“Markets Retreat: Post-Election Optimism Wanes”

Introduction

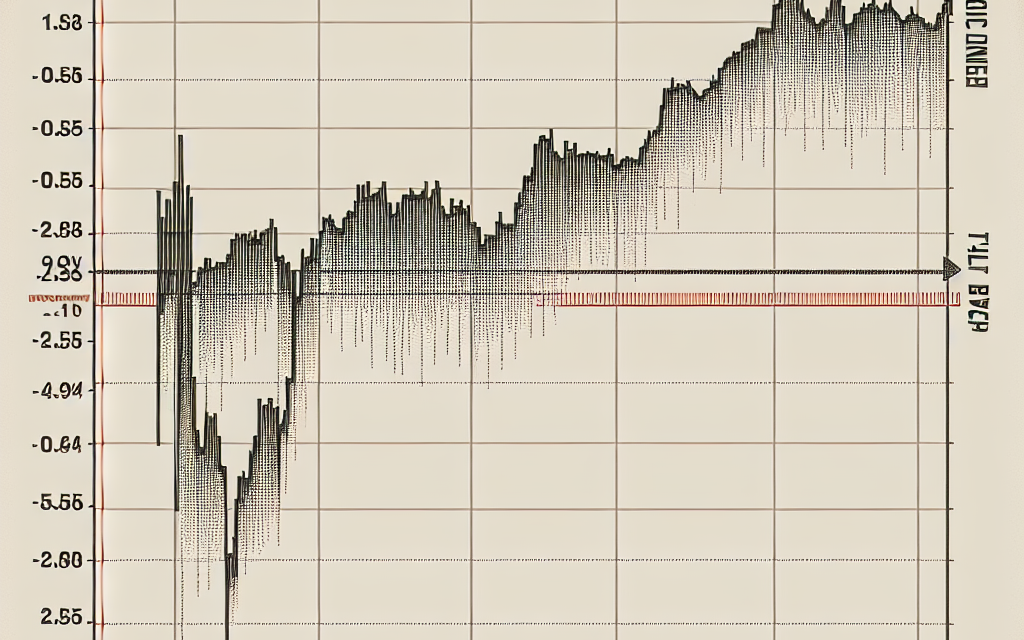

Following a period of optimism and upward momentum in the wake of recent elections, financial markets are experiencing a pullback as initial gains begin to fade. Investors, initially buoyed by the prospect of political stability and potential policy shifts, are now reassessing their positions amid emerging uncertainties and economic realities. This recalibration is driven by a combination of factors, including profit-taking, geopolitical tensions, and macroeconomic indicators that suggest a more cautious outlook. As the euphoria of the election results dissipates, market participants are refocusing on fundamentals, leading to a more tempered and volatile trading environment.

Analyzing Market Volatility Post-Election

In the wake of the recent elections, financial markets initially experienced a surge, buoyed by investor optimism and the anticipation of policy shifts that could stimulate economic growth. However, as the dust settles, this initial exuberance has given way to a more cautious approach, leading to a noticeable pullback in market indices. This phenomenon is not uncommon, as markets often react with volatility in the aftermath of significant political events. Understanding the underlying factors contributing to this pullback is crucial for investors seeking to navigate the current landscape.

To begin with, the initial post-election rally was largely driven by speculative trading, as investors sought to capitalize on potential policy changes. The prospect of new fiscal policies, regulatory adjustments, and economic reforms often fuels market enthusiasm. However, as the reality of implementing these changes sets in, the market’s initial optimism can wane. Investors begin to reassess their positions, leading to a recalibration of asset prices. This recalibration is often accompanied by increased volatility, as market participants digest new information and adjust their expectations accordingly.

Moreover, the transition from election promises to actual policy implementation is fraught with challenges and uncertainties. Political negotiations, legislative hurdles, and bureaucratic processes can delay or dilute the impact of proposed measures. As these realities become apparent, investor sentiment can shift, prompting a reevaluation of risk and return profiles. This shift is further exacerbated by the global economic environment, which remains fraught with uncertainties, including geopolitical tensions, supply chain disruptions, and inflationary pressures. These factors contribute to a complex backdrop against which investors must make decisions, often leading to heightened market volatility.

In addition to domestic factors, global market dynamics also play a significant role in influencing post-election market behavior. International investors closely monitor political developments in major economies, as these can have far-reaching implications for global trade and investment flows. Consequently, any perceived instability or policy uncertainty can trigger capital outflows, impacting market performance. Furthermore, currency fluctuations, driven by changes in investor sentiment and monetary policy expectations, can add another layer of complexity to the investment landscape.

It is also important to consider the role of market psychology in driving post-election volatility. Investor behavior is often influenced by cognitive biases, such as overconfidence and herd mentality, which can amplify market movements. In the immediate aftermath of an election, these psychological factors can lead to exaggerated price swings, as investors react to news and rumors with heightened sensitivity. Over time, as more concrete information becomes available, market participants tend to adopt a more measured approach, leading to a stabilization of prices.

In conclusion, the pullback in markets following the initial post-election gains is a multifaceted phenomenon, driven by a combination of speculative trading, policy uncertainties, global economic conditions, and investor psychology. While this volatility can be unsettling, it also presents opportunities for astute investors who are able to navigate the complexities of the current environment. By maintaining a long-term perspective and focusing on fundamental analysis, investors can better position themselves to weather the inevitable ebbs and flows of the market. As the political landscape continues to evolve, staying informed and adaptable will be key to successfully managing investment portfolios in this dynamic period.

Factors Contributing to the Recent Market Pullback

In the wake of the recent elections, financial markets initially experienced a surge, buoyed by investor optimism and the anticipation of favorable policy shifts. However, this post-election rally has begun to wane, leading to a noticeable market pullback. Several factors contribute to this recent downturn, each playing a significant role in shaping investor sentiment and market dynamics.

Firstly, the initial post-election optimism was largely driven by expectations of policy changes that could stimulate economic growth. Investors were hopeful that the newly elected government would implement measures to boost infrastructure spending, reduce regulatory burdens, and introduce tax reforms. However, as the dust settled, it became apparent that the legislative process would be more protracted and contentious than initially anticipated. This realization has tempered investor enthusiasm, as the anticipated economic benefits may take longer to materialize than previously thought.

Moreover, global economic uncertainties have also contributed to the market pullback. The ongoing geopolitical tensions in various regions, coupled with trade disputes, have created an environment of unpredictability. These factors have led to concerns about potential disruptions in global supply chains and the overall impact on international trade. As a result, investors have become more cautious, reassessing their risk exposure and adjusting their portfolios accordingly.

In addition to geopolitical factors, macroeconomic indicators have also played a role in the recent market downturn. Inflationary pressures have been mounting, with rising commodity prices and supply chain bottlenecks contributing to increased costs for businesses and consumers alike. Central banks around the world have responded by signaling potential interest rate hikes to curb inflation, which has further unsettled markets. Higher interest rates can lead to increased borrowing costs for companies and consumers, potentially dampening economic growth and corporate profitability.

Furthermore, the resurgence of COVID-19 cases in certain regions has reignited fears of potential lockdowns and restrictions, which could hinder economic recovery efforts. The emergence of new variants and the uneven distribution of vaccines globally have added layers of complexity to the pandemic’s trajectory. Investors are wary of the potential economic fallout from renewed health crises, leading to increased market volatility.

Additionally, corporate earnings reports have been a mixed bag, with some companies exceeding expectations while others have fallen short. This inconsistency has added to market uncertainty, as investors grapple with determining which sectors and companies are best positioned to navigate the current economic landscape. The disparity in earnings performance has prompted a reevaluation of investment strategies, with some investors opting to take profits from earlier gains and adopt a more defensive stance.

Lastly, the psychological aspect of market behavior cannot be overlooked. The initial post-election euphoria may have led to overbought conditions, with valuations reaching levels that were unsustainable in the face of emerging challenges. As reality set in, a natural correction ensued, driven by profit-taking and a reassessment of market fundamentals.

In conclusion, the recent market pullback can be attributed to a confluence of factors, including delayed policy implementation, global economic uncertainties, inflationary pressures, pandemic-related concerns, mixed corporate earnings, and psychological market dynamics. As investors navigate this complex landscape, they must remain vigilant and adaptable, carefully weighing the risks and opportunities that lie ahead. The path forward will likely be shaped by how these factors evolve and interact, underscoring the importance of a nuanced and informed approach to investment decision-making.

Historical Trends: Market Behavior After Elections

In the aftermath of elections, financial markets often experience a period of heightened volatility as investors react to the results and adjust their portfolios accordingly. Historically, this post-election phase can be characterized by initial gains, driven by optimism and speculation about the new administration’s policies. However, these gains frequently fade as the realities of governance set in and market participants reassess their positions. Understanding this pattern requires a closer examination of historical trends and the factors that influence market behavior following elections.

To begin with, it is essential to recognize that markets are inherently forward-looking. Investors tend to price in anticipated policy changes well before they are implemented. Consequently, the period leading up to an election is often marked by increased speculation and positioning based on expected outcomes. Once the election results are confirmed, there is typically a relief rally, as uncertainty diminishes and investors gain clarity on the political landscape. This initial surge is often fueled by the belief that the new government will enact policies favorable to economic growth and corporate profitability.

However, as time progresses, the initial euphoria tends to wane. One reason for this is the realization that campaign promises may not translate into immediate policy action. The legislative process is often slow and fraught with challenges, leading to delays in the implementation of key initiatives. Moreover, the complexities of governance mean that not all proposed policies will be enacted in their original form, if at all. This can lead to a reassessment of expectations, prompting investors to adjust their positions accordingly.

Another factor contributing to the fading of post-election gains is the broader economic context. Elections do not occur in a vacuum, and external factors such as global economic conditions, interest rates, and geopolitical tensions can significantly impact market performance. For instance, if the global economy is facing headwinds, such as a slowdown in growth or rising inflation, these factors can overshadow domestic political developments and weigh on market sentiment. Similarly, changes in monetary policy, particularly in major economies like the United States, can influence investor behavior and lead to market pullbacks.

Furthermore, historical data suggests that the party in power can also play a role in shaping market trends. While there is no definitive correlation between political parties and market performance, certain sectors may benefit more from the policies of one party over another. For example, a government that prioritizes infrastructure spending may boost construction and materials stocks, while one that focuses on healthcare reform could impact pharmaceutical and insurance companies. As investors digest the implications of the election results, sector rotation often occurs, leading to shifts in market dynamics.

In conclusion, while post-election periods are often marked by initial market gains, these are not always sustainable. The interplay of political, economic, and external factors can lead to a reassessment of investor expectations and a subsequent pullback in markets. By examining historical trends, investors can gain valuable insights into the potential trajectory of markets following elections. However, it is crucial to remain vigilant and adaptable, as the ever-changing landscape of global finance requires a nuanced understanding of both short-term fluctuations and long-term trends.

Investor Sentiment and Its Impact on Market Movements

In the wake of the recent elections, financial markets initially experienced a surge, buoyed by investor optimism and the anticipation of favorable policy changes. However, as the dust settles, this initial exuberance has begun to wane, leading to a noticeable pullback in market indices. This shift in investor sentiment underscores the complex interplay between political events and market dynamics, highlighting the transient nature of post-election gains.

Investor sentiment is a critical driver of market movements, often dictating the direction of stock prices in the short term. Following the elections, markets rallied on the back of expectations for economic reforms and potential fiscal stimulus. Investors, hopeful for a stable political environment, poured capital into equities, driving up prices. This optimism was further fueled by campaign promises that suggested a pro-business agenda, which historically tends to boost market confidence. However, as the initial excitement fades, investors are beginning to reassess the realities of the political landscape and its implications for the economy.

One of the primary reasons for the recent market pullback is the realization that policy implementation may face significant hurdles. While campaign promises can be enticing, the legislative process is often fraught with challenges that can delay or dilute proposed measures. Investors are now grappling with the uncertainty surrounding the actualization of these policies, leading to a more cautious approach. This shift in sentiment is reflected in the increased volatility and the retreat of major stock indices from their post-election highs.

Moreover, external factors are also contributing to the cooling of investor enthusiasm. Global economic conditions, such as fluctuating commodity prices and geopolitical tensions, continue to exert pressure on markets. These factors, coupled with concerns over inflation and interest rate hikes, are prompting investors to reevaluate their risk exposure. As a result, there is a growing preference for safer assets, such as bonds, which offer more stability in uncertain times. This reallocation of capital away from equities is further exacerbating the market pullback.

In addition to these macroeconomic factors, corporate earnings reports have also played a role in shaping investor sentiment. While some companies have posted strong results, others have issued cautious outlooks, citing supply chain disruptions and rising costs as potential headwinds. These mixed signals are contributing to the overall uncertainty, prompting investors to adopt a more defensive stance. As earnings season progresses, market participants will be closely monitoring corporate guidance for insights into future economic conditions.

Despite the current market retreat, it is important to recognize that such fluctuations are a natural part of the investment landscape. Markets are inherently cyclical, and periods of volatility often present opportunities for astute investors. While the immediate outlook may appear uncertain, the long-term fundamentals of the economy remain intact. As policymakers work to address the challenges facing the economy, there is potential for renewed investor confidence and market stabilization.

In conclusion, the recent pullback in markets following post-election gains highlights the significant impact of investor sentiment on market movements. As initial optimism gives way to a more measured assessment of political and economic realities, investors are adjusting their strategies accordingly. While uncertainty persists, it is crucial for market participants to maintain a balanced perspective, recognizing both the risks and opportunities that lie ahead. Through careful analysis and strategic decision-making, investors can navigate the complexities of the current market environment.

Strategies for Navigating Market Pullbacks

In the wake of recent elections, financial markets initially experienced a surge, buoyed by investor optimism and the anticipation of favorable policy changes. However, as the initial excitement wanes, markets have begun to pull back, prompting investors to reassess their strategies. Understanding how to navigate these market pullbacks is crucial for maintaining a resilient investment portfolio. To begin with, it is essential to recognize that market pullbacks are a natural part of the economic cycle. They often occur as investors digest new information and adjust their expectations accordingly. While these fluctuations can be unsettling, they also present opportunities for astute investors to reassess their positions and make informed decisions. One effective strategy during such times is to maintain a diversified portfolio. Diversification helps mitigate risk by spreading investments across various asset classes, sectors, and geographic regions. This approach ensures that a downturn in one area does not disproportionately impact the entire portfolio. By holding a mix of stocks, bonds, and other assets, investors can better weather the storm of market volatility. Moreover, it is important to focus on long-term investment goals rather than short-term market movements. Emotional reactions to market pullbacks can lead to impulsive decisions that may not align with an investor’s overall strategy. By keeping a long-term perspective, investors can avoid the pitfalls of panic selling and instead remain committed to their financial objectives. In addition to diversification and a long-term outlook, investors should also consider rebalancing their portfolios during market pullbacks. Rebalancing involves adjusting the allocation of assets to maintain the desired level of risk and return. For instance, if a particular asset class has performed well and now represents a larger portion of the portfolio than intended, selling some of those assets and reallocating the proceeds to underperforming areas can help restore balance. This disciplined approach ensures that the portfolio remains aligned with the investor’s risk tolerance and investment goals. Furthermore, it is beneficial to stay informed about the broader economic environment and any potential policy changes that may impact the markets. Understanding the factors driving market movements can provide valuable insights and help investors make more informed decisions. Regularly reviewing economic indicators, corporate earnings reports, and geopolitical developments can offer a clearer picture of the market landscape. Additionally, consulting with financial advisors or investment professionals can provide guidance tailored to individual circumstances. These experts can offer objective perspectives and help investors navigate the complexities of market pullbacks. By leveraging their expertise, investors can gain confidence in their strategies and make well-informed decisions. Finally, it is important to remain patient and disciplined during market pullbacks. While it may be tempting to react to short-term fluctuations, maintaining a steady course is often the most prudent approach. By adhering to a well-thought-out investment plan and avoiding knee-jerk reactions, investors can better position themselves for long-term success. In conclusion, market pullbacks, while challenging, offer opportunities for investors to reassess their strategies and strengthen their portfolios. By maintaining diversification, focusing on long-term goals, rebalancing portfolios, staying informed, and seeking professional advice, investors can navigate these periods of volatility with confidence. Ultimately, a disciplined and informed approach will help ensure that investors remain on track to achieve their financial objectives, even as post-election gains fade.

The Role of Economic Indicators in Market Fluctuations

In the wake of recent elections, financial markets initially experienced a surge, buoyed by investor optimism and the anticipation of favorable policy shifts. However, as the dust settles, these post-election gains have begun to fade, prompting a closer examination of the underlying factors influencing market fluctuations. Central to this analysis is the role of economic indicators, which serve as vital tools for investors and policymakers alike in assessing the health and trajectory of the economy.

Economic indicators, such as gross domestic product (GDP), unemployment rates, and consumer confidence indices, provide critical insights into the current state of the economy and its future direction. These indicators are closely monitored by market participants, as they offer valuable information that can influence investment decisions and market sentiment. For instance, a robust GDP growth rate may signal a thriving economy, encouraging investors to increase their exposure to equities. Conversely, a rising unemployment rate might suggest economic weakness, prompting a shift towards safer assets like bonds.

In the context of post-election market dynamics, economic indicators play a pivotal role in shaping investor expectations. Initially, the election results may have sparked optimism, with investors anticipating policy changes that could stimulate economic growth. However, as the initial euphoria subsides, attention shifts back to the fundamental economic indicators that provide a more grounded assessment of the economy’s health. This transition often results in market pullbacks, as investors recalibrate their expectations based on the latest economic data.

Moreover, the interplay between economic indicators and market sentiment is further complicated by the global economic environment. In an increasingly interconnected world, domestic markets are not insulated from international developments. For example, fluctuations in global trade, geopolitical tensions, and foreign monetary policies can all impact domestic economic indicators, thereby influencing market behavior. As such, investors must consider a broad array of factors when interpreting economic data and making investment decisions.

Additionally, the timing and interpretation of economic indicators can significantly affect market movements. For instance, the release of a key economic report, such as the monthly employment figures, can lead to heightened market volatility as investors react to the new information. In some cases, markets may have already priced in expected outcomes, leading to minimal impact. In other instances, unexpected results can trigger sharp market movements as investors adjust their positions in response to the new data.

Furthermore, it is important to recognize that economic indicators are not infallible predictors of market trends. While they provide valuable insights, they are subject to revisions and can be influenced by short-term anomalies. Therefore, investors must exercise caution and consider a range of indicators in conjunction with other analytical tools to form a comprehensive view of the market landscape.

In conclusion, as post-election gains recede, the focus on economic indicators becomes increasingly crucial in understanding market fluctuations. These indicators offer essential insights into the economy’s current state and future prospects, guiding investor decisions and shaping market sentiment. However, the complexity of the global economic environment and the inherent limitations of these indicators necessitate a nuanced approach to their interpretation. By carefully analyzing economic data and considering a wide array of factors, investors can better navigate the ever-changing market landscape and make informed decisions in the face of uncertainty.

Comparing Post-Election Market Performance Across Decades

In the wake of recent elections, financial markets have experienced a notable pullback, a phenomenon not unfamiliar to seasoned investors. Historically, post-election market performance has varied significantly across different decades, influenced by a myriad of factors including political climate, economic conditions, and investor sentiment. To understand the current market dynamics, it is essential to compare these trends with those observed in previous election cycles.

Looking back to the mid-20th century, the post-election market environment was often characterized by a sense of optimism. For instance, the 1950s and 1960s saw robust economic growth and relatively stable political landscapes, which contributed to positive market performance following elections. During these decades, the markets typically responded favorably to the continuity or change in political leadership, as investors were buoyed by the prospects of economic expansion and policy stability. This period was marked by a general upward trajectory in stock prices, reflecting the confidence of investors in the economic policies of the time.

Transitioning into the 1970s and 1980s, the market’s post-election behavior became more volatile. The 1970s, in particular, were plagued by economic challenges such as stagflation and oil crises, which dampened investor enthusiasm. Consequently, post-election market performance during this decade was often subdued, as investors grappled with uncertainty and fluctuating economic indicators. In contrast, the 1980s witnessed a resurgence of market optimism, driven by deregulation and tax reforms. The post-election periods in this decade often saw significant market rallies, as investors anticipated pro-business policies that would stimulate economic growth.

As we moved into the 1990s and early 2000s, the advent of globalization and technological advancements introduced new dynamics into post-election market performance. The 1990s, in particular, were characterized by the dot-com boom, which fueled unprecedented market gains. Post-election periods during this time often saw heightened investor activity, as the promise of technological innovation overshadowed political uncertainties. However, the early 2000s brought about a more cautious market environment, as the burst of the dot-com bubble and geopolitical tensions tempered investor expectations.

In recent decades, the post-election market performance has been increasingly influenced by global interconnectedness and rapid information dissemination. The 2010s, for example, were marked by heightened market sensitivity to political developments, both domestic and international. The rise of social media and real-time news coverage has amplified market reactions to election outcomes, often resulting in short-term volatility. Despite this, the long-term market trends have generally remained positive, as investors have adapted to the fast-paced flow of information and its implications for economic policy.

In light of these historical trends, the current market pullback following the recent elections can be seen as part of a broader pattern of post-election adjustments. While initial gains may fade as investors reassess the implications of new political leadership, the long-term market trajectory will likely be shaped by underlying economic fundamentals and policy directions. As such, understanding the historical context of post-election market performance provides valuable insights into navigating the complexities of today’s financial landscape. By examining past trends, investors can better anticipate potential market movements and make informed decisions in an ever-evolving economic environment.

Q&A

1. **What caused the markets to pull back?**

The markets pulled back due to fading post-election gains, as initial optimism about political stability and potential policy changes began to wane.

2. **Which sectors were most affected by the market pullback?**

Technology and financial sectors were among the most affected, as investors reassessed the impact of potential regulatory changes and economic policies.

3. **How did investors react to the market pullback?**

Investors reacted by shifting their portfolios, moving away from riskier assets and towards safer investments like bonds and gold.

4. **What role did economic data play in the market pullback?**

Weak economic data contributed to the market pullback by raising concerns about the pace of economic recovery and the potential for slower growth.

5. **Were there any geopolitical factors influencing the market pullback?**

Yes, geopolitical tensions and uncertainties, such as trade negotiations and international conflicts, added to investor concerns and influenced the market pullback.

6. **How did the market pullback affect investor sentiment?**

The market pullback led to increased volatility and a more cautious investor sentiment, with many adopting a wait-and-see approach.

7. **What are analysts predicting for the markets following the pullback?**

Analysts are predicting a period of volatility and caution, with potential for recovery depending on economic indicators, policy developments, and geopolitical stability.

Conclusion

The post-election market rally has lost momentum, leading to a pullback as investors reassess the economic and political landscape. Initial optimism driven by election outcomes has been tempered by concerns over policy implementation, potential regulatory changes, and broader economic challenges. This retracement reflects a shift in investor sentiment, highlighting the market’s sensitivity to evolving geopolitical and economic factors. As the initial euphoria subsides, market participants are likely to focus on fundamental indicators and policy developments to guide their investment strategies moving forward.