market, as well as its capacity to adapt to changing consumer preferences and economic conditions.

In conclusion, Cava’s 243% stock surge in 2024 can be attributed to its successful business model, strategic expansion, digital innovation, sustainability efforts, and strong financial performance. While these factors have undoubtedly contributed to its impressive growth, potential investors must weigh the risks associated with its current valuation and the challenges it may face in sustaining this momentum. As with any investment, thorough due diligence and a comprehensive understanding of the company’s long-term prospects are essential for making informed decisions.

Analyzing Market Trends: Why Cava Stock Skyrocketed in 2024

In the ever-evolving landscape of the stock market, few stories have captured the attention of investors in 2024 quite like the meteoric rise of Cava stock. With an astonishing 243% increase in value, Cava has become a focal point for both seasoned investors and market newcomers alike. To understand the factors behind this remarkable surge, it is essential to delve into the market trends and strategic decisions that have propelled Cava to new heights.

Initially, Cava’s success can be attributed to its strategic expansion and innovative approach to the fast-casual dining sector. As consumer preferences continue to shift towards healthier and more diverse dining options, Cava has positioned itself as a leader in Mediterranean cuisine, offering a menu that appeals to health-conscious consumers. This alignment with consumer trends has not only increased foot traffic to its locations but also bolstered its brand reputation, making it a household name in the industry.

Moreover, Cava’s adept use of technology has played a crucial role in its stock performance. By investing in digital platforms and enhancing its online presence, Cava has effectively tapped into the growing demand for convenient dining solutions. The implementation of a user-friendly mobile app and an efficient delivery system has expanded its customer base, allowing the company to reach a wider audience and increase sales. This digital transformation has been instrumental in driving revenue growth, which in turn has fueled investor confidence.

In addition to its operational strategies, Cava’s financial health has been a significant factor in its stock appreciation. The company has demonstrated strong fiscal management, maintaining a healthy balance sheet and consistently delivering impressive quarterly earnings. This financial stability has not only attracted institutional investors but also reassured individual shareholders of the company’s long-term viability. As a result, Cava’s stock has become a sought-after asset in the portfolios of many investors.

However, while the current market trends and company performance paint a promising picture, potential investors must consider whether Cava remains a viable investment opportunity. The substantial increase in stock value raises questions about the sustainability of such growth. It is crucial to assess whether the current market conditions and consumer trends will continue to favor Cava in the long run. Additionally, investors should be mindful of potential challenges, such as increased competition in the fast-casual dining sector and economic fluctuations that could impact consumer spending.

Furthermore, evaluating Cava’s future growth prospects involves analyzing its expansion plans and potential market saturation. While the company has successfully expanded its footprint, the saturation of key markets could pose a challenge to maintaining its growth trajectory. Investors should closely monitor Cava’s strategic initiatives, such as entering new markets or diversifying its product offerings, to gauge its ability to sustain growth.

In conclusion, Cava’s impressive stock performance in 2024 is a testament to its strategic acumen and alignment with market trends. However, as with any investment, due diligence is essential. Prospective investors should weigh the company’s current strengths against potential risks and market dynamics. By doing so, they can make informed decisions about whether Cava remains a compelling investment opportunity in the ever-changing landscape of the stock market.

Investment Risks: What Potential Investors Should Consider with Cava

Cava, the Mediterranean fast-casual restaurant chain, has captured the attention of investors with its remarkable stock performance, soaring 243% in 2024. This impressive growth has undoubtedly piqued the interest of potential investors, prompting them to consider whether Cava remains a viable investment opportunity. However, as with any investment, it is crucial to weigh the potential risks alongside the rewards. Understanding these risks can provide a more comprehensive view of Cava’s investment landscape.

To begin with, one of the primary concerns for potential investors is the competitive nature of the restaurant industry. The fast-casual dining sector, in particular, is highly saturated, with numerous players vying for market share. Cava’s ability to maintain its growth trajectory hinges on its capacity to differentiate itself from competitors and sustain consumer interest. While Cava has successfully carved out a niche with its Mediterranean-inspired offerings, the ever-evolving consumer preferences and the emergence of new dining trends could pose challenges. Therefore, investors should consider the company’s strategies for innovation and adaptation in a dynamic market.

Moreover, another significant risk factor is the economic environment. The restaurant industry is notoriously sensitive to economic fluctuations, and Cava is no exception. Economic downturns can lead to reduced consumer spending, which may adversely affect Cava’s revenue and profitability. Additionally, inflationary pressures can increase operational costs, such as food and labor expenses, further impacting the company’s bottom line. Potential investors should assess Cava’s financial resilience and its ability to navigate economic uncertainties.

In addition to economic factors, regulatory challenges also warrant consideration. The restaurant industry is subject to a myriad of regulations, ranging from food safety standards to labor laws. Compliance with these regulations is essential but can also be costly and complex. Any lapses in compliance could result in legal repercussions and damage to Cava’s reputation. Investors should evaluate the company’s track record in regulatory compliance and its strategies for managing potential legal risks.

Furthermore, supply chain disruptions present another risk for Cava. The global supply chain has faced significant challenges in recent years, and any disruptions can impact Cava’s ability to source ingredients and maintain consistent menu offerings. This could lead to increased costs or even temporary closures, affecting the company’s financial performance. Investors should consider Cava’s supply chain management practices and its contingency plans for mitigating such disruptions.

Lastly, it is important to consider the potential impact of technological advancements on Cava’s operations. The restaurant industry is increasingly embracing technology to enhance customer experience and streamline operations. While Cava has made strides in integrating technology, such as mobile ordering and delivery services, staying ahead of technological trends is crucial. Failure to do so could result in a competitive disadvantage. Investors should assess Cava’s commitment to technological innovation and its ability to leverage technology for sustained growth.

In conclusion, while Cava’s stock has experienced remarkable growth, potential investors must carefully consider the associated risks. The competitive landscape, economic environment, regulatory challenges, supply chain disruptions, and technological advancements all play a significant role in shaping Cava’s future prospects. By thoroughly evaluating these factors, investors can make informed decisions about whether Cava remains a prudent investment choice in the ever-evolving restaurant industry.

Comparing Cava’s Growth to Industry Peers: A Competitive Analysis

In the dynamic landscape of the restaurant industry, Cava has emerged as a formidable player, capturing the attention of investors with its remarkable stock performance. In 2024, Cava’s stock soared by an impressive 243%, prompting both excitement and scrutiny from market analysts and investors alike. To understand whether Cava remains a viable investment, it is essential to compare its growth trajectory with that of its industry peers, thereby providing a comprehensive competitive analysis.

Cava’s meteoric rise can be attributed to several strategic initiatives that have set it apart from its competitors. The company’s focus on offering a unique Mediterranean dining experience, coupled with its commitment to using fresh, high-quality ingredients, has resonated well with health-conscious consumers. This focus on quality and differentiation has allowed Cava to carve out a niche in a crowded market, where many competitors struggle to maintain customer loyalty. In contrast, some of Cava’s industry peers have faced challenges in adapting to changing consumer preferences, often resulting in stagnant growth or even declines in market share.

Moreover, Cava’s expansion strategy has been a key driver of its success. The company has strategically increased its footprint by opening new locations in high-demand urban areas, thereby capitalizing on the growing trend of urbanization. This expansion has not only increased Cava’s visibility but also its accessibility to a broader customer base. In comparison, some of its competitors have been more conservative in their expansion efforts, opting for a slower growth model that may not capture the same level of market excitement or investor interest.

In addition to its physical expansion, Cava has embraced technological advancements to enhance the customer experience. The integration of digital ordering platforms and loyalty programs has streamlined operations and fostered customer engagement. This tech-savvy approach has positioned Cava as a forward-thinking brand, appealing to a younger, tech-oriented demographic. Conversely, some industry peers have been slower to adopt such innovations, potentially limiting their appeal to a digitally-inclined audience.

However, while Cava’s growth has been impressive, it is crucial to consider the broader industry context. The restaurant sector is notoriously competitive, with new entrants constantly vying for consumer attention. Additionally, economic factors such as inflation and supply chain disruptions can impact profitability and growth prospects. Therefore, investors must weigh Cava’s strengths against these potential challenges when evaluating its long-term investment potential.

Furthermore, it is important to recognize that past performance is not always indicative of future results. While Cava’s stock has experienced significant appreciation, sustaining such growth may prove challenging as the company matures. Investors should consider whether Cava can continue to innovate and adapt to evolving market conditions, as well as how it plans to maintain its competitive edge in an ever-changing industry landscape.

In conclusion, Cava’s impressive stock performance in 2024 highlights its successful growth strategies and competitive positioning within the restaurant industry. By comparing Cava’s achievements with those of its peers, investors can gain valuable insights into the company’s strengths and potential challenges. While Cava’s growth story is compelling, prudent investors should conduct thorough due diligence, considering both the opportunities and risks, to determine whether it remains a sound investment choice in the context of an increasingly competitive market.

Future Projections: Can Cava Sustain Its Impressive Growth?

Cava’s remarkable stock performance in 2024, with a staggering 243% increase, has captured the attention of investors and market analysts alike. This impressive growth trajectory raises the question of whether Cava can sustain such momentum in the future. To assess the potential for continued success, it is essential to examine the factors that have contributed to Cava’s recent achievements and consider the challenges and opportunities that lie ahead.

One of the primary drivers behind Cava’s stock surge is its strategic expansion and innovation in the fast-casual dining sector. The company has successfully capitalized on the growing consumer demand for healthy, Mediterranean-inspired cuisine, which has resonated with a broad demographic. By offering a diverse menu that emphasizes fresh ingredients and customizable options, Cava has differentiated itself from competitors and attracted a loyal customer base. Furthermore, the company’s commitment to sustainability and ethical sourcing has enhanced its brand image, appealing to environmentally conscious consumers.

In addition to its strong brand positioning, Cava’s adept use of technology has played a crucial role in its growth. The company has invested significantly in digital platforms, enhancing its online ordering capabilities and streamlining operations. This focus on technology has not only improved customer convenience but also increased operational efficiency, contributing to higher profit margins. Moreover, Cava’s data-driven approach to understanding consumer preferences has enabled it to tailor its offerings and marketing strategies effectively, further driving sales.

However, while Cava’s recent performance is commendable, sustaining such growth will require navigating several challenges. The fast-casual dining industry is highly competitive, with numerous players vying for market share. To maintain its edge, Cava must continue to innovate and adapt to changing consumer preferences. This may involve expanding its menu offerings, exploring new culinary trends, and enhancing the overall dining experience. Additionally, as Cava expands its footprint, it must ensure that it maintains the quality and consistency that have been central to its success.

Another potential challenge is the economic environment. Fluctuations in consumer spending, driven by factors such as inflation and economic uncertainty, could impact Cava’s growth prospects. To mitigate these risks, the company may need to implement strategies that enhance its resilience, such as diversifying its revenue streams or optimizing its supply chain to reduce costs.

On the other hand, Cava’s growth prospects are bolstered by several opportunities. The increasing consumer focus on health and wellness presents a favorable market environment for Cava’s offerings. Additionally, the company’s expansion into new geographic markets, both domestically and internationally, could provide significant growth avenues. By leveraging its strong brand and operational expertise, Cava can tap into these opportunities and continue its upward trajectory.

In conclusion, while Cava’s stock has soared impressively in 2024, the question of whether it remains a good investment hinges on its ability to sustain growth amidst a dynamic market landscape. The company’s strategic initiatives, technological advancements, and brand strength position it well for future success. However, it must remain vigilant in addressing competitive pressures and economic challenges. For investors, Cava’s potential for continued growth makes it an intriguing prospect, but careful consideration of market conditions and company performance will be essential in making informed investment decisions.

Investor Sentiment: How Analysts View Cava’s Stock Performance

Cava’s stock has experienced a remarkable surge of 243% in 2024, capturing the attention of investors and analysts alike. This impressive performance has sparked a debate on whether the stock remains a viable investment opportunity. To understand the current investor sentiment, it is essential to delve into the factors driving this growth and how analysts perceive Cava’s future prospects.

The Mediterranean fast-casual restaurant chain has capitalized on a growing consumer trend towards healthier dining options, which has significantly contributed to its stock’s meteoric rise. Cava’s ability to expand its market presence and enhance its brand appeal has been instrumental in attracting a loyal customer base. Moreover, the company’s strategic initiatives, such as menu innovation and digital transformation, have further bolstered its competitive edge in the fast-casual dining sector. These efforts have not only increased foot traffic but also improved operational efficiencies, leading to robust financial performance.

Analysts have taken note of Cava’s strong fundamentals, which are reflected in its impressive revenue growth and expanding profit margins. The company’s ability to consistently deliver strong quarterly results has instilled confidence among investors, who view Cava as a growth-oriented company with significant upside potential. Furthermore, Cava’s management team has demonstrated a clear vision for the future, focusing on sustainable growth and long-term value creation. This strategic clarity has resonated well with analysts, who generally maintain a positive outlook on the stock.

However, despite the optimistic sentiment, some analysts urge caution. The rapid appreciation of Cava’s stock price has led to concerns about its current valuation. With the stock trading at a premium compared to its industry peers, questions arise about whether the market has already priced in much of the anticipated growth. This has led to a divergence in analyst opinions, with some advocating for a more cautious approach, suggesting that potential investors wait for a more attractive entry point.

In addition to valuation concerns, analysts also highlight potential risks that could impact Cava’s future performance. The competitive landscape in the fast-casual dining sector is intense, with numerous players vying for market share. Cava must continue to innovate and differentiate itself to maintain its growth trajectory. Additionally, macroeconomic factors such as inflation and supply chain disruptions could pose challenges to the company’s cost structure and profitability.

Despite these concerns, many analysts remain bullish on Cava’s long-term prospects. They point to the company’s strong brand equity, loyal customer base, and strategic growth initiatives as key drivers that could sustain its momentum. Moreover, Cava’s focus on expanding its digital capabilities and enhancing customer experience positions it well to capitalize on evolving consumer preferences.

In conclusion, while Cava’s stock has soared by 243% in 2024, making it a standout performer, the question of whether it remains a good investment is nuanced. Analysts generally view the company favorably, citing its strong fundamentals and growth potential. However, they also caution against potential risks and valuation concerns. As such, prospective investors should carefully weigh these factors and consider their risk tolerance before making investment decisions. Ultimately, Cava’s ability to navigate challenges and execute its strategic vision will be crucial in determining its future stock performance.

Diversification Strategies: Balancing Cava with Other Investments

In the ever-evolving landscape of financial markets, diversification remains a cornerstone strategy for investors seeking to mitigate risk while maximizing potential returns. The recent meteoric rise of Cava’s stock, which has soared by an impressive 243% in 2024, has captured the attention of both seasoned investors and newcomers alike. This remarkable performance prompts a critical examination of whether Cava still represents a viable investment opportunity and how it fits into a broader diversification strategy.

To begin with, the surge in Cava’s stock price can be attributed to several key factors. The company’s innovative approach to the fast-casual dining experience, coupled with its strategic expansion into new markets, has significantly bolstered its financial performance. Moreover, Cava’s commitment to sustainability and its ability to adapt to changing consumer preferences have further solidified its position in the industry. However, while these factors have undoubtedly contributed to the stock’s impressive growth, it is essential to consider the broader context of the market and the inherent risks associated with such rapid appreciation.

In light of Cava’s recent success, investors may be tempted to allocate a substantial portion of their portfolios to this high-performing stock. However, it is crucial to remember that diversification is not merely about chasing the highest returns but rather about balancing potential gains with the associated risks. By spreading investments across a variety of asset classes, sectors, and geographies, investors can reduce the impact of any single investment’s poor performance on their overall portfolio.

One effective strategy for incorporating Cava into a diversified portfolio is to pair it with investments in other sectors that may not be as closely correlated with the restaurant industry. For instance, technology stocks, which have historically demonstrated robust growth, could provide a counterbalance to the cyclical nature of the food and beverage sector. Additionally, considering investments in fixed-income securities, such as bonds, can offer stability and income, particularly during periods of market volatility.

Furthermore, international diversification can also play a pivotal role in balancing a portfolio that includes Cava. By investing in companies outside of the United States, investors can gain exposure to different economic cycles and regulatory environments, thereby reducing the risk associated with domestic market fluctuations. Emerging markets, in particular, present opportunities for growth that may not be available in more developed economies, albeit with their own set of risks.

It is also worth noting that diversification is not a one-time activity but rather an ongoing process that requires regular review and adjustment. As market conditions change and individual investments perform differently over time, the composition of a portfolio should be re-evaluated to ensure it continues to align with the investor’s risk tolerance and financial goals. This dynamic approach allows investors to capitalize on new opportunities while safeguarding against unforeseen challenges.

In conclusion, while Cava’s impressive stock performance in 2024 may present an enticing investment opportunity, it is imperative to consider it within the context of a well-diversified portfolio. By balancing Cava with other investments across various sectors and geographies, investors can enhance their potential for long-term success while minimizing risk. As always, careful analysis and strategic planning remain essential components of any sound investment strategy.

Q&A

1. **What caused Cava’s stock to soar by 243% in 2024?**

Strong financial performance, successful expansion strategies, and increased consumer demand for Mediterranean cuisine.

2. **How has Cava’s revenue growth contributed to its stock performance?**

Significant revenue growth has boosted investor confidence, driving up the stock price.

3. **What are the potential risks associated with investing in Cava now?**

Market volatility, potential overvaluation, and increased competition in the fast-casual dining sector.

4. **How does Cava’s market position compare to its competitors?**

Cava has a strong market position with a unique offering, but faces competition from other fast-casual and Mediterranean-focused chains.

5. **What are analysts saying about Cava’s future growth prospects?**

Analysts are optimistic but caution that sustaining high growth rates may be challenging.

6. **How has Cava’s expansion strategy impacted its stock price?**

Successful expansion into new markets has positively impacted the stock price by increasing revenue potential.

7. **Is Cava still considered a good investment after the stock surge?**

It may still be a good investment for those with a high-risk tolerance, but potential investors should carefully assess valuation and market conditions.

Conclusion

Cava’s stock soaring by 243% in 2024 indicates significant investor interest and strong market performance, likely driven by robust financial results, strategic expansions, or favorable market conditions. However, whether it remains a good investment depends on several factors, including its current valuation, growth prospects, competitive positioning, and broader economic conditions. Potential investors should conduct thorough due diligence, considering both the company’s fundamentals and market dynamics, to assess if the stock’s future growth potential justifies its current price.