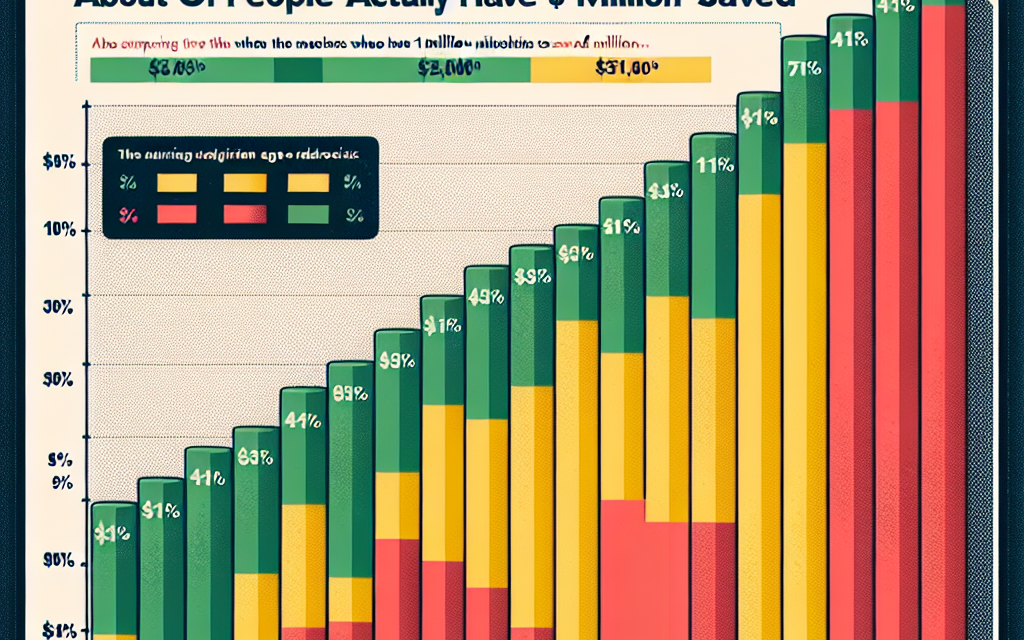

“Unveiling the Millionaire Myth: Discover the Real Numbers Behind $1 Million Savings”

Introduction

In a world where financial security is a common aspiration, the notion of accumulating $1 million in savings often stands as a benchmark of success and stability. However, the reality of how many individuals actually achieve this milestone is both surprising and revealing. While the image of a millionaire might conjure thoughts of luxury and excess, the truth is that reaching this financial goal is more attainable than many might assume, yet still elusive for a significant portion of the population. This exploration into the demographics and statistics of million-dollar savers uncovers unexpected truths about wealth distribution, the factors contributing to financial success, and the broader implications for economic inequality and personal financial planning.

Understanding The Millionaire Myth: How Common Is A $1 Million Net Worth?

In recent years, the concept of becoming a millionaire has often been portrayed as an elusive dream, reserved for the fortunate few who either inherit wealth or achieve extraordinary success in business. However, the reality of how many people actually possess a net worth of $1 million or more is more nuanced than commonly perceived. To understand the prevalence of millionaires, it is essential to delve into the factors that contribute to this financial milestone and examine the data that reveals the true scope of wealth distribution.

Firstly, it is important to clarify what constitutes a net worth of $1 million. This figure includes not only liquid assets such as cash and investments but also the value of real estate, retirement accounts, and other personal property, minus any liabilities. Consequently, many individuals who might not consider themselves wealthy could still meet the criteria for millionaire status, particularly if they own property in high-value real estate markets. This broader definition of net worth helps to explain why the number of millionaires is higher than one might initially assume.

According to recent studies, the number of millionaires worldwide has been steadily increasing. In the United States alone, data from financial institutions and wealth management firms indicate that there are over 20 million individuals with a net worth of $1 million or more. This figure represents a significant portion of the adult population, suggesting that achieving millionaire status is more common than the myth of exclusivity suggests. Moreover, the global landscape of wealth is also shifting, with emerging markets contributing to a growing number of millionaires in countries such as China and India.

Several factors contribute to this rise in millionaire numbers. Economic growth, particularly in technology and finance sectors, has created new opportunities for wealth accumulation. Additionally, the stock market’s performance over the past few decades has enabled many individuals to grow their investments substantially. Furthermore, the increasing value of real estate in urban areas has significantly boosted the net worth of property owners, often pushing them into millionaire territory.

However, it is crucial to recognize that while the number of millionaires is increasing, wealth inequality remains a pressing issue. The concentration of wealth among the top echelons of society continues to widen the gap between the affluent and those with fewer resources. This disparity highlights the importance of understanding the broader context of wealth distribution and the economic factors that influence it.

In conclusion, the notion of a $1 million net worth being an unattainable goal for most is a misconception. The data reveals that a significant number of individuals have reached this financial milestone, driven by a combination of economic growth, investment opportunities, and real estate appreciation. Nevertheless, the increasing number of millionaires should not overshadow the ongoing challenges of wealth inequality. As we continue to explore the dynamics of wealth distribution, it is essential to consider both the opportunities and obstacles that define the financial landscape. By doing so, we can gain a more comprehensive understanding of what it truly means to be a millionaire in today’s world and how this status fits into the broader economic picture.

The Demographics Of Millionaires: Who Really Has $1 Million Saved?

In recent years, the concept of becoming a millionaire has evolved from a distant dream to a more attainable goal for many individuals. However, the reality of how many people actually have $1 million saved is often shrouded in misconceptions. To understand the demographics of millionaires, it is essential to delve into the factors that contribute to this financial milestone and examine who truly holds this level of wealth.

To begin with, the definition of a millionaire can vary, but for the purpose of this discussion, it refers to individuals with a net worth of $1 million or more, excluding the value of their primary residence. This distinction is crucial as it provides a clearer picture of liquid assets available for investment and spending. According to recent studies, a relatively small percentage of the global population falls into this category. In the United States, for instance, approximately 8% of households are considered millionaires, a figure that highlights both the exclusivity and attainability of this status.

Transitioning to the demographics of these millionaires, it is evident that age plays a significant role. The majority of millionaires are older individuals, typically in their 50s and 60s. This trend can be attributed to the accumulation of wealth over time, as these individuals have had decades to save, invest, and benefit from compound interest. Moreover, many have experienced career advancements and salary increases, allowing them to build substantial retirement savings. However, it is noteworthy that younger millionaires are emerging, often due to entrepreneurial ventures, technology-driven businesses, and inheritance.

In addition to age, education and occupation are critical factors influencing millionaire status. A significant proportion of millionaires possess higher education degrees, with many holding advanced qualifications in fields such as finance, law, and medicine. These professions not only offer higher earning potential but also provide opportunities for networking and investment knowledge, which are instrumental in wealth accumulation. Furthermore, business ownership is a common trait among millionaires, as entrepreneurship allows for greater financial growth and asset diversification.

Geographical location also plays a pivotal role in the distribution of millionaires. Urban areas, particularly those with thriving economic sectors, tend to have higher concentrations of wealthy individuals. Cities such as New York, San Francisco, and London are renowned for their affluent populations, driven by industries like finance, technology, and real estate. Conversely, rural areas and regions with limited economic opportunities often have fewer millionaires, underscoring the impact of local economies on wealth distribution.

While these demographic factors provide insight into who is likely to have $1 million saved, it is important to recognize the influence of broader economic conditions. Inflation, interest rates, and market fluctuations can significantly affect the value of investments and savings. Consequently, individuals who are millionaires today may not maintain this status indefinitely, as economic downturns can erode wealth.

In conclusion, the demographics of millionaires reveal a complex interplay of age, education, occupation, and location. While the path to accumulating $1 million is more accessible than in previous generations, it remains a challenging endeavor that requires strategic financial planning and discipline. Understanding these dynamics not only demystifies the millionaire status but also highlights the diverse pathways individuals take to achieve this financial milestone. As economic landscapes continue to evolve, so too will the profiles of those who reach this coveted level of wealth.

Breaking Down The Statistics: The Reality Of Million-Dollar Savings

In recent years, the notion of accumulating a million dollars in savings has become a benchmark for financial success and security. However, the reality of how many individuals actually achieve this milestone is often shrouded in misconceptions. To understand the true landscape of million-dollar savings, it is essential to delve into the statistics and explore the factors that contribute to this financial achievement.

To begin with, it is important to recognize that the number of people with a million dollars in savings is not as high as one might assume. According to data from various financial institutions and surveys, only a small percentage of the population reaches this level of wealth. For instance, a report by Credit Suisse in 2021 estimated that approximately 1% of the global adult population were millionaires. This figure, while seemingly modest, underscores the exclusivity of reaching such a financial milestone.

Moreover, the distribution of million-dollar savings is heavily skewed towards certain regions and demographics. In countries like the United States, where the economy is robust and opportunities for wealth accumulation are more prevalent, the proportion of millionaires is significantly higher. In contrast, developing nations often have fewer individuals with such substantial savings due to economic disparities and limited access to financial resources. This disparity highlights the influence of geographical and economic factors on the ability to save and accumulate wealth.

Transitioning to the demographic aspect, age plays a crucial role in the accumulation of wealth. Typically, older individuals are more likely to have amassed a million dollars in savings compared to their younger counterparts. This trend can be attributed to the longer time horizon older individuals have had to save and invest, coupled with the power of compound interest over time. Consequently, younger generations may find it more challenging to reach this financial milestone, especially in the face of rising living costs and economic uncertainties.

Furthermore, the path to achieving a million dollars in savings is often paved with strategic financial planning and disciplined saving habits. Individuals who reach this level of wealth typically exhibit prudent financial behaviors, such as living below their means, investing wisely, and maintaining a diversified portfolio. These practices not only facilitate the growth of savings but also mitigate risks associated with market volatility and economic downturns.

In addition to personal financial habits, external factors such as economic conditions and government policies can significantly impact an individual’s ability to save. For example, low interest rates may encourage borrowing and spending rather than saving, while favorable tax policies on investments can incentivize wealth accumulation. Therefore, understanding the broader economic environment is crucial for individuals aspiring to reach the million-dollar mark.

In conclusion, while the idea of having a million dollars in savings is often perceived as a common financial goal, the reality is that only a small fraction of the population achieves this milestone. The distribution of million-dollar savings is influenced by a myriad of factors, including geographical location, age, financial habits, and economic conditions. By examining these elements, individuals can gain a clearer understanding of the challenges and opportunities associated with accumulating substantial savings. Ultimately, achieving a million dollars in savings requires a combination of strategic planning, disciplined saving, and an awareness of the broader economic landscape.

The Path To A Million: How Many People Achieve This Financial Milestone?

In today’s world, the concept of becoming a millionaire often seems like a distant dream for many. However, the reality of how many people actually achieve this financial milestone might surprise you. As we delve into the statistics and factors contributing to this achievement, it becomes evident that the path to accumulating $1 million in savings is more attainable than one might initially believe. To begin with, it’s essential to understand the broader context of wealth distribution. According to recent studies, the number of millionaires worldwide has been steadily increasing. This growth can be attributed to various factors, including economic expansion, technological advancements, and the proliferation of investment opportunities. In fact, a report by Credit Suisse revealed that there are over 56 million millionaires globally as of 2021, a number that continues to rise annually. This figure represents a significant portion of the global population, indicating that reaching the $1 million mark is not as rare as it once was.

Transitioning to the specifics of how individuals achieve this milestone, it is crucial to consider the diverse paths people take to accumulate wealth. For some, inheritance plays a significant role, providing a substantial financial foundation. However, for many others, disciplined saving and strategic investing are the primary drivers. The power of compound interest cannot be overstated in this context. By consistently saving and investing over time, individuals can leverage compound interest to grow their wealth exponentially. This approach requires patience and a long-term perspective, but it is a proven method for building substantial savings.

Moreover, the rise of accessible financial education and resources has empowered more people to take control of their financial futures. With the advent of online platforms and tools, individuals can now access a wealth of information on personal finance, investment strategies, and retirement planning. This democratization of financial knowledge has enabled more people to make informed decisions about their money, ultimately increasing their chances of reaching the $1 million milestone.

In addition to these factors, the role of entrepreneurship cannot be overlooked. Many individuals have achieved millionaire status by starting their own businesses and capitalizing on innovative ideas. The entrepreneurial spirit, coupled with a willingness to take calculated risks, has led to significant wealth creation for those who successfully navigate the challenges of business ownership. Furthermore, the gig economy and the rise of remote work have opened new avenues for income generation, allowing individuals to diversify their revenue streams and accelerate their journey to financial independence.

While the path to becoming a millionaire is undoubtedly challenging, it is not insurmountable. It requires a combination of strategic planning, disciplined saving, and a willingness to adapt to changing economic conditions. Additionally, it is important to recognize that the definition of wealth is subjective and varies from person to person. For some, achieving financial security and stability may be more important than reaching a specific monetary goal.

In conclusion, the surprising truth about how many people actually have $1 million saved is that it is more common than one might think. The increasing number of millionaires worldwide reflects the diverse paths individuals take to achieve this financial milestone. By understanding the factors that contribute to wealth accumulation and leveraging available resources, more people can aspire to join the ranks of millionaires and secure their financial futures.

Global Perspectives: Comparing Millionaire Populations Worldwide

In recent years, the concept of becoming a millionaire has evolved from a distant dream to a more attainable goal for many individuals worldwide. However, the actual number of people who have managed to save $1 million or more is often shrouded in misconceptions. To understand the global landscape of millionaire populations, it is essential to delve into the statistics and factors that contribute to this financial milestone.

To begin with, the number of millionaires globally has been steadily increasing, driven by economic growth, technological advancements, and the proliferation of investment opportunities. According to the Credit Suisse Global Wealth Report, there were approximately 56 million millionaires worldwide in 2021. This figure represents a significant increase from previous years, highlighting the growing accessibility of wealth accumulation. However, it is crucial to recognize that this number is not evenly distributed across the globe. The United States, for instance, accounts for a substantial portion of the world’s millionaires, with over 20 million individuals holding this status. This dominance can be attributed to the country’s robust economy, diverse investment avenues, and a culture that encourages entrepreneurship.

In contrast, other regions exhibit varying levels of millionaire populations. Europe, for example, is home to around 15 million millionaires, with countries like Germany, the United Kingdom, and France leading the pack. Meanwhile, Asia has witnessed a rapid surge in its millionaire population, particularly in China and India, where economic reforms and burgeoning middle classes have paved the way for increased wealth accumulation. Despite these impressive numbers, it is important to note that the concentration of millionaires in these regions is often limited to urban centers and major cities, leaving rural areas with significantly fewer opportunities for wealth generation.

Transitioning to the factors that influence the distribution of millionaires, it becomes evident that economic policies, taxation, and access to financial education play pivotal roles. Countries with favorable tax regimes and investment-friendly policies tend to attract and nurture wealthy individuals. Moreover, financial literacy and education are critical in empowering individuals to make informed decisions about saving and investing, ultimately contributing to their ability to amass wealth. In this context, nations that prioritize financial education often see a higher percentage of their population reaching the millionaire milestone.

Furthermore, the rise of technology and digital platforms has democratized access to investment opportunities, enabling individuals from diverse backgrounds to participate in wealth-building activities. Online trading platforms, cryptocurrency markets, and crowdfunding initiatives have opened new avenues for wealth creation, allowing people to diversify their portfolios and increase their chances of reaching the $1 million mark. However, it is essential to approach these opportunities with caution, as they also come with inherent risks and uncertainties.

In conclusion, while the number of millionaires worldwide continues to grow, it is crucial to understand the underlying factors that contribute to this phenomenon. Economic conditions, government policies, and access to financial education all play significant roles in shaping the distribution of wealth across different regions. As the global economy evolves, it is likely that the landscape of millionaire populations will continue to shift, influenced by technological advancements and changing societal norms. Ultimately, the journey to becoming a millionaire is a complex interplay of opportunity, knowledge, and strategic decision-making, underscoring the importance of a holistic approach to financial planning and wealth accumulation.

The Role Of Investments: How They Contribute To Reaching $1 Million

In today’s financial landscape, the notion of amassing $1 million in savings is often perceived as a benchmark of financial success and security. However, the path to achieving this milestone is not solely reliant on traditional savings methods. Instead, investments play a pivotal role in transforming this aspiration into reality. To understand how investments contribute to reaching the $1 million mark, it is essential to explore the dynamics of investment strategies, the power of compound interest, and the influence of market trends.

Firstly, investments offer a unique advantage over conventional savings accounts by providing the potential for higher returns. While savings accounts typically offer minimal interest rates, investments in stocks, bonds, mutual funds, and real estate can yield significantly greater returns over time. This potential for growth is a crucial factor in accumulating substantial wealth. For instance, investing in a diversified portfolio of stocks can lead to an average annual return of around 7% to 10%, far surpassing the meager interest rates offered by most savings accounts. Consequently, individuals who strategically allocate their resources into various investment vehicles are more likely to see their wealth grow exponentially.

Moreover, the concept of compound interest serves as a powerful catalyst in the journey toward $1 million. Compound interest refers to the process by which the earnings on an investment generate additional earnings over time. This compounding effect can significantly accelerate the growth of an investment portfolio. For example, an initial investment of $10,000, with an annual return of 8%, can grow to over $100,000 in 30 years, thanks to the power of compounding. Therefore, starting early and allowing investments to compound over time is a critical strategy for those aiming to reach the $1 million milestone.

In addition to the inherent benefits of investments, market trends and economic conditions also play a significant role in shaping investment outcomes. While markets can be volatile and unpredictable, understanding and leveraging these trends can enhance the potential for financial growth. For instance, during periods of economic expansion, stock markets tend to perform well, offering investors opportunities for substantial gains. Conversely, during economic downturns, certain asset classes, such as bonds or real estate, may provide more stability and protection against market volatility. By staying informed and adapting investment strategies to align with prevailing market conditions, individuals can optimize their chances of reaching their financial goals.

Furthermore, the role of professional financial advisors cannot be overlooked in the pursuit of $1 million. These experts possess the knowledge and experience to guide individuals in making informed investment decisions. They can help tailor investment strategies to align with an individual’s risk tolerance, financial goals, and time horizon. By leveraging the expertise of financial advisors, individuals can navigate the complexities of the investment landscape more effectively, thereby increasing their likelihood of achieving substantial savings.

In conclusion, while the idea of saving $1 million may seem daunting, investments offer a viable and effective pathway to this financial milestone. Through the potential for higher returns, the power of compound interest, and the strategic navigation of market trends, investments play an indispensable role in wealth accumulation. By embracing a diversified investment approach and seeking professional guidance, individuals can enhance their financial prospects and move closer to realizing the goal of having $1 million saved.

Financial Planning Insights: Strategies For Joining The Millionaire Club

In the realm of financial planning, the aspiration to accumulate a million-dollar nest egg is a common goal for many individuals. However, the reality of how many people actually achieve this milestone is often shrouded in misconceptions. Understanding the true landscape of million-dollar savers can provide valuable insights for those striving to join the ranks of the financially secure.

To begin with, it is essential to recognize that the number of individuals with $1 million or more in savings is not as elusive as one might think. According to recent studies, a significant portion of the population has managed to reach this financial benchmark. In the United States alone, the number of millionaires has been steadily increasing, with estimates suggesting that over 20 million individuals have achieved this status. This figure represents a diverse group of people, spanning various age groups, professions, and backgrounds, which underscores the attainability of this financial goal.

One of the key factors contributing to the growing number of millionaires is the power of compound interest. By investing wisely and allowing their money to grow over time, individuals can significantly increase their wealth. For instance, those who start saving and investing early in their careers are more likely to benefit from the exponential growth that compound interest offers. This strategy, coupled with disciplined saving habits, can pave the way for reaching the million-dollar mark.

Moreover, the role of financial literacy cannot be overstated in the journey to becoming a millionaire. Individuals who take the time to educate themselves about personal finance, investment strategies, and market trends are better equipped to make informed decisions that enhance their financial well-being. This knowledge empowers them to navigate economic fluctuations and seize opportunities that may arise, further bolstering their path to financial success.

In addition to financial literacy, diversification of investments is another crucial strategy employed by many millionaires. By spreading their investments across various asset classes, such as stocks, bonds, real estate, and mutual funds, individuals can mitigate risks and increase their chances of achieving substantial returns. This approach not only safeguards their wealth but also positions them to capitalize on different market conditions.

Furthermore, it is important to acknowledge the role of lifestyle choices in accumulating wealth. Many millionaires adopt a frugal mindset, prioritizing savings and investments over extravagant spending. By living below their means and making conscious financial decisions, they are able to allocate more resources towards building their savings. This disciplined approach to spending is a common trait among those who have successfully amassed a million-dollar portfolio.

While the journey to becoming a millionaire may seem daunting, it is important to remember that it is not solely reserved for the privileged few. With careful planning, strategic investments, and a commitment to financial education, individuals from all walks of life can work towards achieving this goal. By understanding the factors that contribute to the success of current millionaires, aspiring savers can adopt similar strategies and increase their chances of joining the millionaire club.

In conclusion, the surprising truth about how many people actually have $1 million saved reveals that this financial milestone is more attainable than commonly perceived. Through the power of compound interest, financial literacy, diversified investments, and prudent lifestyle choices, individuals can set themselves on a path to financial prosperity. As more people embrace these strategies, the ranks of millionaires are likely to continue growing, offering hope and inspiration to those who aspire to achieve financial independence.

Q&A

1. **Question:** What percentage of Americans have $1 million or more saved for retirement?

**Answer:** Approximately 10% of American households have $1 million or more saved for retirement.

2. **Question:** How does the number of millionaires in the U.S. compare to other countries?

**Answer:** The United States has the highest number of millionaires compared to any other country.

3. **Question:** What factors contribute to someone becoming a millionaire?

**Answer:** Factors include consistent saving, investing wisely, living below one’s means, and benefiting from compound interest over time.

4. **Question:** At what age do most people typically reach millionaire status?

**Answer:** Many people reach millionaire status in their 50s or 60s, often after decades of saving and investing.

5. **Question:** How has the number of millionaires changed over the past decade?

**Answer:** The number of millionaires has increased significantly over the past decade, partly due to rising asset values and stock market growth.

6. **Question:** What role does inheritance play in becoming a millionaire?

**Answer:** While inheritance can play a role, many millionaires achieve their status through self-made means, such as entrepreneurship and disciplined financial habits.

7. **Question:** How does inflation impact the perception of being a millionaire?

**Answer:** Inflation can erode the purchasing power of $1 million, making it less significant over time compared to past decades.

Conclusion

The surprising truth about how many people actually have $1 million saved is that while the number of millionaires is increasing globally, a relatively small percentage of the population achieves this milestone. Factors such as income inequality, varying costs of living, and differing financial literacy levels contribute to this disparity. Many individuals face challenges like debt, insufficient savings rates, and unexpected expenses, which hinder their ability to accumulate significant wealth. Despite the perception that becoming a millionaire is a common financial goal, the reality is that it remains an elusive target for most people, highlighting the importance of financial planning and education in achieving long-term financial security.