“GE: Powering Ahead, Surpassing Tech Titans.”

Introduction

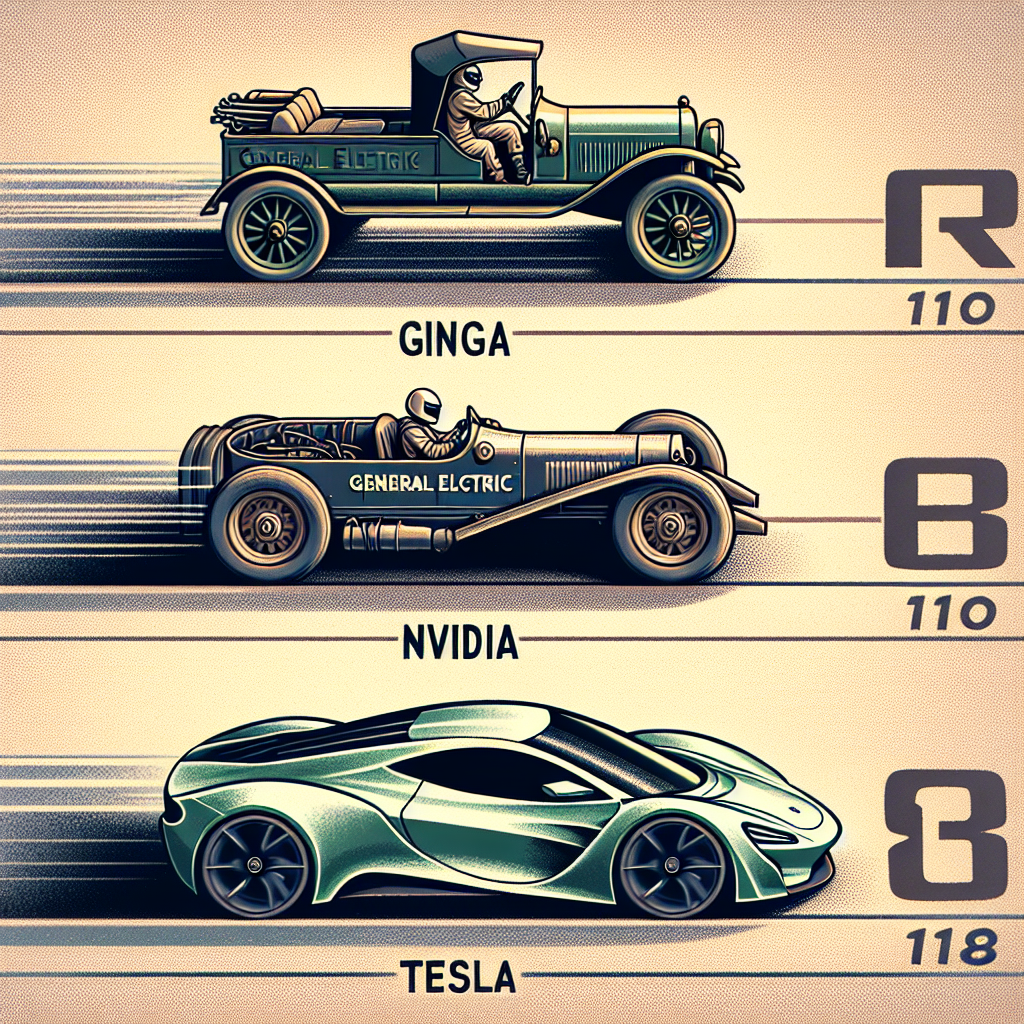

In recent years, the stock market has witnessed remarkable performances from tech giants like Nvidia and Tesla, capturing the attention of investors worldwide. However, amidst the tech frenzy, General Electric (GE), a stalwart of American industry, has quietly staged an impressive comeback, outperforming these high-flying stocks. GE’s resurgence can be attributed to a strategic transformation, focusing on its core industrial strengths, streamlining operations, and capitalizing on emerging market opportunities. This shift has not only revitalized investor confidence but also positioned GE as a formidable contender in the stock market, surpassing the returns of Nvidia and Tesla. By leveraging its expertise in aviation, healthcare, and renewable energy, GE has demonstrated resilience and adaptability, proving that traditional industrial powerhouses can still thrive in a tech-dominated era.

Historical Analysis: GE’s Strategic Moves That Outpaced Nvidia and Tesla

In recent years, the stock market has witnessed remarkable performances from various technology and industrial giants. Among these, General Electric (GE) has emerged as a surprising leader, outperforming notable tech companies like Nvidia and Tesla. This unexpected turn of events can be attributed to a series of strategic moves and historical decisions that have positioned GE favorably in the market. To understand how GE managed to outpace these tech titans, it is essential to delve into the historical context and strategic maneuvers that have defined its recent success.

Initially, GE’s resurgence can be traced back to its decision to streamline operations and focus on core competencies. In the past, GE was known for its sprawling conglomerate structure, which included a diverse range of businesses from financial services to healthcare. However, recognizing the need for a more focused approach, GE embarked on a significant restructuring process. By divesting non-core assets and concentrating on its strengths in aviation, power, and renewable energy, GE was able to enhance operational efficiency and allocate resources more effectively. This strategic pivot not only improved profitability but also restored investor confidence, setting the stage for its stock to outperform.

Moreover, GE’s commitment to innovation and technological advancement has played a crucial role in its stock market success. While Nvidia and Tesla are often lauded for their cutting-edge technologies, GE has quietly been making strides in its own right. The company’s investments in digital industrial technology, particularly through its GE Digital division, have allowed it to harness the power of data analytics and the Industrial Internet of Things (IIoT). By leveraging these technologies, GE has optimized its manufacturing processes, reduced costs, and enhanced product offerings, thereby gaining a competitive edge in the market.

In addition to its focus on innovation, GE’s strategic partnerships and collaborations have further bolstered its market position. Recognizing the importance of collaboration in today’s interconnected world, GE has formed alliances with key industry players to drive growth and expand its market reach. For instance, its partnership with Baker Hughes in the oil and gas sector has enabled GE to tap into new revenue streams and capitalize on emerging opportunities. These collaborations have not only diversified GE’s portfolio but also mitigated risks associated with market volatility, contributing to its stock’s resilience and outperformance.

Furthermore, GE’s strong leadership and effective management have been instrumental in steering the company towards success. Under the guidance of CEO Larry Culp, GE has implemented a disciplined approach to capital allocation and cost management. Culp’s emphasis on transparency and accountability has fostered a culture of trust and stability within the organization, which has resonated positively with investors. This leadership-driven transformation has been a key factor in GE’s ability to navigate challenges and seize opportunities, ultimately leading to its stock’s impressive performance.

In contrast, while Nvidia and Tesla have undoubtedly achieved significant milestones, they have also faced challenges that have impacted their stock performance. Nvidia, for instance, has been affected by supply chain disruptions and increased competition in the semiconductor industry. Meanwhile, Tesla has grappled with production bottlenecks and regulatory scrutiny. These challenges, coupled with market volatility, have contributed to fluctuations in their stock prices, allowing GE to gain an edge.

In conclusion, GE’s stock outperformance relative to Nvidia and Tesla can be attributed to a combination of strategic restructuring, technological innovation, strategic partnerships, and strong leadership. By focusing on its core strengths and embracing a forward-thinking approach, GE has successfully navigated the complexities of the market, emerging as a formidable player in the industrial and technology sectors. As a result, GE’s stock has not only outpaced its tech counterparts but also demonstrated the enduring value of strategic foresight and adaptability in an ever-evolving business landscape.

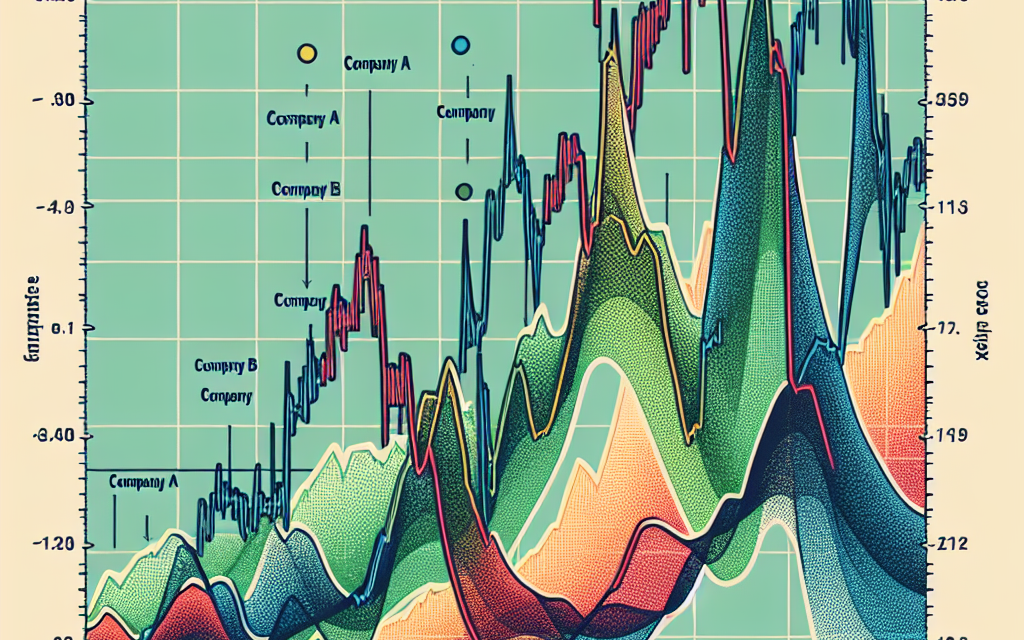

Financial Metrics: Comparing GE’s Growth with Nvidia and Tesla

In recent years, the financial markets have witnessed remarkable performances from various industry giants, with General Electric (GE), Nvidia, and Tesla often capturing the spotlight. While Nvidia and Tesla have been celebrated for their rapid growth and innovation, GE’s stock has quietly outperformed these tech titans in certain financial metrics, offering a compelling narrative of strategic transformation and resilience. To understand this phenomenon, it is essential to delve into the financial metrics that highlight GE’s growth trajectory compared to Nvidia and Tesla.

Firstly, examining revenue growth provides a foundational perspective. GE, traditionally known for its diversified industrial operations, has undergone a significant restructuring process. This transformation has allowed GE to streamline its operations, focusing on core areas such as aviation, healthcare, and renewable energy. As a result, GE has reported steady revenue growth, driven by increased demand in these sectors. In contrast, while Nvidia and Tesla have experienced explosive revenue growth due to their dominance in the semiconductor and electric vehicle markets, respectively, their growth rates have shown signs of stabilization as they mature.

Moreover, profitability metrics further illuminate GE’s competitive edge. GE’s focus on operational efficiency and cost management has led to improved profit margins. The company’s strategic divestitures and emphasis on high-margin businesses have contributed to this financial robustness. On the other hand, Nvidia and Tesla, despite their impressive revenue figures, have faced challenges in maintaining consistent profitability. Nvidia’s heavy investment in research and development, while crucial for innovation, has impacted its profit margins. Similarly, Tesla’s aggressive expansion and production scaling have occasionally strained its profitability.

In addition to revenue and profitability, cash flow generation is a critical metric that underscores GE’s financial strength. GE’s disciplined approach to capital allocation and its ability to generate substantial free cash flow have been pivotal in its stock performance. This financial flexibility has enabled GE to reinvest in growth opportunities and return value to shareholders through dividends and share buybacks. Conversely, Nvidia and Tesla, while generating significant cash flow, have often reinvested heavily in growth initiatives, which, although promising for future expansion, can limit immediate returns to shareholders.

Furthermore, GE’s strategic positioning in the renewable energy sector has provided a unique growth avenue. As the world increasingly shifts towards sustainable energy solutions, GE’s investments in wind and hydroelectric power have positioned it favorably in this burgeoning market. This strategic foresight has not only diversified GE’s revenue streams but also aligned it with global sustainability trends. In contrast, while Nvidia and Tesla are also involved in sustainable technologies, their core businesses remain more susceptible to market volatility and competitive pressures.

Lastly, GE’s stock performance can be attributed to its ability to adapt and innovate within its traditional industrial framework. The company’s commitment to digital transformation, exemplified by its investments in the Industrial Internet of Things (IIoT), has enhanced its operational capabilities and customer offerings. This adaptability has allowed GE to remain relevant in an ever-evolving market landscape. Meanwhile, Nvidia and Tesla, despite their technological prowess, face the challenge of sustaining their growth momentum in highly competitive and rapidly changing industries.

In conclusion, while Nvidia and Tesla have undoubtedly revolutionized their respective sectors, GE’s stock has outperformed them in certain financial metrics due to its strategic restructuring, focus on profitability, robust cash flow generation, and strategic positioning in renewable energy. This underscores the importance of a balanced approach to growth, where operational efficiency and strategic foresight play crucial roles in long-term financial success.

Market Trends: How GE Capitalized on Industry Shifts Better Than Nvidia and Tesla

In recent years, the stock market has witnessed significant fluctuations, with technology giants like Nvidia and Tesla often capturing the spotlight due to their innovative advancements and rapid growth. However, amidst this dynamic landscape, General Electric (GE) has emerged as a surprising outperformer, capitalizing on industry shifts more effectively than its high-profile counterparts. This unexpected success can be attributed to a combination of strategic foresight, diversification, and adaptability, which have allowed GE to navigate market trends with remarkable agility.

To begin with, GE’s resurgence can be traced back to its strategic pivot towards renewable energy and industrial automation. While Nvidia and Tesla have primarily focused on their core competencies—semiconductors and electric vehicles, respectively—GE has diversified its portfolio to include a broader range of industries. This diversification has enabled GE to mitigate risks associated with market volatility and capitalize on emerging opportunities in sectors such as wind energy and digital industrial solutions. By investing heavily in these areas, GE has positioned itself as a leader in the transition towards sustainable energy, a move that has resonated well with investors seeking environmentally responsible investments.

Moreover, GE’s ability to adapt to changing market dynamics has been instrumental in its stock performance. Unlike Nvidia and Tesla, which have faced challenges related to supply chain disruptions and regulatory hurdles, GE has demonstrated resilience by optimizing its operations and streamlining its supply chain. This operational efficiency has not only reduced costs but also enhanced the company’s ability to meet customer demands promptly. Consequently, GE has been able to maintain a competitive edge in an increasingly complex global market, further boosting investor confidence.

In addition to its strategic initiatives, GE’s financial discipline has played a crucial role in its stock’s outperformance. The company has focused on deleveraging its balance sheet and improving its financial health, which has been well-received by the market. By reducing debt and enhancing cash flow, GE has strengthened its financial position, allowing it to reinvest in growth areas and return value to shareholders through dividends and share buybacks. This prudent financial management has contrasted sharply with the more aggressive growth strategies employed by Nvidia and Tesla, which have sometimes led to increased volatility in their stock prices.

Furthermore, GE’s emphasis on innovation and technology has been a key driver of its success. The company has invested significantly in digital transformation, leveraging data analytics and artificial intelligence to enhance its product offerings and improve operational efficiency. This focus on technological advancement has not only differentiated GE from its competitors but also positioned it as a forward-thinking leader in the industrial sector. In contrast, while Nvidia and Tesla have made strides in their respective fields, they have faced challenges in scaling their innovations to meet broader market demands.

In conclusion, GE’s stock outperformance relative to Nvidia and Tesla can be attributed to its strategic diversification, adaptability, financial discipline, and commitment to innovation. By capitalizing on industry shifts and aligning its business model with emerging market trends, GE has successfully navigated the complexities of the modern economy. As the company continues to build on its strengths and explore new growth avenues, it serves as a compelling example of how traditional industrial giants can thrive in an era dominated by technological disruption.

Innovation and Technology: GE’s Edge Over Nvidia and Tesla

In the ever-evolving landscape of technology and innovation, General Electric (GE) has emerged as a surprising frontrunner, outperforming industry giants Nvidia and Tesla in recent stock market performance. This unexpected development has captured the attention of investors and analysts alike, prompting a closer examination of the factors contributing to GE’s success. While Nvidia and Tesla have long been synonymous with cutting-edge technology and innovation, GE’s strategic maneuvers and diversified portfolio have positioned it uniquely in the market.

To begin with, GE’s resurgence can be attributed to its strategic focus on core industrial sectors, particularly in renewable energy and aviation. Unlike Nvidia and Tesla, which are heavily reliant on the semiconductor and electric vehicle markets, respectively, GE has diversified its operations across multiple industries. This diversification has allowed GE to mitigate risks associated with market volatility and capitalize on emerging opportunities. For instance, GE’s investments in wind energy have positioned it as a leader in the renewable energy sector, a market that is experiencing exponential growth due to global efforts to combat climate change.

Moreover, GE’s commitment to innovation has played a pivotal role in its recent success. The company has made significant advancements in digital technology, particularly through its Industrial Internet of Things (IIoT) platform, Predix. This platform enables GE to offer data-driven solutions that enhance operational efficiency and reduce costs for its industrial clients. By leveraging data analytics and artificial intelligence, GE has been able to optimize its manufacturing processes and improve the performance of its products. This technological edge has not only strengthened GE’s competitive position but also attracted a new wave of investors seeking exposure to the industrial tech sector.

In contrast, Nvidia and Tesla have faced challenges that have impacted their stock performance. Nvidia, while a leader in the semiconductor industry, has been affected by supply chain disruptions and increased competition from emerging players. The global chip shortage has further exacerbated these challenges, leading to fluctuations in Nvidia’s stock price. Similarly, Tesla, despite its dominance in the electric vehicle market, has encountered production bottlenecks and regulatory hurdles in key markets. These challenges have raised concerns among investors about the sustainability of Tesla’s growth trajectory.

Furthermore, GE’s financial discipline and strategic divestitures have strengthened its balance sheet, providing the company with the financial flexibility to invest in growth opportunities. By divesting non-core assets and focusing on high-margin businesses, GE has improved its profitability and reduced its debt burden. This financial prudence has instilled confidence among investors, contributing to the upward momentum of GE’s stock.

In conclusion, GE’s outperformance relative to Nvidia and Tesla can be attributed to its strategic focus on core industrial sectors, commitment to innovation, and financial discipline. While Nvidia and Tesla continue to be leaders in their respective fields, GE’s diversified portfolio and technological advancements have positioned it as a formidable player in the innovation and technology landscape. As the market continues to evolve, GE’s ability to adapt and capitalize on emerging trends will be crucial in sustaining its competitive edge. Investors and analysts will undoubtedly keep a close watch on GE’s progress, as it navigates the dynamic and ever-changing world of technology and innovation.

Leadership and Management: Key Decisions That Boosted GE’s Stock Performance

In recent years, General Electric (GE) has experienced a remarkable resurgence in its stock performance, outpacing even the high-flying shares of tech giants like Nvidia and Tesla. This impressive turnaround can be attributed to a series of strategic leadership and management decisions that have revitalized the company. Understanding these key decisions provides valuable insights into how GE managed to outperform its competitors in the stock market.

To begin with, GE’s leadership, under the guidance of CEO Larry Culp, embarked on a comprehensive restructuring plan aimed at streamlining operations and refocusing the company’s core business areas. This strategic pivot involved divesting non-core assets and concentrating on sectors where GE had a competitive advantage, such as aviation, healthcare, and renewable energy. By shedding underperforming divisions, GE was able to allocate resources more efficiently and enhance its operational focus, which in turn improved profitability and investor confidence.

Moreover, GE’s management made significant strides in reducing the company’s debt burden, a critical factor that had previously weighed heavily on its financial health. Through a combination of asset sales and improved cash flow management, GE successfully lowered its debt levels, thereby strengthening its balance sheet. This financial discipline not only reduced risk but also positioned the company to invest in growth opportunities, further boosting its stock performance.

In addition to financial restructuring, GE’s leadership placed a strong emphasis on innovation and technological advancement. Recognizing the importance of staying ahead in a rapidly evolving market, GE invested heavily in research and development to drive innovation across its business units. This commitment to innovation was particularly evident in the renewable energy sector, where GE developed cutting-edge technologies to enhance the efficiency and sustainability of its products. By prioritizing innovation, GE was able to differentiate itself from competitors and capture new market opportunities, contributing to its stock’s upward trajectory.

Furthermore, GE’s management demonstrated a keen ability to adapt to changing market dynamics and capitalize on emerging trends. For instance, the company made strategic investments in digital transformation initiatives, leveraging data analytics and artificial intelligence to optimize operations and improve customer experiences. This digital shift not only enhanced GE’s operational efficiency but also opened up new revenue streams, reinforcing its competitive position in the market.

Another critical factor in GE’s stock performance was its commitment to sustainability and environmental responsibility. As global awareness of climate change and environmental issues grew, GE proactively aligned its business strategies with sustainable practices. By investing in renewable energy solutions and setting ambitious sustainability targets, GE not only met the demands of environmentally conscious investors but also positioned itself as a leader in the transition to a low-carbon economy. This alignment with global sustainability trends further bolstered investor confidence and contributed to the company’s stock outperformance.

In conclusion, GE’s impressive stock performance, surpassing even that of Nvidia and Tesla, can be attributed to a series of astute leadership and management decisions. By focusing on core business areas, reducing debt, fostering innovation, embracing digital transformation, and committing to sustainability, GE successfully revitalized its operations and enhanced its market position. These strategic moves not only improved the company’s financial health but also resonated with investors, driving its stock to new heights. As GE continues to execute its strategic vision, it serves as a compelling example of how effective leadership and management can transform a company’s fortunes in the competitive landscape of the stock market.

Diversification Strategy: GE’s Broader Portfolio Advantage Over Nvidia and Tesla

In the ever-evolving landscape of the stock market, General Electric (GE) has recently emerged as a surprising outperformer compared to tech giants Nvidia and Tesla. This unexpected development can be attributed to GE’s strategic diversification, which has provided the company with a broader portfolio advantage. While Nvidia and Tesla have been celebrated for their innovations in technology and electric vehicles, respectively, GE’s diversified approach has allowed it to navigate market fluctuations more effectively.

To begin with, GE’s diversified portfolio spans multiple industries, including aviation, healthcare, renewable energy, and power. This wide-ranging presence enables GE to mitigate risks associated with market volatility in any single sector. For instance, while the aviation industry faced significant challenges during the COVID-19 pandemic, GE’s healthcare division experienced increased demand for medical equipment and services. This balance allowed GE to maintain stability and even capitalize on growth opportunities in certain areas, offsetting losses in others.

In contrast, Nvidia and Tesla have concentrated their efforts on specific sectors—semiconductors and electric vehicles, respectively. While this focus has driven significant advancements and market leadership, it also exposes these companies to sector-specific risks. For example, Nvidia’s reliance on the semiconductor industry makes it vulnerable to supply chain disruptions and fluctuations in demand for graphics processing units (GPUs). Similarly, Tesla’s fortunes are closely tied to the electric vehicle market, which is subject to regulatory changes, competition, and shifts in consumer preferences.

Moreover, GE’s commitment to innovation across its diverse portfolio has further strengthened its position. The company has invested heavily in research and development, leading to advancements in areas such as renewable energy and digital industrial solutions. By leveraging its expertise across various sectors, GE has been able to introduce cutting-edge technologies that address pressing global challenges, such as climate change and healthcare accessibility. This focus on innovation not only enhances GE’s competitive edge but also attracts investors seeking sustainable and forward-thinking companies.

Additionally, GE’s strategic divestitures have played a crucial role in its recent success. By shedding non-core assets and focusing on high-growth areas, GE has streamlined its operations and improved its financial health. This disciplined approach has allowed the company to allocate resources more efficiently and invest in areas with the highest potential for returns. In contrast, Nvidia and Tesla have primarily concentrated on expanding their existing product lines, which, while successful, may not offer the same level of risk mitigation as GE’s diversified strategy.

Furthermore, GE’s global reach provides another layer of resilience. With operations in over 170 countries, GE can tap into emerging markets and benefit from regional growth trends. This international presence not only diversifies its revenue streams but also positions GE to capitalize on global economic shifts. In comparison, while Nvidia and Tesla have made strides in expanding their global footprint, their reliance on specific markets remains a potential vulnerability.

In conclusion, GE’s recent stock performance, outpacing that of Nvidia and Tesla, underscores the advantages of a diversified portfolio strategy. By spreading its investments across multiple industries, committing to innovation, and strategically divesting non-core assets, GE has positioned itself as a resilient and forward-looking company. As the market continues to evolve, GE’s broader portfolio advantage serves as a testament to the power of diversification in navigating the complexities of the modern business landscape.

Investor Sentiment: Why GE Attracted More Confidence Than Nvidia and Tesla

In recent years, the stock market has witnessed remarkable performances from tech giants like Nvidia and Tesla, yet General Electric (GE) has managed to capture investor sentiment in a way that has led to its stock outperforming these high-profile companies. Understanding why GE attracted more confidence than Nvidia and Tesla requires a closer examination of the factors influencing investor sentiment, including strategic business decisions, market conditions, and broader economic trends.

To begin with, GE’s resurgence can be attributed to its strategic restructuring efforts, which have been pivotal in restoring investor confidence. Under the leadership of CEO Larry Culp, GE embarked on a comprehensive plan to streamline its operations, focusing on core areas such as aviation, healthcare, and renewable energy. This strategic pivot not only helped GE shed non-core assets but also allowed the company to concentrate its resources on sectors with high growth potential. As a result, investors perceived GE as a more focused and agile entity, capable of navigating the complexities of the modern business landscape.

In contrast, Nvidia and Tesla, while undeniably successful, have faced challenges that have tempered investor enthusiasm. Nvidia, for instance, has been grappling with supply chain disruptions and increased competition in the semiconductor industry. Although the company remains a leader in graphics processing units (GPUs) and artificial intelligence (AI) technologies, these external pressures have raised concerns about its ability to maintain its growth trajectory. Similarly, Tesla, despite its dominance in the electric vehicle (EV) market, has encountered production bottlenecks and regulatory scrutiny, which have occasionally overshadowed its achievements.

Moreover, GE’s focus on renewable energy has resonated well with investors who are increasingly prioritizing sustainability. As the world shifts towards cleaner energy sources, GE’s investments in wind and hydroelectric power have positioned it as a key player in the transition to a low-carbon economy. This alignment with global sustainability trends has not only enhanced GE’s growth prospects but also bolstered its reputation among environmentally conscious investors. In contrast, while Tesla is also a major player in the green energy space, its challenges in scaling production and meeting regulatory requirements have sometimes dampened investor confidence.

Additionally, the broader economic environment has played a role in shaping investor sentiment towards these companies. With rising interest rates and inflationary pressures, investors have become more risk-averse, favoring companies with stable cash flows and strong balance sheets. GE’s successful debt reduction efforts and improved financial health have made it an attractive option for risk-averse investors seeking stability amidst economic uncertainty. On the other hand, Nvidia and Tesla, with their higher valuations and growth-oriented business models, have been perceived as riskier bets in a volatile market.

Furthermore, GE’s ability to adapt to changing market dynamics has been a key factor in its stock’s outperformance. The company’s emphasis on innovation and digital transformation has enabled it to stay competitive in an ever-evolving industrial landscape. By leveraging advanced technologies such as the Industrial Internet of Things (IIoT) and digital twins, GE has enhanced its operational efficiency and customer offerings, further strengthening investor confidence.

In conclusion, while Nvidia and Tesla continue to be formidable players in their respective industries, GE’s strategic focus, alignment with sustainability trends, and financial prudence have collectively contributed to its stock outperforming these tech giants. As investors navigate an increasingly complex market environment, GE’s ability to adapt and thrive has made it a compelling choice for those seeking a balance of growth and stability.

Q&A

1. **Q: What factors contributed to GE’s stock outperforming Nvidia and Tesla?**

A: GE’s stock outperformed due to successful restructuring efforts, strong performance in its aviation and healthcare divisions, and effective cost management.

2. **Q: How did GE’s restructuring impact its stock performance?**

A: The restructuring streamlined operations, reduced debt, and focused on core businesses, boosting investor confidence and stock performance.

3. **Q: What role did GE’s aviation division play in its stock success?**

A: The aviation division benefited from increased demand for air travel and aircraft maintenance, driving revenue growth and stock performance.

4. **Q: How did GE’s healthcare division contribute to its stock outperformance?**

A: The healthcare division saw strong demand for medical equipment and services, contributing to overall revenue growth and investor optimism.

5. **Q: What was the impact of cost management on GE’s stock?**

A: Effective cost management improved profit margins and financial stability, enhancing investor confidence and stock performance.

6. **Q: How did market conditions affect GE compared to Nvidia and Tesla?**

A: GE benefited from favorable market conditions in its core industries, while Nvidia and Tesla faced challenges like supply chain issues and market volatility.

7. **Q: What strategic moves did GE make that differed from Nvidia and Tesla?**

A: GE focused on divesting non-core assets and investing in its core industrial segments, while Nvidia and Tesla were more focused on technology and automotive innovation.

Conclusion

General Electric (GE) stock outperformed Nvidia and Tesla due to a combination of strategic restructuring, strong financial performance, and favorable market conditions. GE’s focus on its core industrial businesses, particularly in aviation and renewable energy, allowed it to capitalize on post-pandemic recovery trends and increased demand in these sectors. The company’s efforts to streamline operations and reduce debt also improved investor confidence. In contrast, Nvidia and Tesla faced challenges such as supply chain disruptions, regulatory scrutiny, and market volatility, which impacted their stock performance. GE’s ability to adapt to changing market dynamics and execute its strategic vision effectively contributed to its superior stock performance compared to Nvidia and Tesla.